Current Report Filing (8-k)

September 11 2014 - 4:23PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) September 9, 2014

BLOOMIN’ BRANDS, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | 001-35625 | 20-8023465 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

2202 North West Shore Boulevard, Suite 500, Tampa, Florida 33607

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (813) 282-1225

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

Item 7.01 | Regulation FD Disclosure. |

On September 9, 2014, OSI Restaurant Partners, LLC (“OSI”), a subsidiary of Bloomin’ Brands, Inc. (the “Company”), entered into eight interest rate swap agreements (“Swap Transaction”) to manage its exposure to fluctuations in variable interest rates. The Swap Transaction is for an aggregate notional amount of $400.0 million with a forward start date of June 30, 2015 and a termination date of May 16, 2019.

In connection with the Swap Transaction, the Company effectively converted $400.0 million of its outstanding indebtedness from a Eurocurrency floating interest rate plus 175 to 225 basis points to a weighted average fixed interest rate of 2.02% plus 175 to 225 basis points. Based on the Company’s current debt levels, the Company expects its capital structure would consist of approximately 60.0% to 65.0% fixed interest rate debt after giving effect to the Swap Transaction. Based on the current LIBOR curve, the Company estimates approximately $2.8 million of additional interest expense in fiscal 2015 as a result of the Swap Transaction. For fiscal 2014, no additional interest expense is expected as a result of the Swap Transaction.

Forward-Looking Statements

Certain statements contained herein are not based on historical fact and are “forward-looking statements” within the meaning of applicable securities laws. Generally, these statements can be identified by the use of words such as “believes,” “estimates,” “anticipates,” “expects,” “on track,” “feels,” “forecasts,” “seeks,” “projects,” “intends,” “plans,” “may,” “will,” “should,” “could,” “would” and similar expressions intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements include all matters that are not historical facts. By their nature, forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from the Company’s forward-looking statements. These risks and uncertainties include, but are not limited to: local, regional, national and international economic conditions; consumer confidence and spending patterns; price and availability of commodities, such as beef, chicken, shrimp, pork, seafood, dairy, potatoes, onions and energy supplies, which are subject to fluctuation and could increase or decrease more than the Company expects; weather, acts of God and other disasters; the seasonality of the Company’s business; inflation or deflation; increases in unemployment rates and taxes; increases in labor and health insurance costs; competition and changes in consumer tastes and the level of acceptance of the Company’s restaurant concepts (including consumer acceptance of prices); consumer reaction to public health issues; consumer perception of food safety; demographic trends; the cost of advertising and media; government actions and policies; interest rate changes, compliance with debt covenants and the Company’s ability to make debt payments; and the availability of credit presently arranged from the Company’s revolving credit facilities. Further information on potential factors that could affect the financial results of the Company and its forward-looking statements is included in its Form 10-K filed with the Securities and Exchange Commission on March 3, 2014. The Company assumes no obligation to update any forward-looking statement, except as may be required by law. These forward-looking statements speak only as of the date of this release. All forward-looking statements are qualified in their entirety by this cautionary statement.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | BLOOMIN’ BRANDS, INC. |

| | (Registrant) |

| | | |

| | | |

Date: September 11, 2014 | | By: | /s/ David J. Deno |

| | | David J. Deno |

| | | Executive Vice President and Chief Financial and Administrative Officer |

| | | |

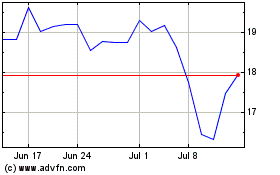

Bloomin Brands (NASDAQ:BLMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

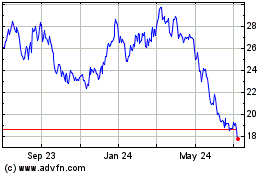

Bloomin Brands (NASDAQ:BLMN)

Historical Stock Chart

From Apr 2023 to Apr 2024