TIDMPMGR

PREMIER MITON GLOBAL RENEWABLES TRUST PLC

Annual Financial Report for the year ended to 31 December 2022

The Directors present the Annual Financial Report of Premier Miton Global

Renewables Trust PLC (the "Company") for the year ended 31 December 2022 (the

"Annual Report").

It has also been submitted in full unedited text to the Financial Conduct

Authority's National Storage Mechanism and is available for inspection at

data.fca.org.uk/#/nsm/nationalstoragemechanism in accordance with DTR 6.3.5(1A)

of the Financial Conduct Authority's Disclosure Guidance and Transparency

Rules. The Annual Report is also available to view and download from the

Company's website, www.globalrenewablestrust.com/documents. References to page

numbers are to those in the Annual Report and Accounts, available to view at

the link above. Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website (or any

other website) is incorporated into or forms part of this announcement.

The information set out below does not constitute the Company's statutory

accounts for the year ended 31 December 2022 but is derived from those

accounts. Statutory accounts for the year ended 31 December 2022 will be

delivered to the Registrar of Companies in due course. The Auditors have

reported on those accounts: their report was (i) unqualified, (ii) did not

include a reference to any matters to which the Auditors drew attention by way

of emphasis without qualifying their report, and (iii) did not contain a

statement under Section 498 (2) or (3) of the Companies Act 2006.

The following text is copied from the Annual Report & Accounts:

Investment Objectives

The investment objectives of the Premier Miton Global Renewables Trust PLC are

to achieve a high income from, and to realise long term growth in the capital

value of its portfolio. The Company seeks to achieve these objectives by

investing principally in the equity and equity-related securities of companies

operating primarily in the renewable energy sector, as well as other

sustainable infrastructure investments.

Company Summary

Group

Premier Miton Global Renewables Trust PLC (the "Company") (formerly Premier

Global Infrastructure Trust PLC), and its wholly-owned subsidiary, PMGR

Securities 2025 PLC.

Capital Structure

Ordinary Shares (1p each) 18,238,480 (as at 14 March 2023)

The Ordinary Shares are entitled to all of the Company's net income available

for distribution by way of dividends. On a winding-up, they will be entitled to

any undistributed revenue reserves and any surplus assets of the Company after

the Zero Dividend Preference Shares ("ZDPs"/"ZDP Shares") accrued capital

entitlement and payment of all liabilities. The Ordinary Shareholders have the

right to receive notice of, to attend and to vote at all general meetings of

the Company. The Ordinary Shares are qualifying investments for ISAs.

Zero Dividend Preference Shares (1p

each)

Issued by PMGR Securities 2025 PLC 14,217,339

The 2025 ZDP Shares ("2025 ZDPs") will have a final capital entitlement of

127.6111p on 28 November 2025, equivalent to a gross redemption yield# from the

date of issue of 5.0% per annum, subject to there being sufficient capital in

the Company. The 2025 ZDPs are qualifying investments for ISAs.

Company Details

Investment Manager

Premier Fund Managers Limited ("PFM Limited"), is a subsidiary of Premier

Miton Group plc ("PMI Group"). PMI Group had £13.9 billion of funds under

management at 31 December 2022. PFM Limited is authorised and regulated by the

Financial Conduct Authority ("FCA"). The Company's portfolio is managed by

James Smith with support from PFM Limited's global equity team. Premier

Portfolio Managers Limited ("PPM") is the Company's Alternative Investment

Fund Manager. PPM has delegated the portfolio management of the Company's

portfolio of assets to PFM Limited.

Management Fee

0.75% per annum of the gross assets under management, charged 40% to revenue

and 60% to capital.

Company Highlights

for the year to 31 December 2022

31 December 31 December % change

2022 2021

Total Return Performance

Total Assets Total (7.3%) 19.8%

Return(1)#

S&P Global Clean 6.6% (22.5%)

Energy Index(2)

(GBP)

Ongoing charges(3)# 1.70% 1.65%

Ordinary Share Returns

Net Asset Value per 178.44p 210.60p (15.3%)

Ordinary Share (cum

income)(4)#

Mid-market price 155.50p 196.50p (20.9%)

per Ordinary Share

(2)

Discount to Net (12.9%) (6.7%)

Asset Value#

Revenue return per 7.29p 7.43p (1.9%)

Ordinary Share

Net dividends 7.00p 7.00p 0.0%

declared per

Ordinary Share

Net Asset Value (12.1%) 26.5%

Total Return(5)#

Share Price Total (17.7%) 30.7%

Return(2)#

2025 Zero Dividend Preference Share Returns

Net Asset Value per 110.71p 105.44p 5.0%

Zero Dividend

Preference Share(4)

Mid-market Price 108.50p 107.50p 0.9%

per Zero Dividend

Preference Share(2)

(Discount)/Premium (2.0%) 2.0%

Hurdle Rates(6)#

Ordinary Shares

Hurdle rate to (0.8%) 0.7%

return the share

price of 155.50p

(2021: 196.50p) at

28 November 2025(2)

Zero Dividend

Preference Shares

Hurdle rate to (27.7%) (23.1%)

return the

redemption share

price for the 2025

ZDPs of 127.6111p

at 28 November 2025

Balance Sheet

Gross Assets less £48.3m £53.4m (9.6%)

Current Liabilities

(excluding Zero

Dividend Preference

Shares)

Zero Dividend (£15.7m) (£15.0m) (5.0%)

Preference Shares

Equity £32.5m £38.4m (15.2%)

Shareholders' Funds

Gearing(7)# 48.4% 39.0%

Zero Dividend 2.51x 2.74x

Preference Share

Cover

(non-cumulative)(8)

#

# Alternative Performance Measure ("APM"). See Glossary of Terms for

definitions and Alternative Performance Measures on page 76.

(1) Source: PFM Limited. Based on opening and closing total assets plus

dividends marked "ex-dividend" within the period.

(2) Source: Bloomberg.

(3) Ongoing charges have been based on the Company's management fees and other

operating expenses as a percentage of average gross assets less current

liabilities over the year (excluding the ZDPs accrued capital entitlement).

(4) Articles of Association basis.

