Filed by Document

Security Systems, Inc.

Pursuant to Rule 425 under the

Securities Act of 1933 (the “Securities Act”) and

deemed filed pursuant to Rule 14a-12 under the

Securities Exchange Act of 1934 (the “Exchange Act”)

Subject Company: Document Security Systems, Inc.

Exchange Act File Number: 001-32146

Set forth below is

a press release of Lexington Technology Group, Inc. (“Lexington”), dated June 5, 2013, providing an update on Lexington’s

operations.

|

NEWS RELEASE

|

Contact:

Bruce

|

|

Berman

|

Brody Berman

|

|

|

|

|

Associates

|

212.683.8125

|

Lexington Technology Group, Inc. Provides

Update on Operations,

Including Proposed Merger with Document

Security Systems, Inc. and

1st Quarter 2013 Financial Results

McLean, Va – June 5th, 2013 – Lexington Technology

Group, Inc.

(“Lexington”) provides an update on its operations, including its proposed merger with Document Security

Systems, Inc. (NYSE MKT: DSS) (“DSS”), and announces Lexington’s financial results for the three months ended

March 31, 2013.

Update on Merger with Document Security Systems

Lexington previously entered into a definitive merger agreement

with Document Security Systems, Inc., a leading developer of anti-counterfeiting, anti-fraud and authentication technologies for

governments, corporations and financial institutions. A Special Meeting of DSS stockholders is scheduled for June 20, 2013 to vote

on proposals relating to the proposed business combination of DSS and Lexington. The meeting will take place at 11:00 a.m.

local time at the Locust Hill Country Club in Pittsford, New York.

DSS's stockholders of record

as of the close of business on May 17, 2013 are entitled to vote at the Special Meeting. A definitive proxy statement/prospectus

for the Special Meeting has been mailed to the DSS stockholders and is available on the U.S. Securities and Exchange Commission

website at:

http://www.sec.gov/Archives/edgar/data/771999/000114420413029108/v345206_424b3.htm

.

The board of directors of DSS recommends stockholders vote in

favor of all the proposals contained in the proxy materials.

The combination of Lexington and DSS is expected to close on

or about July 1, 2013, if approved by DSS's stockholders. If approved, the merger will provide DSS with approximately $7 million

in cash, a new management team that includes Jeff Ronaldi and Peter Hardigan, currently Lexington’s Chief Executive Officer

and Chief Operating Officer, and ownership of investments in Bascom Research, LLC and Virtual Agility, Inc.

Update on Bascom Research Litigation

On March 22, 2013, Lexington learned that its wholly-owned subsidiary,

Bascom Research, LLC, received a date of October 2, 2013 for the Markman hearing in its patent infringement cases against Facebook,

Inc., LinkedIn Corporation and other defendants.

On April 23, 2013, Bascom Research LLC

reached a settlement with a defendant in its ongoing litigation in the Northern District of California. Terms of the patent license

are confidential as stipulated in the agreement, but include an effective royalty rate of approximately 4% for use of the four

Bascom patents currently in litigation. As a result of this settlement, Lexington will record settlement revenue during the second

calendar quarter of 2013.

On May 17, 2013, Bascom Research LLC reached

a settlement with a second defendant in its ongoing litigation in the Northern District of California. Terms of this patent license

are also confidential as stipulated in the agreement, but include an effective royalty rate of approximately 5% for use of the

four Bascom patents currently in litigation. As a result of this settlement, Lexington should record settlement revenue during

the third calendar quarter of 2013.

Following these settlements, Bascom remains in litigation with

Facebook, Inc. LinkedIn Corporation and Novell, Inc. in the Northern District of California.

Lexington’s Financial Results for the Three Months

Ended March 31

st

, 2013

Highlights:

Rights Offering

On February 1, 2013, Lexington completed the sale of 4,285,718

shares of its common stock at a purchase price of $0.35 per share to certain of its existing stockholders, who elected to participate

in an offering, conducted by Lexington to its entire existing stockholders, for aggregate gross proceeds of approximately $1.5

million.

