Apple and Google maintain their #1 and #2 positions and each

exceed USD $100 billion in brand value; Huawei makes Best Global

Brands history as the first Chinese brand to enter the report

For the second year in a row, Apple and Google claim the top

positions on Interbrand’s Best Global Brands ranking. Valued at USD

$118.9 billion, Apple (#1) increased its brand value by 21 percent.

Google (#2), valued at $107.43 billion, increased its brand value

by 15 percent. For the first time in the history of Best Global

Brands two global brands – not just one – have each earned a brand

value that exceeds USD $100 billion.

Huawei (#94), the Chinese telecommunications and network

equipment provider, also makes Best Global Brands history as the

first Chinese company to appear on Interbrand’s ranking. With 65

percent of its revenue coming from outside of China and with its

earnings continuing to climb both domestically and across Europe,

the Middle East, and Africa, Huawei is quickly becoming one of the

largest telecommunications equipment makers in the world. The

company is currently the third largest smartphone manufacturer in

the world—just behind Samsung and Apple. The Chinese brand is one

of five new entrants to enter the Best Global Brands ranking this

year—the others being DHL (#81), Land Rover (#91), FedEx (#92), and

Hugo Boss (#97).

“Apple and Google’s meteoric rise to more than USD $100 billion

is truly a testament to the power of brand building,” said Jez

Frampton, Interbrand’s Global Chief Executive Officer. These

leading brands have reached new pinnacles—in terms of both their

growth and in the history of Best Global Brands—by creating

experiences that are seamless, contextually relevant, and

increasingly based around an overarching ecosystem of integrated

products and services, both physical and digital.”

Interbrand’s Best Global Brands methodology was the first of its

kind to become ISO certified. It analyzes the many ways a brand

benefits an organization—from delivering on customer expectations

to driving economic value.

When determining the top 100 most valuable brands each year,

Interbrand examines three key aspects that contribute to a brand’s

value:

- The financial performance of the

branded product and service

- The role the brand plays in influencing

customer choice

- The strength the brand has to command a

premium price or secure earnings for the company

2014 Overview: Brands Entering the “Age of You”

In addition to identifying the top 100 most valuable brands,

this year’s Best Global Brands report also examines three pivotal

ages in brand history that have reshaped business for the better:

the Age of Identity, the Age of Value, and the Age of Experience.

Interbrand contends that a new, emerging era is upon the global

business world: the Age of You.

“As consumers and devices become more connected and integrated,

the data being generated is creating value for consumers, for

brands, and for the world at large,” said Frampton. “As a result,

brands from all categories and sectors will get smarter—with

products and devices working in concert with one another, across

supply chains, and in tandem with our own individual data sets.

Brands that seek to lead in the forthcoming Age of You will have to

create truly personalized and curated experiences, or what we call

‘Mecosystems,’ around each and every one of us. Such brands will

have to rehumanize the data, uncover genuine insights, and deliver

against individual wants, needs, and desires.”

Key Report Highlights

2014 TOP RISERS: Facebook (#29, +86%), Audi (#45, +27%),

Amazon (#15, +25%), Volkswagen (#31, +23%), and Nissan (#56,

+23%)

Facebook (#29, +86%): The world’s largest social

network, Facebook continues to exceed expectations. Reported on its

Q2 earnings call, income from its operations was a staggering USD

$1.4 billion. One year prior it was USD $562 million. Facebook’s ad

business on mobile phones has been particularly strong. For the

first time in its history, the company reported that revenue from

advertising on mobile phones exceeded half (53 percent) of all its

advertising for the quarter. Facebook’s acquisitions of messaging

service WhatsApp for USD $19 billion and Oculus VR for USD $2

billion signal a new strategy unfolding. The company is building a

vast product portfolio, brimming with competing services and

apps.

Audi (#45, +27%): Audi is the top-rising

automotive brand in this year’s Best Global Brands report. It was a

record-breaking year for the brand, having sold the greatest amount

of cars in its history, and having achieved an operating profit of

more than USD $6 billion. The company also awed audiences at the

2014 International Consumer Electronics Show (CES) in Las Vegas,

Nevada with its A7 self-driving car. Audi also plans to introduce

17 new or revamped models this year and will move forward with the

production of an electric version of the R8 sports car in a push to

gain momentum on rival BMW (#11). The company also plans to invest

more than USD $30 billion through 2018 in new products, technology,

and production sites. Earlier this year, it also announced a

partnership with Google, which will allow Audi drivers and

passengers to use an Android-powered entertainment and information

system that will run on the car’s hardware.

