TIDMAD4

RNS Number : 5955C

adept4 plc

29 June 2016

adept4 plc ("adept4", the "Group" or the "Company")

Interim Results for the six months ended 31 March 2016

adept4 plc (AIM: AD4), the AIM listed provider of IT as a

Service, today announces its unaudited interim results for the six

months ended 31 March 2016.

Financial Summary Unaudited Unaudited

6 months 6 months to

to 31 March

31 March 2015

2016

GBP GBP

----------------------------------- ---------- ------------

Revenue from continuing operations 830,577 -

(4)

Gross Profit from continuing

operations (4) 462,186 -

Gross Profit Margin % 55.6% -

Adjusted Trading Group EBITDA(1) 166,132 -

Adjusted Group EBITDA(2) (138,919) (198,068)

Net Cash(3) 1,439,108 193,197

Net Assets 6,597,826 320,793

Loss for the period (695,338) (521,524)

One-off Reorganisation costs (458,338) -

Operational Highlights

-- Acquisitions of Ancar-B Technologies Limited ("Ancar"),

provider of IT support services and Weston Communications Limited

("Weston"), provider of telecoms and IT support services, in

February 2016

-- Placing and open offer raising gross proceeds of GBP4.80

million in February 2016 to fund cash element of acquisition of

Ancar and provide working capital

-- Acquisition of 70% shareholding not already held in Accent Telecom North in March 2016

-- Disposal of stake (40%) in Stripe 21, a provider of voice

over IP software, a non-core asset, for GBP0.4 million in March

2016.

Post Period End Highlights

-- Disposal of RMS Managed Security IT Limited in May 2016

-- Disposal of trade and assets of Pinnacle CDT Limited in May 2016 for gross proceeds of

GBP2.8 million

-- Acquisition of adept4 Limited, provider of IT as a Service,

in May 2016 with associated issue of GBP5 million loan notes to the

Business Growth Fund plc

-- Change of name to adept4 plc in June 2016

Commenting on the results, Gavin Lyons, Executive Chairman

stated:

"Since I was appointed in December 2015, our entire focus has

been on the turnaround of the business. Having executed five

acquisitions and three disposals in a very short period of time,

that turnaround is now complete

A consequence of all the above activity is that the numbers

reported in this interim condensed financial statement are not

representative of the new underlying trading business - we now have

a trading business with healthy gross margins, high recurring

revenues and positive cashflows.

Our focus now is on the integration of our acquisitions and

scaling our proposition to become a leading UK supplier of IT as a

Service."

(1) Adjusted Trading Group EBITDA is measured as Earnings from

continuing operations before plc costs, interest, taxation,

depreciation, amortisation of intangibles, separately identifiable

costs and income and share based payments

(2)Adjusted EBITDA is measured as Adjusted Trading Group EBITDA

after plc costs

(3)Net cash is calculated as cash and cash equivalents less any

short term borrowings

(4) Continuing operations solely relate to Ancar and Weston

(plus plc and separately identifiable costs and income relating to

these operations) acquired February 2016.

All company announcements can be found at www.adept4plc.com

For further information please contact:

adept4 plc

Gavin Lyons, Chairman

Ian Winn, Chief Operating Officer

and Finance Director 020 8185 6393

N+1 Singer

Shaun Dobson / Jen Boorer 020 7496 3000

MXC Capital Advisory LLP

Marc Young / Charlotte Stranner 020 7965 8149

About adept4

adept4 is seeking to become a leading provider of 'IT as a

Service' to the SME sector in the UK utilising asset light

technology and services so that customers always benefit from

innovative and aggregated solutions. Our value proposition is

focused on helping organisations with their IT strategy, being the

single trusted partner to manage the provisioning process and

provide superior customer experience and support.

adept4, through a dedicated professional services team

comprising software, infrastructure and project management

resources, is perfectly placed to transition customers into a fully

managed service, supported by a 24x7x365, UK based helpdesk. adept4

is a Tier 1 Microsoft SLPA and Cloud Service Provider. adept4 is a

public company quoted on the AIM market of the London Stock

Exchange with offices in Leeds, Warrington, Aberdeen, Brighton and

Northampton.