Repayment of Debt

In February 2013, Lexington repaid the outstanding balance of

senior notes and accrued interest totaling $3.4 million.

Investment

In March 2013, Lexington made a strategic investment in VirtualAgility,

a developer of programming platforms that facilitate the creation of business applications without programming or coding. The investment

by Lexington involves a non-recourse note against the proceeds derived from the patent portfolio owned by VirtualAgility, plus

an equity stake of 1/8 of 7% of the outstanding common stock of VirtualAgility, for $250,000 cash, plus options to make seven additional

quarterly investments of $250,000 apiece, for a total cash investment of up to $2 million. If LTG exercises all of the options,

it will have invested an aggregate of $2 million and, based on the current capitalization of VirtualAgility, would own approximately

7% of the outstanding common stock of VirtualAgility.

Operating Expenses

Lexington is a development stage corporation with limited operations

and did not have revenues for the period from May 10, 2012 (inception) through March 31, 2013.

Operating expenses were $0.9 million for the three months ended

March 31, 2013. Excluding, non-cash items such as $0.3 million of stock based compensation, $0.1 million related to unrealized

gains on investments and $0.1 million related to amortization of intangible assets, operating expenses would have been $0.6 million

for the three months ended March 31, 2013. Operating expenses for the three months ended March 31, 2013 consisted of expenses

associated with the execution of our patent defense strategy, merger-related legal fees and other general and administrative costs.

Liquidity and Capital Resources

At March 31, 2013, cash totaled $7.2 million and total liabilities

amounted to $0.1 million.

The change in cash for the periods presented was comprised of

the following ($ in thousands):

|

|

|

Three Months Ended

March 31, 2013

|

|

|

Period from

May 10, 2012

(inception) through

March 31, 2013

|

|

|

Net cash used in operating activities

|

|

$

|

(638

|

)

|

|

$

|

(2,797

|

)

|

|

Cash flow used in investing activities

|

|

|

(250

|

)

|

|

|

(3,148

|

)

|

|

Cash flow (used in) provided by financing activities

|

|

|

(1,945

|

)

|

|

|

13,143

|

|

|

Total cash flow

|

|

$

|

(2,833

|

)

|

|

$

|

7,198

|

|

Operating Activities

During the three months ended March 31, 2013, Lexington’s

operating activities consisted of the execution of their patent defense strategy, merger-related legal fees and other general and

administrative costs.

Investing Activities

During the three months ended March 31, 2013, Lexington’s

investing activities related to an investment in

VirtualAgility, a developer of programming platforms

that facilitate the creation of business applications without programming or coding for $0.3 million

.

Financing Activities

During the three months ended March 31, 2013, Lexington’s

financing activities consisted of

the repayment of the outstanding balance of senior notes totaling

$3.4 million and the issuance of

4,285,718 shares

of common stock in connection with the rights

offering

at a purchase price of $0.35 per share or approximately $1.5 million.

LEXINGTON TECHNOLOGY GROUP, INC. AND

SUBSIDIARY

(A Development Stage Company)

CONSOLIDATED BALANCE SHEETS

($ IN THOUSANDS)

|

|

|

March 31,

|

|

|

|

|

|

|

|

2013

|

|

|

December

|

|

|

|

|

(unaudited)

|

|

|

31, 2012

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current Assets:

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

7,198

|

|

|

$

|

10,031

|

|

|

Other assets

|

|

|

1

|

|

|

|

1

|

|

|

Investments at fair value

|

|

|

748

|

|

|

|

423

|

|

|

Intangible assets, net of accumulated amortization of $315 and $207 as of March 31, 2013 and December 31, 2012, respectively

|

|

|

1,861

|

|

|

|

1,968

|

|

|

Total assets

|

|

$

|

9,808

|

|

|

$

|

12,423

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

Current Liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses

|

|

$

|

130

|

|

|

$

|

213

|

|

|

Senior notes payable - related parties, net of deferred

|

|

|

|

|

|

|

|

|

|

debt discount of $0 and $848, respectively

|

|

|

-

|

|

|

|

2,590

|

|

|

Total liabilities

|

|

|

130

|

|

|

|

2,803

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock - 29,000,000 shares authorized; par value $0.00001 per share

|

|

|

-

|

|

|

|

-

|

|

|

Series A preferred stock - 27,225,000 shares authorized; par value $0.00001 per share; 17,913,727 and 17,913,727 shares issued and outstanding, respectively

|

|

|

2

|

|

|

|

2

|

|

|

Common stock - 100,000,000 shares authorized; par value $0.00001 per share; 18,150,543 and 13,864,825 shares issued and outstanding, respectively

|

|

|

1

|

|

|

|

1

|

|

|

Additional paid-in capital

|

|

|

20,368

|

|

|

|

18,623

|

|

|

Deficit accumulated during the development stage

|

|

|

(10,693

|

)

|

|

|

(9,006

|

)

|

|

Total stockholders' equity

|

|

|

9,678

|

|

|

|

9,620

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity

|

|

$

|

9,808

|

|

|

$

|

12,423

|

|

LEXINGTON TECHNOLOGY GROUP, INC. AND

SUBSIDIARY

(A Development Stage Company)

CONSOLIDATED STATEMENTS OF OPERATIONS - UNAUDITED

($ IN THOUSANDS)

|

|

|

Three Months Ended March 31, 2013

|

|

|

Period from May 10, 2012 (inception) through March 31, 2013

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

Compensation

and benefits

|

|

$

|

456

|

|

|

|

1,207

|

|

|

Legal

and professional fees

|

|

|

262

|

|

|

|

1,912

|

|

|

General and administrative

|

|

|

87

|

|

|

|

248

|

|

|

Amortization

|

|

|

108

|

|

|

|

315

|

|

|

Loss

from operations

|

|

|

913

|

|

|

|

3,682

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expenses):

|

|

|

|

|

|

|

|

|

|

Interest

|

|

|

(848

|

)

|

|

|

(1,456

|

)

|

|

Unrealized gain (loss) on investment

|

|

|

74

|

|

|

|

(226

|

)

|

|

Change in fair value of warrant liability

|

|

|

-

|

|

|

|

(5,329

|

)

|

|

Total

other expenses

|

|

|

(774

|

)

|

|

|

(7,011

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(1,687

|

)

|

|

$

|

(10,693

|

)

|

LEXINGTON TECHNOLOGY GROUP, INC. AND

SUBSIDIARY

(A Development Stage Company)

CONSOLIDATED STATEMENTS OF CASH FLOWS - UNAUDITED

($ IN THOUSANDS)

|

|

|

Three Months Ended March 31, 2013

|

|

|

Period from May 10, 2012 (inception) through March 31, 2013

|

|

|

Cash flow used in operating activities

|

|

|

|

|

|

|

|

|

|

Net

loss

|

|

$

|

(1,687

|

)

|

|

$

|

(10,693

|

)

|

|

Cash used in operating activities

|

|

|

|

|

|

|

|

|

|

Stock based compensation

|

|

|

251

|

|

|

|

454

|

|

|

Unrealized (gain) loss on investments

|

|

|

(74

|

)

|

|

|

226

|

|

|

Amortization - intangibles

|

|

|

108

|

|

|

|

315

|

|

|

Accretion of note discount

|

|

|

848

|

|

|

|

1,442

|

|

|

Change in fair value of warrant liability

|

|

|

-

|

|

|

|

5,329

|

|

|

Changes in operating assets and liabilities

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in accounts payable and accrued expenses

|

|

|

(83

|

)

|

|

|

130

|

|

|

Net cash used in operating activities

|

|

$

|

(638

|

)

|

|

$

|

(2,797

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash flow used in investing activities

|

|

|

|

|

|

|

|

|

|

Investments

|

|

|

(250

|

)

