As filed with the Securities and Exchange Commission on March 4, 2014

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

BLOOMIN’ BRANDS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

|

20-8023465

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

2202 North West Shore Boulevard, Suite 500, Tampa, Florida 33607

(813) 282-1225

(Address, including zip code, and telephone number, including area code, of principal executive offices)

Joseph J.

Kadow

Executive Vice President and Chief Legal Officer

Bloomin’ Brands, Inc.

2202 North West Shore Boulevard, Suite 500, Tampa, Florida 33607

(813)

282-1225

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

John M. Gherlein

Janet A. Spreen

Baker & Hostetler LLP

PNC Center

1900 East 9th Street

Cleveland, Ohio 44114

Telephone: (216) 621-0200

Facsimile: (216) 696-0740

Approximate date of commencement of proposed sale to the public:

From time to time after the effectiveness of the Registration

Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest

reinvestment plans, please check the following box:

¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box:

x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

x

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer

x

|

|

Accelerated filer

¨

|

|

Non-accelerated filer

¨

|

|

Smaller reporting company

¨

|

|

|

|

(Do not check if a smaller reporting company)

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class of

securities to be registered

|

|

Amount

to be

registered

|

|

Proposed

maximum

offering price

per unit

|

|

Proposed

maximum

aggregate

offering price

(1)

|

|

Amount of

registration fee

(2)

|

|

Common Stock, $.01 par value per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

An indeterminate aggregate amount and initial offering price of common stock is being registered hereunder, as may from time to time be offered, at indeterminate

prices.

|

|

(2)

|

In accordance with Rules 456(b) and 457(r) of the Securities Act of 1933, as amended, the registrant is deferring payment of all of the registration fee.

|

Bloomin’ Brands, Inc.

Common Stock

The selling

stockholders to be named in a prospectus supplement may offer and sell shares of our common stock from time to time in amounts, at prices and on terms that will be determined at the time of the offering.

This prospectus describes the general manner in which the shares of our common stock may be offered and sold by the selling stockholders.

The specific manner in which shares of common stock may be offered and sold will be described in a prospectus supplement.

You

should carefully read this prospectus and any accompanying prospectus supplement, together with the documents we incorporate by reference, before you invest in our common stock.

Our common stock is listed on the Nasdaq Global Select Market under the symbol “BLMN.” On February 28, 2014, the last sale

price of our common stock as reported on the Nasdaq Global Select Market was $25.14 per share.

Investing in our common

stock involves substantial risk. Please read “Risk Factors” beginning on page 2 of this prospectus and any risk factors described in any applicable prospectus supplement and in the documents we incorporate by reference.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus

dated March 4, 2014

We have not authorized anyone to provide any information or to make any representations other than those contained in or incorporated

by reference into this prospectus, any accompanying prospectus supplement or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others

may give you. This prospectus and any accompanying prospectus supplement are an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus

and any accompanying prospectus supplement is current only as of the date of the applicable document.

i

ABOUT THI

S PROSPECTUS

Unless otherwise indicated or the context otherwise requires, references in this prospectus to the “Company,”

“Bloomin’ Brands,” “we,” “us” and “our” refer to Bloomin’ Brands, Inc. and its consolidated subsidiaries.

This prospectus is a part of a Registration Statement that we filed with the Securities and Exchange Commission (“SEC”) as a “well-known seasoned issuer” as defined under Rule 405

under the Securities Act of 1933, as amended (the “Securities Act”), using a “shelf” registration process. Under this shelf registration process, the selling stockholders may from time to time sell common stock in one or more

offerings. This prospectus provides you with a general description of our common stock. Each time the selling stockholders sell securities under this shelf registration, we will provide a prospectus supplement that will contain specific information

about the terms of that offering, including information about the selling stockholders. The prospectus supplement may also add, update or change information contained in this prospectus. Any statement that we make in this prospectus will be modified

or superseded by any inconsistent statement made by us in a prospectus supplement. You should read both this prospectus and any prospectus supplement, including all documents incorporated herein or therein by reference, together with additional

information described under “Where You Can Find More Information.”

1

RISK FACTORS

An investment in our common stock involves substantial risk. See “Item 1A — Risk Factors” in our most recent Annual

Report on Form 10-K and in any subsequent Quarterly Report on Form 10-Q incorporated by reference into this prospectus and the “Risk Factors” section in the applicable prospectus supplement for a discussion of the factors you should

carefully consider, in addition to the other information contained in this prospectus and the accompanying prospectus supplement, before deciding to purchase our common stock. These risks are those that we believe are the material risks that we

face. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment in our common stock.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, the accompanying prospectus supplement and the documents incorporated by reference herein and therein include statements that express our opinions, expectations, beliefs, plans,

objectives, assumptions or projections regarding future events or future results and therefore are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended.