CHAIRMAN'S STATEMENT & BUSINESS AND OPERATIONAL REVIEW

INTRODUCTION

I am pleased to report upon my first set of results since I

joined the Group as Executive Chairman and also the first set of

results under our new name of adept4 plc. The period under review

has been one of considerable change.

I believe it is only appropriate to start by acknowledging the

service of my predecessor in the role of Chairman, James Dodd, as

well as that of Nicholas Scallan, former Chief Executive Officer,

both of whom left the business following the annual general meeting

in March 2016. I wish them well for the future. I also want to

thank former colleagues who left the business with the sale of RMS

Managed IT Security Limited and the disposal of the trade and

assets of Pinnacle CDT Limited. All of their efforts in the face of

challenging circumstances were very much appreciated, and it is to

their ultimate credit that we have been able to effect a

re-organisation which has, in my view, generated the best outcome

for all stakeholders of the business without any further financial

or employment losses.

STRATEGY, PROPOSITION & INITIAL PLAN

On 7 December I was appointed to the Board as Executive Chairman

to drive the strategy of the business and assist executive

management in the execution of that strategy.

In the announcement in January 2016 of the proposed acquisitions

of Ancar B Technologies Limited ("Ancar") and Weston Communications

Limited ("Weston") alongside a placing of new shares and an open

offer, we set out the Company's strategy of re-focusing the

business on higher margin services through a buy and build strategy

to become a leading provider of IT as a Service ("ITaaS").

We also announced the appointment of Ian Winn to the role of

Chief Operating Officer and Finance Director from 1 February with

Nicholas Scallan, CEO, stepping down from the board and the Company

at the end of March 2016.

In the same announcement, we outlined the Board's intention to

perform a full review of the existing Pinnacle business which would

include the possibility of making disposals and potential

acquisitions of joint ventures already within the business to

maximise shareholder value.

As I report to you today, I believe that we have made

substantial progress in a relatively short time frame. Through

executing this strategy we now have a sustainable operational

platform from which to grow the Company organically and through

potential further acquisitions.

ACQUISITIONS AND DISPOSALS DURING THE PERIOD

In February 2016, following shareholder approval, we completed

the acquisitions of Ancar and Weston to create a Yorkshire hub for

provision of ITaaS to SME customers for gross consideration of

GBP6.5m, GBP5.0m net of cash in this business at completion. The

net GBP5m consideration was satisfied by the issue of GBP2.25m new

shares in the Group and GBP2.75m of cash from the placing and open

offer referred to below.

The combined businesses, on a pro-forma basis based on historic

filed information, were generating annual revenues of GBP5m (of

which 59% were recurring) and EBITDA of GBP0.8m.

At the same time, we raised GBP4.8m through a placing and open

offer for new ordinary shares at 4.2p per share, in order to fund

the cash consideration for the acquisition of Ancar and provide

working capital for the Group.

Following the acquisitions of Ancar and Weston, we undertook a

strategic review of the legacy Pinnacle business. The strategic

review concluded, inter alia, that the fragmented operational and

contractual organisation structure required a significant overhaul.

In order to help achieve this, we made the decision to rationalise

the joint venture arrangements in place. To that end, on 14 March

2016 we announced that we had reached agreement with two out of

three of our joint venture partnerships to effectively acquire the

rights to 100% of the gross profit originated by them for an

initial consideration of GBP0.40m, with a further payment to be

made in March 2017 for GBP0.26m. The annual commission payments

saved were GBP0.40m. On the same date we also announced that we had

successfully sold our minority shareholding in Stripe 21 Limited, a

provider of voice over IP software considered non-core to the

Group, for GBP0.39m.

On 31 March 2016, we completed a group re-organisation where we

'hived' up the trade and assets of the majority of the legacy

Pinnacle subsidiaries which provided a range of data,

telecommunication and fixed line services. Following the 'hive' up,

all the activities of those businesses were transacted by a single

legal entity - Pinnacle CDT Limited ("Pinnacle CDT").

We also took the commercial decision to look for ways to exit

from both Pinnacle CDT and RMS Managed IT Security Limited ("RMS"),

which were no longer considered to be in line with the Group's new

strategy and I am pleased to report that, post period end, we

achieved exits for both businesses as described further below.