(5) Source: PFM Limited. Based on opening and closing NAVs with dividends

marked "ex-dividend".

(6) Source: PFM Limited. Hurdle rate definition can be found in the Glossary

of Terms and Alternative Performance Measures on page 77.

(7) Source: PFM Ltd. Based on Zero Dividend Preference Shares divided by

Equity attributable to Ordinary Shareholders at the end of each year.

(8) Source: PFM Limited. Non-cumulative cover = Gross assets at year end

divided by final repayment of ZDPs plus management charges to capital.

Chairman's Statement

for the year to 31 December 2022

Introduction

Following strong performances over recent years, 2022 saw a reversal of

fortunes for the portfolio with the Trust experiencing a fall in asset values

and a negative investment return to shareholders. The underlying portfolio

return, while approximately in line with global equity markets, lagged the

global clean energy sector.

In my letter in last year's report, I noted that markets appeared to be

relatively sanguine over the prospects for higher inflation. In the event,

inflation in the advanced economies reached higher levels than expected,

necessitating a steeper path of interest rate increases.

There are several underlying reasons for higher inflation. Energy costs have

remained at elevated levels, exacerbated by the war in Ukraine. Supply chains

have taken longer to return to normal post Covid-19 lockdowns, and China's

retention of lockdown policies over most of 2022 has been a headwind to global

supply.

On top of these issues, has been the exceptionally loose monetary policy over

recent years, which has created an environment where inflation has been allowed

to take root. The risk now is that central banks over-tighten, causing a sharp

recession.

Higher interest rates have been a headwind for equity markets, as markets

discount future corporate earnings to current values at higher rates. However,

the Trust is fortunate that most of its underlying earnings, the revenues

earned by portfolio companies, are generated from selling electricity.

Electricity prices have been substantially higher in 2022 than in 2021,

particularly in the UK and Europe. However, as yet this has not been fully

reflected in market valuations.

Performance

The Trust's performance over 2022 was disappointing. The total assets total

return, measuring the return on the portfolio including all income and costs,

was a negative 7.3% (2021: positive 19.8%). This was consistent with returns

seen in the leading global equity indices. The Trust's gearing, through the

fixed return Zero Dividend Preference Shares ("ZDP"), means that returns to

Ordinary Shareholders are amplified, with the net asset value ("NAV") total

return being negative 12.1% (2021: positive 26.5%). The NAV per ordinary share

fell by 15.3% to close the year at 178.44p.

Further, and in common with other investment trusts, the discount at which the

shares trade compared to the published NAV increased in the year, closing 2022

at 12.9% (2021: 6.7%). For this reason, the share price total return, based on

share price movement plus dividends received, was negative 17.7% (2021:

positive 30.7%).

Since the Trust's change of investment policy in October 2020, the S&P Global

Clean Energy Index (the "Index") has been used as its performance comparator.

However, as has been pointed out before, the Trust's portfolio is substantially

different to the composition of the index, with a far greater weighting to

renewable energy generators than the index which has higher exposure to

technology, renewable equipment manufacturers and utilities. Also, the Trust's

portfolio is currently more focussed on the UK and Europe, whereas the Index

has a higher weighting to North America. PMGR's performance can, therefore, be

expected to be materially different from that of the Index in any given year.

In 2022, the Index returned a positive 6.6% (GBP adjusted), substantially

better than the Trust. However, since the policy change on 9 October 2020,

shareholders have seen a return, measured on share price plus dividends, of

25.3%, or an average of 10.7% per year. The index has returned 3.7%, or 1.7%

per year on average. Despite the difficult year, the Trust's recent performance

remains well ahead of its performance comparator.

There were some specific negative performance factors, discussed in more detail

in the Investment Manager's report, which require mention here.

Firstly, the Trust's Chinese investments, which performed so well in 2021, were

very poor in 2022. This was mainly for macro-economic and political reasons

rather than any fundamental issues with the companies themselves. A combination

of negative performance and sales of holdings means that the weighting to China

is now substantially reduced. Secondly, Finnish hydro and nuclear generator

Fortum, a 4.3% weighting at the start of the year, was caught out by the

Russian invasion of Ukraine. Fortum had substantial investments in Russia,

representing about 20% of its total profits, and its share price fell sharply

in response. We sold this investment because of its Russian exposure with a

resulting loss. Thirdly, holdings owning operational North American renewable

energy assets were relatively weak. Renewable energy tends to be sold on long

term pre-determined prices in North America, with relatively little inflation

linkage. Share prices therefore fell in response to higher interest rates.

Offsetting this was a generally positive performance in the UK, although the

modest gains look set to lag well behind the growth in underlying earnings

driven by high power prices, even considering the new windfall tax, or "energy

generation levy". Likewise, aside from Fortum as noted above, there were some

good performances among European investments, with the high power price

environment being a performance driver.

The US dollar was strong in the year, and the Trust saw a translation gain on

dollar holdings as a result.

Despite the difficult year, the prospects for long term performance remain

encouraging. For instance, the EU is committed to expanding its renewable

energy production, aiming for renewables to represent at least 45% of the

overall energy mix by 2030 (from 22.1% in 2020). Likewise, the US Inflation

Reduction Act has set clear targets and incentives for renewable investment in

the US and should stimulate and reward investment for the foreseeable future.

Portfolio positioning

The Trust invests in renewable energy companies, and also other sustainable

infrastructure companies, being those that are essential to the construction of

renewable assets and delivery of renewable energy to customers. These currently

include electricity networks, energy storage facilities, and offshore wind

turbine installation vessels.

The most significant portfolio change during the year has been the reduction in

weighting to China, from 19% to 3%. We are concerned about China's economic and

political situation, and China is likely to remain at a low level within the

portfolio while this uncertainty persists. The funds released have been

reinvested into Europe and the UK to take advantage of the favourable

electricity pricing environment.

In this period of high inflation, it is important to be exposed to revenue

streams that reflect inflation, such as some government tariff and subsidy

schemes. UK renewable assets score well in this regard. As noted above, US

renewable companies have less inflation linkage, so are currently held at a

relatively low portfolio weighting.

