UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 or 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of August 2014

Commission File Number 001-36204

ENERGY FUELS INC.

(Translation of

registrant’s name into English)

225 Union Blvd.

Suite 600

Lakewood, CO 80228

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover Form 20-F or Form 40-F

Form 20-F [

]

Form 40-F [X]

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Note: Regulation S-T Rule 101(b)(1) only permits the

submission in paper of a Form 6-K if submitted solely to provide an attached

annual report to security holders.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Note: Regulation S-T Rule 101(b)(7) only permits the

submission in paper of a Form 6-K if submitted to furnish a report or other

document that the registrant foreign private issuer must furnish and make public

under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant’s “home country”), or under the

rules of the home country exchange on which the registrant’s securities are

traded, as long as the report or other document is not a press release, is not

required to be and has not been distributed to the registrant’s security

holders, and, if discussing a material event, has already been the subject of a

Form 6-K submission or other Commission filing on EDGAR.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

ENERGY FUELS INC.

| |

/S/ David C.

Frydenlund

|

| |

David C. Frydenlund |

| Date: August 20, 2014 |

Senior Vice President, General Counsel &

Corporate Secretary |

-2-

INDEX TO EXHIBITS

-3-

Exhibit 99.1

Energy Fuels Announces Closing of Sale of

Non-Core Mining Assets

Toronto, Ontario and Lakewood, Colorado – August 20, 2014

Energy Fuels Inc. (NYSE MKT:UUUU; TSX:EFR) (“Energy Fuels”

or the “Company”) is pleased to announce that it has completed the

previously announced sale of certain non-core uranium assets to a private

investor group led by Baobab Asset Management LLC and George Glasier. As

previously reported, the transaction involved certain mining assets located

along the Colorado-Utah border, including the Sunday Mine Complex, the Willhunt

project, the San Rafael project, the Sage mine, the Van 4 mine, the Farmer Girl

project, the Dunn project and the Yellow Cat project. As a result of the closing

of this transaction, the Company has received cash and other consideration

totaling US$1,500,000, plus another US$151,000 of cash to reimburse the Company

for certain pre-closing expenses. In addition, the Company retained a 1%

production royalty on all of the properties and expects to receive an additional

US$230,000 of cash from the return of collateral from the bonds on the sold

properties. The Piñon Ridge Mill license and related property, included in the

previously announced transaction, are expected to close within two months,

subject to regulatory approval.

Stephen P. Antony, President and CEO of Energy Fuels, stated:

“We are pleased to close this transaction as part of our continued asset

rationalization and cost reduction efforts. By monetizing these non-core uranium

mining assets, Energy Fuels is able to improve our balance sheet and realize

reductions in holding, permitting and compliance costs. Even though Energy Fuels

no longer owns these properties, they still have the potential to provide future

benefits to our White Mesa Mill through toll milling and similar arrangements,

along with the associated production royalties. The White Mesa Mill remains the

only operational uranium production facility in the region.”

About Energy Fuels: Energy Fuels is currently

America’s largest conventional uranium producer, supplying approximately 25% of

the uranium produced in the U.S. in 2013. Energy Fuels operates the White Mesa

Mill, which is the only conventional uranium mill currently operating in the

U.S. The mill is capable of processing 2,000 tons per day of uranium ore and

has a licensed capacity of over 8 million lbs. of

U3O8. Energy Fuels has projects located in a number

of Western U.S. states, including a producing mine, mines on standby, and

mineral properties in various stages of permitting and development. The

Company’s common shares are listed on the Toronto Stock Exchange under the

trading symbol “EFR”, and on the NYSE MKT under the trading symbol “UUUU”.

Cautionary Note Regarding Forward-Looking Statements:

This news release contains certain “Forward Looking Information” and

“Forward Looking Statements” within the meaning of applicable Canadian and

United States securities legislation, which may include, but is not limited to, statements with respect to the ability to

realize reductions in holding, permitting and compliance costs and the potential

of the properties to provide future benefits to the White Mesa Mill through toll

milling and similar arrangements, as well as the expected closing of the sale of

the Piñon Ridge Mill License and related property and the timing thereof.

Generally, these forward-looking statements can be identified by the use of

forward-looking terminology such as “plans”, “expects” “does not expect”, “is

expected”, “is likely”, “budget” “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates”, “does not anticipate”, or “believes”, or variations of

such words and phrases, or state that certain actions, events or results “may”,

“could”, “would”, “might” or “will be taken”, “occur”, “be achieved” or “have

the potential to”. All statements, other than statements of historical fact,

herein are considered to be forward-looking statements. Forward-looking

statements involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of the Company

to be materially different from any future results, performance or achievements

express or implied by the forward-looking statements. Factors that could cause

actual results to differ materially from those anticipated in these

forward-looking statements include: the expected cost savings from the sale, the

potential for toll milling and similar arrangements, the viability of the White

Mesa Mill, the return of collateral, the anticipated closing on the Piñon Ridge

assets, and the other factors described under the caption “Risk Factors” in the

Company’s Annual Information Form dated March 26, 2014, which is available for

review on SEDAR at www.sedar.com, and in its Form 40-F, which is

available for review on EDGAR at www.sec.gov/edgar.shtml. Forward-looking

statements contained herein are made as of the date of this news release, and

the Company disclaims, other than as required by law, any obligation to update

any forward-looking statements whether as a result of new information, results,

future events, circumstances, or if management’s estimates or opinions should

change, or otherwise. There can be no assurance that forward-looking statements

will prove to be accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly, the reader is

cautioned not to place undue reliance on forward-looking statements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Energy Fuels Inc.

Curtis H. Moore

Investor Relations

(303) 974-2140 or Toll free: 1-888-864-2125

investorinfo@energyfuels.com

www.energyfuels.com

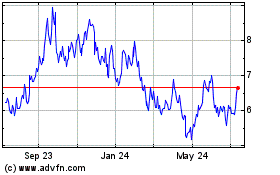

Energy Fuels (AMEX:UUUU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Energy Fuels (AMEX:UUUU)

Historical Stock Chart

From Apr 2023 to Apr 2024