POST PERIOD

During April 2016 we announced to staff in the Ancar and Weston

businesses that we would be consolidating onto a single site -

Ancar's existing office. This integration is on track to be

completed by July 2016 and will generate a modest level of cost

savings.

On 3 May 2016, we announced the disposal of RMS, to Intronovo

Limited for GBP1. At the date of transfer RMS had net liabilities

of GBP45,000, excluding intra group indebtedness of GBP2.15m which

was written off immediately prior to disposal.

On 16 May 2016 we announced that we had disposed of the trade

and assets of Pinnacle CDT to Chess ICT Limited for cash

consideration of GBP2.8m.

The sale of these two businesses meant that all of the Group's

legacy businesses which formed the trading business of the Group at

the start of the financial period were no longer part of the Group.

As part of these disposals, approximately 33 people left the Group,

and the Group no longer has an operating presence in Stoke-on-Trent

or Glasgow.

On 26 May 2016 we announced the acquisition of adept4 Limited, a

provider of ITaaS encompassing fully managed IT service contracts,

cloud based services, professional services, software support and

development. Initial consideration for the acquisition was GBP4.5m,

payable in cash, plus deferred consideration of GBP1m in cash,

payable in January 2018. Further contingent consideration of up to

GBP1.5m in cash is payable in March 2018, subject to performance

criteria for the year to 31 December 2017.

adept4 Limited has a widely experienced and capable executive

management team which will be retained and leveraged across the

larger group. We believe that this team combined with two dedicated

operation centres in Warrington and Leeds provides a strong

platform for future organic and acquisition led growth.

The decision was also taken to rename the Company to adept4 plc,

for which shareholder approval was obtained in June 2016 and the

name change became effective on 13 June 2016, signalling the

beginning of a new era for the Group.

Business Growth Fund plc ("BGF")

In order to fund the acquisition of adept4 Limited, the Company

issued GBP5m loan notes to the BGF in June 2016, with an associated

GBP3m option to subscribe for shares in the Company at 6 pence,

representing a 43% uplift from the February placing price of 4.2

pence. We were particularly pleased to secure the investment from

BGF and also at the speed with which the funding was completed

which, combined with the exercise price of the option, I believe

provides clear external validation of the strategy we are

pursuing.

FINANCIAL SUMMARY

A consequence of all the above activity is that the numbers

reported are not representative of the new underlying trading

business.

The RMS and Pinnacle CDT businesses have been treated as

'discontinued operations' and therefore continued operations relate

solely to the trading performance of Ancar and Weston post

acquisition (10 February 2016) plus plc costs.

On the Consolidated Statement of Financial Position the assets

and liabilities related to discontinued operations have each been

separately identified and classified as a single value and included

in current assets and current liabilities held for sale.

The previous segmentation used to analyse the business is no

longer appropriate for the business as it now exists. ITaaS should

be viewed as a holistic approach to meeting a customer's

requirements and therefore a granular break down of revenue streams

and profitability between data connectivity, mobiles,

telecommunication services etc. is not appropriate. For the

purposes of the interim statement we have analysed revenues and

profitability between recurring and non-recurring. As we integrate

adept4 Limited we will further review any additional segmentation

which is required to effectively manage and control the business

for group reporting purposes.

Revenue for the period was GBP0.83m, with gross profit at

GBP0.46m, which represented a gross profit margin of 55%.

Recurring revenues for the period were GBP0.57m, which

represented 69% of total revenue, and generated gross profit of

GBP0.35m, representing 76% of gross profit.

Trading Group EBITDA for the period was GBP0.16m, which, as

previously stated, represented only two months trading results for

Ancar and Weston.

Plc costs for the period were GBP0.3m and reflected the higher

costs associated with my executive chairmanship due to the

significantly larger time commitment to the business than in the

previous period.

Separately identifiable costs and income for the period were

GBP0.46m comprising costs for the following - compensation for loss

of office GBP0.08m, deal origination costs GBP0.13m and legal and

advisory fees on the Group restructure GBP0.25m.

Discontinued activities generated a loss for the period of

GBP0.32m, which I believe fully vindicates the decisions we took

during the period to exit these business lines.

