UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS

OF REGISTERED MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-22760

Oppenheimer

Diversified Alternatives Fund

(Exact name of registrant as specified in charter)

6803 South Tucson Way,

Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Arthur S.

Gabinet

OFI Global Asset Management, Inc.

Two World Financial Center,

New York, New York 10281-1008

(Name and address of agent for service)

(303) 768-3200

(Registrant’s telephone number, including area code)

Date of fiscal year end: September 30

Date of reporting period: 12/31/2013

Item 1. Schedule of Investments.

|

|

|

|

|

|

|

|

|

|

|

|

|

STATEMENT OF

INVESTMENTS

December 31, 2013 / Unaudited

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

|

Value

|

|

|

|

|

|

Investment Companies—100.2%

|

|

|

|

|

|

|

|

|

|

Alternative Funds—95.2%

|

|

|

|

|

|

|

|

|

|

Oppenheimer Commodity Strategy Total Return Fund, Cl.

I

1,2

|

|

|

1,139,500

|

|

|

$

|

3,429,894

|

|

|

|

|

|

Oppenheimer Currency Opportunities Fund, Cl.

I

1,2

|

|

|

243,738

|

|

|

|

3,370,898

|

|

|

|

|

|

Oppenheimer Global Multi Strategies Fund, Cl. I

2

|

|

|

87,759

|

|

|

|

2,293,154

|

|

|

|

|

|

Oppenheimer Global Real Estate Fund, Cl. I

2

|

|

|

446,580

|

|

|

|

4,461,333

|

|

|

|

|

|

Oppenheimer Gold & Special Minerals Fund, Cl.

I

1,2

|

|

|

186,350

|

|

|

|

3,067,325

|

|

|

|

|

|

Oppenheimer SteelPath Master MLP Fund, LLC

2

|

|

|

365,422

|

|

|

|

4,765,098

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21,387,702

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Domestic Fixed Income Funds—5.0%

|

|

|

|

|

|

|

|

|

|

Oppenheimer Ultra-Short Duration Fund, Cl. Y

2

|

|

|

112,385

|

|

|

|

1,126,099

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investments, at Value (Cost $23,148,862)

|

|

|

100.2

|

%

|

|

|

22,513,801

|

|

|

|

|

|

Liabilities in Excess of Other Assets

|

|

|

(0.2)

|

|

|

|

(55,290)

|

|

|

|

|

|

|

|

|

Net Assets

|

|

|

100.0

|

%

|

|

$

|

22,458,511

|

|

|

|

|

|

|

|

Footnotes to Statement of Investments

1.

Non-income producing security.

2.

Is or was an affiliate, as defined in the Investment Company Act of 1940, at or during the period ended December 31,

2013, by virtue of the Fund owning at least 5% of the voting securities of the issuer or as a result of the Fund and the issuer having the same investment adviser. Transactions during the period in which the issuer was an affiliate are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares

September 30, 2013

|

|

|

Gross

Additions

|

|

|

Gross

Reductions

|

|

|

Shares

December 31, 2013

|

|

|

Oppenheimer Commodity Strategy Total Return Fund, Cl. I

|

|

|

1,018,788

|

|

|

|

154,619

|

|

|

|

33,907

|

|

|

|

1,139,500

|

|

|

Oppenheimer Currency Opportunities Fund, Cl. I

|

|

|

221,671

|

|

|

|

29,469

|

|

|

|

7,402

|

|

|

|

243,738

|

|

|

Oppenheimer Global Multi Strategies Fund, Cl. I

|

|

|

80,148

|

|

|

|

11,251

|

|

|

|

3,640

|

|

|

|

87,759

|

|

|

Oppenheimer Global Real Estate Fund, Cl. I

|

|

|

—

|

|

|

|

459,649

|

|

|

|

13,069

|

|

|

|

446,580

|

|

|

Oppenheimer Gold & Special Minerals Fund, Cl. I

|

|

|

164,982

|

|

|

|

27,519

|

|

|

|

6,151

|

|

|

|

186,350

|

|

|

Oppenheimer Real Estate Fund, Cl. I

|

|

|

176,603

|

|

|

|

12,139

|

|

|

|

188,742

|

|

|

|

—

|

|

|

Oppenheimer SteelPath Master MLP Fund, LLC

|

|

|

358,190

|

|

|

|

38,249

|

|

|

|

31,017

|

|

|

|

365,422

|

|

|

Oppenheimer Ultra-Short Duration Fund, Cl. Y (formerly Oppenheimer Short Duration Fund)

