NEW

YORK, June 20, 2024 /PRNewswire/ -- The

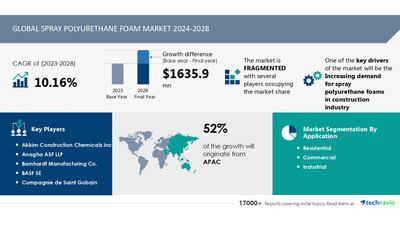

global spray polyurethane foam market size is estimated

to grow by USD 1.63 billion from

2024-2028, according to Technavio. The market is estimated to grow

at a CAGR of almost 10.16% during the forecast period. Increasing

demand for spray polyurethane foams in construction industry is

driving market growth, with a trend towards increasing use of

methylal and HFOs as alternatives to HCFCs and HCFCs. However,

increasing demand for alternatives of spray polyurethane foams

poses a challenge. Key market players include Akkim Construction

Chemicals Inc., Anagha ASF LLP, Barnhardt Manufacturing Co., BASF

SE, Compagnie de Saint Gobain, Covestro AG, Dow Chemical Co.,

Honeywell International Inc., Huntsman International LLC, Indospark

Inc., Innovative Chemical Products, Isothane Ltd., Johns Manville,

Sekisui Chemical Co. Ltd., Shanghai Junbond Building Materials Co.

Ltd., Sika AG, SOPREMA SAS, Specialty Products Inc., Tosoh Corp.,

and Woodbridge Foam Corp..

Get a detailed analysis on regions, market

segments, customer landscape, and companies- View the

snapshot of this report

|

Spray Polyurethane

Foam Market Scope

|

|

Report

Coverage

|

Details

|

|

Base year

|

2023

|

|

Historic

period

|

2018 - 2022

|

|

Forecast

period

|

2024-2028

|

|

Growth momentum &

CAGR

|

Accelerate at a CAGR of

10.16%

|

|

Market growth

2024-2028

|

USD 1635.9

million

|

|

Market

structure

|

Fragmented

|

|

YoY growth 2022-2023

(%)

|

8.98

|

|

Regional

analysis

|

APAC, North America,

Europe, South America, and Middle East and Africa

|

|

Performing market

contribution

|

APAC at 52%

|

|

Key

countries

|

China, US, Japan,

Germany, and South Korea

|

|

Key companies

profiled

|

Akkim Construction

Chemicals Inc., Anagha ASF LLP, Barnhardt Manufacturing Co., BASF

SE, Compagnie de Saint Gobain, Covestro AG, Dow Chemical Co.,

Honeywell International Inc., Huntsman International LLC, Indospark

Inc., Innovative Chemical Products, Isothane Ltd., Johns Manville,

Sekisui Chemical Co. Ltd., Shanghai Junbond Building Materials Co.

Ltd., Sika AG, SOPREMA SAS, Specialty Products Inc., Tosoh Corp.,

and Woodbridge Foam Corp.

|

Market Driver

The Spray Polyurethane Foam (SPF) market is experiencing growth

due to the adoption of alternative blowing agents such as Methylal

and HFOs. These substitutes, including Honeywell's SOLSTICE and The

Chemours Company's Opteon 1100 (HFO-1336mzz-Z), are effective, have

lower Global Warming Potential (GWP), and are widely used in SPF

manufacturing. Methylal, a clear, flammable liquid, is used as a

solvent and will increase usage in the US and Europe due to HCFC bans. HFOs, next-generation

blowing agents, are non-flammable, energy efficient, and have a low

environmental impact, making them preferred choices over HFCs and

HCFCs.

The Spray Polyurethane Foam (SPF) market is experiencing

significant growth due to its versatility and effectiveness in

insulation and roofing applications. Key players in the industry

include manufacturers and suppliers of SPF materials and equipment.

Recent trends include the use of SPF in commercial and residential

buildings for energy efficiency and cost savings. Additionally, the

market is seeing increased demand for open-cell SPF due to its air

sealing properties. Cracks and structural issues can be addressed

with SPF's ability to expand and fill spaces. The market also

caters to various industries such as automotive, construction, and

industrial. The use of SPF in these sectors is driven by its

insulation properties, durability, and cost-effectiveness. Overall,

the SPF market is poised for continued growth in the coming

years.

Research report provides comprehensive data on

impact of trend. For more details- Download a Sample

Report

Market Challenges

- The global market for Spray Polyurethane Foam (SPF) is expected

to experience a decline due to the rising demand for eco-friendly

alternatives. Natural substitutes like natural latex, coconut fiber

foam, organic wool, plain cotton, short-staple polyester fiber, and

polystyrene are gaining popularity in various applications. These

alternatives offer benefits such as biodegradability, resistance to

mold and mildew, and absence of harmful chemicals. Latex is used in

furniture and bedding, while cotton fiber foam is utilized in

carpets and soundproofing materials. Organic wool is a natural

alternative to SPF in insulation, and plain cotton is used as a

filler in construction. Synthetic polymers like short-staple

polyester fiber and polystyrene are also used in packaging,

automotive, and construction applications.

