UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): August 28, 2014

LAS VEGAS SANDS CORP.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| NEVADA |

|

001-32373 |

|

27-0099920 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

| 3355 LAS VEGAS BOULEVARD SOUTH

LAS VEGAS, NEVADA |

|

89109 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (702) 414-1000

NOT APPLICABLE

(Former

name or former address, if changed since last report)

Check the

appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2. below):

| |

¨ |

Written Communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 |

Regulation FD Disclosure. |

On August 28, 2014, Sands China Ltd. (“SCL”),

a subsidiary of Las Vegas Sands Corp. with ordinary shares listed on The Stock Exchange of Hong Kong Limited (the “SEHK”), filed its interim report in respect of the six month period ended June 30, 2014 (the “2014 Interim

Report”) with the SEHK. The 2014 Interim Report is furnished as Exhibit 99.1 to this Form 8-K.

The information in this Form 8-K and

Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933,

as amended, except as shall be expressly set forth by specific reference in any such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| 99.1 |

|

2014 Interim Report of Sands China Ltd. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report on Form 8-K to be signed on

its behalf by the undersigned, thereunto duly authorized.

Dated: August 28, 2014

|

|

|

| LAS VEGAS SANDS CORP. |

|

|

| By: |

|

/s/ Ira H. Raphaelson |

| Name: |

|

Ira H. Raphaelson |

| Title: |

|

Executive Vice President and Global General Counsel |

3

INDEX TO EXHIBITS

| 99.1 2014 Interim Report of Sands China Ltd. |

|

4

Exhibit 99.1

Exhibit

99.1

INTERIM REPORT2014

Sands Macao

May 2004

The Venetian Macao

August 2007

The Plaza Macao

August 2008

Sands Cotai Central

April 2012

The Parisian Macao

2015

Sands china Ltd.

(incorporated in the Cayman Islands with limited liability)

Stock Code: 1928

This interim report is printed on recycled paper using soy ink

FROM

FABULOUS RESTAURANTS AND LUXURIOUS HOTEL SUITES TO WORLD-CLASS MICE AND ENTERTAINMENT, COME AND DISCOVER EVERYTHING

SANDS CHINA LTD.

CONTENTS

1. Overview 3

1.1 Financial Highlights 3

2. Management

Discussion

5

and Analysis

2.1 Results of Operations 5

2.2 Liquidity and Capital Resources 11

2.3 Capital Expenditures 12

2.4 Capital Commitments 13

2.5 Dividends 13

2.6 Pledge of Fixed Assets 13

2.7 Contingent Liabilities and Risk Factors 14

2.8 Capital Risk Management 14

2.9 Foreign Exchange Risk 15

2.10 Business Review

and Prospects 15

3. Corporate Governance 17

3.1 Human Resources 17

3.2 Environment 17

3.3 Corporate Governance

Practices 19

3.4 Model Code for Securities Transactions 19

3.5 Board and Board Committees Composition 19

3.6 Disclosure of Directors’ Information pursuant to 21

Rule 13.51B(1) of the Listing Rules

3.7 Audit

Committee Review 22

3.8 Interests of Directors and Chief Executives 22

3.9 Interests of Substantial Shareholders 24

3.10 Interests of Any Other Persons 24

3.11

Equity Award Plan 24

3.12 Purchase, Sale or Redemption of 27

the Company’s Listed Shares

4. Condensed Consolidated

28

Financial Statements

4.1 Report on Review of Condensed Consolidated 28

Financial Statements

4.2 Condensed Consolidated Financial Statements 29

4.3 Notes to the Condensed Consolidated 35

Financial Statements

5. Corporate Information 57

6. Contact Us 58

7. Glossary 59

This interim report is prepared in

English and Chinese. In case of any inconsistency, please refer to the English version as it shall prevail.

OUR

LUXURIOUS HOTEL ROOMS AND SUITES AWAIT YOU.

SANDS

CHINA LTD. Interim Report 2014

1. OVERVIEW

1.1 FINANCIAL HIGHLIGHTS

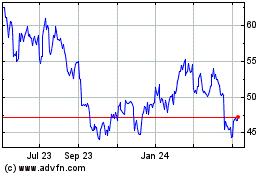

We generated an all-time half year record of US$1,737.4 million (HK$13,467.1 million) of adjusted EBITDA, an increase

of 35.7% compared to US$1,280.1 million (HK$9,931.3 million) in the first half of 2013.

Total net revenues for the Group increased 24.7% to US$5,075.3 million (HK$39,340.2 million) in the first half of 2014,

compared to US$4,070.3 million (HK$31,578.2 million) in the first half of 2013.

Profit for the Group increased 45.7% to US$1,370.4 million (HK$10,622.4 million) in the first half of 2014, compared to

US$940.5 million (HK$7,296.6 million) in the first half of 2013.

Capitalized terms used but not defined herein shall have the meanings ascribed to them in our 2013 Annual Report.

Note: The translation of US$ amounts into HK$ amounts has been made at the rate of US$1.00 to HK$7.7513 (six

months ended June 30, 2013:

US$1.00 to HK$7.7582) for the purposes of illustration only.

Adjusted EBITDA

(US$Million)

35.7%

34.2% 31.4% $1,737.4

$1,280.1

1H2013 1H2014

Adjusted EBITDA

Adjusted EBITDA as a % of Net Revenues

Net

Revenues

(US$Million)

24.7%

$5,075.3

$4,070.3

1H2013 1H2014

Net Revenues

Profit

(US$Million)

45.7%

27.0% 23.1% $1,370.4

$940.5

1H2013 1H2014

Profit

Profit as a % of Net Revenues

3

SOMETHING

SUMPTUOUS

TO SUIT EVERY TASTE.

SANDS

CHINA LTD. Interim Report 2014

2. MANAGEMENT

DISCUSSION

AND ANALYSIS

2.1 RESULTS OF OPERATIONS

The Board of Directors (the “Board”) of Sands China Ltd. (“we” or our “Company”)

is pleased to present the unaudited consolidated results of the Company and its subsidiaries (the “Group”) for the six months ended June 30, 2014 compared to the six months ended June 30, 2013.

Net Revenues

Our net revenues consisted of the following:

Casino Rooms Mall

Food and beverage

Convention, ferry, retail and

other

Total net revenues

Six months ended June 30,

2014 2013 Percent

change

(US$ in millions, except percentages)

4,571.5

164.9

147.9

84.1

106.9

5,075.3

3,650.7

136.1

119.6

69.2

94.7

4,070.3

25.2% 21.2% 23.7% 21.5% 12.9%

24.7%

Net revenues were US$5,075.3 million for

the six months ended June 30, 2014, an increase of US$1,005.0 million, or 24.7%, compared to US$4,070.3 million for the six months ended June 30, 2013. Net revenues increased in all the segments, mainly driven by market growth as well as

an increase in visitation resulting from efforts in marketing and management’s focus on driving the high-margin mass market gaming segment, while continuing to provide luxury amenities and high service levels to our VIP and premium players.

Net revenues increased

24.7%

to US$5,075.3 million

Our net casino revenues for the six months ended June 30, 2014 were US$4,571.5 million, an increase of US$920.8

million, or 25.2%, compared to US$3,650.7 million for the six months ended June 30, 2013. The growth was primarily attributable to an increase of US$419.6 million at The Venetian Macao and US$391.5 million at Sands Cotai Central driven by an

increase in volume in our mass market segment, as well as a ramp-up in our premium mass segment.

5

2.

