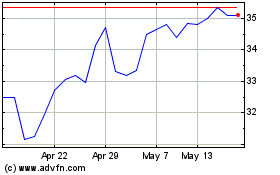

Metro Bank Holdings PLC (MTRO)

Metro Bank Holdings PLC: Interim results for half year ended 30 June 2023

01-Aug-2023 / 07:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

Metro Bank Holdings PLC

Interim results

Trading update H1 2023

1 August 2023

Metro Bank Holdings PLC (LSE: MTRO LN)

Interim results for half year ended 30 June 2023

Highlights

Underlying profit before tax of GBP16.1 million (H2 2022: loss of GBP2.6 million) represents the third

-- consecutive quarter of underlying profitability, reflecting improved operating margins driven by the

actions taken as part of the turnaround plan to optimise the balance sheet and control cost inflation

for sustainable profitability.

-- Statutory profit before tax of GBP15.4 million (H2 2022: loss of GBP10.5 million) reflects the significant

reduction in exceptional items and has supported capital accretion in the half.

-- Total underlying revenue was up 21% YoY but remained flat HoH at GBP285.6 million (H2 2022: GBP285.9

million, H1 2022: GBP236.2 million) reflecting improved lending yields offset by increased cost of

deposits and limited loan growth given capital availability.

Total underlying operating expenses reduced 3% both YoY and HoH to GBP258.2 million (H2 2022: GBP266.5

-- million, H1 2022: GBP266.3 million), driving positive jaws of 24% YoY and 3% HoH, despite persistent high

inflation, as a result of the continued focus on cost discipline and the successful implementation of

initiatives that enable the bank to scale appropriately.

The bank's service-led core deposit franchise remains resilient to increased competition in the market

-- and continues to attract new customers, opening 106,000 Personal Current Accounts and 23,000 Business

Current Accounts in the half. The bank remained ranked first for customer service in Stores in the CMA

survey.

-- Customer deposits reduced 3% HoH to GBP15.5 billion (31 December 2022: GBP16.0 billion) in line with

prevailing market conditions, though the bank saw net deposit inflows in June, a trend that continued in

July.

-- The bank's MREL ratio was 18.1% as at 30 June 2023, up 40bps from 17.7% as at 31 December 2022 and up

70bps from 17.4% as at 1 January 2023, reflecting the disciplined origination strategy and statutory

profit for the half.

Daniel Frumkin, Chief Executive Officer at Metro Bank, said:

"I am encouraged by the activity across the business. Our

statutory profitability in H1, making this the third consecutive

quarter of underlying profitability, demonstrates that our strategy

is working. We continue to win new customers every day through our

service-led franchise, at the same time as showing ongoing cost

discipline and pursuing our targeted store expansion. Whilst we

remain watchful of macro-economic headwinds, we have the expertise,

capability and infrastructure in place to unlock our future growth

potential."

Key Financials

30 Jun 31 Dec Change from 30 Jun Change from

GBP in millions 2023 2022 FY 2022 2022 H1 2022

Assets GBP21,747 GBP22,119 (2%) GBP22,566 (4%)

Loans GBP12,572 GBP13,102 (4%) GBP12,364 2%

Deposits GBP15,529 GBP16,014 (3%) GBP16,514 (6%)

Loan to deposit ratio 81% 82% (1pp) 75% 6pps

CET1 capital ratio 10.4% 10.3% 10bps 10.6% (20bps)

Total capital ratio (TCR) 13.2% 13.4% (20bps) 13.8% (60bps)

MREL ratio 18.1% 17.7% 40bps 18.3% (20bps)

Liquidity coverage ratio 214% 213% 1pp 257% (43pps)

H1 H2 Change from H1 Change from

GBP in millions 2023 2022 H2 2022 2022 H1 2022

Total underlying revenue1 GBP285.6 GBP285.9 - GBP236.2 21%

Underlying profit/(loss) before tax2 GBP16.1 (GBP2.6) n.m. (GBP48.0) n.m.

Statutory profit/(loss) before tax GBP15.4 (GBP10.5) n.m. (GBP60.2) n.m.

Net interest margin 2.14% 2.11% 3bps 1.73% 41bps

Lending yield 4.50% 3.93% 57bps 3.40% 110bps

Cost of deposits 0.66% 0.25% 41bps 0.14% 52bps

Cost of risk 0.18% 0.33% (15bps) 0.29% (11bps)

Coverage ratio 1.54% 1.41% 13bps 1.36% 18bps

Underlying EPS 7.8p (2.0p) n.m. (28.5p) n.m.

Tangible book value per share GBP4.42 GBP4.29 3% GBP4.30 3% 1. Underlying revenue excludes grant income recognised relating to the Capability & Innovation fund. 2. Underlying profit/(loss) before tax is an alternative performance measure and excludes impairment andwrite-off of property, plant & equipment (PPE) and intangible assets, transformation costs, remediation costs andcosts incurred as part of the holding company insertion.

Investor presentation

A presentation for investors and analysts will be held at 9.30AM

(UK time) on 1 August 2023. The presentation will be webcast

on:

https://webcast.openbriefing.com/mb23h1/

For those wishing to dial-in:

From the UK: 0800 358 1035

From the US: +1 855 979 6654

Access code: 332501

Other global dial-in numbers:

https://www.netroadshow.com/events/global-numbers?confId=52736

Financial performance for the half year ended 30 June 2023

Deposits

30 Jun 31 Dec Change from 30 Jun Change from

GBP in millions

2023 2022 FY 2022 2022 H1 2022

Demand: current accounts GBP7,106 GBP7,888 (10%) GBP7,770 (9%)

Demand: savings accounts GBP7,218 GBP7,501 (4%) GBP7,817 (8%)

Fixed term: savings accounts GBP1,205 GBP625 93% GBP927 30%

Deposits from customers GBP15,529 GBP16,014 (3%) GBP16,514 (6%)

Deposits from customers includes:

Retail customers (excluding retail partnerships) GBP5,647 GBP5,797 (3%) GBP6,267 (10%)

SMEs3 GBP5,066 GBP5,080 - GBP4,892 4%

GBP10,713 GBP10,877 (2%) GBP11,159 (4%)

Retail partnerships GBP1,910 GBP1,949 (2%) GBP1,871 2%

Commercial customers (excluding SMEs3) GBP2,906 GBP3,188 (9%) GBP3,484 (17%)

GBP4,816 GBP5,137 (6%) GBP5,355 (10%)

3. SME defined as enterprises which employ fewer than 250 persons and which have an annual turnover not

exceeding EUR50 million, and/or an annual balance sheet total not exceeding EUR43 million, and have aggregate deposits

less than EUR1 million.

-- Total deposits of GBP15.5 billion as at 30 June 2023 reduced by 3% from the full year position reflecting

the impact of the cost of living crisis as well as seasonal factors such as tax payments in January, partially

offset by growth in June, a trend that continued in July. The core customer deposit base continues to be

predominantly Retail and SME with low average balances, and therefore a significant majority of customer deposits

are protected by the Financial Services Compensation Scheme.

-- The strength of the underlying service-led core deposit franchise is highlighted by continued growth in

customer numbers in the first half, opening 106,000 new Personal Current Accounts and 23,000 new Business Current

Accounts, representing HoH growth in account openings of 8% for PCA and 20% for BCA. Average customer deposit

balances have however reduced from the full year position, a theme consistent across the industry as customers

manage impacts of the cost of living crisis.

-- The bank re-entered the Fixed Term Deposit (FTD) market in the first half as guided at full year, adding

additional duration to the book, FTDs now make up 8% of the total deposit base (31 December 2022: 4%) and

non-interest bearing deposits now total 46% (31 December 2022: 49%). Cost of deposits has increased to 0.66% (H2

2022: 0.25%), reflecting the increase in FTDs, higher pass-through rates on interest bearing liabilities and

increased price competition in the market.

-- The bank's market share of Cash ISAs, Retail Easy Access and Business Easy Access is well below its

current natural market share of Personal and Business Current Accounts, representing significant opportunity for

organic deposit growth supported by recent and continuing investments in digital and switching capabilities.

-- Stores remain at the heart of the bank's service offering and while geographic expansion is planned in

areas where significant opportunity exists, the bank is disciplined in the cost that it will attach to future store

openings and their operation. The bank remains committed to opening stores in the North of England and these stores

are still expected to be opened in 2024 and 2025. The store proposition and the deposit franchise it underpins are

increasingly valuable in a more normalised interest rate environment.

