TIDMNBDD TIDMNBDX TIDMNBDG

RNS Number : 3911K

NB Distressed Debt Invest. Fd. Ltd

25 August 2023

NB DISTRESSED DEBT INVESTMENT FUND LIMITED

2023 Interim Report

unaudited CONSOLIDATED interim Financial Statements

For the six month period ended 30 june 2023

COMPANY OVERVIEW | Features

Features

NB Distressed Debt Investment Fund Limited (the "Company")

The Company is a closed-ended investment company incorporated

and registered in Guernsey on 20 April 2010 with registration

number 51774 . The Company is governed under the provisions of the

Companies (Guernsey) Law, 2008 (as amended) (the "Law"), and the

Registered Collective Investment Scheme Rules and Guidance 2021

issued by the Guernsey Financial Services Commission ("GFSC"). It

is a non-cellular company limited by shares and has been declared

by the GFSC to be a registered closed-ended collective investment

scheme. The Company trades on the Specialist Fund Segment ("SFS")

of the London Stock Exchange ("LSE").

The Company is a member of the Association of Investment

Companies (the "AIC") and is classified within the Debt - Loans

& Bonds Category.

Investment Objective

The Company's primary objective is to provide investors with

attractive risk-adjusted returns through long-biased, opportunistic

exposure to stressed, distressed and special situation

credit-related investments while seeking to limit downside risk by,

amongst other things, focusing on senior and senior secured debt

with both collateral and structural protection.

Investment Policy

More information on the Company's investment policy is provided

on page 4 of the Annual Report and Financial Statements for the

year ended 31 December 2022.

Alternative Investment Fund Manager ("AIFM") and Manager

Investment management services are provided to the Company by

Neuberger Berman Investment Advisers LLC (the "AIFM") and Neuberger

Berman Europe Limited (the "Manager"), collectively the "Investment

Manager". The AIFM is responsible for risk management and

discretionary management of the Company's Portfolio and the Manager

provides, amongst other things, certain administrative services to

the Company.

Share Capital

As at 30 June 2023 the Company's share capital comprised the

following(1) :

Ordinary Share Class ("NBDD")

15,382,770 Ordinary Shares, none of which were held in

treasury.

Extended Life Share Class ("NBDX")

47,875,446 Extended Life Shares, none of which were held in

treasury.

New Global Share Class ("NBDG")

27,821,698 New Global Shares, none of which were held in

treasury.

(1) In addition the Company has two Class A Shares in issue.

Further information is provided in the Capital Structure section of

this report below

For the purposes of efficient portfolio management, the Company

has established a number of wholly-owned subsidiaries domiciled in

Luxembourg. All references to the Company in this document refer to

the Company together with its wholly-owned subsidiaries.

Non-Mainstream Pooled Investments

The Company currently conducts its affairs so that the shares

issued by the Company can be recommended by Independent Financial

Advisers to ordinary retail investors in accordance with the

Financial Conduct Authority's ("FCA") rules in relation to

non-mainstream pooled investment ("NMPI") products and intends to

continue to do so for the foreseeable future.

The Company's shares are excluded from the FCA's restrictions

which apply to NMPI products.

Company Numbers

Ordinary Shares

LSE ISIN code: GG00BDFZ6F78

Bloomberg code: NBDD: LN

Extended Life Shares

LSE ISIN code: GG00BRZRVJ00

Bloomberg code: NBDX:LN

New Global Shares

LSE ISIN code: GG00BNTXRB08

Bloomberg code: NBDG:LN

Legal Entity Identifier

YRFO7WKOU3V511VFX790

Website

www.nbddif.com

COMPANY OVERVIEW | Capital Structure

Capital Structure

The Company's share capital consists of three different share

classes, all of which are in the harvest period: the Ordinary Share

Class; the Extended Life Share Class; and the New Global Share

Class. These share classes each have different capital return

profiles and, in one instance a different geographical remit. In

addition, the Company has two Class A Shares in issue. While the

Company's share classes are all now in harvest, returning capital

to shareholders, the Company's corporate umbrella itself has an

indefinite life to allow for flexibility for the Company to add new

share classes if demand, market opportunities and shareholder

approval supported such a move, although the Company has no current

plans to create new share classes. Each share class is considered

in turn below.

Ordinary Share Class

NBDD was established at the Company's launch on 10 June 2010

with a remit to invest in the global distressed debt market with a

focus on North America. The investment period of NBDD expired on 10

June 2013.

Voting rights: Yes

Denomination: US Dollars

Hedging: Portfolio hedged to US Dollars

Authorised share capital: Unlimited

Par value: Nil

Extended Life Share Class

A vote was held at a class meeting of NBDD shareholders on 8

April 2013 where the majority of shareholders voted in favour of a

proposed extension.

Following this meeting and with the NBDD shareholders' approval

of the extension, on 9 April 2013 a new Class, NBDX, was created

and the NBDX Shares were issued to 72% of initial NBDD investors

who elected to convert their NBDD Shares to NBDX Shares. NBDX had a

remit to invest in the global distressed debt market with a focus

on North America. The investment period of NBDX expired on 31 March

2015.

Voting rights: Yes

Denomination: US Dollars

Hedging: Portfolio hedged to US Dollars

Authorised share capital: Unlimited

Par value: Nil

New Global Share Class

NBDG was created on 4 March 2014 and had a remit to invest in

the global distressed market with a focus on Europe and North

America. The investment period of NBDG expired on 31 March

2017.

Voting rights: Yes

Denomination: Pound Sterling

Hedging: Unhedged portfolio

Authorised share capital: Unlimited

Par value: Nil

Class A Shares

The Class A Shares are held by a trustee pursuant to a purpose

trust established under Guernsey law. Under the terms of the Trust

Deed the Trustee holds the Class A Shares for the purpose of

exercising the right to receive notice of general meetings of the

Company but the Trustee shall only have the right to attend and

vote at general meetings of the Company when there are no other

Shares of the Company in issue.

Voting rights: No

Denomination: US Dollars

Authorised share capital: 10,000 Class A Shares

Par value: US Dollar $1

2023 INTERIM PERFORMANCE REVIEW | Financial Highlights

Financial Highlights

Key Figures

Extended

Ordinary Life Share New Global

AS At 30 jUNE 2023 (uNAUDITED) Share Class Class Share Class(1) Aggregated

-------------------------------- ------------- ------------ ---------------- -----------

Net Asset Value ("NAV")

($ millions) 12.2 49.2 23.1 84.5

================================ ============= ============ ================ ===========

NAV per Share ($) 0.7959 1.0267 0.8290 -

================================ ============= ============ ================ ===========

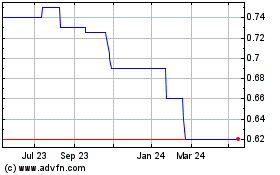

Share Price ($) 0.740 0.5600 0.4513 -

================================ ============= ============ ================ ===========

NAV per Share (GBP) - - 0.6521 -

================================ ============= ============ ================ ===========

Share Price (GBP) - - 0.355 -

================================ ============= ============ ================ ===========

Premium /(Discount) to

NAV per Share (7.02%) (45.46%) (45.56%) -

================================ ============= ============ ================ ===========

Portfolio of Distressed

Investments ($ millions) 7.4 31.8 22.1 61.3

================================ ============= ============ ================ ===========

