TIDMGRIT

RNS Number : 2711S

Global Resources Investment Tst PLC

29 September 2017

To: RNS

From: Global Resources Investment Trust plc

LEI: 2138005OJKGWG3X4SY51

Date: 29 September 2017

Chairman's Statement

Introduction

Since I last wrote to you, your Company has made extremely

encouraging progress in restoring shareholder value.

Investment and Share Price Performance

On 30 June 2017 your Company's net asset value was 20.3 pence, a

decrease of 10.3% from the 22.4 pence at which it stood on 31

December 2016. In stark contrast, the Company's ordinary share

price rose by 53.1% from 8.0p to 12.25p over the same period, as

the discount at which its ordinary shares trade to net asset value

narrowed from 64.3% to 39.5%. This re-rating of the Company's

shares is a welcome development, and one which we look to see

continue.

The net asset value has risen since the period end, currently

standing at 21.0 pence.

A more comprehensive overview of the investment portfolio is

contained in the Investment Manager's Review.

9% Cumulative Unsecured Loan Stock 2017 ('CULS')

The Company issued GBP5 million nominal of CULS in 2014 to

provide working capital, of which GBP2.7 million remained in issue

at 31 December 2016. This outstanding balance was repaid during the

first quarter, leaving the Company ungeared and removing a

significant constraint on performance.

Change to Investment Strategy and Outlook

The change in the Company's investment policy reflected our

desire to reduce the portfolio's exposure to exploration and early

stage development companies, and to focus more on companies with

potentially large scale assets that are likely to be brought into

production in the foreseeable future. It is here that we see the

best opportunities to create value for shareholders.

The principal factor underpinning the increase in the Company's

net asset value since the period end has been the more than

trebling in value of our investment in the Bougainville based Kalia

Holdings, which is elaborated upon in more detail in the Investment

Manager's Review. This investment is directly in line with our new,

focussed investment strategy.

The marked recovery in both sentiment and in commodity prices

continues, with confidence bolstered by stability and growth in a

China that remains determinedly committed to its $5 trillion Belt

and Road initiative. This will help to sustain demand over the next

decade.

Board Changes

After I took on the role of non-executive Chairman in March

2014, we experienced a longer than expected bear market in

commodity prices which necessitated substantial change and

restructuring, both to ensure that the CULS holders were repaid and

to restore value to shareholders. This has been accomplished.

It has always been my desire to serve one term of office, and to

this end I shall be retiring and handing on the baton to the able

stewardship of Simon Farrell at the end of November. The

concomitant process of Board refreshment will be carried out with a

careful eye to Board balance.

Lord St John

Chairman

29 September 2017

Investment Manager's Review

In general it has been a better six months for the natural

resource sector, and although the net asset value shows a small

decline, there has been a significant improvement in the share

price.

Since the year end, the IAMGOLD bid for Merrex Gold completed

and subsequently the majority of our new holding in IAMGOLD was

sold to allow the full repayment of the outstanding convertible

loan notes.

As indicated in the Annual Report, and following the changes to

the investment policy approved at the Annual Meeting in January

this year, the investment portfolio is now a much more focused

portfolio, as we have made a conscious decision to sell the

investments where we are minority shareholders, to focus on the

investments where we have a meaningful exposure and where the

potential for delivering higher returns is better. The three

largest investments are now; Siberian Goldfields Ltd, Anglo African

Minerals plc and Kalia Holdings Pty Ltd.

The investment in Siberian Goldfields Ltd was originally made

via a convertible loan note instrument in a private offshore

company which was a joint venture with its Russian partner in the

Zhefezny Kryazh gold project in Russia. In anticipation of listing

the company on a recognised stock exchange, Siberian Goldfields

agreed a corporate restructuring with its Russian partner, so that

a new holding company (also called Siberian Goldfields) was created

to own 100% of the operational asset and consequently we agreed to

convert our loan notes and accrued interest into ordinary shares in

the new company. The new Siberian Goldfields is currently looking

to raise additional money via a pre-IPO fund raising, in

anticipation of a listing in late 2017, early 2018. Significant

pre-production work has been done on site, but additional funding

is required to complete early stage construction items and

technical documentation for the IPO.