Group loss after tax for the period was GBP0.7m (H1

2015:GBP0.5m).

The placing and open offer in February 2016 resulted in the

issue of 114.3 million new ordinary shares raising GBP4.64m net of

issue costs which was used to acquire Ancar, settle the joint

venture arrangements, cover re-organisation costs and provide

working capital.

Intangible assets recognised on the acquisition of Ancar and

Weston based on the provisional opening balancing sheet were

GBP5.8m, split between goodwill GBP1.8m and customer contracts

GBP4.0m (which will be amortised over 10 years). As a result of the

disposal of Pinnacle CDT after the period end for GBP2.8m there has

been no need to impair the intangible assets related to this asset

as these proceeds more than support the carrying value of

intangibles at the period end.

At the period end net cash balances were GBP1.39m (H1 2015:

GBP0.15m). Following the acquisition of adept4 Limited and

receiving funding from the BGF the cash balances of the group were

GBP4.3m at 27 May 2016.

During the period there was a net cash inflow of GBP0.8m. This

breaks down as follows:

-- Trading cash inflow from continuing operations (excluding plc costs) of GBP0.2m;

-- Corporate activity, including the placing and open offer,

acquisitions, restructure costs and the cost of running the plc

generated net cash inflow of GBP1.0m; and

-- Operating cash outflow from discontinued operations was GBP0.4m.

OUTLOOK

Having acquired three trading businesses, all of which are

profitable, our focus is now on the integration of our acquisitions

so that we can scale our 'IT as a Service' proposition. We have

started to cross sell across these businesses and we expect to make

further progress on this front.

We have a strategy which is aligned with an asset light approach

and therefore does not require us to make substantial investments

in technology or assets, allowing us to be flexible and pick best

of breed solutions that meet our customers' requirements.

We now have a strong operational management team, who are

motivated through an earn-out and an employee share scheme is in

the process of being put in place (in line with the detail in my

announcement in January 2016), and which firmly aligns their

rewards with the creation of shareholder value.

Finally we have funds in the bank which allow us the potential

to make further acquisitions, subject to identifying suitable

targets, which align with our strategy.

I look forward to providing further updates through the

remainder of this year on our progress and look to the future with

confidence.

Gavin Lyons

CHAIRMAN

29 June 2016

INDEPENT REVIEW REPORT TO ADEPT4 PLC ("the Company")

Introduction

We have been engaged by the Company to review the interim

condensed financial statements for the six months ended 31 March

2016 which comprises the consolidated statement of financial

position, the consolidated income statement, consolidated statement

of changes in equity, consolidated statement of comprehensive

income, consolidated statement of cash flows and the related

explanatory notes.

We have read the other information contained in the half-yearly

report and considered whether it contains any apparent

misstatements or material inconsistencies with the financial

information in the condensed set of financial statements.

This report is made solely to the Company in accordance with the

terms of our engagement to assist the Company in meeting the

requirements of the AIM Rule 18. Our review has been undertaken so

that we might state to the Company those matters we are required to

state to it in this report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the Company for our review work, for this

report or for the conclusions we have reached.

Directors' responsibilities

The half-yearly report is the responsibility of, and has been

approved by, the directors. The directors are responsible for

preparing the half-yearly report in accordance with AIM Rule

18.

As disclosed in note 2, the annual financial statements of the

group are prepared in accordance with IFRS as adopted by the

European Union. It is the responsibility of the directors to ensure

that the condensed set of financial statements included in this

half-yearly report have been prepared on a basis consistent with

that which will be adopted in the Group's annual financial

statements.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly report

based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK and

Ireland) and consequently does not enable us to obtain assurance

that we would become aware of all significant matters that might be

identified in an audit. Accordingly we do not express an audit

opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly report for the six months ended 31 March 2016 is

not prepared, in all material respects, in accordance with the

requirements of the AIM rules.