Cash and Cash Equivalents

($ millions) 4.3 15.5 0.7 20.5

================================ ============= ============ ================ ===========

Total Expense Ratio ("TER")(2) 1.08% 1.18% 1.53% -

================================ ============= ============ ================ ===========

Ongoing Charges (3) 1.05% 1.13% 1.48% -

================================ ============= ============ ================ ===========

Extended

AS At 31 December 2022 Ordinary Life Share New Global

(AUDITED) Share Class Class Share Class(1) Aggregated

-------------------------------- ------------- ------------ ---------------- -----------

Net Asset Value ("NAV")

($ millions) 11.9 58.5 24.8 95.2

================================ ============= ============ ================ ===========

NAV per Share ($) 0.7730 0.9728 0.7987 -

================================ ============= ============ ================ ===========

Share Price ($) 0.740 0.4800 0.4691 -

================================ ============= ============ ================ ===========

NAV per Share (GBP) - - 0.6640 -

================================ ============= ============ ================ ===========

Share Price (GBP) - - 0.39 -

================================ ============= ============ ================ ===========

Premium /(Discount) to

NAV per Share (4.27%) (50.66%) (41.26%) -

================================ ============= ============ ================ ===========

Portfolio of Distressed

Investments ($ millions) 7.3 42.5 24.0 73.8

================================ ============= ============ ================ ===========

Cash and Cash Equivalents

($ millions) 4.4 15.2 0.2 19.8

================================ ============= ============ ================ ===========

Total Expense Ratio ("TER")(2) 0.97% 0.99% 1.33% -

================================ ============= ============ ================ ===========

Ongoing Charges (3) 0.95% 0.96% 1.29% -

================================ ============= ============ ================ ===========

(1) Stated in US Dollars, the GBP price as at 30 June 2023 and

31 December 2022 converted to US Dollars using respective

period/year end exchange rates.

(2) The TERs represent the operating expenses, as required by US

Generally Accepted Accounting Principles ("US GAAP"), expressed as

a percentage of average net assets.

(3) In the period to 30 June 2023, the Company's Ongoing Charges

were 1.21%. This figure is based on an expense figure for the

period to 30 June 2023 of $547,458. This figure, which has been

prepared in accordance with AIC guidance represents the Company's

operating expenses, excluding finance costs payable, expressed as a

percentage of average net assets. Effective 18 March 2021, the

Investment Manager had waived its entitlement to all fees from the

Company. The Ongoing Charges by share class are disclosed

above.

Summary of Value in Excess of Original Capital Invested

Extended

Ordinary Life New Global

Share Class Share Class Share Class

AS At 30 June 2023 ($) ($) (GBP)

------------------------------------- -------------- -------------- --------------

Original Capital Invested (124,500,202) (359,359,794) (110,785,785)

------------------------------------- -------------- -------------- --------------

Total Capital Distributions 129,627,394 290,315,104 51,444,766

------------------------------------- -------------- -------------- --------------

Total Income Distributions (1) 3,166,835 20,695,255 5,070,285

------------------------------------- -------------- -------------- --------------

Distributions as % of Original

Capital 107% 87% 51%

------------------------------------- -------------- -------------- --------------

Total Buybacks - 12,112,379 10,924,963

------------------------------------- ============== -------------- --------------

NAV 12,243,896 49,152,033 18,141,858

------------------------------------- -------------- -------------- --------------

Total of NAV Plus Capital and

Income Returned ("Value") 145,038,125 372,274,771 85,581,872

------------------------------------- -------------- -------------- --------------

Value in Excess of Original Capital

Invested 20,537,923 12,914,977 (25,203,913)

------------------------------------- -------------- -------------- --------------

Value as % of Original Capital

Invested 116% 104% 77%

------------------------------------- -------------- -------------- --------------

Extended

Ordinary Life New Global

Share Class Share Class Share Class

AS At 31 December 2022 ($) ($) (GBP)

------------------------------------- -------------- -------------- --------------

Original Capital Invested (124,500,202) (359,359,794) (110,785,785)

------------------------------------- -------------- -------------- --------------

Total Capital Distributions 129,627,394 278,812,413 49,279,634

------------------------------------- -------------- -------------- --------------

Total Income Distributions (1) 3,166,835 20,695,255 5,070,285

------------------------------------- -------------- -------------- --------------

Distributions as % of Original

Capital 107% 83% 49%

------------------------------------- -------------- -------------- --------------

Total Buybacks - 12,112,379 10,924,963

------------------------------------- ============== -------------- --------------

NAV 11,890,321 58,477,990 20,598,910

------------------------------------- -------------- -------------- --------------

Total of NAV Plus Capital and

Income Returned ("Value") 144,684,550 370,098,037 85,873,792

------------------------------------- -------------- -------------- --------------

Value in Excess of Original Capital

Invested 20,184,348 10,738,243 (24,911,993)

------------------------------------- -------------- -------------- --------------

Value as % of Original Capital

Invested 116% 103% 78%

------------------------------------- -------------- -------------- --------------

(1) By way of dividend

2023 INTERIM PERFORMANCE REVIEW | Chairman's Statement

Chairman's Statement

Dear Shareholder,

The six-month period ending 30 June 2023 continued to see

interest rate increases, high inflation, the war in Ukraine, rising

recession risk and volatile energy prices. With each share class in

its harvest period, we continue to seek to balance the pace of

exits and the value achieved for shareholders as we return capital

to our investors. As a reminder, the Ordinary class shareholders

will no longer receive capital distributions until such time as all

final assets attributable to them have been realised to ensure

compliance with UK regulations.

Company Performance

As at 30 June 2023, the Company had returned a total of $129m or

107% of NBDD investors' original capital of $124.5m, $290m or 87%

of NBDX investors' original capital of $359.4m and GBP51.4m or 51%

of NBDG investors' original capital of GBP110.8m. Currently we are

in what we hope to be the final stages of harvesting a number of

investments and we will keep investors informed as they occur. It

is our intention to fully harvest NBDD during the next 12 months,

subject to market conditions and with this in mind the Investment

Manager is evaluating all options. The Board continues to monitor

all costs to ensure that they are appropriate as we are conscious

that shareholders may be concerned about the impact of costs on a

reducing portfolio during the harvest period. We would therefore

remind shareholders that with effect from 18 March 2021 our

investment manager has agreed to waive all future fees.

Annual General Meeting ("AGM") Results

We were pleased to see that shareholders voted overwhelmingly in

favour of all resolutions proposed at our AGM held on 28 June 2023.

We appreciate that circumstances have adversely impacted the

results the company has achieved and would like to take the

opportunity to thank you all for your votes and continued support.

We would continue to highlight the importance of voting in the AGM.

We are always happy to receive any questions or concerns from

shareholders ahead of the AGM so they can be addressed

beforehand.

Board Composition, Independence and Diversity

Due to the expected wind up of the fund it is not considered

appropriate or practical to refresh the board at this time and we

believe the results of the relevant AGM resolutions endorse this

approach.

Distributions

During the period we made good progress on the realisation of

assets. Following the receipt of proceeds from the realisation of a

lodging & casinos investment the Board resolved on April 17,

2023 to make capital distributions of $0.1356 and GBP0.0698 per

share in respect of the NBDX and NBDG classes respectively. These

distributions were made by a compulsory pro rata redemption of

shares held as at May 2, 2023 with payment being made on May 17,

2023.

