UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): August 14, 2014

Aastrom Biosciences, Inc.

(Exact name of registrant as specified in its charter)

|

Michigan |

|

000-22025 |

|

94-3096597 |

|

(State or other jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

|

of incorporation) |

|

File Number) |

|

Identification No.) |

|

24 Frank Lloyd Wright Drive, P.O. Box

376, Ann Arbor, Michigan |

|

48106 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (734) 418-4400

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition

On August 14, 2014, the Registrant issued a press release, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

|

Exhibit 99.1 |

|

Press release, dated August 14, 2014. |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: August 14, 2014 |

Aastrom Biosciences, Inc. |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Gerard Michel |

|

|

Name: |

Gerard Michel |

|

|

Title: |

Chief Financial Officer, and Vice President |

|

|

|

Corporate Development |

3

Exhibit 99.1

Aastrom Biosciences Reports Second Quarter 2014 Financial Results

U.S. Commercial Business Generates Positive Contribution

Conference Call Today at 8:30 a.m. Eastern Time

ANN ARBOR, Mich., August 14, 2014 (GLOBE NEWSWIRE) — Aastrom Biosciences, Inc. (Nasdaq: ASTM), a leading developer of patient-specific, expanded cellular therapies for the treatment of severe diseases and conditions, today reported financial results for the quarter ended June 30, 2014. These results are the first financial results reported following the May 30, 2014 acquisition of Sanofi’s cell therapy and regenerative medicine business (the acquired business).

Aastrom reported a net loss for the quarter ended June 30, 2014 of $4.6 million, or $0.94 per share, compared to $4.9 million, or $2.72 per share, for same period a year ago. The results for the three months ended June 30, 2014 incorporate one month of operating results of the acquired business, which generated $2.6 million of the reported GAAP loss for the period. The loss included restructuring charges of $3.0 million and expenses of $0.2 million from the acquired business in Denmark which is in the process of being closed. Adjusting for those charges, the U.S. commercial business generated a positive contribution of $0.6 million in the second quarter.

Net revenues for the quarter ended June 30, 2014 were $4.4 million and reflect one month of results from commercial operations of the acquired business in the U.S. Revenues were comprised of approximately $3.4 million of net sales of Carticel® implants and surgical kits, approximately $0.9 million of net sales of Epicel® grafts and biopsy kits, and approximately $0.1 million of revenue from commercial sales of bone marrow generated by Marrow Donation, LLC in June 2014.

Gross profit for the quarter ended June 30, 2014 was ($0.6) million. Gross profit was significantly reduced by $2.4 million of charges included in cost of goods sold related to the recently announced restructuring of the acquired business.

Research and development expenses for the quarter ended June 30, 2014 were $4.4 million versus $3.7 million for the same period a year ago. The increase in research and development expenses is due primarily to an increase in clinical trial expenses resulting from increased enrollment in the Phase 2b ixCELL-DCM clinical trial of ixmyelocel-T for the treatment of advanced heart failure due to ischemic dilated cardiomyopathy (DCM).

General and administrative expenses for the quarter ended June 30, 2014 were $3.6 million compared to $1.6 million for the same period a year ago. The increase in SG&A expenses is due to an increase of approximately $0.4 million in legal and other expenses related to the acquisition of the acquired business, approximately $0.6 million in restructuring expenses, approximately $0.8 million in additional SG&A costs related to the acquired business in the U.S., and $0.2 million in SG&A costs from the acquired business in Denmark which is in the process of being closed.

1

Other income for the quarter ended June 30, 2014 was $3.9 million compared to $0.3 million for the same period a year ago. The increase in other income is primarily due to a bargain purchase gain of $3.6 million associated with the acquisition of the acquired business. The gain was recorded based upon preliminary fair values assigned to the assets acquired and liabilities assumed upon the closing of the acquisition.

As of June 30, 2014, the company had $7.3 million in cash and cash equivalents compared to $8.1 million in cash and cash equivalents at December 31, 2013. For the six months ended June 30, 2014, cash used for operations was $10.7 million.