Amazon (#15, +25%): It was another banner year for

Amazon, “Earth’s most customer-centric company.” Amazon’s

commitment to responsiveness has become part of the brand’s mythos.

It continues to grow its core business through services such as

Amazon Prime, which, at one point, garnered more than a million

subscribers in a single week. Expansions on previously popular

product lines—the new Kindle Paperwhite and Fire Phone—brought more

customers into the Amazon ecosystem, while a content licensing

agreement with HBO helped it to make a bigger push into the

entertainment sector.

Volkswagen (#31, +23%): Volkswagen, Europe’s

leading automaker and one of this year’s top-rising Best Global

Brands, is striving to become the world’s leading automaker by

2018. Its latest model, the XL Sport, recently debuted at the Paris

Motor Show and served as yet another symbol of the innovative

power, passion, and technical competence of the Volkswagen brand.

Beyond its manufacturing and design capabilities, Volkswagen’s

“Think Blue” concept continues to prove that ecological

sustainability remains a top corporate objective.

Nissan (#56, +23%): Nissan continues to drive up the Best

Global Brands ranking with improved financial and brand

performance. Nissan’s leadership consistently pushes brand building

as a major priority across the organization, clearly identifying

the link between a strong brand and market share. Nissan’s recent

car launches—Qashqai, Murano, and Rogue—have demonstrated how its

“Innovation and Excitement for EVERYONE” brand positioning is

shaping its product lineup.

2014 NEW ENTRANTS: DHL (#81), Land Rover (#91), FedEx (#92),

Huawei (#94), and Hugo Boss (#97)

DHL (#81): The burgeoning e-commerce market has

opened a sea of opportunity for delivery and logistics companies.

As international online shopping continues to grow—and is poised to

grow 200 percent in the next five years—brands like DHL and FedEx

have made strides in bolstering their e-commerce capabilities. The

most valuable brand of the new entrants to this year’s Best Global

Brands ranking, DHL announced recently announced a five-year

strategy plan aimed at tapping emerging markets to grow its global

market share. As part of its plan, its MAIL division will be

renamed Post – eCommerce – Parcel to better reflect its character

under the new strategy.

FedEx (#92): FedEx is also realigning its business

to make the most of the booming e-commerce sector. Earlier this

year, the company launched a new service designed to make it easier

for customers to control when and where packages are delivered. The

service is called FedEx Delivery Manager and is available through

multiple digital platforms, including a free mobile app. Customers

can request alerts via email, SMS text, or phone. FedEx has also

developed a host of Web-based services to help brick-and-mortar

retailers boost their online sales. Retailers can easily integrate

FedEx’s Web Services platform into their own Web systems—allowing

them to track shipment information. With FedEx’s Web Integration

Wizard, its customers can track the shipments directly via the

retailer’s home site.

Land Rover (#91): British carmaker Land Rover

continues to refine its product lineup with fresh styling,

high-tech platforms, and downsized engines. Since being acquired by

Indian automobile company Tata Motors in 2008, Land Rover has

witnessed double-digit growth each consecutive year. This past

year, Land Rover’s unit sales rose 15 percent year-over-year to

nearly 350,000.

Huawei (#94): As mentioned previously, Huawei is

both a new entrant and the first Chinese brand to ever appear on

the Best Global Brands ranking. In 2013, the Chinese

telecommunications and network equipment provider reported a net

profit increase of 34.4 percent to CNY ¥21 billion (USD $3.38

billion) up from CNY ¥15.6 billion in 2012. As companies, as well

as entire industries, continue to shift from legacy storage and

equipment to more agile products (cloud services, 3G routing,

security solutions, etc.), Huawei is poised to dominate key

areas of the IT market—from mobile phones to carrier-grade

networks.