On 16 June, 2023, the Board announced a further capital

distribution of $0.0651 per Extended Life Share, again from the

realisation of a lodging & casinos investment, which was paid

13 July 2023.

We will continue to put our income distribution policy to a

shareholder vote at each annual general meeting. I would like to

remind shareholders that such distributions occur on an ad-hoc

basis and are not expected to be either material or equal for each

share class.

Outlook

As I said in the annual report, the final distributions from

each share class have been delayed. The Ordinary class of shares

will be the first to commence the final wind-up process in the next

12 months, followed by the Extended share class and then the New

Global share class. As is normally the case with investment

companies, as opposed to those with commercial undertakings, this

does not currently have any material impact on the Company's

ability to continue as a going concern or to remain viable.

However, the whole process must be managed in a way that ensures

compliance with UK regulations. The Extended and Global classes

will continue to distribute until their net assets are reduced to

approximately $36.5m and GBP8.4m respectively. In certain cases,

the cash associated with these share classes will need to remain in

underlying corporate vehicles while tax and other matters relating

to those vehicles are concluded. We will keep investors appraised

of developments in respect of the remaining assets.

For regulatory reasons, the final 10% of the total return (NAV

plus cumulative distributions) in respect of any class of

participating shares in the Company will be returned to

shareholders with a final compulsory redemption of all of the

outstanding shares of that class.

On behalf of the Board, I would like to thank our longstanding

shareholders for your support of our Company. We look forward to

updating you further on investment realisations throughout the

remainder of the year.

John Hallam

Chairman

24 August 2023

2023 INTERIM PERFORMANCE REVIEW | Investment Manager's

Report

Investment Manager's Report

Ordinary Share Class

Summary

The NAV per share increased by 3.0 % for the period ended June

30, 2023. Public markets were volatile as investors monitored

multiple themes that could impact global growth, including

tightening fiscal and monetary conditions, persistently higher

inflation, supply chain disruptions, a tight labour market, the

ongoing Russian war in Ukraine, and recent bank failures. All could

lead to elevated volatility over the next 12 months and beyond.

Given these circumstances, the timing and quantum of any financial

impact on the portfolio remains very difficult to predict. Despite

the uncertainty, the Investment Manager is committed to realising

the investments in a timely manner and winding down the share class

as soon as practicable, but there is one asset we are working

through which will determine the final distribution date. Currently

we are in what we hope to be the final stages of harvesting a

number of investments and we will keep investors informed as they

occur. It is our intention to fully harvest NBDD during the next 12

months.

Portfolio Update

NBDD ended the period with a NAV per share of $0.7959 compared

to $0.7730 at end of 2022. The rise in NAV was principally driven

by an increase in the value of a packaging company investment. At

30 June 2023, 57% of NBDD's NAV was invested in distressed assets,

and $4M in US Government securities which represented a further 43%

of NAV, with a minimal amount cash net of payables (see table

below). Cash balances will continue to increase as assets are

realised, subject to variations in collateral cash, but as noted

previously cannot be distributed until the final liquidation of the

share class. The portfolio consisted of 5 issuers across four

sectors. The largest sector concentrations were in surface

transportation, containers & packaging and financial

intermediaries.

There were no notable events during 2023.

Cash Analysis

====================== ========

Balance Sheet - Cash $4.3m

====================== ========

Collateral cash ($3.1m)

====================== ========

Other payables ($0.0m)

====================== ========

Total available cash $1.2m

====================== ========

Significant Price Movement during 2023 (more than 1% of NBDD NAV

or approximately $120,000)

INDUSTRY INSTRUMENT TOTAL RETURN COMMENT

(US DOLLARS MILLIONS)

----------------------- ------------------ ------------------------ ---------------------------

Containers & packaging Private Equity 0.4 Sponsor Equity Injection

Surface transport Total Return Swap 0.3 Interest accruals

Exits

During the period, we had no exits. The total number of exits

since inception in NBDD is 51, with a total return of $35.4m.

Partial Realisations

The partial realisations have generated net realised gains of

$7.8m over the life of the fund. Detailed descriptions of the

partial realisations are at the end of this report.

Distributions

To date, $132.8m or 107% of original capital has been

distributed to investors in the form of capital distributions via

redemptions and income dividends. Total value to investors

including NAV and all distributions paid is $145.0m (116% of

original capital). For regulatory reasons, the final 10% of the

total return (NAV plus cumulative distributions) in respect of any

class of participating shares in NBDDIF will be returned to

shareholders with a final compulsory redemption of all of the

outstanding shares of that class. The next distribution for NBDD

will be the final distribution to shareholders and will wind down

the share class which is expected to be in 2024, assuming

supportive market conditions. We will continue to update investors

as we gain clarity on the realisations.

Extended Life Share Class

Summary

The NAV per share increased by 5.5 % for the period ended June

30, 2023. Public markets were volatile as investors monitored

multiple themes that could impact global growth, including

tightening fiscal and monetary conditions, persistently higher

inflation, supply chain disruptions, a tight labour market, the

ongoing Russian war in Ukraine, and recent bank failures. All could

lead to elevated volatility over the next 12 months and beyond.

Given these circumstances, the timing and quantum of any financial

impact on the portfolio remains very difficult to predict. Despite

the uncertainty, the Investment Manager is committed to realising

the investments in a timely manner and winding down the share class

as soon as practicable. Currently we are in what we hope to be the

final stages of harvesting a number of investments and we will keep

investors informed as they occur. It is our intention to fully

harvest NBDX during the next 12 months.

Portfolio Update

NBDX ended the period with a NAV per share of $1.0267 compared

to $0.9728 at end of 2022. At 30 June 2023, 82% of NBDX's NAV was

invested in distressed assets, and $1.9M in US Government

securities which represented a further 18% of NAV with a minimal

amount of cash net of payables (see table below). Cash balances

will continue to increase as assets are realised, subject to

variations in collateral cash, but as noted previously not all can

be distributed until the final liquidation of the share class. The

NAV per share increase during the period was principally driven by

a distribution received from a financial intermediary investment,

an increase in value of a packaging investment, and the exit of two

lodging & casinos investments. The NBDX portfolio consists of 8

issuers across 6 sectors. The largest sector concentrations were in

surface transportation, financial intermediaries, oil & gas,

containers & packaging.

Cash Analysis

====================== ========

Balance Sheet - Cash $15.5m

====================== ========

Collateral cash ($8.7m)

====================== ========

Other payables ($0.1m)

====================== ========

Total available cash $6.6m

====================== ========

Notable events below describe activity in the investments during

2023:

-- In March of 2023, a restructuring agreement for a lodging

& casinos investment was executed which resulted in a paydown

of the Secured Notes. Proceeds were received in April. NBDX

received approximately $6.4mm.

-- In May of 2023, we exited another lodging & casinos

investment in the secondary market. NBDX received approximately

$2.0mm.

-- In June 2023, a financial intermediary investment made a

distribution to its surplus note holders of approximately $33.4

million, of which NBDX received $4.3mm.

Significant Price Movements during 2023 (approximately 1% of

NBDX NAV or $490,000)

INDUSTRY INSTRUMENT TOTAL RETURN COMMENT

(USD MILLIONS)

------------------- ---------------- ---------------- -------------------------

Containers &

Packaging Private Equity 1.1 Sponsor Equity Injection

Total Return

Surface Transport Swap 0.7

Exits

In 2023 we had two exits. The total number of exits since

inception in NBDX to 71 with total return of $70.9m.