MANAGEMENT DISCUSSION

AND ANALYSIS

The following table summarizes the results of our casino activity:

Six months ended June 30,

2014 2013 Change

(US$ in millions, except percentages and points)

The Venetian Macao

Total net casino revenues

Non-Rolling Chip drop

Non-Rolling Chip win percentage

Rolling Chip volume

Rolling Chip win percentage

Slot handle

Slot hold percentage

Sands Cotai Central

Total net casino revenues

Non-Rolling Chip drop

Non-Rolling Chip win

percentage

Rolling Chip volume

Rolling Chip win percentage

Slot handle

Slot hold percentage

The Plaza Macao

Total net casino revenues

Non-Rolling Chip drop

Non-Rolling Chip win percentage

Rolling Chip

volume

Rolling Chip win percentage

Slot handle

Slot hold percentage

Sands Macao

Total net casino revenues

Non-Rolling Chip drop

Non-Rolling Chip win percentage

Rolling Chip volume

Rolling Chip win percentage

Slot handle

Slot hold percentage

1,985.2

4,645.1

25.9%

27,645.2

3.47%

2,798.3

5.0%

1,445.8

3,682.3

22.2%

27,909.7

2.89%

3,788.1

3.6%

534.9

718.6

25.1%

14,841.6

3.42%

460.2

5.1%

605.7

2,173.2

17.7%

10,032.1

2.87%

1,635.6

3.8%

1,565.6

2,927.7

30.0%

23,508.9

3.49%

2,341.2

5.5%

1,054.3

2,263.5

21.8%

27,957.8

2.71%

2,478.1

3.9%

446.4

296.6

32.3%

19,424.4

2.58%

366.4

5.6%

584.4

1,586.1

20.7%

12,197.2

2.69%

1,343.7

3.9%

26.8%

58.7%

(4.1)pts

17.6%

(0.02)pts

19.5%

(0.5)pts

37.1%

62.7%

0.4pts

(0.2)%

0.18pts

52.9%

(0.3)pts

19.8%

142.3%

(7.2)pts

(23.6)%

0.84pts

25.6%

(0.5)pts

3.6%

37.0%

(3.0)pts

(17.8)%

0.18pts

21.7%

(0.1)pts

Net room revenues for the six months

ended June 30, 2014 were US$164.9 million, an increase of US$28.8 million, or 21.2%, compared to US$136.1 million for the six months ended June 30, 2013. Sands Cotai Central and The Venetian Macao continued to experience strong growth in

both occupancy and ADR driven by strong demand.

6

SANDS

CHINA LTD. Interim Report 2014

The following table summarizes our room activity. Information in this table

takes into account rooms provided to customers on a complimentary basis.

Six months ended June 30,

2014 2013 Change

(US$, except percentages and points)

The Venetian

Macao

Gross room revenues (in millions)

Occupancy rate

Average daily rate

Revenue per available room

Sands Cotai Central

Gross room revenues (in millions)

Occupancy rate

Average daily rate

Revenue per available room

The Plaza Macao

Gross room revenues (in millions)

Occupancy rate

Average daily rate

Revenue per available room

Sands Macao

Gross room revenues (in millions)

Occupancy rate

Average daily rate

Revenue per available room

126.6

91.7%

265

243

152.7

86.9%

173

150

24.7

86.4%

419

363

12.8

97.6%

254

248

105.5

89.5%

229

205

94.2

69.0%

148

102

19.9

81.0%

361

292

12.0

94.9%

244

232

20.0%

2.2pts

15.7%

18.5%

62.1%

17.9pts

16.9%

47.1%

24.1%

5.4pts

16.1%

24.3%

6.7%

2.7pts

4.1%

6.9%

Net mall revenues for the six months ended June 30, 2014 were US$147.9 million, an increase of US$28.3 million, or

23.7%, compared to US$119.6 million for the six months ended June 30, 2013. The increase was primarily driven by higher base fees due to contract renewals and replacements, additional stores opened at Shoppes at Venetian, and the opening of the

third phase of Shoppes at Cotai Central in June 2014.

Net food and beverage revenues for the six months ended

June 30, 2014 were US$84.1 million, an increase of US$14.9 million, or 21.5%, compared to US$69.2 million for the six months ended June 30, 2013. The increase was primarily driven by stronger business volume at most outlets due to

increased property visitation.

Net convention, ferry, retail and other revenues for the six months ended

June 30, 2014 were US$106.9 million, an increase of US$12.2 million, or 12.9%, compared to US$94.7 million for the six months ended June 30, 2013. The increase was driven by the entertainment segment due to shows with higher popularity,

and convention and exhibition revenues from some major groups at Sands Cotai Central and The Venetian Macao.

7

2.

MANAGEMENT

DISCUSSION

AND ANALYSIS

Operating Expenses

Our operating expenses consisted of the following:

Six months ended June 30,

2014 2013 Percent change

(US$ in millions, except

percentages)

Casino

Rooms

Mall

Food and beverage

Convention, ferry, retail and other

Provision for

doubtful accounts

General and administrative

Corporate

Pre-opening

Depreciation and amortization

Net foreign exchange (gains)/losses

Loss on disposal of property and equipment and

investment properties

Fair value losses on financial assets

at fair

value through profit or loss

Total operating expenses

2,793.0

36.5

19.8

69.0

105.7

24.5

300.0

29.3

20.3

257.3

(1.2)

1.4

0.0

3,655.4

2,290.3

35.9

17.9

61.8

96.2

31.9

261.5

33.0

7.4

246.3

4.7

3.0

0.1

3,090.0

21.9%

1.7%

10.6%

11.7%

9.9%

(23.2)%

14.7%

(11.2)%

174.3%

4.5%

(125.5)%

(53.3)%

(100.0)%

18.3%

Operating expenses were US$3,655.4 million for the six months ended June 30, 2014, an increase of US$565.4 million,

or 18.3%, compared to US$3,090.0 million for the six months ended June 30, 2013. The increase in operating expenses was primarily attributed to the corresponding revenue growth at The Venetian Macao and Sands Cotai Central and a new bonus

program for manager grade employees and below.

Casino expenses for the six months ended June 30, 2014

were US$2,793.0 million, an increase of US$502.7 million, or 21.9%, compared to US$2,290.3 million for the six months ended June 30, 2013. The increase was primarily due to an increase in total gaming taxes as a result of increased gaming

revenues, and increases in payroll and other operating expenses due to higher business volumes.

Room expenses

for the six months ended June 30, 2014 were US$36.5 million, an increase of US$0.6 million, or 1.7%, compared to US$35.9 million for the six months ended June 30, 2013. The increase was mainly driven by increases in payroll and other

operating expenses as a result of higher room revenues.

Mall expenses for the six months ended June 30,

2014 were US$19.8 million, an increase of US$1.9 million, or 10.6%, compared to US$17.9 million for the six months ended June 30, 2013. The increase was mainly due to increased spending on common area maintenance and enhancement.

8

SANDS

CHINA LTD. Interim Report 2014

Food and beverage expenses for the six months ended June 30, 2014 were

US$69.0 million, an increase of US$7.2 million, or 11.7%, compared to US$61.8 million for the six months ended June 30, 2013. The increase was primarily driven by increases in cost of sales and payroll expenses associated with the increased

food and beverage revenues.

Convention, ferry, retail and other expenses for the six months ended

June 30, 2014 were US$105.7 million, an increase of US$9.5 million, or 9.9%, compared to US$96.2 million for the six months ended June 30, 2013. The increase was primarily driven by an increase in contract entertainment expenses for

hosting shows with higher popularity.

Provision for doubtful accounts expenses were US$24.5 million for the

six months ended June 30, 2014, a decrease of US$7.4 million, or 23.2%, compared to US$31.9 million for the six months ended June 30, 2013. The decrease was mainly driven by credit control and the improvement of the overall casino

receivables balance.

General and administrative expenses were US$300.0 million for the six months ended

June 30, 2014, an increase of US$38.5 million, or 14.7%, compared to US$261.5 million for the six months ended June 30, 2013. The increase was mainly driven by increases in marketing expenses to promote the properties, and increases in

payroll expenses to support business expansions.

Corporate expenses were US$29.3 million for the six months

ended June 30, 2014, a decrease of US$3.7 million, or 11.2%, compared to US$33.0 million for the six months ended June 30, 2013. The decrease was mainly driven by a decrease in corporate legal expenses.

Pre-opening expenses were US$20.3 million for the six months ended June 30, 2014, an increase of US$12.9 million, or

174.3%, compared to US$7.4 million for the six months ended June 30, 2013. The increase was primarily driven by pre-opening expenses of The Parisian Macao.

