El Paso Electric Company (NYSE:EE):

Overview

- For the second quarter of 2014, El Paso

Electric Company ("EE" or the "Company") reported net income of

$30.1 million, or $0.75 basic and diluted earnings per share. In

the second quarter of 2013, EE reported net income of $29.2

million, or $0.73 and $0.72 basic and diluted earnings per share,

respectively.

- For the six months ended June 30, 2014,

EE reported net income of $34.7 million, or $0.86 basic and diluted

earnings per share. Net income for the six months ended June 30,

2013 was $36.8 million, or $0.92 basic and diluted earnings per

share.

“El Paso Electric achieved several significant milestones in the

second quarter of 2014. First, we began construction of our new

Montana Power Station Units 1 and 2; second, we reached a new

native system peak of 1,766 MW on June 4, 2014, and continue to see

growth in the number of customers we serve; and, finally, we

successfully settled our 2013 Texas fuel reconciliation case. This

settlement covers $545.3 million of fuel and purchased power

expenses incurred during the 45-month period of July 1, 2009

through March 31, 2013,” said Tom Shockley, Chief Executive

Officer. “Our earnings for the second quarter of 2014 were slightly

ahead of the corresponding quarter of 2013 and include Palo Verde

performance rewards realized after settling the Texas fuel

reconciliation proceeding which added $0.04 earnings per share in

our most recent quarter.”

Earnings Summary

The table and explanations below present the major factors

affecting 2014 net income relative to 2013 net income:

Quarter Ended

Six Months Ended Pre-Tax

Effect

After-TaxNetIncome

BasicEPS

Pre-TaxEffect

After-TaxNetIncome

BasicEPS

June 30, 2013 $ 29,193 $ 0.73 $ 36,827 $ 0.92 Changes in: Palo

Verde performance rewards, net $ 2,143 1,415 0.04 $ 2,143 1,415

0.04 Allowance for funds used during construction 1,395 1,242 0.03

1,699 1,525 0.04 Miscellaneous income and deductions 1,624 1,072

0.03 3,192 2,107 0.05 Investment and interest income 71 27 — 3,081

2,436 0.06 Taxes other than income taxes (1,710 ) (1,128 ) (0.03 )

(4,290 ) (2,831 ) (0.07 ) Depreciation and amortization (1,521 )

(1,005 ) (0.03 ) (2,721 ) (1,796 ) (0.05 ) Retail non-fuel base

revenues (883 ) (583 ) (0.02 ) (5,676 ) (3,746 ) (0.09 ) Other (137

) — (1,226 ) (0.04 ) June 30, 2014 $ 30,096 $ 0.75

$ 34,711 $ 0.86

Second Quarter 2014

Income for the quarter ended June 30, 2014, when compared to the

same period last year, was positively affected by:

- Recognition of Palo Verde performance

rewards associated with the 2009 to 2012 performance periods, net

of disallowed fuel and purchased power costs related to the

resolution of the Texas fuel reconciliation proceeding designated

as PUCT Docket No. 41852.

- Increased allowance for funds used

during construction ("AFUDC") due to higher balances of

construction work in progress subject to AFUDC.

- Increased miscellaneous income and

deductions, primarily due to gains recognized on the sale of assets

in 2014 with no comparable activity in the same period of 2013, and

decreased donations.

Income for the quarter ended June 30, 2014, when compared to the

same period last year, was negatively affected by:

- Increased taxes other than income taxes

primarily due to higher property taxes.

- Increased depreciation and amortization

due to increased depreciable plant balances including Rio Grande

Unit 9, which began commercial operation on May 13, 2013.

- Decreased retail non-fuel base revenues

primarily due to a $0.8 million reduction in non-fuel base revenues

from sales to our residential customers reflecting a 1.5% decrease

in kWh sales due to milder weather in the second quarter of 2014

compared to the same period last year.

Year to Date

Income for the six months ended June 30, 2014, when compared to

the same period last year, was positively affected by:

- Increased investment and interest

income primarily due to net realized gains on equity investments in

our Palo Verde decommissioning trust funds compared to the same

period last year.