Recent Business Highlights

During and since the second quarter of 2014, the company has:

· Completed its acquisition of Sanofi’s cell therapy and regenerative medicine business;

· Implemented aggressive cost-cutting and revenue-enhancing initiatives;

· Achieved second-quarter positive contribution for its U.S. commercial operations;

· Initiated commercial sales of bone marrow through its Marrow Donation, LLC subsidiary;

· Appointed Gerard Michel as chief financial officer;

· Appointed Zac Taylor as national sales director; and

· Achieved enrollment and treatment of more than 50% of patients in the Phase 2b ixCELL-DCM clinical trial of ixmyelocel-T for the treatment of advanced heart failure due to ischemic dilated cardiomyopathy (DCM).

“We are successfully implementing our strategic plan for the acquired business and, excluding restructuring charges, achieved a positive contribution from the acquired U.S. commercial business during the second quarter,” said Nick Colangelo, president and chief executive officer of Aastrom. “Our autologous cell therapy franchise now includes two marketed products in the United States, a high-potential late-stage pipeline and a recently launched bone marrow commercial business which reflects our commitment to and expanding leadership position in the field of regenerative medicine.”

Conference Call Information

Aastrom’s management will host a conference call to discuss these results today at 8:30 a.m. Eastern time. Interested parties should call toll-free (877) 312-5881, or from outside the U.S. (253) 237-1173 and use conference ID 44774762. The call will be available live in the Investors section of Aastrom’s website at http://investors.aastrom.com/investors.cfm. A replay of the call will be available until August 18, 2014 by calling (855) 859-2056, or from outside the U.S. at (404) 537-3406 and using conference ID 44774762.

About Aastrom Biosciences

Aastrom Biosciences is the leader in developing patient-specific expanded cellular therapies for use in the treatment of patients with severe diseases and conditions. Aastrom markets two

2

autologous cell therapy products in the United States for the treatment of cartilage repair and skin replacement. Aastrom is also developing MACI™, a third-generation autologous chondrocyte implant for the treatment of cartilage defects in the knee, and ixmyelocel-T, a patient-specific multicellular therapy for the treatment of advanced heart failure due to ischemic dilated cardiomyopathy. For more information, please visit Aastrom’s website at www.aastrom.com.

The Aastrom Biosciences, Inc. logo is available at http://www.globenewswire.com/newsroom/prs/?pkgid=3663

This document contains forward-looking statements, including, without limitation, statements concerning anticipated progress, objectives and expectations regarding the commercial potential of our products and growth in revenues, intended product development, clinical activity timing, and objectives and expectations regarding the business opportunity described herein, all of which involve certain risks and uncertainties. These statements are often, but are not always, made through the use of words or phrases such as “anticipates,” “intends,” “estimates,” “plans,” “expects,” “we believe,” “we intend,” and similar words or phrases, or future or conditional verbs such as “will,” “would,” “should,” “potential,” “could,” “may,” or similar expressions. Actual results may differ significantly from the expectations contained in the forward-looking statements. Among the factors that may result in differences are the inherent uncertainties associated with competitive developments, clinical trial and product development activities, regulatory approval requirements, the availability and allocation of resources among different potential uses, estimating the commercial potential of our products and product candidates and growth in revenues, market demand for our products, and our ability to supply or meet customer demand for our products. These and other significant factors are discussed in greater detail in Aastrom’s Annual Report on Form 10-K for the year ended December 31, 2013, filed with the Securities and Exchange Commission (“SEC”) on March 13, 2014, Quarterly Reports on Form 10-Q and other filings with the SEC. These forward-looking statements reflect management’s current views and Aastrom does not undertake to update any of these forward-looking statements to reflect a change in its views or events or circumstances that occur after the date of this release except as required by law.

