- GAAP net income of $1.0 billion, $1.07

earnings per common share

- Core earnings of $350.1 million, $0.35

earnings per common share

- Strong capital position with capital

ratio of 15.1%, net capital ratio of 15.9%, and leverage of

5.0:1

- Commercial investment portfolio doubled

since CXS acquisition, now representing 14% of stockholders’

equity

- Book value of $12.13

Annaly Capital Management, Inc. (NYSE: NLY) today announced

financial results for the quarter ended December 31, 2013.

Financial

Performance

GAAP net income for the quarter ended December 31, 2013 was $1.0

billion or $1.07 per average common share as compared to GAAP net

income of $192.5 million or $0.18 per average common share for the

quarter ended September 30, 2013, and GAAP net income of $700.5

million or $0.70 per average common share for the quarter ended

December 31, 2012. The increase from both prior periods was largely

attributable to higher unrealized gains on interest rate swaps,

trading assets and interest-only Agency mortgage-backed securities.

Core earnings for the quarter ended December 31, 2013 was $350.1

million or $0.35 per average common share as compared to $282.3

million or $0.28 per average common share for the quarter ended

September 30, 2013, and $335.1 million or $0.32 per average common

share for the quarter ended December 31, 2012. "Core earnings"

represents a non-GAAP measure and is defined as net income (loss)

excluding gains or losses on disposals of investments and

termination of interest rate swaps, unrealized gains or losses on

interest rate swaps and Agency interest-only mortgage-backed

securities, net loss on extinguishment of the 4% Convertible Senior

Notes due 2015, net gains and losses on trading assets, impairment

losses and loss on previously held equity interest in CreXus

Investment Corp.

GAAP net income for the years ended December 31, 2013 and 2012,

respectively was $3.7 billion or $3.86 per average common share and

$1.7 billion or $1.74 per average common share. Core earnings for

the years ended December 31, 2013 and 2012, was $1.2 billion or

$1.21 per average common share and $1.5 billion or $1.54 per

average common share, respectively.

For the quarter ended December 31, 2013, the annualized yield on

average interest-earning assets was 3.50% and the annualized cost

of funds on average interest-bearing liabilities, including the net

interest payments on interest rate swaps, was 2.07%, which resulted

in an average interest rate spread of 1.43%. This was a 36 basis

point increase from the 1.07% average interest rate spread for the

quarter ended September 30, 2013, and a 49 basis point increase

from the 0.94% average interest rate spread for the quarter ended

December 31, 2012. Our annualized yield on average interest-earning

assets increased for the quarter ended December 31, 2013 when

compared to the quarter ended September 30, 2013 due to lower

amortization expense on our Investment Securities, primarily driven

by lower prepayment speeds experienced during the current quarter.

Our annualized cost of funds on average interest-bearing

liabilities increased for the quarter ended December 31, 2013 when

compared to the quarter ended September 30, 2013 due to higher

interest rate swap notional amounts and higher cost of interest

rate swaps coupled with lower repurchase agreements balances during

the current quarter.

Wellington J. Denahan, Chairman and Chief Executive Officer of

Annaly, commented on the Company’s results. “We are encouraged by

the reduced uncertainty in the fixed income markets with the

introduction of monetary policy tapering. Our commercial assets

continue to build momentum, with commercial investments now

representing 14% of our stockholders’ equity. The lower leverage

stance permits us to be opportunistic with capital deployment

allowing us to strengthen earnings in future periods.”

Asset

Portfolio

Investment Securities, which is comprised of Agency

mortgage-backed securities and Agency debentures, were $73.4

billion at December 31, 2013, compared to $83.0 billion at

September 30, 2013 and $127.0 billion at December 31, 2012. As of

December 31, 2013, substantially all of the Company’s Investment

Securities were Fannie Mae, Freddie Mac and Ginnie Mae

mortgage-backed securities and debentures. Fixed-rate Agency

mortgage-backed securities and debentures comprised 91% of the

Company’s Investment Securities portfolio at December 31, 2013.

Adjustable-rate Agency mortgage-backed securities and debentures

comprised 9% of the Company’s Investment Securities portfolio.