- Increased miscellaneous income and

deductions, primarily due to the gains recognized on the sale of

assets in 2014 with no comparable activity in the same period last

year, and decreased donations.

- Increased AFUDC due to higher balances

of construction work in progress subject to AFUDC.

- Recognition of Palo Verde performance

rewards associated with the 2009 to 2012 performance periods, net

of disallowed fuel and purchased power costs related to the

resolution of the Texas fuel reconciliation proceeding designated

as PUCT Docket No. 41852.

Income for the six months ended June 30, 2014, when compared to

the same period last year, was negatively affected by:

- Decreased retail non-fuel base revenues

primarily due to a $4.8 million reduction in non-fuel base revenues

from sales to our residential customers reflecting a 5.2% decrease

in kWh sales due to milder weather in 2014, particularly in the

first quarter of 2014, when compared to the same period last

year.

- Increased taxes other than income taxes

primarily due to higher property taxes including a one-time

adjustment to the 2013 Arizona property tax rate recorded during

the first quarter of 2014.

- Increased depreciation and amortization

due to increased depreciable plant balances including Rio Grande

Unit 9, which began commercial operation on May 13, 2013.

Retail Non-fuel Base Revenues

Retail non-fuel base revenues decreased $0.9 million, pre-tax,

or 0.6% in the second quarter of 2014 compared to the same period

in 2013. This decrease reflects milder weather in the second

quarter of 2014, which impacted sales to residential, small

commercial, and to a lesser extent public authority customers.

Cooling degree days decreased 3.8% for the second quarter of 2014

compared to the same quarter last year but remained higher than the

10-year average by 4.2%. KWh sales to residential customers

decreased by 1.5%, despite a 1.3% increase in the average number of

residential customers served. KWh sales to small commercial and

industrial customers in the second quarter of 2014 decreased 1.7%

compared to the same quarter in 2013, despite a 1.9% increase in

the average number of customers served. Retail non-fuel base

revenues from sales to public authorities increased slightly,

primarily due to demand charges, despite a 0.5% decrease in kWh

sales to public authorities compared to the same quarter in 2013.

Retail non-fuel base revenues and kWh sales to large commercial and

industrial customers were relatively unchanged for the quarter.

Non-fuel base revenues and kWh sales are provided by customer class

on page 10 of this release.

For the six months ended June 30, 2014, retail non-fuel base

revenues decreased $5.7 million, pre-tax, or 2.2% compared to the

same period in 2013. This decrease reflects milder weather in the

first six months of 2014, which impacted sales to residential,

small commercial, and to a lesser extent public authority

customers. Heating degree days decreased 26.6% for the six months

of 2014 compared to the same period last year and were 17.0% below

the 10-year average. Cooling degree days decreased 4.4% compared to

the same period last year but remained higher than the 10-year

average by 4.0%. KWh sales to residential customers decreased by

5.2% despite a 1.3% increase in the average number of residential

customers served. KWh sales to small commercial and industrial

customers decreased 1.6% compared to the same period in 2013,

despite a 2.0% increase in the average number of customers served.

KWh sales to large commercial and industrial customers decreased

3.4% and non-fuel base revenues decreased 1.5%. While kWh sales to

public authorities in the six months of 2014 decreased

approximately 2.3% compared to the same period in 2013, non-fuel

base revenues increased slightly due to demand charges. Non-fuel

base revenues and kWh sales are provided by customer class on page

12 of this release.

Texas Fuel Reconciliation Proceeding

On July 11, 2014, the PUCT approved a settlement in the Texas

fuel reconciliation proceeding designated as PUCT Docket No. 41852.

The settlement provides for the reconciliation of fuel and

purchased power costs incurred from July 1, 2009 through March 31,

2013. The quarter ended June 30, 2014 financial results includes a

$2.1 million, pre-tax increase to income reflecting the settlement

of the Texas fuel reconciliation proceeding. This amount includes

Palo Verde performance rewards associated with the 2009 to 2012

performance periods net of disallowed fuel and purchased power

costs as determined by the PUCT.