Depreciation and amortization expense was US$257.3 million for the six months ended June 30, 2014, an increase of US$11.0 million, or 4.5%, compared to US$246.3 million for the six

months ended June 30, 2013, driven by The Venetian Macao and Sands Cotai Central properties, partially offset by a decrease at the other properties due to some assets being fully depreciated.

9

2.

MANAGEMENT

DISCUSSION

AND ANALYSIS

Adjusted EBITDA(1)

The following table summarizes information related to our segments:

Six months ended June 30,

2014 2013 Percent change

(US$ in millions, except

percentages)

The Venetian Macao

Sands Cotai Central

The Plaza Macao

Sands Macao

Ferry and other operations

Total adjusted EBITDA

872.9

513.0

180.8

173.0

(2.4)

1,737.4

709.5

277.0

115.2

184.4

(6.1)

1,280.1

23.0%

85.2%

56.9%

(6.2)%

60.7%

35.7%

Adjusted EBITDA for the six months ended June 30, 2014 was US$1,737.4 million, an increase of US$457.3 million, or

35.7%, compared to US$1,280.1 million for the six months ended June 30, 2013. This performance was driven by revenue increases in all of the business segments, as a result of growth in Non-Rolling Chip win and improvement in operational

efficiencies at all properties. The management team continues to focus on operational efficiencies throughout both gaming and non-gaming areas of the business, further improve adjusted EBITDA.

(1) Adjusted EBITDA is profit before share-based compensation, corporate expense, pre-opening expense, depreciation and

amortization, net foreign exchange gains/(losses), gain/(loss) on disposal of property and equipment and investment properties, fair value losses on financial assets at fair value through profit or loss, interest, loss on modification or early

retirement of debt and income tax expense. Adjusted EBITDA is used by management as the primary measure of operating performance of the Group’s properties and to compare the operating performance of the Group’s properties with that of its

competitors. However, adjusted EBITDA should not be considered in isolation; construed as an alternative to profit or operating profit; as an indicator of the Group’s IFRS operating performance, other combined operations or cash flow data; or

as an alternative to cash flow as a measure of liquidity. Adjusted EBITDA as presented by the Group may not be directly comparable to other similarly titled measures presented by other companies.

Interest Expense

The following table summarizes information related to interest expense:

Six months ended June 30,

2014 2013 Percent

change

(US$ in millions, except percentages)

Interest and other finance costs

Less — capitalized interest

Interest

expense, net

41.9

(3.7)

38.2

46.7

(2.7)

44.0

(10.3)%

37.0%

(13.2)%

10

SANDS

CHINA LTD. Interim Report 2014

Interest expense, net of amounts capitalized, was US$38.2 million for the six

months ended June 30, 2014, compared to US$44.0 million for the six months ended June 30, 2013. The decrease was primarily due to the decrease in interest and other finance costs resulting primarily from a reduced interest rate after the

Group amended the 2011 VML Credit Facility in March 2014, as described below.

Profit for the Period

Profit for the six months ended June 30, 2014 was US$1,370.4 million, an increase of US$429.9 million, or

45.7%, compared to US$940.5 million for the six months ended June 30, 2013.

2.2 LIQUIDITY AND CAPITAL

RESOURCES

We fund our operations through cash generated from our operations and our debt financing.

In March 2014, we amended our 2011 VML Credit Facility, which extended the maturity of US$2.39 billion in

aggregate principal amount of the term loans under the facility to March 31, 2020 (the “Extended 2011 VML Term Facility”), and provided for revolving loan commitments of US$2.0 billion (the “Extended 2011 VML Revolving

Facility”). A portion of the revolving proceeds was used to pay down the US$819.7 million in aggregate principal balance of the 2011 VML Term Facility loans that were not extended. Borrowings under the Extended 2011 VML Revolving Facility are

being used to fund the development, construction and completion of Sands Cotai Central and The Parisian Macao, and for working capital requirements and general corporate purposes. As at June 30, 2014, the Group had US$1.18 billion of available

borrowing capacity under the Extended 2011 VML Revolving Facility.

As at June 30, 2014, we had cash and

cash equivalents of US$1.51 billion, which was primarily generated from our operations.

Cash Flows —

Summary

Our cash flows consisted of the following:

Six months ended June 30,

2014 2013

(US$ in millions)

Net cash generated from operating activities

Net cash used in investing activities

Net cash

used in financing activities

Net decrease in cash and cash equivalents

Cash and cash equivalents at beginning of period

Effect of exchange rate on cash and cash equivalents

Cash and cash equivalents at end of period

1,671.0

(418.4)

(2,690.2)

(1,437.5)

2,943.4

1.9

1,507.8

1,361.3

(236.6)

(1,430.1)

(305.5)

1,948.4

(3.9)

1,639.0

11

2.

MANAGEMENT DISCUSSION

AND ANALYSIS

Cash Flows — Operating Activities

We derive

most of our operating cash flows from our casino, hotel and mall operations. Net cash generated from operating activities for the six months ended June 30, 2014 was US$1,671.0 million, an increase of US$309.7 million, or 22.8%, compared to

US$1,361.3 million for the six months ended June 30, 2013. The increase in net cash generated from operating activities was primarily due to the increase in our operating results.

Cash Flows — Investing Activities

Net cash used in investing activities for the six months ended June 30, 2014 was US$418.4 million, and was primarily attributable to capital expenditures for development projects as

well as maintenance spending. Capital expenditures for the six months ended June 30, 2014, totaled US$428.0 million, including US$346.1 million for construction activities at Sands Cotai Central and The Parisian Macao and US$81.9 million for

our operations, mainly at The Venetian Macao, The Plaza Macao and Sands Macao.

Cash Flows — Financing

Activities

For the six months ended June 30, 2014, net cash used in financing activities was US$2,690.2

million, which was primarily attributable to US$2,600.9 million in dividend payments.

2.3 CAPITAL EXPENDITURES

Capital expenditures were used primarily for new projects and to renovate, upgrade and maintain existing

properties. Set forth below is historical information on our capital expenditures, excluding capitalized interest and construction payables:

Six months ended June 30,

2014 2013

(US$ in millions)

The Venetian Macao

Sands Cotai Central

The Plaza Macao

Sands Macao

Ferry and other operations

The Parisian Macao

Total capital expenditures

44.2

156.5

21.9

14.8

1.1

189.6

428.0

44.2

123.4

5.7

9.7

0.2

58.5

241.7

Our capital expenditure plans are significant. In April 2012, September 2012 and January 2013, we opened the Conrad and Holiday Inn tower, the first Sheraton tower and the second

Sheraton tower, respectively, of Sands Cotai Central, which is part of our Cotai Strip development. We have begun construction activities on the remaining phase of the project, which will include a fourth hotel and mixed-use tower, located on parcel

5, under the St. Regis brand. The total cost to complete the remaining phase of the project is expected to be approximately US$700 million.

12

SANDS

CHINA LTD. Interim Report 2014

We have commenced construction activities on The Parisian Macao, our integrated

resort development on Parcel 3, but stopped

in June 2014, pending receipt of certain government approvals,

which management has been informed are scheduled to be

issued in October 2014. In the meantime, the Company is

working to accelerate the permit approval process and, as with

projects of this nature, will continue to

analyze options for both a full and phased opening of the facility in 2015. We have

capitalized costs of

US$595.9 million, including land, as at June 30, 2014. The Parisian Macao is targeted to open in late 2015

and we expect the cost to design, develop and construct The Parisian Macao will be approximately US$2.7 billion, inclusive

of

land premium payments.

These investment plans are preliminary and subject to change based upon the execution of our business plan, the progress of

our capital projects, market conditions and the outlook on future business conditions.