These forward-looking statements can generally be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “feels,”

“seeks,” “forecasts,” “projects,” “intends,” “plans,” “may,” “will,” “should,” “could” or “would” or, in each case, their negative or other

variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout these documents and include statements regarding our intentions, beliefs or

current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth, strategies and the industry in which we operate.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances

that may or may not occur in the future. Although we base these forward-looking statements on assumptions that we believe are reasonable when made, we caution you that forward-looking statements are not guarantees of future performance and that our

actual results of operations, financial condition and liquidity, and industry developments may differ materially from statements made in or suggested by the forward-looking statements contained in this prospectus. In addition, even if our results of

operations, financial condition and liquidity, and industry developments are consistent with the forward-looking statements contained in this prospectus, those results or developments may not be indicative of results or developments in subsequent

periods. Important factors that could cause actual results to differ materially from statements made or suggested by forward-looking statements include, but are not limited to, those referred to in the “Risk Factors” section of this

prospectus and the following:

|

|

(i)

|

The restaurant industry is a highly competitive industry with many well-established competitors;

|

|

|

(ii)

|

Challenging economic conditions may affect our liquidity by adversely impacting numerous items that include, but are not limited to: consumer confidence and

discretionary spending; the availability of credit presently arranged from our revolving credit facilities; the future cost and availability of credit; interest rates; foreign currency exchange rates; and the liquidity or operations of our

third-party vendors and other service providers;

|

|

|

(iii)

|

Our ability to expand is dependent upon various factors such as the availability of attractive sites for new restaurants; our ability to obtain appropriate real estate

sites at acceptable prices; our ability to obtain all required governmental permits including zoning approvals and liquor licenses on a timely basis; the impact of government moratoriums or approval processes, which could result in significant

delays; our ability to obtain all necessary contractors and subcontractors; union activities such as picketing and hand billing that could delay construction; our ability to generate or borrow funds; our ability to negotiate suitable lease terms;

our ability to recruit and train skilled management and restaurant employees; and our ability to receive the premises from the landlord’s developer without any delays;

|

2

|

|

(iv)

|

Our results can be impacted by changes in consumer tastes and the level of consumer acceptance of our restaurant concepts (including consumer tolerance of our prices);

local, regional, national and international economic and political conditions; the seasonality of our business; demographic trends; patterns of customer traffic and our ability to effectively respond in a timely manner to changes in patterns of

customer traffic; changes in consumer dietary habits; product mix; employee availability; the cost of advertising and media; the timing of restaurant opening expenses; government actions and policies; inflation or deflation; unemployment rates;

interest rates; foreign exchange rates; and increases in various costs, including construction, real estate and health insurance costs;

|

|

|

(v)

|

Weather, natural disasters and other disasters could result in construction delays or slower customer traffic and could adversely affect the results of one or more

restaurants for an indeterminate amount of time;

|

|

|

(vi)

|

Our results can be negatively impacted by the effects of acts of war; periods of widespread civil unrest; actual or threatened armed conflicts or terrorist attacks,

efforts to combat terrorism, or other military action affecting countries in which we do business; and the effects of heightened security requirements on local, regional, national, or international economies or consumer confidence;

|

|

|

(vii)

|

Our results can be impacted by tax and other legislation and regulation in the jurisdictions in which we operate and by accounting standards or pronouncements;

|

|

|

(viii)

|

Our results can be impacted by anticipated or unanticipated changes in our tax rates, exposure to additional income tax liabilities, and a change in our ability to

realize deferred tax benefits;

|

|

|

(ix)

|

Minimum wage increases and mandated employee benefits could cause a significant increase in our labor costs;

|

|

|

(x)

|

Commodities, including but not limited to, beef, chicken, shrimp, pork, seafood, dairy, produce, potatoes, onions and energy supplies, are subject to fluctuation in

price and availability, and prices could increase or decrease more than we expect;

|

|

|

(xi)

|

Our results can be impacted by consumer reaction to public health issues and perception of food safety;

|

|

|

(xii)

|

We could face liabilities if we are unable to protect our information technology systems or experience an interruption or breach of security that could prevent us from

effectively operating our business, protecting customer credit and debit card data or personal employee information; and

|

|

|

(xiii)

|

Our substantial leverage and significant restrictive covenants in our various credit facilities could adversely affect our ability to raise additional capital to fund

our operations, limit our ability to make capital expenditures to invest in new or renovate restaurants, limit our ability to react to changes in the economy or our industry, and expose us to interest rate risk in connection with our variable-rate

debt.

|

In light of these risks and uncertainties, we caution you not to place undue reliance on these

forward-looking statements. Any forward-looking statement that we make in this prospectus, the accompanying prospectus supplement or the documents incorporated by reference herein or therein speaks only as of the date of such statement, and we

undertake no obligation to update any forward-looking statement or to publicly announce the results of any revision to any of those statements to reflect future events or developments. Comparisons of results for current and any prior periods are not

intended to express any future trends or indications of future performance, unless specifically expressed as such, and should only be viewed as historical data.