Quarterly Cash Dividend

On May 29, 2014, the Board of Directors approved an increase to

the quarterly cash dividend to $0.28 per share of common stock from

our previous quarterly rate of $0.265 per share. This represents an

increase in the annualized cash dividend from $1.06 to $1.12 per

share. The dividend increase commenced with the June 30, 2014

payments. On July 24, 2014, the Board of Directors declared a

quarterly cash dividend of $0.28 per share payable on September 30,

2014 to shareholders of record on September 15, 2014.

Capital and Liquidity

We continue to maintain a strong capital structure to ensure

access to capital markets at reasonable rates. At June 30, 2014,

common stock equity represented 47.0% of our capitalization (common

stock equity, long-term debt, and short-term borrowings under the

revolving credit facility (the "RCF")). At June 30, 2014, we had a

balance of $12.7 million in cash and cash equivalents. We expect to

issue long-term debt in the capital markets in 2014 or early 2015

to repay short-term borrowings and finance capital requirements.

Based on current projections, we believe that we will have adequate

liquidity through the issuance of long-term debt, our current cash

balances, cash from operations, and available borrowings under the

RCF to meet all of our anticipated cash requirements for the next

twelve months.

Cash flows from operations for the six months ended June 30,

2014 were $57.0 million compared to $51.4 million in the

corresponding period in 2013. The primary factors affecting the

increased cash flow were the funding of $17.9 million for employee

pension and other post-retirement benefit plans in the first six

months of 2013 compared to $6.9 million in the first six months of

2014, and a decrease in accounts receivable due to the timing of

customer payments. These increases in cash flows from operations

were partially offset by an increase in the under-collection of

fuel revenues. The difference between fuel revenues collected and

fuel expense incurred is deferred to be either refunded

(over-recoveries) or surcharged (under-recoveries) to customers in

the future. During the six months ended June 30, 2014, the Company

had a fuel under-recovery of $13.4 million compared to an

under-recovery of fuel costs of $8.9 million during the six months

ended June 30, 2013. At June 30, 2014, we had a net fuel

under-recovery balance of $19.6 million, including an

under-recovery balance of $17.2 million in Texas, $2.3 million in

New Mexico, and $0.1 million for our FERC customer. On April 15,

2014, we filed a request to increase our Texas fixed fuel factor by

6.9% to reflect increases in prices for natural gas. This increase

received final approval on May 28, 2014 and was effective with May

2014 billings.

During the six months ended June 30, 2014, our primary capital

requirements were for the construction and purchase of electric

utility plant, payment of common stock dividends, and purchases of

nuclear fuel. Capital requirements for new electric plant were

$106.0 million for the six months ended June 30, 2014 and $110.3

million for the six months ended June 30, 2013. Capital

expenditures for 2014 are expected to be $316 million as we

construct the Montana Power Station and related transmission

facilities. Capital requirements for purchases of nuclear fuel were

$17.7 million for the six months ended June 30, 2014 and

$16.9 million for the six months ended June 30, 2013.

On June 30, 2014, we paid a quarterly cash dividend of $0.28 per

share, or $11.3 million to shareholders of record on June 13, 2014.

We paid a total of $22.0 million in cash dividends during the six

months ended June 30, 2014. At the current dividend rate, we expect

to pay cash dividends of approximately $44.6 million during

2014.

No shares of common stock were repurchased during the six months

ended June 30, 2014. As of June 30, 2014, a total of 393,816 shares

remain available for repurchase under the currently authorized

stock repurchase program. The Company may repurchase shares in the

open market from time to time.

