TIDMPGH

RNS Number : 7105A

Personal Group Holdings PLC

27 September 2022

27 September 2022

PERSONAL GROUP HOLDINGS PLC

("Personal Group", "Company" or "Group")

Interim Results & Interim Dividend for the six months ended

30 June 2022

Underlying growth, a strong balance sheet, and products that

resonate in a challenging market for both employers and their

employees, positions the Group well for future uplift in EBITDA. On

track to meet full year market expectations.

Personal Group Holdings Plc (AIM: PGH), the workforce benefits

and services provider is pleased to announce its interim results

for the six months ended 30 June 2022.

Financial Highlights

-- Group revenue increased 5.8% to GBP34.7m (H1 2021: GBP32.8m)

-- Annualised Premium Income for the Group's largest division,

Affordable Insurance, rebuilding post-pandemic, up 7% to GBP26.2m,

providing a strong basis for future growth

-- Adjusted EBITDA* of GBP1.5m (H1 2021: GBP4.1m), in line with

management expectations reflecting the anticipated reduced

contribution from insurance due to investment in policyholder

acquisition and increased claims costs, offset by strong growth

from other divisions

-- Profit before tax of GBP0.5m (H1 2021: GBP3.2m) in line with adjusted EBITDA

-- Basic EPS of 1.7p (H1 2021: 8.4p)

-- Strong balance sheet and liquidity with cash and deposits at

period end of GBP21.8m (Dec 2021: GBP22.9m), and debt free

-- Interim dividend of 5.3p (H1 2021: 5.3p) to be paid,

reflecting continued confidence in the Group's business model and

prospects

Operational Highlights

-- 52 new client wins secured in the period including Vinci, Renfrewshire Council and BSI Group

-- Strong retention and new insurance sales across Affordable

Insurance segment, successfully building back towards pre-pandemic

levels

-- Continued substantial increase in contribution from SME

channel via Sage Employee Benefits; Annual Recurring Revenue of

GBP2.1m at 30 June 22 (GBP1.6m at 31 December 21, GBP1.2m at June

21)

-- Hapi platform subscriptions showing growth; ARR of GBP1.7m at

30 June 22 (GBP1.5m at 31 December 21), with significant investment

into the platform, driving immediate and ongoing cost savings

-- Strong organic growth in Pay & Reward

Post-Period Trading and Outlook

-- New client gains continue with notable wins with Secure Trust

Bank and Aston University choosing HapiFlex as their benefit

platform

-- Insurance sales and retention rates in H2 to date remain

positive despite the macroeconomic environment and cost of living

crisis, demonstrating the continued relevance of the Group's

product offering in the current economic environment

-- Strategic acquisition of Quintige Consulting Group ("QCG")

post period end brings new clients to the Group with cross-sell

opportunities for Hapi, Insurance and Innecto Digital products

-- Trading remains in line to meet market's full year expectations

-- Board is confident in longer-term outlook for the business

* Adjusted EBITDA is defined as earnings before interest, tax,

depreciation, amortisation of intangible assets, goodwill

impairment, share-based payment expenses, corporate acquisition

costs and restructuring costs.

Deborah Frost, Chief Executive of Personal Group, commented:

"These half-year results are a demonstration of the resilience

of our business model and product offering. We have made

significant progress in executing our strategy and meeting the

goals we set ourselves in the first six months of the year and we

are starting to see new sales driving future growth.

Despite the challenges in the economic environment the Group has

continued to successfully rebuild the Affordable Insurance side of

the business, which will drive growth in a weighted second half,

underpinning our confidence in meeting full-year targets for FY

2022.

Our relationship with Sage has gathered further momentum and

gives us access to the previously untapped market of the UK's SME

sector. We have also maintained significant investment into the

business to support further innovation across our offering,

including the new and improved Hapi 2.0 which, once launched, we

expect will add significant value for clients and their

employees.

Whilst we are cognisant of the macro environment and potential

challenges it may bring, we believe that our products are valued by

customers, as evidenced by the retention rates we've seen so far,

across all of our product set, and which assures us that the

million-plus employees using them share our views. We are seeing

growth across the breadth of the business, which reinforces our

belief in the relevance and importance of our product in these

difficult times. These results are a credit to the hard work of our

dedicated team and the Board is excited to see what we can achieve

over the next twelve months."