3

AASTROM BIOSCIENCES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited, amounts in thousands)

|

|

|

June 30, |

|

December 31, |

|

|

|

|

2014 |

|

2013 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash |

|

$ |

7,263 |

|

$ |

8,059 |

|

|

Accounts receivable |

|

4,317 |

|

8 |

|

|

Inventory |

|

1,922 |

|

— |

|

|

Other current assets |

|

610 |

|

409 |

|

|

Total current assets |

|

14,112 |

|

8,476 |

|

|

Property and equipment, net |

|

2,387 |

|

739 |

|

|

Intangible assets |

|

3,337 |

|

— |

|

|

Total assets |

|

$ |

19,836 |

|

$ |

9,215 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

9,845 |

|

$ |

2,676 |

|

|

Accrued employee benefits |

|

1,732 |

|

620 |

|

|

Short-term debt |

|

2,500 |

|

6 |

|

|

Warrant liabilities |

|

2,974 |

|

2,019 |

|

|

Total current liabilities |

|

17,051 |

|

5,321 |

|

|

|

|

|

|

|

|

|

Shareholders’ equity: |

|

|

|

|

|

|

Series B-2 voting convertible preferred stock, no par value: shares authorized and reserved — 39, shares issued and outstanding — 12 |

|

38,389 |

|

38,389 |

|

|

Common stock, no par value; shares authorized — 75,000 and 15,000; shares issued and outstanding — 7,019 and 4,723, respectively |

|

262,789 |

|

253,270 |

|

|

Other comprehensive income |

|

5 |

|

— |

|

|

Accumulated deficit |

|

(298,398 |

) |

(287,765 |

) |

|

Total shareholders’ equity |

|

2,785 |

|

3,894 |

|

|

Total liabilities and shareholders’ equity |

|

$ |

19,836 |

|

$ |

9,215 |

|

4

AASTROM BIOSCIENCES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, amounts in thousands except per share amounts)

|

|

|

Quarter Ended

June 30, |

|

Six Months Ended

June 30, |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

Product sales |

|

$ |

4,432 |

|

$ |

3 |

|

$ |

4,432 |

|

$ |

11 |

|

|

Total revenues |

|

4,432 |

|

3 |

|

4,432 |

|

11 |

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

Cost of product sales |

|

5,009 |

|

1 |

|

5,009 |

|

3 |

|

|

Gross Profit (Loss) |

|

(577 |

) |

2 |

|

(577 |

) |

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

4,364 |

|

3,676 |

|

7,635 |

|

9,214 |

|

|

Selling, general and administrative |

|

3,581 |

|

1,560 |

|

4,954 |

|

3,193 |

|

|

Total operating expenses |

|

7,945 |

|

5,236 |

|

12,589 |

|

12,407 |

|

|

Loss from operations |

|

(8,522 |

) |

(5,234 |

) |

(13,166 |

) |

(12,399 |

) |

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

(Increase) decrease in fair value of warrants |

|

248 |

|

345 |

|

(1,104 |

) |

1,964 |

|

|

Bargain purchase gain |

|

3,634 |

|

— |

|

3,634 |

|

— |

|

|

Interest income |

|

4 |

|

3 |

|

6 |

|

8 |

|

|

Interest expense |

|

(2 |

) |

(3 |

) |

(3 |

) |

(6 |

) |

|

Total other income (expense) |

|

3,884 |

|

345 |

|

2,533 |

|

1,966 |

|

|

Net loss |

|

$ |

(4,638 |

) |

$ |

(4,889 |

) |

$ |

(10,633 |

) |

$ |

(10,433 |

) |

|

Net loss per share attributable to common shareholders (Basic and Diluted) |

|

$ |

(0.94 |

) |

$ |

(2.72 |

) |

$ |

(2.18 |

) |

$ |

(5.75 |

) |

|

Weighted average number of common shares outstanding (Basic and Diluted) |

|

6,518 |

|

2,283 |

|

6,195 |

|

2,263 |

|

5

AASTROM BIOSCIENCES, INC.