- The Spray Polyurethane Foam (SPF) market faces several

challenges. One major challenge is the high cost of raw materials,

including isocyanates and polyols. Another challenge is the

complexity of application techniques, requiring specialized

training and equipment. Compliance with environmental regulations,

such as VOC emissions, adds to the cost and complexity. The need

for consistent quality and durability is crucial for customer

satisfaction and repeat business. Competition from alternative

insulation materials, like fiberglass and cellulose, also poses a

challenge. Additionally, the construction industry's cyclical

nature and economic downturns can impact demand for SPF. Cracks and

leaks in SPF systems can lead to energy loss and potential health

concerns, requiring regular maintenance and repair.

For more insights on driver and

challenges - Request a sample report!

Segment Overview

This spray polyurethane foam market report extensively covers

market segmentation by

- Application

- 1.1 Residential

- 1.2 Commercial

- 1.3 Industrial

- Type

- 2.1 Open cell

- 2.2 Closed cell

- Geography

- 3.1 APAC

- 3.2 North America

- 3.3 Europe

- 3.4 South America

- 3.5 Middle East and

Africa

1.1 Residential- The residential segment of the global

spray polyurethane foam market is anticipated to expand due to the

increasing urban population, particularly in APAC and MEA. With

China and India leading the way as the most populous

countries in these regions, the demand for new residences is

projected to rise. Notable urban population growth in cities like

Bengaluru, Mumbai, Chennai, Pune, and in countries such as Saudi Arabia, Qatar, and the UAE, will fuel this trend. For

instance, Puravankara Ltd.'s planned 15 million square feet

expansion in India and ongoing

projects in these regions will boost demand for spray polyurethane

foam during the forecast period.

For more information on market segmentation with

geographical analysis including forecast (2024-2028) and historic

data (2017-2021) - Download a Sample Report

Research Analysis

The Spray Polyurethane Foam (SPF) market encompasses the

production and application of SPF for insulation and roofing

systems in various buildings. SPF offers advantages such as air

sealing, energy efficiency, and waterproofing properties. However,

its use is subject to stringent regulations due to adverse weather

conditions, overspray potential, and the use of petroleum-based

feedstock, including Toluene diisocyanate (TDI). Corrosions and

high maintenance are potential challenges. Construction activities

in buildings, including walls, roofs, interior, and exterior,

benefit from SPF. The Middle Eastern upheaval and Iran's prohibition on TDI exports may impact

the market's supply and demand dynamics. Weather conditions and

crude oil prices are crucial factors influencing the SPF

market.

Market Research Overview

The Spray Polyurethane Foam (SPF) market refers to the

production, sale, and application of spray polyurethane foam

insulation systems. SPF is a two-component, closed-cell spray foam

insulation made up of isocyanate and polyol resin components. It is

used for insulation, air sealing, and roofing applications. SPF

offers several advantages such as high R-value, excellent air and

moisture barrier properties, and energy efficiency. The global SPF

market is driven by factors such as increasing energy efficiency

requirements, growing demand for sustainable insulation solutions,

and the rising construction industry. Applications of SPF include

residential, commercial, and industrial buildings, as well as

transportation and infrastructure sectors. The market is expected

to grow significantly due to its versatility and effectiveness in

various applications.

Table of Contents:

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation

- Application

-

- Residential

- Commercial

- Industrial

- Type

-

- Geography

-

- APAC

- North America

- Europe

- South America

- Middle East And Africa

7 Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

About Technavio

Technavio is a leading global technology research and advisory

company. Their research and analysis focuses on emerging market

trends and provides actionable insights to help businesses identify

market opportunities and develop effective strategies to optimize

their market positions.

With over 500 specialized analysts, Technavio's report library

consists of more than 17,000 reports and counting, covering 800

technologies, spanning across 50 countries. Their client base

consists of enterprises of all sizes, including more than 100

Fortune 500 companies. This growing client base relies on

Technavio's comprehensive coverage, extensive research, and

actionable market insights to identify opportunities in existing

and potential markets and assess their competitive positions within

changing market scenarios.

Contacts

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

View original content to download

multimedia:https://www.prnewswire.com/news-releases/spray-polyurethane-foam-market-size-is-set-to-grow-by-usd-1-63-billion-from-2024-2028--increasing-demand-for-spray-polyurethane-foams-in-construction-industry-boost-the-market-technavio-302177204.html

View original content to download

multimedia:https://www.prnewswire.com/news-releases/spray-polyurethane-foam-market-size-is-set-to-grow-by-usd-1-63-billion-from-2024-2028--increasing-demand-for-spray-polyurethane-foams-in-construction-industry-boost-the-market-technavio-302177204.html

SOURCE Technavio