An overview of the interim results from Deborah Frost, Chief

Executive, is available to watch here:

www.fmp-tv.co.uk/2022/09/27/personal-group-interim-results-tv-interview/

Personal Group Holdings will be hosting a webinar for private

investors on Friday 30 September at 12.00. If you would like to

register for the webinar, please follow this link:

https://www.investormeetcompany.com/personal-group-holdings-plc/register-investor

-S-

For more information please contact:

Personal Group Holdings Plc

Deborah Frost / Sarah Mace +44 (0)1908 605 000

Cenkos Securities Plc

Camilla Hume / Callum Davidson

(Nominated Adviser) +44 (0)20 7397 8900

Russell Kerr (Sales)

Alma PR

Caroline Forde / Lily Soares +44 (0)20 3405 0205

Smith / personalgroup@almapr.co.uk

Joe Pederzolli

Notes to Editors

Personal Group Holdings Plc (AIM: PGH) is a workforce benefits

and services provider. The Group enables employers across the UK to

improve employee engagement and support their people's physical,

mental, social and financial wellbeing. Its vision is to create a

brighter future for the UK workforce.

Personal Group provides health insurance services and a broad

range of employee benefits, engagement, and wellbeing products. Its

offerings can also be delivered through its proprietary app, Hapi,

and the recently developed extension to the platform, Hapiflex.

The Group's growth strategy is centred around widening the

footprint of the business into the SME, talent-led & Public

Sectors, thereby expanding the addressable customer base. In

addition, it aims to grow in its existing industrial heartlands, to

re-invigorate growth in insurance policyholders and to drive the

use of its SaaS offerings.

Group Clients include: Airbus, B & Q, Barchester Healthcare,

British Transport Police, The Prince's Trust, Randstad, Royal Mail

Group, The Royal Mint, the Sandwell & Birmingham NHS Trust,

Stagecoach Group plc, and The University of York.

For further information on the Group please see

www.personalgroup.com

CEO STATEMENT

I am pleased to report that over the first six months we have

seen all our underlying growth drivers moving in the right

direction and we reflect on a period of good momentum and clear

strategic progress.

As anticipated, year-on-year profit comparison is lower,

reflecting the lagged impact of the pandemic and 17 months of

lockdowns on the insurance business. However this comparison masks

the underlying growth and important achievements, at an operational

level, across the Group and which will underpin future profitable

growth.

Over the period I am particularly pleased to have seen the

insurance book re-building substantially, a very strong period for

Pay & Reward, and acceleration in our offering to the small and

mid-sized business market. All of this reflects the continued high

demand for workforce benefits and services and the relevance of our

product offering.

With workers throughout the country becoming increasingly

exposed to challenging macroeconomic trends, such as the

cost-of-living crisis, the value of our offering has never been

more apparent as is demonstrated by new client wins and positive

insurance sales and retention rates during the period. We continue

to enable employers across the UK to improve employee engagement

and support their people's physical, mental, social and financial

wellbeing, priorities which have all become more important in times

of uncertainty.

Performance against Growth Strategy

Our overarching strategy is to build workforce resilience for

clients, helping employees thrive in work and in life. With our

preliminary results, I announced our refreshed strategy, focusing

on three core pillars:

-- Driving insurance

-- Transforming Reward & Benefits

-- Accelerating our SME offer

In H1 we've made clear progress against each of these pillars.

Our insurance book continues to build back towards pre-Pandemic

levels, with Annualised Premium Income seeing real growth from the

end of last year. Subscriptions for our market-leading employee

engagement platform, Hapi, also grew across the first six months of

the year, and we are planning significant investment into the

platform. This investment into 'Hapi 2.0' is expected to further

drive growth, with immediate and ongoing savings across the

platform and a better user experience for clients. The acquisition

of QCG, alongside organic growth for Innecto, strengthens our

strategic reward offer and allows for cross-sell of Innecto Digital

products and other benefit products. Our strategic development into

the SME sector continues to show significant growth in terms of

Annualised Recurring Revenue.

