New Zealand Energy Corp. (TSX VENTURE:NZ)(OTCQX:NZERF) ("NZEC" or the "Company")

has released the results of its third quarter ended September 30, 2013. Details

of the Company's financial results are described in the Unaudited Condensed

Consolidated Interim Financial Statements and Management's Discussion and

Analysis which, together with further details on each of the Company's projects,

will be available on the Company's website at www.newzealandenergy.com and on

SEDAR at www.sedar.com. All amounts are in Canadian dollars unless otherwise

stated.

HIGHLIGHTS

Financing

-- Closed oversubscribed private placement for gross proceeds of $16.1

million

Property Portfolio

-- Completed acquisition of strategic upstream and midstream assets in

Taranaki Basin

-- Acquired 50% interest in three petroleum mining licenses (totalling

23,049 acres) in main production fairway

-- Acquired 50% interest in full-cycle high-capacity production

facility and associated gathering and sales infrastructure

-- Entered into joint arrangement with L&M Energy to explore, develop

and operate the new petroleum mining licenses, production facility

and associated assets

-- Booked additional 1,072,350 boe (86% oil) of Proved + Probable

reserves with estimated before tax net present value (10% discount

rate) of $31.4 million(1)

-- Extended Alton Permit to September 2018

-- Received approval to defer commitments wells on Alton and Castlepoint

permits to 2014

-- Applied to extend Eltham Permit to September 2018 and convert a portion

of the property to a petroleum mining permit with an initial duration of

15 years

Production and Development

-- Field netback of $58.90/barrel of oil ("bbl") for Q3-2013

-- 60,694 bbl produced and 63,852 bbl sold during nine-month period,

generating pre-tax oil sales of $6.6 million

-- Announced 2013/2014 work program for Taranaki Basin, estimating 2,300

boe/d (82% oil) of production by year-end 2014 (net to NZEC) based on

successful completion of the planned work program

-- Commenced reactivation of oil production from six wells on TWN Licenses.

Production results will be announced once all six wells are in

production, which is anticipated to occur by the end of November 2013

FINANCIAL SNAPSHOT

----------------------------------------------------------------------------

Nine Three Nine Three

months months months months

ended ended ended ended

September September September September

30, 2013 30, 2013 30, 2012 30, 2012

----------------------------------------------------------------------------

Production 60,694 bbl 11,958 bbl 155,285 bbl 37,850 bbl(i)

Sales 63,852 bbl 14,648 bbl 154,533 bbl 38,565 bbl

----------------------------------------------------------------------------

Price 107.63 $/bbl 108.84 $/bbl 107.33 $/bbl 100.93 $/bbl

Production costs 62.08 $/bbl 44.80 $/bbl 25.22 $/bbl 32.58 $/bbl

Royalties 4.98 $/bbl 5.14 $/bbl 4.98 $/bbl 4.77 $/bbl

Field netback 40.57 $/bbl 58.90 $/bbl 77.13 $/bbl 63.58 $/bbl

----------------------------------------------------------------------------

Revenue $6,553,968 $1,519,010 $13,527,930 $3,708,254

Pre-production

recoveries - - - -

Total comprehensive

(loss) income ($3,339,589) $1,347,788 $98,313 ($2,018,634)

Net finance expense

(income) $66,794 $27,220 ($200,003) 41,377

(Loss) earnings per

share - basic and

diluted ($0.06) ($0.02) ($0.01) ($0.02)

----------------------------------------------------------------------------

Current assets $6,403,134 $49,680,292

Total assets $105,313,813 $98,882,087

Total long-term

liabilities $11,094,916 $2,042,768

Total liabilities $12,749,253 $6,518,365

Shareholders' equity $92,564,560 $92,263,722

----------------------------------------------------------------------------

Note: The abbreviation bbl means barrel or barrels of oil.

At the date of this MD&A, the Company had an estimated $6 million in working

capital.

Nine-month Operating Results

During the nine-month period ended September 30, 2013, the Company produced

60,694 barrels of oil and sold 63,852 barrels for total oil sales of $6,872,180

with an average oil sale price of $107.63 per barrel. Total recorded production

revenue, net of a 5% royalty payable to the New Zealand Government (an average

of $4.98 per barrel), was $6,553,968. Production costs during the nine-month

period ended September 30, 2013 totalled $3,964,141, or an average of $62.08 per

barrel, generating an average field netback of $40.57 per barrel during the

period. NZEC calculates the netback as the oil sale price less fixed and

variable production costs and a 5% royalty. The notable reduction in netback

during the nine-month period ended September 30, 2013, when compared to the same

period in 2012, is predominantly the result of decreased oil production,

considering the large proportion of fixed production cost. As previously

announced, the Company had shut in the Waitapu-2 well during May 2013 in order

to gather critical data for a Mt. Messenger reservoir study and to evaluate and

install artificial lift. In addition, the Company experienced lower production

from the Copper Moki wells as partial work-over activities were undertaken on

two of the three wells.