During the quarter ended December 31, 2013, the Company disposed of

$11.9 billion of Investment Securities, resulting in a realized

gain of $49.6 million. During the quarter ended September 30, 2013,

the Company disposed of $13.0 billion of Investment Securities,

resulting in a realized gain of $43.6 million. During the quarter

ended December 31, 2012, the Company disposed of $13.2 billion of

Investment Securities, resulting in a realized gain of $121.4

million.

During the year ended December 31, 2013, the Company disposed of

$56.8 billion of Investment Securities, resulting in a realized

gain of $424.1 million. During the year ended December 31, 2012,

the Company disposed of $32.2 billion of Investment Securities,

resulting in a realized gain of $438.5 million.

The Constant Prepayment Rate for the quarters ended December 31,

2013, September 30, 2013, and December 31, 2012, was 7%, 13% and

20%, respectively. The net amortization of premiums and accretion

of discounts on Investment Securities for the quarters ended

December 31, 2013, September 30, 2013, and December 31, 2012, was

$30.7 million, $201.9 million, and $433.3 million, respectively.

The total net premium balance on Investment Securities at December

31, 2013, September 30, 2013, and December 31, 2012, was $4.6

billion, $4.7 billion, and $5.8 billion, respectively. The

amortized cost basis of the Company’s non-interest-only Investment

Securities at December 31, 2013, September 30, 2013, and December

31, 2012, was 105.0%, 104.7%, and 104.3%, respectively. The

amortized cost basis of the Company’s interest-only Investment

Securities at December 31, 2013, September 30, 2013, and December

31, 2012, was 14.1%, 13.8%, and 13.6%, respectively.

The Company’s commercial investment portfolio consists of

commercial real estate investments and corporate debt. At December

31, 2013, the Company’s commercial investment portfolio represented

14% of stockholders’ equity compared to 11% at September 30, 2013.

Commercial real estate debt and preferred equity totaled $1.6

billion and investments in commercial real estate totaled $60.1

million at December 31, 2013. Total commercial real estate

investments increased from $1.3 billion at September 30, 2013 to

$1.6 billion at December 31, 2013.

Capital and

Funding

At December 31, 2013 total stockholders’ equity was $12.4

billion. Leverage at December 31, 2013, September 30, 2013, and

December 31, 2012, was 5.0:1, 5.4:1 and 6.5:1, respectively.

Leverage includes repurchase agreements, Convertible Senior Notes

and non-recourse loan participation and mortgages payable. At

December 31, 2013, September 30, 2013, and December 31, 2012, the

Company’s capital ratio, which represents the ratio of

stockholders’ equity to total assets, was 15.1%, 13.9%, and 11.9%,

respectively. At December 31, 2013, September 30, 2013, and

December 31, 2012, the Company’s net capital ratio was 15.9%,

14.8%, and 12.3%, respectively. The Company’s net capital ratio

takes into account the net balances of its U.S. Treasury securities

and U.S Treasury securities sold, not yet purchased, reverse

repurchase agreements and repurchase agreements, and securities

borrowed and securities loaned. On a GAAP basis, the Company

produced an annualized return on average equity for the quarters

ended December 31, 2013, September 30, 2013, and December 31, 2012

of 32.46%, 5.87%, and 16.97%, respectively. On a Core earnings

basis, the Company provided an annualized return on average equity

for the quarters ended December 31, 2013, September 30, 2013, and

December 31, 2012, of 11.05%, 8.62%, and 8.12%, respectively.

At December 31, 2013, September 30, 2013, and December 31, 2012

the Company had outstanding $61.8 billion, $69.2 billion, and

$102.8 billion of repurchase agreements, respectively, with

weighted average borrowing rates of 2.33%, 2.02%, and 1.53%,

respectively, after giving effect to the Company’s interest rate

swaps, and weighted average remaining maturities of 204 days, 200

days, and 191 days, respectively.

At December 31, 2013, September 30, 2013, and December 31, 2012,

the Company had a common stock book value per share of $12.13,

$12.70 and $15.85, respectively.