Divisional H1 Segmental Analysis

Affordable Insurance

Our traditional face-to-face insurance sales' model was

significantly affected by the series of lockdowns seen in 2020 and

2021 and we have witnessed the expected lagged impact of this over

the past few reporting periods. However, with the field sales team

now up to full strength, we continue to successfully rebuild the

insurance book and in June 2022 we recorded the highest amount of

new business signed in a single month since November 2018. This,

combined with retention rates remaining above the Group's

historical averages, has helped to drive the Annualised Premium

Income (API) value up to GBP26.2m (December 2021: GBP24.4m).

The level of claims in H1, and particularly in Q1, was higher

than anticipated, although this has subsequently returned to

projected levels. This, in combination with a smaller insurance

book and the increased policy-holder acquisition costs associated

with having a full sales team out in the field, resulted in an

adjusted EBITDA contribution of GBP4.0m (H1 2021: GBP6.5m), which

should now continue to build in line with our increasing API.

Pay and Reward

(Innecto)

Pay & Reward delivered strong organic growth during the

period with overall revenue up 73%, consultancy fee income up 93%

and annual subscription income from Innecto Digital products up 24%

versus H1 2021. The acquisition of QCG and early wins achieved in

H2 are anticipated to drive growth throughout the remainder of the

year.

Benefits platform

Organic growth was seen in the period across the Company's

Benefits Platform with the combined Annualised Recurring Revenue

(ARR) standing at GBP3.8m as of June 2022 (December 2021: GBP3.2m).

This growth was largely driven by the substantial contribution from

the Group's partnership with Sage, where ARR via Sage Employee

Benefits increased to GBP2.1m at the end of the period (December

2021: GBP1.6m), and where we continue to see good momentum. We are

now also exploring further routes to market including reaching SMEs

directly, as well as through other potential partnerships.

Other Owned Benefits

(Let's Connect)

Revenue for Let's Connect is down year-on-year, largely due to

comparison with a strong H1 2021, where schemes were deferred from

2020. The division proves to be a popular benefit for employees,

with order numbers up 10% on H1 2021, and one that we expect to

remain highly relevant against the current macro backdrop as it

moves into its peak period in Q4.

Interim Dividend

The Company is pleased to announce that an interim dividend for

2022 of 5.3p will be paid on 15 November 2022 to members on the

register as at 7 October 2022 (the record date). Shares will be

marked ex-dividend on 6 October 2022. The last day for elections

will be on 25 October 2022. The Board has considered the level of

dividend in the context of the full year results, reflecting

continued confidence in the Group's business model and

prospects.

Board Changes

As detailed in the RNS dated 1 June 2022, Liam McGrath stepped

down from the Board, and left the Company, on 30 August 2022.

Current Trading and Outlook

Trading into July and August has remained robust, and in line

with management's expectations, giving the Board confidence in

meeting market expectations for the full year.

Operationally, the Company is full of activity, with the core

business delivering well and new opportunities being driven forward

by an energised workforce.

Despite the confidence and positivity that currently surrounds

the business we are very aware of the difficult and uncertain

macro-environment in which we are all living. Whilst we continually

monitor our lead indicators for signs of impact to the business, we

are pleased that, to date, all indicators remain positive thereby

supporting the Board's current confidence in the full year outcome.

We are mindful, too, of industrial action by unions which could

become more widespread and affect our client base and will also

continue to monitor this. That said, our insurance offer is good

value and gives peace of mind, qualities which are highly sought

after in the current challenging climate and our Benefits and Pay

& Reward products are becoming ever more important as employers

look at how they can best remunerate teams against an inflationary

backdrop.

We will continue to monitor events carefully and remain

committed to executing on our growth strategy and look forward to

delivering for shareholders going forward.

Deborah Frost

Group Chief Executive

27 September 2022

Consolidated Income Statement

Restated*

6 months 6 months

ended ended

30 June 2022 30 June 2021

Unaudited Unaudited

Note GBP'000 GBP'000

Gross premiums written 12,360 12,752

Outward reinsurance premiums (70) (79)

Change in unearned premiums (59) (186)

Change in reinsurers' share of

unearned premiums (7) (8)

(________) (________)

Earned premiums net of reinsurance 12,224 12,479

Employee benefits and services 8,436 8,108

Voucher resale income 13,848 12,082

Other income 128 135

Investment income 29 13

(________) (________)

Revenue 34,665 32,817

(________) (________)

Claims incurred (3,663) (2,713)

Insurance operating expenses (3,227) (1,888)

Employee benefits and services

expenses (8,268) (8,417)