Loans

30 Jun 31 Dec Change from 30 Jun Change from

GBP in millions

2023 2022 FY 2022 2022 H1 2022

Gross loans and advances to customers GBP12,769 GBP13,289 (4%) GBP12,535 2%

Less: allowance for impairment (GBP197) (GBP187) 5% (GBP171) 15%

Net loans and advances to customers GBP12,572 GBP13,102 (4%) GBP12,364 2%

Gross loans and advances to customers consists of:

Retail mortgages GBP7,591 GBP7,649 (1%) GBP6,785 12%

Commercial lending4 GBP2,659 GBP2,847 (7%) GBP2,993 (11%)

Consumer lending GBP1,410 GBP1,480 (5%) GBP1,269 11%

Government-backed lending5 GBP1,109 GBP1,313 (16%) GBP1,488 (25%)

4. Includes CLBILS.

5. BBLS, CBILS and RLS.

-- Total net loans as at 30 June 2023 were GBP12.6 billion, down 4% compared to GBP13.1 billion at 31 December

2022 as the bank continues to focus on optimising risk-adjusted return on regulatory capital through the strategic

allocation of RWAs, noting that unfulfilled demand exists across all lending products. Yields continue to improve

reflecting further rate rises and decisions on mix optimisation. The loan to deposit ratio remained stable at 81%

(31 December 2022: 82%).

-- Retail mortgages of GBP7.6 billion remained flat compared to the full year position (31 December 2022: GBP7.6

billion) as they were constrained to replacement levels. Owner occupied mortgages represent 72% of total portfolio

(31 December 2022: 72%). GBP779 million of retail mortgages matured in the first half at an average yield of 2.28%

and a further GBP1.1 billion is expected to mature in the second half at an average yield of 2.38%. The DTV of the

portfolio was 58% (31 December 2022: 56%) reflecting updated valuations. The bank has signed up to the Mortgage

Charter to provide additional support and ensure the best outcomes are achieved for customers potentially requiring

support.

-- Commercial lending reduced by 7% to GBP2.7 billion reflecting the continued reduction in the buy-to-let and

real estate portfolios. 90% of term lending excluding Professional-Buy-To-Let and Bounce Back Loan Scheme (BBLS) is

floating rate and the book remains highly collateralised. Commercial real estate is down 9% compared to 31 December

2022 and now makes up 23% of the book.

-- Consumer lending reduced by 5% to GBP1.4 billion (31 December 2022: GBP1.5 billion) as the bank continued to

optimise lending mix and capital allocation. High quality application volumes remain strong and for originations in

the first half the average customer income was GBP49,000 (H2 2022: GBP48,000, H1 2022: GBP46,000). Non-performing loans

for consumer unsecured were 4.8% at 30 June 2023 (31 December 2022: 3.4%) in line with the expected maturity

profile, and the portfolio has prudent ECL coverage of 6.6% (31 December 2022: 5.1%).

-- Government backed lending is now closed to new borrowers and continues to reduce as loans are repaid. The

bank continues to have a strong record of claims made to the British Business Bank being upheld.

-- The loan portfolio remains highly collateralised and prudently provisioned. In H1 2023 the average DTV

for retail mortgages was 58% (31 December 2022: 56%) and for commercial lending 55% (31 December 2022: 55%). The

ECL provision as at 30 June 2023 was GBP197 million with a coverage ratio of 1.54%, compared to GBP187 million with a

coverage ratio of 1.41% as at 31 December 2022. The level of Post-Model Overlays and Adjustments remained

appropriate at 12% of the ECL stock, or GBP24 million.

-- Cost of risk decreased to 0.18% for the half (H2 2022: 0.33%). The bank has seen several months in the

first half where repayments and ECL releases from the commercial book lowered the risk costs. The credit quality of

new lending continues to be strong although the macro-economic environment remains uncertain and the bank has

retained its prudent approach to provisioning.

-- Overall arrears levels have remained broadly stable and there have been no significant signs of increased

stress. Non-performing loans increased to 2.9% (31 December 2022: 2.6%) driven by maturation of the consumer

portfolio and impacts of cost of living on the retail mortgages book, partly offset by successful BBLS claims and

repayments of a number of large commercial exposures. Excluding government-backed lending, non-performing loans

were 2.5% as at 30 June 2023 (31 December 2022: 2.0%).

Profit and Loss Account

-- Underlying profit before tax of GBP16.1 million achieved in the first half (H2 2022: loss of GBP2.6 million)

following completion of the turnaround plan that set out to return the bank to profitability. The balance sheet

optimisation strategy has transformed the balance sheet to maximise return on regulatory capital whilst margins

have been improved through disciplined cost control. Growth in profitability from here remains constrained as the

bank assertively manages its capital position.

-- Statutory profit before tax of GBP15.4 million (H2 2022: loss of GBP10.5 million) reflects significantly

reduced exceptional items as one-off remediation programs have been delivered and the holding company was

successfully inserted.

-- Net interest margin (NIM) of 2.14% for the half is up 3bps compared to 2.11% in H2 2022 and 1.73% in H1

2022 reflecting the strategy to optimise lending mix for risk adjusted return on regulatory capital and continued

rate rises. NIM growth is limited by continued pressure on deposit pricing, the increased mix of FTDs and the

capital constraints on asset growth.

-- Underlying net interest income remained broadly flat HoH at GBP221.5 million (H2 2022: GBP223.3 million) as

the bank's ability to grow lending remains constrained by capital and benefits seen from assets maturing into

higher rate environments are offset by increased deposit costs.

-- Underlying net fee and other income increased marginally HoH to GBP63.3 million (H2 2022: GBP62.6 million, H1

2022: GBP55.3 million). The YoY increase of 14% better reflects the seasonal nature of fee income largely driven by

customer activity, the second half includes higher FX income as customers travel more and we have seen growth in

safe deposit box income as more customers return to using stores post-pandemic.

-- Underlying costs reduced 3% to GBP258.2 million (H2 2022: GBP266.5 million) despite rising inflation,

reflecting the bank's continued focus on cost discipline, automation initiatives and investment in infrastructure

to enable the bank to deliver significant increases in volume with only marginal increases in cost, and therefore

improve operational leverage.

Capital, Funding and Liquidity

Position Position Minimum Minimum

Capital ratios 30 June 31 December requirement requirement

2023 2022 including buffers6 excluding buffers

Common Equity Tier 1 (CET1) 10.4% 10.3% 8.2% 4.7%

Tier 1 10.4% 10.3% 9.8% 6.3%

Total Capital 13.2% 13.4% 11.9% 8.4%

Total Capital + MREL 18.1% 17.7% 20.2% 16.7% 6. Based on capital requirements at 30 June 2023 plus buffers, excluding any confidential PRA buffer, ifapplicable.

-- As at 1 January 2023 the bank's MREL ratio was 17.4%

following a step down in the IFRS 9 ECL relief on 1January 2023, as

such the current position reflects the capital accretion of net

70bps as the bank achievedstatutory profitability in the half and

assertively managed asset origination volumes and RWA.

-- Total capital ratio reduced by 20bps in the half reflecting

the impact of the haircut to the Tier 2instrument, arising from

implementation of the holding company in May 2023.

-- Effective 1 January 2023 the Prudential Regulation Authority

(PRA) reduced the bank's Pillar 2A capitalrequirement from 0.50% to

0.36%.

-- Effective 5 July 2023 the Countercyclical Buffer (CCyB)

increased from 1% to 2%. Following the CCyBincrease, the bank is

now operating within both the Tier 1 and MREL buffers and continues

to strategically manageRWA allocation to ensure all regulatory

minimum requirements are met and the group is able to gradually

accretecapital headroom.

-- On 28 July 2023 the Bank of England's Resolution Directorate

agreed to a further extension of theeligibility of the GBP250

million 9.139% Tier 2 Notes (the "Notes") issued by Metro Bank PLC

with respect to MREL forMetro Bank Holdings PLC for the remaining

life of the instrument (June 2028).

-- Total RWAs as at 30 June 2023 were GBP7.8 billion (31

December 2022: GBP8.0 billion) reflecting the bank'sdecision to

strategically limit asset and liability growth to accrete capital

in the near term.