2.4 CAPITAL COMMITMENTS

Future commitments for property and equipment that are not recorded in the financial statements herein are as follows:

June 30,

December 31,

2014 2013

(US$ in millions)

Contracted but not provided for

Authorized but

not contracted for

Total capital commitments

1,836.5

1,693.3

3,529.7

1,227.4

2,031.3

3,258.7

2.5 DIVIDENDS

On February 26, 2014, the Company paid an interim dividend of HK$0.87 (equivalent to US$0.112) per share and a special dividend of HK$0.77 (equivalent to US$0.099) per share for the

year ended December 31, 2013, amounting in aggregate to HK$13.23 billion (equivalent to US$1.71 billion), to Shareholders of record on February 14, 2014.

On May 30, 2014, the Shareholders approved a final dividend of HK$0.86 (equivalent to US$0.111) per share for the year ended December 31, 2013 to Shareholders of record on

June 9, 2014. This final dividend, amounting in aggregate to HK$6.94 billion (equivalent to US$894.4 million), was paid on June 30, 2014.

The Board does not recommend the payment of an interim dividend for the six months ended June 30, 2014.

2.6 PLEDGE OF FIXED ASSETS

We have pledged a

substantial portion of our fixed assets to secure our loan facilities. As at June 30, 2014, we have pledged leasehold interests in land; buildings; building, land and leasehold improvements; furniture, fittings and equipment; construction in

progress; and vehicles with an aggregate net book value of approximately US$7.60 billion (December 31, 2013: US$7.04 billion).

13

2.

MANAGEMENT

DISCUSSION

AND ANALYSIS

2.7 CONTINGENT LIABILITIES AND RISK

FACTORS

The Group has contingent liabilities arising in the ordinary course of business. Management has made

estimates for potential

litigation costs based upon consultation with legal counsel. Actual results could

differ from these estimates; however, in the

opinion of management, such litigation and claims will not have a

material adverse effect on our financial condition, results of

operations or cash flows.

Under the land concession for The Parisian Macao, we are required to complete the development by April 2016. The land

concession for Sands Cotai Central contains a similar requirement, which was extended by the Macao Government

in April

2014, that the development be completed by December 2016. Should we determine that we are unable to

complete The

Parisian Macao or Sands Cotai Central by their respective deadlines, we would expect to apply for

another extension from the

Macao Government. If we are unable to meet the current deadlines and the deadlines

for either development are not extended,

we could lose our land concessions for The Parisian Macao or Sands

Cotai Central, which would prohibit us from operating any

facilities developed under the respective land

concessions. As a result, the Group could record a charge for all or some portion

of the US$595.9 million or

US$4.37 billion in capitalized construction costs including land, as at June 30, 2014, related to The

Parisian Macao and Sands Cotai Central, respectively.

2.8 CAPITAL RISK MANAGEMENT

The Group’s primary objective when managing capital is to safeguard the Group’s ability to continue as a going concern in

order to provide returns for Shareholders and benefits for other stakeholders, by pricing products and services

commensurately

with the level of risk.

The capital structure of the Group consists of debt, which includes borrowings (including current and non-current

borrowings

as shown in note 15 to the condensed consolidated financial statements), cash and cash equivalents,

and equity attributable to

Shareholders, comprising issued share capital and reserves.

The Group actively and regularly reviews and manages its capital structure to maintain the net debt-to-capital ratio

(gearing

ratio) at an appropriate level based on its assessment of the current risk and circumstances. This

ratio is calculated as net debt

divided by total capital. Net debt is calculated as interest bearing

borrowings, net of deferred financing costs, less cash and cash

equivalents and restricted cash and cash

equivalents. Total capital is calculated as equity, as shown in the consolidated balance

sheet, plus net debt.

June 30,

December 31,

2014

2013

(US$ in millions, except percentages)

Interest

bearing borrowings, net of deferred financing costs

Less: cash and cash equivalents

restricted cash and cash equivalents

Net debt

Total equity

Total capital

Gearing ratio

3,107.7

(1,507.8)

(6.3)

1,593.7

5,242.2

6,835.9

23.3%

3,139.6

(2,943.4)

(5.7)

190.5

6,449.9

6,640.4

2.9%

14

SANDS

CHINA LTD. Interim Report 2014

The increase in the gearing ratio during the six months ended June 30,

2014 was primarily due to dividend payments of US$2.60 billion.

2.9 FOREIGN EXCHANGE RISK

The Group’s foreign currency transactions are mainly denominated in US$. The majority of assets and liabilities are

denominated in US$, HK$ and MOP. The Group is subject to foreign exchange rate risk arising from future commercial transactions and recognized assets and liabilities that are denominated in a currency other than MOP, which is the functional currency

of major operating companies within the Group. The Group currently does not have a foreign currency hedging policy.

2.10 BUSINESS REVIEW AND PROSPECTS

Our business

strategy is to continue to successfully execute our Cotai Strip developments and to leverage our integrated resort business model to create Asia’s premier gaming, leisure and convention destination. The Company continues to execute on the

strategies outlined in our 2013 Annual Report. These strategies have proven to be successful in the first half of 2014 and we are confident they will continue to be successful into the future.

Sands Cotai Central

Sands Cotai Central is located across the street from The Venetian Macao and The Plaza Macao. It is our largest integrated resort on Cotai. Sands Cotai Central consists of three hotel

towers including 636 five-star rooms and suites under the Conrad brand, 1,224 four-star rooms and suites under the Holiday Inn brand and 3,863 rooms and suites under the Sheraton brand. In April 2012, we opened the Conrad and Holiday Inn tower, a

variety of retail offerings, approximately 350,000 square feet of meeting space, several food and beverage establishments, along with the Himalaya casino and VIP gaming areas. In September 2012, we opened the first Sheraton tower featuring 1,796

rooms and suites, the Pacifica casino and additional retail, entertainment, dining and meeting facilities. In January 2013, we opened the second Sheraton tower featuring an additional 2,067 rooms and suites.

We have begun construction activities on the remaining phase of the project, which will include a fourth hotel and

mixed-use tower, located on parcel 5, under the St. Regis brand. The total cost to complete the remaining phase of the project is expected to be approximately US$700 million.

The Parisian Macao

The Parisian Macao, which is

currently expected to open in late 2015, is intended to include a gaming area (to be operated under our gaming subconcession), a hotel with over 3,000 rooms and suites and retail, entertainment, dining and meeting facilities. We expect the cost to

design, develop and construct The Parisian Macao to be approximately US$2.7 billion, inclusive of land premium payments. We have commenced construction activities, but stopped in June 2014, pending receipt of certain government approvals, which

management has been informed are scheduled to be issued in October 2014. In the meantime, the Company is working to accelerate the permit approval process and, as with projects of this nature, will continue to analyze options for both a full and

phased opening of the facility in 2015. We have capitalized construction costs of US$595.9 million for The Parisian Macao, including land, as at June 30, 2014.

15

BE

IMMERSED IN

LUXURY DUTY FREE SHOPPING.

SANDS

CHINA LTD. Interim Report 2014

3. CORPORATE

GOVERNANCE

3.1 HUMAN RESOURCES

As at June 30, 2014, our

Team Member profile was as follows:

Number of Full-time Team Members: Average Age: Gender Ratio:

Total Number of Nationalities:

Number of Team Members of Hotel Partners: Number of Full-time Team Members:

Total Number of Team Members:

25,884

38

Male 48%

Female 52%

58

2,259

25,884

28,143

Sands China Ltd. announced at the beginning of July 2014 that a special reward will be paid to full-time manager grade and below Team Members. The reward is equivalent to one month’s

salary and will be paid every July together with the Team Members’ salary until 2017. There have been no other material changes to the information disclosed in the 2013 Annual Report regarding remuneration of Team Members, remuneration

policies, and Team Members’ development.

3.2 ENVIRONMENT

We recognize the impact our business has on the environment and we continue to strive to achieve the goals we have set

ourselves in the areas of resource conservation and reducing our environmental foot print. We encourage and are grateful to those Shareholders who have elected to receive our annual and interim reports via electronic means, thereby reducing the need

to print hard copies of our reports. Should you wish to start receiving an electronic copy of our annual and interim reports, please refer to page 58 of this report for more information.

To minimize the impact on our environment, this 2014 Interim Report is printed on recycled paper using soy ink.