We maintain the RCF for working capital and general corporate

purposes and financing of nuclear fuel through the Rio Grande

Resources Trust ("RGRT"). The RGRT, the trust through which we

finance our portion of nuclear fuel for Palo Verde, is consolidated

in the Company's financial statements. The RCF has a term ending

January 14, 2019. The aggregate unsecured borrowing available under

the RCF is $300 million. We may increase the RCF by up to $100

million (up to a total of $400 million) during the term of the

agreement, upon the satisfaction of certain conditions, more fully

set forth in the agreement, including obtaining commitments from

lenders or third party financial institutions. The amounts we

borrow under the RCF may be used for working capital and general

corporate purposes. The total amount borrowed for nuclear fuel by

the RGRT was $126.8 million at June 30, 2014 of which $16.8 million

had been borrowed under the RCF and $110 million was borrowed

through senior notes. Borrowings by the RGRT for nuclear fuel were

$130.3 million as of June 30, 2013, of which $20.3 million had been

borrowed under the RCF and $110 million was borrowed through senior

notes. Interest costs on borrowings to finance nuclear fuel are

accumulated by the RGRT and charged to us as fuel is consumed and

recovered through fuel recovery charges. At June 30, 2014, $81.0

million was outstanding under the RCF for working capital and

general corporate purposes and we expect to refinance the working

capital and general corporate borrowings on the RCF with long-term

debt in late 2014 or early 2015. At June 30, 2013, $6.0 million was

outstanding under the RCF for working capital or general corporate

purposes.

2014 Earnings Guidance

We are narrowing our earnings guidance for 2014 to $2.15 to

$2.40 per basic share from the previous range of $2.10 to

$2.50.

Conference Call

A conference call to discuss second quarter 2014 financial

results is scheduled for 10:30 A.M. Eastern Daylight Time, on

August 6, 2014. The dial-in number is 888-401-4669 with a

conference ID number of 6099953. The international dial-in number

is 719-785-1753. The conference leader will be John Boomer, Vice

President, Treasurer. A replay will run through August 20, 2014

with a dial-in number of 888-203-1112 and a conference ID number of

6099953. The replay international dial-in number is 719-457-0820.

The conference call and presentation slides will be webcast live on

the Company's website found at http://www.epelectric.com. A replay of the webcast

will be available shortly after the call.

Safe Harbor

This news release includes statements that may constitute

forward-looking statements made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

This information may involve risks and uncertainties that could

cause actual results to differ materially from such forward-looking

statements. Factors that could cause or contribute to such

differences include, but are not limited to: (i) increased prices

for fuel and purchased power and the possibility that regulators

may not permit EE to pass through all such increased costs to

customers or to recover previously incurred fuel costs in rates;

(ii) recovery of capital investments and operating costs

through rates in Texas and New Mexico; (iii) uncertainties and

instability in the general economy and the resulting impact on EE's

sales and profitability; (iv) changes in customers' demand for

electricity as a result of energy efficiency initiatives and

emerging competing services and technologies; (v) unanticipated

increased costs associated with scheduled and unscheduled outages

of generating plant; (vi) the size of our construction program and

our ability to complete construction on budget; (vii) potential

delays in our construction schedule due to legal challenges or

other reasons; (viii) costs at Palo Verde;

(ix) deregulation and competition in the electric utility

industry; (x) possible increased costs of compliance with

environmental or other laws, regulations and policies;

(xi) possible income tax and interest payments as a result of

audit adjustments proposed by the IRS or state taxing authorities;

(xii) uncertainties and instability in the financial markets

and the resulting impact on EE's ability to access the capital and

credit markets; and (xiii) other factors detailed by EE in its

public filings with the Securities and Exchange Commission. EE's

filings are available from the Securities and Exchange Commission

or may be obtained through EE's website, http://www.epelectric.com. Any such

forward-looking statement is qualified by reference to these risks

and factors. EE cautions that these risks and factors are not

exclusive. EE does not undertake to update any forward-looking

statement that may be made from time to time by or on behalf of EE

except as required by law.