Anglo African Minerals continues in its progression from

explorer to producer as it looks to finalise a joint venture on its

FAR Project with a major Chinese State Owned enterprise. This will

provide full project funding, mining services and an "off take"

agreement with production anticipated by Q2 2018. The company is

also working to increase the reserves of its other two major

projects, Somalu and Toubal which have potential resources of over

2 billion tonnes.

Kalia Holdings Pty Ltd, is a new portfolio investment and is a

private Australian company that is the parent company of a Papua

New Guinean registered subsidiary Kalia Investments Limited. Kalia

Investments Limited holds contractual rights to explore for

minerals and develop mines in the Tinputz district of North

Bougainville, Papua New Guinea which is prospective for gold copper

and other minerals. The area over which Kalia holds contractual

rights is known as the Tore Project.

Bougainville is one of the last undeveloped mineralised

provinces of the world. The island straddles the Pacific "Ring of

Fire" tectonic plate boundary, an ideal setting for the porphyry

copper-gold and associated epithermal gold mineralisation. Rio

Tinto developed the Panguna Mine (the world's largest copper mine)

in the 1960s until it shut down in 1989. During its 17 years of

operation the Panguna Mine produced 3m tonnes of copper and 9m

ounces of gold.

Since we invested in Kalia there have been several significant

developments. The moratorium on exploration and mining, in place

since 1971, was lifted and the President of the Autonomous

Bougainville Government announced that applications for exploration

licences would be accepted. Kalia lodge applications for the Tore

Project area on 19 June 2017 and in September 2017, Kalia completed

mining warden hearings in the Tore Project area.

As was announced to the Stock Exchange on 22 September 2017, GB

Energy Limited (ASX: GBX) an Australian listed company exercised an

option to acquire the outstanding share capital of Kalia Holdings

Pty Ltd, for the issue of new GB Energy Limited shares. We have

subsequently advised GB Energy that we will not be accepting this

offer but will instead be entering into a Shareholder's Agreement

with the company. However going forward we will be valuing our

investment in Kalia on a "see through" value of the offer of the GB

Energy shares, which has resulted in significate uplift in value

for the investment. While still an exploration project, it remains

a very exciting investment.

Given the concentration of the portfolio in the three holdings

as outlined above (they represent 79% of shareholders' funds) the

fund's future performance is now directly linked to their future

performance and consequently we will be monitoring and working

closely with each of the companies in order to maximise our

returns.

David Hutchins

Director

29 September 2017

Enquiries:

David Hutchins

Director

Tel: +44 (0) 207 290 8541

Maitland Administration Services (Scotland) Limited

Martin Cassels

Tel: +44 (0) 131 550 3760

Income Statement

Six months ended 30 June

2017

Revenue Capital Total

Unaudited Unaudited Unaudited

------------------------------ ------ ---------- ---------- ----------

Notes GBP'000 GBP'000 GBP'000

------------------------------ ------ ---------- ---------- ----------

Losses on investments - (77) (77)

Exchange gains - 15 15

Foreign exchange forward

contract loss - (121) (121)

Income 58 - 58

Investment management

fee (25) (229) (254)

Other expenses (273) - (273)

------------------------------ ------ ---------- ---------- ----------

Net return before finance

costs and taxation (240) (412) (652)

Interest payable and similar

charges (24) - (24)

------------------------------ ------ ---------- ---------- ----------

Net return on ordinary

activities before taxation (264) (412) (676)

Tax on ordinary activities - - -

------------------------------ ------ ---------- ---------- ----------

Net return attributable

to equity shareholders (264) (412) (676)

------------------------------ ------ ---------- ---------- ----------

Loss per ordinary share 2 (0.63)p (0.99)p (1.62)p

------------------------------ ------ ---------- ---------- ----------

Six months ended 30 June

2016

Revenue Capital Total

Unaudited Unaudited Unaudited

------------------------------ ------ ---------- ---------- ----------

Notes GBP'000 GBP'000 GBP'000

------------------------------ ------ ---------- ---------- ----------

Gains on investments - 3,144 3,144

Exchange gains - 77 77

Foreign exchange forward - - -

contract loss

Income 228 - 228

Investment management

fee (80) - (80)

Other expenses (244) - (244)

------------------------------ ------ ---------- ---------- ----------

Net return before finance

costs and taxation (96) 3,221 3,125

Interest payable and similar

charges (209) - (209)

