As

filed with the Securities and Exchange Commission on September 23, 2014

Registration

No. 333-198802

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

AMENDMENT

NO. 1

TO

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

GLOBAL

DIGITAL SOLUTIONS, INC.

(Exact

name of registrant as specified in its charter)

| New

Jersey |

|

2844 |

|

22-3392051 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

777

South Flagler Drive, Suite 800 West Tower

West

Palm Beach, Florida 33401

Telephone:

(561) 515-6163

(Address,

including zip code, and telephone number,

including area code, of registrant’s principal executive offices) |

|

David

A. Loppert

Chief

Financial Officer

777

South Flagler Drive, Suite 800 West Tower

West

Palm Beach, Florida 33401

Telephone:

(561) 515-6163

(Name,

address, including zip code, and telephone number,

including

area code, of agent for service) |

Copies

to:

Owen

Naccarato

Naccarato

& Associates

1100

Quail Street, Suite 100

Newport

Beach, CA 92660

Office:

949-851-9261

Fax:

949-851-9262

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration

statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration

statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

Indicate

by a check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check One):

| |

Large Accelerated Filer

☐ |

|

Accelerated Filer ☐ |

|

| |

Non-Accelerated

Filer ☐ (Do not check if a smaller reporting company) |

|

Smaller Reporting Company ☒ |

|

THE

REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL

THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME

EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE

ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant has duly caused this registration statement on Form S-1 to be

signed on its behalf by the undersigned, thereunto duly authorized, in the City of West Palm Beach, State of Florida on the 23rd

day of September, 2014.

| |

GLOBAL

DIGITAL SOLUTIONS, INC.

(Registrant) |

| |

|

| |

By: |

/s/

Richard J. Sullivan |

| |

|

Name:

Richard J. Sullivan |

| |

|

Title: President

and Chief Executive Officer |

| |

|

(Principal

Executive Officer) |

Pursuant

to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the

capacities and on the dates indicated.

| Name |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Richard J. Sullivan |

|

Chief

Executive Officer and Chairman

of

the Board

(Principal

Executive Officer) |

|

September

23, 2014 |

| Richard

J. Sullivan |

|

|

|

| |

|

|

|

| |

|

|

|

|

| /s/

David A. Loppert |

|

Chief

Financial Officer

(Principal

Financial Officer and

Principal

Accounting Officer) |

|

September

23, 2014 |

| David A.

Loppert |

|

|

|

| |

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

September

23, 2014 |

| Stephen L. Norris |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

September

23, 2014 |

| William

J. Delgado |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

September

23, 2014 |

| Arthur F. Noterman |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

September

23, 2014 |

| Stephanie C.

Sullivan |

|

|

|

|

* - Signed by

David A. Loppert as attorney-in-fact.

EXHIBIT

INDEX

| |

|

|

|

Incorporated

by Reference |

|

| Exhibit

No. |

|

Description |

|

Form |

|

Filing

Date /

Period

End |

|

Exhibit

Number |

|

| 2.1 |

|

Purchase

Agreement, dated as of January 1, 2012, by and between Global Digital Solution, Inc., and Bronco Communications, LLC |

|

|

10 |

|

8/9/13 |

|

|

2.1 |

|

| 2.2 |

|

Amendment to

Purchase Agreement dated October 15, 2012, by and between Global Digital Solution, Inc., and Bronco Communications, LLC |

|

|

10 |

|

8/9/13 |

|

|

2.2 |

|

| 2.3 |

|

Agreement of

Merger and Plan of Reorganization dated as of October __, 2012, by and between Global Digital Solution, Inc., and Airtronic

USA, Inc. |

|

|

10/A |

|

9/10/13 |

|

|

2.3 |

|

| 2.4 |

|

First Amendment

to Agreement of Merger and Plan of Reorganization dated as of August 5, 2013, by and between Global Digital Solution, Inc.,

and Airtronic USA, Inc. |

|

|

10/A |

|

9/10/13 |

|

|

2.4 |

|

| 2.5 |

|

Equity Purchase

Agreement dated June 16, 2014 by and among Brian A. Dekle, John Ramsey, GDSI Acquisition Corporation, Global Digital Solutions,

