Tatton Asset Management PLC Pre-close trading statement (7523T)

October 17 2017 - 2:00AM

UK Regulatory

TIDMTAM

RNS Number : 7523T

Tatton Asset Management PLC

17 October 2017

17 October 2017

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

THE COMPANY TO CONSTITUTE INSIDE INFORMATION STIPULATED UNDER THE

MARKET ABUSE REGULATION (EU) NO. 596/2014. UPON THE PUBLICATION OF

THIS ANNOUNCEMENT VIA THE REGULATORY INFORMATION SERVICE, THIS

INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC

DOMAIN.

FOR IMMEDIATE RELEASE

Tatton Asset Management plc ("Tatton" or the "Group")

Pre-close trading statement

Tatton Asset Management plc (AIM:TAM), the on-platform

discretionary fund management (DFM) and IFA support services

business, today issues a pre-close trading update for the six

months ended 30 September 2017, ahead of publishing its interim

results announcement on Tuesday 5 December 2017.

Management is pleased to report that the Group is trading in

line with expectations, with funds under management on its

on-platform DFM business increasing to GBP4.44 billion at 30

September 2017, compared with GBP3.85 billion at 31 March 2017.

Furthermore, this business continues to experience fund inflows at

a run-rate of over GBP80 million per month.

Paradigm Partners, the Group's IFA support services business,

continues to see membership growth, rising to 356 IFA firms at

September 2017, up from 352 at March 2017. Paradigm Mortgage

Services, the Group's mortgage distribution and support services

business, has seen membership rise to 1,143 mortgage firms during

the period.

Paul Hogarth, Founder and CEO of Tatton Asset Management plc,

commented:

"Our successful IPO in July 2017 has been very well received by

client firms supported by the Group and I am also pleased to report

the continued strong growth in our funds under management. This

growth is further evidence of the increasing demand for a low cost

DFM service to the mass affluent market place served by the IFA

sector, which the Group is ideally placed to capitalise on.

"We look forward to updating the market with our maiden interim

results in early December."

Enquiries

Tatton Asset Management plc +44 (0) 161 486 3441

Paul Hogarth (Chief Executive

Officer)

Lothar Mentel (Chief Investment

Officer)

Noel Stubley (Chief Financial

Officer)

Nomad and Broker

Zeus Capital +44 (0) 20 3829 5000

Martin Green (Corporate Finance)

Dan Bate (Corporate Finance

and QE)

Pippa Underwood (Corporate

Finance)

Media Enquiries

Powerscourt +44 (0) 20 7250 1446

Justin Griffiths

Mazar Masud

Roddi Vaughan-Thomas

Notes to editors

Tatton Asset Management offers a range of services to Directly

Authorised financial advisers in the UK, including on-platform only

discretionary fund management, regulatory, compliance and business

consulting services, and a whole of market mortgage provision.

On 6 July 2017, the Group was admitted to the Alternative

Investment Market (AIM) of the London Stock Exchange, raising

GBP51.6 million in an institutional placing.

For more information, please visit:

www.tattonassetmanagement.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTDMMMGGVGGNZZ

(END) Dow Jones Newswires

October 17, 2017 02:00 ET (06:00 GMT)

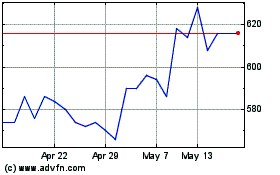

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Oct 2024 to Nov 2024

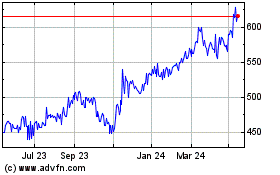

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Nov 2023 to Nov 2024