Voucher resale expenses (13,872) (12,135)

Other expenses (38) 119

Group administration expenses (4,679) (4,410)

Share based payment expenses (152) (81)

Charitable donations (50) (35)

(________) (________)

Expenses (33,949) (29,560)

(________) (________)

Operating profit 716 3,257

Finance costs (13) (17)

Loss on equity investments (244) -

(________) (________)

Profit before tax 459 3,240

Tax 4 73 (602)

(________) (________)

Profit for the period after tax 532 2,638

(________) (________)

Total comprehensive income for

the period 532 2,638

(________) (________)

Earnings per share Pence Pence

Basic 1.7 8.4

Diluted 1.7 8.4

The total comprehensive income for the period is attributable to

equity holders of Personal Group Holdings Plc.

*While the results remain unchanged, the presentation of the

prior year has been restated to add clarity to the reader. For

further details on the nature and rationale of the restatement,

please refer to the consolidated financial statements of the Group

for the year ended 31 December 2021.

Consolidated Balance Sheet

At 30 June 2022 At 31 Dec 2021

Unaudited Audited

Note GBP'000 GBP'000

ASSETS

Non-current assets

Goodwill 6 12,696 12,696

Intangible assets 7 1,746 1,637

Property, plant and equipment 8 4,988 5,033

(_______) (_______)

19,430 19,366

(________) (________)

Current assets

Financial assets 9 2,989 2,596

Trade and other receivables 8,361 14,035

Reinsurance assets 107 108

Inventories 1,059 898

Cash and cash equivalents 20,102 20,291

Current tax assets 441 310

(________) (________)

33,059 38,238

(________) (________)

Total assets 52,489 57,604

(________) (________)

Consolidated Balance Sheet

At 30 June 2022 At 31 Dec 2021

Unaudited Audited

Note GBP'000 GBP'000

EQUITY

Equity attributable to equity

holders of Personal Group Holdings

plc

Share capital 1,562 1,561

Share premium 1,134 1,134

Capital redemption reserve 24 24

Other reserve (61) (32)

Share based payment reserve 247 158

Profit and loss reserve 37,379 38,436

(________) (________)

Total equity 40,285 41,281

(________) (________)

LIABILITIES

Non-current liabilities

Deferred tax liabilities 455 478

Trade and other payables 254 402

(________) (________)

709 880

(________) (________)

Current liabilities

Trade and other payables 8,272 12,356

Insurance contract liabilities 3,223 3,087

(________) (________)

11,495 15,443

(________) (________)

(________) (________)

Total liabilities 12,204 16,323

(________) (________)

(________) (________)

Total equity and liabilities 52,489 57,604

(________) (________)

Consolidated Statement of Changes in Equity for the six months

ended 30 June 2022

Share Share Capital Other Share Profit Total

capital Premium redemption reserve Based & loss equity

reserve Payment reserve

Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance as at

1 January

2022 1,561 1,134 24 (32) 158 38,436 41,281

(________) (________) (________) (________) (________) (________) (________)

Dividends - - - - - (1,654) (1,654)

Employee

share-based

compensation - - - - 152 - 152

Proceeds of

SIP*

share sales - - - - - 11 11

Cost of SIP

shares

sold - - - 9 - (9) -

Cost of SIP

shares

purchased - - - (18) - - (18)

Purchase of

New

shares - - (20) - - (20)

Shares issued

in year -

LTIP

exercise 1 - - - (63) 63 1

(________) (________) (________) (________) (________) (________) (________)

Transactions

with owners 1 - - (29) 89 (1,589) (1,528)

(________) (________) (________) (________) (________) (________) (________)

Profit for the

period - - - - - 532 532

(________) (________) (________) (________) (________) (________) (________)

Total

comprehensive

income for

the

period - - - - - 532 532

(________) (________) (_______) (_______) (_______) (_______) (_______)

Balance as at

30 June 2022 1,562 1,134 24 (61) 247 37,379 40,285

(________) (________) (________) (________) (________) (________) (________)

* PG Share Ownership Plan (SIP)

Consolidated Statement of Changes in Equity for the six months

ended 30 June 2021

Share

Capital Based Profit

Share Share redemption Other Payment & loss Total

capital Premium reserve reserve Reserve reserve equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance as at

