UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October

27, 2015

AGENUS

INC.

(Exact

name of registrant as specified in its charter)

|

DELAWARE

|

000-29089

|

06-1562417

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

3 Forbes Road

Lexington, MA

|

02421

|

|

(Address of principal executive offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: 781-674-4400

N/A

(Former

name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2. below):

⃞

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

⃞

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

⃞

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

⃞

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On October 27, 2015, Agenus Inc. announced its financial results for the

quarter ended September 30, 2015. The full text of the press release

issued in connection with the announcement is being furnished as Exhibit

99.1 to this Current Report on Form 8-K.

The information set forth under Item 2.02 and in Exhibit 99.1 attached

hereto is intended to be furnished and shall not be deemed “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934 or

otherwise subject to the liabilities of that section, nor shall it be

deemed incorporated by reference in any filing under the Securities Act

of 1933, except as expressly set forth by specific reference in such

filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibit is furnished herewith:

99.1 Press Release dated October 27, 2015

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

Date:

|

October 27, 2015

|

AGENUS INC.

|

|

|

|

|

|

|

|

By:

|

/s/ C. Evan Ballantyne

|

|

|

|

|

|

C. Evan Ballantyne

|

|

|

|

|

Chief Financial Officer

|

EXHIBIT INDEX

|

Exhibit No.

|

Description of Exhibit

|

|

|

|

|

99.1

|

Press Release dated October 27, 2015

|

Exhibit 99.1

Agenus

Reports Third Quarter 2015 Financial Results

Corporate

Update Conference Call at 11 am ET Today

LEXINGTON, Mass.--(BUSINESS WIRE)--October 27, 2015--Agenus Inc.

(NASDAQ:AGEN), an immunology company discovering and developing

innovative treatments for cancers and other diseases, today announced

its financial results for the third quarter ended September 30, 2015.

“We are rapidly advancing our broad pipeline of potentially

best-in-class therapies and combination therapies for patients with

cancer. We look forward to providing further details on this progress

during our Analyst Day, scheduled for November 19 in New York City,”

said Dr. Garo H. Armen, Chairman and CEO of Agenus. “We have also

strengthened our balance sheet by monetizing a portion of our QS-21

adjuvant royalty stream, which provided us with net proceeds of

approximately $78 million. We also acquired the rights to antibodies

targeting CEACAM1, expanding our portfolio to include powerful

immune-modulators that may be complementary with other checkpoint

modulators, including those in our pipeline.”

Third Quarter 2015 Financial Results

For the third quarter ended September 30, 2015, Agenus reported a net

loss attributable to common stockholders of $13.2 million, or $0.16 per

share, basic and diluted, compared with a net loss attributable to

common stockholders for the third quarter of 2014 of $8.2 million, or

$0.13 per share, basic and diluted.

For the nine months ended September 30, 2015, the company reported a net

loss attributable to common stockholders of $72.4 million, or $0.95 per

share, basic and diluted, compared with a net loss attributable to

common stockholders of $16.7 million, $0.28 per share, basic and

diluted, for the nine months ended September 30, 2014.

The increase in net loss attributable to common stockholders for the

nine-months ended September 30, 2015, compared to the net loss

attributable to common stockholders for the same period in 2014, was

primarily due to the advancement of our check point modulator programs

including the $13.2 million charge for the acquisition of the SECANT

yeast display platform in addition to other license and technology

transfer arrangements. We also recorded a total of $14.2 million in

non-cash expense for fair value adjustments to our contingent

obligations. During the same period in 2014, the company recorded

non-cash non-operating income of $10.7 million related to the fair value

adjustment of our contingent obligations.

Cash, cash equivalents and short-term investments were $199.1 million as

of September 30, 2015.

Third Quarter 2015 and Recent Corporate Highlights

-

In September, Agenus completed a $115 million non-dilutive royalty

transaction pursuant to a Note Purchase Agreement with an investor

group led by Oberland Capital Management, LLC for rights to a portion

of the worldwide royalties on future sales of GlaxoSmithKline’s

shingles (HZ/su) and malaria (RTS,S) prophylactic vaccine products

that contain Agenus’ QS-21 adjuvant. The transaction resulted in net

proceeds of approximately $78 million at closing.

-

Also in September, Agenus presented data at the CRI-CIMT-EATI-AACR

Inaugural International Cancer Immunotherapy Conference from an

exploratory study showing the role of unique tumor neo-epitopes and

immunological responses to Prophage in glioblastoma patients,

highlighting the importance of patient-specific neo-epitopes in

individualized immunotherapy for treating cancer.

-

In July, Agenus acquired rights to antibodies targeting

Carcinoembryonic Antigen Cell Adhesion Molecule 1 (CEACAM1), a

glycoprotein expressed on T cell and NK cell lymphocytes from Diatheva

s.r.l., an Italian biotech company controlled by SOL S.p.A. CEACAM1 is

overexpressed in melanoma, bladder, lung, colon, pancreas, and gastric

cancers, and appears to mediate innate and adaptive immune suppression

allowing tumors to escape immune destruction. Antibodies to CEAMCAM1

should be effective in treating patients with many forms of cancer.