In terms of sectors, the weighting to yield companies (renewable companies

which buy operational assets and then hold them for the long term, paying out

the majority of cash-flow to investors), has risen as the Manager increases

exposure to core UK and European operational assets benefitting from higher

power prices and inflation.

Weightings in the waste to energy sector and renewable-focussed utilities

sector (i.e. utilities having substantial renewable energy businesses) have

fallen on poor relative performance and the Manager focussing on core

"pure-play" renewable energy generators.

Capital structure, Gearing, and ZDP Shares

Following the weaker performance in the year, gearing increased from 39.0% at

December 2021 to 48.4% at December 2022 (gearing being calculated as the ZDP

share liability over the equity attributable to Ordinary Shareholders). The

nature of the ZDP shares means that the gearing is, for the time being,

"semi-permanent". The Board will review the Company's capital structure on the

maturity of the ZDP shares in 2025.

The share price of the ZDP Shares rose only slightly in the year, from 107.50p

at the start of the year to 108.50p by the close of 2022. Their NAV increased

at their accrual rate of 5%, to reach 110.71p at the close of the year. As such

the ZDP Shares stood at a modest discount to their accrued value. The ZDP Share

Cover fell to 2.51x from 2.74x reflecting the fall in assets. Note that

"Gearing" and "Zero Dividend Preference Share Cover" are Alternative

Performance Measures; please see pages 76 to 80 for definitions and

calculations.

No Ordinary or ZDP shares were either issued or redeemed in the year.

Income and dividends

Net revenue return per Ordinary Share in 2022 was 7.24p, a reduction of 2.6% on

the 7.43p recorded in 2021. Underlying revenue generation remained healthy,

with dividends paid to Ordinary Shareholders being fully covered by net revenue

earnings.

It should be noted that 2021 saw the recovery of a historic tax reclaim of £

104,000, or 0.57p per Ordinary share, a receipt not repeated in 2022.

During the year, the Board declared three interim dividends in respect of the

2022 financial year, each of 1.75p per Ordinary Share. The Board has now

declared a fourth interim dividend of 1.75p, to bring the total dividend for

the year to 7.00p, fully covered by revenue earnings, and in line with

dividends paid in respect of 2021. The fourth interim dividend will be paid on

31 March 2023 with the shares to be marked ex-dividend on 9 March 2023.

Shareholder relations

The Company's AGM will be held on Wednesday, 26 April 2023, at the offices of

Stephenson Harwood LLP, 1 Finsbury Circus, London EC2M 7SH, at 12.15p.m. when a

presentation will be given. Attending shareholders will have the opportunity to

meet the Board and Manager and ask questions.

Shareholders can find additional details regarding your Company, including

factsheets and articles on topics relating to both the renewables sector and

the Company, on the Company's website, www.globalrenewablestrust.com.

Environmental, Social and Governance ('ESG')

Given the change of investment policy in 2020, ESG measures are an integral

part of the Manager's approach to running the portfolio. Further, Premier Miton

is a signatory to the Principles for Responsible Investment, an organisation

which assists signatory firms to develop and maintain responsible investment

practices.

The Trust's portfolio is given additional consideration by Premier Miton's

Responsible Investing Oversight Committee, with the aim of ensuring that

investee companies adhere to high standards of governance, and that the

portfolio's composition is consistent with its investment policy.

By its nature the Trust's portfolio has strong environmental credentials. The

portfolio mainly consists of companies generating renewable electricity in the

form of wind, solar, biomass, and hydro, together with other technologies which

have positive environmental outcomes, such as waste to energy. It also contains

companies operating infrastructure such as electricity transmission and battery

storage, essential for the delivery and management of renewably-generated

power.

The Trust's Manager engages with investee companies to promote good governance

and encourage responsible social policies. The Manager always votes at

shareholder meetings of investee companies.

I am pleased to report that the one remaining holding not consistent with the

renewable energy investment policy adopted in October 2020, the Indian

coal-fired power generator OPG Power Ventures, was sold during the year. This

completed the portfolio's transition from a generalist infrastructure investor

to specialist renewable energy.

Change of brokership

Following a review of the Company's brokership arrangements, in March the

directors appointed finnCap Capital Markets ("finnCap") as the Company's

stockbroker, replacing Singer Capital Markets. The Directors are pleased with

finnCap's performance since appointment.

The Board and the Manager remain committed to increasing the size of the Trust

and have been active in marketing the Trust's shares to potential new investors

during the year. I hope that this will help to achieve a lower discount to NAV,

and consequent improved share price, during 2023.

Outlook

The macro-economic environment has been against the Company over the past year,

and equity markets have been weak. While developed market interest rates are

expected to reach their peaks in 2023, financial markets are likely to remain

turbulent as historic monetary stimulus is withdrawn.

China faces a difficult situation as Covid-19 runs through the country. As a

result, its government could see its domestic popularity fall, and it may be

tempted into ill-advised actions both at home and abroad, which have the

potential to destabilise its economy and the region. Further, it is at this

stage difficult to envisage a near term resolution to the conflict in Ukraine.

However, despite this troubling backdrop, the underlying earnings performance

of the majority of the portfolio's holdings has been strong, and we expect this

to continue in the short to medium term. We expect European power prices should

remain elevated as the EU withdraws from its dependence on Russian natural gas.

The implementation of European windfall taxes has been a notable headwind over

the year. However, with the relevant taxes now published and in operation, the

market again hopefully has some clarity. Generally speaking, windfall taxes

have been set at a level which, while providing some compensation to

governments that can be used to subsidise tariffs, still allow generators to

make good returns from the high pricing environment.

Over the long term, the issues of natural gas supply and high commodity prices

further reinforce the benefits of moving to renewable energy. In addition to

being much more environmentally friendly than traditional power sources,

renewables have the advantage of generating electricity closer to where it is

consumed, together with the potential for a less volatile pricing environment.

The Board believes that the Company's investment policy remains very relevant

and is one from which attractive long term investment returns can continue to

be made.