“Huawei’s rapid growth and long-term investments in its brand

helped it earn a place among the world’s most valuable brands,”

said Frampton. Despite its low brand awareness in the U.S., Huawei

has gradually expanded its reach around the world. It continues to

demonstrate its technological prowess in both its consumer products

as well as in its enterprise solutions—and it remains well

positioned to meet the needs of customers in both emerging and

developed markets.”

Hugo Boss (#97): Hugo Boss, the German fashion

house, was one of the strongest-performing apparel brands globally

in the past year. The company saw revenue grow 10 percent in

Europe, where it makes more than half its sales, while the Americas

grew 7 percent, and Asia grew just 2 percent, largely due to

China’s slowing economy. On the whole, Hugo Boss is moving away

from selling through partners and starting to run its own stores,

allowing it to have greater control over price points and the way

the clothes are presented. This year, Hugo Boss celebrated its 20th

anniversary with an exhibit at the Saatchi Gallery in London, a

microsite, and a multichannel campaign. The microsite offered a

look into the Saatchi Gallery exhibit by illustrating 20 iconic

Hugo Boss items and 20 internationally acclaimed artists. Clicking

on a product brought consumers directly to the e-commerce site

where they could either purchase the product or find it in a

store.

Key Sector Highlights

Leading automotive brands continue to rethink the future of

mobility. A combined focus on energy-efficient products and

integrated technology is helping leading auto brands drive brand

loyalty and value.

This year, the collective brand value of the automotive brands

appearing on the Best Global Brands ranking increased 14.6 percent.

All 14 automotive brands collectively make up a combined brand

value of USD $211.9 billion. With three out of the five Top Risers

hailing from the automotive sector, the past year proved to be a

record-breaking one. This year’s top 14 automotive brands include:

Toyota (#8, +20%), Mercedes-Benz (#10, +8%),

BMW (#11, +7%), Honda (#20, +17%), Volkswagen

(#31, +23%), Ford (#39, +18%), Hyundai (#40, +16%),

Audi (#45, +27%), Nissan (#56, +23%), Porsche

(#60, +11%), Kia (#74, +15%), Chevrolet (#82, +10%),

Harley-Davidson (#87, +13%), and Land Rover (#91,

NEW). Toyota, which has been the most valuable automotive brand on

the Best Global Brands ranking since 2004, continues to be a leader

in green technology development. Since the launch of its

first-generation Prius 17 years ago, Toyota has sold a total 3.2

million units of the vehicle globally. Toyota has also expanded its

hybrid range to a total of 25 vehicles, including the Prius Plug-in

Hybrid. Toyota plans to spend USD $7 billion on environmental

technology in the fiscal year ending March 2014, an increase of 11

percent compared to the previous fiscal year. With the era of the

connected car rapidly approaching, the sector’s Top Risers—Audi,

Volkswagen, and Nissan—are working to redefine the essence of the

driving experience and build stronger emotional ties with their

customers.

The technology sector leads as the most valuable category

overall. Legacy and one-time leading brands struggle to evolve at

the pace of change.

Out of this year’s top 100 brands, 13 hail from the tech sector.

The category as a whole grew 11.3 percent year-over-year, and

collectively is worth USD $493.2 billion in brand value. While

Facebook (#29, +86%), Apple (#1, +21%), and

Google (#2, +15%) represent this year’s fastest growing

brands, a number of one-time leading brands experienced the

steepest decline in brand value. Finnish communications and

information technology provider Nokia (#98, -44%)

experienced the largest decline in value among the top 100 brands,

dropping from its #57 position in 2013 to #98 this year. Once a

dominant player in the cell phone industry, it has seen its market

share decline steadily since 2010, struggling to compete against

rivals Apple and Samsung. Microsoft (#5, +3%) acquired the

Finnish brand’s consumer products in April this year, and despite

changes in leadership and operational structure, it remains unclear

how Microsoft will use the brand and how it will evolve in the

future. Japanese consumer electronics company Nintendo

(#100, -33%), had another difficult year. The brand fell 33 places

this year to take the #100 position, with a brand value of USD $4.1

billion. The company has acknowledged its woes in the hardware

space, and CEO Satoru Iwata also publicly stated that the company

must evaluate other opportunities, including those in the mobile

market. Earlier this year, he announced that the company has plans

to start a new health-related business by March 2016.

Against the backdrop of global economic recovery, financial

services brands experience growth in brand value.