Partial Realisations

The partial realisations generated net realised gains of $20.0m

over the life of the Company. Detailed descriptions of the partial

realisations are at the end of this report.

Distributions

During 2023 NBDX made $11.5m distributions. The total

distributions to date (dividends, redemptions and buy-backs) amount

to $323.1m or 90% of original capital. Total value to investors

including NAV and all distributions paid is $372.3m or 104% of

original capital. For regulatory reasons, the final 10% of total

return in respect of any class of participating shares in NBDDIF

will be returned to shareholders with the final compulsory

redemption of all of the outstanding shares of that class. The

investment manager has undertaken a review of all the investments

in the light of a changed market and we have updated the

distribution schedule for the investments based on current

expectations. Our current expectation is to wind down the share

class in 2024, assuming supportive market conditions. We will

continue to update investors as we gain clarity on the

realisations.

New Global Share Class

Summary

The NAV per share decreased by 1.79% for the period ended June

30, 2023. Public markets were volatile as investors monitored

multiple themes that could impact global growth, including

tightening fiscal and monetary conditions, persistently higher

inflation, supply chain disruptions, a tight labour market, the

ongoing Russian war in Ukraine, and recent bank failures. All could

lead to elevated volatility over the next 12 months and beyond.

Given these circumstances, the timing and quantum of any financial

impact on the portfolio remains very difficult to predict. Despite

the uncertainty, the Investment Manager is committed to realising

the investments in a timely manner and winding down the share class

as soon as practicable. Currently we are in what we hope to be the

final stages of harvesting a number of investments and we will keep

investors informed as they occur. It is our intention to fully

harvest NBDG during the next 12 months.

Portfolio Update

NBDG ended the period with a NAV per share of GBP0.6521 compared

to GBP0.6640 at the end of 2022. At 30 June 2023, 97% of NBDG's NAV

was invested in distressed assets and 3% of NAV with a minimal

amount of cash net of payables (see table below). NAV per share

decreased during the period principally due to a reduction in value

of a lodging & casinos investment and the strengthening of the

Pound Sterling . T he portfolio consisted of 5 issuers across 5

sectors. The largest sector concentrations were in lodging &

casinos, commercial mortgage, surface transportation and oil &

gas.

Cash Analysis

====================== ========

Balance Sheet - Cash $0.7m

====================== ========

Other payables ($0.1m)

====================== ========

Total available cash $0.6m

====================== ========

Notable events involving NBDG's investments during 2023 are

below :

-- In March of 2023, a restructuring agreement for a lodging

& casinos investment was executed which resulted in a paydown

of the Secured Notes. Proceeds were received in April. NBDG

received approximately GBP2.6mm.

Significant Price Movements during 2023 (approximately 1% of

NBDG NAV or GBP180,000)

INDUSTRY INSTRUMENT TOTAL RETURN COMMENT

(USD MILLIONS)

------------------ ------------------------------------ ----------------- ---------------

Lower Expected

Surface Transport Bank Debt Investments 0.2 Value

Exits

During 2023 there was one exit. The total number of exits since

inception is 32 with a total return of GBP2.7m. Detailed

descriptions of the exits are at the end of this report.

Partial Realisations

There were no partial realisations in NBDG during 2023.

Distributions

During 2023, there were GBP2.2m of distributions. Total

distributions to date (dividends, redemptions, and buy-backs) are

GBP67.4m or 61% of original capital. Total value to investors

including NAV and all distributions paid is GBP85.6m or 77% of

original capital. For regulatory reasons, the final 10% of total

return in respect of any class of participating shares in NBDDIF

will be returned to shareholders with the final compulsory

redemption of all the outstanding shares of that class. The

investment manager has undertaken a review of all the investments

in the light of a changed market and we have updated the

distribution schedule for the investments based on current

expectations. Our current expectation is to wind down the share

class in 2024, assuming supportive market conditions. We will

continue to update investors as we gain clarity on the

realisations.

Summary of Exits across all Share Classes

Exits experienced from inception to date were as follows:

NBDD 51 exits with a total return of $35.4m, IRR (1) of 10% and

ROR of 19%

NBDX 71 exits with a total return of $70.9m, IRR (1) of 5% and

ROR of 12%

NBDG 32 exits with a total return of GBP(2.2m), IRR (1) of (4)%

and ROR of (2)%

The annualised internal rate of return ("IRR") is computed based

on the actual dates of the cash flows of the security (purchases,

sales, interest and principal pay downs), calculated in the base

currency of each portfolio. The Rate of Return ("ROR") represents

the change in value of the security (capital appreciation,

depreciation, and income) as a percentage of the purchase amount.

The purchase amount can include multiple purchases. Total Return

represents the inception to date gain/loss on an investment.

Exit A1 (Exit 32 for NBDG and Exit 70 for NBDX)

Cash Invested Cash Received Total Return Months

Exit (millions) (millions) (millions) IRR ROR Held

A1 Exit

======== ===== ================ ================ =============== ====== ====== =========

8.9 67.8

NBDX 70 $7.8 $13.0 $5.3 % % 101

======== ===== ================ ================ =============== ====== ====== =========

12.9 109.9

NBDG 32 GBP2.5 GBP5.2 GBP2.7 % % 101

======== ===== ================ ================ =============== ====== ====== =========

Exit A2 (Exit 71 for NBDX)

Cash Invested Cash Received Total Return Months

Exit (millions) (millions) (millions) IRR ROR Held

A2 Exit

======== ===== ================ ================ =============== ====== ====== =========

NBDX 71 $14.0 $20.2 $6.1 8.0% 43.7% 116

======== ===== ================ ================ =============== ====== ====== =========

Summary of Partial Realisations across all Share Classes

All partial realisations currently in the portfolio are reported

as at 30 June 2023 and it should be noted that their IRR and ROR

are likely to be different at the time of the final exit. These

were the following partial realisations:

Partial Realisation B: NBDD and NBDX

NBDD and NBDX invested $7.1m to purchase first lien secured bank

debt with attached private equity of an international packaging

company. The debt was repaid in full shortly after the purchase

with the receipt of $5.8m and the Company retained the equity,

receiving dividends of $1.7m during the holding period. During the

second quarter of 2017 the company's sale to a complementary

packaging company was announced. NBDX and NBDD elected to receive

sale proceeds in cash and newly created shares in the acquirer for

a combined value of $4.0m. In the third quarter of 2017, the

Company received $1.5m cash as part of the sale proceeds from the

disposal completed at the end of the second quarter of 2017 and

$1.0m for partial redemption of new shares received in the

acquirer. The company's operating performance declined due to raw

material price increases. The current value of the private equity

position is $1.3m generating a total return of $4.2m as of 30 June

2023. IRR was 25% and ROR was 59% with a holding period of 128

months at 30 June 2023.