Gillian Nott OBE

Chairman

14 March 2023

Investment Manager's Report

for the year to 31 December 2022

Performance overview

The Premier Miton Global Renewables Trust's ("PMGR") portfolio experienced a

fall in value over the year, with a negative total assets total return

performance, including all operating and trading costs, of 7.3%. The

performance was below that of the Trust's comparator benchmark, but performance

does remain comfortably ahead of that index since the investment policy change

in October 2020.

Under normal conditions, I would have hoped for another good year for PMGR. The

build out of renewable energy continues apace, power prices are strong, and

there is a considerable level of political goodwill.

However, higher interest rates, political intervention, additional taxes, the

ongoing uncertainty from the war in Ukraine, and economic and political risks

in China meant that it turned out to be a rather difficult year. In addition,

there have been some stock-specific losses, detailed below.

Higher power prices have been a double-edged sword in that they have driven

greater political intervention through windfall taxes. Asymmetric taxes,

whereby Governments help themselves to gains in good times without committing

to helping companies should the situation reverse, may make for good politics

but have caused investor uncertainty and are likely to increase companies'

required future returns to compensate for greater political risks.

Reversing the trend of recent years, capital costs of renewable projects were

increased by higher logistics and component costs, although these are now

showing signs of moderating. Finance costs within the sector are largely fixed,

but higher interest rates will contribute to higher financing costs for new

projects. Fortunately, the power price environment is such that available

investment returns remain healthy.

Market review

Perhaps the most significant market development during the year has been the

unprecedented increase in European power prices. Prices began to increase in

mid-2021 on the back of higher prices for carbon emission permits (which make

fossil fuel generation more expensive), increasing further over the early part

of 2022 on concerns over low European gas storage levels, followed by a surge

in both price and volatility on the Russian invasion of Ukraine in February.

Approximately one third of European gas is sourced from Russia, and although

trade has not completely stopped, volumes are much reduced. Further, in

September, both Nord Stream 1 and 2 pipelines, which connect Germany to Russian

supplies through the Baltic Sea, were damaged by explosions. Although those

responsible and their motivations are unconfirmed, neither pipeline will be in

use for the foreseeable future. Gas is an important component of the European

electricity generation mix, and the resulting higher gas prices have fed

directly into higher electricity prices.

With the aim of ending its dependence on Russian fossil fuels, the EU through

its "REPowerEU" plan, aims to expand renewable energy generation capacity

substantially with streamlined approval processes, diversify its gas supplies

including new investments in LNG capacity, and improve energy efficiency. Newer

technologies that directly substitute gas usage, such as biomethane, hydrogen,

and heat pumps will also be encouraged.

Adding to the European energy shortage has been the decline in output from

French nuclear reactors, expected to be over 20% lower in 2022 than in 2021.

France went from a position of being an electricity exporter, to being an

importer, with a consequent tightening of neighbouring power markets such as

Germany and the UK.

Power prices in the US have increased, although to a lesser extent than seen in

Europe. In any case, renewable energy companies in the US tend to be less

exposed to merchant power pricing than their European counterparts, with

renewable power usually being sold on long term contracts at relatively fixed

prices. This has made them vulnerable to higher inflation and interest rates.

On the plus side, the passing of the of the Inflation Reduction Act aims to

stimulate almost $370 billion of clean energy investment over the next 10

years, and gives the sector an improved growth outlook.

Portfolio segmentation and allocation

The Trust seeks to offer investors a diversified global exposure to renewable

energy and sustainable infrastructure. This differentiates PMGR from many other

clean energy investment funds, including exchange-traded funds, which often

have a more technology-oriented profile. I believe that focussing on mainly

contracted and regulated infrastructure investments offers an attractive risk /

reward dynamic for long term investment, offering high visibility of earnings

and dividends.

The portfolio has a wide exposure to differing sub-sectors, aiming to invest

not just in wind and solar assets, but in the full energy production and

delivery value chain, including energy storage, electricity transmission

networks and utilities that own high quality renewable energy businesses.

One important distinction we make is to segment renewable energy companies into

two broad categories. Renewable energy developers plan, construct, and then own

and operate renewable assets. Alternatively, yield companies ("yieldcos"),

usually acquire existing renewable assets. Developers typically pay a modest

dividend, retaining a high portion of cash flows for reinvestment, sometimes

recycling capital through asset sales. Yieldcos by contrast, pay out the

majority of cash flows, raising new capital to acquire assets as required.

Renewable energy developers offer potentially higher returns as they take on

development and construction risk. Yieldcos prefer to remove these by acquiring

recently constructed projects (or occasionally at the "pre-construction" stage)

and then financing and operating them as efficiently as possible. They forego

developer profits in return for greater visibility and the benefit of having a

higher proportion of their capital invested in productive assets.

It is notable this year that the weighting to small cap companies, which we

define as companies with a market capitalisation between £250 million and £2.0

billion, has increased at the expense of the midcaps, being companies

capitalised between £2.0 and £10.0 billion. This is a result of the sell down

of midcap Chinese holdings, and reinvestment into smaller European and UK

companies. At the year end, the simple average market capitalisation of

portfolio was £4.9 billion (2021: £5.4 billion).

Renewable Energy Developers

The performance of the Trust's renewable energy developers was mixed in 2022.

Going into the year, two Chinese developers, China Suntien Green Energy and

China Longyuan Power represented a combined 11.5% of the portfolio, both having

performed exceptionally well in 2021, with share price increases of 155.5% and

134.2% respectively. I am concerned about both the economic and political

situation in China, and therefore cut the Suntien holding back sharply over the

year (to 1.8% by the year end) and sold Longyuan in its entirety. Despite both

companies performing perfectly well on a fundamental basis, Suntien's share

price fell 46.5% and Longyuan 47.6% in 2022 as investors divested from Chinese

stocks. With hindsight, it would have been better to have reduced exposure at

an earlier stage.

European renewable developers fared better. RWE remained at the top end of the

portfolio and performed well on excellent financial results through the year,

helped by high power prices and an excellent result in its trading division.

Its proposed acquisition of the Con Edison renewables business in the US

represents a step change in RWE's international renewables business. RWE's

share price increased by 16.4% over the year.

The position in Spanish listed solar developer, Grenergy, was increased during

the year. Grenergy has made good progress with its development portfolio, and

2023 looks set to be a milestone year for the company as it completes several

large solar projects in Spain, Chile and Peru. Grenergy's shares fell by 4.4%

in the year.