3

THE COMPANY

Our Company

We are one

of the largest casual dining restaurant companies in the world with a portfolio of leading, differentiated restaurant concepts. As of December 31, 2013, we owned and operated 1,344 restaurants and franchised 164 restaurants across 48 states,

Puerto Rico, Guam and 21 countries. We have five founder-inspired concepts: Outback Steakhouse, Carrabba’s Italian Grill, Bonefish Grill, Fleming’s Prime Steakhouse and Wine Bar and Roy’s. Each of our concepts maintains its unique,

founder-inspired brand identity and entrepreneurial culture to provide a compelling customer experience combining great food, highly-attentive service and lively ambience at attractive prices. Our restaurants attract customers across a variety of

occasions, including everyday dining, celebrations and business entertainment. We consider Outback Steakhouse, Carrabba’s Italian Grill, Bonefish Grill and Fleming’s Prime Steakhouse and Wine Bar to be our core concepts.

Our strategic plan and operating model keeps the customer at the center of our decision-making and focuses on continuous innovation and

productivity to drive sustainable sales and profit growth while preserving our entrepreneurial culture at the operating level. Our restaurant managing partners are a key element of this culture, each of whom shares in the cash flows of his or her

restaurant after making a required initial cash investment.

Company Information

Our principal executive offices are located at 2202 North West Shore Boulevard, Suite 500, Tampa, Florida 33607, our telephone number at

that address is (813) 282-1225 and our website address is www.bloominbrands.com. Our website and the information contained on or accessible through our website are not part of this prospectus.

USE OF PROCEEDS

We will not receive any proceeds from the sale of shares of our common stock by the selling stockholders.

4

DESCRIPTION OF CAPITAL STOCK

General

Our second

amended and restated certificate of incorporation provides for authorized capital stock of 475,000,000 shares of common stock, par value $0.01 per share, and 25,000,000 shares of undesignated preferred stock. As of February 25, 2014, we had

124,921,652 shares of common stock outstanding held by 192 stockholders of record, and we had outstanding options to purchase 9,923,928 shares of common stock, which options had a weighted average exercise price of $9.83 per share.

The following summary describes all material provisions of our capital stock. We urge you to read our certificate of incorporation and

our bylaws, which are exhibits to the Registration Statement of which this prospectus forms a part and have been filed with the SEC.

Our certificate of incorporation and bylaws contain provisions that are intended to enhance the likelihood of continuity and stability in the composition of the Board of Directors and that may have the

effect of delaying, deferring or preventing a future takeover or change in control of our Company unless that takeover or change in control is approved by our Board of Directors. These provisions include a classified Board of Directors, elimination

of stockholder action by written consents (except in limited circumstances), elimination of the ability of stockholders to call special meetings (except in limited circumstances), advance notice procedures for stockholder proposals, and

supermajority vote requirements for amendments to our certificate of incorporation and bylaws.

Common Stock

Dividend Rights

. Subject to preferences that may apply to shares of preferred stock outstanding at the time, holders of

outstanding shares of common stock are entitled to receive dividends out of assets legally available at the times and in the amounts as the Board of Directors may from time to time determine.

Voting Rights

. Each outstanding share of common stock is entitled to one vote on all matters submitted to a vote of stockholders.

Holders of shares of our common stock do not have cumulative voting rights.

Preemptive Rights

. Our common stock is not

entitled to preemptive or other similar subscription rights to purchase any of our securities.

Conversion or Redemption

Rights

. Our common stock is neither convertible nor redeemable.

Liquidation Rights

. Upon our liquidation, the

holders of our common stock will be entitled to receive pro rata our assets that are legally available for distribution, after payment of all debts and other liabilities and subject to the prior rights of any holders of preferred stock then

outstanding.

Listing

. Our shares of common stock are listed on the Nasdaq Global Select Market under the symbol

“BLMN.”

Preferred Stock

Our Board of Directors may, without further action by our stockholders, from time to time, authorize the issuance of shares of preferred stock in series and may, at the time of issuance, determine the

designations, powers, preferences, privileges, and relative participating, optional or special rights as well as the qualifications, limitations or restrictions thereof, including dividend rights, conversion rights, voting rights, terms of

redemption and liquidation preferences, any or all of which may be greater than the rights of the common stock. Satisfaction of any dividend preferences on outstanding shares of preferred stock would reduce the amount of funds available

5

for the payment of dividends on shares of our common stock. Holders of shares of preferred stock may be entitled to receive a preference payment in the event of our liquidation before any payment

is made to the holders of shares of our common stock. Under specified circumstances, the issuance of shares of preferred stock may render more difficult or tend to discourage a merger, tender offer or proxy contest, the assumption of control by a

holder of a large block of our securities or the removal of incumbent management. Upon the affirmative vote of a majority of the total number of directors then in office, our Board of Directors, without stockholder approval, may issue shares of

preferred stock with voting and conversion rights that could adversely affect the holders of shares of our common stock and the market value of our common stock. There are no shares of preferred stock outstanding, and we have no present intention to

issue any shares of preferred stock.

Anti-Takeover Effects of Our Certificate of Incorporation and Bylaws

Our certificate of incorporation and bylaws contain certain provisions that are intended to enhance the likelihood of continuity and

stability in the composition of our Board of Directors and that may have the effect of delaying, deferring or preventing a future takeover or change in control of the Company unless that takeover or change in control is approved by our Board of

Directors. Some of these provisions take effect when investment funds associated with Bain Capital Partners, LLC and Catterton Management Company, LLC (collectively, our “Sponsors”) cease to beneficially own more than 50% of our

outstanding common stock. We expect that such funds will hold less than 50% of our outstanding common stock following this offering.

