Annaly Capital Management, Inc. Announces Net Lease Initiative with Inland Real Estate Group

May 08 2014 - 4:05PM

Business Wire

Annaly Capital Management, Inc. (NYSE:NLY)

(“Annaly”) today announced that its subsidiary Annaly Commercial

Real Estate Group, Inc. has commenced an initiative to acquire net

leased commercial real estate assets across a wide array of markets

and industries, including industrial, office, retail and restaurant

properties. Annaly will purchase commercial properties of a certain

size and profile sourced and managed exclusively for Annaly by

affiliates of The Inland Real Estate Group of Companies, Inc.

(“Inland”). Inland is one of the nation’s leading providers of

commercial real estate services. Since 2002, Inland has acquired in

excess of $35 billion of commercial properties, including $11

billion of net leased acquisitions, and maintains a national

presence with over $20 billion in commercial real estate assets

under management.

“We believe that the potential to utilize Inland’s extensive

experience acquiring, managing, leasing, financing and developing

real estate nationwide will complement our ability to take

advantage of a variety of opportunities as we expand our commercial

platform into ownership of real property,” said Wellington J.

Denahan, Annaly’s Chairman and Chief Executive Officer. This

initiative further augments Annaly’s continued expansion of its

commercial real estate portfolio. As of March 31, 2014, Annaly

owned approximately $1.7 billion in commercial real estate assets,

an increase from $1.0 billion at June 30, 2013.

Dan Goodwin, Inland’s Chairman and Chief Executive Officer said,

“We are honored to have been chosen by Annaly to assist in creating

an enviable net lease platform and excited about our strategic

relationship.” Joe Cosenza, a Vice Chairman of Inland and President

of Inland Real Estate Acquisitions, Inc., who is leading the Inland

team said, “Annaly’s impressive expansion of its commercial real

estate business highlights the strength of its balance sheet and

flexibility, and we look forward to helping one of the largest

mortgage REITs leverage upon those attributes.”

Annaly’s principal business objective is to generate net income

for distribution to its shareholders from its investments. Annaly

is a Maryland corporation that has elected to be taxed as a real

estate investment trust (“REIT”). Annaly is managed and advised by

Annaly Management Company LLC.

Inland is one of the nation’s leading providers of commercial

real estate services with companies specializing in a variety of

areas including acquisitions, auctions, brokerage, development, and

financing. Inland offers real estate investment opportunities

backed by more than 40 years of experience and an unrivaled track

record. Programs include real estate investment trusts, specialty

funds, limited partnerships and 1031 exchanges.

This news release and our public documents to which we refer

contain or incorporate by reference certain forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Forward-looking statements which are based on

various assumptions (some of which are beyond our control) may be

identified by reference to a future period or periods or by the use

of forward-looking terminology, such as “may,” “will,” “believe,”

“expect,” “anticipate,” “continue,” or similar terms or variations

on those terms or the negative of those terms. Actual results could

differ materially from those set forth in forward-looking

statements due to a variety of factors, including, but not limited

to, changes in interest rates, changes in the yield curve, changes

in prepayment rates, the availability of mortgage-backed securities

and other securities for purchase, the availability of financing

and, if available, the terms of any financing, changes in the

market value of our assets, changes in business conditions and the

general economy, our ability to consummate any contemplated

investment opportunities, our ability to grow the commercial

mortgage business, changes in government regulations affecting our

business, our ability to maintain our qualification as a REIT for

federal income tax purposes, our ability to maintain our exemption

from registration under the Investment Company Act of 1940, as

amended, risks associated with the broker-dealer business of our

subsidiary, and risks associated with the investment advisory

business of our subsidiary. For a discussion of the risks and

uncertainties which could cause actual results to differ from those

contained in the forward-looking statements, see “Risk Factors” in

our most recent Annual Report on Form 10-K and any subsequent

Quarterly Reports on Form 10-Q. We do not undertake, and

specifically disclaim any obligation, to publicly release the

result of any revisions which may be made to any forward-looking

statements to reflect the occurrence of anticipated or

unanticipated events or circumstances after the date of such

statements.

Annaly Capital Management, Inc.Investor

Relations1-888-8Annalywww.annaly.com

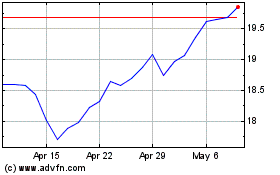

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

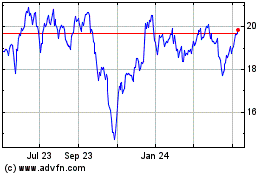

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Apr 2023 to Apr 2024