More information about Sands ECO360o Global Sustainability Strategy and the Environmental Reports published by

Las Vegas Sands Corp. covering its global properties is available at http://www.sands.com/sands-eco-360/our-vision.html.

17

The

Environmentally Responsible

Choice for green meetings worldwide

17.5M

kWh of Energy was saved by installing LED and other energy efficient lights, and through optimization of cooling and hearing systems

37

The number of Olymic-sized swimming pools of water were saved in 2013 through water flow controllers, low-flow shower heads and an automatic irrigation system

GREEN HOTEL AWARDS

The Venetian Macao received a Macao Green Hotel Gold Award in 2012 and the Green IIFA Award

Sands Macao received a Macao Green Hotel Silver Award in 2012

Conrad Macao has received awards for World’s Leading Green Hotel, Asia’s Leading Green Hotel and Best Green Hotel

100 Number of recycling points at the Sands China facilities are used for collection and separation of recyclable

materials. Glass recycling, a food waste digester and wood chipping facilitates improved waste diversion

EURO

V & EURO IV

Emission standards were followed for the shuttle buses in order to reduce air pollution. An

electric Bus was tried as a Team Member Shuttle in Nov and Dec 2013

CONTRIBUTION TO COMMUNITY

59 Community activities including 9 green action events in 2013

Sands China Green Fund supported 6 green action activities in 2013 held by Macau Ecological Society

Sands China Green Fund granted scholarships to 6 students in the 2012-2013 academic year

85%

Portion of our suite lighting and other operational areas that use the latest LED and other energy saving technologies

EARTH HOUR

Earth Hour Every Month implemented at Sands China properties

15 hotels in Macao have taken our ‘l Will if You Will Challenge’ to join Earth Hour Every Month

EarthCheck

The Venetian Macao received a Bronze

Benchmarked certification in 2014

SANDS

CHINA LTD. Interim Report 2014

3.3 CORPORATE GOVERNANCE PRACTICES

Good corporate governance underpins the creation of Shareholder value and maintaining the highest standards of corporate

governance is a core responsibility of the Board. An effective system of corporate governance requires that our Board approves strategic direction, monitors performance, oversees effective risk management and leads the creation of the right culture

across the organization. It also gives our investors confidence that we are exercising our stewardship responsibilities with due skill and care.

To ensure that we adhere to high standards of corporate governance, we have developed our own corporate governance principles and guidelines that set out how corporate governance operates

in practice within the Company. This is based on the policies, principles and practices set out in the Corporate Governance Code (the “Code”) contained in Appendix 14 of the Listing Rules and draws on other best practices.

The Board is of the view that throughout the six months ended June 30, 2014, save as disclosed below, the Company

fully complied with all the code provisions and certain recommended best practices set out in the Code.

Code

Provision E.1.2

Under code provision E.1.2 of the Code, the Chairman of the Board should attend the annual

general meeting of the Company. The Chairman of the Board was absent from the Company’s annual general meeting held on May 30, 2014 due to other business commitments.

3.4 MODEL CODE FOR SECURITIES TRANSACTIONS

The

Company has developed its own securities trading code for securities transactions (the “Company Code”) by the Directors and relevant employees who are likely to be in possession of unpublished inside information of the Company on terms no

less exacting than the Model Code for Securities Transactions by Directors of Listed Issuers as set out in Appendix 10 of the Listing Rules (the “Model Code”). Following specific enquiry by the Company, all Directors have confirmed that

they have complied with the Company Code and, therefore, with the Model Code throughout the six months ended June 30, 2014 and to the date of this Interim Report.

3.5 BOARD AND BOARD COMMITTEES COMPOSITION

Mr. Jeffrey Howard Schwartz resigned as a Non-Executive Director of the Company with effect from May 30, 2014.

Mr. Irwin Abe Siegel and Mr. Lau Wong William did not offer themselves for re-election as Non-Executive Directors of the Company at the annual general meeting of the Company on May 30, 2014.

Mr. Charles Daniel Forman and Mr. Robert Glen Goldstein were elected as Non-Executive Directors of the Company

at the annual general meeting held on May 30, 2014.

19

3.

CORPORATE

GOVERNANCE

The Directors of the Company as at the date of this Interim Report are:

Executive Directors

Edward Matthew Tracy

Toh Hup Hock

Non-Executive Directors

Sheldon Gary Adelson

Michael Alan Leven

Charles Daniel Forman

Robert Glen Goldstein

Independent Non-Executive Directors

Iain Ferguson Bruce

Chiang Yun

David Muir Turnbull

Victor Patrick Hoog Antink

Steven Zygmunt

Strasser

Alternate Director

David Alec Andrew Fleming

Title

President and Chief Executive Officer

Executive Vice President and Chief

Financial

Officer

Chairman of the Board

General Counsel, Company Secretary and

alternate

director to Michael Alan Leven

Note

Appointed July 27, 2011

Appointed

June 30, 2010

Appointed August 18, 2009

Redesignated July 27, 2011

Elected May 30, 2014

Elected May 30,

2014

Appointed October 14, 2009

Appointed October 14, 2009

Appointed

October 14, 2009

Appointed December 7, 2012

Elected May 31, 2013

Appointed March 1, 2011

20

SANDS

CHINA LTD. Interim Report 2014

The Board has established four committees, being the Audit Committee, the

Remuneration Committee, the Nomination Committee and the Sands China Capital Expenditure Committee. The table below details the membership and composition of each of the four committees.

Director

Sheldon Gary Adelson

Edward Matthew Tracy

Toh Hup Hock

Michael Alan Leven

Charles Daniel Forman

Robert Glen Goldstein

Iain Ferguson Bruce

Chiang Yun

David Muir Turnbull

Victor Patrick Hoog Antink

Steven Zygmunt

Strasser

Audit

Committee

—

—

—

—

—

—

Member

Member

—

Chairman

Member

Remuneration

Committee

—

—

—

—

—

—

Member

—

Chairman

Member

Member

Nomination

Committee

Chairman

—

—

—

—

—

Member

—

Member

—

—

Sands China

Capital

Expenditure

Committee

—

Member

—

Chairman

—

—

—

—

—

Member

—

3.6 DISCLOSURE OF DIRECTORS’ INFORMATION PURSUANT TO RULE 13.51B(1) OF THE LISTING RULES

Renewal of Appointment Letter

On May 5, 2014, the Board approved the renewal of appointment letter of Mr. Edward Matthew Tracy as Executive Director for a term of three years commencing from July 27,

2014.

Other Major Appointment

On May 23, 2014, Ms. Chiang Yun, an Independent Non-Executive Director of the Company, was redesignated from a Non-Executive Director to an Independent Non-Executive Director of

Goodbaby International Holdings Limited, listed on the Hong Kong Stock Exchange (stock code: 1086).

On

April 1, 2014, Mr. Victor Patrick Hoog Antink, an Independent Non-Executive Director of the Company, was redesignated from a Chairman to a Director of Property Industry Foundation.

Change in Composition of the Audit Committee and the Remuneration Committee

On June 26, 2014, Mr. Victor Patrick Hoog Antink, an Independent Non-Executive Director of the Company, was

appointed to replace Mr. Iain Ferguson Bruce, an Independent Non-Executive Director of the Company, as Chairman of the Audit Committee of the Company. Mr. Iain Ferguson Bruce continues to act as a member of the Audit Committee.

On June 26, 2014, Mr. Steven Zygmunt Strasser, an Independent Non-Executive Director of the Company, was

appointed as a member of the Audit Committee and the Remuneration Committee of the Company.

21

3.

CORPORATE

GOVERNANCE

3.7 AUDIT COMMITTEE REVIEW

The Audit Committee

has reviewed the accounting policies adopted by the Group and the unaudited condensed consolidated financial statements for the six months ended June 30, 2014. All of the Audit Committee members are Independent Non-Executive Directors, with

Mr. Victor Patrick Hoog Antink (Chairman of the Audit Committee) and Mr. Iain Ferguson Bruce possessing the appropriate professional qualifications and accounting and related financial management expertise.

