Xumanii (OTCQB:XUII) announced that it has acquired RFID business,

Trakkers LLC, for 2 million preferred shares of Xumanii. The

effective date of the transaction is October 1, 2013. The preferred

shares have a face value of $1, valuing Trakkers at $2 million.

Trakkers has developed its own proprietary RFID scanners (named

"Mi"). The "Mi" has some unique features including the ability to

scan RFID, 1 & 2 dimensional bar codes and mag stripes - all

from one device approximately the size of a smart phone. The Mi

also has a touch screen and a GPRS capability (scanned data can be

sent over mobile phone networks to any location). Trakkers is

currently generating revenue by providing the scanners to major

trade shows where they are used as lead retrieval devices. Trakkers

devices have been used at many of the biggest trade shows in the

United States including CES, Comicon and many more.

Revenue for Trakkers for the fiscal year ending April 2013 and

2012 was $1,573,473 and $1,200,142 respectively. Adjusted EBITDA

for the fiscal year ending April 2013 and 2012 was $383,110 and

$228,270 respectively. More financial and other information will be

provided in a super 8K. More information about Trakkers can be

found at www.Trakkers.com.

Xumanii acquired Trakkers from Tesselon LLC, a subsidiary of

Inova Technology, Inc. ("Inova"). Inova CEO, Adam Radly, said, "We

decided to break Inova into two parts so that our network solutions

business and the RFID business can pursue their own business plans

without being constrained by each other and also to enable our

shareholders to invest in one or the other or both as opposed to

being forced to invest in both."

Upon completion of the transaction Mr. Adam Radly will

temporarily hold the position of CEO of both Inova and Xumanii

concurrently while the board and senior management of Inova and

Xumanii are adjusted to reflect their new business plans. Mr.

Frigon has resigned from the board of Xumanii and is no longer

playing a role in Xumanii.

Mr. Radly said, "The primary strategy going forward for Xumanii

will be to build a company around mobile solutions. Although we

have a great platform business in Trakkers, we do not intend to

only focus on trade show solutions. It will be more accurate to say

that we will focus on mobile and wireless solutions and that the

current lead retrieval solution is just one application of our

wireless, mobile technology. We plan to build a mobile solutions

business that will include the use of RFID in mobile solutions for

asset tracking among other mobile solutions. I look forward to

providing more detail about our strategy over the next several days

and weeks".

The assets acquired by Xumanii include the following:

- Trakkers LLC along with all of the intellectual property

associated with its current and future products and solutions.

- The business and assets of Right Tag, Inc.

- Trakkers LLC has approximately $4 million of debt that will

remain with Trakkers.

Xumanii plans to file an S1 registration Statement in order to

raise capital to fund its business plan and allow Inova

shareholders to become Xumanii shareholders. Upon being deemed

effective by the SEC, the registration statement will allow Inova

shareholders to acquire one Xumanii share for each Inova share that

they owned as at the Effective Date (October 1, 2013). However,

shareholders should be aware that there can be no assurance that

the SEC will deem the S1 Registration Statement effective. As at

September 30, 2013 the shareholders of Inova held shares valued at

approximately $400,000 so dilution as a result of this share issue

is not expected to be significant given Xumanii's current market

cap of approximately $8 million.

Upon completion of the transaction and after giving effect to

the issue of shares owed to certain people and entities that were

previously involved with Xumanii the number of shares outstanding

will increase from the current number of approximately 341 million

to approximately 550 million shares. The increase in authorized

will required a shareholder meeting.

The new Xumanii management will assess the ongoing viability of

the existing streaming business in Xumanii. Among the opportunities

that may be pursued is using the Xumanii technology to stream live

events at trade shows in addition to live concerts.

Contact: Adam Radly, info@inovatechnology.com.

About Xumanii

Xumanii broadcasts live events in HD from multiple cameras,

wirelessly, with an extremely low production cost. Xumanii will

allow content to be broadcasted as a Pay-Per-View model, generating

revenues from consumers directly or as a "FREE" content model,

generating revenues from advertisement, product placements and

sponsorship.

Safe Harbor Statement under the Private Securities

Litigation Reform Act of 1995: Except for historical

information, the forward-looking matters discussed in this news

release are subject to certain risks and uncertainties which could

cause the Company's actual results and financial condition to

differ materially from those anticipated by the forward-looking

statements including, but not limited to, the Company's liquidity

and the ability to obtain financing, the timing of regulatory

approvals, uncertainties related to corporate partners or

third-parties, product liability, the dependence on third parties

for manufacturing and marketing, patent risk, copyright risk,

competition, and the early stage of products being marketed or

under development, as well as other risks indicated from time to

time in the Company's filings with the Securities and Exchange

Commission. The Company assumes no obligation to update or

supplement forward-looking statements that become untrue because of

subsequent events.

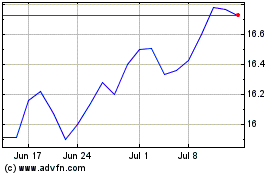

Innoviva (NASDAQ:INVA)

Historical Stock Chart

From Mar 2024 to Apr 2024

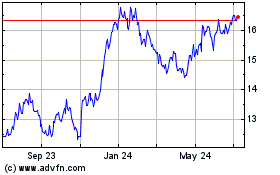

Innoviva (NASDAQ:INVA)

Historical Stock Chart

From Apr 2023 to Apr 2024