The following table presents the maturities of repurchase

agreements at December 31, 2013:

Maturity Principal

Balance Weighted Average Rate (dollars in

thousands) Within 30 days $ 21,171,574 0.36% 30 to 59 days

13,373,921 0.43% 60 to 89 days 3,592,266 0.44% 90 to 119 days

4,010,334 0.52% Over 120 days(1) 19,632,906

1.29%

Total $ 61,781,001 0.68%

(1) Approximately 16% of the total

repurchase agreements have a remaining maturity over 1 year.

Hedge

Portfolio

At December 31, 2013, the Company had entered into interest rate

swaps with a notional amount of $52.4 billion and interest rate

swaptions with a net notional amount of $4.2 billion, or 92% of the

Company’s repurchase agreements, compared to 85% of the Company’s

repurchase agreements at September 30, 2013 and 46% of the

Company’s repurchase agreements at December 31, 2012. Changes in

the unrealized gains or losses on the interest rate swaps are

reflected in the Company’s consolidated statements of comprehensive

income (loss). The purpose of the interest rate swaps is to

mitigate the risk of rising interest rates that affect the

Company’s cost of funds. Since the Company pays a fixed rate and

receives a floating rate on the notional amount of the swaps, the

intended effect of the swaps is to lock in a cost of financing. As

of December 31, 2013, the swap portfolio had a weighted average pay

rate of 2.14%, a weighted average receive rate of 0.20% and

weighted average maturity of 5.26 years.

At December 31, 2013, the Company had entered into interest rate

swaptions with a net notional amount of $4.2 billion. Changes in

the unrealized gains or losses on the interest rate swaptions are

reflected in the Company’s consolidated statements of comprehensive

income (loss). The interest rate swaptions provide the Company with

the option to enter into an interest rate swap agreement for a

specified notional amount, duration, and pay and receive rates. As

of December 31, 2013, the long swaption portfolio had a weighted

average pay rate of 3.07% and weighted average maturity of 4.26

months. As of December 31, 2013, the short swaption portfolio had a

weighted average receive rate of 2.83% and weighted average

maturity of 23.71 months.

The following table summarizes certain characteristics of the

Company’s interest rate swaps at December 31, 2013:

Maturity Current Notional

Weighted Average Pay Rate Weighted Average

Receive Rate Weighted Average Years to

Maturity (dollars in thousands)

0 - 3 years $ 24,286,000 1.83 % 0.18 %

1 .98 3 - 6 years 8,865,410 2.02 % 0.19 % 4 .19 6 - 10 years

15,785,500 2.37 % 0.23 % 7 .66 Greater than 10 years

3,490,000 3.62 % 0.20 %

19 .93 Total / Weighted Average $ 52,426,910 2.14 %

0.20 % 5 .26

The following table summarizes certain characteristics of the

Company’s interest rate swaptions at December 31, 2013:

Current Underlying Notional Weighted

Average Underlying Pay Rate Weighted Average

Underlying Receive Rate Weighted Average

Underlying Years to Maturity Weighted Average

Months to Expiration

(dollars in thousands)

Long $ 5,150,000 3.07% 3M LIBOR

10.10 4.26 Short $ 1,000,000 3M LIBOR 2.83%

5.96 23.71

Key

Metrics

The following table presents key metrics of the Company’s

portfolio, liabilities and hedging positions, and performance as of

and for the quarters ended December 31, 2013, September 30, 2013,

and December 31, 2012:

December 31, 2013 September

30, 2013 December 31, 2012

Portfolio Related

Metrics:

Fixed-rate Agency mortgage-backed

securities and debentures as a percentage of portfolio 91 % 91 % 93

% Adjustable-rate Agency mortgage-backed securities and debentures

as a percentage of portfolio 9 % 9 % 7 % Weighted average yield on

commercial real estate debt and preferred equity at period-end 9.17

% 9.71 % N/A Weighted average net equity yield on investments in

commercial real estate at period-end (1) 12.69 %

14.13 % N/A

Liabilities and

Hedging Metrics:

