Mutual Fund Summary Prospectus (497k)

July 01 2013 - 3:23PM

Edgar (US Regulatory)

|

|

|

|

|

MainStay

Floating Rate Fund

|

Summary Prospectus

February 28, 2013

as revised July 1, 2013

|

|

Class/

Ticker

|

A

MXFAX

Investor

MXFNX

B

MXFBX

C

MXFCX

I

MXFIX

|

Before you invest, you may want to review the Fund's Prospectus,

which contains more information about the Fund and its risks. You can find the Fund's Prospectus and

other information about the Fund by going online to mainstayinvestments.com/documents, by calling 800-MAINSTAY

(624-6782) or by sending an e-mail to MainStayShareholderServices@nylim.com. The Fund's Prospectus and

Statement of Additional Information, both dated February 28, 2013, as may be amended from time to time,

are incorporated by reference into this Summary Prospectus.

The Fund seeks high current income.

Fees and Expenses of the Fund

The table below describes the fees and expenses that you may pay if you buy and hold

shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree

to invest in the future, at least $50,000 in the MainStay Funds. This amount may vary depending on the

MainStay Fund in which you invest. More information about these and other discounts is available from

your financial professional and in the "Information on Sales Charges" section starting on page 104 of

the Prospectus and in the "Alternative Sales Arrangements" section on page 103 of the Statement of Additional

Information.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investor Class

|

|

Class A

|

|

Class

B

|

|

Class C

|

|

Class

I

|

|

Shareholder Fees

(fees

paid directly from your investment)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maximum

Sales Charge (Load) Imposed on Purchases (as a percentage of offering price)

|

|

3.00

|

%

|

|

3.00

|

%

|

|

None

|

|

|

|

None

|

|

|

|

None

|

|

|

|

|

Maximum

Deferred Sales Charge (Load) (as a percentage of the lesser of the original offering price or redemption

proceeds)

|

|

None

|

1

|

|

|

None

|

1

|

|

|

3.00

|

%

|

|

1.00

|

%

|

|

None

|

|

|

|

Annual Fund Operating Expenses

(expenses that

you pay each year as a percentage of the value of your investment)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Management

Fees (as an annual percentage of the Fund's average daily net assets)

2

|

|

0.60

|

%

|

|

0.60

|

%

|

|

0.60

|

%

|

|

0.60

|

%

|

|

0.60

|

%

|

|

|

Distribution

and/or Service (12b-1) Fees

|

|

0.25

|

%

|

|

0.25

|

%

|

|

1.00

|

%

|

|

1.00

|

%

|

|

None

|

|

|

|

|

Other

Expenses

|

|

0.21

|

%

|

|

0.14

|

%

|

|

0.21

|

%

|

|

0.21

|

%

|

|

0.14

|

%

|

|

|

Total

Annual Fund Operating Expenses

|

|

1.06

|

%

|

|

0.99

|

%

|

|

1.81

|

%

|

|

1.81

|

%

|

|

0.74

|

%

|

1.

A contingent

deferred sales charge of 1.00% may be imposed on certain redemptions made within one year of the date

of purchase on shares that were purchased without an initial sales charge.

2.

The management fee is as follows: 0.60% on assets up to $1 billion;

0.575% on assets from $1 billion to $3 billion; and 0.565% on assets in excess of $3 billion.

The Example is intended to help you compare the

cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that

you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the

end of those periods (except as indicated with respect to Class B and Class C shares). The Example also

assumes that your investment has a 5% return each year and that the Fund's operating expenses remain

the same. The Example also reflects Class B shares converting into Investor Class shares in year 4; fees

could be lower if you are eligible to convert to Class A shares instead. Although your actual costs may

be higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses After

|

|

Investor

|

|

Class A

|

|

|

Class B

|

|

Class C

|

|

Class I

|

|

|

|

|

Class

|

|

|

|

|

Assuming no redemption

|

|

|

Assuming redemption at end

of period

|

|

Assuming no redemption

|

|

|

Assuming redemption at end

of period

|

|

|

|

1

Year

|

|

$ 405

|

|

|

$ 398

|

|

|

$ 184

|

|

|

$ 484

|

|

|

$ 184

|

|

|

$ 284

|

|

|

$ 76

|

|

|

3

Years

|

|

$ 627

|

|

|

$ 606

|

|

|

$ 569

|

|

|

$ 769

|

|

|

$ 569

|

|

|

$ 569

|

|

|

$ 237

|

|

|

5

Years

|

|

$ 867

|

|

|

$ 831

|

|

|

$ 894

|

|

|

$ 894

|

|

|

$ 980

|

|

|

$ 980

|

|

|

$ 411

|

|

|

10

Years

|

|

$ 1,555

|

|

|

$ 1,477

|

|

|

$ 1,583

|

|

|

$ 1,583

|

|

|

$ 2,127

|

|

|

$ 2,127

|

|

|

$ 918

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The

Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over"

its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher

taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual

fund operating expenses or in the Example, affect the Fund's performance. During the most recent fiscal

year, the Fund's portfolio turnover rate was 47% of the average value of its portfolio.