Despite sometimes excellent financial results, smaller companies were often out

of favour. A good example would be Norwegian listed Bonheur, better known for

its ownership of Fred Olsen Renewables. It has targeted an almost 30% increase

in renewable production for 2022 and reported sharply higher financial results

through the year. Bonheur has ambitious plans for offshore wind development,

and the position was increased steadily over the year. However, despite the

strong business fundamentals, its shares fell by 19.2% in the year.

Northland Power's shares were relatively flat. This was disappointing given

strong financial results and continued progress with their development

portfolio.

We sold the holding in Acciona, re-investing in the newly listed Acciona

Energias, which owns the group's renewable energy activities and was spun out

as a separately listed company to improve visibility for the group. Acciona

Energias's shares gained 10.9% in 2022.

Further down the portfolio, the position in Enefit Green was increased. Enefit

develops renewable projects in the Baltic states and recorded strong results

during the year. It was rewarded with a share price increase of 8.3%. 7C

Solarparken, which focusses on German and Belgian solar, also saw strong

figures driven by power pricing. Its shares fell by 1.4% however.

Yieldcos and Funds

The exposure to yieldcos increased in the year, from 25.7% at December 2021, to

38.9% by the end of 2022. Some new positions were added, taking advantage of

share price weakness in the second half of the year. I believe that UK and

European yieldcos could benefit from a "higher for longer" power price

environment.

Greencoat UK Wind remains a key holding for the Trust. Its strategy to sell

power at market rates served it well as UK power prices increased. Its

published NAV per share has increased over the year, and given the conservative

basis on which it had been calculated, the UK windfall tax was absorbed without

a significant detriment to the NAV. Greencoat's share price increased by 8.3%

in 2022.

NextEnergy Solar Fund's shares gained 9.5% as it made good progress in its

diversification strategy, with new battery storage developments acquired during

the year. The position in Foresight Solar was increased, and its shares rose by

16.2%.

In the second half of the year, the Trust took advantage of share price falls

to increase the position in Octopus Renewable Infrastructure and start a new

holding in Aquilla European Renewables. Both these companies should benefit

from higher power pricing and the completion of assets currently in

construction (acquired at the pre-construction stage). They both trade at

attractive discounts to their published NAVs.

North American positions were less successful than those in the UK. We

attribute this to the lack of power price and inflation linkages in their

revenues, with power tending to be sold on pre-determined long term prices. In

a rising interest rate environment, their shares were marked down accordingly.

Clearway Energy (A) shares fell by 10.6%, Atlantica Sustainable Infrastructure

by 27.6%, and Transalta Renewables by 40.0%. Transalta fell sharply in the

final quarter as it gave lower cash flow guidance on the back of expected

higher tax payments and higher maintenance expenditure. On the plus side,

following another year of largely negative performance, North American yieldcos

now offer very attractive yields, and operate in what should be a high growth

environment.

Renewable focussed utilities

As mentioned in the Chairman's letter, the holding in Fortum was sold following

the Russian invasion of Ukraine. Fortum had not only some direct Russian power

generation investments, but also a far larger liability through its ownership

of German power and gas business Uniper. With Uniper's upstream gas purchases

from Russia severely curtailed, they were forced to buy more expensive gas

elsewhere to fulfil sales contracts. The Fortum stake was sold over the second

quarter, at an average price approximately 40% below the price at which it

closed 2021.

The other major disappointment within this segment was Algonquin Power &

Utilities, whose shares fell by 51.5% over the year. The fall took place almost

entirely in the final quarter in response to a poor third quarter financial

result. The company has now released a new strategy based on internally funded

growth, with a rebased dividend. We believe that the company's business of

North American renewable energy and smaller utilities is fundamentally sound,

and that there is scope for the shares to recover well in 2023.

The two other constituents of this category, SSE and Iberdrola both performed

well, their shares increasing over the year by 3.8% and 5.0% respectively. Both

have sizable and growing renewable businesses.

Other segments

Drax Group, Biomass generation and production sector has remained at the top

end of the portfolio and delivered excellent financial results. 2023 should see

a decision from the UK Government on whether to approve the company's carbon

capture plans. Drax's shares gained 16.2% in 2022.

Also in the UK, the portfolio's exposure to energy storage companies increased.

Batteries are a key component in grid balancing and managing short term power

volatility. Following additional investment and a 24.1% increase in share

price, Harmony Energy Income Trust became the Trust's largest battery storage

investment. Likewise, Gresham House Energy Storage Fund also performed well,

its share price recording an increase of 24.7%.

Less successful was the holding in waste to energy company China Everbright,

which lost value in line with the other Chinese positions. The position was cut

back sharply in the year to reduce exposure to China.

Currency and hedging

The Trust made currency hedging losses of £0.7 million (2021: gains of £0.4m)

over the year, offsetting equivalent currency gains made on investments held in

those currencies. Currency hedge contracts are undertaken to mitigate against

currency volatility and to offset potential losses from adverse currency

movements.

Outlook

Following a strong period of returns, it is disappointing to record an

investment loss in 2022. However, this was concentrated in a limited number of

positions, which experienced outsized losses. The majority of other holdings

performed relatively well, although share price gains were typically some way

behind earnings growth.

While there is much uncertainty in the global economy, and political risk

remains an ongoing issue, 2023 should see a peak in inflation and therefore

also in interest rates. As such, some of the negative macro headwinds should, I

hope, abate.

While recent weeks have seen a welcome moderation in the high fuel commodity

price environment, those driving the electricity price, such as natural gas and

carbon permits, remain at elevated levels in comparison to recent history. The

phase out of both coal and older nuclear capacity in coming years should keep

the margin of supply over demand relatively tight in the European electricity

market. I therefore believe that European electricity prices could stay higher

for longer than anticipated by the market, sustaining a positive backdrop for

the portfolio.