1 January 2021 1,561 1,134 24 (21) - 38,076 40,774

(________) (________) (________) (________) (________) (________) (________)

Dividends - - - - - (1,592) (1,592)

Employee share-based

compensation - - - - 76 5 81

Proceeds of SIP*

share sales - - - - - 19 19

Cost of SIP shares

sold - - - 13 - (13) -

Cost of SIP shares

purchased - - - (24) - - (24)

(________) (________) (________) (________) (________) (________) (________)

Transactions

with owners - - - (11) 76 (1,581) (1,516)

(________) (________) (________) (________) (________) (________) (________)

Profit for the

period - - - - - 2,638 2,638

(________) (________) (________) (________) (________) (________) (________)

Total comprehensive

income for the

period - - - - - 2,638 2,638

(________) (________) (_______) (_______) (_______) (_______) (_______)

Balance as at

30 June 2021 1,561 1,134 24 (32) 76 39,133 41,896

(________) (________) (________) (________) (________) (________) (________)

* PG Share Ownership Plan (SIP)

Consolidated Statement of Cash Flows

6 months

6 months ended

ended 30 June 2021

30 June 2022 Unaudited

Unaudited

GBP'000 GBP'000

Net cash from operating activities (see

opposite) 3,023 3,930

(______) (______)

Investing activities

Additions to property, plant and equipment (222) (69)

Additions to intangible assets (473) (122)

Purchase of financial assets (1,509) (1)

Sale of financial assets 871 -

Interest received 29 13

(______) (______)

Net cash from investing activities (1,304) (179)

(______) (______)

Financing activities

Proceeds from issue of shares 1 -

Purchase of own shares by the SIP (31) (16)

Proceeds from disposal of own shares

by the SIP 6 8

Interest paid (4) (2)

Payment of lease liabilities (226) (233)

Dividends paid (1,654) (1,592)

(______) (______)

Net cash used in financing activities (1,908) (1,835)

(______) (______)

Net change in cash and cash equivalents (189) 1,916

Cash and cash equivalents, beginning

of period 20,291 17,589

(_______) (_______)

Cash and cash equivalents, end of period 20,102 19,505

(________) (________)

Consolidated Statement of Cash Flows

6 months

6 months ended

ended 30 June 2021

30 June 2022 Unaudited

Unaudited

GBP'000 GBP'000

Operating activities

Profit after tax 532 2,638

Adjustment for:

Depreciation 493 480

Amortisation of intangible assets 364 266

Loss on disposal of property, plant and equipment 24 -

Interest received (29) (13)

Realised and unrealised investment losses 244 -

Interest charge 13 17

Share-based payment expenses 152 81

Taxation expense recognised in income statement (73) 602

Changes in working capital:

Trade and other receivables 5,675 4,658

Trade and other payables (4,129) (4,420)

Inventories (161) 64

Taxes paid (82) (443)

(________) (________)

Net cash from operating activities 3,023 3,930

(________) (________)

Notes to the Consolidated Financial Statements

1 General information

The principal activities of Personal Group Holdings Plc ('the

Company') and subsidiaries (together 'the Group') include

transacting short-term accident and health insurance and providing

employee services in the UK.

The Company is a limited liability company incorporated and

domiciled in England. The address of its registered office is John

Ormond House, 899 Silbury Boulevard, Milton Keynes, MK9 3XL.

The Company is listed on the Alternative Investment Market of

the London Stock Exchange.

The condensed consolidated financial statements do not include

all the information required for full annual financial statements

and should be read in conjunction with the consolidated financial

statements of the Group for the year ended 31 December 2021.

The financial information for the year ended 31 December 2021

set out in this interim report does not constitute statutory

accounts as defined in Section 434 of the Companies Act 2006. The

statutory financial statements for the year ended 31 December 2021

have been filed with the Registrar of Companies. The auditor's

report on those financial statements was unqualified and did not

contain a statement under Section 498 (2) or (3) of the Companies

Act 2006.

These interim financial statements are unaudited and have not

been reviewed by the auditors under International Standard on

Review Engagements (UK and Ireland) 2410.

These consolidated interim financial statements have been

approved for issue by the board of directors on 27 September

2022.

2 Accounting policies

These June 2022 interim consolidated financial statements of

Personal Group Holdings Plc are for the six months ended 30 June

2022. These interim financial statements have been prepared in

accordance with IAS 34 Interim Financial Reporting.