El Paso Electric CompanyStatements of

OperationsQuarter Ended June 30, 2014 and 2013(In

thousands except for per share data)(Unaudited)

2014 2013

Variance Operating revenues, net of energy expenses:

Base revenues $ 151,061 $ 151,966 $ (905 ) (a) Deregulated Palo

Verde Unit 3 revenues 3,551 3,177 374 Palo Verde performance

rewards, net 2,220 — 2,220 Other 7,169 7,628 (459 )

Operating Revenues Net of Energy Expenses 164,001

162,771 1,230 Other operating expenses: Other

operations and maintenance 50,034 49,843 191 Palo Verde operations

and maintenance 26,196 25,175 1,021 Taxes other than income taxes

15,557 13,847 1,710 Other income 1,914 202 1,712

Earnings Before Interest, Taxes, Depreciation and

Amortization 74,128 74,108 20 (b)

Depreciation and amortization 21,083 19,562 1,521 Interest on

long-term debt 14,607 14,610 (3 ) AFUDC and capitalized interest

6,709 5,340 1,369 Other interest expense 288 154 134

Income Before Income Taxes 44,859

45,122 (263 ) Income tax expense 14,763

15,929 (1,166 )

Net Income $

30,096 $ 29,193 $

903 Basic Earnings per Share $

0.75 $ 0.73 $ 0.02

Diluted Earnings per Share $

0.75 $ 0.72 $ 0.03

Dividends declared per share of common stock $ 0.28

$ 0.265 $ 0.015 Weighted average number

of shares outstanding 40,181 40,112 69

Weighted average number of shares and

dilutive potential shares outstanding

40,212 40,160 52

(a) Base revenues exclude fuel recovered through New Mexico base

rates of $17.1 million and $17.6 million, respectively.

(b) Earnings before interest, taxes, depreciation and amortization

("EBITDA") is a non-generally accepted accounting principles

("GAAP") financial measure and is not a substitute for net income

or other measures of financial performance in accordance with GAAP.

El Paso Electric CompanyStatements of

OperationsSix Months Ended June 30, 2014 and 2013(In

thousands except for per share data)(Unaudited)

2014 2013 Variance

Operating revenues, net of energy expenses: Base revenues $ 255,208

$ 260,846 $ (5,638 ) (a) Deregulated Palo Verde Unit 3 revenues

7,959 6,213 1,746 Palo Verde performance rewards, net 2,220 — 2,220

Other 14,629 15,726 (1,097 )

Operating Revenues

Net of Energy Expenses 280,016 282,785

(2,769 ) Other operating expenses: Other

operations and maintenance 99,098 96,081 3,017 Palo Verde

operations and maintenance 47,552 47,456 96 Taxes other than income

taxes 30,919 26,629 4,290 Other income 7,253 963

6,290

Earnings Before Interest, Taxes, Depreciation and

Amortization 109,700 113,582 (3,882

) (b) Depreciation and amortization 41,651 38,930

2,721 Interest on long-term debt 29,186 29,206 (20 ) AFUDC and

capitalized interest 12,545 10,928 1,617 Other interest expense 461

303 158

Income Before Income Taxes

50,947 56,071 (5,124 ) Income

tax expense 16,236 19,244 (3,008 )

Net

Income $ 34,711 $ 36,827

$ (2,116 ) Basic Earnings per

Share $ 0.86 $ 0.92

$ (0.06 ) Diluted Earnings per

Share $ 0.86 $ 0.92

$ (0.06 ) Dividends declared per share

of common stock $ 0.545 $ 0.515 $ 0.03

Weighted average number of shares outstanding 40,165 40,095

70

Weighted average number of shares and

dilutive potential shares outstanding

40,181 40,119 62

(a) Base revenues exclude fuel recovered through New Mexico base

rates of $33.2 million and $34.6 million, respectively.

(b) EBITDA is a non-GAAP financial measure and is not a substitute

for net income or other measures of financial performance in

accordance with GAAP.