CONDENSED STATEMENT OF OPERATIONS — LEGACY AND ACQUIRED BUSINESS

(Unaudited, amounts in thousands except per share amounts)

|

|

|

For the Three and Six months ended June 30, 2014 |

|

|

|

|

For the Three Months Ended June 30, 2014 |

|

For the Six Months Ended June 30, 2014 |

|

|

|

|

Legacy

Business |

|

Acquired

Business |

|

Consolidated |

|

Legacy

Business |

|

Acquired

Business |

|

Consolidated |

|

|

Total revenues |

|

$ |

59 |

|

$ |

4,373 |

|

$ |

4,432 |

|

$ |

59 |

|

$ |

4,373 |

|

$ |

4,432 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of product sales |

|

87 |

|

4,922 |

|

5,009 |

|

87 |

|

4,922 |

|

5,009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit (loss) |

|

(28 |

) |

(549 |

) |

(577 |

) |

(28 |

) |

(549 |

) |

(577 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses |

|

5,851 |

|

2,094 |

|

7,945 |

|

10,495 |

|

2,094 |

|

12,589 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from Operations |

|

(5,879 |

) |

(2,643 |

) |

(8,522 |

) |

(10,523 |

) |

(2,643 |

) |

(13,166 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense) |

|

250 |

|

— |

|

250 |

|

(1,101 |

) |

— |

|

(1,101 |

) |

|

Bargain purchase gain |

|

3,634 |

|

— |

|

3,634 |

|

3,634 |

|

— |

|

3,634 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total other income |

|

3,884 |

|

— |

|

3,884 |

|

2,533 |

|

— |

|

2,533 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss |

|

$ |

(1,995 |

) |

$ |

(2,643 |

) |

$ |

(4,638 |

) |

$ |

(7,990 |

) |

$ |

(2,643 |

) |

$ |

(10,633 |

) |

6

NON-GAAP FINANCIAL MEASURE

In addition to the results reported in accordance with generally accepted accounting principles in the United States (GAAP), management is providing information regarding a non-GAAP financial measure. The Company completed its acquisition of the U.S. Commercial Business in the quarter ended June 30, 2014, and shortly thereafter incurred significant restructure costs. These costs are included in the financial results for the quarter. The Company is providing this non-GAAP financial measure to help investors better understand the future impact of the acquired business on Aastrom’s financial performance after certain costs, such as severance payments and other costs associated with the restructure activities. During the quarter ended June 30, 2014, management used this non-GAAP financial measure in making decisions related to the operations of the acquired business because, in addition to meaningful supplemental information regarding the future operating performance of the acquired business, the measure gives us a better understanding of the acquired business and the resources we should devote to successfully integrating the acquired business and ultimately achieve profitability. The non-GAAP measure is intended only as a supplement to the comparable GAAP measurement and the Company compensated for the limitations inherent in the use of this non-GAAP measure by using a GAAP measure in conjunction with the non-GAAP measure. As a result, investors should consider this non-GAAP measure in addition to, and not in substitution for or as superior to, the comparable measurement of financial performance prepared in accordance with GAAP.

Non-GAAP Financial Measure:

(in thousands of dollars):

|

|

|

2014 |

|

|

Net loss - GAAP |

|

$ |

(4,638 |

) |

|

Legacy business loss |

|

1,995 |

|

|

Subtotal — Acquired business results |

|

(2,643 |

) |

|

Restructure costs |

|

3,005 |

|

|

Denmark business expenses |

|

231 |

|

|

Contribution from U.S. commercial business — Non-GAAP |

|

$ |

593 |

|

7

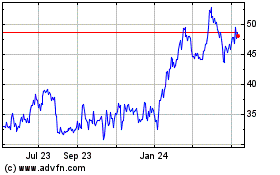

Vericel (NASDAQ:VCEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vericel (NASDAQ:VCEL)

Historical Stock Chart

From Apr 2023 to Apr 2024