Nexia Smith & Williamson 25 Moorgate

Statutory Auditor London

Chartered Accountants EC2R 6AY

29 June 2016

CONSOLIDATED INCOME STATEMENT

for the six month period ended 31 March 2016

6 months 6 months Year

to to to

31 March 31 March 30 Sept

2016 2015 2015

Note GBP GBP GBP

------------------------------- ----- ------------ ---------- ------------

Revenue 3 830,577 - -

Cost of sales (368,391) - -

------------------------------- ----- ------------ ---------- ------------

Gross profit 462,186 - -

Operating expenses (1,131,768) (205,431) (476,562)

------------------------------- ----- ------------ ---------- ------------

Operating loss (669,582) (205,431) (476,562)

Trading EBITDA 166,132 - -

Head Office costs (305,051) (198,068) (457,547)

------------ ---------- ------------

Adjusted EBITDA loss (138,919) (198,068) (457,547)

Amortisation of Intangible

Assets 8 (65,105) - -

Depreciation (6,050) - -

Separately identifiable

costs and expenses 4 (458,338) - -

Share based payments (1,170) (7,363) (19,015)

Operating loss (669,582) (205,431) (476,562)

------------------------------- ----- ------------ ---------- ------------

Interest receivable 33 123 96

Interest payable (219) (1,041) (254)

------------------------------- ----- ------------ ---------- ------------

Net Finance expense (186) (918) (158)

------------------------------- ----- ------------ ---------- ------------

Profit on sale of associate 284,592 - -

Loss before tax (385,176) (206,349) (476,720)

Taxation 6 13,021 - -

------------------------------- ----- ------------ ---------- ------------

Loss for the period

from continuing operations (372,155) (206,349) (476,720)

------------------------------- ----- ------------ ---------- ------------

Discontinued operations

Loss for the period

from discontinued operations 5 (323,183) (315,175) (775,322)

------------------------------- ----- ------------ ---------- ------------

Loss for the period (695,338) (521,524) (1,252,042)

------------------------------- ----- ------------ ---------- ------------

Loss per share (pence)

basic and fully diluted

- continuing operations 7 (0.56) (0.51) (0.95)

basic and fully diluted

- discontinued operations 7 (0.48) (0.78) (1.56)

basic and fully diluted 7 (1.04) (1.29) (2.51)

Notes 1 to 11 form part of the analysis of the

interim condensed financial statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

as at 31 March 2016

At 31 March At 31 March At 30

2016 2015 September

2015

Note GBP GBP GBP

--------------------------- ----- ------------- ------------- -------------

Non-current assets

Goodwill 8 1,849,177 - -

Intangible assets 8 3,962,551 790,029 490,773

Investments 35,319 165,300 100,408

Property, plant

and equipment 79,331 170,876 125,664

Total non-current

assets 5,926,378 1,126,205 716,845

--------------------------- ----- ------------- ------------- -------------

Current assets

Inventories 65,941 33,118 7,365

Trade and other

receivables 1,169,679 1,565,255 1,461,011

Assets of the disposal

group and non-current

assets classified

as held for sale 5 2,947,768 - -

Cash and cash equivalents 1,439,108 193,197 640,838

--------------------------- ----- ------------- ------------- -------------

Total current

assets 5,622,496 1,791,570 2,109,214

--------------------------- ----- ------------- ------------- -------------

Total assets 11,548,874 2,917,775 2,826,059

--------------------------- ----- ------------- ------------- -------------

Liabilities

Short term borrowings (57,497) (64,506) (65,881)

Trade and other

payables (703,628) (1,602,817) (1,486,429)

Liabilities of

the disposal group

classified as held

for sale 5 (2,354,093) - -

Other taxes and

social security

costs (279,987) (172,369) (158,910)

Accruals and other

payables (763,333) (584,254) (604,822)

--------------------------- ----- ------------- ------------- -------------

Total current liabilities (4,158,538) (2,423,946) (2,316,042)

--------------------------- ----- ------------- ------------- -------------

Non-current liabilities

Long term borrowings - (7,130) (10,079)

Deferred tax liability (792,510) (165,906) (98,155)

--------------------------- ----- ------------- ------------- -------------

Total liabilities (4,951,048) (2,596,982) (2,424,276)

--------------------------- ----- ------------- ------------- -------------

Net assets 6,597,826 320,793 401,783

--------------------------- ----- ------------- ------------- -------------

Equity

Share capital 2,270,651 6,949,092 591,826

Share premium account 13,050,861 7,171,261 7,839,475

Capital Redemption

Reserve 6,488,907 - 6,488,907

Merger reserve 283,357 283,357 283,357

Other reserve 52,210 39,387 51,040

Fair value adjustment (1,064,130) (1,064,130) (1,064,130)

