Mentor Capital Proposes to Accept and Dividend $1.8 Million in Bhang Stock to Shareholders

August 04 2014 - 3:55PM

Business Wire

Bhang Owners Have Not Returned $1.5 Million Paid to Them and

Stock in Lieu of Repayment Would Make Mentor Shareholders Whole,

According to Mentor

Mentor Capital, Inc. (OTC Markets: MNTR) reports that Bhang

Corporation owners, Mr. Scott Van Rixel (67.5%), Mr. Richard

Sellers (30%), and Mr. William Waggoner (7.5%) have received $1.5

million from Mentor Capital without returning value for Mentor’s

shareholders and while repudiating their agreement with Mentor. It

appears that the Bhang owners intend to keep the $1.5 Million, and

give Mentor and its shareholders nothing in return.

Because Mentor and many of Mentor’s shareholders were looking

forward to Bhang Corporation growth, Mentor has made an offer to

resolves its differences with Bhang and its owners including

exploring dividending the Bhang stock Mentor purchased to its

shareholders.

In its most recent offer, Mentor Capital provided a blue print

to Bhang and its owners on August 1, 2014 as to how Bhang shares

might be fairly exchanged for the cash the Bhang owners were paid

and continue to hold. To ensure there is no negative bias to this

win-win proposal, it is proposed that neither Mentor Capital, Inc.

nor its CEO, Chet Billingsley would hold any shares in the

resulting Bhang public entity.

Alternatively, if the Bhang owners wish to find substitute

investors or otherwise pay back the $1.5 Million owners received,

Mentor Capital provided a plan for that repayment which allowed for

a market return to Mentor and its shareholders. Mentor Capital

would then intend to find alternative investments in the cannabis

market for the benefit of its shareholders.

These proposals and the call to integrity and fair treatment

follow two months of ongoing discussions between the lawyers and

owners of Bhang Corporation and Mentor Capital, Inc. During this

time, and earlier, Bhang has steadfastly refused to perform its

contract provisions and has failed to return or even publicly

mention the $1.5 Million in funds the owners have received and

kept. Mentor Capital and its management team have fiduciary

responsibility to pursue a fair and equitable resolution of this

dispute by all legal means. The Bhang proposal that they keep the

$1.5 Million and Mentor’s shareholders receive nothing is

untenable.

The Bhang / Mentor contract is posted at the Mentor Capital home

page and defines payment, alternatives in case of shortfall, the

going public option and the contingent payoff provision. The

contingent payoff provision is at the sole discretion of Mentor,

has been triggered, trumps other provisions, and allows for payment

over about three years with any shortfall made up in stock. Mentor

Capital is in full compliance with this contingent payoff

provision, which, as its name implies, was designed to provide for

the orderly continuation of the contract in the event of changing

circumstances.

Mentor Capital, Inc. has made a $1.5 Million cash investment

into Bhang Corporation and retains significant active contract

rights. The company will continue to list its investment in Bhang

Corporation and Bhang Financial in its portfolio until the

investment is resolved by action of the parties or the courts.

About Mentor Capital: By acquisition or stock purchase,

Mentor Capital, Inc. seeks to invest in leading cannabis companies.

Additional important information for investors and founders seeking

expansion funding is presented at: www.MentorCapital.com

This press release is neither an offer to sell, nor a

solicitation of offers to purchase, securities.

Forward Looking Statements: This press release contains

forward-looking statements within the meaning of the federal

securities laws, including statements concerning financial

projections, financing activities, corporate combinations, product

development activities and sales and licensing activities. Such

forward-looking statements are not guarantees of future results or

performance, are sometimes identified by words of condition such as

“should,” “could,” “expects,” “may,” or “intends,” and are subject

to a number of risks and uncertainties, known and unknown, that

could cause actual results to differ materially from those intended

or anticipated. Such risks include, without limitation:

nonperformance of investments, partner and portfolio difficulties,

potential delays in marketing and sales activities, problems

securing the necessary financing to continue operations, problems

encountered in commercializing cannabis products, potential of

competitive products, services, and technologies, difficulties

experienced in product development, difficulties in recruiting

knowledgeable and potential problems in protecting intellectual

property. Further information concerning these and other risks is

included in the Company’s 15c2-11 filing which, along with other

very important information about the Company, can be found

here:

http://mentorcapital.com/disclosures/

The Company undertakes no obligation to update or revise such

forward-looking statements to reflect events or circumstances

occurring after the date of this press release.

Mentor Capital, Inc.Chet Billingsley, CEO(760) 788-4700

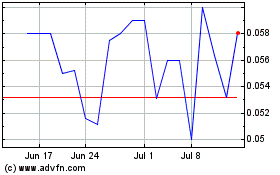

Mentor Capital (QB) (USOTC:MNTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

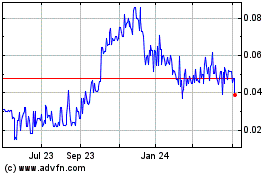

Mentor Capital (QB) (USOTC:MNTR)

Historical Stock Chart

From Apr 2023 to Apr 2024