Principal Investment Strategies

The

Fund, under normal circumstances, invests at least 80% of its assets (net assets plus any borrowings

for investment purposes) in a portfolio of floating rate loans and other floating rate debt securities.

The Fund may also purchase fixed-income debt securities and money market securities or instruments.

(NYLIM)

NL013 MSFR01a-07/13

When

New York Life Investment Management LLC, the Fund's Manager, believes that market or economic conditions

are unfavorable to investors, up to 100% of the Fund's assets may be invested in money market or short-term

debt securities. The Manager may also invest in these types of securities or hold cash, while looking

for suitable investment opportunities or to maintain liquidity.

The Fund may invest up to 25%

of its total assets in foreign securities which are generally U.S. dollar-denominated loans and other

debt securities issued by one or more non-U.S. borrower(s) without a U.S. domiciled co-borrower.

Investment Process:

The Manager seeks to identify

investment opportunities based on the financial condition and competitiveness of individual companies.

The Manager seeks to invest in companies with a high margin of safety that are leaders in industries

with high barriers to entry. The Manager prefers companies with positive free cash flow, solid asset

coverage and management teams with strong track records. In virtually every phase of the investment process,

the Manager attempts to control risk and limit defaults.

Floating rate loans may offer a favorable yield

spread over other short-term fixed-income alternatives. Historically, floating rate loans have displayed

little correlation to the movements of U.S. common stocks, high-grade bonds and U.S. government securities.

Some securities that are rated below investment grade by an independent rating agency, such as Standard

& Poor's or Moody's Investors Service Inc., are commonly referred to as “junk bonds.” Floating

rate loans are speculative investments and are usually rated below investment grade. They typically have

less credit risk and historically have had lower default rates than junk bonds. These loans are typically

the most senior source of capital in a borrower's capital structure and usually have certain of the borrower's

assets pledged as collateral. Floating rate loans feature rates that reset regularly, maintaining a fixed

spread over the London InterBank Offered Rate or the prime rates of large money-center banks. The interest

rates for floating rate loans typically reset quarterly, although rates on some loans may adjust at other

intervals. Floating rate loans mature, on average, in five to seven years, but loan maturity can be as

long as nine years.

The Manager may reduce or eliminate the Fund's position in a security if it no longer

believes the security will contribute to meeting the investment objectives of the Fund. In considering

whether to sell a security, the Manager may evaluate, among other things, meaningful changes in the issuer's

financial condition and competitiveness. The Manager continually evaluates market factors and comparative

metrics to determine relative value.

Loss

of Money Risk:

Before considering an investment in the Fund, you should understand that you could

lose money.

Market Changes Risk:

The

value of the Fund's investments may change because of broad changes in the markets in which the Fund

invests, which could cause the Fund to underperform other funds with similar objectives. From time to

time, markets may experience periods of acute stress that may result in increased volatility. Such market

conditions tend to add significantly to the risk of short-term volatility in the net asset value of the

Fund's shares.

Management Risk:

The investment

strategies, practices and risk analysis used by the Manager may not produce the desired results.

Debt Securities Risk:

The risks of investing

in debt securities include (without limitation): (i) credit risk, i.e., the issuer may not repay the

loan created by the issuance of that debt security; (ii) maturity risk, i.e., a debt security with a

longer maturity may fluctuate in value more than one with a shorter maturity; (iii) market risk, i.e.,

low demand for debt securities may negatively impact their price; (iv) interest rate risk, i.e., when

interest rates go up, the value of a debt security goes down, and when interest rates go down, the value

of a debt security goes up; (v) selection risk, i.e., the securities selected by the Manager may underperform

the market or other securities selected by other funds; and (vi) call risk, i.e., during a period of

falling interest rates, the issuer may redeem a security by repaying it early, which may reduce the Fund’s

income if the proceeds are reinvested at lower interest rates.