Cash Value of

Cash Received Residual

Effective Invested to Date Investment Total Return MonthS

B Period (millions) (millions) (millions) (millions) IRR ROR Held

====== ============= ============= ============ ============= =============== ====== ====== =========

NBDD H1 2017 $2.0 $2.8 $0.4 $1.2 25% 59% 128

====== ============= ============= ============ ============= =============== ====== ====== =========

NBDX H1 2017 $5.1 $7.2 $1.0 $3.0 25% 59% 128

====== ============= ============= ============ ============= =============== ====== ====== =========

Partial Realisation C: NBDD and NBDX

NBDD and NBDX invested $9.2m in preferred equity certificates

("PECs") and private equity of a European packaging company. The

PECs were retired in full in 2015 and the company paid dividends on

the equity during the holding period. Cash received to date is

$23.2m. In the second quarter, the company announced it was

purchasing another complementary packaging company (Partial

Realisation B, above) and completing a recapitalisation to

refinance existing debt, provide cash for the acquisition and pay a

dividend to shareholders. The company's operating performance

declined due to raw material price increases. The current value of

the private equity position is $9.6m, generating a total return of

$23.6m as at 30 June 2023. IRR was 52% and ROR was 256% with a

holding period of 131 months at 30 June 2023.

Cash Value of

Cash Received Residual

Effective Invested to Date Investment Total Return Months

C Period (millions) (millions) (millions) (millions) IRR ROR Held

====== ============= ============= ============ ============= =============== ====== ====== =========

NBDD H1 2017 $2.6 $6.5 $2.7 $6.6 52% 256% 131

====== ============= ============= ============ ============= =============== ====== ====== =========

NBDX H1 2017 $6.6 $16.7 $6.9 $17.0 52% 256% 131

Neuberger Berman Investment Advisers LLC Neuberger Berman Europe Limited

24 August 2023 24 August 2023

2023 INTERIM PERFORMANCE REVIEW | Portfolio Information

Portfolio Information

Ordinary Share Class

Top 4(1) Holdings as at 30 June 2023

Purchased % of

Holding Sector Instrument Status Country NAV Primary Asset

---------- ------------------------- ------------ ----------- ----------- ----- --------------------

1 Surface Transport(2) Trade Claim Defaulted Brazil 31% Municipal Claim

========== ========================= ============ =========== =========== ===== ====================

Post-Reorg Manufacturing Plant

2 Specialty Packaging Equity Post-Reorg Luxembourg 22% and Equipment

========== ========================= ============ =========== =========== ===== ====================

Secured

3 Financial Intermediaries Notes Post-Reorg US 3% Cash & Securities

========== ========================= ============ =========== =========== ===== ====================

Post-Reorg Manufacturing Plant

4 Specialty Packaging Equity Post-Reorg Luxembourg 3% and Equipment

========== ========================= ============ =========== =========== ===== ====================

Total 59%

========== ========================= ============ =========== =========== ===== ====================

Sector Breakdown(3)

[For Investment Structure of the Company, click on, or paste the

following link into your web browser, to view page 1 in the

associated PDF document]

http://www.rns-pdf.londonstockexchange.com/rns/3911K_1-2023-8-24.pdf

(1) Ordinary Share Class holds four investments by issuer.

(2) As at 30 June 2023 collateral pledged is included in the

Surface Transport Market Value.

(3) Categorisations determined by Neuberger Berman; percentages

determined by Neuberger Berman and U.S Bank Global Fund Services

(Guernsey) Limited / U.S. Bank Global Fund Services (Ireland)

Limited as Administrator / Sub-Administrator to the Company.

[For Investment Structure of the Company, click on, or paste the

following link into your web browser, to view page 2 in the

associated PDF document]

(http://www.rns-pdf.londonstockexchange.com/rns/3911K_1-2023-8-24.pdf)

(4) Categorisations determined by Neuberger Berman and

percentages determined by the Administrator, as a percentage of the

net asset values as at 30 June 2023 and 31 December 2022.

(5) As at 30 June 2023 collateral pledged is included in the

Brazil Market Value.

Extended Life Share Class

Top 8(1) Holdings as at 30 June 2023

%

Purchased of

Holding Sector Instrument Status Country NAV Primary Asset

---------- --------------------- -------------- ----------- ------------ ----- --------------------

1 Surface Transport(2) Trade Claim Defaulted Brazil 20% Municipal Claim

========== ===================== ============== =========== ============ ===== ====================

Post-Reorg

2 Oil & Gas Equity Post-Reorg US 16% Ethanol Plant

========== ===================== ============== =========== ============ ===== ====================

Specialty Post-Reorg Manufacturing Plant

3 Packaging Equity Post-Reorg Luxembourg 14% and Equipment

========== ===================== ============== =========== ============ ===== ====================

Commercial Commercial Real

4 Mortgage Secured Loan Defaulted Netherlands 10% Estate

========== ===================== ============== =========== ============ ===== ====================

5 Surface Transport Secured Loan Defaulted Spain 9% Concession

========== ===================== ============== =========== ============ ===== ====================

Financial

6 Intermediaries Secured Notes Defaulted US 8% Cash and Securities

========== ===================== ============== =========== ============ ===== ====================

Manufacturing Plant

7 Auto Components Secured Loan Post-Reorg US 4% and Equipment

========== ===================== ============== =========== ============ ===== ====================

Specialty Post-Reorg Manufacturing Plant

8 Packaging Equity Post-Reorg Luxembourg 2% and Equipment

========== ===================== ============== =========== ============ ===== ====================

Total 83%

========== ===================== ============== =========== ============ ===== ====================

Sector Breakdown(3)

[For Investment Structure of the Company, click on, or paste the

following link into your web browser, to view page 3 in the

associated PDF document]

http://www.rns-pdf.londonstockexchange.com/rns/3911K_1-2023-8-24.pdf

(1) Extended Share Class holds eight investments by issuer.

(2) As at 30 June 2023 collateral pledged is included in the

Surface Transport Market Value.

(3) Categorisations determined by Neuberger Berman; percentages

determined by Neuberger Berman and U.S Bank Global Fund Services

(Guernsey) Limited / U.S. Bank Global Fund Services (Ireland) as

Administrator / Sub-Administrator to the Company.

[For Investment Structure of the Company, click on, or paste the

following link into your web browser, to view page 4 in the

associated PDF document]

http://www.rns-pdf.londonstockexchange.com/rns/3911K_1-2023-8-24.pdf

(4) Categorisations determined by Neuberger Berman and

percentages determined by the Administrator, as a percentage of the

net asset values as at 30 June 2023 and 31 December 2022.

(5) As at 31 December 2022 collateral pledged is included in the

Brazil Market Value.

New Global Share Class

Top 5(1) Holdings as at 30 June 2023

Purchased % of

Holding Sector Instrument Status Country NAV Primary Asset

---------- ------------------------- ----------------- ----------- ------------ ----- -------------------

Secured Loan

Lodging & / Private

1 Casinos Equity Current Spain 37% Hotel/Casino

========== ======================= =================== =========== ============ ======= =================

Commercial Commercial

2 Mortgage Secured Loan Defaulted Netherlands 26% Real Estate

========== ======================= =================== =========== ============ ======= =================

3 Surface Transportation Secured Loan Defaulted Spain 18% Legal Claim

========== ======================= =================== =========== ============ ======= =================

4 Oil & Gas Private Equity Post-Reorg US 14% Ethanol Plant

========== ======================= =================== =========== ============ ======= =================

Manufacturing

5 Auto Components Secured Loan Post-Reorg US 3% Plant

========== ======================= =================== =========== ============ ======= =================

Total 98%

========== =========================== =============== =========== ============ ======= =================

Sector Breakdown(2)

[For Investment Structure of the Company, click on, or paste the

following link into your web browser, to view page 5 in the

associated PDF document]

http://www.rns-pdf.londonstockexchange.com/rns/3911K_1-2023-8-24.pdf

(1) Global Share Class holds five investments by issuer

(2) Categorisations determined by Neuberger Berman; percentages

determined by Neuberger Berman and U.S Bank Global Fund Services

(Guernsey) Limited / U.S. Bank Global Fund Services (Ireland)

Limited as Administrator / Sub-Administrator to the Company.