Inc. and North American Custom Specialty Vehicles, LLC. |

|

|

8-K |

|

6/19/14 |

|

|

2.1 |

|

| 3.1 |

|

Certificate

of Incorporation |

|

|

10 |

|

8/9/13 |

|

|

3.1 |

|

| 3.2 |

|

Articles of

Merger |

|

|

10 |

|

8/9/13 |

|

|

3.2 |

|

| 3.3 |

|

Certificate

of Amendment to Certificate of Incorporation |

|

|

10 |

|

8/9/13 |

|

|

3.3 |

|

| 3.4 |

|

Bylaws |

|

|

10 |

|

8/9/13 |

|

|

3.4 |

|

| 3.5 |

|

Certificate

of Amendment to Certificate of Incorporation filed July 7, 2014 |

|

|

8-K |

|

7/30/14 |

|

|

3.1 |

|

| 5.1 + |

|

Opinion of

Naccarato & Associates |

|

|

|

|

|

|

|

|

|

| 10.1 |

|

Debtor In Possession

Note Purchase Agreement by and between the Company and Airtronic USA, Inc. dated October 22, 2012 |

|

|

10 |

|

8/9/13 |

|

|

10.1 |

|

| 10.2 |

|

8 1/4% Secured

Promissory Note in the original principal amount of $750,000 dated October 22, 2012 in favor of the Company |

|

|

10 |

|

8/9/13 |

|

|

10.2 |

|

| 10.3 |

|

Security Agreement

by and between the Company and Airtronic USA, Inc. dated October 22, 2012 |

|

|

10 |

|

8/9/13 |

|

|

10.3 |

|

| 10.4 |

|

Bridge Loan

Modification and Ratification Agreement by and between the Company and Airtronic USA, Inc. dated March __, 2013 |

|

|

10/A |

|

9/10/13 |

|

|

10.4 |

|

| 10.5 |

|

Second Bridge

Loan Modification and Ratification Agreement by and between the Company and Airtronic USA, Inc. dated as of August 5, 2013 |

|

|

10/A |

|

9/10/13 |

|

|

10.5 |

|

| 10.6 |

|

8 1/4% Secured

Promissory Note in the original principal amount of $550,000 dated August 5, 2013, in favor of the Company |

|

|

10/A |

|

9/10/13 |

|

|

10.6 |

|

| 10.7 |

|

Intellectual

Property Security Agreement dated as of August 5, 2013, by and between Merriellyn Kett and the Company |

|

|

10/A |

|

9/10/13 |

|

|

10.7 |

|

| 10.8 |

|

Promissory

Note Purchase Agreement by and between the Company and the investors listed therein dated December __, 2012 |

|

|

10 |

|

8/9/13 |

|

|

10.8 |

|

| 10.9 |

|

Secured Promissory

Note in the original principal amount of $750,000 dated December __, 2012 in favor of Gabriel De Los Reyes |

|

|

10 |

|

8/9/13 |

|

|

10.9 |

|

| 10.10 |

|

Security Agreement

dated December __, 2012 by and between the Company, Bay Acquisition, LLC and the noteholder identified on Schedule A |

|

|

10 |

|

8/9/13 |

|

|

10.10 |

|

| |

|

|

|

Incorporated

by Reference |

|

| Exhibit

No. |

|

Description |

|

Form |

|

Filing

Date /

Period

End |

|

Exhibit

Number |

|

| 10.11 |

|

Warrant

dated December __, 2012 for 3,000,000 shares of common stock |

|

|

10 |

|

8/9/13 |

|

|

10.11 |

|

| 10.12 |

|

Amendment dated

May 6, 2013, by and between the Company and Gabriel De Los Reyes |

|

|

10 |

|

8/9/13 |

|

|

10.12 |

|

| 10.13 |

|

Form of Subscription

Agreement and Securities Purchase Agreement |

|

|

10 |

|

8/9/13 |

|

|

10.13 |

|

| 10.14 |

|

Form of Indemnification

Agreement |

|

|

10 |

|

8/9/13 |

|

|

10.14 |

|

| 10.15 |

|

8 1/4% Secured

Promissory Note in the original principal amount of $200,000 dated October 10, 2013, in favor of the Company |