Interest rates in the United

States are at, or near, historic lows, which may increase the Fund’s exposure to risks associated

with rising rates. Moreover, rising interest rates may lead to decreased liquidity in the bond markets,

making it more difficult for the Fund to sell its bond holdings at a time when the Manager might wish

to sell. Decreased market liquidity also may make it more difficult to value some or all of the Fund’s

bond holdings.

Floating Rate Loans Risk:

The floating rate loans in which the Fund invests are usually rated below investment grade (commonly

referred to as "junk bonds") and are generally considered speculative because they present a greater

risk of loss, including default, than higher quality debt securities. Moreover, such securities may,

under certain circumstances, be less liquid than higher quality debt securities. Although certain floating

rate loans are collateralized, there is no guarantee that the value of the collateral will be sufficient

to repay the loan. In times of unusual or adverse market, economic or political conditions, floating

rate loans may experience higher than normal default rates. In the event of a recession or serious credit

event, among other eventualities, the Fund's investments in floating rate loans are more likely to decline.

Liquidity and Valuation Risk:

Securities purchased

by the Fund that are liquid at the time of purchase may subsequently become illiquid due to events relating

to the issuer of the securities, market events, economic conditions or investor perceptions.The lack

of an active trading market may make it difficult to obtain an accurate price for a security. If market

conditions make it difficult to value securities, the Fund may value these securities using more subjective

methods, such as fair value pricing. In such cases, the value determined for a security could be different

than the value realized upon such security's sale. As a result, an investor could pay more than the market

value when buying Fund shares or receive less than the market value when selling Fund shares. Liquidity

risk may also refer to the risk that the Fund may not be able to pay redemption proceeds within the allowable

time period because of unusual market conditions, unusually high volume of redemptions, or other reasons.

To meet redemption requests, the Fund may be forced to sell securities at an unfavorable time and/or

under unfavorable conditions.

Trading Market

Risk:

An active trading market may not exist for many of the Fund's loans. In addition, some loans

may be subject to restrictions on their resale, which may prevent the Fund from obtaining the full value

of the loan when it is sold. If this occurs, the Fund may experience a decline in its net asset value.

Some of the Fund's investments may be considered to be illiquid.

Foreign Securities Risk:

Investments in foreign securities may be riskier than

investments in U.S. securities. Differences between U.S. and foreign regulatory regimes and securities

markets, including less stringent investor protections and disclosure standards of some foreign markets,

less liquid trading markets and political and economic developments in foreign countries, may affect

the value of the Fund's investments in foreign securities. Foreign securities may also subject the Fund's

investments to changes in currency rates. These risks may be greater with respect to securities of companies

that conduct their business activities in emerging markets or whose securities are traded principally

in emerging markets.

2

Money Market/Short-Term Securities Risk:

To the

extent the Fund holds cash or invests in money market or short-term securities, the Fund may be less

likely to achieve its investment objective. In addition, it is possible that the Fund's investments in

these instruments could lose money.

The following bar chart and tables indicate some

of the risks of investing in the Fund. The bar chart shows you how the Fund's calendar year performance

has varied over the life of the Fund. Sales loads are not reflected in the bar chart. If they were, returns

would be less than those shown.The average annual total returns table shows how the Fund's average annual

total returns (before and after taxes) for the one- and five-year periods and for the life of the Fund

compare to those of a broad-based securities market index. The Fund has selected the Credit Suisse Leveraged

Loan Index

as its primary benchmark. The Credit Suisse Leveraged Loan Index represents tradable, senior-secured,

U.S. dollar-denominated non-investment-grade loans.

Performance data for the classes varies based

on differences in their fee and expense structures. The Fund commenced operations on May 3, 2004. Performance

figures for Investor Class shares, first offered on February 28, 2008, include the historical performance

of Class A shares through February 27, 2008. Unadjusted, the performance shown for the newer class would

likely have been different. Past performance (before and after taxes) is not necessarily an indication

of how the Fund will perform in the future. Please visit mainstayinvestments.com for more recent performance

information.