[For Investment Structure of the Company, click on, or paste the

following link into your web browser, to view page 6 in the

associated PDF document]

http://www.rns-pdf.londonstockexchange.com/rns/3911K_1-2023-8-24.pdf

(3) Categorisations determined by Neuberger Berman and

percentages determined by the Administrator, as a percentage of the

net asset values as at 30 June 2023 and 31 December 2022.

2023 INTERIM PERFORMANCE REVIEW | GOVERNANCE

Interim Management Report and Directors' Responsibility

Statement

Principal and Emerging Risks and Uncertainties

The principal and emerging risks of the Company are in the

following areas:

-- investment activity and performance;

-- principal risks associated with harvest periods;

-- level of premium or discount;

-- market price risk;

-- fair valuation of illiquid assets;

-- accounting, legal and regulatory risk;

-- operational risk;

-- climate related risks; and

-- issuance of new regulations;

These risks, and the way in which they are managed, are

described in more detail in the Strategic Report on pages 24 to 25

of the Company's latest annual report and audited financial

statements for the year ended 31 December 2022, which can be found

on the Company's website at

www.nbddif.com/pdf/nbddif_annual_report_2022_042923.pdf. The

Board's view is that these risks remain appropriately identified

for the remainder of 2023.

In addition to the Principal Risks, the invasion of Ukraine is

of concern and the Company has considered its potential impact on

asset values, and while no direct impact has been identified,

values are affected by its impact on the global economy. To manage

these risks further, the Investment Manager reviews time to

realisation quarterly to ensure balance between timing and value.

Moreover, while the risks associated with the COVID 19 pandemic

have largely receded the Investment Manager continues to monitor

the situation.

Going Concern

The financial position of the Company is set out below. In

addition, note 4 to the Unaudited Consolidated Interim Financial

Statements includes the Company's objectives, policies and

processes for managing its capital, its financial risk management

and its exposures to credit risk and liquidity risk.

The Directors have undertaken a rigorous review of the Company's

ability to continue as a going concern including reviewing the

on-going cash flows and the level of cash balances, the likely

liquidity of investments and any income deriving from those

investments as of the reporting date as well as taking into

consideration the impact of emerging risks and have determined that

the Company has adequate financial resources to meet its

liabilities as they fall due.

Having reassessed the principal and emerging risks , the

Directors consider it appropriate to prepare the Unaudited

Consolidated Interim Financial Statements (the "Financial

Statements") on a going concern basis.

Related Party Transactions

The contracts with the Investment Manager and Directors are the

only related party transactions currently in place. Other than fees

payable in the ordinary course of business, there have been no

material transactions with related parties, which have affected the

financial position or performance of the Company in the six month

period ended 30 June 2023. Additional related party disclosures are

given in Note 6 below.

Directors' Responsibilities Statement

The Board of Directors confirms that, to the best of its

knowledge:

-- The Financial Statements have been prepared in conformity

with US generally accepted accounting principles ("US GAAP"), give

a true and fair view of the assets, liabilities, financial position

and the return of the undertakings included in the consolidation as

a whole as required by DTR 4.2.4R of the Disclosure Guidance and

Transparency Rules ("DTR") of the UK's Financial Conduct Authority

(the "UK FCA"); and

-- The combination of the Chairman's Statement, the Investment

Manager's Report, this Interim Management Report and the notes to

the Financial Statements meet the requirements of an interim

management report, and include a fair view of the information

required by:

1. DTR 4.2.7R, being an indication of important events that have

occurred during the first six months of the current financial year

and their impact on the set of financial statements together with a

description of the principal risks and uncertainties for the

remaining six months of the year; and

2. DTR 4.2.8R, being related party transactions that have taken

place in the first six months of the current financial year and

that have materially affected the financial position or performance

of the Company during that period; and any changes in the related

party transactions described in the last annual report that could

do so.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website and for the preparation and dissemination of

Financial Statements. Legislation in Guernsey governing the

preparation and dissemination of the Financial Statements may

differ from legislation in other jurisdictions.

These Interim Report and Financial Statements have been reviewed

by the Company's auditor and their report is set out below.

By order of the Board

John Hallam Christopher Legge

Chairman Director

24 August 2023 24 August 2023

2023 INTERIM PERFORMANCE REVIEW | GOVERNANCE

Independent Review Report to NB Distressed Debt Investment Fund

Limited

Conclusion

We have been engaged by NB Distressed Debt Investment Fund

Limited (the "Company") to review the consolidated financial

statements (the "financial statements") in the half-yearly

financial report for the six months ended 30 June 2023 of the

Company and its subsidiaries (together, the "Group"), which

comprises the unaudited consolidated statement of assets and

liabilities, the unaudited consolidated statement of operations,

the unaudited consolidated statement of changes in net assets, the

unaudited consolidated statement of cash flows, the unaudited

consolidated condensed schedule of investments and the related

explanatory notes.

Based on our review, nothing has come to our attention that

causes us to believe that the financial statements in the

half-yearly financial report for the six months ended 30 June 2023

do not give a true and fair view of the financial position of the

Group as at 30 June 2023 and of its financial performance and its

cash flows for the six month period then ended, in accordance with

U.S. generally accepted accounting principles and the Disclosure

Guidance and Transparency Rules ("the DTR") of the UK's Financial

Conduct Authority ("the UK FCA").

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410 Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity ("ISRE (UK) 2410") issued by the Financial Reporting Council

for use in the UK. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. We read the other information contained in the

half-yearly financial report and consider whether it contains any

apparent misstatements or material inconsistencies with the

information in the financial statements.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and

consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Scope of review

section of this report, nothing has come to our attention to

suggest that the directors have inappropriately adopted the going

concern basis of accounting or that the directors have identified

material uncertainties relating to going concern that are not

appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410. However future events or conditions

may cause the Group to cease to continue as a going concern, and

the above conclusions are not a guarantee that the Group will

continue in operation.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the interim financial report in accordance with the

DTR of the UK FCA.

The financial statements included in this interim report have

been prepared in accordance with U.S. generally accepted accounting

principles.

In preparing the half-yearly financial report, the directors are

responsible for assessing the Group's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless

liquidation is imminent.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the financial statements in the half-yearly financial report based

on our review. Our conclusion, including our conclusions relating

to going concern, are based on procedures that are less extensive

than audit procedures, as described in the scope of review

paragraph of this report.

The purpose of our review work and to whom we owe our

responsibilities

This report is made solely to the Company in accordance with the

terms of our engagement letter to assist the Company in meeting the

requirements of the DTR of the UK FCA. Our review has been

undertaken so that we might state to the Company those matters we

are required to state to it in this report and for no other

purpose. To the fullest extent permitted by law, we do not accept

or assume responsibility to anyone other than the Company for our

review work, for this report, or for the conclusions we have

reached.