3.8 INTERESTS OF DIRECTORS AND CHIEF EXECUTIVES

The interests of each of the Directors and Chief Executives in the shares, underlying shares and debentures of the Company and any of the Company’s associated corporations (within the

meaning of Part XV of the SFO) as at June 30, 2014, as recorded in the register required to be kept under Section 352 of Part XV of the SFO or as otherwise notified to the Company and the Stock Exchange pursuant to the Model Code, are set

out in the table and explanatory notes below:

Name of Director

Sheldon Gary Adelson

Toh Hup Hock

David Alec Andrew Fleming

(Alternate Director to

Michael Alan Leven)

Edward Matthew Tracy

Company

Company

Company

Company

Company

Nature of interest

Interest in a controlled

corporation

Beneficial owner

Beneficial owner

Beneficial owner

Number of

Shares

5,657,814,885(L)

981,200(L)(3)

1,044,900(L)(5)

1,000,000(L)(6)

Approximate

percentage of

shareholding

interest

70.15%

0.01%

0.01%

0.01%

Name of Director

Sheldon Gary Adelson

Toh Hup Hock

Michael Alan Leven

Edward Matthew Tracy

Charles Daniel Forman

Robert Glen Goldstein

Associated

corporation

LVS

LVS

LVS

LVS

LVS

LVS

Nature of interest

Bene?cial owner

Family Interest

Bene?cial owner

Bene?cial owner

Bene?cial owner

Bene?cial owner

Bene?cial owner

Number of

securities

66,029,461(L)(1)

341,771,319(L)(2)

60,000(L)(3)

1,036,751(L)(4)

78(L)(6)

214,483(L)(7)

861,017(L)(8)

Approximate

percentage of

shareholding

interest

8.19%

42.39%

0.01%

0.13%

0.00%

0.03%

0.11%

The letter “L” denotes the

person’s long position in such securities.

Notes:

(1) This amount includes (a) 65,845,040 shares of LVS’s common stock (see note 9), (b) 47,734 unvested

shares of LVS’s restricted stock, and (c) 136,687 unvested options to purchase 136,687 shares in LVS’s common stock. Mr. Adelson and his wife together are entitled to control the exercise of one-third or more of the voting power

at stockholders’ meetings of LVS. LVS’s interests in our Company are set out in the below paragraph “Interests of Substantial Shareholders”.

22

SANDS

CHINA LTD. Interim Report 2014

(2) This amount includes (a) 85,973,066 shares of LVS’s common stock

held by Dr. Miriam Adelson, (b) 220,674,894 shares of LVS’s common stock held by trusts for the benefit of Dr. Adelson and her family members over which Dr. Adelson, as trustee, retains sole voting control,

(c) 20,330,587 shares of LVS’s common stock held by a trust for the benefit of Dr. Adelson and her family members over which Dr. Adelson, as trustee, retains sole dispositive control, (d) 2,226,062 shares of LVS’s

common stock held by trusts or custodial accounts for the benefit of Dr. Adelson’s family members over which Dr. Adelson, as trustee or in another fiduciary capacity, retains sole voting and dispositive control, and

(e) 12,566,710 shares of LVS’s common stock held by Adfam Investment Company LLC over which Dr. Adelson, as co-manager, shares voting and dispositive control with Mr. Adelson.

(3) These amounts include (a) 538,000 shares of the Company, (b) 443,200 unvested restricted share units of the

Company, and (c) 60,000 options to purchase 60,000 shares of LVS’s common stock, all of which are vested and exercisable.

(4) This amount includes (a) 726,751 shares of LVS’s common stock (see note 9), of which 207,565 shares are held by a corporation which Mr. Leven controls one-third or more

of the voting power at its general meetings, or the corporation or its directors are accustomed to act in accordance with his directions, (b) 100,000 unvested LVS’s restricted stock, (c) 200,000 unvested LVS’s restricted stock

units, and (d) 10,000 options to purchase 10,000 shares in LVS’s common stock, all of which are vested and exercisable.

(5) This amount includes (a) 400 shares of the Company, (b) 432,000 unvested restricted share units of the Company, and (c) 612,500 options to purchase 612,500 shares of the

Company, of which 320,000 options are vested and exercisable.

(6) These amounts include (a) 1,000,000

unvested restricted share units of the Company, and (b) 78 shares of LVS’s common stock.

(7) This

amount includes (a) 171,134 shares of LVS’s common stock (see note 9), and (b) 43,349 options to purchase 43,349 shares in LVS’s common stock, all of which are vested and exercisable.

(8) This amount includes (a) 75,000 shares of LVS’s common stock (see note 9), (b) 300,000 unvested

LVS’s restricted stock, and (c) 486,017 options to purchase 486,017 shares in LVS’s common stock, all of which are vested and exercisable.

(9) In the annual and interim reports of the Company published prior to 2012, the Company has disclosed LVS’s common stock and LVS’s vested restricted stock separately. From the

2012 interim report onwards, the total number of LVS’s common stock includes the number of vested LVS’s restricted stock and LVS’s common stock.

None of the Directors or the Chief Executives had short positions in respect of shares, underlying shares and debentures of the Company and its associated corporations (within the meaning

of Part XV of the SFO) as at June 30, 2014.

Save as disclosed above, so far as was known to the

Directors, as at June 30, 2014, none of the Directors or the Chief Executives of the Company had, pursuant to Divisions 7 and 8 of Part XV of the SFO, nor were they taken or deemed to have under such provisions of the SFO, any interest or short

position in any shares or underlying shares or interest in debentures of the Company or any of its associated corporations (within the meaning of Part XV of the SFO) that were required to be notified to the Company and the Stock Exchange, or any

interests that were required, pursuant to Section 352 of the SFO, to be entered into the register referred to therein, or any interests that were required, pursuant to the Model Code, to be notified to the Company and the Stock Exchange.

As at June 30, 2014, save as disclosed above, none of the Directors nor the Chief Executives of the

Company (including their spouses and children under 18 years of age) had any interest in, or had been granted, or exercised, any rights to subscribe for Shares (or warrants or debentures, if applicable) of the Company and its associated corporations

(within the meaning of Part XV of the SFO).

23

3.

CORPORATE

GOVERNANCE

3.9 INTERESTS OF SUBSTANTIAL SHAREHOLDERS

The

interests of substantial Shareholders in the shares and underlying shares of the Company as at June 30, 2014, as recorded in the register required to be kept under Section 336 of Part XV of the SFO or as the Company is aware, are set out

in the table below.

The Company had been notified of the following substantial Shareholders’ interests in

the shares of the Company as at June 30, 2014:

Name of substantial Shareholder

Sheldon Gary Adelson

Las Vegas Sands Corp.

Las Vegas Sands, LLC

Venetian Casino Resort, LLC

LVS (Nevada) International

Holdings, Inc.

LVS Dutch Finance CV

LVS Dutch Holding BV

Sands IP Asset Management BV

Venetian Venture Development

Intermediate II

Capacity/Nature of interest

Interest in a controlled corporation

Interest in a controlled corporation

Interest in

a controlled corporation

Interest in a controlled corporation

Interest in a controlled corporation

Interest in a controlled corporation

Interest in

a controlled corporation

Interest in a controlled corporation

Beneficial owner

Number of

Shares

5,657,814,885(L)

5,657,814,885(L)

5,657,814,885(L)

5,657,814,885(L)

5,657,814,885(L)

5,657,814,885(L)

5,657,814,885(L)

5,657,814,885(L)

5,657,814,885(L)

% of issued

share capital

70.15%

70.15%

70.15%

70.15%

70.15%

70.15%

70.15%

70.15%

70.15%

The letter “L” denotes the

person’s long position in such securities.

As at June 30, 2014, the Company had not been notified of

any short positions being held by any substantial Shareholder in the shares or underlying shares of the Company.

3.10 INTERESTS OF ANY OTHER PERSONS

Save as disclosed above, as at June 30, 2014, the Company had not been notified of any persons who had interests or short positions in the shares or underlying shares of the Company,

as recorded in the register required to be kept under Section 336 of Part XV of the SFO.

