New Zealand Energy Production and Operational Update

March 04 2014 - 6:17AM

Marketwired Canada

New Zealand Energy Corp. (TSX VENTURE:NZ)(OTCQX:NZERF) today announced that at

the end of February 2014, the Company was producing light, high-quality oil from

nine wells in the Taranaki Basin of New Zealand's North Island. Consistent with

guidance in the Company's previous production update, no new wells were added in

February but substantial progress was made in order to prepare four existing

wells to further add to oil production. As a result of optimization efforts on

existing wells, production for February 2014 increased 11% over January's

average, with an average of 228 barrels of oil per day ("bbl/d") in February

compared to 202 bbl/d in January. In addition, the Company's Waitapu-2 well

re-commenced production on March 3.

"NZEC remains focused on its primary objectives of increasing production and

cash flow while reducing costs," said John Proust, Chief Executive Officer and

Director of NZEC. "The Company is committed to providing monthly updates so that

investors can track our progress. While production rates continue to fluctuate

as a result of optimization and workover activities on the wells, monthly

production averages are the best representation of our corporate production.

During March and early April NZEC will systematically complete workover

activities on a number of existing wells that are expected to add to the

Company's oil production."

Workover activities at existing wells on the Eltham Permit and TWN Licenses are

on track as outlined in the February 4, 2014 press release. Following the

mobilization of a service rig on February 17, NZEC completed workover activities

on the Waitapu-2 well as well as wireline activities on the Waihapa-1B well.

Waitapu-2 has been pumping since February 27 and produced load fluid (water that

was pumped into the well during workover activities) for a number of days. On

March 3 the well started to produce oil along with load fluid and is expected to

finish cleaning up the load fluid in the next few days. The TWN Joint

Arrangement ("TWN JA") (NZEC and L&M Energy, joint owners of the TWN Licenses)

also identified a cost savings opportunity on the Waihapa-8 well. Initially

expected to require installation of a dedicated downhole pump for artificial

lift, further review determined that the well can likely be produced by heating

gas at the wellhead and using existing gas lift. If successful, this should

result in savings of approximately NZ$200,000 net to NZEC and accelerate

Waihapa-8 production to March 2014.

The TWN JA also advanced the Waihapa-1B well in February by removing a plug from

the well and commencing evaluation of the potential to produce oil from the

Tikorangi Formation. If successful, Tikorangi production could resume in March

2014, with the alternative of an uphole completion in the Mt. Messenger

Formation. The TWN JA also commenced installation of artificial lift on the

Waihapa-2 well with the expectation of achieving production from the Mt.

Messenger Formation in April 2014.

During February the TWN JA entered into an agreement with a gas marketing

counterparty to transport gas along a section of the TAW gas pipeline for a term

of four years with a five-year right of renewal. The arrangement is expected to

generate between NZ$250,000 and NZ$1million revenue per year (net to NZEC).

First gas is expected to flow during Q2-2014.

Third-party revenue at the Waihapa Production Station year to date totals

approximately NZ$346,000 net to NZEC.

Upcoming Catalysts

-- Waitapu-2: Contributing oil production as of March 3

-- Waihapa-8: Production from Mt. Messenger Formation anticipated in March

2014 using existing gas lift

-- Waihapa-1B: Continuing to evaluate production potential from Tikorangi

Formation. If successful, Tikorangi production could resume in March

2014. If unsuccessful, the TWN JA will proceed to complete the well

uphole in Mt. Messenger Formation

-- Waihapa-2: Artificial lift installation underway with production

anticipated from Mt. Messenger Formation in April 2014

-- Toko-2B: ESP installation targeted for March 2014, with a production

increase anticipated in April 2014

NZEC and L&M Energy applied to New Zealand Petroleum & Minerals and were granted

an extension to drill the Alton Permit Horoi commitment well by June 22, 2014.

Management Changes

Further to NZEC's commitment to reduce costs, two of NZEC's senior executives,

Bruce McIntyre and Ian Brown, have taken early retirement from their paid

employment positions. Bruce McIntyre will remain on the Board of Directors and

Ian Brown will act as an advisor to NZEC.