Weighted average days to maturity on repurchase agreements

outstanding at period-end 204 200 191 Notional amount of interest

rate swaps and swaptions as a percentage of repurchase agreements

92 % 85 % 46 % Weighted average pay rate on interest rate swaps at

period-end 2.14 % 2.06 % 2.21 % Weighted average receive rate on

interest rate swaps at period-end 0.20 % 0.21 % 0.24 % Weighted

average net rate on interest rate swaps at period-end 1.94 % 1.85 %

1.97 % Leverage at period-end (2) 5.0:1 5.4:1 6.5:1 Capital ratio

at period end 15.1 % 13.9 % 11.9 % Net capital ratio at period end

15.9 % 14.8 % 12.3 %

Performance Related

Metrics:

Annualized yield on average interest earning assets during the

quarter (3) 3.50 % 2.88 % 2.44 % Annualized cost of funds on

average interest bearing liabilities during the quarter 2.07 % 1.81

% 1.50 % Annualized interest rate spread during the quarter 1.43 %

1.07 % 0.94 % Annualized return on average equity 32.46 % 5.87 %

16.97 % Annualized Core return on average equity 11.05 % 8.62 %

8.12 % Common dividend declared during the quarter $0.30 $0.35

$0.45 Book value per common share $12.13

$12.70 $15.85

(1) Excludes real estate

held-for-sale.

(2) Includes non-recourse loan

participations and mortgages payable.

(3) Average interest earning assets

reflects the average amortized cost of our investments during the

period.

The following table presents a reconciliation between GAAP net

income and Core earnings for the quarters ended December 31, 2013,

September 30, 2013, and December 31, 2012:

For the quarters ended

December 31, 2013 September 30, 2013

December 31, 2012 (dollars in

thousands) GAAP net income $ 1,028,749 $ 192,458

$ 700,495 Realized (gains) losses on termination of

interest rate swaps 13,177 36,658 - Unrealized (gains) losses on

interest rate swaps (561,101 ) (6,343 ) (341,554 ) Net (gains)

losses on disposal of investments (28,602 ) (43,602 ) (114,831 )

Net loss on extinguishment of 4% Convertible Senior Notes - -

75,012 Net (gains) losses on trading assets (41,936 ) 96,022

(15,181 ) Net unrealized (gains) losses on interest-only Agency

mortgage-backed securities (60,181 )

7,099 31,148 Core earnings $

350,106 $ 282,292 $

335,089 GAAP net income per average common share $

1.07 $ 0.18 $ 0.70

Core earnings per average common share $ 0.35

$ 0.28 $ 0.32

The following table presents a reconciliation between GAAP net

income and Core earnings for the years ended December 31, 2013 and

2012:

For the years ended December

31, 2013 December 31, 2012 (dollars in

thousands) GAAP net income $ 3,729,698 $

1,735,900 Realized (gains) losses on termination of interest rate

swaps 101,862 2,385 Unrealized (gains) losses on interest rate

swaps (2,002,200 ) 32,219 Net (gains) losses on disposal of

investments (403,045 ) (432,139 ) Net loss on extinguishment of 4%

Convertible Senior Notes - 162,340 Net (gains) losses on trading

assets (1,509 ) (22,910 ) Net unrealized (gains) losses on

interest-only Agency mortgage-backed securities (244,730 ) 59,937

Impairment of goodwill 23,987 - Loss on previously held equity

interest in CreXus 18,896 -

Core earnings $ 1,222,959 $ 1,537,732

GAAP net income per average common share $ 3.86

$ 1.74 Core earnings per average common

share $ 1.21 $ 1.54

Dividend

Declarations

Common dividends declared for the quarters ended December 31,

2013, September 30, 2013, and December 31, 2012 were $0.30, $0.35,

and $0.45 per common share, respectively. The Company distributes

dividends based on its current estimate of taxable earnings per

common share, not GAAP net income. Taxable earnings and GAAP net

income will typically differ due to items such as non-taxable

unrealized and realized gains and losses, differences in premium

amortization and discount accretion, and non-deductible general and

administrative expenses. The annualized dividend yield on the

Company’s common stock for the quarter ended December 31, 2013,

based on the December 31, 2013 closing price of $9.97, was 12.04%,

as compared to 12.09% for the quarter ended September 30, 2013, and

12.82% for the quarter ended December 31, 2012.