|

|

10-K |

|

3/28/14 |

|

|

10.15 |

|

| 10.16 |

|

Third Bridge

Loan Modification and Ratification Agreement by and between the Company and Airtronic USA, Inc. dated as of October 10, 2013 |

|

|

10-K |

|

3/28/14 |

|

|

10.16 |

|

| 10.17 |

|

Investment

Banking Agreement with Midtown Partners & Co, LLC dated October 16, 2013 |

|

|

10-K |

|

3/28/14 |

|

|

10.17 |

|

| 10.18 |

|

Addendum dated

April 16, 2014 to Investment Banking Agreement with Midtown Partners & Co, LLC dated October 16, 2013 |

|

|

DRS/A |

|

8/5/14 |

|

|

10.17 |

|

| 10.19 * |

|

Global Digital

Solutions, Inc. 2014 Equity Incentive Plan approved by Shareholders May 19, 2014 |

|

|

DRS/A |

|

8/5/14 |

|

|

10.19 |

|

| 10.20 |

|

Online Virtual

Office Agreement dated August 19, 2013 |

|

|

DRS/A |

|

8/5/14 |

|

|

10.20 |

|

| 10.21 * |

|

Restricted Stock

Unit Agreement dated as of August 25, 2014 between Global Digital Solutions, Inc. and Stephen L. Norris |

|

|

8-K/A |

|

8/25/14 |

|

|

10.1 |

|

| 21.1 |

|

List of Subsidiaries |

|

|

10-K |

|

3/28/14 |

|

|

21 |

|

| 23.1 |

|

Consent of

PMB Helin Donovan, LLP |

|

|

S-1 |

|

9/17/14 |

|

|

23.1 |

|

| 23.2 + |

|

Consent of

Naccarato & Associates (included in Exhibit 5.1) |

|

|

|

|

|

|

|

|

|

| 24.1 |

|

Power of Attorney

(included on the Signature Page of this Registration Statement on Form S-1). |

|

|

|

|

|

|

|

|

|

| 99.1 |

|

NIMS Standards for Mobile Command Center

Vehicles |

|

|

DRS/A |

|

9/2/14 |

|

|

99.1 |

|

| 101.INS** |

|

XBRL Instance |

|

|

S-1 |

|

9/17/14 |

|

|

101.INS |

|

| 101.SCH** |

|

XBRL Taxonomy Extension Scheme |

|

|

S-1 |

|

9/17/14 |

|

|

101.SCH |

|

| 101.CAL** |

|

XBRL Taxonomy Extension Calculation |

|

|

S-1 |

|

9/17/14 |

|

|

101.CAL |

|

| 101.DEF** |

|

XBRL Taxonomy Extension Definition |

|

|

S-1 |

|

9/17/14 |

|

|

101.DEF |

|

| 101.LAB** |

|

XBRL Taxonomy Extension Labels |

|

|

S-1 |

|

9/17/14 |

|

|

101.LAB |

|

| 101.PRE** |

|

XBRL Taxonomy Extension Presentation |

|

|

S-1 |

|

9/17/14 |

|

|

101.PRE |

|

| * |

Management contract or

compensatory plan or arrangement. |

| |

|

| + |

Filed herewith. |

| |

|

| ** |

XBRL (Extensible Business Reporting

Language) information is furnished and not filed or a part of a registration statement or prospectus of sections 11 or

12 of the Securities Act of 1933, as amended, is deemed not filed for purposes of section 18 of the Securities Exchange Act

of 1934, as amended, and otherwise is not subject to liability under these sections. |

Exhibit 5.1

OWEN M. NACCARATO, Esq.

Naccarato & Associates

1100 Quail Street, Suite 100

Newport Beach, CA 92660

Office: (949) 851-9261 Facsimile: (949)

851-9262

September 23, 2014

GLOBAL DIGITAL SOLUTIONS, INC.