The value of financial services brands has experienced steady

growth in recent years. All 11 financial services brands appearing

on this year’s Best Global Brands ranking increased in brand value:

American Express (#23, +11%), HSBC (#33, +8%),

J.P. Morgan (#35, +9%), Goldman Sachs (#47, +3%),

Citi (#48, +10%), AXA (#53, +14%), Allianz

(#55, +15%), Morgan Stanley (#63, +11%), Visa (#69,

+10%), Santander (#75, +16%), and MasterCard (#88,

+13%). On the whole, companies within the financial services

industry are continuing to build brand value by engaging with their

customers and providing more seamless, convenient, and fully

integrated experiences. Many financial services organizations have

increased investments in mobile marketing, social media, online

video, and more—and such efforts, as evidenced by this year’s Best

Global Brands ranking, are paying off.

Leading luxury brands continue to embrace digital platforms.

A new era of exclusivity is paving the way for personalization and

curated brand experiences.

While luxury brands have been slower to embrace online channels,

the rise of digital sales, online browsing, and brand consideration

is forcing them to reimagine their respective customer experiences.

As reported by Luxury Interactive and ShopIgniter, 65 percent of

luxury marketers expect digital marketing to be the most important

form of marketing for their brand.

Best Global Brands 2014 Website

Detailed brand profiles, thought leadership articles,

interactive charts, and interviews with brand leaders from around

the world are available at bestglobalbrands.com.

Interbrand’s 2014 Best Global

Brands

2014

RANK

2013

RANK

BRAND SECTOR

2014 BRAND

VALUE

(USD $billion)