Other

Information

Annaly’s principal business objective is to generate net income

for distribution to its shareholders from its investments. Annaly

is a Maryland corporation that has elected to be taxed as a real

estate investment trust (“REIT”). Annaly is managed and advised by

Annaly Management Company LLC.

The Company prepares a supplement to provide additional

quarterly information for the benefit of its shareholders. The

supplement can be found at the Company’s website in the Investor

Relations section under “Quarterly Supplemental Information”.

Conference

Call

The Company will hold the 2013 fourth quarter earnings

conference call on February 26, 2014 at 10:00 a.m. EST. The number

to call is 888-317-6003 for domestic calls and 412-317-6061 for

international calls. The conference passcode is 1477019. There will

also be an audio webcast of the call on www.annaly.com. The replay

of the call is available for one week following the conference

call. The replay number is 877-344-7529 for domestic calls and

412-317-0088 for international calls and the conference passcode is

10040001. If you would like to be added to the e-mail distribution

list, please visit www.annaly.com, click on Investor Relations,

then select Email Alerts and complete the email notification

form.

This news release and our public documents to which we refer

contain or incorporate by reference certain forward-looking

statements which are based on various assumptions (some of which

are beyond our control) and may be identified by reference to a

future period or periods or by the use of forward-looking

terminology, such as "may," "will," "believe," "expect,"

"anticipate," "continue," or similar terms or variations on those

terms or the negative of those terms. Actual results could differ

materially from those set forth in forward-looking statements due

to a variety of factors, including, but not limited to, changes in

interest rates; changes in the yield curve; changes in prepayment

rates; the availability of mortgage-backed securities and other

securities for purchase; the availability of financing and, if

available, the terms of any financings; changes in the market value

of our assets; changes in business conditions and the general

economy; our ability to grow the commercial mortgage business;

credit risks related to our investments in commercial real estate

assets and corporate debt; our ability to consummate any

contemplated investment opportunities; changes in government

regulations affecting our business; our ability to maintain our

qualification as a REIT for federal income tax purposes; our

ability to maintain our exemption from registration under the

Investment Company Act of 1940, as amended; risks associated with

the businesses of our subsidiaries, including the investment

advisory business of our wholly-owned subsidiary; and risks

associated with the broker-dealer business of our wholly-owned

subsidiary. For a discussion of the risks and uncertainties which

could cause actual results to differ from those contained in the

forward-looking statements, see "Risk Factors" in our most recent

Annual Report on Form 10-K and any subsequent Quarterly Reports on

Form 10-Q. We do not undertake, and specifically disclaim any

obligation, to publicly release the result of any revisions which

may be made to any forward-looking statements to reflect the

occurrence of anticipated or unanticipated events or circumstances

after the date of such statements.

ANNALY CAPITAL MANAGEMENT, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (dollars

in thousands, except per share data)

December

31, September 30, June 30, March 31,

December 31, 2013 2013 2013 2013

2012(1)

(Unaudited) (Unaudited)

(Unaudited) (Unaudited)