Conference Call and Web Cast Information

Agenus executives will host a conference call at 11:00 a.m. Eastern Time

today. To access the live call, dial 1-888-799-5016 (U.S.) or

1-704-908-0465 (international) and refer to conference ID number

63478685. The call will also be webcast and will be accessible from the

company’s website at www.agenusbio.com/webcast/. A replay

will be available on the company’s website approximately two hours after

the call and will remain available for 60 days. The replay number is

1-855-859-2056 (U.S.) 1-404-537-3406 (international), conference ID

number 63478685.

Analyst Day Information

Agenus will be hosting an Analyst Day on November 19th in New York City

at 4:00pm. The Company intends to provide the financial community with a

detailed update on our R&D efforts, and the progress we are making

toward establishing a deep, promising portfolio of immuno-oncology

therapies focused on checkpoint modulators, vaccines and combination

approaches. The event will also be webcast live and will be accessible

from the company’s website at www.agenusbio.com/webcast/.

About Agenus

Agenus is an immunology company engaged in the discovery and development

of novel checkpoint modulators, vaccines and adjuvants to treat cancer

and other diseases. Using its proprietary platforms Retrocyte Display™

and SECANT®, the Company is discovering and developing novel antibodies

to target GITR, OX40, CTLA-4, LAG-3, TIM-3, PD-1, CEACAM1 and other

undisclosed checkpoints in partnered and internal programs. Agenus’ heat

shock protein vaccine, Prophage, has successfully completed Phase 2

studies in newly diagnosed glioblastoma multiforme. The Company’s QS-21

Stimulon® adjuvant is partnered with GlaxoSmithKline and Janssen

Sciences Ireland UC. For more information, please visit www.agenusbio.com;

information that may be important to investors will be routinely posted

on our website.

Forward-Looking Statement

This press release contains forward-looking statements that are made

pursuant to the safe harbor provisions of the federal securities laws,

including statements regarding the Company’s research and development

and clinical trial activities and the potential application of the

Company’s technologies and product candidates in the prevention and

treatment of diseases. These forward-looking statements are

subject to risks and uncertainties that could cause actual results to

differ materially. These risks and uncertainties include, among others,

the factors described under the Risk Factors section of our Quarterly

Report on Form 10-Q filed with the Securities and Exchange Commission

for the period ended June 30, 2015. Agenus cautions investors not to

place considerable reliance on the forward-looking statements contained

in this release. These statements speak only as of the date of

this press release, and Agenus undertakes no obligation to update or

revise the statements, other than to the extent required by law. All

forward-looking statements are expressly qualified in their entirety by

this cautionary statement.

|

|

|

Summary Consolidated Financial Information

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of Operations Data

|

|

(in thousands, except per share data)

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September

30,

|

|

Nine months ended

September 30,

|

|

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$6,848

|

|

$1,563

|

|

$17,178

|

|

$5,358

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

18,502

|

|

5,284

|

|

52,495

|

|

14,980

|

|

General and administrative

|

|

6,408

|

|

4,920

|

|

19,910

|

|

16,209

|

|

Non-cash contingent consideration

fair value adjustment

|

|

(6,994)

|

|

(969)

|

|

7,327

|

|

164

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss

|

|

(11,068)

|

|

(7,672)

|

|

(62,554)

|

|

(25,995)

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense), net

|

|

(2,054)

|

|

(437)

|

|

(9,720)

|

|

9,487

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

(13,122)

|

|

(8,109)

|

|

(72,274)

|

|

(16,508)

|

|

|

|

|

|

|

|

|

|

|

|

Dividends on Series A-1 convertible

preferred stock

|

|

(51)

|

|

(51)

|

|

(152)

|

|

(153)

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to common stockholders

|

|

$(13,173)

|

|

$(8,160)

|

|

$(72,426)

|

|

$(16,661)

|

|

|

|

|

|

|

|

|

|

|

|

Per common share data, basic and diluted:

|

|

|

|

|

|

|

|

|

|

Net loss attributable to common

stockholders

|

|

$(0.16)

|

|

$(0.13)

|

|

$(0.95)

|

|

$(0.28)

|

|

Weighted average number of

common shares outstanding, basic

and

diluted

|

|

84,569

|

|

62,832

|

|

75,936

|

|

58,710

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Balance Sheet Data

|

|

(in thousands)

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September

30, 2015

|

|

December

31, 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and short-term

investments

|

|

$199,133

|

|

$40,224

|

|

|

|

|

|

Total assets

|

|

242,608

|

|

74,527

|

|

|

|

|

|

Total stockholders' equity

|

|

76,976

|

|

23,018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONTACT:

Agenus:

Agenus Inc.

Michelle Linn,

774-696-3803

michelle.linn@agenusbio.com

or

Media:

BMC

Communications

Brad Miles, 646-513-3125

bmiles@bmccommunications.com

or

Investors:

Argot

Partners

Andrea Rabney/ Jamie Maarten, 212-600-1902

andrea@argotpartners.com

jamie@argotpartners.com

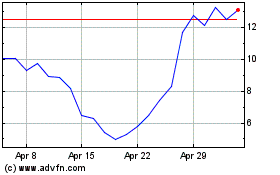

Agenus (NASDAQ:AGEN)

Historical Stock Chart

From Sep 2024 to Oct 2024

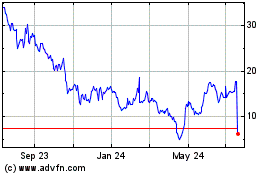

Agenus (NASDAQ:AGEN)

Historical Stock Chart

From Oct 2023 to Oct 2024