The Company undertook a number of reservoir and production tests during the

period with the objective of optimizing oil production, and these tests added to

production costs. During the nine-month period ended September 30, 2013, fixed

production costs represented approximately 88% of total production costs.

Installation of the Copper Moki surface facilities was completed in May and, as

expected, this resulted in a reduction in production costs for the Copper Moki

site since June 2013. Although shutting in the Waitapu-2 well in May 2013

reduced some of the fixed operating costs, the Company continued to incur costs

on that site. However, the field netback improved significantly for the quarter

ended September 30, 2013 compared to the quarter ended June 30, 2013, as

outlined in Three-month Operating Results.

Three-month Operating Results

During the three-month period ended September 30, 2013, the Company produced

11,958 barrels of oil and sold 14,648 barrels for total oil sales of $1,594,302,

with an average oil sale price of $108.84 per barrel. Total recorded production

revenue, net of a 5% royalty payable to the New Zealand Government (an average

of $5.14 per barrel), was $1,519,010. Production costs during the three-month

period ended September 30, 2013 totalled $656,264, or an average of $44.80 per

barrel, generating an average field netback of $58.90 per barrel during the

period.

As discussed in Nine-month Operating Results, reduced production following the

shut-in of Waitapu-2 and work-overs on the Copper Moki-1 and Copper Moki-3 wells

greatly impacted the nine-month netback results. A significant reduction in

production costs on the Copper Moki site in the third quarter resulted in a

marked increase in the netback results reported for the three months ended

September 30, 2013, with the netback improving from $22.46/bbl during the

quarter ended June 30, 2013 to $58.90/bbl during the quarter ended September 30,

2013.

RECENT DEVELOPMENTS

Subsequent to the period end, NZEC completed a strategic acquisition, assumed

joint control of the acquired assets and commenced the work required to

reactivate oil production in six wells drilled by the previous operator; booked

additional reserves and resources related to the acquisition; closed an

oversubscribed private placement for gross proceeds of $16.1 million; and made a

number of changes to its New Zealand senior management team.

Acquisition of Interest in Upstream and Midstream Assets

On October 28, 2013, the Company closed the acquisition of strategic upstream

and midstream assets (the "Acquisition") from Origin Energy Resources NZ (TAWN)

Limited ("Origin"). The Acquisition was originally announced on May 31, 2012 and

is described in more detail in Note 2 to the Condensed Consolidated Interim

Financial Statements for the quarter ended September 30, 2013. NZEC now owns,

through its wholly-owned subsidiaries, a 50% interest in the Tariki, Waihapa and

Ngaere PMLs ("TWN Licenses") in the main Taranaki Basin production fairway, as

well as a 50% interest in the Waihapa Production Station and associated

gathering and sales infrastructure (collectively, "TWN Assets"). NZEC and L&M

acquired the assets jointly and formed a 50/50 joint arrangement ("TWN Joint

Arrangement") to explore and develop the TWN Licenses and operate the TWN

Assets, with NZEC as the operator. NZEC and L&M formed the TWN Limited

Partnership to operate the TWN Assets, with NZEC as the operator. The TWN

Limited Partnership also operates the Ahuroa Gas Storage Facility, owned by

Contact Energy Limited ("Contact"), a subsidiary of Origin. Contact pays TWN

Limited Partnership a monthly operating fee of NZ$201,000.

The purchase price for the Acquisition was $33.7 million in cash, with $30

million payable to Origin and $3.7 million (NZ$4.25 million) payable to Contact.

The Company paid a $5 million deposit to Origin for the Acquisition in June 2012

and a further $1 million deposit in August 2013. The remaining $27.7 million was

paid on closing, of which $18.25 million was contributed by L&M and $9.45

million was contributed by NZEC. The TWN Joint Arrangement will also pay Origin

a 9% net revenue royalty on all future hydrocarbon production from the TWN

Licenses, and can reduce the royalty at any time by as much as 4% by paying

Origin $4.25 million per percentage point. The TWN Licenses are also subject to

a "grandfathered" NZPAM 10% net revenue royalty.

The Company took joint control of the TWN Licenses and TWN Assets on October 28,

2013, and immediately commenced the work required to reactivate oil production

from six existing wells that had been drilled by a previous operator and

produced oil from the Tikorangi Formation. The reactivation activities are

proceeding as expected. Results will be released once all six wells have

commenced production, which is anticipated to occur by the end of November 2013.