These provisions include:

Classified Board

. Our certificate of

incorporation provides that our Board of Directors be divided into three classes of directors, with the classes as nearly equal in number as possible. As a result, approximately one-third of our Board of Directors will be elected each year. The

classification of directors has the effect of making it more difficult for stockholders to change the composition of our Board of Directors. In addition, because our Board of Directors is classified, under Delaware General Corporation Law, directors

may only be removed for cause. Our certificate of incorporation also provides that, subject to any rights of holders of preferred stock to elect additional directors under specified circumstances, the number of directors is to be fixed exclusively

pursuant to a resolution adopted by our Board of Directors. Our Board of Directors currently has ten members.

Action by

Written Consent; Special Meetings of Stockholders

. Our certificate of incorporation provides that stockholder action can be taken only at an annual or special meeting of stockholders and cannot be taken by written consent in lieu of a meeting

once investment funds associated with our Sponsors cease to beneficially own more than 50% of our outstanding shares. Our certificate of incorporation and bylaws also provide that, except as otherwise required by law, special meetings of the

stockholders can be called only pursuant to a resolution adopted by a majority of the total number of directors that the Company would have if there were no vacancies or, until the date that investment funds associated with our Sponsors cease to

beneficially own more than 50% of our outstanding shares, at the request of holders of 50% or more of our outstanding shares. Except as described above, stockholders are not permitted to call a special meeting or to require the Board of Directors to

call a special meeting.

Advance Notice Procedures

. Our bylaws establish an advance notice procedure for stockholder

proposals to be brought before an annual meeting of our stockholders, including proposed nominations of persons for election to the Board of Directors. Stockholders at an annual meeting are only able to consider proposals or nominations specified in

the notice of meeting or brought before the meeting by or at the direction of the Board of Directors or by a stockholder who was a stockholder of record on the record date for the meeting, who is entitled to vote at the meeting and who has given our

Secretary timely written notice, in accordance with our bylaws, of the stockholder’s intention to bring that business before the meeting. Although the bylaws do not give the Board of Directors the power to approve or disapprove stockholder

nominations of candidates or proposals regarding other business to be conducted at a special or annual meeting, the bylaws may have the effect of precluding the conduct of certain business at a meeting if the proper procedures are not followed or

may

6

discourage or deter a potential acquiror from conducting a solicitation of proxies to elect its own slate of directors or otherwise attempting to obtain control of the Company.

Super Majority Approval Requirements

. The Delaware General Corporation Law generally provides that the affirmative vote of a

majority of the outstanding stock entitled to vote on any matter is required to amend a corporation’s certificate of incorporation or bylaws, unless either a corporation’s certificate of incorporation or bylaws require a greater

percentage. Our certificate of incorporation and bylaws provide that the affirmative vote of holders of at least 75% of the total votes entitled to vote in the election of directors is required to amend, alter, change or repeal our bylaws and

specified provisions of our certificate of incorporation once investment funds associated with our Sponsors cease to beneficially own more than 50% of our outstanding shares. This requirement of a supermajority vote to approve amendments to our

certificate of incorporation and bylaws could enable a minority of our stockholders to exercise veto power over any such amendments.

Authorized but Unissued Shares

. Our authorized but unissued shares of common stock and preferred stock are available for future issuance without stockholder approval. These additional shares may be

utilized for a variety of corporate purposes, including future public offerings to raise additional capital, corporate acquisitions and employee benefit plans. The existence of authorized but unissued shares of common stock and preferred stock could

render more difficult or discourage an attempt to obtain control of a majority of our common stock by means of a proxy contest, tender offer, merger or otherwise.

Business Combinations with Interested Stockholders

. We have elected in our certificate of incorporation not to be subject to Section 203 of the Delaware General Corporation Law, which

generally prohibits a publicly held Delaware corporation from engaging in a business combination, such as a merger, with a person or group owning 15% or more of the corporation’s voting stock, for a period of three years following the date the

person became an interested stockholder, unless (with certain exceptions) the business combination or the transaction in which the person became an interested stockholder is approved in a prescribed manner. Accordingly, we are not subject to any

anti-takeover effects of Section 203. However, our certificate of incorporation contains provisions that have the same effect as Section 203, except that they provide that our Sponsors and their respective affiliates will not be deemed to

be “interested stockholders,” regardless of the percentage of our voting stock owned by them, and accordingly will not be subject to such restrictions.

Corporate Opportunities

Our certificate of incorporation provides that we

renounce any interest or expectancy of the Company in the business opportunities of our Sponsors and of their officers, directors, agents, stockholders, members, partners, affiliates and subsidiaries and each such party shall not have any obligation

to offer us those opportunities unless presented to a director or officer of the Company in his or her capacity as a director or officer of the Company.