Annual Returns, Class I Shares

(by calendar year 2005-2012)

|

|

|

|

|

Best Quarter

|

|

|

2Q/09

|

13.81

|

%

|

|

Worst

Quarter

|

|

|

4Q/08

|

-18.29

|

%

|

Average Annual Total Returns

(for the periods ended December 31, 2012)

|

|

|

|

|

|

|

|

|

|

|

|

|

1

Year

|

5

Years

|

Life

of Fund

|

|

|

Return Before Taxes

|

|

|

|

|

|

|

|

|

|

Investor Class

|

|

3.97

|

%

|

3.50

|

%

|

3.60

|

%

|

|

|

Class A

|

|

4.04

|

%

|

3.60

|

%

|

3.66

|

%

|

|

|

Class B

|

|

3.39

|

%

|

3.36

|

%

|

3.21

|

%

|

|

|

Class C

|

|

5.50

|

%

|

3.36

|

%

|

3.20

|

%

|

|

|

Class I

|

|

7.63

|

%

|

4.50

|

%

|

4.31

|

%

|

|

|

Return

After Taxes on Distributions

|

|

|

|

|

|

|

|

|

|

Class I

|

|

6.07

|

%

|

2.96

|

%

|

2.60

|

%

|

|

|

Return

After Taxes on Distributions and Sale of Fund Shares

|

|

|

|

|

|

|

|

|

|

Class I

|

|

4.93

|

%

|

2.91

|

%

|

2.65

|

%

|

|

|

Credit Suisse Leveraged Loan

Index (reflects no deductions for fees, expenses, or taxes)

|

9.43

|

%

|

4.81

|

%

|

4.86

|

%

|

|

After-tax

returns are calculated using the highest individual federal marginal income tax rates in effect at the

time of each distribution or capital gain or upon the sale of fund shares, and do not reflect the impact

of state and local taxes. In some cases, the return after taxes may exceed the return before taxes due

to an assumed tax benefit from any losses on a sale of shares at the end of the measurement period. Actual

after-tax returns depend on your tax situation and may differ from those shown. After-tax returns are

not relevant if you hold your shares through tax-deferred arrangements, such as 401(k) plans or individual

retirement accounts. After-tax returns shown are for Class I shares. After-tax returns for the other

share classes may vary.

New York Life Investment Management

LLC serves as the Fund’s Manager and is responsible for the day-to-day portfolio management of the

Fund.

|

|

|

|

|

Manager

|

Portfolio Manager

|

Service Date

|

|

New York Life Investment Management LLC

|

Robert

H. Dial, Managing Director

|

Since 2004

|

|

|

Mark A. Campellone, Managing

Director

|

Since 2012

|

|

|

Arthur

S. Torrey, Managing Director

|

Since 2012

|

How to Purchase and Sell Shares

You

may purchase or sell shares of the Fund on any day the Fund is open for business by contacting your financial

adviser or financial intermediary firm, or by contacting the Fund by telephone at

800-MAINSTAY (624-6782)

, by mail at MainStay Funds, P.O. Box 8401, Boston, MA

02266-8401 or by accessing our website at mainstayinvestments.com. Generally, an initial investment minimum

of $1,000 applies if you invest in Investor Class, Class B, or Class C

3

shares,

$25,000 for Class A shares and $5,000,000 for individual investors in Class I shares investing directly

(i) with the Fund; or (ii) through certain private banks and trust companies that have an agreement with

NYLIFE Distributors LLC, the Fund’s principal underwriter and distributor, or its affiliates. A

subsequent investment minimum of $50 applies to investments in Investor Class, Class B and Class C shares.

However, for Investor Class, Class B, or Class C shares purchased through AutoInvest, a monthly systematic

investment plan, a $500 initial investment minimum ($50 for subsequent purchases) applies. Institutional

shareholders in Class I shares have no initial or subsequent investment minimums.

The

Fund's distributions are generally taxable to you as ordinary income, capital gains, or a combination

of the two, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an

individual retirement account.

Compensation to Financial Intermediary Firms

If you purchase Fund shares

through a financial intermediary firm (such as a broker/dealer or bank), the Fund and its related companies

may pay the intermediary for the sale of Fund shares and related services. These payments may create

a conflict of interest by influencing the financial intermediary firm or your financial adviser to recommend

the Fund over another investment. Ask your financial adviser or visit your financial intermediary firm's

website for more information. For additional information about compensation to financial intermediaries,

please see the section entitled "Compensation to Financial Intermediary Firms" in the "Shareholder Guide"

section starting on page 110 of the Prospectus.

4

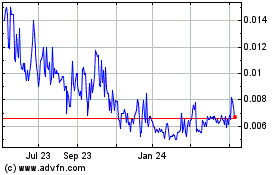

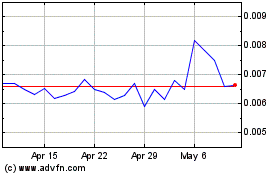

GB Sciences (PK) (USOTC:GBLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

GB Sciences (PK) (USOTC:GBLX)

Historical Stock Chart

From Apr 2023 to Apr 2024