TWN Reserves and Resources

Concurrent with closing of the Acquisition, NZEC booked reserves and resources

related to the TWN Licenses.(1)The TWN reserves and resources are in addition to

the Company's existing reserves attributable to its Eltham Permit, and to the

resources attributable to its Eltham, Alton, Castlepoint, Ranui and pending East

Cape permits. NZEC's 50% share of Proved and Probable Reserves (2P Reserves)

attributable to the TWN Licences is estimated to have a before tax net present

value of $31.4 million (10% discount rate). NZEC's 50% share of 2P Reserves is

estimated at 926,350 barrels of oil, 723.9 million cubic feet of natural gas and

25,350 barrels of natural gas liquids, collectively 1,072,350 boe). NZEC's share

of Contingent Resources is estimated at 580,000 boe, with Prospective Resources

estimated at 11,706,000 boe. Additional information regarding the Company's

reserves and resources is available in the Company's Form 51-101F1 Statement of

Reserves Data dated April 22, 2013 and in the Company's Interim Statement of

Reserves and Resources dated October 28, 2013, both of which are filed on SEDAR

at www.sedar.com.

Private Placement

On October 28, 2013, the Company closed a $16.1 million non-brokered private

placement, raising $1.1 million more than the original objective of $15 million.

Of the funds raised, $8.2 million was earmarked for financing costs and general

working capital while the remainder was used to finance the Acquisition.

The Company issued 48.9 million subscription receipts ("Subscription Receipts")

at a price of $0.33 per Subscription Receipt. The Subscription Receipts were

convertible into units (the "Units") consisting of one common share (a "Share")

and one-half of one non-transferable share purchase warrant (each whole warrant

referred to as a "Warrant") of the Company. Each Warrant will entitle the holder

to acquire one Share at a price of $0.45 with an expiry date of October 28,

2014.

NZEC filed a short form prospectus with the applicable regulatory authorities in

each of the provinces of Canada where Subscription Receipts were sold. On

November 21, 2013, following final receipt for the prospectus by the applicable

regulatory authorities, each Subscription Receipt converted into one Unit and

the Shares and the Shares underlying the Warrants became free-trading. In

relation to the private placement, NZEC paid $1 million in finder's fees and

issued three million finder's special warrants, which converted into finder's

warrants on November 21, 2013. Each finder's warrant entitles the finder to

acquire one Share at an exercise price of $0.33 with an expiry date of October

28, 2014. The Shares underlying the finder's warrants will be free-trading on

exercise of the finder's warrants.

Changes to Senior Management

The Company has made a number of changes to its New Zealand leadership team.

With the Acquisition complete and well reactivations proceeding as planned, NZEC

is set to significantly increase its exploration and production activities.

Clarifying roles and responsibilities in New Zealand has refocused and

streamlined the team.

New Zealand Leadership Team

-- Chris Bush - New Zealand Country Manager

-- Gerrie van der Westhuizen - Interim Chief Financial Officer

-- Mike Oakes - General Manager Operations

-- Bruce McIntyre - Director and Acting General Manager Exploration

-- Ian Brown - General Manager Development & Corporate Affairs

-- Susan Baas - Legal Counsel

Chris Bush was appointed New Zealand Country Manager in October 2012. Chris is

an experienced oil and gas professional with more than 30 years of experience in

both upstream and downstream sectors. Prior to joining NZEC he was employed by

Origin Energy as New Zealand Country Manager/Director. As NZEC's New Zealand

Country Manager, Chris leads the New Zealand team in all relevant activities,

including delivery of the work programs and budgets, as well as health and

safety performance.

Gerrie van der Westhuizen joined NZEC in November 2012 as Vice President Finance

and was appointed Interim Chief Financial Officer in October 2013. Gerrie is a

Chartered Accountant with considerable experience in the resource industry. As

Interim Chief Financial Officer, Gerrie is responsible for all aspects of the

Company's financial management and reporting. Gerrie is supported by a New

Zealand based accounting team and Newton Cockerill, who was appointed Financial

Controller in October 2013.

Mike Oakes joined NZEC in August 2012 as General Manager Midstream Operations.

In his new role as General Manager Operations, Mike will oversee all of NZEC's

exploration and production activities and operation of the Waihapa Production

Station. Mike has worked in the oil and gas industry for 33 years overseeing

design, commissioning and start up, staffing and operation of both onshore and

offshore oil and gas fields and production facilities. Most recently Mike worked

for Origin Energy in New Zealand as Operations Manager, Asset Manager and

Operational Excellence Advisor.