James Smith

Premier Fund Managers Limited

14 March 2023

Investment Portfolio

at 31 December 2022

Company Activity Country of Value % total Ranking Ranking

operation £000 investments 2022 2021

Drax Group Biomass United Kingdom 3,295 6.8 1 3

generation

and

production

Greencoat UK Yieldcos & United Kingdom 3,059 6.4 2 6

Wind funds

NextEnergy Yieldcos & United Kingdom 2,969 6.2 3 7

Solar Fund funds

RWE Renewable Europe (ex. 2,952 6.1 4 4

energy UK)

developers

Octopus Yieldcos & Europe (ex. 2,550 5.3 5 -

Renewable funds UK)

Infrastructure

Aquila European Yieldcos & Europe (ex. 2,273 4.7 6 -

Renewables funds UK)

Atlantica Yieldcos & Global 2,150 4.5 7 10

Sustainable funds

Infrastructure

Iberdrola Renewable Global 1,939 4.0 8 19

focused

utilities

Harmony Energy Energy United Kingdom 1,899 3.9 9 21

Income Trust storage

(incl. 'C'

Shares)

Clearway Energy Yieldcos & North America 1,865 3.9 10 13

'A' funds

Grenergy Renewable Global 1,845 3.8 11 16

Renovables energy

developers

Foresight Solar Yieldcos & United Kingdom 1,820 3.8 12 18

Fund funds

Gresham House Energy United Kingdom 1,777 3.7 13 12

Energy Storage storage

Fund

Corp. Acciona Renewable Europe (ex. 1,603 3.3 14 -

Energias energy UK)

Renovables developers

SSE Renewable United Kingdom 1,540 3.2 15 15

focused

utilities

Bonheur Renewable Europe (ex. 1,211 2.5 16 41

energy UK)

developers

Northland Power Renewable Global 1,135 2.4 17 20

energy

developers

National Grid Electricity Global 1,097 2.3 18 5

networks

Algonquin Power Renewable North America 1,080 2.2 19 9

and Utilities focused

utilities

China Suntien Renewable China 863 1.8 20 1

Green Energy energy

developers

TransAlta Yieldcos & North America 742 1.5 21 17

Renewables funds

Gore Street Energy United Kingdom 666 1.4 22 24

Energy Storage storage

Fund

China Waste to China 632 1.3 23 2

Everbright energy

Environment

Greencoat Yieldcos & Europe (ex. 604 1.3 24 27

Renewables funds UK)

7C Solarparken Renewable Europe (ex. 596 1.2 25 30

energy UK)

developers

US Solar Fund Yieldcos & North America 571 1.2 26 -

funds

Enefit Green Renewable Europe (ex. 562 1.2 27 35

energy UK)

developers

MPC Energy Renewable Latin America 539 1.1 28 23

Solutions energy

developers

Cloudberry Renewable Europe (ex. 523 1.1 29 -

Clean Energy energy UK)

developers

Opdenergy Renewable Europe (ex. 504 1.0 30 -

energy UK)

developers

Omega Energia Renewable Latin America 377 0.8 31 32

(1) energy

developers

Eneti Renewable Global 292 0.6 32 29

technology

and service

Atrato Onsite Renewable United Kingdom 287 0.6 33 39

Energy energy

developers

Fusion Fuel Renewable Europe (ex. 285 0.6 34 33

Green (incl. technology UK)

warrants) and service

Orsted Renewable Europe (ex. 264 0.5 35 -

energy UK)

developers

Seaway 7 Renewable Global 258 0.5 36 31

technology

and service

Boralex Renewable Global 245 0.5 37 -

energy

developers

Cadeler Renewable Europe (ex. 227 0.5 38 -

technology UK)

and service

Solaria Energía Renewable Europe (ex. 213 0.5 39 38

y Medio energy UK)

Ambiente developers

GreenVolt Renewable Europe (ex. 160 0.3 40 -

energy UK)

developers

Innergex Renewable North America 148 0.3 41 44

Renewable energy

developers

Tion Renewables Renewable Europe (ex. 145 0.3 42 42

(2) energy UK)

developers

Bluefield Solar Yieldcos & United Kingdom 136 0.3 43 -

Income Fund funds

Scatec Renewable Global 113 0.2 44 40

energy

developers

Clearvise Renewable Europe (ex. 106 0.2 45 -

energy UK)

developers

48,117 99.9

Unquoteds Activity Country Value % total

£000 investments

PMGR Securities ZDP United Kingdom 50 0.1

2025 PLC subsidiary

Total 48,167 100.0%

investments

(1) Omega Energia (formerly Omega Geracao).

(2) Tion Renewables (formerly Pacifico Renewables).

Review of Top Ten Holdings

at 31 December 2022

1. Drax Group

Market cap: £2.8 billion

www.drax.com

UK listed Drax Group operates the UK's largest renewable energy facility, the

Drax power station in Yorkshire, which it converted from coal to biomass

pellets manufactured from sustainable wood waste. The facility benefits from UK

subsidy schemes lasting through to 2027. Drax is also one of the world's

largest producers of biomass pellets from its facilities in the US and Canada.

Future growth options include developing a carbon capture plant at the Drax

power station, expanding their upstream pellet business, adding additional

capacity at their Cruachan pump storage hydro plant in Scotland, and developing

new biomass power stations in the US. Drax recorded strong earnings for the

first half of 2022, with adjusted earnings per share increasing 37.0%. The

company has locked in high power prices for a large portion of their output for

the next two years, ensuring earnings should remain healthy. Drax's shares rose

by 16.2% in 2022.

2. Greencoat UK Wind

Market cap: £3.5 billion

www.greencoat-ukwind.com

Greencoat UK Wind ("UKW") is a UK listed renewable energy investment company,

owning both on and offshore wind farms. It operates as a yield company,

acquiring completed assets rather than taking development risk. UKW's strategy

is to sell power predominantly in the merchant markets rather than hedging

output through commercial forward sales contracts or financial derivatives.

Higher power prices meant that UKW's dividend was 3.2x covered by available

cash generation in 2022, as compared to 1.9x in 2021. Over the course of 2022,

UKW's published NAV increased by 25.2% to 167.10p per share. The UK energy

generator levy or "windfall tax", applying to revenues from 2023, was

incorporated into the December 2022 NAV. However, UKW's NAV had assumed a

substantial discount between forward electricity prices and those expected to

be achieved by the company, and the levy was absorbed within this discount. In

2022, UKW's share price increased by 8.3% to 152.10p, standing at a discount to

the December 2022 asset value.