They do not include all the information required for a complete

set of IFRS financial statements. However, selected explanatory

notes are included to explain events and transactions that are

significant to an understanding of the changes in the Group's

financial position and performance since the last annual

consolidated financial statements as at and for the year ended 31

December 2021.

These financial statements have been prepared in accordance with

IFRS standards and IFRIC interpretations as adopted by the EU,

issued and effective as at 30 June 2022.

The principal accounting policies remain unchanged from the year

ended 31 December 2021. No new standards have become applicable for

accounting periods commencing on or after 1 January 2022.

Notes to the Consolidated Financial Statements

3 Segment analysis

The format of the segmental analysis was changed in for the year

ended 31 December 2022 and a full explanation of this change can be

found in those financial statements. The segments used by

management to review the operations of the business are disclosed

below.

1) Affordable Insurance

Personal Assurance Plc (PA), a subsidiary within the Group, is a

PRA regulated general insurance Company and is authorised to

transact accident and sickness insurance. It was established in

1984 and has been underwriting business since 1985. In 1997

Personal Group Holdings Plc (PGH) was created and became the

ultimate parent undertaking of the Group.

Personal Assurance (Guernsey) Limited (PAGL), a subsidiary

within the Group, is regulated by the Guernsey Financial Services

Commission and has been underwriting death benefit policies since

March 2015.

This operating segment derives the majority of its revenue from

the underwriting by PA and PAGL of insurance policies that have

been bought by employees of host companies via bespoke benefit

programmes. During 2020 PAGL began underwriting employee default

insurance for a proportion of LC customers.

2) Other Owned Benefits

This segment constitutes any goods or services in the benefits

platform supply chain which are owned by the Group. At present this

is made up of a technology salary sacrifice business trading as PG

Let's Connect, purchased by the Group in 2014.

3) Benefits Platform

Revenue in this segment relates to the annual subscription

income and other related income arising from the licensing of Hapi,

the Group's employee benefit platform. This includes sales to both

the large corporate and SME sectors.

4) Pay and Reward

Pay and Reward refers to the trade of Innecto, a pay and reward

consultancy Company purchased in 2019. Revenue in this segment

relates to consultancy and license income derived from selling

Innecto digital platform subscriptions.

5) Other

The other operating segment includes revenue generated from the

resale of vouchers. This segment also consists of revenue generated

by Berkeley Morgan Group (BMG) and its subsidiary undertakings

along with any investment and rental income obtained by the

Group.

Notes to the Consolidated Financial Statements

The revenue and net result generated by each of the Group's

operating segments are summarised as follows,

6 months 6 months

ended ended

30 June 2022 30 June 2021

Unaudited Unaudited

GBP'000 GBP'000

Revenue by Segment

---------------------------------------- ------------- -------------

Insurance (Earned Premium) 12,224 12,477

IT Salary Sacrifice 5,387 6,203

Benefits Platform 3,574 2,759

Platform - Group Elimination (1,425) (1,374)

Pay & Reward 900 520

---------------------------------------- ------------- -------------

Other Income:

Voucher resale 13,848 12,082

Other 128 135

Investment income 29 13

---------------------------------------- ------------- -------------

Group Revenue 34,665 32,815

---------------------------------------- ------------- -------------

Adjusted EBITDA contribution by segment

---------------------------------------- ------------- -------------

Insurance (Earned Premium) 3,970 6,514

IT Salary Sacrifice (32) (40)

Benefits Platform 1,298 1,003

Pay & Reward 282 107

---------------------------------------- ------------- -------------

Other (149) 214

Administrative Expenses (3,798) (3,683)

Charitable donations (50) (35)

---------------------------------------- ------------- -------------

Adjusted EBITDA 1,521 4,080

---------------------------------------- ------------- -------------

Depreciation (493) (479)

Amortisation (364) (266)

Interest (13) (17)

Share Based Payments Expenses (152) (81)

---------------------------------------- ------------- -------------

Acquisition Costs (Note 11) (40) -

---------------------------------------- ------------- -------------

Profit before tax 459 3,237

---------------------------------------- ------------- -------------

All 2022 income was derived from customers that are based in the

UK.