|

|

|

103,007

|

|

|

|

14,212

|

|

|

|

4,834

|

|

|

|

112,385

|

|

1 OPPENHEIMER

DIVERSIFIED ALTERNATIVES FUND

|

|

|

|

|

|

|

|

|

|

|

|

|

STATEMENT OF

INVESTMENTS

Unaudited / (Continued)

|

|

|

|

|

|

|

|

|

|

|

|

Footnotes to Statement of Investments (Continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Realized

|

|

|

|

|

Value

|

|

|

Income

|

|

|

Gain (Loss)

|

|

|

Oppenheimer Commodity Strategy Total Return Fund, Cl. I

|

|

$

|

3,429,894

|

|

|

$

|

—

|

|

|

$

|

(13,450)

|

|

|

Oppenheimer Currency Opportunities Fund, Cl. I

|

|

|

3,370,898

|

|

|

|

—

|

|

|

|

(4,302)

|

|

|

Oppenheimer Global Multi Strategies Fund, Cl. I

|

|

|

2,293,154

|

|

|

|

11,698

|

|

|

|

(1,313)

|

|

|

Oppenheimer Global Real Estate Fund, Cl. I

|

|

|

4,461,333

|

|

|

|

42,627

|

|

|

|

(3,703)

|

|

|

Oppenheimer Gold & Special Minerals Fund, Cl. I

|

|

|

3,067,325

|

|

|

|

—

|

|

|

|

(84,613)

|

|

|

Oppenheimer Real Estate Fund, Cl. I

|

|

|

—

|

|

|

|

—

|

|

|

|

51,393

|

|

|

Oppenheimer SteelPath Master MLP Fund, LLC

|

|

|

4,765,098

|

|

|

|

57,672

|

|

|

|

(2,341)

|

|

|

Oppenheimer Ultra-Short Duration Fund, Cl. Y (formerly Oppenheimer Short Duration

Fund)

|

|

|

1,126,099

|

|

|

|

1,000

|

|

|

|

(1)

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

22,513,801

|

|

|

$

|

112,997

|

|

|

$

|

(58,330)

|

|

|

|

|

|

|

|

2 OPPENHEIMER DIVERSIFIED ALTERNATIVES FUND

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTES TO STATEMENT OF

INVESTMENTS

Unaudited

|

|

|

Risks of Investing in the Underlying Funds.

Each of the Underlying Funds in

which the Fund invests has its own investment risks, and those risks can affect the value of the Fund’s investments and therefore the value of the Fund’s shares. To the extent that the Fund invests more of its assets in one Underlying Fund

than in another, the Fund will have greater exposure to the risks of that Underlying Fund.

Investment in Oppenheimer

Master Limited Partnerships (“MLP”).

The Fund is permitted to invest in entities sponsored and/or advised by the Manager or an affiliate. Certain of these entities in which the Fund invests are mutual funds registered under the

Investment Company Act of 1940 that expect to be treated as partnerships for tax purposes, specifically Oppenheimer SteelPath Master MLP Fund, LLC (the “MLP Fund”). The MLP Fund has its own investment risks, and those risks can affect the

value of the Fund’s investments and therefore the value of the Fund’s shares.

The investment

objective of Oppenheimer SteelPath Master MLP Fund, LLC is to seek long-term capital appreciation. It seeks to achieve this objective by investing primarily in equity securities of a minimum of forty Master Limited Partnerships (“MLPs”).

These securities represent limited partnership interests in energy infrastructure assets.

The

Fund’s investment in the MLP Fund is included in the Statement of Investments. The Fund recognizes income and gain (loss) on its investment in the MLP Fund according to its allocated pro-rata share, based on its relative proportion of total

outstanding MLP Fund shares held, of the total net income (loss) earned and the net gain (loss) realized on investments sold by the MLP Fund. As a shareholder, the Fund is subject to its proportional share of the MLP Fund’s expenses, including

its management fee.

