Churchill Downs Incorporated ("CDI" or "Company") (Nasdaq:CHDN)

announced today, Friday, October 5, 2012, that it has entered into

a definitive purchase agreement to acquire Riverwalk Casino and

Hotel ("Riverwalk" or "Sellers") in Vicksburg, Miss., for total

consideration of approximately $141 million, to be paid in cash.

The transaction, which is contingent upon the

Company securing a gaming license from the Mississippi Gaming

Commission and other usual and customary closing conditions, is

anticipated to close by the end of the year. If certain closing

conditions are not satisfied, the Company could be obligated to pay

a $7 million termination fee.

The transaction price represents a multiple of approximately 7.4

times the property's trailing twelve month EBITDA (earnings before

interest, taxes, depreciation and amortization) and will be funded

through the Company's existing credit facility. While the

acquisition is an equity transaction, for tax purposes it will be

treated as an asset transaction which the Company expects will

provide tax benefits that will effectively reduce the transaction

price multiple to approximately 6.4 times the property's trailing

twelve month EBITDA.

The transaction is expected to be immediately accretive to

earnings per share by approximately $0.31.

Based on historical performance, the Company

estimates that Riverwalk's annual impact is expected to be

approximately $55 million in revenue (net of promotional

allowances), $19 million in EBITDA, and $9.9 million in free cash

flow (EBITDA minus maintenance capital, interest and taxes).

CDI Chairman and CEO Robert L. Evans said this

acquisition continues to reflect CDI's commitment to the Company's

growth via diversification strategy.

"We are excited to have another property in the

business-friendly state of Mississippi to add to our Harlow's

Casino Resort & Hotel property in Greenville, located 90 miles

north of Riverwalk along the Mississippi River," Evans said.

"Riverwalk is an attractive investment for CDI as it is a newer

facility with superior design, high quality amenities and is

operated by an outstanding team of over 400 employees with whom we

look forward to working in the near future. We continue to look for

opportunities to invest capital in growth opportunities, and we are

hopeful that other jurisdictions, such as Kentucky and Illinois,

will offer us a similar opportunity to invest and create jobs in

the near future."

Greg Carlin, CEO of Riverwalk and Rush Street

Gaming, said, "We're grateful to the entire Riverwalk team for its

dedication and hard work in making Riverwalk the best casino in

Vicksburg." Carlin went on to note that, "Operations at our

remaining casinos in the U.S. and Canada are unaffected by this

transaction and we continue to pursue new development

opportunities."

Riverwalk, which is located on approximately 22

acres of land in Vicksburg, Miss., on the Mississippi River less

than one mile from Interstate 20, features a 25,000-square-foot

single-level gaming floor with 723 Class III slot machines and 18

table games; a five-story, 80-room attached hotel; a

5,600-square-foot multi-functional event center overlooking the

river; and two separate dining areas. Of the 19 Mississippi casinos

located along the Mississippi River, Riverwalk was one of the two

facilities that were not forced to close in 2011 due to record

flooding.

The property, which opened in October 2008, is

operated by Magnolia Hill, LLC and is owned by High River Gaming,

LLC; JB3 Corporation; and Taiman Holdings Corporation. Neil Bluhm

is the largest principal in Riverwalk with an approximately 70

percent equity position.

Sidley Austin LLP is acting as legal advisor to the Company in

this transaction. Macquarie Capital is acting as financial advisor

and Perkins Coie, LLP is acting as legal advisor to the Sellers in

this matter.

About Churchill Downs

Incorporated

Churchill Downs Incorporated ("CDI") (Nasdaq:CHDN),

headquartered in Louisville, Ky., owns and operates the

world-renowned Churchill Downs Racetrack, home of the Kentucky

Derby and Kentucky Oaks, as well as racetrack and casino operations

and a poker room in Miami Gardens, Fla.; racetrack, casino and

video poker operations in New Orleans, La.; racetrack operations in

Arlington Heights, Ill.; and a casino resort in Greenville, Miss.

CDI also owns the country's premier advance-deposit wagering

company, TwinSpires.com; the totalisator company, United Tote;

Bluff Media, an Atlanta-based multimedia poker content, brand and

publishing company; and a collection of racing-related

telecommunications and data companies. Information about CDI can be

found online at www.churchilldownsincorporated.com.