Limitations on Liability and Indemnification of Officers and Directors

Our certificate of incorporation limits the liability of our directors to the fullest extent permitted by the Delaware General

Corporation Law, and our bylaws provide that we will indemnify them to the fullest extent permitted by such law. We have entered into indemnification agreements with our current directors and executive officers and expect to enter into a similar

agreement with any new directors or executive officers. We also maintain customary directors’ and officers’ liability insurance policies that provide coverage to our directors and officers against loss arising from claims made by reason of

breach of duty or other wrongful act and to us with respect to indemnification payments that we may make to directors and officers.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Computershare Trust Company, N.A. Its telephone number is (877) 373-6374 (toll free) or (781) 575-2879.

7

PLAN OF DISTRIBUTION

The selling stockholders may sell securities in any of the ways described below or in any combination thereof:

|

|

•

|

|

to or through underwriters, brokers or dealers;

|

|

|

•

|

|

through one or more agents; or

|

|

|

•

|

|

directly to purchasers or to a single purchaser.

|

The distribution of the securities by the selling stockholders may be effected from time to time in one or more transactions:

|

|

•

|

|

at a fixed price, or prices, which may be changed from time to time;

|

|

|

•

|

|

at market prices prevailing at the time of sale;

|

|

|

•

|

|

at prices related to such prevailing market prices; or

|

Each prospectus supplement will describe the method of distribution of the securities and any applicable restrictions.

The prospectus supplement with respect to each offering will describe the terms of the offering of the securities, including the following:

|

|

•

|

|

the name or names of any underwriters, dealers or agents and the amounts of securities underwritten or purchased by each of them;

|

|

|

•

|

|

if a fixed price offering, the public offering price of the securities, the proceeds to the selling stockholders, and any discounts, commissions or

concessions allowed or reallowed or paid to dealers; and

|

|

|

•

|

|

information about the selling stockholders, including the relationship between the selling stockholders and us.

|

Any offering price and any discounts or concessions allowed or reallowed or paid to dealers will be specified in the applicable

prospectus supplement and may be changed from time to time.

Only the agents or underwriters named in each prospectus

supplement are agents or underwriters in connection with the securities being offered thereby.

The selling stockholders may

authorize underwriters, dealers or other persons acting as their agents to solicit offers by certain institutions to purchase securities from the selling stockholders pursuant to delayed delivery contracts providing for payment and delivery on the

date stated in each applicable prospectus supplement. Each contract will be for an amount not less than, and the aggregate amount of securities sold pursuant to such contracts shall not be less nor more than, the respective amounts stated in each

applicable prospectus supplement. Institutions with whom the contracts, when authorized, may be made include commercial and savings banks, insurance companies, pension funds, investment companies, educational and charitable institutions and other

institutions, but shall in all cases be subject to our approval. Delayed delivery contracts will

8

be subject only to those conditions set forth in each applicable prospectus supplement, and each prospectus supplement will set forth any commissions we pay for solicitation of these contracts.

Agents, underwriters and other third parties described above may be entitled to indemnification by us and the selling

stockholders against certain civil liabilities, including liabilities under the Securities Act, or to contribution from us and the selling stockholders with respect to payments which the agents, underwriters or third parties may be required to make

in respect thereof. Agents, underwriters and such other third parties may be customers of, engage in transactions with, or perform services for us or the selling stockholders in the ordinary course of business. We and the selling stockholders may

also use underwriters or such other third parties with whom we or such selling stockholders have a material relationship. We and the selling stockholders will describe the nature of any such relationship in the applicable prospectus supplement.

Certain underwriters may use this prospectus and any accompanying prospectus supplement for offers and sales related to

market-making transactions in the securities. These underwriters may act as principal or agent in these transactions, and the sales will be made at prices related to prevailing market prices at the time of sale. Any underwriters involved in the sale

of the securities may qualify as “underwriters” within the meaning of Section 2(a)(11) of the Securities Act. In addition, the underwriters’ commissions, discounts or concessions may qualify as underwriters’ compensation

under the Securities Act and the rules of the Financial Industry Regulatory Authority.

Our common stock is listed on the

Nasdaq Global Select Market. Underwriters may make a market in our common stock, but will not be obligated to do so and may discontinue any market making at any time without notice. We can make no assurance as to the development, maintenance or

liquidity of any trading market for the securities.

Certain persons participating in an offering may engage in overallotment,

stabilizing transactions, short covering transactions and penalty bids in accordance with rules and regulations under the Securities Exchange Act of 1934, as amended. Overallotment involves sales in excess of the offering size, which create a short

position. Stabilizing transactions permit bids to purchase the underlying security so long as the stabilizing bids do not exceed a specified maximum. Short covering transactions involve purchases of the securities in the open market after the

distribution is completed to cover short positions. Penalty bids permit the underwriters to reclaim a selling concession from a dealer when the securities originally sold by the dealer are purchased in a covering transaction to cover short

positions. Those activities may cause the price of the securities to be higher than it would otherwise be. If commenced, the underwriters may discontinue any of the activities at any time.

9

LEGAL MATTERS

Baker & Hostetler LLP, Cleveland, Ohio, will pass upon the validity of the common stock offered hereby on our behalf. Certain

legal matters with respect to the common stock may be passed upon by counsel for any underwriters, dealers or agents, each of whom will be named in the related prospectus supplement.