Securities Valuation

The Fund calculates the net asset value of its shares based upon the net asset value of the applicable Underlying Fund. For each Underlying Fund, the net asset value per share for a class of shares is

determined as of the close of the New York Stock Exchange (the “Exchange”), normally 4:00 P.M. Eastern time, on each day the Exchange is open for trading by dividing the value of the Underlying Fund’s net assets attributable to that

class by the number of outstanding shares of that class on that day.

The Fund’s Board has adopted

procedures for the valuation of the Fund’s securities and has delegated the day-to-day responsibility for valuation determinations under those procedures to the Manager. The Manager has established a Valuation Committee which is responsible for

determining a “fair valuation” for any security for which market quotations are not “readily available.” The Valuation Committee’s fair valuation determinations are subject to review, approval and ratification by the

Fund’s Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined.

Valuations Methods and Inputs

To determine their net asset values, the Underlying Funds’ assets are valued primarily on the basis of current market quotations as generally supplied by third party portfolio pricing services or by dealers.

Such market quotations are typically based on unadjusted quoted prices in active markets for identical securities or other observable market inputs.

If a market value or price cannot be determined for a security using the methodologies described above, or if, in

the “good faith” opinion of the Manager, the market value or price obtained does not constitute a “readily

3 OPPENHEIMER

DIVERSIFIED ALTERNATIVES FUND

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTES TO STATEMENT OF

INVESTMENTS

Unaudited / (Continued)

|

|

|

Securities Valuation (Continued)

available market quotation,” or a

significant event has occurred that would materially affect the value of the security the security is fair valued either (i) by a standardized fair valuation methodology applicable to the security type or the significant event as previously

approved by the Valuation Committee and the Fund’s Board or (ii) as determined in good faith by the Manager’s Valuation Committee. The Valuation Committee considers all relevant facts that are reasonably available, through either

public information or information available to the Manager, when determining the fair value of a security. Fair value determinations by the Manager are subject to review, approval and ratification by the Fund’s Board at its next regularly

scheduled meeting covering the calendar quarter in which the fair valuation was determined. The methodologies used for valuing securities are not necessarily an indication of the risks associated with investing in those Underlying Funds.

To assess the continuing appropriateness of security valuations, the Manager, or its third party service provider

who is subject to oversight by the Manager, regularly compares prior day prices, prices on comparable securities, and sale prices to the current day prices and challenges those prices exceeding certain tolerance levels with the third party pricing

service or broker source. For those securities valued by fair valuations, whether through a standardized fair valuation methodology or a fair valuation determination, the Valuation Committee reviews and affirms the reasonableness of the valuations

based on such methodologies and fair valuation determinations on a regular basis after considering all relevant information that is reasonably available.

Classifications

Each investment asset or liability of the Fund is assigned a

level at measurement date based on the significance and source of the inputs to its valuation. Various data inputs are used in determining the value of each of the Fund’s investments as of the reporting period end. These data inputs are

categorized in the following hierarchy under applicable financial accounting standards:

1) Level 1-unadjusted quoted

prices in active markets for identical assets or liabilities (including securities actively traded on a securities exchange)

2) Level 2-inputs other than unadjusted quoted prices that are observable for the asset or liability (such as unadjusted quoted prices for similar assets and market corroborated inputs such as interest rates,

prepayment speeds, credit risks, etc.)

3) Level 3-significant unobservable inputs (including the Manager’s own

judgments about assumptions that market participants would use in pricing the asset or liability).

The inputs used for

valuing securities are not necessarily an indication of the risks associated with investing in those securities.

The Fund classifies each of its investments in those Underlying Funds which are publicly offered and reported on an exchange as Level 1, and those Underlying Funds which are not publicly offered as Level 2,

without consideration as to the classification level of the specific investments held by the Underlying Funds.