El Paso Electric

CompanyCash Flow SummarySix Months Ended June 30,

2014 and 2013(In thousands and Unaudited)

2014 2013 Cash flows from operating

activities: Net income $ 34,711 $ 36,827 Adjustments to

reconcile net income to net cash provided by operations:

Depreciation and amortization of electric plant in service 41,651

38,930 Amortization of nuclear fuel 21,877 21,897 Deferred income

taxes, net 15,141 16,888 Other (2,336 ) 2,993 Change in: Accounts

receivable (33,585 ) (43,626 ) Net undercollection of fuel revenues

(13,369 ) (8,940 ) Accounts payable 1,983 2,733 Other (a) (9,102 )

(16,315 )

Net cash provided by operating activities

56,971 51,387 Cash flows from

investing activities: Cash additions to utility property, plant

and equipment (105,999 ) (110,279 ) Cash additions to nuclear fuel

(17,690 ) (16,879 ) Decommissioning trust funds (4,550 ) (4,552 )

Other (2,151 ) (2,331 )

Net cash used for investing

activities (130,390 ) (134,041 )

Cash flows from financing activities: Dividends paid

(21,969 ) (20,714 ) Borrowings under the revolving credit facility,

net 83,420 4,164 Other (928 ) (207 )

Net cash provided by (used

for) financing activities 60,523 (16,757

) Net decrease in cash and cash equivalents

(12,896 ) (99,411 ) Cash and

cash equivalents at beginning of period 25,592

111,057 Cash and cash equivalents at end of

period $ 12,696 $ 11,646

(a) Includes funding of $6.9 million for employee

pension and other post-retirement benefit plans for the six months

ended June 30, 2014, compared to funding of $17.9 million for the

six months ended June 30, 2013.

El Paso Electric

CompanyQuarter Ended June 30, 2014 and 2013Sales and

Revenues Statistics

Increase (Decrease) 2014 2013

Amount Percentage

kWh sales (in

thousands):

Retail: Residential 650,003 659,825 (9,822 ) (1.5 )% Commercial and

industrial, small 620,630 631,246 (10,616 ) (1.7 )% Commercial and

industrial, large 292,113 292,282 (169 ) (0.1 )% Public authorities

434,930 437,248 (2,318 ) (0.5 )% Total retail sales

1,997,676 2,020,601 (22,925 ) (1.1 )% Wholesale:

Sales for resale 20,328 20,141 187 0.9 % Off-system sales 565,853

532,334 33,519 6.3 % Total wholesale sales

586,181 552,475 33,706 6.1 % Total kWh sales

2,583,857 2,573,076 10,781 0.4 %

Operating

revenues (in thousands):

Non-fuel base revenues: Retail: Residential $ 59,828 $ 60,631 $

(803 ) (1.3 )% Commercial and industrial, small 53,675 53,729 (54 )

(0.1 )% Commercial and industrial, large 9,963 10,021 (58 ) (0.6 )%

Public authorities 26,915 26,883 32 0.1 %

Total retail non-fuel base revenues 150,381 151,264 (883 ) (0.6 )%

Wholesale: Sales for resale 680 702 (22 ) (3.1 )%

Total non-fuel base revenues 151,061 151,966 (905 )

(0.6 )% Fuel revenues: Recovered from customers during the period

40,529 32,368 8,161 25.2 % Under collection of fuel (a) 15,369

12,788 2,581 20.2 % New Mexico fuel in base rates 17,132

17,642 (510 ) (2.9 )% Total fuel revenues (b) 73,030

62,798 10,232 16.3 % Off-system sales: Fuel cost

18,000 14,993 3,007 20.1 % Shared margins 2,645 2,246 399 17.8 %

Retained margins 322 273 49 17.9 % Total

off-system sales 20,967 17,512 3,455 19.7 % Other (c) 6,743

7,838 (1,095 ) (14.0 )% Total operating revenues $ 251,801

$ 240,114 $ 11,687 4.9 % (a) 2014

includes $2.2 million related to Palo Verde performance rewards,

net. (b) Includes deregulated Palo Verde Unit 3 revenues for the

New Mexico jurisdiction of $3.6 million and $3.2 million,

respectively. (c) Represents revenues with no related kWh sales.