Retained earnings 9 (14,484,030) (13,058,174) (13,788,692)

--------------------------- ----- ------------- ------------- -------------

Total equity 6,597,826 320,793 401,783

--------------------------- ----- ------------- ------------- -------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for six month period ended 31 March 2016

Capital

Share Share Redemption Merger Other Fair Retained

Capital Premium Reserve Reserve Reserve Value Earnings Total

GBP GBP GBP GBP GBP GBP GBP GBP

--------------- ---------------- ---------------- ----------- -------- -------------- -------------------- ------------- ------------

At 1 October

2014 6,862,250 6,774,870 - 283,357 32,024 (1,064,130) (12,536,650) 351,721

Loss and total

comprehensive

loss for the

period - - - - - - (521,524) (521,524)

Transactions

with owners

564,470

Share Issue 86,842 477,628 - - - - - ,

Share based

payments - - - - 7,363 - - 7,363

Expenses on

Share Issue - (81,237) - - - - - (81,237)

Total

Transactions

with owners 86,842 396,391 - - 7,363 - - 490,596

--------------- ---------------- ---------------- ----------- -------- -------------- -------------------- ------------- ------------

Total

movements 86,842 396,391 - - 7,363 - (521,524) 30,928

--------------- ---------------- ---------------- ----------- -------- -------------- -------------------- ------------- ------------

66

Equity at

31 March 2015 6,949,092 7,171,261 - 283,357 39,387 (1,064,130) (13,058,174) 320,793

--------------- ---------------- ---------------- ----------- -------- -------------- -------------------- ------------- ------------

Capital

Share Share Redemption Merger Other Fair Retained Total

Capital Premium Reserve Reserve Reserve Value Earnings GBP

GBP GBP GBP GBP GBP GBP GBP

--------------- ------------ ---------- ------------ --------- --------- ------------ ------------- ----------

At 1 April

2015 6,949,092 7,171,261 - 283,357 39,387 (1,064,130) (13,058,174) 320,793

Loss and total

comprehensive

loss for the

period - - - - - - (730,518) (730,518)

Transactions

with owners

Share Issue 131,641 724,027 - - - - - 855,668

Cancellation

of Deferred

Shares (6,488,907) - 6,488,907 - - - - -

Share based

payments - - - - 11,653 - - 11,653

Expenses on

Share Issue - (55,813) - - - - - (55,813)

--------------- ------------ ---------- ------------ --------- --------- ------------ ------------- ----------

Total

Transactions

with owners (6,357,266) 668,214 6,488,907 - 11,653 - - 811,508

--------------- ------------ ---------- ------------ --------- --------- ------------ ------------- ----------

Total

movements (6,357,266) 668,214 6,488,907 - 11,653 - (730,518) 80,990

--------------- ------------ ---------- ------------ --------- --------- ------------ ------------- ----------

Equity at

30 September

2015 591,826 7,839,475 6,488,907 283,357 51,040 (1,064,130) (13,788,692) 401,783

--------------- ------------ ---------- ------------ --------- --------- ------------ ------------- ----------

Capital

Share Share Redemption Merger Other Fair Retained

Capital Premium Reserve Reserve Reserve Value Earnings Total

GBP GBP GBP GBP GBP GBP GBP GBP

--------------- ---------- ----------- ----------- -------- -------- -------------------- ------------- -----------

At 1 October

2015 591,826 7,839,475 6,488,907 283,357 51,040 (1,064,130) (13,788,692) 401,783

Loss and total

comprehensive

loss for the

period - - - - - - (695,338) (695,338)

Transactions

with owners

Share Issue 1,678,825 5,372,241 - - - - - 7,051,066

Share based

payments - - - - 1,170 - - 1,170

Expenses on

Share Issue - (160,855) - - - - - (160,855)

Total

Transactions

with owners 1,678,825 5,211,386 - - 1,170 - - 6,891,381

--------------- ---------- ----------- ----------- -------- -------- -------------------- ------------- -----------

