Alliant Energy Hits a New 52-Week High - Analyst Blog

April 11 2014 - 9:50AM

Zacks

On April 10, 2014, the shares of

Alliant Energy Corporation (LNT) hit a 52-week

high of $57.37 in intraday trading to finally close a trifle lower

at $56.52. This comes to a gain of 13.8% over the past one-year

period. The company has been performing well, registering positive

earnings surprises in the last four quarters, with an average beat

of 9.85%.

Alliant Energy’s performance is attributed to a steadily increasing

pool of customers in its service territories. The company was thus

able to sell higher volumes of electricity and natural gas in the

fourth quarter compared to the prior year comparable period. In

addition, industrial customers are expanding their operations,

thereby creating further avenues for demand growth in 2014.

Improvement in the economies of Iowa and Wisconsin and a lower

unemployment rate in these states compared to the national average

are expected to boost demand for Alliant’s services.

Recently, Alliant Energy entered into an agreement with Iowa

Utilities Board for not increasing the base electricity rate until

2016. In addition, the company applied to keep the electric base

rates unchanged in Wisconsin through 2016 (decision expected in

second quarter 2014). We believe these moves will allow the company

to retain and add more customers in its service territories.

Alliant Energy is also investing judiciously to create a balanced

generation portfolio, which will attract lesser environmental ire.

In addition, Alliant Energy plans to invest nearly $190 million in

the 2014 to 2016 time period to strengthen its transmission

network. These planned investments will help serve its customers in

a more efficient manner.

Alliant Energy reported earnings per share of $3.31 in 2013. The

company projected earnings in the range of $3.25 to $3.40 per share

for 2014 taking into consideration higher Interstate Power and

Light Company and Wisconsin Power and Light Company rate base.

The Zacks Consensus Estimate for 2014 inched up 0.6% over the last

60 days to $3.40 per share. This reflects a year-over-year

estimated increase of 4.58%. The long-term earnings growth is

projected at 5.50%.

Alliant Energy currently carries a Zacks Rank #3 (Hold). Other

companies in the industry worth considering are NRG Energy,

Inc. (NRG), Otter Tail Corporation (OTTR)

and Public Service Enterprise Group Inc. (PEG),

all presently holding a Zacks Rank #1 (Strong Buy).

ALLIANT ENGY CP (LNT): Free Stock Analysis Report

NRG ENERGY INC (NRG): Free Stock Analysis Report

OTTER TAIL CORP (OTTR): Free Stock Analysis Report

PUBLIC SV ENTRP (PEG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

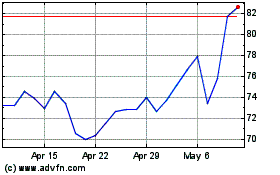

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

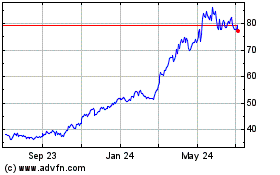

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Apr 2023 to Apr 2024