EXPERTS

The financial statements and management’s assessment of the effectiveness of internal control over financial reporting (which is included in Management’s Annual Report on Internal Control over

Financial Reporting) incorporated in this prospectus by reference to the Annual Report on Form 10-K for the year ended December 31, 2013 have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, an independent

registered certified public accounting firm, given on the authority of said firm as experts in auditing and accounting.

The

consolidated financial statements of PGS Consultoria e Serviços Ltda. as of December 31, 2012 and for the year then ended, incorporated in this prospectus and Registration Statement have been audited by Ernst & Young Auditores

Independentes S.S., independent auditors, as set forth in their report thereon incorporated herein, have been so incorporated in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a Registration Statement on Form S-3 under the Securities Act with respect to the shares of our common stock

being offered by this prospectus. This prospectus and the accompanying prospectus supplement, which form a part of the Registration Statement, do not contain all of the information set forth in the Registration Statement. For further information

with respect to us and the shares of our common stock, reference is made to the Registration Statement and its exhibits. Statements contained in this prospectus and the accompanying prospectus supplement as to the contents of any contract or other

document are not necessarily complete. We are required to file annual and quarterly reports, special reports, proxy statements, and other information with the SEC. The Registration Statement, such reports and other information can be inspected and

copied at the Public Reference Room of the SEC located at 100 F Street, N.E., Washington, D.C. 20549. Copies of such materials, including copies of all or any portion of the Registration Statement, can be obtained from the Public Reference Room of

the SEC at prescribed rates. You can call the SEC at 1-800-SEC-0330 to obtain information on the operation of the Public Reference Room. Such materials may also be accessed electronically by means of the SEC’s website at

www.sec.gov

.

10

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus information we file with it, which means

that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus, and information in documents that we file later with the SEC will

automatically update and supersede information in this prospectus. We incorporate by reference into this prospectus the documents listed below and any future filings made by us with the SEC under Section 13(a), 13(c), 14 or 15(d) of the

Exchange Act, except for information “furnished” under Items 2.02, 7.01 or 9.01 on Form 8-K or other information “furnished” to the SEC which is not deemed filed and not incorporated in this prospectus, until the termination of

the offering of securities made by this prospectus. We hereby incorporate by reference the following documents:

|

|

•

|

|

Our Annual Report on Form 10-K for the year ended December 31, 2013, filed with the SEC on March 3, 2014 (File No. 001-35625);

|

|

|

•

|

|

Our Current Reports on Form 8-K or amendments thereto, filed with the SEC on November 4, 2013, January 6, 2014, January 17,

2014, January 21, 2014 (which replaces and supersedes the pro forma financial information filed as exhibit 99.3 of the Form 8-K/A filed on January 17, 2014), January 31, 2014 and February 11, 2014 (File No. 001-35625);

and

|

|

|

•

|

|

The description of capital stock contained in the Registration Statement on Form 8-A, as filed with the SEC on August 3, 2012 (File

No. 001-35625), as supplemented by the “Description of Capital Stock” found on page 5 of this prospectus and including any amendments or reports filed for the purpose of updating such description.

|

You may request a copy of these filings, at no cost, by writing or telephoning us at the following address:

Investor Relations

Bloomin’ Brands, Inc.

2202 North West Shore Boulevard, Suite 500

Tampa, Florida 33607

(813) 282-1225

Copies of these filings are also available, without charge, on the SEC’s website at www.sec.gov and on our website at

www.bloominbrands.com as soon as reasonably practicable after they are filed electronically with the SEC. The information contained on our website is not a part of this prospectus.

11

PART II. INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table sets forth the various expenses in connection with the sale and distribution of the securities being registered.

|

|

|

|

|

|

|

Securities and Exchange Commission registration fee

|

|

|

$ *

|

|

|

FINRA filing fee

|

|

|

225,500

|

|

|

Printing and engraving expenses

|

|

|

**

|

|

|

Legal fees and expenses

|

|

|

**

|

|

|

Accounting fees and expenses

|

|

|

**

|

|

|

Transfer Agent and Registrar fees

|

|

|

**

|

|

|

Miscellaneous

|

|

|

**

|

|

|

|

|

|

|

|

|

Total

|

|

|

$ **

|

|

|

*

|

Omitted because the registration fee is being deferred pursuant to Rule 456(b) and 457(r).

|

|

**

|

These fees are calculated based on the number of issuances and the amount of securities offered and accordingly cannot be estimated at this time.