Total

movements 1,678,825 5,211,386 - - 1,170 - (695,338) 6,196,043

--------------- ---------- ----------- ----------- -------- -------- -------------------- ------------- -----------

Equity at

31 March 2016 2,270,651 13,050,861 6,488,907 283,357 52,210 (1,064,130) (14,484,030) 6,597,826

--------------- ---------- ----------- ----------- -------- -------- -------------------- ------------- -----------

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the six month period ended 31 March 2016

6 months 6 months 12 months

to to to

31 March 31 March 30 Sept

2016 2015 2015

GBP GBP GBP

------------------------------ ---------- ---------- ------------

Loss for the year from

total operations (695,338) (521,524) (1,252,042)

Total comprehensive

negative income for

the year (695,338) (521,524) (1,252,042)

Attributable to equity

holders of the parent (695,338) (521,524) (1,252,042)

------------------------------ ---------- ---------- ------------

CONSOLIDATED STATEMENT OF CASH FLOWS

for the six month period ended 31 March 2016

6 months 6 months 12 months

to to to 30

31 March 31 March September

2016 2015 2015

Note GBP GBP GBP

------------------------------ ----- ------------ ---------- -----------

Cash flows from continuing

operating activities

Net cash flow from operating

activities 10 (325,436) (219,886) (499,824)

------------------------------ ----- ------------ ---------- -----------

Cash flows from investing

activities

Interest received 33 123 96

Acquisition of subsidiaries, (3,130,138) - -

net of cash acquired

Net cash used in investing

activities (3,130,105) 123 96

------------------------------ ----- ------------ ---------- -----------

Cash flows from financing

activities

Issue of shares 9 4,801,067 564,470 1,420,138

Expenses paid in connection

with share issue (160,855) (81,237) (137,050)

Interest paid (219) (1,041) (254)

------------------------------ ----- ------------ ---------- -----------

Net cash from financing

activities 4,639,993 482,192 1,282,834

------------------------------ ----- ------------ ---------- -----------

Cashflow from discontinued

operations (392,648) (168,668) (246,905)

------------------------------ ----- ------------ ---------- -----------

Net (decrease)/increase

in cash 791,804 93,761 536,201

Cash at bank and in

hand at beginning of

period 593,304 57,103 57,103

------------------------------ ----- ------------ ---------- -----------

Cash at bank and in

hand at end of period 1,385,108 150,864 593,304

------------------------------ ----- ------------ ---------- -----------

Comprising:

Cash at bank and in

hand 1,439,108 193,197 640,838

Bank overdrafts (54,000) (42,333) (47,534)

------------------------------ ----- ------------ ---------- -----------

1,385,108 150,864 593,304

------------------------------ ----- ------------ ---------- -----------

NOTES TO THE FINANCIAL INFORMATION

for the six month period ended 31 March 2016

1. General Information

Adept4 plc is a company incorporated in the United Kingdom under

the Companies Act 2006. The principal activity of the group is the

provision of IT as a Service ("ITaaS") to small and medium sized

businesses in the United Kingdom. The interim condensed financial

statements are presented in pounds sterling because that is the

currency of the primary economic environment in which each of the

Group's subsidiaries operates.

The address of its registered office is 5 Fleet Place, London,

EC4M 7RD and its principal places of business are Leeds and

Warrington. The company is listed on the AIM market of the London

Stock Exchange under ticker symbol AD4.L

2. Basis of preparation

These unaudited consolidated interim condensed financial

statements are for the six months ended 31 March 2016. They have

not been prepared in accordance with IAS 34 "Interim Financial

Reporting". They do not include all of the information required for

full annual financial statements and should be read in conjunction

with the consolidated financial statements of the group for the

year ended 30 September 2015.

The financial information set out in these unaudited

consolidated interim condensed financial statements does not

constitute statutory accounts as defined in section 434 of the

Companies Act 2006. The consolidated statement of financial

position as at 30 September 2015 and the consolidated statement of

comprehensive income, consolidated statement of cash flows,

consolidated statement of changes in equity and associated notes

for the period then ended have been extracted from the group's

financial statements as at 30 September 2015. Page 33 of those

financial statements have received an unmodified report from the

auditors, Nexia Smith & Williamson LLP, and have been delivered

to the Registrar of Companies. The 2015 statutory accounts

contained no statement under section 498(2) or section 498(3) of

the Companies Act 2006.