"On behalf of the Board of Directors and NZEC employees, I thank Bruce and Ian

for their significant contributions to NZEC," said John Proust, Chief Executive

Officer and Director of NZEC. "They remain committed to the Company's success

and I look forward to their continued input.

To view Table 1 - NZEC's Production & Development Wells, please visit the

following link: http://media3.marketwire.com/docs/931145_TABLE_1.pdf.

On behalf of the Board of Directors

John Proust, Chief Executive Officer & Director

About New Zealand Energy Corp.

NZEC is an oil and natural gas company engaged in the production, development

and exploration of petroleum and natural gas assets in New Zealand. NZEC's

property portfolio collectively covers approximately 1.93 million acres of

conventional and unconventional prospects in the Taranaki Basin and East Coast

Basin of New Zealand's North Island. The Company's management team has extensive

experience exploring and developing oil and natural gas fields in New Zealand

and Canada, and takes a multi-disciplinary approach to value creation with a

track record of successful discoveries. NZEC plans to add shareholder value by

executing a technically disciplined exploration and development program focused

on the onshore and offshore oil and natural gas resources in the politically and

fiscally stable country of New Zealand. NZEC is listed on the TSX Venture

Exchange under the symbol NZ and on the OTCQX International under the symbol

NZERF. More information is available at www.newzealandenergy.com or by emailing

info@newzealandenergy.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

This document contains certain forward-looking information and forward-looking

statements within the meaning of applicable securities legislation (collectively

"forward-looking statements"). The use of the word "will", "anticipated",

"expected", "targeted", "evaluate", "should", "could", "prepare", "likely",

"expectation", "optimization", and similar expressions are intended to identify

forward-looking statements. These statements involve known and unknown risks,

uncertainties and other factors that may cause actual results or events to

differ materially from those anticipated in such forward-looking statements

including, without limitation, the speculative nature of exploration, appraisal

and development of oil and natural gas properties; uncertainties associated with

estimating oil and natural gas reserves and resources; uncertainties in both

daily and long-term production rates and resulting cash flow; volatility in

market prices for oil and natural gas; changes in the cost of operations,

including costs of extracting and delivering oil and natural gas to market, that

affect potential profitability of oil and natural gas exploration and

production; the need to obtain various approvals before exploring and producing

oil and natural gas resources; exploration hazards and risks inherent in oil and

natural gas exploration; operating hazards and risks inherent in oil and natural

gas operations; the Company's ability to generate sufficient cash flow from

production to fund future development activities; market conditions that prevent

the Company from raising the funds necessary for exploration and development on

acceptable terms or at all; global financial market events that cause

significant volatility in commodity prices; unexpected costs or liabilities for

environmental matters; competition for, among other things, capital,

acquisitions of resources, skilled personnel, and access to equipment and

services required for exploration, development and production; changes in

exchange rates, laws of New Zealand or laws of Canada affecting foreign trade,

taxation and investment; failure to realize the anticipated benefits of

acquisitions; and other factors as disclosed in documents released by NZEC as

part of its continuous disclosure obligations. Such forward-looking statements

should not be unduly relied upon. The Company believes the expectations

reflected in those forward-looking statements are reasonable, but no assurance

can be given that these expectations will prove to be correct. Actual results

could differ materially from those anticipated in these forward-looking

statements. The forward-looking statements contained in the document are

expressly qualified by this cautionary statement. These statements speak only as

of the date of this document and the Company does not undertake to update any

forward-looking statements that are contained in this document, except in

accordance with applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

New Zealand Energy Corp.

John Proust

Chief Executive Officer & Director

North American toll-free: 1-855-630-8997

New Zealand Energy Corp.

Bruce McIntyre

Director

North American toll-free: 1-855-630-8997

New Zealand Energy Corp.

Rhylin Bailie

Vice President Communications & Investor Relations

North American toll-free: 1-855-630-8997

info@newzealandenergy.com

www.newzealandenergy.com

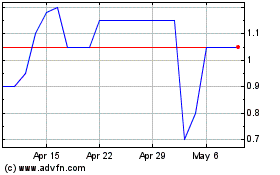

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

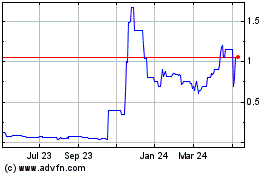

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Apr 2023 to Apr 2024