Universal Forest Products, Inc. (Nasdaq: UFPI) today announced

first-quarter 2012 net sales of $457.1 million, up 18 percent over

net sales in the same period of 2011. The Company reported net

earnings of $4.2 million, or $0.21 per diluted share for the first

quarter of 2012, compared with a loss of $3.7 million, or a loss of

$0.19 per diluted share, for the first quarter of 2011. Net sales

increased in each of the Company’s five markets, with double-digit

increases in four.

“The Company benefited from the improved execution of our growth

strategies and continued emphasis on managing costs though

production efficiencies and optimization of certain administrative

functions. Of course, we were aided by exceptionally good weather

and improved demand in our markets,” said CEO Matthew J. Missad,

adding that the Company is optimistic that the stronger demand will

continue to drive sales in the second quarter.

“The Company was able to maintain costs as sales grew, creating

significant operating leverage that drove profitability,” Missad

added. “We are focused on growing our business and increasing

market share through opportunistic sales efforts as well as

synergistic acquisitions.”

“I’m proud of the way our people are focusing on improving

profitability. We’re diversifying, we’re expanding into new areas

and with new products, and we’re coming to work every day

determined to be better than we were the day before,” Missad

said.

The lumber market was comparable to the same period last year

and didn’t have a significant impact on sales. By market, Universal

posted the following gross sales results for the first quarter of

2012:

Retail building materials: $196.9 million, an increase of

12.3 percent over the same period of 2011. Universal continues

to focus on growing its independent retail customer base, on

providing a broader mix of products to big box and independent

retailers alike, and on entering into profitable business

opportunities.

Industrial packaging/components: $132.3 million, up 20.9

percent over the first quarter of 2011. Universal saw this

double-digit sales increase at a time when total industrial

production in the United States was up 4.1 percent February 2012

over February 2011 and up 3.8 percent January 2012 over January

2011, the most recent statistics available. Universal continues to

focus on adding customers and products in this fragmented market,

on expanding its reach into non-wood packaging materials and on

providing complete packaging solutions.

Manufactured housing: $63.0 million, an increase of 34.0

percent over the same period of 2011. Demand for temporary

housing related to shale oil and gas development in some areas of

the United States and Canada contributed to an increase in sales to

this market. Industry shipments of HUD-code homes in January and

February 2012 were up 42.1 and 43.5 percent, respectively, compared

to the same months of 2011. Additionally, approximately one-third

of the Company’s sales to this market are for modular homes, for

which shipments were up 8 percent year-over-year in the fourth

quarter of 2011 over 2010, the most recent statistics

available.

Residential construction: $51.9 million, up 8.6 percent over

the same period of 2011. Total housing starts December 2011 to

February 2012 were up 25.5 percent over the same period a year

earlier, which included increases in single-family and multifamily

starts of 19.7 and 41.2 percent, respectively. Universal continues

to focus on profitable business opportunities in this market, where

excess capacity continues to have an impact on sales and margins.

Our decline in market share was anticipated and was a result of

selective practices and taking business that meets profitability

objectives.

Commercial construction and concrete forming: $20.2 million,

an increase of 37.9 percent over the same period of 2011. In

this highly fragmented market, Universal manufactures and supplies

forms and other materials for concrete construction projects. The

Company continues to expand its sales reach and market penetration

and to leverage its design and manufacturing capabilities and its

nationwide presence to offer designed components to customers,

large and small.

CONFERENCE CALL

Universal Forest Products will conduct a conference call to

discuss information included in this news release and related

matters at 8:30 a.m. ET on Thurs., April 19, 2012. The call will be

hosted by CEO Matthew J. Missad and CFO Michael Cole, and will be

available for analysts and institutional investors domestically at

(877) 299-4454 and internationally at (617) 597-5447. Use

conference pass code 12037812. The conference call will be

available simultaneously and in its entirety to all interested

investors and news media through a webcast at http://www.ufpi.com.

A replay of the call will be available through May 18, 2012,

domestically at (888) 286-8010 and internationally at (617)

801-6888. Use replay pass code 29968020.

UNIVERSAL FOREST PRODUCTS, INC.

Universal Forest Products, Inc. is a holding company that

provides capital, management and administrative resources to

subsidiaries that design, manufacture and market wood and

wood-alternative products for DIY/retail home centers and other

retailers, structural lumber products for the manufactured housing

industry, engineered wood components for residential and commercial

construction, specialty wood packaging and components for various

industries, and forming products for concrete construction. The

Company's consumer products subsidiary offers a large portfolio of

outdoor living products, including wood composite decking,

decorative balusters, post caps and plastic lattice. Its lawn and

garden group offers an array of products, such as trellises and

arches, to retailers nationwide. Universal’s subsidiaries also

provide framing services for the site-built construction market.

Founded in 1955, Universal Forest Products is headquartered in

Grand Rapids, Mich., with operations throughout North America. For

more about Universal Forest Products, go to www.ufpi.com.