Bruce McIntyre, in addition to his role as Director of NZEC (which he has

performed since January 2011), has been appointed to the role of Acting General

Manager Exploration. Bruce is a professional geologist with more than 30 years

of oil and gas experience. As Acting General Manager Exploration Bruce will

oversee the Company's technical activities, working with the Wellington-based

technical team to de-risk drill targets and expand the Company's drilling

inventory, manage permitting and reporting activities, and identify new

opportunities in New Zealand's petroleum basins.

Ian Brown, Chief Operating Officer of the Company since March 2011, has assumed

the role of General Manager Development & Corporate Affairs. Ian is a chartered

professional engineer with more than 25 years of geological consulting

experience in New Zealand. In his new role, Ian will be responsible for

community engagement and government relations, compliance with environmental

regulations, and overseeing the resource consent and land access agreement

process. Ian is also responsible for implementing the Company's East Coast

strategy and is actively seeking strategic partners to fund exploration and

development of NZEC's East Coast Basin permits.

Susan Baas joined NZEC in February 2013 as Legal Counsel and has since been

appointed an officer of the Company. Susan has both a Bachelor and Master of Law

and initially worked as a solicitor in private practice in New Zealand for five

years. In 2004 Susan moved into an in-house corporate law position, taking on

progressively senior roles with Contact Energy until joining NZEC in 2013. As

Legal Counsel, Susan will provide legal support, oversee corporate governance

and regulatory compliance, and assist with commercial negotiations and contract

drafting and administration.

The Company has also appointed Dan MacDonald as Drilling Manager, commencing

November 25, 2013. Dan is a mechanical engineer with an MBA and more than 30

years of oil and gas drilling experience. Reporting to the General Manager

Operations, Dan will be responsible for all drilling and completion work,

including design, approvals and implementation of the drilling program.

Cliff Butchko, General Manager Upstream Operations, and Celeste Curran, Vice

President Corporate and Legal Affairs, will both be leaving NZEC at the end of

December to pursue new opportunities.

PROPERTY REVIEW

Taranaki Basin

The Taranaki Basin is situated on the west coast of the North Island and is

currently New Zealand's only oil and gas producing basin, with total production

of approximately 130,000 barrels of oil equivalent per day ("boe/d") from 18

fields. Within the Taranaki Basin, NZEC holds a 100% interest in the Eltham

Permit, a 65% interest in the Alton Permit in joint arrangement with L&M, a 60%

interest in the Manaia Permit in joint arrangement with NZOG, and a 50% interest

in the TWN Licenses and the TWN Assets in joint arrangement with L&M. The Eltham

Permit covers approximately 93,166 acres (377 km2) of which approximately 31,877

acres (129 km2) are offshore in shallow water. The Company has lodged an

application to convert 18.73 km2 of the Eltham Permit into a PMP, as outlined in

Application for Eltham Petroleum Mining Permit, and to extend the Eltham Permit

for another five years to allow for continued exploration. In November 2013,

NZEC extended the Alton Permit for a second five-year term, and was required to

relinquish 50% of the permit as part of the extension. The new Alton Permit

covers approximately 59,565 onshore acres (241 km2). The Manaia Permit covers

approximately 27,426 onshore acres (111 km2) and was granted to NZEC and NZOG in

December 2012 as part of the annual New Zealand block offer for exploration

permits. The TWN Licenses cover approximately 23,049 onshore acres (93 km2).

Production

TWN Licenses

Following closing of the Acquisition, the Company immediately proceeded with the

work required to reactivate oil production in six wells, drilled by the previous

operator. The Company has entered each of the wells by wireline to ensure that

the tubing is clear and has installed well head meters to allow the Company to

monitor oil and gas production rates on a well-by-well basis. The Company has

commenced reactivation of production in a number of wells using an existing gas

lift system. The reactivations are proceeding as planned. Information regarding

the Company's oil and gas production rates will be released once all six wells

have commenced production, which is expected to occur by the end of November

2013.

Eltham Permit

At the date of this MD&A, two of the Company's four commercially producing wells

are in active production. The Waitapu-2 well is currently shut-in awaiting

further work-over to complete the installation of artificial lift, with the

expectation that production will resume before year-end 2013. During the

quarter, the Company also temporarily shut-in its Copper Moki-1 well to replace

rods, while the Copper Moki-3 well is currently undergoing maintenance on its

down-hole pump. The Eltham Permit wells produce light approx. 41 API oil from

the Mt. Messenger formation. Oil is trucked to the Shell-operated Omata tank

farm and sold at Brent pricing. Cumulatively to October 28, 2013, the Company

has produced approximately 271,671 barrels of oil from its Eltham Permit wells,

with cumulative pre-tax oil sales of approximately $29.2 million, including

sales from oil produced during testing. The Company is not yet generating cash

flows from extracted gas, since the rich gas being produced from NZEC's Copper

Moki wells requires blending to meet the specifications required to sell the gas

in New Zealand. NZEC intends to blend its Copper Moki natural gas with gas

produced from the reactivated TWN License wells, and anticipates that the

blended gas will meet the required specifications for sale, allowing NZEC to

begin generating cash flows from its natural gas and associated natural gas

liquids production before year-end 2013.