% CHANGE

IN BRAND

VALUE

1 1 Apple

Technology 118.863 21% 2

2 Google Technology

107.439 15% 3 3

Coca-Cola Beverages

81.563 3% 4 4

IBM Business Services

72.244 -8% 5 5

Microsoft Technology 61.154

3% 6 6 GE

Diversified 45.480 -3% 7

8 Samsung

Technology 45.462 15% 8

10 Toyota Automotive

42.392 20% 9 7

McDonald’s Restaurants

42.254 1% 10 11

Mercedes-Benz Automotive

34.338 8% 11 12

BMW Automotive 34.214

7% 12 9 Intel

Technology 34.153 -8% 13

14 Disney

Media 32.223 14% 14 13

Cisco Technology

30.936 6% 15 19

Amazon Retail 29.478

25% 16 18

Oracle Technology 25.980

8% 17 15 HP

Technology 23.758 -8% 18

16 Gillette FMCG

22.845 -9% 19 17

Louis Vuitton Luxury

22.552 -9% 20 20

Honda Automotive 21.673

17% 21 21 H&M

Apparel 21.083 16% 22

24 Nike

Sporting Goods 19.875 16% 23

23 American Express

Financial Services 19.510 11% 24

22 Pepsi

Beverages 19.119 7% 25 25

SAP Technology

17.340 4% 26 26

IKEA Retail 15.885

15% 27 27 UPS

Transportation 14.470 5%

28 28 eBay

Retail 14.358 9% 29 52

Facebook Technology

14.349 86% 30 29

Pampers FMCG

14.078 8% 31 34

Volkswagen Automotive 13.716

23% 32 30

Kellogg’s FMCG 13.442 4%

33 32 HSBC

Financial Services 13.142 8% 34

31 Budweiser

Alcohol 13.024 3% 35 33

J.P. Morgan Financial

Services 12.456 9% 36 36

Zara Apparel

12.126 12% 37 35

Canon Electronics 11.702

6% 38 37

Nescafe Beverages 11.406

7% 39 42 Ford

Automotive 10.876 18% 40

43 Hyundai

Automotive 10.409 16% 41

38 Gucci Luxury

10.385 2% 42 40

Philips Electronics

10.264 5% 43 39

L’Oréal FMCG 10.162

3% 44 41 Accenture

Business Services 9.882

4% 45 51 Audi

Automotive 9.831 27% 46

54 Hermès Luxury

8.977 18% 47 44

Goldman Sachs Financial Services

8.758 3% 48 48

Citi Financial Services

8.737 10% 49 45

Siemens Diversified 8.672

2% 50 50

Colgate FMCG 8.215 5% 51

49 Danone

FMCG 8.205 3% 52 46

Sony Electronics

8.133 -3% 53 59

AXA Financial Services

8.120 14% 54 56

Nestlé FMCG 8.000

6% 55 63 Allianz

Financial Services 7.702 15% 56

65 Nissan

Automotive 7.623 23% 57

47 Thomson Reuters Media

7.472 -8% 58 60

Cartier Luxury

7.449 8% 59 55

adidas Sporting Goods 7.378

-2% 60 64

Porsche Automotive 7.171

11% 61 58 Caterpillar

Diversified 6.812 -4% 62

62 Xerox

Business Services 6.641 -2% 63

71 Morgan Stanley

Financial Services 6.334 11% 64

68 Panasonic

Electronics 6.303 8% 65

73 Shell Energy

6.288 14% 66 76

3M Diversified 6.177

14% 67 70

Discovery Media 6.143 7%

68 66 KFC

Restaurants 6.059 -2% 69

74 Visa Financial

Services 5.998 10% 70 72

Prada Luxury

5.977 7% 71 75

Tiffany & Co. Luxury

5.936 9% 72 69

Sprite Beverages 5.646

-3% 73 77 Burberry

Luxury 5.594 8% 74

83 Kia Automotive

5.396 15% 75 84

Santander Financial Services

5.382 16% 76 91

Starbucks Restaurants

5.382 22% 77 79

Adobe Technology 5.333

9% 78 81

Johnson & Johnson FMCG 5.194

9% 79 80 John

Deere Diversified 5.124

5% 80 78 MTV

Media 5.102 2% 81

N/A DHL Transportation

5.084 NEW 82 89

Chevrolet Automotive

5.036 10% 83 88

Ralph Lauren Apparel

4.979 9% 84 85

Duracell FMCG 4.935

6% 85 86 Jack

Daniel’s Alcohol 4.884 5%

86 82 Johnnie Walker

Alcohol 4.842 2% 87

96 Harley-Davidson

Automotive 4.772 13% 88

97 MasterCard

Financial Services 4.758 13% 89

90 Kleenex FMCG

4.643 5% 90 95

Smirnoff Alcohol

4.609 8% 91 N/A

Land Rover Automotive 4.473

NEW 92 N/A

FedEx Transportation 4.414

NEW 93 93 Corona

Alcohol 4.387 3% 94

N/A Huawei

Technology 4.313 NEW 95

92 Heineken Alcohol

4.221 -3% 96 94

Pizza Hut Restaurants

4.196 -2% 97 N/A

Hugo Boss Apparel 4.143

NEW 98 57

Nokia Technology 4.138

-44% 99 100 Gap

Apparel 4.122 5% 100

67 Nintendo

Electronics 4.103 -33%

About Interbrand

Interbrand is the world’s leading brand consultancy, with a

network of 33 offices in 27 countries. Since it opened for business

in 1974, it has changed the way the world sees branding: from just

another word for “logo” to a business’ most valuable asset to

business strategy brought to life. Publisher of the highly

influential annual Best Global Brands ranking, Interbrand believes

that brands have the power to change the world—and helps its

clients achieve this goal every day. Interbrand’s combination of

strategy, creativity, and technology delivers fresh ideas and

insights, deep brand intelligence, clear business opportunities,

and compelling brand experiences. Interbrand is part of the Omnicom

Group Inc. (NYSE:OMC) network of agencies. For more information,

please visit us at Interbrand.com and follow us on Twitter and

Facebook.

For more information:InterbrandLindsay Beltzer,

+1-212-798-7786Senior Associate, Global Marketing &

Communicationslindsay.beltzer@interbrand.com

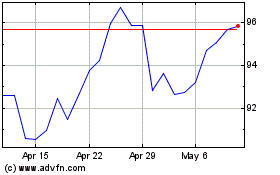

Omnicom (NYSE:OMC)

Historical Stock Chart

From Nov 2024 to Dec 2024

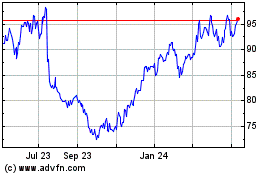

Omnicom (NYSE:OMC)

Historical Stock Chart

From Dec 2023 to Dec 2024