------------------------------ ------ ---------- ---------- ----------

Net return on ordinary

activities before taxation (305) 3,221 2,916

Tax on ordinary activities - - -

------------------------------ ------ ---------- ---------- ----------

Net return attributable

to equity shareholders (305) 3,221 2,916

------------------------------ ------ ---------- ---------- ----------

(Loss)/gain per ordinary

share 2 (0.76)p 8.06p 7.30p

------------------------------ ------ ---------- ---------- ----------

Year ended 31 December

2016

Revenue Capital Total

Audited Audited Audited

------------------------------ ------ -------- -------- --------

Notes GBP'000 GBP'000 GBP'000

------------------------------ ------ -------- -------- --------

Gains on investments - 1,664 1,664

Exchange gains - 114 114

Foreign exchange forward

contract loss - (38) (38)

Income 258 - 258

Investment management

fee (155) - (155)

Other expenses (638) - (638)

------------------------------ ------ -------- -------- --------

Net return before finance

costs and taxation (535) 1,740 1,205

Interest payable and similar

charges (374) - (374)

------------------------------ ------ -------- -------- --------

Net return on ordinary

activities before taxation (909) 1,740 831

Tax on ordinary activities - - -

------------------------------ ------ -------- -------- --------

Net return attributable

to equity shareholders (909) 1,740 831

------------------------------ ------ -------- -------- --------

(Loss)/gain per ordinary

share 2 (2.28)p 4.35p 2.08p

------------------------------ ------ -------- -------- --------

The 'total' column of this statement represents the Company's

profit and loss account, prepared in accordance with IFRS. All

revenue and capital items in this statement derive from continuing

operations. All of the loss for the period is attributable to the

owners of the Company.

No operations were acquired or discontinued in the year.

A Statement of Total Recognised Gains and Losses is not required

as all gains and losses of the Company have been reflected in the

above Income Statement.

Balance Sheet

As at As at

30 June 31 December

2017 2016

Unaudited Audited

----------------------------- ------ ---------- -------------

Notes GBP'000 GBP'000

----------------------------- ------ ---------- -------------

Fixed assets

Investments 7,431 10,235

Current assets

Debtors 954 663

Cash at bank and on deposit 157 3,142

----------------------------- ------ ---------- -------------

1,111 3,805

Creditors: amounts falling

due within one year

Other creditors (43) (2,484)

9% Convertible Unsecured

Loan Stock 2017 - (2,700)

----------------------------- ------ ---------- -------------

Net current liabilities (43) (5,184)

Net assets 8,499 8,946

----------------------------- ------ ---------- -------------

Capital and Reserves

Called up share capital 420 400

Share premium 36,880 36,800

Capital reserve (25,594) (25,311)

Revenue reserve (3,207) (2,943)

----------------------------- ------ ---------- -------------

Equity shareholders' funds 8,499 8,946

----------------------------- ------ ---------- -------------

Net asset value per share 3 20.25p 22.38p

----------------------------- ------ ---------- -------------

Statement of Changes in Equity

For the 6 months to 30 June 2017 (unaudited)

Share

Share premium Capital Revenue

capital account reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- --------- --------- --------- --------

Balance at 31 December

2016 400 36,800 (25,311) (2,943) 8,946

Return on ordinary

activities after taxation - - (412) (264) (676)

Investment management

fee - charged to capital - - 229 - 229

Issue of shares 20 80 (100) - -

---------------------------- --------- --------- --------- --------- --------

Balance at 30 June

2017 420 36,880 (25,594) (3,207) 8,499

---------------------------- --------- --------- --------- --------- --------

For the 6 months to 30 June 2016 (unaudited)

Share

Share premium Capital Revenue

capital account reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- --------- --------- --------- --------

Balance at 31 December

2015 400 36,800 (27,051) (2,034) 8,115

Return on ordinary

activities after taxation - - 3,221 (305) 2,916

Balance at 30 June

2016 400 36,800 (23,830) (2,339) 11,031

---------------------------- --------- --------- --------- --------- --------

The revenue reserve represents the amount of the Company's

reserves distributable by way of dividend.