Application for Eltham Petroleum Mining Permit

During the quarter ended June 30, 2013, the Company lodged an application with

NZPAM to convert 4,628 acres (18.73 km2) on the Eltham Permit into a PMP with an

initial duration of 15 years. The land included in the PMP application comprises

the Copper Moki field and surrounding acreage with petroleum discoveries. Once

the request has been reviewed and approved, NZEC will relinquish 50% of the

remainder of the Eltham Permit (which will have been reduced by the area

converted to a PMP) as part of the Company's application to extend the permit

for its second five-year term to September 23, 2018.

Alton Permit Extended

On November 6, 2013, the Company announced receipt of approval to extend the

Alton Permit for a second five-year term to September 23, 2018. Concurrent with

the extension, the Company and L&M relinquished 50% of the Alton Permit. The new

permit area comprises 59,565 acres (241 km2). The Company and L&M also received

an extension to the obligation to drill a commitment well on the Alton Permit.

The new work program requires the Company to drill two exploration wells,

process 20 km2 of 3D seismic and 20 km of 2D seismic, and complete a number of

technical studies and reports. The Company plans to drill the first commitment

well (the Horoi well) targeting the Mt. Messenger formation in late February

2014.

East Coast Basin

The East Coast Basin of New Zealand's North Island hosts two prospective oil

shale formations, the Waipawa and Whangai, which are the source of more than 300

oil and gas seeps. Within the East Coast Basin, NZEC holds a 100% interest in

the Castlepoint Permit, which covers approximately 551,042 onshore acres (2,230

km2), and a 100% interest in the Ranui Permit, which covers approximately

223,087 onshore acres (903 km2) and is adjacent to the Castlepoint Permit. NZEC

is considering relinquishing the Ranui Permit but has not yet made a definitive

decision in this regard. On September 3, 2010, NZEC applied to the Minister of

Energy to obtain a 100% interest in the East Cape Permit. The application is

uncontested and the Company expects the East Cape Permit to be granted to NZEC

upon completion of NZPAM's review of the application. The East Cape Permit

covers approximately 1,067,495 onshore acres (4,320 km2) on the northeast tip of

the North Island. In addition, NZEC has entered into a binding agreement with

Westech to acquire 80% ownership and become operator of the Wairoa Permit, which

covers approximately 267,862 onshore acres (1,084 km2) south of the East Cape

Permit. Preliminary approval of transfer of ownership was obtained from NZPAM on

December 20, 2012 and formation of a joint arrangement with Westech is subject

to final NZPAM approval.

The Company has completed the coring of two test holes on the Castlepoint

Permit. The Orui (125 metres total depth) and Te Mai (195 metres total depth)

collected core data across the Waipawa and Whangai shales. NZEC also completed a

test hole on the Ranui Permit. Ranui-2 was drilled to 1,440 metres, coring the

Whangai shale across several intervals. In Q2-2012, NZEC completed 70 line km of

2D seismic data across the Castlepoint and Ranui permits to further its

technical understanding of the area and identify targets for exploration.

The Wairoa Permit has been actively explored for many years, with extensive 2D

seismic data across the permit and log data from more than 15 wells drilled on

the property. Historical exploration focused on the conventional Miocene sands.

NZEC's technical team has identified conventional opportunities as well as

potential in the unconventional oil shales that underlie the property. NZEC's

team knows the property well and provided extensive consulting services (through

the consulting company Ian R Brown Associates) to previous permit holders.

During Q1-2013 the Company completed a 50 km 2D seismic program on the property,

the results of which are currently being processed and reviewed and will help to

identify exploration targets on the permit.

OUTLOOK

Completing the acquisition of the TWN Licenses and TWN Assets has been

transformative for NZEC, resulting in a fully integrated upstream/midstream

company with the cash flow, infrastructure and inventory to support long-term

growth.

Taranaki Basin

Closing the Acquisition, which has added a full-cycle production facility to the

Company's infrastructure, will allow NZEC to optimize the development of all of

its Taranaki Basin permits. As NZEC continues to explore the Eltham and Alton

permits, the Company will focus on drill targets that are close to the Waihapa

Production Station and associated pipelines, allowing for rapid and cost

effective tie-in of both oil and gas production.