-- Strong liquidity and funding position maintained. Customer

loans continued to be funded fully by customerdeposits with a loan

to deposit ratio of 81% compared to 82% at the end of 2022. The

Liquidity Coverage Ratio (LCR)was 214% compared to 213% at 31

December 2022, and the Net Stable Funding Ratio (NSFR) was 132%

compared to 134% at31 December 2022, both remain significantly

above their respective requirements.

-- The Treasury portfolio of GBP8.0 billion includes GBP5.3

billion of investment securities, of which 77% arerated AAA and 23%

rated AA. The average repricing duration excluding cash is 1.1

years and GBP560 million ofsecurities are due to mature in H2 2023

at an average yield of 3.7%. Of the total investment securities,

91% isheld at amortised cost and 9% is held at fair value through

other comprehensive income.

-- UK leverage ratio was 4.4% as at 30 June 2023 (31 December

2022: 4.2%).

-- The bank's AIRB application is still in progress. As

previously highlighted, the bank continues to reviewits options,

across the capital stack, to strengthen its capital base.

Outlook and Guidance

-- Guidance for 2023 has been re-affirmed including the ROTE target of mid-single digit by 2024.

2022 2023

NIM 1.92% NIM accretion over 2023 tempered by limited ability to leverage balance sheet

Lending yield 3.67% Continue optimising mix for maximum risk-adjusted returns on regulatory capital

Cost of 0.20% Pricing will reflect rate environment and competitive pressures, expect strong account

deposits acquisition to offset lower average customer balances

Underlying GBP533m Inflationary pressures expected to moderately outweigh cost initiatives

costs

Cost of risk 0.32% Watchful of economic cycle but not yet seeing significant signs of stress

RWA GBP8.0b Managed for optimal risk-adjusted returns on regulatory capital as lending growth constrained by

capital availability

MREL 17.7% Continue to operate within buffers with increasing headroom to regulatory minima

Metro Bank Holdings PLC

Summary Balance Sheet and Profit & Loss Account

(Unaudited)

YoY HoH 30 Jun 31 Dec 30 Jun

Balance Sheet

change change 2023 2022 2022

GBP'million GBP'million GBP'million

Assets

Loans and advances to customers 2% (4%) GBP12,572 GBP13,102 GBP12,364

Treasury assets7 GBP8,023 GBP7,870 GBP9,036

Other assets8 GBP1,152 GBP1,147 GBP1,166

Total assets (4%) (2%) GBP21,747 GBP22,119 GBP22,566

Liabilities

Deposits from customers (6%) (3%) GBP15,529 GBP16,014 GBP16,514

Deposits from central banks GBP3,800 GBP3,800 GBP3,800

Debt securities GBP573 GBP571 GBP577

Other liabilities GBP875 GBP778 GBP706

Total liabilities (4%) (2%) GBP20,777 GBP21,163 GBP21,597

Total shareholder's equity GBP970 GBP956 GBP969

Total equity and liabilities GBP21,747 GBP22,119 GBP22,566 7. Comprises investment securities and cash & balances with the Bank of England. 8. Comprises property, plant & equipment, intangible assets and other assets.

Half year ended

YoY

HoH 30 Jun 31 Dec 30 Jun

Profit & Loss Account change

change 2023 2022 2022

GBP'million GBP'million GBP'million

Underlying net interest income 22% (1%) GBP221.5 GBP223.3 GBP180.9

Underlying net fee and other income 14% 1% GBP63.3 GBP62.6 GBP55.3

Underlying net gains on sale of assets GBP0.8 - -

Total underlying revenue 21% - GBP285.6 GBP285.9 GBP236.2

Underlying operating costs (3%) (3%) (GBP258.2) (GBP266.5) (GBP266.3)

Expected credit loss expense (GBP11.3) (GBP22.0) (GBP17.9)

Underlying profit/(loss) before tax GBP16.1 (GBP2.6) (GBP48.0)

Impairment and write-off of property plant & equipment and intangible - (GBP1.5) (GBP8.2)

assets

Transformation costs - (GBP2.3) (GBP1.0)

Remediation costs GBP0.8 (GBP2.3) (GBP3.0)

Holding company insertion (GBP1.5) (GBP1.8) -

Statutory profit/(loss) before tax GBP15.4 (GBP10.5) (GBP60.2)

Statutory taxation (GBP2.7) (GBP0.5) (GBP1.5)

Statutory profit/(loss) after tax GBP12.7 (GBP11.0) (GBP61.7)

Half year ended

30 Jun 31 Dec 30 Jun

Key metrics

2023 2022 2022

Underlying earnings per share - basic 7.8p (2.0p) (28.5p)

Number of shares 172.6m 172.5m 172.4m

Net interest margin (NIM) 2.14% 2.11% 1.73%

Cost of deposits 0.66% 0.25% 0.14%

Cost of risk 0.18% 0.33% 0.29%

Arrears rate 3.5% 3.2% 3.1%

Underlying cost:income ratio 90% 93% 113%

Tangible book value per share GBP4.42 GBP4.29 GBP4.30

Enquiries

For more information, please contact:

Metro Bank PLC Investor Relations

Jo Roberts

+44 (0) 20 3402 8900

IR@metrobank.plc.uk

Metro Bank PLC Media Relations

Tina Coates / Mona Patel

+44 (0) 7811 246016 / +44 (0) 7815 506845

pressoffice@metrobank.plc.uk

Teneo

Charles Armitstead / Haya Herbert Burns

+44 (0) 7703 330269 / +44 (0) 7342 031051

Metrobank@teneo.com

S

About Metro Bank

Metro Bank services 2.8 million customer accounts and is

celebrated for its exceptional customer experience. It is the

highest rated high street bank for overall service quality for

personal customers and the best bank for service in-store for

personal and business customers, in the Competition and Markets

Authority's Service Quality Survey in February 2023. Metro Bank has

also been awarded "2023 Best Lender of the Year - UK" in the

M&A Today, Global Awards, "Best Mortgage Provider of the Year"

in 2022 MoneyAge Mortgage Awards, "Best Business Credit Card" in

2022 Moneynet Personal Finance Awards, "Best Business Credit Card

2022", Forbes Advisor, "Best Current Account for Overseas Use" by

Forbes 2022 and accredited as a top ten Most Loved Workplace 2022.

It was "Banking Brand of The Year" at the Moneynet Personal Finance

Awards 2021 and received the Gold Award in the Armed Forces

Covenant's Employer Recognition Scheme 2021.

The community bank offers retail, business, commercial and

private banking services, and prides itself on giving customers the

choice to bank however, whenever and wherever they choose, and

supporting the customers and communities it serves. Whether that's

through its network of 76 stores open seven days a week, 362 days a

year; on the phone through its UK-based contact centres; or online

through its internet banking or award-winning mobile app, the bank

offers customers real choice.

Metro Bank Holdings PLC (registered in England and Wales with

company number 14387040, registered office: One Southampton Row,

London, WC1B 5HA) is the listed entity and holding company of Metro

Bank PLC.

Metro Bank PLC (registered in England and Wales with company

number 6419578, registered office: One Southampton Row, London,

WC1B 5HA) is authorised by the Prudential Regulation Authority and

regulated by the Financial Conduct Authority and Prudential

Regulation Authority. 'Metrobank' is a registered trademark of

Metro Bank PLC. Eligible deposits are protected by the Financial

Services Compensation Scheme. For further information about the

Scheme refer to the FSCS website www.fscs.org.uk. All Metro Bank

products are subject to status and approval.

Metro Bank is an independent UK bank - it is not affiliated with

any other bank or organisation (including the METRO newspaper or

its publishers) anywhere in the world. Please refer to Metro Bank

using the full name.

METRO BANK HOLDINGS PLC

Interim report for the half year ended 30 June 2023

Forward-looking statements

This interim report contains statements that are, or may be

deemed to be, forward-looking statements. Forward-looking

statements typically use terms such as 'believes', 'projects',

'anticipates', 'expects', 'intends', 'plans', 'may', 'will',

'would', 'could' or 'should' or similar terminology. Any

forward-looking statements in this interim report are based on

Metro Bank Holdings PLC's ("the Group", "the Bank", "we" or "our")

current expectations. By their nature, forward-looking statements

are subject to a number of risks and uncertainties, many of which

are beyond our control, that could cause our actual results and

performance to differ materially from any expected future results

or performance expressed or implied by any forward-looking

statements. As a result, you are cautioned not to place undue

reliance on such forward-looking statements. Past performance

should not be taken as an indication or guarantee of future

results, and no representation or warranty, expressed or implied,

is made regarding future

performance.