Cash Flow Statement

Six months Six months

ended ended

30 June 30 June

2017 2016

Unaudited Unaudited

--------------------------------- ----------- -----------

GBP'000 GBP'000

--------------------------------- ----------- -----------

Operating activities

(Losses)/gains before finance

costs and taxation (652) 3,125

Gains/(losses) on investments 77 (3,144)

Increase in other receivables (61) (211)

Decrease in forward exchange (2,412) -

creditor

Decrease in other payables (28) (61)

Value of share issued in 229 -

lieu of management fee

Net cash outflow from operating

activities before interest

and taxation (2,847) (291)

Interest paid (24) (209)

Net cash outflow from

operating activities (2,871) (500)

---------------------------------- ----------- -----------

Investing activities

Purchases of investments (1,306)

Sales of investments 4,123 2,508

Advanced Loan to AAM (231) (744)

Interest received - 1

Net cash inflow from

investing activities 2,586 1,765

---------------------------------- ----------- -----------

Financing

Redemption of CULS (2,700) -

Net cash outflow from (2,700) -

financing

--------------------------------- ----------- -----------

(Decrease)/Increase in cash

and cash equivalents (2,985) 1,265

---------------------------------- ----------- -----------

Net cash at the start

of the period 3,142 331

---------------------------------- ----------- -----------

Net cash at the end of

the period 157 1,596

---------------------------------- ----------- -----------

The accompanying notes are an integral part of the financial

statements.

Notes

1. Accounting Policies

Going Concern basis of accounting

The Company's operations have been cash flow negative since its

inception; the Company relies on the sale of investments to

generate the cash needed to continue to operate. GBP4.1m was

realised from the sale of investments during the 6 month period

under review.

2. Return per Ordinary Share

The revenue loss per ordinary share for the six months ended 30

June 2017 is based on a net loss after taxation of GBP264,000 and

on a weighted average of 41,786,233 ordinary shares in issue during

the period.

The capital return per ordinary share for the six months ended

30 June 2017 is based on a net capital loss after taxation of

GBP412,000 and on a weighted average of 41,786,233 ordinary shares

in issue during the period.

3. Net Asset Value per Ordinary Share

The net asset value per ordinary share is based on net assets of

GBP8,499,000 (31 December 2016: GBP8,900,000) and on 41,964,512 (31

December 2016: 39,970,012) ordinary shares, being the number of

ordinary shares in issue at the period end.

4 . 9% Convertible Unsecured Loan Stock 2017

Nominal value

of CULS

GBP'000

-------------------------------- --------------

Opening balance at 31 December

2016 2,700

Repayment of CULS (2,700)

Balance at 30 June 2017 -

-------------------------------- --------------

5. Warrant Instrument

The Company issued 5,000,000 warrants in 2014. The warrants are

unlisted and are exercisable up to the fifth anniversary of

admission in amounts or multiples of 50,000 warrants at GBP1.00 per

ordinary share.

6. Related Party Transactions

The Board of Directors is considered to be a related party. All

of the Directors are considered to be independent, with the

exception of Mr Hutchins who was appointed at the conclusion of the

General Meeting noted in 7 below. No Director has an interest in

any transactions which are, or were, unusual in their nature or

significant to the nature of the Company except as noted in 7

below.

The Directors of the Company received fees for their services.

Total fees for the six months to 30 June 2017 were GBP42,000 (six

months ended 30 June 2016: GBP38,000) of which GBP3,750 (30 June

2016: GBP12,000) remained payable at the period end.

RDP Fund Management LLP ('RDP') received GBP25,000 in relation

to the six months ended 30 June 2017, (six months ended 30 June

2016: GBP80,000) of which GBPnil (30 June 2016: GBP13,000) remained

payable at the period end.

The issue of up to four tranches of shares to RDP were approved

at the General Meeting, each of 2,000,000 shares at a price of

GBP0.05, subject to the satisfying of certain conditions, in

particular share price triggers. The first tranche of shares was

issued following the General Meeting and RDP received 1,994,500

shares; 5,500 further shares remain to be issued. The second

tranche of shares falls to be issued if the Company's share price

remains for a period of at least one month at or above 14p; the

third and fourth tranches similarly fall to be issued at trigger

prices of 16p and 18p respectively.