Notes to the Consolidated Financial Statements

4 Taxation

The tax expense recognised is based on the weighted average

annual tax rate expected for the full financial year multiplied by

management's best estimate of the taxable profit of the interim

reporting period.

The Group's consolidated effective tax rate in respect of

continuing operations for the six-month period ended 30 June 2022

was a credit of 15.9% (six-month period ended 30 June 2021: 18.6%

charge). The tax income recognised in the period is mostly as a

result of the application of the super-deduction capital allowances

tax relief, eligible until 31 March 2023.

5 Earnings per share and dividends

The weighted average numbers of outstanding shares used for

basic and diluted earnings per share are as follows:

6 months ended EPS 6 months ended EPS

30 June 2022 Pence 30 June 2021 Pence

Basic 31,210,686 1.7 31,213,128 8.4

-------------- ------ -------------- ------

Diluted 31,218,953 1.7 31,214,981 8.4

-------------- ------ -------------- ------

During the first six months of 2022 Personal Group Holdings Plc

paid dividends of GBP1,654,000 to its equity shareholders (2021:

GBP1,592,000). This represents a payment of 5.30p per share (2021:

5.10p).

6 months ended 6 months ended

30 June 2022 30 June 2021

GBP'000 GBP'000

Dividends paid or provided for

during the period 1,654 1,592

(_____) (_____)

6 Goodwill

PG Let's Innecto Total

Connect

GBP'000 GBP'000 GBP'000

Cost

At 1 January 2022 10,575 2,121 12,696

Additions in the year - - -

(________) (________)

_________ _______ (________)

At 30 June 2022 10,575 2,121 12,696

(________) (________)

_________ _________ (________)

Amortisation and impairment

At 1 January 2022 - - -

Impairment charge for year - - -

(________) (________) (________)

_________ _________ _________

At 30 June 2022 - - -

(________) (________) (________)

Net book value at 30 June 2022 10,575 2,121 12,696

(________) (________) (________)

Net book value at 31 December 2021 10,575 2,121 12,696

(________) (________) (________)

Notes to the Consolidated Financial Statements

7 Intangible assets

Customer Computer Innecto Internally Work Total

Value software Technology Generated in Progress

and development Computer

Software

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 January 2022 2,374 2,287 298 506 198 5,663

Transfers - - - - - -

Additions - 191 - - 282 473

Disposals - - - - - -

(________) (________) (________) (________) (________) (________)

At 30 June 2022 2,374 2,478 298 506 480 6,136

(________) (________) (________) (________) (________) (________)

Amortisation

At 1 January 2021 2,059 1,293 170 504 - 4,026

Amortisation charge

for the year 73 259 30 2 - 364

Provided in the - - - - - -

period

Disposals in the - - - - - -

period

(________) (________) (________) (________) (________) (________)

At 30 June 2022 2,132 1,552 200 506 - 4,390

(________) (________) (________) (________) (________) (________)

Net book amount

at 30 June 2022 242 926 98 - 480 1,746

(________) (________) (________) (________) (________) (________)

Net book amount

at 31 December

2021 315 994 128 2 198 1,637

(________) (________) (________) (________) (________) (________)

8 Property, plant and equipment

Freehold Motor vehicles Computer Furniture Leasehold Right of Total

land and equipment fixtures improve- use Assets

properties & fittings ments

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 January 2022 5,037 157 1,112 2,310 38 1,204 9,858

Additions - - 221 1 - 250 472

Disposals - - - - - (36) (36)

(______) (______) (______) (______) (______) (______) (______)

At 30 June 2022 5,037 157 1,333 2,311 38 1,418 10,294

(______) (______) (______) (______) (______) (______) (______)

Depreciation

At 1 January 2022 1,828 125 786 1,265 37 784 4,825

Provided in the

period 43 5 131 108 1 205 493

Disposals - - - - - (12) (12)

(______) (______) (______) (______) (______) (______) (______)

At 30 June 2022 1,871 130 917 1,373 38 977 5,306

(______) (______) (______) (______) (______) (______) (______)

Net book amount

at

30 June 2022 3,166 27 416 938 - 441 4,988

(______) (______) (______) (______) (______) (______) (______)

Net book amount

at

31 December 2021 3,209 32 326 1,045 1 420 5,033

(______) (______) (______) (______) (______) (______) (______)