No assurances can be given that the forward-looking statements

in this interim report will be realised. We undertake no obligation

to release the results of any revisions to any forward-looking

statements in this interim report that may occur due to any change

in its expectations or to reflect events or circumstances after the

date of this announcement and we disclaim any such obligation.

Basis of preparation

Financial information in this interim report is prepared on a

statutory (taken from our financial statements) and underlying

basis (which we use to assess performance on a management

basis).

Further details on how we calculate underlying performance, as

well as our other alternative performance measures can be found

later in this release.

To meet Bank of England's resolution requirements, on 19 May

2023, Metro Bank Holdings PLC was inserted as the new ultimate

holding company and listed entity of the Group. Prior to this date

Metro Bank PLC was both a banking entity and the ultimate parent

company of the Group but has subsequently become a 100% subsidiary

of Metro Bank Holdings PLC. These financial statements are have

been prepared as if Metro Bank Holdings PLC had been the parent

company throughout the current and prior years, to treat the new

structure as if it has always been in place. Further details on the

insertion of Metro Bank Holdings PLC can be found in note 1 to the

condensed consolidated interim financial statements.

sumMarised interim results

Half year to Half year to Half year to

Change Change

30 Jun 2023 31 Dec 2022 30 Jun 2022

Profit and loss

Underlying profit/(loss) before tax1 GBP16.1m (GBP2.6m) n/a (GBP48.0m) n/a

Statutory profit/(loss) before tax GBP15.4m (GBP10.5m) n/a (GBP60.2m) n/a

Total income (statutory) GBP286.4m GBP287.0m - GBP236.5m 21%

Total operating expenses (statutory) GBP259.7m GBP275.5m (6%) GBP278.8m (7%)

Net interest margin 2.14% 2.11% 3bps 1.73% 41bps

Cost of deposits 0.66% 0.25% 41bps 0.14% 52bps

Return on tangible equity 2% (1%) 3pps (8%) 10pps

30 Jun 2023 31 Dec 2022 Change 30 Jun 2022 Change

Balance sheet

Customer deposits GBP15,529m GBP16,014m (3%) GBP16,514m (6%)

Customer loans GBP12,572m GBP13,102m (4%) GBP12,364m 2%

Loan to deposit ratio 81% 82% (1pp) 75% 6pps

Total assets GBP21,747m GBP22,119m (2%) GBP22,566m (4%)

Tangible book value per share GBP4.42 GBP4.29 3% GBP4.30 3%

Asset quality

Coverage ratio 1.54% 1.41% 13bps 1.36% 18bps

Cost of risk 0.18% 0.33% (15bps) 0.29% (11bps)

Capital ratios

Common Equity Tier 1 (CET1) ratio 10.4% 10.3% 10.6%

Total capital ratio 13.2% 13.4% 13.8%

Total regulatory capital plus MREL ratio 18.1% 17.7% 18.3%

Regulatory leverage ratio 4.4% 4.2% 4.3%

Customer metrics

Customer accounts 2.8m 2.7m 2.6m

Stores 76 76 76

1. Underlying profit/(loss) before tax is an alternative performance measure and excludes items consideredto distort period-on-period comparisons, in order to provide readers with a better and more relevant understandingof the underlying trends in the business. A reconciliation between our statutory and underlying results can befound later in this release.

officers and external auditors

As at 30 June 2023

Board of Directors

Executive Directors

Daniel Frumkin Chief Executive Officer

James Hopkinson Chief Financial Officer

Non-executive Directors

Robert Sharpe Chair (N)

Anna (Monique) Melis Senior Independent Director (A,N)

Catherine Brown Independent Non-Executive Director (N,P,R)

Dorita Gilinski Shareholder-Nominated Non-Executive Director

Anne Grim Independent Non-Executive Director (P)

Ian Henderson Independent Non-Executive Director (A,R)

Paul Thandi CBE Independent Non-Executive Director (P,N)

Michael Torpey Independent Non-Executive Director (A,R)

Independent Non-Executive Director and Designated Non-Executive Director for

Nicholas Winsor MBE

Colleague Engagement (R)

(A) Member of the Audit Committee

(N) Member of the Nomination Committee

(P) Member of the People and Remuneration Committee

(R) Member of the Risk Oversight Committee

Company Secretary

Stephanie Wallace General Counsel and Company Secretary

On 31 July 2023 Clare Gilligan joined as our new Company

Secretary, taking over from Stephanie Wallace (our General Counsel)

who was filling the role on a temporary basis following the

departure of our previous Company Secretary, Melissa Conway in

December 2022.

Independent auditors

PricewaterhouseCoopers LLP

7 More London Riverside

London

SE1 2RT

BUSINESS review

The first six months of 2023 mark our first set of results since

we completed our turnaround at the end of 2022 and has seen us

deliver our strongest financial performance in several years. I am

pleased to report our first half year of statutory profitability,

with a profit before tax of GBP15.4 million (half year to 31

December 2022: loss of GBP10.5 million; half year to 30 June 2022:

loss of GBP60.2 million), as well as our third successive quarter

of profitability on an underlying basis. This was delivered whilst

retaining the top spot as the highest rated high street bank for

overall service quality for personal customers in the CMA's latest

Service Quality Survey, for the tenth time running.

This momentum is evidence that our business model works, and

that combined with continued execution of our strategic priorities

is seeing us deliver on our ambition to be the number one community

bank.

Progress against our strategic priorities

We have always been clear that we are building a business for

the long-term, that can meaningfully scale and unleash its full

capabilities as and when we are able to access additional growth

capital. Our return to profitability on a statutory basis is an

important milestone in this journey.

Key to this has been the continued delivery of our strategic

priorities. At the start of the year, we refreshed these to move

our focus from fixing the problems of the past to leveraging the

strengths of our business model for future growth, whilst keeping

the headline priorities the same.

Revenue

Total revenue increased year-on-year to GBP286.4 million from

GBP236.5 million, but remained flat compared to the second half of

2022 (GBP287.0 million). We continued to see increased momentum in

interest income as rate rises continued to flow through to our

variable rate and front book lending pricing, although net interest

income was constrained by a rise in our cost of deposits, which was

impacted by our return to the fixed term deposit market, as

previously guided. Fixed term deposits increased to GBP1,205

million (31 December 2022: GBP625 million) and now represent 8% of

balances (31 December 2022: 4%) and provide additional duration

into our deposit base.

Overall, we saw our total deposits fall 3% to GBP15,529 million

(31 December 2022: GBP16,014 million) as cost of living pressures

saw customers draw down balances. Whilst the competitive savings

environment put pressures on pricing, our service-led proposition

continues to ensure we maintain a high-quality deposit position. In

the second quarter of the year we saw balances stabilise with

inflows in June, a trend that continued in July. Although average

balances have reduced we continue to win customers, with new

personal and business currents of 106,000 and 23,000 respectively,

demonstrating our proposition continues to resonate in a

competitive marketplace.

Costs

Our total operating expenses fell 7% year-on-year to GBP259.7

million (half year to 31 December 2022: GBP275.5 million; half year

to 30 June 2022: GBP278.8 million), despite a backdrop of

persistently high inflation. This helped drive positive jaws of 28%

year-on-year and 6% half-on-half.

The cost reductions have been achieved through our continued

focus on cost discipline and the successful implementation of

initiatives that enable the Bank to scale appropriately. Operating

costs were aided by roll-off of legacy issues as well as the ending

of our transformation plan.

We incurred additional costs in the first half of the year from

the insertion of our new holding company, Metro Bank Holdings PLC.

We completed this in May and it marks another key step in

delivering our requirements under the Bank of England Resolution

Framework.

Balance sheet optimisation

Over the past three years we have built a suite of products that

will allow us to compete in any interest rate environment, allowing

us to appropriately react to market conditions. A clear example of

this is our RateSetter capabilities, where we were able to

appropriately scale this whilst interest rates were low. As rates

have increased and the economic outlook remains uncertain, we have

been able to moderate originations within this portfolio. This has

seen the average borrower salary increase to GBP49,000 (half year

to 30 June 2022: GBP46,000) ensuring we continue to maintain a

strong level of credit quality.

Our continued discipline to focus on return on regulatory

capital has instead seen us put a greater emphasis on building our

mortgage pipeline as well as focus on the treasury portfolio, both

of which provide meaningfully higher returns than at the start of

the year. As part of this focus we also continue to progress our

AIRB application for residential mortgages.