The Company anticipates that the TWN wells will initially produce oil at higher

rates as a result of flush production, and then flow rates will gradually

decline to stabilized rates. Based on data collected using well meters, the

Company will identify the two best-performing wells and will install high-volume

electric submersible pumps ("ESPs") to further increase production. The ESPs

will be installed once flow rates have stabilized, with the expectation of

installing the first ESPs in Q1-2014.

The Company announced its initial development plans for the TWN Licenses and

other permits in the Taranaki Basin on August 6, 2013. As outlined in the

Company's Taranaki Basin development program, NZEC anticipates that successful

execution of the work program planned for 2013 and 2014 will result in NZEC

producing 2,300 boe/d (82% oil) by year-end 2014, based on the Company's working

interest in its various permits. This forecast reflects management's mid-case

production assumptions, as outlined in Forward-looking Information at the end of

this document. The Company continues to refine these plans as production and

development work proceeds on the TWN Licenses and in order to reflect:

-- A closing date for the Acquisition of October 28, 2013

-- Installing the first Tikorangi high-volume lift in Q1-2014

-- Drilling the Horoi well on the Alton Permit in Q1-2014

Development and operating costs are to be funded initially by existing working

capital and cash flows from production. However, in order to carry out all of

the planned development activities, the Company is considering a number of

options to increase its financial capacity. These options include increasing

cash flow from oil production, additional joint arrangements, commercial

arrangements or other financing alternatives.

East Coast Basin

The Company is actively seeking a joint venture partner for its East Coast

permits, to participate in and help fund exploration and development in the East

Coast Basin.

NZEC has drilled two stratigraphic holes on its 100% working interest

Castlepoint Permit and one stratigraphic hole on its 100% working interest Ranui

Permit. NZEC has received approval from NZPAM to extend the deadline for

drilling an exploration well on the Castlepoint Permit to May 2014. The Company

has identified its preferred drill location and continues to work towards

obtaining the requisite consents and land access agreements. The Company has met

regularly with local communities to discuss its exploration plans. The Company

is currently considering its plans for the Ranui Permit, including possible

relinquishment of the permit.

NZEC completed a 50-km 2D seismic survey on the Wairoa Permit in Q2-2013 and is

currently processing the data. The Company will finalize its exploration plans

for the permit after reviewing all of the seismic and well log data.

The Company's application for the East Cape Permit is uncontested and NZEC

expects the permit to be granted before year-end 2013, at which time the Company

will begin planning its exploration plans for the permit.

SUMMARY OF QUARTERLY RESULTS

----------------------------------------------------------------------------

2013-Q3 2013-Q2 2013-Q1 2012-Q4

$ $ $ $

----------------------------------------------------------------------------

Total assets 105,313,813 127,318,182 129,545,992 116,059,939

Exploration and

evaluation assets 55,859,632 52,357,470 49,610,922 37,379,726

Property, plant and

equipment 26,621,043 26,135,651 25,793,089 23,867,758

Working capital 4,748,797 9,517,742 17,533,636 28,293,845

Revenues 1,519,010 2,109,700 2,925,258 2,948,041

Accumulated deficit (27,292,947) (24,616,053) (22,386,089) (19,992,243)

Total comprehensive

income (loss) 1,347,788 (6,000,775) 1,313,397 (1,333,805)

Basic (loss)

earnings per share (0.02) (0.02) (0.02) (0.02)

Diluted (loss)

earnings per share (0.02) (0.02) (0.02) (0.02)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2012-Q3 2012-Q2 2012-Q1 2011-Q4

$ $ $ $

----------------------------------------------------------------------------

Total assets 98,882,087 98,814,102 96,979,923 31,152,804

Exploration and

evaluation assets 26,377,188 25,373,718 12,103,712 6,052,699

Property, plant and

equipment 16,293,123 8,674,152 8,150,802 5,509,511

Working capital 45,204,695 53,844,035 70,401,191 18,030,398

Revenues 3,708,254 5,910,993 3,908,683 974,517

Accumulated deficit (17,804,045) (15,613,594) (16,548,180) (16,911,070)

Total comprehensive

income (loss) (2,018,634) 1,317,915 799,032 (1,258,314)

Basic (loss)

earnings per share (0.02) 0.01 0.00 0.01

Diluted (loss)

earnings per share (0.02) 0.01 0.00 0.01

----------------------------------------------------------------------------

On behalf of the Board of Directors

"John Proust"

Chief Executive Officer & Director

About New Zealand Energy Corp.