Barry Ryan

For and on behalf of KPMG Channel Islands Limited

Chartered Accountants

Guernsey

24 August 2023

FINANCIAL STATEMENTS | Unaudited Consolidated Statement of

Assets and Liabilities

Unaudited - see accompanying accountants report

Unaudited Consolidated Statement of Assets and Liabilities

AS AT 30 JUNE 2023 AND 31 DECEMBER 2022

30 June 31 December

2023 2022

(EXPRESSED IN US DOLLARS EXCEPT WHERE

STATED OTHERWISE) (Unaudited) (Audited)

============================================== ============== === ===================================

Assets

============================================== ============== === ===================================

Investments at fair value (2023: cost

of $89,077,176; 2022: cost of $103,009,846) 61,368,128 73,743,616

============================================== ============== === ===================================

Forward currency contracts 137,116 12,018

============================================== ============== === ===================================

Total Return Swaps (2023: cost of $Nil

, 2022: cost of $Nil) 2,802,366 1,558,420

============================================== ============== === ===================================

Cash and cash equivalents 8,617,196 8,733,589

============================================== ============== === ===================================

Restricted Cash:

============================================== ============== === ===================================

Forward currency contracts Collateral 820,000 90,000

============================================== ============== === ===================================

Total return swap Collateral 10,970,000 10,970,000

============================================== ============== === ===================================

84,714,806 95,107,643

============================================== ============== === ===================================

Other assets

============================================== ============== === ===================================

Interest receivables 436,736 596,024

============================================== ============== === ===================================

Receivables for investments sold 39,907 498,514

============================================== ============== === ===================================

Other receivables and prepayments 29,863 72,304

============================================== ============== === ===================================

Withholding tax receivable 445,762 445,762

============================================== ============== === ===================================

Total assets 85,667,074 96,720,247

============================================== ============== === ===================================

Liabilities

============================================== ============== === ===================================

Credit default swap (2023: cost of $16,821;

2022: cost of $16,821) 42,900 21,494

============================================== ============== === ===================================

Forward currency contracts 911,324 1,269,365

============================================== ============== === ===================================

Accrued expenses and other liabilities 252,270 282,649

============================================== ============== === ===================================

Total liabilities 1,206,494 1,573,508

============================================== ============== === ===================================

Net assets 84,460,580 95,146,739

============================================== ============== === ===================================

Net assets attributable to Ordinary Shares

(shares 2023: 15,382,770;

2022: 15,382,770) 12,243,896 11,890,321

============================================== ============== === ===================================

Net asset value per Ordinary Share 0.7959 0.7730

============================================== ============== === ===================================

Net assets attributable to Extended Life

Shares (shares 2023: 47,875,446;

2022: 60,116,016) 49,152,033 58,477,990

============================================== ============== === ===================================

Net asset value per Extended Life Share 1.0267 0.9728

============================================== ============== === ===================================

Net assets attributable to New Global

Shares (shares 2023: 27,821,698;

2022: 31,023,609) GBP18,141,858 GBP 20,598,909

============================================== ============== === ===================================

Net asset value per New Global Share GBP0.6521 GBP0.6640

============================================== ============== === ===================================

Net assets attributable to New Global

Shares (USD equivalent) 23,064,651 24,778,428

============================================== ============== === ===================================

Net asset value per New Global Share

(USD equivalent) 0.8290 0.7987

============================================== ============== === ===================================

The Unaudited Consolidated Interim Financial Statements were

approved and authorised for issue by the Board of Directors on 24

August 2023, and signed on its behalf by:

John Hallam Christopher Legge

Chairman Director

The accompanying notes below are an integral part of the

Unaudited Consolidated Interim Financial Statements.

FINANCIAL STATEMENTS | Unaudited Consolidated Statement of Operations

Unaudited - see accompanying accountants report

Unaudited Consolidated Statement of Operations

FOR THE SIX MONTH PERIODED 30 JUNE 2023 AND 30 JUNE 2022

(UNAUDITED)

30 jUNE

2023 30 jUNE 2022

(EXPRESSED IN US DOLLARS) (UNAUDITED) (UNAUDITED)

=============================================== ==== ============== === === ==============

Income

=============================================== ==== ============== === === ==============

Interest income 1,196,890 2,788,620

===================================================== ============== === === ==============

1,196,890 2,788,620

==================================================== ============== === === ==============

Expenses

=============================================== ==== ============== === === ==============

Professional and other expenses 418,980 494,094

===================================================== ============== === === ==============

Administration fee 43,636 49,412

===================================================== ============== === === ==============

Loan administration and custody fees 9,959 15,187

===================================================== ============== === === ==============

Directors' fees and expenses 96,725 97,900

===================================================== ============== === === ==============

569,300 656,593

==================================================== ============== === === ==============

Net investment income 627,590 2,132,027

===================================================== ============== === === ==============

Realised and unrealised (loss)/gain

from investments and foreign exchange

=============================================== ==== ============== === === ==============

Net realised gain on investments,

credit default swap, total return

swap and forward currency transactions 1,836,516 546,562

===================================================== ============== === === ==============

Net change in unrealised gain on investments,

credit default swap, total return

swap and forward currency transactions 1,050,289 1,491,006

===================================================== ============== === === ==============

Realised and unrealised gain from

investments and foreign exchange 2,886,805 2,037,568

===================================================== ============== === === ==============

Net increase in net assets resulting

from operations 3,514,395 4,169,595

===================================================== ============== === === ==============

The accompanying notes below are an integral part of the

Unaudited Consolidated Interim Financial Statements.

FINANCIAL STATEMENTS | Unaudited Consolidated Statement of Changes

in Net Assets

Unaudited - see accompanying accountants report

Unaudited Consolidated Statement of Changes in Net Assets

FOR THE SIX MONTH PERIODED 30 JUNE 2023 (UNAUDITED)

30 JUNE 30 JUNE

2023 30 JUNE 2023 2023 30 JUNE

Ordinary Extended New Global 2023

(EXPRESSED IN US DOLLARS) Shares Life Shares Shares Aggregated

================================ =========== ============= ============ =============

Net assets at the beginning

of the period 11,890,321 58,477,990 24,778,428 95,146,739

================================ =========== ============= ============ =============

Net investment gain 11,102 188,164 428,324 627,590

================================ =========== ============= ============ =============

Net realised gain/(loss)

on investments, credit

default swap and forward

currency transactions 365,374 2,059,942 (588,800) 1,836,516

================================ =========== ============= ============ =============

Net change in unrealised

gain/(loss) on investments,

credit default swap and

forward currency transactions (22,901) (71,372) 1,144,562 1,050,289

================================ =========== ============= ============ =============

Shares redeemed during

the period - (11,502,691) (2,697,863) (14,200,554)

================================ =========== ============= ============ =============

Net assets at the end

of the period 12,243,896 49,152,033 23,064,651 84,460,580

================================ =========== ============= ============ =============

FOR THE SIX MONTH PERIODED 30 JUNE 2022 (UNAUDITED)

30 JUNE 30 JUNE

2022 30 JUNE 2022 2022 30 JUNE

Ordinary Extended New Global 2022

(EXPRESSED IN US DOLLARS) Shares Life Shares Shares Aggregated

================================ ============ ============= ============ ============

Net assets at the beginning

of the period 13,887,833 74,450,993 32,215,319 120,554,145

================================ ============ ============= ============ ============

Net investment (loss)/gain (44,404) 1,460,412 716,019 2,132,027

================================ ============ ============= ============ ============

Net realised (loss)/gain

on investments, credit

default swap and forward

currency transactions (242,763) 736,512 52,813 546,562

================================ ============ ============= ============ ============

Net change in unrealised

(loss)/gain on investments,

credit default swap and

forward currency transactions (1,046,046) 1,459,930 1,077,122 1,491,006

================================ ============ ============= ============ ============

Dividends - (3,302,348) (1,647,824) (4,950,172)

================================ ============ ============= ============ ============

Net assets at the end

of the period 12,554,620 74,805,499 32,413,449 119,773,568

================================ ============ ============= ============ ============

The accompanying notes below are an integral part of the

Unaudited Consolidated Interim Financial Statements.