|

Item 15. Indemnification of Officers and Directors

The Registrant is governed by the Delaware General Corporation Law, or DGCL. Section 145 of the DGCL provides that a corporation may

indemnify any person, including an officer or director, who was or is, or is threatened to be made, a party to any threatened, pending or completed legal action, suit or proceeding, whether civil, criminal, administrative or investigative (other

than an action by or in the right of such corporation), by reason of the fact that such person was or is an officer, director, employee or agent of such corporation or is or was serving at the request of such corporation as a director, officer,

employee or agent of another corporation or enterprise. The indemnity may include expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such

action, suit or proceeding, provided such officer, director, employee or agent acted in good faith and in a manner such person reasonably believed to be in, or not opposed to, the corporation’s best interest and, for criminal proceedings, had

no reasonable cause to believe that such person’s conduct was unlawful. A Delaware corporation may indemnify any person, including an officer or director, who was or is, or is threatened to be made, a party to any threatened, pending or

contemplated action or suit by or in the right of such corporation, under the same conditions, except that such indemnification is limited to expenses (including attorneys’ fees) actually and reasonably incurred by such person, and except that

no indemnification is permitted without judicial approval if such person is adjudged to be liable to such corporation. Where an officer or director of a corporation is successful, on the merits or otherwise, in the defense of any action, suit or

proceeding referred to above, or any claim, issue or matter therein, the corporation must indemnify that person against the expenses (including attorneys’ fees) which such officer or director actually and reasonably incurred in connection

therewith.

The Registrant’s amended and restated bylaws authorize the indemnification of its officers and directors,

consistent with Section 145 of the Delaware General Corporation Law, as amended. The Registrant has also entered into indemnification agreements with each of its directors and executive officers. These agreements, among other things, require

the Registrant to indemnify each director and executive officer to the fullest extent permitted by Delaware law, including advancement of expenses such as attorneys’ fees, judgments, fines and settlement amounts incurred by the director or

executive officer in any action or proceeding, including any action or proceeding by or in right of the Registrant, arising out of the person’s services as a director or executive officer.

Pursuant to Section 102(b)(7) of the DGCL, the Registrant’s certificate of incorporation contains a provision eliminating the

personal liability of a director for violations of the director’s fiduciary duty, except

II-1

(i) for any breach of the director’s duty of loyalty to the Registrant or its stockholders, (ii) for acts or omissions not in good faith or that involve intentional misconduct or a

knowing violation of law, (iii) pursuant to Section 174 of the DGCL, which provides for liability of directors for unlawful payments of dividends or unlawful stock purchases or redemptions or (iv) for any transaction from which a

director derived an improper personal benefit.

The Registrant maintains customary policies of insurance that provide coverage

(i) to its directors and officers against loss arising from claims made by reason of breach of duty or other wrongful act and (ii) to the Registrant with respect to indemnification payments that it may make to such directors and officers.

Any form of Underwriting Agreement to be filed as Exhibit 1.1 to this Registration Statement, if applicable, may provide for

indemnification to the Registrant’s directors and officers by the underwriters against certain liabilities.

Item 16. Exhibits

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

|

1.1

|

|

Form of Underwriting Agreement*

|

|

|

|

|

4.1

|

|

Second Amended and Restated Certificate of Incorporation of Bloomin’ Brands, Inc. (included as an exhibit to the Registrant’s Registration Statement on Form S-8, File No.

333-183270, filed on August 13, 2012 and incorporated herein by reference)

|

|

|

|

|

4.2

|

|

Second Amended and Restated Bylaws of Bloomin’ Brands, Inc. (included as an exhibit to the Registrant’s Registration Statement on Form S-8, File No. 333-183270, filed on

August 13, 2012 and incorporated herein by reference)

|

|

|

|

|

4.3

|

|

Form of Common Stock Certificate (included as an exhibit to Amendment No. 4 to the Registrant’s Registration Statement on Form S-1, File No. 333-180615, filed on July 18, 2012

and incorporated herein by reference)

|

|

|

|

|

5.1

|

|

Opinion of Baker & Hostetler LLP, counsel to the Company

|

|

|

|

|

23.1

|

|

Consent of Baker & Hostetler LLP (included in Exhibit 5.1)

|

|

|

|

|

23.2

|

|

Consent of PricewaterhouseCoopers LLP

|

|

|

|

|

23.3

|

|

Consent of Ernst & Young Auditores Independentes S.S.

|

|

|

|

|

24

|

|

Power of Attorney (included on the signature pages of this Registration Statement)

|

|

*

|

To be filed by amendment or as an exhibit to a document to be incorporated or deemed to be incorporated by reference in the Registration Statement, if applicable.

|

Item 17. Undertakings

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period

in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any

prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events

arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement.

II-2

Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any

deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20

percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration

Statement;

provided, however

, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the information

required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

that are incorporated by reference in the Registration Statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act to any purchaser:

(A) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration

statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing

the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the

first contract of sale of securities in the offering described in prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of

the registration statement relating to the securities in the registration statement to which the prospectus relates, and the offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof. Provided,

however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of

the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement

or made in any such document immediately prior to such effective date; and

(5) That, for the purpose of determining liability

of the registrant under the Securities Act to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration

statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to

the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or

prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

II-3

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the

undersigned registrant or used or referred to by the undersigned Registrant;

(iii) The portion of any other free writing

prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of an undersigned registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b) The undersigned hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s

annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act of 1934 that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities offered

therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers, and controlling

persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that, in the opinion of the Securities and Exchange Commission, such indemnification is against public policy as expressed in the

Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the

registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer, or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the

matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final

adjudication of such issue.