NZEC is an oil and natural gas company engaged in the production, development

and exploration of petroleum and natural gas assets in New Zealand. NZEC's

property portfolio collectively covers approximately 2.25 million acres

(including permits and acquisitions pending) of conventional and unconventional

prospects in the Taranaki Basin and East Coast Basin of New Zealand's North

Island. The Company's management team has extensive experience exploring and

developing oil and natural gas fields in New Zealand and Canada. NZEC plans to

add shareholder value by executing a technically disciplined exploration and

development program focused on the onshore and offshore oil and natural gas

resources in the politically and fiscally stable country of New Zealand. NZEC is

listed on the TSX Venture Exchange under the symbol "NZ" and on the OTCQX

International under the symbol "NZERF". More information is available at

www.newzealandenergy.com or by emailing info@newzealandenergy.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Forward-looking Information

This document contains certain forward-looking information and forward-looking

statements within the meaning of applicable securities legislation (collectively

"forward-looking statements"). The use of any of the words "will", "intend",

"objective", "become", "transforming", "potential", "continuing", "pursue",

"subject to", "look forward", "unlocking" and similar expressions are intended

to identify forward-looking statements. These statements involve known and

unknown risks, uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such forward-looking

statements. Such forward-looking statements should not be unduly relied upon.

The Company believes the expectations reflected in those forward-looking

statements are reasonable, but no assurance can be given that these expectations

will prove to be correct. This document contains forward-looking statements and

assumptions pertaining to the following: business strategy, strength and focus;

the granting of regulatory approvals; the timing for receipt of regulatory

approvals; geological and engineering estimates relating to the resource

potential of the properties; the estimated quantity and quality of the Company's

oil and natural gas resources; supply and demand for oil and natural gas and the

Company's ability to market crude oil and natural gas; expectations regarding

the Company's ability to continually add to reserves and resources through

acquisitions and development; the Company's ability to obtain qualified staff

and equipment in a timely and cost-efficient manner; the Company's ability to

raise capital on appropriate terms, or at all; the ability of the Company's

subsidiaries to obtain mining permits and access rights in respect of land and

resource and environmental consents; the recoverability of the Company's crude

oil, natural gas reserves and resources; and future capital expenditures to be

made by the Company.

Actual results could differ materially from those anticipated in these

forward-looking statements as a result of the risk factors set forth below and

elsewhere in the document, such as the speculative nature of exploration,

appraisal and development of oil and natural gas properties; uncertainties

associated with estimating oil and natural gas resources; changes in the cost of

operations, including costs of extracting and delivering oil and natural gas to

market, that affect potential profitability of oil and natural gas exploration;

operating hazards and risks inherent in oil and natural gas operations;

volatility in market prices for oil and natural gas; market conditions that

prevent the Company from raising the funds necessary for exploration and

development on acceptable terms or at all; global financial market events that

cause significant volatility in commodity prices; unexpected costs or

liabilities for environmental matters; competition for, among other things,

capital, acquisitions of resources, skilled personnel, and access to equipment

and services required for exploration, development and production; changes in

exchange rates, laws of New Zealand or laws of Canada affecting foreign trade,

taxation and investment; failure to realize the anticipated benefits of

acquisitions; and other factors. Readers are cautioned that the foregoing list

of factors is not exhaustive. Statements relating to "reserves and resources"

are deemed to be forward-looking statements, as they involve the implied

assessment, based on certain estimates and assumptions, that the resources

described can be profitably produced in the future. This document includes

references to management's forecasts of future development, production and cash

flows from such operations. The major assumptions applied by management include

the following:

Tikorangi Reactivations (Gas Lift / High Volume Lift)

Reserves (unrisked @ 100% working

interest) 150,000 bbl/well - 448,000 bbl/well

Working interest 50%

Probability of success 100%

IP rate 49 boe/day - 365 boe/day(ii)

Decline 2% - 0.5% per month

Mt. Messenger - Uphole Completion in Existing Tikorangi Wells

EUR (unrisked @ 100% working

interest) 123,000 bbl/well(i)

Working interest 50%

Probability of success 100%

IP rate 365 boe/day(ii)

Decline 3% - 9% per month

Mt. Messenger Development (incl.