Notes to the Consolidated Financial Statements

9 Financial Investments

At 30 June At 31 December

2022 2021

Unaudited Audited

GBP'000 GBP'000

Bank deposits 1,733 2,596

Equity Investments 1,256 -

(________) (________)

2,989 2,596

(_________) (_________)

IFRS 13 Fair Value Measurement establishes a fair value

hierarchy that categorises into three levels the inputs to

valuation techniques used to measure fair value. The fair value

hierarchy gives the highest priority to quoted prices (unadjusted)

in active markets for identical assets or liabilities (Level 1

inputs) and the lowest priority to unobservable inputs (Level 3

inputs)

-- Level 1: quoted prices (unadjusted) in active markets for

identical assets or liabilities

-- Level 2: inputs other than quoted prices included within

Level 1 that are observable for the asset or liability, either

directly (i.e. as prices) or indirectly (i.e. derived from

prices)

-- Level 3: inputs for the asset or liability that are not based

on observable market data (unobservable

input).

Bank deposits, held at amortised cost, are due within 6 months

and the amortised cost is a reasonable approximation of the fair

value. These would be included within Level 2 of the fair value

hierarchy.

Equity Investments are held at fair value and are considered

Level 1 financial assets.

10 Long Term Incentive Plan (LTIP)

LTIP 2021

During the period, the Remuneration Committee approved a second

tranche of share awards under the existing LTIP approved on 6 April

2021. Further details of the award can be found in the RNS

announcement from 20 April 2022.

Under the scheme share options of Personal Group Holdings Plc

are granted to senior executives with an Exercise Price of 5p

(nominal value of the shares). The share options have various

market and non-market performance conditions which are required to

be achieved for the options to vest. The options also contain

service conditions that require option holders to remain in

employment of the Group. The market and non-market performance

conditions are set out below.

Total Shareholder Return (Market condition)

50% of the awards vest under this condition. Subject to Compound

Annual Growth Rate (CAGR) of the Total Shareholder Return (TSR)

over the Performance Period.

EBITDA Targets (Non-market condition)

35% of the awards vest under this condition. Subject to

cumulative EBITDA over the Performance Period.

Environmental, social and governance targets ("ESG") Targets

(Non-market condition)

Up to 15% of the awards vest under this condition. The awards

shall vest upon the Remuneration Committee determining that all ESG

targets have been met.

The fair value of the of the share options is estimated at the

grant date using a Monte-Carlo binomial option pricing model for

the market conditions, and a Black-Scholes pricing model for

non-market conditions.

Notes to the Consolidated Financial Statements

However, the above performance condition is only considered in

determining the number of instruments that will ultimately

vest.

There are no cash settlements alternatives. The Group does not

have a past practice of cash settlement for these share options.

The Group accounts for the LTIP as an equity-settled plan.

In total, GBP142,000 of employee share-based compensation has

been included in the consolidated income statement to 30 June 2022

(2021: GBP76,000). The corresponding credit is taken to equity. No

liabilities were recognised from share-based transactions. The

remaining GBP10,000 of share-based compensation expense relates to

the Company Share Option Plan (CSOP).

11 Post balance sheet events

On 1(st) July 2022 Personal Group Holdings Plc acquired 100% of

Quintige Consulting Group Limited ("QCG") for GBP965,652.

Included within the half year financial statements are GBP40,000

of acquisition costs incurred in the purchase of QCG.

12 Financial calendar for the year ending 31 December 2022

The Company announces the following dates in its financial

calendar for the year ending 31 December 2022:

-- Preliminary results for the year ending 31 December 2022 -

March 2023

-- Publication of Report and Accounts for 2022 - March 2023

-- AGM

- April/May 2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAPNKAFFAEFA

(END) Dow Jones Newswires

September 27, 2022 02:01 ET (06:01 GMT)

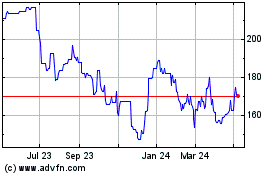

Personal (LSE:PGH)

Historical Stock Chart

From Jan 2025 to Feb 2025

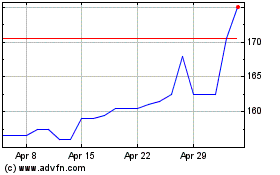

Personal (LSE:PGH)

Historical Stock Chart

From Feb 2024 to Feb 2025