We continue to let balances in our commercial book attrite,

particularly in the commercial real estate sector, where we have

significantly reduced our exposure over the past few years. This

combined with the run-off of COVID-related government backed

lending has seen commercial lending as a proportion of the total

book fall marginally to 30% of total loans as at 30 June 2023 (31

December 2022: 31%; 30 June 2022: 36%). Despite this fall we

continue to remain committed to maintaining a strong commercial

lending offering but are focused primarily on higher-quality

relationship driven business. This includes the strengthening of

our business overdraft product which we launched in 2022 and a new

business credit card offering that we will launch in the second

half of the year, which as well as supporting lending growth offers

the potential for increased fee income.

Infrastructure

We maintain our focus on building out our digital and physical

infrastructure to both ensure that we keep the Bank safe and secure

today, and invest for the growth of tomorrow. The first half of the

year has seen us lay the groundwork for the expansion of our store

network in the North of England. Whilst competitors continue to

shrink their branch numbers and reduce hours, we are continuing to

see the benefits of being rooted in the communities we serve and

believe this will continue to differentiate our proposition in the

years ahead.

Alongside our physical offering we have worked to enhance our

digital infrastructure. This included a major transformation of our

mortgage origination platform, which will streamline the process

for both mortgage intermediaries and customers. As well as being

beneficial for customers it will allow us to be much more flexible

in the markets we choose to operate in, including our upcoming

products for shared ownership and limited company buy-to-let.

Alongside this we have continued our investment in automating

customer journeys and working to deliver end-to-end digital

products. This includes our auto-finance proposition which we

launched at the end of 2022 and our soon to be launched business

credit card. Ensuring this fully digital approach will allow us to

scale these lending streams up as well as drive greater

productivity and efficiency across the Bank.

In addition to our investment in our lending streams we are

focused on enhancing our deposit proposition, to ensure we retain a

competitive suite of products. This investment will improve our

switching capabilities to better compete within the ISA market as

well as offer a broader range of savings accounts including a

savings-boost propositions and RateSetter branded savings account.

Given earlier investment prioritisation elsewhere, our market share

in these products is lower than for other core products and

therefore represents an opportunity for growth.

Communications

We continue to focus on engaging our colleagues, communities and

other stakeholders to push forward our story.

I am pleased that in the first half of the year we have seen

record levels in colleague engagement scores. We continue to focus

on our culture of promoting from within, with over 40% of the

positions filled in the first half of the year, partly as a result

of colleagues being promoted or moving around the business. For the

remaining hires we have amplified our community focus when

recruiting talent, increased opportunities available for

apprentices from disadvantaged backgrounds into new areas of the

Bank, run a series of roadshows for professional returners trying

to get back into the workplace, and engaged with later in career

populations to support our diverse workforce. We have also

introduced a new optional shift pattern, whereby store colleagues

can now take a three-day break benefiting those colleagues who need

more flexibility in their working week.

We have worked harder than ever for our local communities and

become even more inclusive by rolling out our BSL Sign Language

service which customers can now access in any of our 76 stores, or

on the phone, in app or online.

Our financial education programme Money Zone has now been

delivered to 2,800 schools and 250,000 children - we were even

invited to deliver Money Zone to 1,100 children in just one day at

the Hertfordshire Agricultural Society Food & Farming Day.

Later this year we are extending the scheme with bespoke programmes

for our armed forces' communities as well as to teenagers aged

16-18.

52 of our stores are now designated as Safe Spaces - places

where those suffering domestic abuse can go to safely go to start

the process of rebuilding their lives.

Our colleagues remain supportive of their local communities and

have helped collect and donate thousands of items to local

foodbanks. Colleagues have also volunteered to feed the homeless,

care for abandoned dogs, walked up hill and down dale for charity,

picked up litter, ran miles - sometimes over obstacle courses,

celebrated Pride in London, Birmingham and Cardiff and even

organised our first charity golf day.

We continue to provide support to our customers who are

struggling and during the year we signed up to the government's

recently announced Mortgage Charter.

I'm also delighted that Metro Bank has become the first ever

champion partner of women's and girls' cricket. It represents a

real partnership with purpose built on Metro Bank's commitments to

local communities and diversity and inclusion and will help to

deliver a lasting legacy for women's and girls' cricket.

Capital

I am pleased to say that in the first half of 2023, our return

to profitability and our strategic management of risk-weighted

assets (RWAs) both supported organic capital accretion. Whilst we

continue to operate in capital buffers, we remain in close dialogue

with the regulators regarding our future plans and also the ongoing

work relating to our AIRB application.

The regulators remain supportive and on 1 January 2023 the

Prudential Regulation Authority (PRA) reduced our Pillar 2A capital

requirement from 0.50% to 0.36%. This was followed by a further

extension to the pre-existing adjustment (announced 9 December

2022) with respect to the existing GBP250 million 9.139% Tier 2

Notes issued by Metro Bank PLC regarding minimum requirement for

own funds and eligible liabilities (MREL) eligibility. The Bank of

England's Resolution Directorate has agreed the adjustment now

extends the MREL eligibility to the instrument's maturity date on

26 June 2028.

On 5 July 2023, however, the scheduled increase in the Bank of

England's Countercyclical Buffer (CCyB) came into effect,

increasing the level from 1% to 2%. Accordingly, our Tier 1

requirement, including the combined public buffers, increased from

9.8% to 10.8% and we are therefore now operating within buffers for

Tier 1 capital as well as MREL, however we remain above all of our

minimum capital requirements.

We continue to consider all options, across the capital stack,

that could strengthen our capital base.

Outlook

Over the past few years we have built a stable business

foundation, fixing issues of the past whilst positioning ourselves

for the future. I am pleased our return to profitability in the

first six months, the first since our transformation plan

completed, demonstrates that our approach is working. We have

delivered this despite challenging headwinds and I would like to

acknowledge the dedication and unwavering hard work of each and

every colleague who has helped us to get where we are today.

Our proposition continues to resonate with customers and is

providing a force for good in UK banking. We have created the

infrastructure and capability to enable us to provide a

differentiated customer offering as well as meaningful alternative

to further communities in the years ahead.

Daniel Frumkin

Chief Executive Officer

31 July 2023

Finance review

Our results for the first six months of 2023 mark an important

milestone in our journey, as we report our first full half year of

profitability since 2019. The statutory profit before tax of

GBP15.4 million (half year to 31 December 2022: loss of GBP10.5

million; half year to 30 June 2022: loss of GBP60.2 million)

reflects the improved performance of the business, driven by the

actions taken as part of the turnaround plan and more recent

measures to optimise the return on the balance sheet and mitigate

the impact of cost inflation.

The Bank's return to profitability, combined with a reduction in

RWAs, supported our capital ratios in the first half, although were

impacted by a step down in the IFRS 9 transition relief on 1

January 2023. We ended the period with CET1 capital ratio of 10.4%

and an MREL ratio of 18.1%. These compared to the regulatory minima

including buffers as at 30 June 2023 (excluding any confidential

buffer) of 8.2% for CET1 and 20.2% for MREL. We therefore continue

to operate within our capital buffers, although remained above

regulatory minima throughout the period.

The underlying business has continued to attract new customers,

totalling 129,000 new business and personal current accounts in the

first half of the year. This inflow of new customers has partially

offset the market-wide reduction in average current account

balances. We have started to see our deposits stabilise with

increases in balances in June and July partially offsetting the

outflows seen earlier in the year, aided by our return to the

fixed-term deposit market.

Whilst the performance for the first six months of the year is

positive, we remain cautious given the continued volatile external

economic conditions, the impact of inflation on cost of living and

the increasingly competitive deposit market as interest rates

rise.

Income statement review

Table 1: Summary income statement

Half year to Half year to Half year to

30 Jun 2023 31 Dec 2022 30 Jun 2022 Year-on-year

(unaudited) (audited) (unaudited) change

GBP'million GBP'million GBP'million

Net interest income 221.5 223.3 180.8 23%

Net fee, commission and other income 64.1 63.7 55.7 15%

Net gains on sale of assets 0.8 - - n/a

Total income 286.4 287.0 236.5 21%

General operating expenses (221.4) (234.4) (233.2) (5%)

Depreciation and amortisation (38.3) (39.6) (37.4) 2%

Impairment and write-off of PPE and intangible assets - (1.5) (8.2) n/a

Expected credit loss expense (11.3) (22.0) (17.9) (37%)

Profit/(loss) before tax 15.4 (10.5) (60.2) n/a

Taxation (2.7) (0.5) (1.5) 80%

Profit/(loss) after tax 12.7 (11.0) (61.7) n/a

Net interest income

The continued increase in base rate over the past 18 months has

driven growth in net interest income, which rose to GBP221.5

million, up 23% compared to a year ago (half year to 30 June 2022:

GBP180.8 million) aided by a continued disciplined approach with

respect to both pricing and mix.