3.11 EQUITY

AWARD PLAN

On November 8, 2009, our Company adopted an Equity Award Plan for the purpose of attracting

able persons to enter and remain in the employment of our Group. The Equity Award Plan also provides a means whereby employees, Directors and consultants of our Group can acquire and maintain Share ownership, thereby strengthening their commitment

to the welfare of our Group and promoting an identity of interest between Shareholders and these persons.

Share Options

As at June 30, 2014, 58,663,291 options to purchase shares in the Company had been granted under the Equity Award Plan of which 17,988,261 options had been exercised and 16,114,884

options had lapsed.

24

SANDS

CHINA LTD. Interim Report 2014

Details of the grant of share options and a summary of movements of the

outstanding share options during the period under the Equity Award Plan were as follows:

Options to Subscribe

for Ordinary Shares Granted under the Company’s Equity Award Plan

Directors &

eligible

employees

Toh Hup Hock

David Alec Andrew

Fleming

Other eligible

employees

Date

granted

March 31, 2010

November 1, 2010

September 1, 2011

March 31, 2010

July 6, 2010

September 30, 2010

January 17, 2011

May 11, 2011

August 30, 2011

November 24, 2011

March 5, 2012

May 14, 2012

August 31, 2012

September 17, 2012

November 22, 2012

December 24, 2012

February 15, 2013

May 16, 2013

September 18, 2013

November 13, 2013

February 24, 2014

March 18, 2014

May 21, 2014

June 18, 2014

June 23, 2014

Options

granted

1,000,000

910,000

130,000

16,876,100

330,000

2,672,500

2,746,300

2,530,591

1,584,400

2,671,000

1,434,500

1,787,100

1,538,100

845,000

585,100

312,000

1,486,800

1,241,900

1,058,500

749,600

2,602,300

3,238,800

2,723,800

1,071,400

552,500

Exercise

price per

share

HK$

11.63

16.33

23.28

11.63

10.70

13.23

18.57

21.73

22.48

20.23

28.23

28.14

26.82

28.43

31.48

33.28

36.73

40.26

46.78

53.95

59.35

62.94

57.75

53.64

54.20

Closing price

of shares

immediately

before the

date of

grant

HK$

12.10

16.84

24.20

12.10

11.08

14.32

19.14

21.40

22.80

20.95

29.25

28.90

27.50

28.50

31.65

34.05

36.50

40.45

47.65

54.70

58.90

62.25

57.40

53.10

54.60

Exercise period

March 31, 2011–

March 30, 2020

November 1, 2011–

October 31, 2020

September 1, 2012–

August 31, 2021

March 31, 2011–

March 30, 2020

July 6, 2011–

July 5, 2020

September 30, 2011–

September 29,

2020

January 17, 2012–

January 16, 2021

May 11, 2012–

May 10, 2021

August 30, 2012–

August 29, 2021

November 24, 2012–

November 23, 2021

March 5, 2013–

March 4, 2022

May 14, 2013–

May 13, 2022

August 31, 2013–

August 30, 2022

September 17,

2013–

September 16, 2022

November 22, 2013–

November 21,

2022

December 24, 2013–

December 23, 2022

February 15,

2014–

February 14, 2023

May 16, 2014–

May 15, 2023

September 18, 2014–

September 17, 2023

November 13,

2014–

November 12, 2023

February 24, 2015–

February 23,

2024

March 18, 2015–

March 17, 2024

May 21, 2015–

May 20, 2024

June 18, 2015–

June 17, 2024

June 23, 2015–

June 22, 2024

Number of options

outstanding

as at

January 1,

2014

250,000

682,500

130,000

2,920,425

41,250

600,725

945,450

889,471

623,325

1,277,325

800,175

1,256,400

1,366,100

390,000

585,100

312,000

1,486,800

1,241,900

1,058,500

749,600

—

—

—

—

—

granted

during the

period

—

—

—

—

—

—

—

—

—

—

—

—

—

—

—

—

—

—

—

—

2,602,300

3,238,800

2,723,800

1,071,400

552,500

vested

during the

period

250,000

—

—

1,834,375

—

—

441,200

389,148

—

—

248,925

381,775

—

—

—

—

371,700

310,475

—

—

—

—

—

—

—

lapsed

during the

period

—

—

—

—

—

—

—

—

—

—

97,500

—

—

—

—

—

—

—

234,000

244,700

—

—

—

—

—

exercised

during the

period

250,000

200,000

—

874,675

—

—

328,425

181,475

64,875

112,875

221,075

117,000

—

—

—

—

146,600

162,500

—

—

—

—

—

—

—

outstanding

as at

June 30,

2014

—

482,500

130,000

2,045,750

41,250

600,725

617,025

707,996

558,450

1,164,450

481,600

1,139,400

1,366,100

390,000

585,100

312,000

1,340,200

1,079,400

824,500

504,900

2,602,300

3,238,800

2,723,800

1,071,400

552,500

Weighted

average

closing price

of shares

immediately

before the

dates on

which

options were

exercised

HK$

53.37

57.80

—

56.78

—

—

59.92

54.56

63.48

62.34

59.63

56.50

—

—

—

—

58.91

53.85

—

—

—

—

—

—

—

25

3.

CORPORATE

GOVERNANCE

Notes:

1. The exercise price of the share options

is determined upon the offer of grant of the options and which should not be less than the higher of (a) the closing price per share of the Company on the date of offer of such options, which must be a business day; (b) the average closing

price per share of the Company for the five business days immediately preceding the date of offer of such options; and (c) the nominal value per share of the Company.

2. The proportion of underlying shares in respect of which the above outstanding share options will vest is as follows:

Proportion of underlying shares in respect of which the above outstanding share options will vest is as follows:

Before the first anniversary of the date of grant of the option (the “Offer Anniversary”) From the

first Offer Anniversary to the date immediately before the second Offer Anniversary From the second Offer Anniversary to the date immediately before the third Offer Anniversary From the third Offer Anniversary to the date immediately before the

fourth Offer Anniversary From the fourth Offer Anniversary and thereafter

None

One-quarter

Two-quarters

Three-quarters

All

3. On January 24, 2014, the Board declared a Special Dividend of HK$0.77 per share (the “Special Dividend”) payable to Shareholders of the Company whose names appeared on

the register of members of the Company on February 14, 2014. Pursuant to the Equity Award Plan, as a result of the Special Dividend, an equitable adjustment of the exercise price of the outstanding share options granted under the Equity Award

Plan as at February 14, 2014 was made.

When the options are forfeited after the vesting date or are still

not exercised at the expiry date, the amount previously recognized in share-based compensation reserve will be transferred to retained earnings.

The Company estimates the fair value of options granted using the Black-Scholes option-pricing model. The weighted average fair value of options granted during the six months ended

June 30, 2014, measured as at the date of grant, was approximately US$3.52.

Significant estimates and

assumptions are required to be made in determining the parameters for applying the Black-Scholes option-pricing model, including estimates and assumptions regarding the risk-free rate of return, expected dividend yield and volatility of the

underlying shares and the expected life of the options. These estimates and assumptions could have a material effect on the determination of the fair value of the share options and the amount of such equity awards expected to vest, which may in turn

significantly impact the determination of the share-based compensation expense. The following assumptions were used to derive the fair values of options granted during the six months ended June 30, 2014:

Weighted average volatility Expected term (in years) Risk-free rate Expected dividends

65.5%

6.3

1.3%

3.0%

26

SANDS

CHINA LTD. Interim Report 2014

Restricted Share Units

As at June 30, 2014, 2,797,600 restricted share units had been granted under the Equity Award Plan, none of which had

vested or lapsed.

Save as disclosed herein, no options, restricted share units or any other share-based awards

were granted under the Equity Award Plan or any share option scheme of the Group as at June 30, 2014 and no options, restricted share units or any other share-based awards were cancelled during the period.

3.12 PURCHASE, SALE OR REDEMPTION OF THE COMPANY’S LISTED SHARES

Neither the Company, nor any of its subsidiaries purchased, sold or redeemed any of the listed shares of the Company

during the six months ended June 30, 2014.