II-4

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe it meets all of the requirements for filing on Form S-3 and has duly caused

this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Tampa, State of Florida, on March 4, 2014.

|

|

|

|

|

B

LOOMIN

’ B

RANDS

, I

NC

.

|

|

|

|

|

By:

|

|

/s/ Elizabeth A. Smith

|

|

Name:

|

|

Elizabeth A. Smith

|

|

Title:

|

|

Chief Executive Officer

|

POWER OF ATTORNEY

We, the undersigned officers and directors of Bloomin’ Brands, Inc., hereby severally constitute and appoint David J. Deno, Joseph J. Kadow and Amanda L. Shaw, and each of them singly (with full

power to each of them to act alone), our true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution in each of them for him or her and in his or her name, place and stead, and in any and all capacities, to sign

any and all amendments (including post-effective amendments) to this Registration Statement, and to file the same, with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said

attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite or necessary to be done in and about the premises, as full to all intents and purposes as he or she might or could do

in person, hereby ratifying and confirming all that said attorneys-in-fact and agents or any of them, or their or his or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the

capacities held on the dates indicated.

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/s/ Elizabeth A. Smith

Elizabeth A. Smith

|

|

Chief Executive Officer and Director

(Principal Executive Officer)

|

|

March 4, 2014

|

|

|

|

|

|

/s/ David J. Deno

David J. Deno

|

|

Executive Vice President and Chief Financial and Administrative Officer

(Principal Financial Officer)

|

|

March 4, 2014

|

|

|

|

|

|

/s/ Amanda L. Shaw

Amanda L. Shaw

|

|

Senior Vice President, Technology and Chief Accounting Officer

(Principal Accounting Officer)

|

|

March 4, 2014

|

|

|

|

|

|

/s/ Andrew B. Balson

Andrew B. Balson

|

|

Director

|

|

March 4, 2014

|

|

|

|

|

|

/s/ James R. Craigie

James R. Craigie

|

|

Director

|

|

March 4, 2014

|

|

|

|

|

|

/s/ David R. Fitzjohn

David R. Fitzjohn

|

|

Director

|

|

March 4, 2014

|

II-5

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/s/ Mindy Grossman

Mindy Grossman

|

|

Director

|

|

March 4, 2014

|

|

|

|

|

|

/s/ David Humphrey

David Humphrey

|

|

Director

|

|

March 4, 2014

|

|

|

|

|

|

/s/ Tara Walpert Levy

Tara Walpert Levy

|

|

Director

|

|

March 4, 2014

|

|

|

|

|

|

/s/ John J. Mahoney

John J. Mahoney

|

|

Director

|

|

March 4, 2014

|

|

|

|

|

|

/s/ Mark E. Nunnelly

Mark E. Nunnelly

|

|

Director

|

|

March 4, 2014

|

|

|

|

|

|

/s/ Chris T. Sullivan

Chris T. Sullivan

|

|

Director

|

|

March 4, 2014

|

II-6

EXHIBIT INDEX

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

1.1

|

|

Form of Underwriting Agreement*

|

|

|

|

|

4.1

|

|

Second Amended and Restated Certificate of Incorporation of Bloomin’ Brands, Inc. (included as an exhibit to the Registrant’s Registration Statement on Form S-8, File No.

333-183270, filed on August 13, 2012 and incorporated herein by reference)

|

|

|

|

|

4.2

|

|

Second Amended and Restated Bylaws of Bloomin’ Brands, Inc. (included as an exhibit to the Registrant’s Registration Statement on Form S-8, File No. 333-183270, filed on

August 13, 2012 and incorporated herein by reference)

|

|

|

|

|

4.3

|

|

Form of Common Stock Certificate (included as an exhibit to Amendment No. 4 to the Registrant’s Registration Statement on Form S-1, File No. 333-180615, filed on July 18, 2012

and incorporated herein by reference)

|

|

|

|

|

5.1

|

|

Opinion of Baker & Hostetler LLP, counsel to the Company

|

|

|

|

|

23.1

|

|

Consent of Baker & Hostetler LLP (included in Exhibit 5.1)

|

|

|

|

|

23.2

|

|

Consent of PricewaterhouseCoopers LLP

|

|

|

|

|

23.3

|

|

Consent of Ernst & Young Auditores Independentes S.S.

|

|

|

|

|

24

|

|

Power of Attorney (included on the signature pages of this Registration Statement)

|

|

*

|

To be filed by amendment or as an exhibit to a document to be incorporated or deemed to be incorporated by reference in the Registration Statement, if applicable.

|

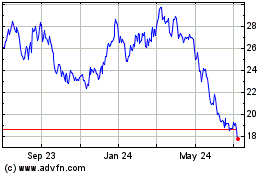

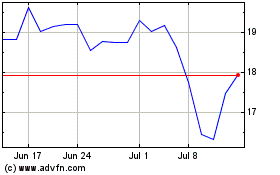

Bloomin Brands (NASDAQ:BLMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bloomin Brands (NASDAQ:BLMN)

Historical Stock Chart

From Apr 2023 to Apr 2024