Half-on-half net interest income reduced marginally from

GBP223.3 million, as a continued increase in asset yield was offset

by increased deposit pricing, in part due to our decision to

re-enter the fixed term deposit market, and the market-wide

reduction in average current account balances. This trend was also

reflected in muted net interest margin growth, which increased

slightly to 2.14% half-on-half (half year to 31 December 2022:

2.11%; half year to 30 June 2022: 1.73%).

The Bank of England base rate rises in the period have flowed

through to our front book loan pricing and variable rate lending.

This has driven an increase in interest income both year-on-year

and half-on-half to GBP400.1 million (half year to 31 December

2022: GBP324.0 million; half year to 30 June 2022: GBP239.7

million).

As at 30 June 2023 91% of our retail mortgages were fixed rate

(31 December 2022: 90%, 30 June 2022: 87%) with a weighted average

life of 2.40 years before they reprice (31 December 2022: 2.45

years; 30 June 2022: 1.97 years). In our consumer term lending and

BBLS (closed to new borrowers) portfolios, all of the loans are

fixed rate, limiting the impact of rising rates on these

portfolios. As our fixed-rate lending rolls-off it will be replaced

with higher-yielding loans. We therefore anticipate seeing

continued interest income growth.

The rise in base rates has also partially flowed through to

deposits, with cost of deposits increasing to 0.66% in the first

six months of the year, up from 0.14% in the first half, and 0.25%

in the second half of 2022. This increase has been driven in part

by our return to the fixed-term deposit market as previously guided

due to the market-wide decline in average balances.

Interest expense was GBP178.6 million in the period, up from

GBP58.9 million in the first half of last year and GBP100.7 million

in the six months to 31 December 2022. The rise in interest expense

over the period also reflects the increase cost of wholesale

funding, notably the amounts borrowed from the Bank of England

under the Term Funding Scheme for SMEs. As the cost of this funding

is directly linked to base rate it has increased significantly in

the first half of the year to GBP78.0 million, compared to GBP13.1

million in the first half of last year and GBP42.4 million in the

last six-month of 2022. We do not rely on this funding for

operational activities and our lending remains entirely deposit

funded. It does however provide an additional form of stable

funding which, whilst dilutive to net interest margin, can be

deployed into high quality floating rate securities or assets.

Fee, commission and other income

Statutory net fee, commission and other income has increased

year-on-year to GBP64.1 million from GBP55.7 million and remained

broadly flat from the last six months (half year to 31 December

2022: GBP63.7 million).

Service charges and other fee income increased year-on-year as

we continue to see increasing customer activity through account

acquisition, although growth slowed in comparison to the second

half of the year as transaction volumes reduced, driven by a

decline in consumer spending, resulting from cost of living

pressures.

Operating expenses

Total statutory operating expenses decreased to GBP259.7 million

from GBP278.8 million in the first six months of 2022 and from

GBP275.5 million in the second half of 2022, reflecting our

continued cost discipline despite high inflation conditions. The

reduction also reflects a continued lessening in our use of

contractors, leading to a reduction in our spend on professional

fees. People-related costs at GBP120.4 million during the period

were broadly flat compared to GBP119.9 million a year earlier and

GBP116.7 million in the second half of 2022, despite delivering an

average pay rise across our workforce of 5% in April 2023.

The reduction in statutory operating expense was aided by the

reduction in non-underlying expenses as we completed our

transformation program and closed outstanding legacy issues. Most

of the non-underlying costs recognised during the period related to

the implementation of our holding company in May this year and as

such are not forecast to recur going forward.

Expected credit loss expense

We recognised an expected credit loss (ECL) expense of GBP11.3

million for the period (half year to 30 June 2022: GBP17.9 million;

half year to 31 December 2022: GBP22.0 million). The ECL charge in

the period reflects the challenging external economic conditions

and the maturation of the loan books, offset by ECL releases from

commercial repayments and management's actions to constrain lending

growth. As part of our approach to calculating ECL we continue to

maintain management overlays and adjustments of GBP24.1 million (31

December 2022: GBP30.9 million) which represent 12% of the total

ECL stock (31 December 2022: 17%). As at 30 June 2023 our coverage

ratio increased to 1.54% (31 December 2022: 1.41%).

Despite the challenging external conditions, we have recognised

fewer individual impairments in the first six months of the year,

particularly in the commercial space as customers remain resilient

despite the economic environment and we have also seen repayments

which have resulted in ECL releases in the period. We continue to

have high levels of collateral with average debt to value for

retail mortgages and commercial term loans as at 30 June of 58% and

55% respectively (31 December 2022: 56% and 55% respectively).

Within our consumer lending portfolio, we undertake a robust

approach to credit decisioning and have seen few signs of

deterioration in credit quality. At a total level non-performing

loans (NPLs) representing 2.86% of gross lending (31 December 2022:

2.65%).

Balance sheet review

Table 2: Summary balance sheet

30 Jun 2023 31 Dec 2022

(unaudited) (audited) Change

GBP'million GBP'million

Assets

Cash and balances with the Bank of England 2,708 1,956 38%

Loans and advances to customers 12,572 13,102 (4%)

Investment securities held at fair value through other comprehensive income 489 571 (14%)

Investment securities held at amortised cost 4,826 5,343 (10%)

Financial assets held at fair value through profit and loss 1 1 -

Derivatives financial assets 26 23 13%

Property, plant and equipment 733 748 (2%)

Intangible assets 207 216 (4%)

Prepayments and accrued income 107 85 26%

Other assets 78 74 5%

Total assets 21,747 22,119 (2%)

Liabilities

Deposits from customers 15,529 16,014 (3%)

Deposits from central banks 3,800 3,800 -

Debt securities 573 571 -

Repurchase agreements 363 238 53%

Derivative financial liabilities 25 26 (4%)

Lease liabilities 238 248 (4%)

Deferred grant 17 17 -

Provisions 5 7 (29%)

Deferred tax liability 12 12 -

Other liabilities 215 230 (7%)

Total liabilities 20,777 21,163 (2%)

Total equity 970 956 1%

Deposits

The Bank remains highly liquid and deposit funded. The Bank's

loan to deposit ratio was 81% as at 30 June 2023 compared to 82% at

the end of 2022. The Bank's deposit mix remains focused on core

deposits (covering current and interest-bearing savings accounts),

representing 92% of total deposits.

During the first six months of the year deposits reduced from

GBP16,014 million to GBP15,529 million, primarily driven by a

reduction in average account balances. This reduction reflects

increased costs of living, including interest costs, paying down

borrowing, as well as seasonal factors such as tax payments in

January and a greater propensity to transfer surplus current

account balances into higher yielding accounts.

Although average balances have reduced our core deposit

franchise remains resilient to increased competition in the market

and continues to attract new customers, opening 106,000 Personal

Current Accounts and 23,000 Business Current Accounts in the first

half. The more recent deposit trajectory has been positive with net

inflows towards the end of the period.

As guided at the full year we have started to re-enter the fixed

term deposit market, after several years of letting these balances

reduce. As at 30 June 2023, fixed term deposits were GBP1,205

million (31 December 2022: GBP625 million) representing only 8% (31

December 2022: 4%) of total deposits. We intend to continue to

gradually increase fixed term deposits as we introduce more tenure

into our deposit profile.

During the period the Bank has invested in building out a

competitive range of products for the current rate environment.

This investment will improve our switching capabilities to better

compete within the ISA market as well as offer a broader range of

savings accounts including savings-boost propositions. Given

earlier investment prioritisation elsewhere, our market share in

these products is lower than for other core products and therefore

represents an opportunity for growth.

Lending

As previously guided the Bank is actively constraining the new

lending to around or below replacement levels. Accordingly, net

lending decreased during the period to GBP12,572 million compared

to GBP13,102 million at the end of 2022.