El Paso Electric CompanyQuarter Ended June

30, 2014 and 2013Other Statistical Data

Increase (Decrease) 2014

2013 Amount Percentage

Average number of

retail customers: (a)

Residential 352,035 347,360 4,675 1.3

%

Commercial and industrial, small 39,482 38,739 743 1.9 % Commercial

and industrial, large 49 49 — — Public authorities 5,108

4,978 130 2.6 % Total 396,674 391,126

5,548 1.4 %

Number of retail

customers (end of period): (a)

Residential 352,340 347,866 4,474 1.3 % Commercial and industrial,

small 39,557 38,801 756 1.9 % Commercial and industrial, large 49

49 — — Public authorities 5,079 5,012 67 1.3 %

Total 397,025 391,728 5,297 1.4 %

Weather

statistics: (b)

10-Yr Average Heating degree days 84 81 69 Cooling degree

days 1,095 1,138 1,051

Generation and

purchased power (kWh, in thousands):

Increase (Decrease) 2014 2013 Amount

Percentage Palo Verde 1,191,898 1,219,051 (27,153 )

(2.2 )% Four Corners 137,988 140,027 (2,039 ) (1.5 )% Gas plants

1,027,544 1,001,564 25,980 2.6 % Total

generation 2,357,430 2,360,642 (3,212 ) (0.1 )% Purchased power:

Photovoltaic 79,385 38,363 41,022 — Other 321,504 335,019

(13,515 ) (4.0 )% Total purchased power 400,889

373,382 27,507 7.4 % Total available energy 2,758,319

2,734,024 24,295 0.9 % Line losses and Company use 174,462

160,948 13,514 8.4 % Total kWh sold 2,583,857

2,573,076 10,781 0.4 %

Palo Verde capacity factor

87.8

%

89.6

%

(1.8

)%

(a)

The number of retail customers is based on

the number of service locations.

(b)

A degree day is recorded for each degree

that the average outdoor temperature varies from a standard of 65

degrees Fahrenheit.

El Paso Electric CompanySix Months Ended June 30,

2014 and 2013Sales and Revenues Statistics

Increase (Decrease)

2014 2013 Amount Percentage

kWh sales (in

thousands):

Retail: Residential 1,193,033 1,258,331 (65,298 ) (5.2 )%

Commercial and industrial, small 1,114,549 1,132,950 (18,401 ) (1.6

)% Commercial and industrial, large 518,665 536,867 (18,202 ) (3.4

)% Public authorities 777,958 796,332 (18,374 ) (2.3

)% Total retail sales 3,604,205 3,724,480 (120,275 )

(3.2 )% Wholesale: Sales for resale 32,720 32,140 580 1.8 %

Off-system sales 1,262,867 1,208,261 54,606

4.5 % Total wholesale sales 1,295,587 1,240,401

55,186 4.4 % Total kWh sales 4,899,792 4,964,881

(65,089 ) (1.3 )%

Operating

revenues (in thousands):

Non-fuel base revenues: Retail: Residential $ 105,422 $ 110,239 $

(4,817 ) (4.4 )% Commercial and industrial, small 85,796 86,504

(708 ) (0.8 )% Commercial and industrial, large 18,291 18,569 (278

) (1.5 )% Public authorities 44,571 44,444 127

0.3 % Total retail non-fuel base revenues 254,080 259,756 (5,676 )

(2.2 )% Wholesale: Sales for resale 1,128 1,090 38

3.5 % Total non-fuel base revenues 255,208 260,846

(5,638 ) (2.2 )% Fuel revenues: Recovered from

customers during the period 71,702 59,095 12,607 21.3 % Under

collection of fuel (a) 13,359 8,946 4,413 49.3 % New Mexico fuel in

base rates 33,227 34,551 (1,324 ) (3.8 )% Total fuel

revenues (b) 118,288 102,592 15,696 15.3 %

Off-system sales: Fuel cost 39,463 31,156 8,307 26.7 %

Shared margins 9,389 6,247 3,142 50.3 % Retained margins 1,124

749 375 50.1 % Total off-system sales 49,976

38,152 11,824 31.0 % Other (c) 13,845 15,814 (1,969 )

(12.5 )% Total operating revenues $ 437,317 $ 417,404

$ 19,913 4.8 % (a) 2014 includes $2.2 million related

to Palo Verde performance rewards, net. (b) Includes deregulated

Palo Verde Unit 3 revenues for the New Mexico jurisdiction of $8.0

million and $6.2 million, respectively. (c) Represents revenues

with no related kWh sales.