27

4.1 REPORT

ON REVIEW OF CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS

TO THE BOARD OF DIRECTORS OF SANDS CHINA LTD.

(Incorporated in the Cayman Islands with limited liability)

INTRODUCTION

We have reviewed the condensed

consolidated financial statements of Sands China Ltd. (the “Company”) and its subsidiaries (collectively referred to as the “Group”) set out on pages 29 to 56, which comprises the consolidated balance sheet as at June 30,

2014 and the related consolidated income statement, consolidated statement of comprehensive income, consolidated statement of changes in equity and condensed consolidated statement of cash flows for the six-month period then ended, and certain

explanatory notes. The Main Board Listing Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited require the preparation of a report on interim financial information to be in compliance with the relevant provisions

thereof and International Accounting Standard 34 Interim Financial Reporting (“IAS 34”). The directors of the Company are responsible for the preparation and presentation of these condensed consolidated financial statements in accordance

with IAS 34. Our responsibility is to express a conclusion on these condensed consolidated financial statements based on our review, and to report our conclusion solely to you, as a body, in accordance with our agreed terms of engagement, and for no

other purpose. We do not assume responsibility towards or accept liability to any other person for the contents of this report.

SCOPE OF REVIEW

We conducted our review in

accordance with International Standard on Review Engagements 2410 “Review of Interim Financial Information Performed by the Independent Auditor of the Entity”. A review of these condensed consolidated financial statements consists of

making inquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with International Standards

on Auditing and consequently does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

CONCLUSION

Based on our review, nothing has come to our attention that causes us to believe that the condensed consolidated financial statements are not prepared, in all material respects, in

accordance with IAS 34.

Deloitte Touche Tohmatsu

Certified Public Accountants

Hong Kong August 15, 2014

28

SANDS

CHINA LTD. Interim Report 2014

4.2 CONSOLIDATED

INCOME STATEMENT

Six months ended June 30,

2014 2013

US$’000, except per share data

(Unaudited)

Net revenues

Gaming tax

Employee benefit expenses

Depreciation and

amortization

Gaming promoter/agency commissions

Inventories consumed

Other expenses and losses

Operating profit

Interest income

Interest expense, net of amounts capitalized

Loss

on modification or early retirement of debt

Profit before income tax

Income tax expense

Profit for the period attributable to equity holders

of the Company

Earnings per share for profit

attributable to

equity holders of the Company

— Basic

— Diluted

Note

5

6

7

15

8

9

9

5,075,255

(2,169,447)

(529,555)

(257,250)

(183,949)

(49,932)

(465,309)

1,419,813

9,489

(38,193)

(17,964)

1,373,145

(2,729)

1,370,416

US16.99 cents

US16.98 cents

4,070,271

(1,777,301)

(440,988)

(246,276)

(178,766)

(40,610)

(406,105)

980,225

5,230

(44,011)

—

941,444

(949)

940,495

US11.67 cents

US11.66 cents

The notes on pages 35 to 56 form an integral part of these condensed consolidated financial statements.

29

4.2

CONSOLIDATED

STATEMENT OF COMPREHENSIVE INCOME

Profit for the period attributable to equity holders of the Company

Other comprehensive income/(loss), net of tax

Item that will not be reclassified subsequently to profit or loss:

Currency translation differences

Total

comprehensive income for the period attributable to

equity holders of the Company

1,370,416

3,823

1,374,239

940,495

(4,604)

935,891

Six months ended June 30,

2014

2013

US$’000

(Unaudited)

The notes on pages 35 to 56 form an

integral part of these condensed consolidated financial statements.

30

SANDS

CHINA LTD. Interim Report 2014

4.2 CONSOLIDATED

BALANCE SHEET

June 30, December 31,

2014 2013

US$’000

ASSETS

Non-current assets

Investment properties, net

Property and equipment, net

Intangible assets,

net

Deferred income tax assets

Other assets, net

Trade and other receivables and

prepayments, net

Total non-current assets

Current assets

Inventories

Trade and other receivables and

prepayments, net

Financial assets at fair value through profit or loss

Restricted cash and cash equivalents

Cash and cash equivalents

Total current assets

Total assets

Note

11

12

(Unaudited)

910,193

6,850,706

22,023

58

31,329

16,765

7,831,074

13,561

680,288

—

6,255

1,507,785

2,207,889

10,038,963

(Audited)

891,230

6,722,586

20,147

195

32,561

15,392

7,682,111

13,361

820,926

15

5,663

2,943,424

3,783,389

11,465,500

The notes on pages 35 to 56 form an integral part of these condensed consolidated financial statements.

31

4.2

CONSOLIDATED

BALANCE SHEET

June 30, December 31,

2014 2013

US$’000

EQUITY

Capital and reserves attributable to

equity holders

of the Company

Share capital

Reserves

Total equity

LIABILITIES

Non-current liabilities

Trade and other payables

Borrowings

Total non-current liabilities

Current liabilities

Trade and other payables

Current income tax

liabilities

Borrowings

Total current liabilities

Total liabilities

Total equity and liabilities

Net current assets

Total assets less current

liabilities

Note

13

14

15

14

15

(Unaudited)

80,659

5,161,587

5,242,246

69,477

3,186,855

3,256,332

1,531,608

2,697

6,080

1,540,385

4,796,717

10,038,963

667,504

8,498,578

(Audited)

80,632

6,369,250

6,449,882

59,618

3,022,903

3,082,521

1,724,343

1,968

206,786

1,933,097

5,015,618

11,465,500

1,850,292

9,532,403

Approved by the Board of Directors on August 15, 2014 and signed on behalf of the Board by

Edward Matthew Tracy

Director

Toh Hup Hock

Director

The notes on pages 35 to 56 form an integral part of these condensed consolidated financial statements.

32

SANDS

CHINA LTD. Interim Report 2014

4.2 CONSOLIDATED

STATEMENT OF CHANGES IN EQUITY

For the six months ended

June 30, 2013

Balance at January 1, 2013

Profit for the period

Other comprehensive loss

for the period, net of tax

Total comprehensive income

Transfer to statutory

reserve

Exercise of share options

Transfer to share premium upon

exercise of share

options

Share-based compensation

of the Company

Share-based compensation

charged by LVS

Dividends to equity holders

of the Company (Note

10)

Balance at June 30, 2013

For the six months ended

June 30, 2014

Balance at January 1, 2014

Profit for the period

Other comprehensive income

for the period, net of tax

Total comprehensive income

Exercise of share

options

Transfer to share premium upon

exercise of share options

Share-based compensation

of the Company

Share-based compensation

charged by LVS

Dividends to equity holders

of the Company (Note 10)

Balance at June 30, 2014

Share

capital

80,554

—

—

—

—

21

—

—

—

—

80,575

80,632

—

—

—

27

—

—

—

—

80,659

Capital

reserve

87,435

—

—

—

—

—

—

—

—

—

87,435

87,435

—

—

—

—

—

—

87,435

Share

premium

2,150,228

—

—

—

—

4,643

2,702

—

—

—

2,157,573

2,180,495

—

—

—

6,636

3,866

—

—

(800,563)

1,390,434

Statutory

reserve

6,316

—

—

—

1

—

—

—

—

—

6,317

6,317

—

—

—

—

—

6,317

Share-based

compensation

reserves

50,748

—

—

—

—

—

(2,702)

5,389

420

—

53,855

52,731

—

—

—

—

—

(3,866)

11,635

390

—

60,890

Currency

translation

reserve

9,712

—

(4,604)

(4,604)

—

—

—

—

—

—

5,108

7,804

—

3,823

3,823

—

—

—

—

—

11,627

Retained

earnings

3,201,133

940,495

—

940,495

(1)

—

—

—

—

(1,381,546)

2,760,081

4,034,468

1,370,416

—

1,370,416

—

—

—

—

(1,800,000)

3,604,884

Total

5,586,126

940,495

(4,604)

935,891

—

4,664

—

5,389

420