777 South Flagler Drive, Suite 800 West Tower

West Palm Beach, Florida 33401

Ladies and Gentlemen:

This letter is in reference to the Registration

Statement on Form S-1 (the “Registration Statement”) filed by Global Digital Solutions, Inc., a New Jersey corporation

(the "Company"), with the Securities and Exchange Commission, in connection with the registration under the Securities

Act of 1933, as amended (the “ACT”), for resale by the selling stockholders listed in the prospectus included as part

of the Registration Statement (the “Selling Stockholder”) of 32,082,170 shares of the Company’s common stock,

$0.001 par value per share (the “Common Stock”) which consists of: (i) 11,022,170 shares of the Company’s

common stock issued or issuable in connection with our acquisition of North American Custom Specialty Vehicles, LLC, (ii) 5,634,000 shares

of the Company’s common stock issued to investors in various private placements, (iii) 4,250,000 shares of the Company’s

common stock currently issued and outstanding, and 4,250,000 shares issuable upon the conversion of warrants (as defined

below) issued in connection with convertible debt, for services, and for investment banking fees, (iv) 2,676,000 shares

of the Company’s common stock issued to certain acquisition, investor relations professionals and consultants for acquisition,

investor relations and marketing services; and (v) 4,250,000 shares of the Company’s common stock issued for

conversion of debt and debt guarantees (the “Notes” as defined below).

In connection with the opinions expressed

herein, we have examined such documents and records and considered such legal matters as we have deemed relevant or necessary for

the purposes of this opinion, including, without limitation, (i) the Registration Statement; (ii) the Articles of Incorporation

and Bylaws of the Company, each as amended to date; (iii) certain resolutions of the board of directors of the Company, relating

to the issuance and sale of the Shares, secured convertible promissory notes convertible into a portion of the Shares (the “Notes”),

and warrants exercisable for a portion of the Shares (the “Warrants”), (iv) that certain Securities Purchase Agreements

by and between the Company and the Selling Stockholders, (the “Purchase Agreement”), and (v) records of meetings and

consents of the Board of Directors of the Company provided to us by the Company. With respect to such examination, we have assumed

the genuineness of all signatures, the authenticity of all documents submitted to us as originals, the conformity to original documents

of all documents submitted to us as reproduced or certified copies, and the authenticity of the originals of those latter documents.

As to questions of fact material to this opinion, we have, to the extent deemed appropriate, relied upon certain representations

of certain officers of the Company.

Based on the foregoing, subject to the

limitations and qualifications set forth herein, and assuming that the full consideration for each share issuable upon exercise

of each Warrant is received by the Company in accordance with the terms of each such Warrant, it is our opinion that the 32,082,170

shares of Common Stock being sold pursuant to the registration statement are duly authorized and will be, when issued in the manner

described in the registration, legally and validly issued, fully paid and non-assessable.

We express no opinion as to the effect

or application of any laws or regulations other than the New Jersey Uniform Securities Law and the Federal laws of the United States,

in each case, as currently in effect.

We hereby consent to the filing of this opinion

as an exhibit to the Registration Statement and to the reference to our firm under the caption “Experts” in the Registration

Statement. In so doing, we do not admit that we are in the category of persons whose consent is required under Section 7 of the

Act and the rules and regulations of the Securities and Exchange Commission promulgated thereunder.

Very truly yours,

/s/ Owen Naccarato

Owen Naccarato

Naccarato & Associates

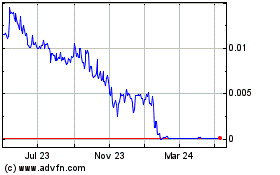

Global Digital Solutions (CE) (USOTC:GDSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

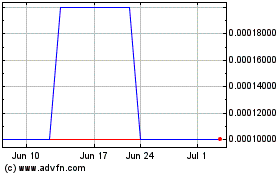

Global Digital Solutions (CE) (USOTC:GDSI)

Historical Stock Chart

From Apr 2023 to Apr 2024