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act, as

amended, that are based on management’s beliefs, assumptions,

current expectations, estimates and projections about the markets

we serve, the economy and the company itself. Words like

“anticipates,” “believes,” “confident,” “estimates,” “expects,”

“forecasts,” “likely,” “plans,” “projects,” “should,” variations of

such words, and similar expressions identify such forward-looking

statements. These statements do not guarantee future performance

and involve certain risks, uncertainties and assumptions that are

difficult to predict with regard to timing, extent, likelihood and

degree of occurrence. The Company does not undertake to update

forward-looking statements to reflect facts, circumstances, events,

or assumptions that occur after the date the forward-looking

statements are made. Actual results could differ materially from

those included in such forward-looking statements. Investors are

cautioned that all forward-looking statements involve risks and

uncertainty. Among the factors that could cause actual results to

differ materially from forward-looking statements are the

following: fluctuations in the price of lumber; adverse or unusual

weather conditions; adverse conditions in the markets we serve;

government regulations, particularly involving environmental and

safety regulations; and our ability to make successful business

acquisitions. Certain of these risk factors as well as other risk

factors and additional information are included in the Company's

reports on Form 10-K and 10-Q on file with the Securities and

Exchange Commission.

CONSOLIDATED STATEMENTS OF EARNINGS AND COMPREHENSIVE

INCOME (UNAUDITED) FOR THE THREE MONTHS ENDED MARCH

2012/2011 Quarter Period Year to

Date (In thousands, except per share data)

2012 2011

2012 2011

NET SALES $ 457,111 100 % $ 387,233 100 % $ 457,111 100 % $

387,233 100 %

COST OF GOODS SOLD 403,445

88.3 345,819 89.3 403,445 88.3

345,819 89.3

GROSS PROFIT 53,666 11.7

41,414 10.7 53,666 11.7 41,414 10.7

SELLING, GENERAL AND

ADMINISTRATIVE EXPENSES 45,778 10.0 46,488 12.0 45,778 10.0

46,488 12.0

NET LOSS ON DISPOSITION OF ASSETS, EARLY

RETIREMENT, AND OTHER IMPAIRMENT AND EXIT CHARGES

95 - 7 - 95 - 7 -

EARNINGS (LOSS) FROM OPERATIONS 7,793 1.7 (5,081 )

(1.3 ) 7,793 1.7 (5,081 ) (1.3 )

OTHER EXPENSE

(REVENUE) 708 0.2 618 0.2

708 0.2 618 0.2

EARNINGS (LOSS)

BEFORE INCOME TAXES 7,085 1.5 (5,699 ) (1.5 ) 7,085 1.5 (5,699

) (1.5 )

INCOME TAXES (BENEFIT) 2,699

0.6 (2,287 ) (0.6 ) 2,699 0.6 (2,287 )

(0.6 )

NET EARNINGS (LOSS) 4,386 1.0 (3,412 ) (0.9 )

4,386 1.0 (3,412 ) (0.9 )

LESS NET EARNINGS ATTRIBUTABLE

TO NONCONTROLLING INTEREST (231 ) (0.1 )

(258 ) (0.1 ) (231 ) (0.1 ) (258 ) (0.1 )

NET EARNINGS (LOSS) ATTRIBUTABLE TO CONTROLLING

INTEREST $ 4,155 0.9 $ (3,670 ) (0.9 ) $ 4,155

0.9 $ (3,670 ) (0.9 )

EARNINGS (LOSS) PER SHARE -

BASIC $ 0.21 $ (0.19 ) $ 0.21 $ (0.19 )

EARNINGS

(LOSS) PER SHARE - DILUTED $ 0.21 $ (0.19 ) $ 0.21 $ (0.19 )

WEIGHTED AVERAGE SHARES OUTSTANDING FOR BASIC

EARNINGS (LOSS) 19,569 19,306 19,569 19,306

WEIGHTED

AVERAGE SHARES OUTSTANDING FOR DILUTED EARNINGS (LOSS)

19,700 19,306 19,700 19,306

COMPREHENSIVE INCOME (LOSS)

5,444 (2,702 ) 5,444 (2,702 )

LESS COMPREHENSIVE INCOME

ATTRIBUTABLE TO NONCONTROLLING INTEREST (655 )

(429 ) (655 ) (429 )

COMPREHENSIVE

INCOME (LOSS) ATTRIBUTABLE TO CONTROLLING INTEREST $

4,789 $ (3,131 ) $ 4,789 $ (3,131 )