Horoi)

EUR (unrisked @ 100% working

interest) 502,000 bbl/well

Working interest 50% - 65%

Probability of success 35% - 40%

IP rate 420 boe/day - 511 boe/day(ii)

Decline 2% per month

Tikorangi New Wells

EUR (unrisked @ 100% working

interest) 561,000 bbl/well(iii)

Working interest 50%

Probability of success 50%

IP rate 1824 boe/day(ii)

Decline 5% - 12% per month

Kapuni New Wells

EUR (unrisked @ 100% working

interest) 7.97 Bcf

Working interest 25%

Probability of success 60%

IP rate 1,013 boe/day(ii)

Decline 1% per month

(i) EUR = Estimated Ultimate Recovery (management derived)

(ii) IP rate = Estimated initial production rate

(ii) Deloitte LLP has ascribed 2P reserves (100% basis) of 410,300 bbl of

oil to one Tikorangi New well

The forward-looking statements contained in the document are expressly qualified

by this cautionary statement. These statements speak only as of the date of this

document and the Company does not undertake to update any forward-looking

statements that are contained in this document, except in accordance with

applicable securities laws.

Cautionary Note Regarding Reserve and Resource Estimates

The oil and gas reserves calculations and income projections were estimated in

accordance with the Canadian Oil and Gas Evaluation Handbook ("COGEH") and

National Instrument 51-101 ("NI 51-101"). The term barrels of oil equivalent

("boe") may be misleading, particularly if used in isolation. A boe conversion

ratio of six Mcf: one bbl was used by NZEC. This conversion ratio is based on an

energy equivalency conversion method primarily applicable at the burner tip and

does not represent a value equivalency at the wellhead. Reserves are estimated

remaining quantities of oil and natural gas and related substances anticipated

to be recoverable from known accumulations, as of a given date, based on: the

analysis of drilling, geological, geophysical, and engineering data; the use of

established technology; and specified economic conditions, which are generally

accepted as being reasonable. Reserves are classified according to the degree of

certainty associated with the estimates. Proved Reserves are those reserves that

can be estimated with a high degree of certainty to be recoverable. It is likely

that the actual remaining quantities recovered will exceed the estimated proved

reserves. Probable Reserves are those additional reserves that are less certain

to be recovered than proved reserves. It is equally likely that the actual

remaining quantities recovered will be greater or less than the sum of the

estimated proved plus probable reserves. Possible Reserves are those additional

reserves that are less certain to be recovered than probable reserves. There is

a 10% probability that the actual remaining quantities recovered will exceed the

sum of the estimated proved plus probable plus possible reserves.

Revenue projections presented are based in part on forecasts of market prices,

current exchange rates, inflation, market demand and government policy which are

subject to uncertainties and may in future differ materially from the forecasts

above. Present values of future net revenues do not necessarily represent the

fair market value of the reserves evaluated. The report also contains

forward-looking statements including expectations of future production and

capital expenditures. Information concerning reserves may also be deemed to be

forward looking as estimates imply that the reserves described can be profitably

produced in the future. These statements are based on current expectations that

involve a number of risks and uncertainties, which could cause the actual

results to differ from those anticipated. Contingent resources are those

quantities of oil and gas estimated on a given date to be potentially

recoverable from known accumulations using established technology or technology

under development, but which are not currently considered to be commercially

recoverable due to one or more contingencies. Contingencies may include factors

such as economic, legal, environmental, political and regulatory matters, or a

lack of markets. Prospective resources are those quantities of oil and gas

estimated on a given date to be potentially recoverable from undiscovered

accumulations. The resources reported are estimates only and there is no

certainty that any portion of the reported resources will be discovered and

that, if discovered, it will be economically viable or technically feasible to

produce.

-----------------------------------------

(1) Reserve and resource estimates for the TWN Licences prepared by

Deloitte LLP, with an effective date of April 30, 2013. See Cautionary

Note Regarding Reserve and Resource Estimates, NZEC's Form 51-101F1

Report and NZEC's Interim Statement of Reserves and Resources. Barrels

of oil equivalent (boe) is calculated using a conversion rate of 6 Mcf

: 1 bbl and may be misleading, particularly if used in isolation. The

boe conversion ratio is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not represent a

value equivalency at the wellhead.

FOR FURTHER INFORMATION PLEASE CONTACT:

New Zealand Energy Contacts

North American toll-free: 1-855-630-8997

John Proust - Chief Executive Officer & Director

Bruce McIntyre - Executive Director

Rhylin Bailie - Vice President Communications

& Investor Relations

New Zealand: 64-6-757-4470

Chris Bush - New Zealand Country Manager

New Zealand Energy Corp.

Email: info@newzealandenergy.com

Website: www.newzealandenergy.com

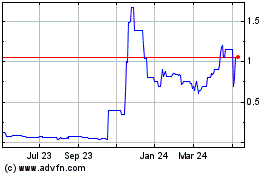

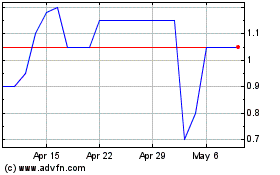

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Apr 2023 to Apr 2024