3. NextEnergy Solar Fund

Market cap: £655 million

www.nextenergysolarfund.com

NextEnergy ("NESF") is a UK listed renewable energy investment company, owning

large-scale UK solar assets. NESF has diversified from solar over recent years,

and 2022 saw the acquisition, with a partner, of a large (250 MW) battery

storage development project, expected to be operational in 2025. NESF's solar

business has continued to perform well, with the company's most recent projects

being awarded 15-year index linked contracts in the UK government's August 2022

Contracts for Difference auction. NESF's NAV gained 15.8% over 2022 reaching

120.90p. In common with UKW above, the December 2022 NAV calculation

incorporated the UK's new windfall tax. Also in common with UKW, NESF's share

price failed to keep pace with the increasing NAV, gaining 9.6% over the year

to reach 110.10p, and standing at a discount to the NAV at the year end

therefore.

4. RWE

Market cap: £24.9 billion

www.rwe.com

RWE is a German listed multi-national energy company, which is transitioning

from fossil fuels to renewable energy. It has expanded rapidly in renewables

over recent years and has set out a capital programme to spend Euro 50 billion

on green growth to 2030. RWE is in the process of transitioning away from

fossil fuels, having closed 12 GW of coal-fired power stations since 2012. In

2022 RWE substantially expanded its US renewables business through the

acquisition of Co Edison Clean Energy ("CEB"). CEB's primarily solar based

portfolio complements well RWE's wind focussed US business. Financial

performance was strong in 2022, with adjusted earnings per share over the 9

months to September, increasing by 105.9%, and RWE's share price gaining 16.4%

over the year.

5. Octopus Renewables Infrastructure Trust

Market cap: £568 million

www.octopusrenewalesinfrastructure.com

Octopus Renewables Infrastructure ("ORIT"), a new holding acquired during the

year, is a UK listed investment company with assets across Europe including the

UK, France, Poland, Finland, Ireland, and Sweden. Its investments are

approximately equally split between solar and wind. ORIT's NAV per share

increased by 6.9% to 109.40p over 2022. However, despite the higher asset

value, its share price fell by 9.2% and trades at a discount to the NAV.

6. Aquila European Renewables Income Fund

Market cap: £333 million

www.aquila-european-renewables.com

Like ORIT, Aquila European Renewables ("AERI") is another new UK listed yieldco

holding, having been acquired in the year. Unlike ORIT, AERI is not present in

the UK, with its assets located in Spain, Portugal, Norway, Denmark, Finland,

and Greece. Its investments are approximately equally split between wind and

solar, with a small amount of hydro capacity. AERI's NAV per share increased by

7.8% over 2022 to reach Euro 110.64 cents. However, and in common with ORIT,

AERI's shares moved in the opposite direction, falling by 9.6% during the year

to close 2022 at a large discount to their NAV.

7. Atlantica Sustainable Infrastructure

Market cap: £2.5 billion

www.atlantica.com

Atlantica Yield is listed in the US and operates as a yield company, with 70%

(by cashflow) of assets being renewable energy and the balance being natural

gas generation, electricity transmission, and water treatment plants. Atlantica

has a commitment to maintain at least 80% of gross earnings from low-carbon

assets, and it sits in the first percentile of the Sustainalytics ESG rankings.

Their assets are located in the US, Europe, South Africa and Latin America,

have a weighted average remaining contract length of 15 years, with 90% of

revenues denominated in US dollars. Atlantica had another active year,

including the acquisition of a large solar plant in Chile, to which it intends

to add a battery storage facility. Despite reporting interim earnings

consistent with the prior year, Atlantica's share price fell by 27.6% in 2022

as it reacted to higher US interest rates.

8. Iberdrola

Market cap: £61.6 billion

www.iberdrola.com

Iberdrola is a large Spain listed international utility and renewable energy

business. It operates in the UK through its Scottish Power subsidiary, in the

US through Avangrid, in Brazil through Neoenergia, plus operations in Mexico

and other European countries. Its renewables business is one of the world's

largest, with Iberdrola targeting renewable energy investment of Euro 17

billion over the three years of 2023 to 2025, almost half of which will be in

offshore wind. Installed renewable capacity is targeted to increase from 40 GW

at the end of 2022, to 52 GW by the end of 2025. Results have been strong in

2022, with nine-month earnings per share to September increasing by 29.2%, and

the shares gaining 5.0% over the year.

9. Harmony Energy Income Trust

Market cap: £296 million

www.heitp.co.uk

Harmony Energy Income Trust ("HEIT") is a UK listed battery storage investor

which undertook a £210m share listing in November 2021. HEIT's sponsor and

major investor, Harmony Energy, is a leading UK battery storage developer and

is responsible for the management of HEIT. Its first project, a 98 MW, 2-hour

duration project, was completed in November 2022, and has the distinction of

being Europe's largest battery storage project. A further four sites are

expected to be completed over the course of 2023. In October 2022, Harmony

issued further new shares for cash proceeds of £15 million, enabling it to

acquire a further three "ready to build" projects from its sponsor. HEIT's

shares increased by 24.1% in 2022.

10. Clearway Energy

Market cap: £3.0 billion

www.investor.clearwayenergy.com

Clearway Energy is a US listed yield company, operating solar and wind

generation facilities together with gas generation plants which operate under

system reliability contracts to provide peaking / standby capacity. Clearway

also owned a thermal energy business providing steam and hot water to

commercial and public sector clients. The thermal business was sold in 2021 at

an excellent price, which has allowed the company to reinvest proceeds in

expanding their renewable energy business, with several new wind, solar, and

storage assets acquired during 2022. Financial results reported during 2022

have been good. However, US renewable companies were weak on higher interest

rates, with the company's A shares held by PMGR falling by 10.6%.

Statement of Directors' Responsibilities in Respect of the Annual Report and

the Financial Statements

The Directors are responsible for preparing the Annual Report and the Group and

Parent Company financial statements in accordance with applicable law and

regulations.