Information set forth in this news release contains

various "forward-looking statements" within the meaning of Section

27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. The Private Securities Litigation Reform Act

of 1995 (the "Act") provides certain "safe harbor" provisions for

forward-looking statements. All forward-looking statements made in

this Quarterly Report on Form 10-Q are made pursuant to the

Act.

The reader is cautioned that such forward-looking

statements are based on information available at the time and/or

management's good faith belief with respect to future events, and

are subject to risks and uncertainties that could cause actual

performance or results to differ materially from those expressed in

the statements. Forward-looking statements speak only as of the

date the statement was made. We assume no obligation to update

forward-looking information to reflect actual results, changes in

assumptions or changes in other factors affecting forward-looking

information. Forward-looking statements are typically identified by

the use of terms such as "anticipate," "believe," "could,"

"estimate," "expect," "intend," "may," "might," "plan," "predict,"

"project," "hope," "should," "will," and similar words, although

some forward-looking statements are expressed differently. Although

we believe that the expectations reflected in such forward-looking

statements are reasonable, we can give no assurance that such

expectations will prove to be correct. Important factors that could

cause actual results to differ materially from expectations

include: the effect of global economic conditions, including any

disruptions in the credit markets; a decrease in consumers'

discretionary income; the effect (including possible increases in

the cost of doing business) resulting from future war and terrorist

activities or political uncertainties; the overall economic

environment; the impact of increasing insurance costs; the impact

of interest rate fluctuations; the effect of any change in our

accounting policies or practices; the financial performance of our

racing operations; the impact of gaming competition (including

lotteries, online gaming and riverboat, cruise ship and land-based

casinos) and other sports and entertainment options in the markets

in which we operate; our ability to maintain racing and gaming

licenses to conduct our businesses; the impact of live racing day

competition with other Florida, Illinois and Louisiana racetracks

within those respective markets; the impact of higher purses and

other incentives in states that compete with our racetracks; costs

associated with our efforts in support of alternative gaming

initiatives; costs associated with customer relationship management

initiatives; a substantial change in law or regulations affecting

pari-mutuel and gaming activities; a substantial change in

allocation of live racing days; changes in Kentucky, Florida,

Illinois or Louisiana law or regulations that impact revenues or

costs of racing operations in those states; the presence of

wagering and gaming operations at other states' racetracks and

casinos near our operations; our continued ability to effectively

compete for the country's horses and trainers necessary to achieve

full field horse races; our continued ability to grow our share of

the interstate simulcast market and obtain the consents of

horsemen's groups to interstate simulcasting; our ability to enter

into agreements with other industry constituents for the purchase

and sale of racing content for wagering purposes; our ability to

execute our acquisition strategy and to complete or successfully

operate planned expansion projects; our ability to successfully

complete any divestiture transaction; market reaction to our

expansion projects; the inability of our totalisator company,

United Tote, to maintain its processes accurately or keep its

technology current; our accountability for environmental

contamination; the ability of our online business to prevent

security breaches within its online technologies; the loss of key

personnel; the impact of natural and other disasters on our

operations and our ability to obtain insurance recoveries in

respect of such losses (including losses related to business

interruption); our ability to integrate any businesses we acquire

into our existing operations, including our ability to maintain

revenues at historic levels and achieve anticipated cost savings;

the impact of wagering laws, including changes in laws or

enforcement of those laws by regulatory agencies; the outcome of

pending or threatened litigation; changes in our relationships with

horsemen's groups and their memberships; our ability to reach

agreement with horsemen's groups on future purse and other

agreements (including, without limiting, agreements on sharing of

revenues from gaming and advance deposit wagering); the effect of

claims of third parties to intellectual property rights; and the

volatility of our stock price.

CONTACT: Courtney Yopp Norris

(502) 636-4564

Courtney.Norris@kyderby.com

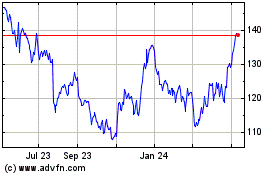

Churchill Downs (NASDAQ:CHDN)

Historical Stock Chart

From Mar 2024 to Apr 2024

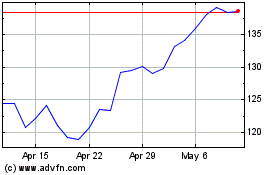

Churchill Downs (NASDAQ:CHDN)

Historical Stock Chart

From Apr 2023 to Apr 2024