SUPPLEMENTAL

SALES DATA

Quarter Period Year to Date

Market

Classification

2012 % 2011 %

2012 % 2011 %

Retail Building Materials $ 196,871 43 % $ 175,265 44 % $

196,871 43 % $ 175,265 44 %

Residential Construction 51,926

11 % 47,831 12 % 51,926 11 % 47,831 12 %

Commercial Construction

and Concrete Forming 20,206 4 % 14,652 4 % 20,206 4 % 14,652 4

%

Industrial 132,307 28 % 109,427 28 % 132,307 28 % 109,427

28 %

Manufactured Housing 63,039 14 %

47,046 12 % 63,039 14 % 47,046

12 %

Total Gross Sales 464,349 100 % 394,221 100 % 464,349

100 % 394,221 100 %

Sales Allowances (7,238 )

(6,988 ) (7,238 ) (6,988 )

Total Net

Sales $ 457,111 $ 387,233 $ 457,111 $

387,233

CONSOLIDATED BALANCE SHEETS

(UNAUDITED) MARCH 2012/2011 (In thousands)

ASSETS 2012

2011 LIABILITIES AND EQUITY

2012 2011 CURRENT ASSETS

CURRENT LIABILITIES Accounts receivable $ 192,427 $ 176,970

Cash overdraft $ 4,282 $ 41 Inventories 218,553 243,639 Accounts

payable 75,347 66,571 Assets held for sale - 7,528 Accrued

liabilities 47,741 49,427 Other current assets 23,752 27,905

Current portion of long-term debt and capital leases

42,774 74,647

TOTAL CURRENT ASSETS

434,732 456,042

TOTAL CURRENT LIABILITIES 170,144 190,686

OTHER ASSETS 15,712 11,698

LONG-TERM DEBT AND

INTANGIBLE ASSETS, NET 167,242 171,534

CAPITAL LEASE

OBLIGATIONS, PROPERTY, PLANT less current portion

43,668 52,474

AND EQUIPMENT, NET 221,704 216,802

OTHER

LIABILITIES 35,112 33,018

EQUITY

590,466 579,898

TOTAL ASSETS $ 839,390 $

856,076

TOTAL LIABILITIES AND EQUITY $ 839,390 $ 856,076

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

FOR THE THREE MONTHS ENDED

MARCH 2012/2011

(In thousands)

2012

2011

CASH FLOWS FROM OPERATING ACTIVITIES: Net

earnings (loss) attributable to controlling interest $ 4,155 $

(3,670 ) Adjustments to reconcile net earnings attributable to

controlling interest to net cash from operating activities:

Depreciation 7,178 6,902 Amortization of intangibles 745 1,441

Expense associated with share-based compensation arrangements 504

875 Excess tax benefits from share-based compensation arrangements

(12 ) (121 ) Deferred income tax (credit) (50 ) (69 ) Net earnings

attributable to noncontrolling interest 231 258 Equity in earnings

of investee (62 ) (17 ) Net gain on sale or impairment of assets

(25 ) (142 ) Changes in: Accounts receivable (64,829 ) (55,869 )

Inventories (23,392 ) (53,007 ) Accounts payable 25,585 7,035

Accrued liabilities and other 5,327 (13,095 )

NET CASH FROM OPERATING ACTIVITIES (44,645 ) (109,479 )

CASH FLOWS FROM INVESTING ACTIVITIES: Purchase of

property, plant, and equipment (7,860 ) (6,309 ) Proceeds from sale

of property, plant and equipment 2,035 177 Purchase of patents (21

) - Collections of notes receivable 647 243 Other, net (302

) 25

NET CASH FROM INVESTING ACTIVITIES (5,501

) (5,864 ) CASH FLOWS FROM FINANCING ACTIVITIES: Net

borrowings under revolving credit facilities 33,968 71,817 Debt

issuance costs (81 ) - Proceeds from issuance of common stock 1,036

456 Purchase of additional noncontrolling interest - (100 )

Distributions to noncontrolling interest (379 ) (395 ) Capital

contribution from noncontrolling interest - 40 Excess tax benefits

from share-based compensation arrangements 12 121 Other, net

3 -

NET CASH FROM FINANCING ACTIVITIES

34,559 71,939

NET CHANGE IN

CASH AND CASH EQUIVALENTS (15,587 ) (43,404 )

CASH

AND CASH EQUIVALENTS, BEGINNING OF PERIOD 11,305

43,363

CASH AND CASH EQUIVALENTS, END OF

PERIOD $ (4,282 ) $ (41 )

SUPPLEMENTAL

INFORMATION: Cash paid during the period for: Interest 261 250

Income taxes 3,400 1,690

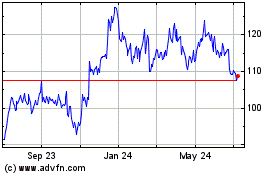

UFP Industries (NASDAQ:UFPI)

Historical Stock Chart

From Apr 2024 to May 2024

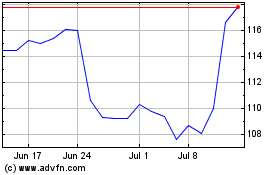

UFP Industries (NASDAQ:UFPI)

Historical Stock Chart

From May 2023 to May 2024