ASSETS Cash and cash equivalents $ 552,436 $

1,122,722 $ 725,537 $ 1,862,550 $ 615,789 Reverse repurchase

agreements 100,000 31,074 171,234 4,933,465 1,811,095 Securities

borrowed 2,582,893 3,439,954 2,425,024 2,688,485 2,160,942

Investments, at fair value: U.S. Treasury securities 1,117,915

2,459,617 - 1,645,930 752,076 Agency mortgage-backed securities

70,388,949 79,902,834 92,487,318 108,256,671 123,963,207 Agency

debentures 2,969,885 3,128,853 3,306,473 3,970,279 3,009,568

Investment in affiliates 139,447 136,748 134,948 267,547 234,120

Commercial real estate debt and preferred equity 1,583,969

1,227,182 938,357 - - Investments in commercial real estate 60,132

60,424 67,203 - - Corporate debt, held for investment 117,687

75,988 61,682 66,539 63,944 Receivable for investments sold

1,193,730 934,964 1,499,140 1,292,478 290,722 Accrued interest and

dividends receivable 273,079 297,161 340,671 388,665 419,259

Receivable for investment advisory income 6,839 10,055 10,374

12,817 17,730 Intangible for customer relationships - 4,572 6,474

6,731 6,989 Goodwill 94,781 103,245 102,783 55,417 55,417 Interest

rate swaps, at fair value 559,044 360,373 38,950 - - Other

derivatives, at fair value 146,725 85,180 91,270 - 9,830 Other

assets 34,949 52,211

61,146 54,282

41,607 Total assets $

81,922,460 $ 93,433,157 $

102,468,584 $ 125,501,856

$ 133,452,295

LIABILITIES AND STOCKHOLDERS’

EQUITY Liabilities: U.S. Treasury securities sold, not

yet purchased, at fair value $ 1,918,394 $ 2,403,524 $ - $ 611,167

$ 495,437 Repurchase agreements 61,781,001 69,211,309 81,397,335

100,322,942 102,785,697 Securities loaned 2,527,668 3,299,090

2,284,245 2,330,060 1,808,315 Payable for investments purchased

764,131 2,546,467 2,833,214 3,203,461 8,256,957 Payable for share

buyback program - - - - 141,149 Convertible Senior Notes 825,262

824,512 824,229 824,902 825,541 Mortgages payable 19,332 19,346

19,361 - - Participation sold 14,065 14,164 14,324 - - Accrued

interest payable 160,921 162,755 164,190 175,749 186,896 Dividends

payable 284,230 331,557 396,888 426,173 432,154 Interest rate

swaps, at fair value 1,141,828 1,504,258 1,189,178 2,259,173

2,584,907 Other derivatives, at fair value 55,518 125,468 - 4,812 -

Accounts payable and other liabilities 25,055

44,983 82,316

37,048 10,798

Total liabilities 69,517,405

80,487,433 89,205,280

110,195,487

117,527,851 Stockholders’ Equity:

7.875% Series A Cumulative Redeemable

Preferred Stock: 7,412,500 authorized, issued and outstanding

177,088 177,088 177,088 177,088 177,088

7.625% Series C Cumulative Redeemable

Preferred Stock 12,650,000 authorized, 12,000,000 issued and

outstanding

290,514 290,514 290,514 290,514 290,514

7.50% Series D Cumulative Redeemable

Preferred Stock: 18,400,000 authorized, issued and outstanding

445,457 445,457 445,457 445,457 445,457 Common stock, par value

$0.01 per share, 1,956,937,500 authorized, 947,432,862,

947,304,761, 947,483,487, 947,293,099 and 947,213,204 issued and

outstanding, respectively 9,474 9,473 9,475 9,473 9,472 Additional

paid-in capital 14,765,761 14,759,738 14,754,681 14,746,579

14,740,774 Accumulated other comprehensive income (loss) (2,748,933

) (1,454,790 ) (1,289,246 ) 2,003,248 3,053,242 Accumulated deficit

(534,306 ) (1,281,756 )

(1,124,665 ) (2,365,990 )

(2,792,103 ) Total stockholders’ equity

12,405,055 12,945,724

13,263,304 15,306,369

15,924,444 Total

liabilities and stockholders’ equity $ 81,922,460

$ 93,433,157 $ 102,468,584

$ 125,501,856 $ 133,452,295

(1) Derived from the audited consolidated financial

statements at December 31, 2012

ANNALY CAPITAL MANAGEMENT, INC.

AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME (UNAUDITED) (dollars in thousands, except per

share data)

For the quarters ended

December 31, September 30, June 30, March

31, December 31, 2013 2013

2013 2013

2012 Interest income: Investment Securities and

corporate debt $ 723,248 $ 659,058 $ 686,577 $ 724,820 $ 748,122

Commercial real estate debt and preferred equity 36,124 26,066

13,906 - - U.S. Treasury securities 8,125 7,718 7,242 5,996 3,819

Securities loaned 2,087 1,787 2,302 2,612 2,106 Reverse repurchase

agreements 1,587 2,461 2,775 3,636 2,449 Other 78

70 134

153 165

Total interest income 771,249

697,160 712,936

737,217 756,661

Interest expense: Repurchase agreements 111,038 120,123

141,945 157,064 165,600 Convertible Senior Notes 17,788 17,092

16,364 15,813 15,503 U.S. Treasury securities sold, not yet

purchased 6,684 6,688 4,075 2,788 2,930 Securities borrowed 1,718

1,405 1,737 1,925 1,458 Participation sold 165

168 134

- - Total interest

expense 137,393 145,476

164,255 177,590

185,491

Net interest

income 633,856 551,684

548,681

559,627 571,170

Other

income (loss): Realized gains (losses) on interest rate

swaps(1) (242,182 ) (227,909 ) (212,727 ) (225,476 ) (228,155 )

Realized gains (losses) on termination of interest rate swaps

(13,177 ) (36,658 ) (35,649 ) (16,378 ) - Unrealized gains (losses)

on interest rate swaps 561,101

6,343 1,109,022

325,734 341,554

Subtotal 305,742 (258,224

) 860,646 83,880

113,399 Investment advisory

income 8,490 9,558 12,187 13,408 18,773 Net gains (losses) on

disposal of investments 28,602 43,602 147,998 182,843 114,831 Net

loss on extinguishment of 4% Convertible Senior Notes - - - -

(75,012 ) Dividend income from affiliates 4,048 4,048 4,048 6,431

7,097 Net gains (losses) on trading assets 41,936 (96,022 ) 54,046

1,549 15,181 Net unrealized gains (losses) on interest-only Agency

mortgage-backed securities 60,181 (7,099 ) 111,521 80,127 (31,148 )

Impairment of goodwill - - (23,987 ) - - Loss on previously held

equity interest in CreXus - - (18,896 ) - - Other income (loss)

3,945 4,212

7,192 132

161

Subtotal 147,202

(41,701 ) 294,109

284,490 49,883

Total other income (loss) 452,944

(299,925 ) 1,154,755

368,370 163,282

General and administrative expenses:

Compensation and management fee 43,385 41,774 43,764 38,443 25,842

Other general and administrative expenses 12,909

16,970 21,367

13,469

14,242

Total general and administrative expenses

56,294 58,744

65,131 51,912

40,084

Income (loss) before

income taxes 1,030,506 193,015 1,638,305 876,085 694,368

Income taxes 1,757 557

92 5,807

(6,127 )

Net income

(loss) 1,028,749 192,458 1,638,213 870,278 700,495

Dividends on preferred stock 17,992

17,992 17,992

17,992 19,717

Net income (loss) available (related) to common

shareholders $ 1,010,757 $ 174,466

$ 1,620,221 $ 852,286

$ 680,778

Net income (loss) per

share available (related) to common shareholders: Basic $ 1.07

$ 0.18 $ 1.71

$ 0.90 $ 0.70 Diluted $

1.03 $ 0.18 $ 1.64

$ 0.87 $ 0.68

Weighted average number of common shares outstanding: Basic

947,386,060 947,303,205

947,411,380

947,249,901 970,602,863 Diluted

995,625,622 955,690,471

995,229,637

994,815,169 1,017,925,849

Net income (loss) $ 1,028,749 $ 192,458

$ 1,638,213 $ 870,278

$ 700,495

Other comprehensive income

(loss): Unrealized gains (losses) on available-for-sale

securities (1,244,500 ) (121,942 ) (3,144,496 ) (867,151 ) (894,972

) Reclassification adjustment for net (gains) losses included in

net income (loss) (49,643 ) (43,602 )

(147,998 ) (182,843 )

(121,393 ) Other comprehensive income (loss)

(1,294,143 ) (165,544 )

(3,292,494 ) (1,049,994 )

(1,016,365 )

Comprehensive income (loss) $ (265,394 )

$ 26,914 $ (1,654,281 )

$ (179,716 ) $ (315,870 ) (1) Interest

expense related to the Company’s interest rate swaps is recorded in

Realized gains (losses) on interest rate swaps on the Consolidated

Statements of Comprehensive Income.