Gross commercial lending made up the largest component of the

reduction, decreasing 9% to GBP3,768 million from GBP4,160 million

at 31 December 2022. This reflects the continued reduction in the

professional buy-to-let portfolio and commercial real estate

portfolios which reduced by 13% from GBP1,412 million to GBP1,234

million in the period. We also continue to see a reduction in

government-backed lending, which are closed to new borrowers, as

these loans are paid back, with balances reducing from GBP1,313

million as at 31 December 2022 to GBP1,109 million at the end of

June 2023.

Gross consumer lending reduced to GBP1,410 million (GBP1,480

million at 31 December 2022) Whilst the Bank has not sought to

build the consumer lending portfolio during the period, it remains

an important product area through the cycle and we continue to

build out the breadth of our offering including through the launch

of a new motor finance proposition towards the end of 2022.

Gross mortgage balances also reduced slightly to GBP7,591

million from GBP7,649 million at 31 December 2022 as originations

were kept broadly in line with repayments. Our retail mortgage

portfolio continues to be primarily focused on owner occupied

loans. These make up 72% of balances at 30 June 2023 (31 December

2022: 72%) and continue to have a low loan to value profile. We

continue to progress our AIRB application in respect of our retail

mortgages portfolio.

Property, plant & equipment and intangibles

Non-current assets and intangible asset balances continued to

decrease during the period as depreciation and amortisation charges

exceeded the level of additions. Property plant and equipment ended

the first half of the year at GBP733 million, down from GBP748

million at year end, as we did not open any additional stores in

the period. Stores remain core to our service offering and we

continue to evaluate a pipeline of sites to deliver on our

commitment of 11 new stores in the North of England, which we

expected to open in 2024 and 2025, expanding our reach into new

markets.

Intangible assets also continued to decrease to GBP207 million

from GBP216 million as at 31 December 2022, reflecting how we have

reduced the levels of investment from the peaks during the

turnaround period. Alongside key regulatory enhancement projects we

have invested more recently in our deposit proposition as well as

enhancing our core service offering, which includes the delivery of

confirmation of payee which was launched in July 2023, enhanced

business overdrafts which are delivered entirely electronically and

the roll out of our new mortgage platform.

Capital

Our return to profitability in the first half of the year

combined with moderated asset origination, and therefore moderated

RWA deployment, has seen us generate organic capital through the

period. Risk weighted assets ended the period at GBP7,802 million,

a reduction of 2% from GBP7,990 million as at 31 December 2022. The

reduction has been driven by a decrease in lending volumes partly

offset by an increase to our annual operational risk

adjustment.

Table 3: Capital ratios and requirements

30 Jun 2023

Minimum requirement excluding Minimum requirement including

(unaudited) buffers¹ buffers¹

GBP'million

CET1 10.4% 4.7% 8.2%

Tier 1 10.4% 6.3% 9.8%

Total regulatory capital 13.2% 8.4% 11.9%

Total regulatory capital plus 18.1% 16.7% 20.2%

MREL 1. Excluding any confidential buffer, where applicable. Countercyclical buffer increased by 1% to 2% on 5July 2023

The MREL requirement of 16.7% reflects the reduction of our

Pillar 2A requirements from 0.50% to 0.36%, from the 1 January

2023, and the decision by the Bank of England to set our binding

MREL requirement as the lower of 18% and two times the sum of

Pillar 1 and Pillar 2A, which were announced in June 2022.

On 5 July 2023 the scheduled increase in the CCyB came into

effect, increasing the level from 1% to 2%. Accordingly, the Bank's

Tier 1 requirement, including the combined public buffers,

increased from 9.8% to 10.8%. The Bank's Tier 1 ratio as at 30 June

2023 (including profits) was 10.4% and we are therefore now

operating within buffers for Tier 1 capital as well as MREL,

however the Bank remains above all of its minimum capital

requirements.

In May we completed the implementation of our holding company

marking an important milestone in meeting our requirements in

respect of the Bank of England's resolution framework. Upon the

implementation of the holding company our existing MREL debt moved

up to sit within the new holding company entity. This consists of

GBP350 million of 9.5% Senior Non preferred notes which have a call

date on 8 October 2024. The Board continues to review our options,

across the capital stack, to strengthen our capital base, including

the refinancing of this MREL debt.

Our Tier 2 notes however have remained within the existing

banking entity (Metro Bank PLC), although following the agreement

by the Bank of England's Resolution Directorate on 28 July 2023,

these will continue to contribute to our MREL requirements up until

their maturity on 26 June 2028. The Tier 2 notes had a call date

during the first six months of the year and we took the decision

not to exercise this. As a result the coupon on this instrument

reset from 5.500% to 9.139%. By not calling the notes their Tier 2

eligibility will amortise over their remaining life at a rate of

20% each year, calculated on a daily basis. Following the insertion

of the new holding company, these notes are also now subject to a

haircut at the Group level.

Liquidity and wholesale funding

We continue to maintain strong levels of liquidity. We ended 30

June 2023 with a Liquidity Coverage Ratio (LCR) of 214% (31

December 2022: 213%) which continues to be significantly in excess

of the regulatory requirements of 100%.

We remain primarily deposit funded with our loan to deposit

ratio at the 30 June 2023 being 81% (31 December 2022: 82%). Whilst

we utilise wholesale funding in the form of the Bank of England's

Term Funding Scheme (TFSME) and repurchase agreements, these act as

additional stable forms of funding and liquidity.

As at 30 June 2023 the Bank held GBP2,708 million in cash and

balances at the Bank of England (31 December 2022: GBP1,956

million) with a further GBP5,315 million in high quality investment

securities (31 December 2022: GBP5,914 million), which nearly all

are AAA rated or are UK Gilts. Of our total investment securities

GBP4,826 million, 91% are held at amortised cost (31 December 2022

GBP5,343 million; 90%). Given the rising rate environment the fair

value of these securities is GBP4,502 million (31 December 2022:

GBP5,009 million). As we have no intention to sell these

securities, their fair value will pull back to carrying value as

they approach maturity.

The weighted-average repricing duration on the portfolio

(excluding cash) is 1.1 years and virtually all the securities are

Bank of England eligible so are available for entering into

repurchase agreements, should we need additional liquidity. The

remaining GBP489 million of our investment securities are held at

fair value and therefore market movements on these assets are

already reflected in our reserves and capital ratios.

Going concern and outlook

These condensed consolidated interim financial statements are

prepared on a going concern basis, as the Directors are satisfied

that the Group has the resources to continue to operate for a

period of at least twelve months from when the interim financial

statements are authorised for issue. In making this assessment, the

Directors considered a wide range of information relating to

present and future conditions, including future projections of

profitability, liquidity and capital resources as well as factoring

in the uncertainties relating to the economic and market outlook

and future financing requirements.

Given the Bank's year to date performance and taking account of

the external environment, we reiterate the guidance that we are

targeting mid-single digit return on tangible equity by 2024.

James Hopkinson

Chief Financial Officer

31 July 2023

RISK review

As at 30 June 2023, our business model, risk management

framework and risk appetites remain consistent with our 2022 Annual

Report and Accounts. The key risks we face (our 'principal risks')

are unchanged:

-- Credit risk - The risk of financial loss should our borrowers

or counterparties fail to fulfil theircontractual obligations in

full and on time.

-- Capital risk - The risk that we fail to meet minimum

regulatory capital (and MREL) requirements.

-- Liquidity and Funding risk - The risk that we fail to meet

our short-term obligations as they fall due orthat we cannot fund

assets that are difficult to monetise at short notice (i.e.

illiquid assets) with funding thatis behaviourally or contractually

long term (i.e. stable funding).

-- Market risk - The risk of loss arising from movements in

market prices. Market risk is the risk posed toearnings, economic

value or capital that arises from changes in interest rates, market

prices or foreign exchangerates.

-- Operational risk - The risk that events arising from

inadequate or failed internal processes, people andsystems, or from

external events cause regulatory censure, reputational damage,

financial loss, service disruptionand/or detriment to our

customers.

-- Financial crime - The risk of financial loss or reputational

damage due to regulatory fines, restrictionor suspension of

business, or cost of mandatory corrective action as a result of

failing to comply with prevailinglegal and regulatory requirements

relating to financial crime.

-- Regulatory risk - The risk of regulatory sanction, financial

loss and reputational damage as a result offailing to comply with

relevant regulatory requirements.

-- Conduct risk - The risk that our behaviours or actions result

in unfair outcomes or detriment tocustomers and/ or undermines

market integrity.

-- Model risk - The risk of potential loss, poor strategic

decision making and regulatory non-compliance dueto decisions that

could be principally based on the output of models, due to errors

in the assumptions,development, implementation or use of such

models.