|

|

|

(973

|

)

|

|

Acquisition of intangible assets

|

|

|

-

|

|

|

|

(2,175

|

)

|

|

Net cash used in investing activities

|

|

$

|

(250

|

)

|

|

$

|

(3,148

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash flow (used in) provided by financing activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of senior notes and common shares to related parties on July 26, 2012 and on June 2012 private placement

|

|

|

-

|

|

|

|

4,377

|

|

|

Proceeds from exercise of warrants

|

|

|

-

|

|

|

|

5,625

|

|

|

Net proceeds from issuance of shares of common stock

|

|

|

-

|

|

|

|

5,086

|

|

|

Repayment of notes payable

|

|

|

(3,438

|

)

|

|

|

(3,438

|

)

|

|

Net proceeds from issuance of shares of common stock in connection with a rights offering

|

|

|

1,493

|

|

|

|

1,493

|

|

|

Net cash (used in) provided by financing activities

|

|

$

|

(1,945

|

)

|

|

$

|

13,143

|

|

|

Net (decrease) increase in cash

|

|

|

(2,833

|

)

|

|

|

7,198

|

|

|

Cash at the beginning of the period

|

|

|

10,031

|

|

|

|

-

|

|

|

Cash at the end of the period

|

|

$

|

7,198

|

|

|

$

|

7,198

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Disclosure of Cash Flow Information:

|

|

|

|

|

|

|

|

|

|

Cash paid for income taxes

|

|

$

|

-

|

|

|

|

-

|

|

|

Cash paid for interest

|

|

$

|

14

|

|

|

$

|

14

|

|

|

Non-Cash investing and financing activities:

|

|

|

|

|

|

|

|

|

|

Liability - Patents

|

|

$

|

-

|

|

|

|

45

|

|

|

Conversion of senior notes into shares of common stock

|

|

$

|

-

|

|

|

|

937

|

|

|

Reclassification of warrant liability upon exercise of warrants

|

|

$

|

-

|

|

|

|

5,625

|

|

About Lexington Technology Group

Lexington Technology

Group is an intellectual property management firm that invests business experience, legal expertise and capital to monetize pioneering

inventions. LTG’s goal is to identify and capitalize on opportunities for return, while rewarding highly qualified innovators.

The firm typically engages with companies that have identified important innovations but that may lack the experience, relationships

or capital to succeed on their own, and have not been fairly rewarded in the marketplace. LTG’s initiatives contribute to

an intellectual property market that enables innovators to benefit from their discoveries and investors to profit from prudent

risk. LTG’s management team is comprised of experienced patent managers and strategists that have collectively generated

over $1 billion in licenses, settlements and damages awards to date.

www.lex-tg.com

|

LTG Contact:

|

DSS Contact

|

|

|

Bruce Berman

|

Peter Salkowski

|

|

|

Brody Berman Associates

|

Blueshirt Group

|

|

|

bberman@brodyberman.com

|

peter@blueshirtgroup.com

|

|

|

212.683.8125

|

415.489.2184

|

|

Important Additional Information Will Be Filed with the SEC

This communication does not constitute an offer to sell or the

solicitation of an offer to buy any securities of DSS, or Lexington or the solicitation of any vote or approval. In connection

with the proposed transaction, DSS has filed with the SEC, and the SEC has declared effective, a Registration Statement on Form

S-4 containing a proxy statement/prospectus. The definitive proxy statement/prospectus contains important information about DSS,

Merger Sub, Lexington, the transaction contemplated by the Merger Agreement and related matters. DSS has mailed the definitive

proxy statement/prospectus to its stockholders. Prospective investors and security holders of DSS and Lexington are urged to read

carefully the proxy statement/prospectus relating to the Merger (including any amendments or supplements thereto) in its entirety

because it will contain important information about the proposed transaction.