ANNALY CAPITAL MANAGEMENT,

INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME (dollars in thousands, except per share

data) For the years ended

December 31, December 31, 2013

2012(2)

(Unaudited) Interest income:

Investment Securities and corporate debt $ 2,793,703 $ 3,225,269

Commercial real estate debt and preferred equity 76,096 - U.S.

Treasury securities 29,081 17,222 Securities loaned 8,788 9,903

Reverse repurchase agreements 10,459 6,218 Other 435

533

Total interest income

2,918,562 3,259,145

Interest expense: Repurchase agreements 530,170 577,243

Convertible Senior Notes 67,057 67,221 U.S. Treasury securities

sold, not yet purchased 20,235 15,114 Securities borrowed 6,785

7,594 Participation sold 467 -

Total interest expense 624,714

667,172

Net interest income 2,293,848

2,591,973

Other income

(loss): Realized gains (losses) on interest rate swaps(1)

(908,294 ) (893,769 ) Realized gains (losses) on termination of

interest rate swaps (101,862 ) (2,385 ) Unrealized gains (losses)

on interest rate swaps 2,002,200

(32,219 )

Subtotal 992,044

(928,373 ) Investment advisory income 43,643 82,138 Net

gains (losses) on disposal of investments 403,045 432,139 Net loss

on extinguishment of 4% Convertible Senior Notes - (162,340 )

Dividend income from affiliates 18,575 28,336 Net gains (losses) on

trading assets 1,509 22,910 Net unrealized gains (losses) on

interest-only Agency mortgage-backed securities 244,730 (59,937 )

Impairment of goodwill (23,987 ) - Loss on previously held equity

interest in CreXus (18,896 ) - Other income (loss) 15,481

525

Subtotal

684,100 343,771

Total other

income (loss) 1,676,144

(584,602 )

General and administrative expenses:

Compensation and management fee 167,366 190,702 Other general and

administrative expenses 64,715

44,857

Total general and administrative expenses

232,081 235,559

Income (loss) before income taxes 3,737,911 1,771,812

Income taxes 8,213 35,912

Net income (loss) 3,729,698 1,735,900

Dividends on preferred stock 71,968

39,530

Net income (loss) available

(related) to common shareholders $ 3,657,730

$ 1,696,370

Net income (loss) per share

available (related) to common shareholders: Basic $ 3.86

$ 1.74 Diluted $ 3.74 $

1.71

Weighted average number of common shares

outstanding: Basic 947,337,915

972,902,459 Diluted 995,557,026

1,005,755,057

Net income (loss)

$ 3,729,698 $ 1,735,900

Other

comprehensive income (loss): Unrealized gains (losses) on

available-for-sale securities (5,378,089 ) 482,765 Reclassification

adjustment for net (gains) losses included in net income (loss)

(424,086 ) (438,511 ) Other

comprehensive income (loss) (5,802,175 )

44,254

Comprehensive income (loss) $

(2,072,477 ) $ 1,780,154 (1) Interest

expense related to the Company’s interest rate swaps is recorded in

Realized gains (losses) on interest rate swaps on the Consolidated

Statements of Comprehensive Income. (2) Derived from the audited

consolidated financial statements at December 31, 2012.

Photos/Multimedia Gallery Available:

http://www.businesswire.com/multimedia/home/20140225007054/en/

Annaly Capital Management, Inc.Investor

Relations1-888-8Annalywww.annaly.com

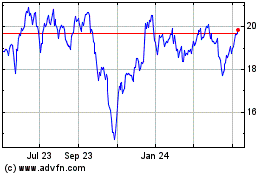

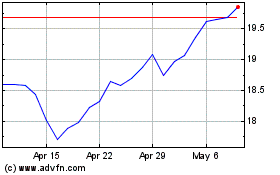

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Apr 2023 to Apr 2024