Company law requires the Directors to prepare Group and Parent Company

financial statements for each financial year. Under that law they are required

to prepare the Group financial statements in accordance with UK-adopted

international accounting standards and applicable law and have elected to

prepare the Parent Company financial statements on the same basis.

Under company law the Directors must not approve the financial statements

unless they are satisfied that they give a true and fair view of the state of

affairs of the Group and Parent Company and of the Group's profit or loss for

that period. In preparing each of the Group and Parent Company financial

statements, the Directors are required to:

* select suitable accounting policies and then apply them consistently;

* make judgements and estimates that are reasonable, relevant and reliable;

* state whether they have been prepared in accordance with UK-adopted

international accounting standards;

* assess the Group and Parent Company's ability to continue as a going

concern, disclosing, as applicable, matters related to going concern; and

* use the going concern basis of accounting unless they either intend to

liquidate the Group or the Parent Company or to cease operations or have no

realistic alternative but to do so.

The Directors are responsible for keeping adequate accounting records that are

sufficient to show and explain the Parent Company's transactions and disclose

with reasonable accuracy at any time the financial position of the Parent

Company and enable them to ensure that its financial statements comply with the

Companies Act 2006. They are responsible for such internal control as they

determine is necessary to enable the preparation of financial statements that

are free from material misstatement, whether due to fraud or error, and have

general responsibility for taking such steps as are reasonably open to them to

safeguard the assets of the Group and to prevent and detect fraud and other

irregularities.

Under applicable law and regulations, the Directors are also responsible for

preparing a Strategic Report, Directors 'Report, Directors' Remuneration Report

and Corporate Governance Statement that complies with that law and those

regulations.

The Directors are responsible for the maintenance and integrity of the

corporate and financial information included on the Company's website.

Legislation in the UK governing the preparation and dissemination of financial

statements may differ from legislation in other jurisdictions.

In accordance with Disclosure Guidance and Transparency Rule 4.1.14R, the

financial statements will form part of the annual financial report prepared

using the single electronic reporting format under the TD ESEF Regulation. The

auditor's report on these financial statements provides no assurance over the

ESEF format.

Responsibility of the Directors in respect of the annual financial report

We confirm to the best of our knowledge:

* the financial statements, prepared in accordance with the applicable set of

accounting standards, give a true and fair view of the assets, liabilities,

financial position and profit or loss of the Company and the undertakings

included in the consolidation taken as a whole; and

* the strategic report includes a fair review of the development and

performance of the business and the position of the issuer, and the

undertakings included in the consolidation taken as a whole, together with

a description of the principal risks and uncertainties that they face.

We consider the Annual Report and Accounts, taken as a whole, is fair,

balanced, and understandable and provides the information necessary for

shareholders to assess the Group's position and performance, business model and

strategy.

For and on behalf of the Board

Gillian Nott OBE

Chairman

14 March 2023

Directors and Advisers

Directors

Gillian Nott OBE - Chairman

Melville Trimble - Chairman of the Audit Committee

Victoria Muir - Chairman of the Remuneration Committee

Alternative Investment Fund Manager ("AIFM")

Premier Portfolio Managers Limited

Eastgate Court

High Street

Guildford

Surrey GU1 3DE

Telephone: 01483 306 090

www.premiermiton.com

Authorised and regulated by the Financial Conduct Authority

Investment Manager

Premier Fund Managers Limited

Eastgate Court

High Street

Guildford

Surrey GU1 3DE

Telephone: 01483 306 090

www.premiermiton.com

Authorised and regulated by the Financial Conduct Authority

Secretary and Registered Office

Link Company Matters Limited

6th floor

65 Gresham Street

London EC2V 7NQ

Registrar

Link Group

The Registry

10th Floor

Central Square

29 Wellington Street

Leeds LS1 4DL

Telephone: 0371 664 0300*

Overseas: +44 (0) 371 664 0300*

E-mail: shareholderenquiries@linkgroup.co.uk

www.signalshares.com

Depositary

Northern Trust Investor Services Limited

50 Bank Street

Canary Wharf

London E14 5NT

Authorised by the Prudential Regulation Authority ("PRA") and regulated by the

FCA and PRA

Custodian

The Northern Trust Company

50 Bank Street

Canary Wharf

London E14 5NT

Auditor

KPMG LLP

15 Canada Square

London E14 5GL

Tax Advisor

Crowe U.K. LLP

55 Ludgate Hill

London EC4M 7JW

Stockbroker

finnCap Capital Markets

One Bartholomew Close

London EC1A 7BL

Ordinary Shares

SEDOL 3353790GB

LSE PMGR

Zero Dividend Preference Shares

SEDOL BNG43G3GB

LSE PMGZ

Global Intermediary Identification Number

GIIN W6S9MG.00000.LE.826

*Calls are charged at the standard geographic rate and will vary by provider.

Calls outside the United Kingdom will be charged at the applicable

international rate. The Registrar is open between 09:00 - 17:30 Monday to

Friday excluding public holidays in England and Wales

For the purposes of complying with the Disclosure and Transparency Rules ("DTRs

") and the requirements imposed on the Company through the DTRs, the Annual

Report, as will be submitted to the National Storage Mechanism, contains the

full text of the Directors' Report at page 26, the Statement of Corporate

Governance at page 34, the Directors' Remuneration Report at page 38, the Audit

Committee Report at page 42, and the Auditors' Report at page 46, which are

excluded from this announcement.

LEI Number: 2138004SR19RBRGX6T68

END

(END) Dow Jones Newswires

March 15, 2023 03:00 ET (07:00 GMT)

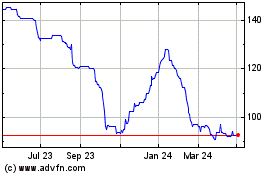

Premier Miton Global Ren... (LSE:PMGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

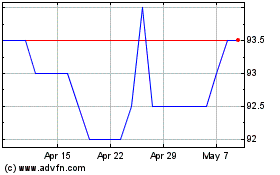

Premier Miton Global Ren... (LSE:PMGR)

Historical Stock Chart

From Apr 2023 to Apr 2024