Prospective investors and security holders of DSS will be able

to obtain free copies of the definitive proxy statement/prospectus for the proposed Merger and other documents filed with the SEC

by DSS through the website maintained by the SEC at www.sec.gov. In addition, prospective investors and security holders of DSS

and Lexington will be able to obtain free copies of the definitive proxy statement/prospectus for the proposed Merger by contacting

Document Security Systems, Inc., Attn.: Philip Jones, Chief Financial Officer, at First Federal Plaza, 28 East Main Street, Suite

1525, Rochester, New York 14614, or by e-mail at ir@dsssecure.com. Prospective investors and security holders of Lexington will

also be able to obtain free copies of the definitive proxy statement/prospectus for the Merger by contacting Lexington Technology

Group, Inc., Attn.: Investor Relations, 1616 Anderson Road, McLean, VA, 22101, or by e-mail at info@lex-tg.com.

DSS and Lexington, and their respective directors and certain

of their executive officers, may be deemed to be participants in the solicitation of proxies in respect of the transactions contemplated

by the agreement between DSS, Merger Sub and Lexington. Information regarding DSS’s directors and executive officers is contained

in DSS’s Form 10-K/A filed with the SEC on April 26, 2013. Information regarding Lexington’s directors and officers

and a more complete description of the interests of DSS’s directors and officers in the proposed transaction is available

in the definitive proxy statement/prospectus that was filed by DSS with the SEC in connection with the proposed transaction.

Cautionary Note Regarding Forward-Looking Statements

Statements in this press release regarding the proposed transaction

between DSS and Lexington Technology Group; the expected timetable for completing the transaction; the potential value created

by the proposed Merger for DSS’s and Lexington Technology Group’s stockholders; the potential of the combined companies’

technology platform; our respective or combined ability to raise capital to fund our combined operations and business plan; the

continued listing of DSS's or the combined company’s securities on the NYSE MKT; market acceptance of DSS products and services;

our collective ability to maintain or protect our intellectual property rights through litigation or otherwise; Lexington Technology

Group’s limited operating history, competition from other industry competitors with greater market presence and financial

resources than those of DSS’s; our ability to license and monetize the patents owned by Lexington Technology Group; potential

new legislation or regulation related to enforcing patents; the complexity and costly nature of acquiring patent or other intellectual

property assets; the combined company’s management and board of directors; and any other statements about DSS’ or

Lexington Technology Group’s management teams’ future expectations, beliefs, goals, plans or prospects constitute

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements that are

not statements of historical fact (including statements containing the words "believes," "plans," "could,"

"anticipates," "expects," "estimates," "plans," "should," "target,"

"will," "would" and similar expressions) should also be considered to be forward-looking statements. There

are a number of important factors that could cause actual results or events to differ materially from those indicated by such

forward-looking statements, including: the risk that DSS and Lexington Technology Group may not be able to complete the proposed

transaction; the inability to realize the potential value created by the proposed Merger for DSS’s and Lexington Technology

Group’s stockholders; our respective or combined inability to raise capital to fund our combined operations and business

plan; DSS’s or the combined company’s inability to maintain the listing of our securities on the NYSE MKT; the potential

lack of market acceptance of DSS’s products and services; our collective inability to protect our intellectual property

rights through litigation or otherwise; competition from other industry competitors with greater market presence and financial

resources than those of DSS’s; our inability to license and monetize the patents owned by Lexington Technology Group; and

other risks and uncertainties more fully described in DSS’s Annual Report on Form 10-K for the year ended December 31, 2012

as filed with the SEC, as well as the other filings that DSS makes with the SEC. Investors and stockholders are also urged to

read the risk factors set forth in the definitive proxy statement/prospectus carefully.

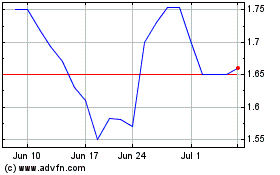

DSS (AMEX:DSS)

Historical Stock Chart

From May 2024 to Jun 2024

DSS (AMEX:DSS)

Historical Stock Chart

From Jun 2023 to Jun 2024