-- Strategic risk - The risk of having an insufficiently

defined, flawed or poorly implemented strategy, astrategy that does

not adapt to political, environmental, business and other

developments and/or a strategy thatdoes not meet the requirements

and expectations of our stakeholders.

-- Legal risk - The risk of loss, including to reputation, which

can result from lack of awareness ormisunderstanding of, ambiguity

in, or reckless indifference to, the way law applies to the

Directors, the business,its relationships, processes, products and

services.

We continue to actively monitor and regularly reassess our

exposure to each of these risks, with particular focus on those

that could result in events or circumstances that might harm our

customers, threaten our business model, solvency or liquidity, and

reputation.

Top risks

Our top risks are defined as risks which are considered to be

the most material to the Bank with the potential for the greatest

impact during the forthcoming 12 months and currently consist

of:

-- Macroeconomic risk (credit risk)

-- Capital risk

-- Financial crime risk

-- Regulatory risk

-- Technology risk

Further information on our top and emerging risks are outlined

below.

Credit risk

Credit portfolio performance has remained resilient during the

first half of 2023 despite a challenging external environment for

our customers. Notwithstanding the recent increases in market

expectations for interest rates, the overall macroeconomic outlook

has improved since the end of 2022. The overall impact of risk

profile, credit performance and macroeconomic outlook has resulted

in a cost of risk of 0.18% (six months to 31 December 22: 0.33%).

Expected credit losses

Table 4: Expected credit loss allowances

30 Jun 2023 31 Dec 2022

Change

GBP'million GBP'million

GBP'million

(unaudited) (audited)

Retail mortgages 21 20 1

Consumer lending 93 75 18

Commercial lending 83 92 (9)

Total expected credit loss allowances 197 187 10

ECL have increased during the year by GBP10 million to GBP197

million (31 December 2022: GBP187 million) predominantly driven by

maturation of the consumer portfolio, offset by repayments in

commercial and improvements in macroeconomic scenarios. As part of

our ECL we continue to hold overlays to reflect the continued

macroeconomic uncertainty given the high inflation and cost of

living pressures as well as anticipated interest rate increases not

fully captured in the latest macroeconomic scenarios and IFRS 9

models. Non-performing loans

Table 5: Non-performing loans

30 Jun 2023 (unaudited) 31 Dec 2022 (unaudited)

NPLs NPL ratio NPLs NPL ratio

GBP'million % GBP'million %

Retail mortgages 139 1.83% 111 1.45%

Consumer lending 68 4.82% 50 3.38%

Commercial lending 158 4.19% 191 4.59%

Total 365 2.86% 352 2.65%

NPLs increased to GBP365 million (31 December 2022: GBP352

million) with the overall NPL ratio increasing to 2.86% (31

December 2022: 2.65%). The NPL ratio for mortgages has increased to

1.83% (31 December 2022: 1.45%), driven largely by our legacy

acquired mortgage portfolios. These portfolios were not written

under our organic credit criteria, and we have seen poorer arrears

performance, exacerbated in the recent period as these have on

average poorer risk scores and are more likely to be on a variable

rate. The NPL ratio for consumer customers has increased to 4.82%

(31 December 2022: 3.38%) driven by the maturation of the

RateSetter loans portfolio. The NPL ratio for Commercial has

reduced to 4.19% (31 December 2022: 4.59%) driven by successful

BBLS claims and repayments as well as the write-off of a small

number of large commercial exposures. Cost of risk

Table 6: Cost of risk and coverage ratios

Cost of risk Coverage ratios

Half year to Full year to

30 Jun 2023 31 Dec 2022

30 Jun 2023 31 Dec 2022

(unaudited) (unaudited)

(unaudited) (unaudited)

% %

% %

Retail mortgages 0.02% 0.02% 0.28% 0.26%

Consumer lending 2.95% 2.26% 6.60% 5.07%

Commercial lending (0.52%) 0.11% 2.20% 2.21%

Cost of risk 0.18% 0.32% 1.54% 1.41%

The change in overall cost of risk is primarily driven by

increased ECL for consumer lending (resulting from maturation of

this portfolio) which now equates to 11% of our total lending (31

December 2022: 11%) and carries a higher cost of risk than retail

mortgages and commercial. As at the 30 June 2023 our coverage ratio

on our consumer lending portfolio stood at 6.60%, up from 5.07% as

the year-end. The cost of risk for retail mortgages has remained

flat. The cost of risk for commercial has reduced due to

improvements in macroeconomic scenarios and repayments of a small

number of large commercial exposures. Stage 2 balances

Stage 2 balances are identified using quantitative and

qualitative tests that determine the significant increase in credit

risk (SICR) criteria. In addition, customers that trigger the 30

days back stop classification are also reported in Stage 2, in line

with IFRS 9 standards.

Table 7: Stage 2 balances1

30 Jun 2023 (unaudited) 31 Dec 2022 (unaudited)

Gross carrying amount Loss allowance Gross carrying amount Loss allowance

GBP'million GBP'million GBP'million GBP'million

Quantitative 1,414 36 1,845 38

Qualitative 160 5 189 7

30 days past due backstop 51 6 54 6

Total Stage 2 1,625 47 2,088 51 1. Where an account satisfies more than one of the Stage 2 criteria above, the gross carrying amount andloss allowance has been assigned in the order presented. For example, an account that triggers both quantitativeand qualitative SICR criteria will only be reported as quantitative SICR.

Stage 2 balances have decreased in the first half of 2023, with

the quantitative SICR criteria continuing to be the primary driver

and improvements in macroeconomic outlook resulting in customers no

longer triggering SICR and transferring back to Stage 1. Marginal

decreases in Stage 2 balances have also been observed in the

qualitative and 30 days past due backstop criteria. As at 30 June

2023, 87% (31 December 2022: 88%) of Stage 2 balances triggered

quantitative SICR criteria, 10% (31 December 2022: 9%) triggered

qualitative SICR and the remaining 3% (31 December 2022: 3%)

triggered the 30 days past due backstop criteria. Credit risk

exposure by internal PD rating

Table 8: Credit risk exposure, by IFRS 9 12-month PD rating and

stage allocation1

30 Jun 2023 (unaudited)

Gross lending Loss allowance

GBP'million GBP'million

PD Range % Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total Coverage

ratio

Band 1 0.00 - 2.99 8,937 380 - 9,317 33 3 - 36 0.39%

Band 2 3.00 - 16.99 1,346 994 - 2,340 27 25 - 52 2.22%

Band 3 17.00 - 99.99 496 251 - 747 1 19 - 20 2.68%

Band 4 100 - - 365 365 - - 89 89 24.38%

Total 10,779 1,625 365 12,769 61 47 89 197 1.54%

31 Dec 2022 (audited)

Gross lending Loss allowance

GBP'million GBP'million

PD Range % Stage 1 Stage 2 Stage 3 Total Stage 1 Stage 2 Stage 3 Total Coverage

ratio

Band 1 0.00 - 2.99 8,042 549 - 8,591 32 5 - 37 0.43%

Band 2 3.00 - 16.99 2,209 1,313 - 3,522 33 29 - 62 1.76%

Band 3 17.00 - 99.99 598 226 - 824 1 17 - 18 2.18%

Band 4 100 - - 352 352 - - 70 70 19.89%

Total 10,849 2,088 352 13,289 66 51 70 187 1.41%

1. IFRS 9 12-month PD excludes post model overlays (PMO).

The migration observed across bandings, in particular band 1, is

primarily driven by the improvement in macroeconomic scenarios

feeding through the IFRS 9 models resulting in customers moving to

lower PD bands. Retail mortgage lending

Mortgage balances have been broadly stable in the first six

months of 2023 at GBP7,591 million (31 December 2022: GBP7,649

million) with modest organic book growth offsetting the run-off of

our back book portfolios.

Despite the challenging economic environment, the credit

performance of the portfolio during the first half of 2023 has

remained broadly stable. Debt-to-value (DTV) has increased by 2% to

58% as at 30 June 2023 (31 December 2022: 56%) as a result of

falling house prices. Early arrears cases (one to less than three

months in arrears) have remained stable at 0.63% at 30 June 2023

(31 December 2022: 0.63%). Accounts that are three or more months

in arrears have increased from 0.73% at 31 December 2022 to 0.91%

at 30 June 2023, mainly driven by increases in arrears in the