7. Change of Management Arrangements

On 17 January 2017 at the Company's General Meeting, the

Shareholders voted in favour of Resolutions 1-3. Resolution 1

authorised the Directors of the Company to allot shares up to a

maximum of GBP80,000, resolution 2 resulted in the termination of

the Management Agreement and resolution 3 approved a New Investing

Policy as detailed below. As a result of the approval of these

resolutions, the Company became a self-managed trust run by its

Board and David ('Sam') Hutchins was appointed as an Executive

Director of the Company.

The New Investment Policy is as follows:

"GRIT will seek to achieve its investment objective through

investment in companies globally which have a significant focus on

natural resources and mining. GRIT will invest in companies that

are in the field of the exploration and production of oil, gas,

precious and industrial metals, and industrial and commercial

minerals which, in the opinion of GRIT's investment manager, have

the potential to increase their value considerably. These companies

may be producing companies with a historical track record of

production or they may be development companies or companies with

exploration potential. GRIT will seek to ensure,through active

shareholder involvement, that investee companies act to maximise

long-term shareholdervalue. GRIT will invest primarily in companies

with shares and securities which are listed, quoted or areadmitted

to dealing, on a relevant exchange (including debt securities which

are convertible into quotedequity securities). For the purpose of

this investment policy, a "relevant exchange" is (i) a regulated

market,recognised investment exchange, recognised stock exchange,

recognised overseas investment exchange or

designated investment exchange, or (ii) a junior market operated

by the operator of an exchange referred to in (i). However GRIT may

hold some investments in non-quoted, seed capital or pre-IPO

companies."

8. Post Balance Sheet Events

On 22 September the Company announced to the Stock Exchange that

GB Energy Limited had exercised an option to acquire the

outstanding share capital of Kalia Holdings Pty Ltd for the issue

of new GB Energy Limited shares. The Company has not accepted this

offer, but instead intends to enter into a Shareholder's Agreement

with the company. Going forward the Company is valuing its

investment in Kalia on a "see through" value of the offer of the GB

Energy shares. This resulted in a significant uplift in value for

the investment.

9. Financial Information

The financial information set out above does not constitute the

Company's statutory accounts for the six months ended 30 June 2017.

The statutory accounts for the twelve months ended 31 December 2016

are audited and the Auditors have issued an unqualified

opinion.

Directors' Statement of Principle Risks and Uncertainties

The risks, and the way in which they are managed, are described

in more detail in the Strategic report contained within the Annual

Report and Financial Statements for the year ended 31 December

2016. In the opinion of the Directors, the Company's principal

risks and uncertainties have not changed materially since the date

of the report and are not expected to change materially for the

rest of the Company's financial reporting period to 31 December

2017.

Statement of Directors' Responsibilities in Respect of the

Interim Report

We confirm that to the best of our knowledge:

-- the condensed set of financial statements has been prepared

in accordance with IAS 34 'Interim Financial Reporting' and gives a

true and fair view of the assets, liabilities, financial position

and profit of the Company;

-- the Chairman's Statement and Investment Manager's Review

(together constituting the Interim Management Report) include a

fair review of the information required by the Disclosure Guidance

and Transparency Rules ('DTR') 4.2.7R, being an indication of

important events that have occurred during the first six months of

the year and their impact on the financial statements;

-- the Statement of Principle Risks and Uncertainties referred

to above is a fair review of the information required by DTR

4.2.7R; and

-- the condensed set of financial statements included a fair

review of the information required by DTR 4.2.8R, being related

party transactions that have taken place in the first six months of

the year and that have materially affected the financial position

or performance of the Company during the period.

On behalf of the Board

Lord St. John

Chairman

29 September 2017

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BBGDCCXDBGRC

(END) Dow Jones Newswires

September 29, 2017 07:41 ET (11:41 GMT)

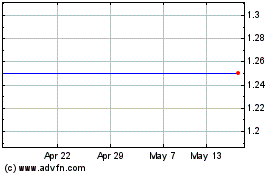

Grit Investment (LSE:GRIT)

Historical Stock Chart

From May 2024 to Jun 2024

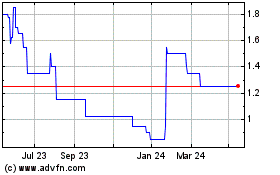

Grit Investment (LSE:GRIT)

Historical Stock Chart

From Jun 2023 to Jun 2024