FINANCIAL STATEMENTS | Unaudited Consolidated Statement of Cash

Flows

Unaudited - see accompanying accountants report

Unaudited Consolidated Statement of Cash Flows

FOR THE SIX MONTH PERIODED 30 JUNE 2023 AND 30 JUNE 2022

30 JUNE

30 JUNE 2023 2022

(UNAUDITED) (UNAUDITED)

============================================ ====== ==== ============== === ==============

Cash flows from operating activities:

==================================================== ==== ============== === ==============

Net increase in net assets resulting

from operations 3,514,395 4,169,595

==================================================== ==== ============== === ==============

Adjustment to reconcile net increase/(decrease)

in net assets resulting from operations

to net cash flow provided by operations:

==================================================== ==== ============== === ==============

Net realised gain on investments, credit

default swap, total return swap and forward

currency transactions (1,836,516) (546,562)

==================================================== ==== ============== === ==============

Net change in unrealised (gain) on investments,

credit default swap, total return swap

and forward currency transactions (1,050,289) (1,491,006)

==================================================== ==== ============== === ==============

Accretion of discount on loans and bonds 63,648 (91,835)

==================================================== ==== ============== === ==============

Changes in interest receivable 159,288 280,557

==================================================== ==== ============== === ==============

Changes in receivables for investments

sold 458,607 37,783

==================================================== ==== ============== === ==============

Changes in other receivables and prepayments 42,441 51,447

==================================================== ==== ============== === ==============

Changes in withholding tax receivable - -

==================================================== ==== ============== === ==============

Changes in payables, accrued expenses

and other liabilities (30,379) 3,162

==================================================== ==== ============== === ==============

Cash received on settled forward currency

contracts and spot currency contracts (2,334,367) (724,615)

==================================================== ==== ============== === ==============

Capitalised payment in kind (1,101,998) (2,054,670)

==================================================== ==== ============== === ==============

Sale of investments 16,897,272 10,548,892

==================================================== ==== ============== === ==============

Net cash provided by operating activities 14,782,102 10,182,748

==================================================== ==== ============== === ==============

Cash flows from financing activities:

==================================================== ==== ============== === ==============

Shares redeemed during the period (14,200,554) -

==================================================== ==== ============== === ==============

Changes in movement in forward currency

collateral payable - 880,000

==================================================== ==== ============== === ==============

Net cash (used in)/ from financing activities (14,200,554) 880,000

==================================================== ==== ============== === ==============

Net increase in cash, cash equivalents

and restricted cash 581,548 11,062,748

==================================================== ==== ============== === ==============

Cash and cash equivalents at the beginning

of the period 8,733,589 4,370,854

==================================================== ==== ============== === ==============

Restricted cash at the beginning of the

period 11,060,000 10,970,000

==================================================== ==== ============== === ==============

Effect of exchange rate changes on cash

and cash equivalents 32,059 (17,816)

==================================================== ==== ============== === ==============

Cash and cash equivalents at the end

of the period 8,617,196 15,415,786

==================================================== ==== ============== === ==============

Restricted cash at the end of the period 11,790,000 10,970,000

==================================================== ==== ============== === ==============

Supplemental cash flow information

There were no reorganisations requiring disclosure in the period to

30 June 2023 (30 June 2022: None).

The accompanying notes below are an integral part of the

Unaudited Consolidated Interim Financial Statements.

FINANCIAL STATEMENTS | Unaudited Consolidated Condensed Schedule

of Investments

Unaudited - see accompanying accountants report

Unaudited Consolidated Condensed Schedule of Investments (by

financial instrument)

Extended

AS AT 30 JUNE 2023 Ordinary Life New Global Total

(UNAUDITED) Shares Shares Shares Company

(EXPRESSED IN US DOLLARS) Cost Fair Value (%)(1) (%)(1) (%)(1) (%)(1)

============================ =========== =========== =========== ========= ============ =========

Portfolio of Distressed

Investments

============================ =========== =========== =========== ========= ============ =========

Bank Debt Investments 50,776,643 33,851,612 0.00 33.97 74.38 40.08

============================ =========== =========== =========== ========= ============ =========

Private Equity 11,238,099 17,826,931 25.12 19.89 21.58 21.11

============================ =========== =========== =========== ========= ============ =========

Private Note 19,707,684 3,717,786 2.25 7 - 4.40

============================ =========== =========== =========== ========= ============ =========

Short term Investments

============================ =========== =========== =========== ========= ============ =========

US Treasury Bills 7,354,750 5,971,799 33.04 3.92 - 7.07

============================ =========== =========== =========== ========= ============ =========

Total Investments 89,077,176 61,368,128 60.41 64.78 95.96 72.66

============================ =========== =========== =========== ========= ============ =========

Ordinary Shares 7,010,194 7,396,782 60.41 - - 8.76

============================ =========== =========== =========== ========= ============ =========

Extended Life Shares 48,353,557 31,840,117 - 64.78 - 37.70

============================ =========== =========== =========== ========= ============ =========

New Global Shares 33,713,425 22,131,229 - - 95.96 26.20

============================ =========== =========== =========== ========= ============ =========

89,077,176 61,368,128 60.41 64.78 95.96 72.66

============================ =========== =========== =========== ========= ============ =========

Credit Default Swap

============================ =========== =========== =========== ========= ============ =========

Ordinary Shares (4,715) (12,025) (0.10) - - (0.01)

============================ =========== =========== =========== ========= ============ =========

Extended Life Shares (12,106) (30,875) - (0.06) - (0.04)

============================ =========== =========== =========== ========= ============ =========

(16,821) (42,900) (0.10) (0.06) - (0.05)

============================ =========== =========== =========== ========= ============ =========

Forward Currency

Contracts

============================ =========== =========== =========== ========= ============ =========

Assets

============================ =========== =========== =========== ========= ============ =========

Ordinary Shares - 22,697 0.19 - - 0.03

============================ =========== =========== =========== ========= ============ =========

Extended Life Shares - 114,419 - 0.23 - 0.13

============================ =========== =========== =========== ========= ============ =========

- 137,116 0.19 0.23 - 0.16

============================ =========== =========== =========== ========= ============ =========

Liabilities

============================ =========== =========== =========== ========= ============ =========

Ordinary Shares - (255,889) (2.09) - - (0.30)

============================ =========== =========== =========== ========= ============ =========

Extended Life Shares - (655,435) - (1.33) - (0.78)

============================ =========== =========== =========== ========= ============ =========

- (911,324) (2.09) (1.33) - (1.08)