The

table below categorizes amounts as of December 31, 2013 based on valuation input level:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1—

Unadjusted

Quoted Prices

|

|

|

Level 2—

Other Significant

Observable Inputs

|

|

|

Level 3—

Significant

Unobservable

Inputs

|

|

|

Value

|

|

|

|

|

|

Assets Table

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments, at Value:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment Companies

|

|

$

|

17,748,703

|

|

|

$

|

4,765,098

|

|

|

$

|

—

|

|

|

$

|

22,513,801

|

|

|

|

|

|

|

|

|

Total Assets

|

|

$

|

17,748,703

|

|

|

$

|

4,765,098

|

|

|

$

|

—

|

|

|

$

|

22,513,801

|

|

|

|

|

|

|

|

4 OPPENHEIMER

DIVERSIFIED ALTERNATIVES FUND

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTES TO STATEMENT OF

INVESTMENTS

Unaudited / (Continued)

|

|

|

Securities Valuation (Continued)

Currency contracts and forwards, if any, are

reported at their unrealized appreciation/depreciation at measurement date, which represents the change in the contract’s value from trade date. Futures, if any, are reported at their variation margin at measurement date, which represents the

amount due to/from the Fund at that date. All additional assets and liabilities included in the above table are reported at their market value at measurement date.

Federal Taxes

The approximate aggregate cost of securities and other investments and the composition of unrealized appreciation

and depreciation of securities and other investments for federal income tax purposes as of December 31, 2013 are noted below. The primary difference between book and tax appreciation or depreciation of securities and other investments, if

applicable, is attributable to the tax deferral of losses.

|

|

|

|

|

|

|

Federal tax cost of securities

|

|

$

|

23,213,051

|

|

|

|

|

|

|

|

|

|

|

|

Gross unrealized appreciation

|

|

$

|

736,516

|

|

|

Gross unrealized depreciation

|

|

|

(1,435,766)

|

|

|

|

|

|

|

|

|

Net unrealized depreciation

|

|

$

|

(699,250)

|

|

|

|

|

|

|

|

5 OPPENHEIMER

DIVERSIFIED ALTERNATIVES FUND

Item 2. Controls and Procedures.

|

|

(a)

|

Based on their evaluation of the registrant’s disclosure controls and procedures (as defined in rule 30a-3(c) under the Investment Company Act of 1940 (17 CFR 270.30a-3(c)) as of 12/31/2013, the registrant’s

principal executive officer and principal financial officer found the registrant’s disclosure controls and procedures to provide reasonable assurances that information required to be disclosed by the registrant in the reports that it files

under the Securities Exchange Act of 1934 (a) is accumulated and communicated to the registrant’s management, including its principal executive officer and principal financial officer, to allow timely decisions regarding required

disclosure, and (b) is recorded, processed, summarized and reported, within the time periods specified in the rules and forms adopted by the U.S. Securities and Exchange Commission.

|

|

|

(b)

|

There have been no significant changes in the registrant’s internal controls over financial reporting that occurred during the registrant’s last fiscal quarter that has materially affected, or is reasonably

likely to materially affect, the registrant’s internal control over financial reporting.

|

Item 3. Exhibits.

Exhibits attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be

signed on its behalf by the undersigned, thereunto duly authorized.

Oppenheimer Diversified Alternatives Fund

|

|

|

|

|

By:

|

|

/s/ William F. Glavin, Jr.

|

|

|

|

William F. Glavin, Jr.

|

|

|

|

Principal Executive Officer

|

|

Date:

|

|

2/10/2014

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has

been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

|

|

|

|

By:

|

|

/s/ William F. Glavin, Jr.

|

|

|

|

William F. Glavin, Jr.

|

|

|

|

Principal Executive Officer

|

|

Date:

|

|

2/10/2014

|

|

|

|

|

|

By:

|

|

/s/ Brian W. Wixted

|

|

|

|

Brian W. Wixted

|

|

|

|

Principal Financial Officer

|

|

Date:

|

|

2/10/2014

|

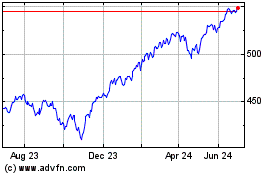

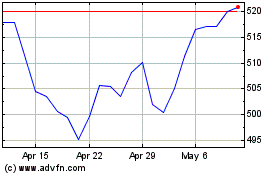

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Aug 2024 to Sep 2024

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Sep 2023 to Sep 2024