COREwafer Industries, Inc. Announces Its 2013 Year in Review and Material Events

February 27 2014 - 8:00AM

Marketwired

COREwafer Industries, Inc. Announces Its 2013 Year in Review and

Material Events

HOLLYWOOD, FL--(Marketwired - Feb 27, 2014) - COREwafer

Industries, Inc. (PINKSHEETS: WAFR), a holding company that manages

and develops its wholly owned subsidiaries through mergers and

acquisitions announces its yearly review and certain other material

events for 2013.

Looking back, 2013 was a year of transformation and transition

which included four key areas of priority; reestablishing our

Mission Statement/Strategy, restructuring our debt, finding

investors and structuring the board. The new structure had to be

capable of achieving known objectives as well as responding to the

market demands, often with short turn-around timeframes. It

was also a year of unexpected challenges resulting in delays in the

regeneration and marketing of our end-of-life products, and major

funding needed for growth and operations.

Board of

Directors

COREwafer also expanded its board of directors to 7 members,

including the recent additions of Teresa McWilliams, Dale Churchill

and Jerald Wrightsil positioning COREwafer Industries with strong

guidance and expertise to better deal with the growth and

diversification of a company dealing in emerging markets.

Management

Team

The board of directors appointed Cyril Moreau as chief executive

officer and president, following the resignation of Gary

Polistena. Stepping into the CEO and president roles along

with his position on the board will help facilitate leadership

continuity as the company continues to navigate through this period

of transformation. Cyril possesses decades of software and

technology leadership and management expertise which is ideal for

ensuring the smooth and orderly execution of the company's

strategic plan.

Chief financial officer, Teresa McWilliams, extended her term

with the company for another two years until May 31, 2015 and

assumed additional responsibilities as the corporate secretary.

Material

Events

During the second half of the year the company was notified

about a number of law suits and legal actions being taken against

the previous President/CEO of its wholly owned subsidiary, Core

Wafer Systems, resulting in joint legal actions against both

COREwafer Industries and Core Wafer Systems, Inc. The company

is taking every measure to defend itself against these and possible

future incidents as a result of past and present actions of CWS'

past president/CEO.

In addition to the law suits, the company discovered there is

approximately $3.4 million in debt owed by its wholly owned

subsidiary, CWS, which was hidden from and otherwise undisclosed to

company officials and consultants during and after the

merger. The company is working diligently to authenticate

and/or dispute these liabilities which include approximately

$322,000 owed to the IRS for unpaid payroll taxes and $3.1 million

in defaulted short term promissory notes, accounts payable and

judgments.

In October the company entered into a Debt Purchase Agreement

and increased its authorized common and preferred stock to 775M

shares in order to eliminate a portion the company's overall

debt.

COREwafer Industries,

Inc. 2014 Outlook

According to the 2014 outlook reports for the Technology and

Semi-Conductor sectors, 2014 will show a growth of 4% to 7% which

confirms our strategy for both our software offers in the

semiconductor testing sector and our acquisition strategy into the

technology sector. Economists agree that the Asian and US

market will grow and the European market will still face obstacles,

this is why we will continue to concentrate our efforts in the US

and Asia while we will re-visit the European market through the end

of the year.

We have created the following slogan to summarize our objectives

for 2014

"Achieve Our Targets by Treating Challenges as

Opportunities"

Operating under this slogan, our areas of emphasis in 2014 are

as follows:

1. Further strengthening of financial results (Cash flow,

reduce debt, increase revenue, finalize funding) 2. Growth as

a key player in the semiconductor sector with the re-launch of our

software 3. Improve customer satisfaction 4. New

acquisition(s) in the Technology sector 5. Up listing to the

Amex marketplace

About COREwafer Industries

COREWAFER INDUSTRIES, INC. (WAFR) is a holding company

headquartered in Hollywood, FL, that develops and manages

subsidiary companies in the technology industry. The goal of WAFR

is to strategically acquire businesses with strong growth potential

and a solid business plan in various industries including consumer

goods, software and technology. For information, visit

www.corewaferindustries.com.

CORE WAFER SYSTEMS, INC. (CWS), a wholly owned subsidiary and

Flagship Company of WAFR, creates proprietary software, software

algorithms, and hardware used in testing and data mining of the

most commonly used computer hard drives, memory, and magnetics; as

well as other advanced magnetics, semiconductor and

nanotechnology-based device components. CWS has an install base of

over 800 clients and 1,500 installed systems on HP, Keithley, and

Agilent Test hardware.

Safe Harbor This release may contain "forward-looking

statements," within the meaning of Section 27A of the Securities

Act of 1933, as amended, and of Section 21E of the Securities

Exchange Act of 1934, as amended, and such forward-looking

statements are made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. Those statements

include statements regarding the intent, belief, or current

expectations of COREwafer Industries, Inc. and members of its

management, as well as the assumptions on which such statements are

based. Prospective investors are cautioned that any such

forward-looking statements are not guarantees of future performance

and involve risks and uncertainties, and that actual results may

differ materially from those contemplated by such forward-looking

statements. Important factors currently known to management that

could cause actual results to differ materially from those in

forward-looking statements include fluctuation of operating

results, the ability to compete successfully in its market segment,

and the ability to complete some or all of the before-mentioned

transactions. The company undertakes no obligation to update or

revise forward-looking statements to reflect changed assumptions,

the occurrence of unanticipated events, or changes to future

operating results.

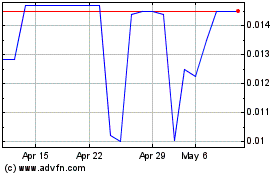

Aluf (PK) (USOTC:AHIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

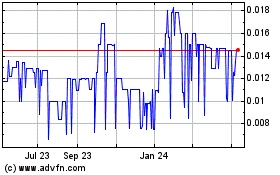

Aluf (PK) (USOTC:AHIX)

Historical Stock Chart

From Apr 2023 to Apr 2024