El Paso Electric

CompanySix Months Ended June 30, 2014 and 2013Other

Statistical Data Increase

(Decrease) 2014 2013 Amount

Percentage

Average number of

retail customers: (a)

Residential 351,183 346,757 4,426 1.3 % Commercial and industrial,

small 39,350 38,571 779 2.0 % Commercial and industrial, large 50

49 1 2.0 % Public authorities 5,078 4,966 112

2.3 % Total 395,661 390,343 5,318 1.4 %

Number of retail

customers (end of period): (a)

Residential 352,340 347,866 4,474 1.3 % Commercial and industrial,

small 39,557 38,801 756 1.9 % Commercial and industrial, large 49

49 — — Public authorities 5,079 5,012 67 1.3 %

Total 397,025 391,728 5,297 1.4 %

Weather

statistics: (b)

10-Yr Average Heating degree days 1,042 1,419 1,255 Cooling

degree days 1,120 1,171 1,077

Generation and

purchased power (kWh, in thousands):

Increase (Decrease) 2014 2013 Amount

Percentage Palo Verde 2,555,975 2,552,933 3,042 0.1 %

Four Corners 272,224 324,070 (51,846 ) (16.0 )% Gas plants

1,595,288 1,610,927 (15,639 ) (1.0 )% Total

generation 4,423,487 4,487,930 (64,443 ) (1.4 )% Purchased power:

Photovoltaic 108,184 66,063 42,121 63.8 % Other 653,448

656,024 (2,576 ) (0.4 )% Total purchased power 761,632

722,087 39,545 5.5 % Total available energy

5,185,119 5,210,017 (24,898 ) (0.5 )% Line losses and Company use

285,327 245,136 40,191 16.4 % Total kWh sold

4,899,792 4,964,881 (65,089 ) (1.3 )%

Palo Verde capacity factor

94.6

%

94.5

%

0.1

%

(a)

The number of retail customers presented

is based on the number of service locations.

(b)

A degree day is recorded for each degree

that the average outdoor temperature varies from a standard of 65

degrees Fahrenheit.

El Paso Electric CompanyFinancial

StatisticsAt June 30, 2014 and 2013(In thousands,

except number of shares, book value per share, and ratios)

Balance Sheet 2014 2013

Cash and cash equivalents $ 12,696 $ 11,646

Common stock equity $ 973,828 $ 848,427 Long-term debt 999,665

999,576 Total capitalization $ 1,973,493 $

1,848,003 Short-term borrowings under the revolving

credit facility $ 97,772 $ 26,319 Number of

shares - end of period 40,352,024 40,250,257

Book value per common share $ 24.13 $ 21.08

Common equity ratio (a) 47.0 % 45.3 % Debt ratio 53.0 % 54.7 %

(a) The capitalization component includes common stock

equity, long-term debt and the current maturities of long-term

debt, and short-term borrowings under the RCF.

El Paso Electric CompanyMedia ContactsEddie Gutierrez,

915-543-5763eduardo.gutierrez@epelectric.comorInvestor

RelationsJohn Boomer,

915-543-4347john.boomer@epelectric.comorLisa Budtke,

915-543-5947lisa.budtke@epelectric.com

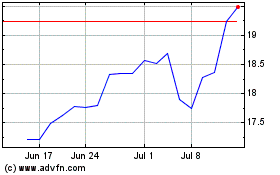

Excelerate Energy (NYSE:EE)

Historical Stock Chart

From Aug 2024 to Sep 2024

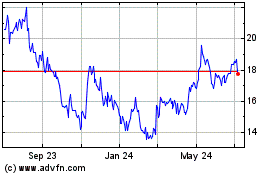

Excelerate Energy (NYSE:EE)

Historical Stock Chart

From Sep 2023 to Sep 2024