The consolidated interim condensed financial statements for the

period ended 31 March 2016 have not been audited but reviewed in

accordance with International Standard on Review Engagements 2410

issued by the Auditing Practices Board. The independent review

report to adept4 plc follows the Chairman's Statement and Business

and Operational Review in this interim condensed financial

statement.

The interim statements were approved by the Board of Directors

on 29 June 2016.

3. Segment Reporting

Following the disposal of all of the trading operations which

comprised the Group's operating activities at 1 October 2015 and

the subsequent acquisitions, as referred to in note 8, the

operating segments used by the Group are currently under review to

ensure they meet its requirements for effective management and

reporting. However management consider that a key feature of the

business is the differentiation between recurring revenues, which

are by definition either contractual or a regular commitment to

take services, and non-recurring revenues, which are primarily

hardware, product or installation related. Segmental information

has therefore been presented on the basis of revenue and gross

profit split between these two revenue types.

All revenues for continuing operations relate to the UK.

3.1 Analysis of revenue 6 months 6 months 12 months

to to to

31 March 31 March 30 September

2016 2015 2015

GBP GBP GBP

--------------------------- ---------- ---------- --------------

By operating segment

Recurring and renewable -

- continuing operations 568,767 -

Non-Recurring - continuing -

operations 261,810 -

Continuing operations 830,577 - -

--------------------------- ---------- ---------- --------------

Total revenue 830,577 - -

--------------------------- ---------- ---------- --------------

3.2 Analysis of gross 6 months 6 months 12 months

profit for continuing to to to

operations 31 March 31 March 30 September

2016 2015 2015

GBP GBP GBP

--------------------------- ---------- ---------- --------------

By operating segment

Recurring and renewable -

- continuing operations 349,574 -

Non-Recurring - continuing -

operations 112,612 -

Continuing operations 462,186 - -

--------------------------- ---------- ---------- --------------

Total gross profit 462,186 - -

--------------------------- ---------- ---------- --------------

4. Separately identifiable costs and expenses

During the period, the Group incurred the following separately

identifiable costs and expenses which are material by their size or

incidence:

6 Months 6 Months 12 Months

to to to

31 March 31 March 30 September

2016 2015 2015

GBP GBP GBP

------------------------------- ---------- ---------- --------------

Costs:

Deal origination fees (125,000) - -

Legal and advisory fees - -

on group re-structure (249,329)

Settlement of former Directors - -

Service Agreements (84,009)

------------------------------- ---------- ---------- --------------

Separately identifiable

costs and expenses (458,338) - -

------------------------------- ---------- ---------- --------------

5. Discontinued operations

As detailed in Note 11, on 30 April 2016, the Group disposed of

the entire share capital of RMS Managed ICT Security Limited (and

its dormant subsidiary Aware Distribution Limited) to Intronovo

Limited, for a net gain of GBP45,000. On 13 May 2016, the Group

also sold the entire trade and assets of Pinnacle CDT Limited to

Chess ICT Limited for GBP2,800,000 in cash.

These transactions allowed the Group to exit the highly

competitive, but declining, IT Security and Telecommunications

markets and as such represent an exit from these major business

lines.

The decision and process to dispose of these businesses were

initiated prior to 31 March 2016 and in accordance with IFRS5, all

trade and assets relating to these disposals have been classified

as discontinued operations in the Income Statement of the

Group.

5.1 Net loss from discontinued

operations

6 Months 6 Months 12 Months

to to to

31 March 31 March 30 September

2016 2015 2015

GBP GBP GBP

---------------------------------- ------------ ------------ -------------

Revenue 3,744,044 3,987,548 7,883,640

Gross profit 1,093,861 1,242,868 2,317,790

Administrative expenses (1,170,972) (1,279,042) (2,432,671)

Amortisation and impairment

of intangible assets (88,471) (202,067) (501,323)

Depreciation (30,584) (105,196) (197,773)

Separately identifiable costs (70,000) - (64,892)

------------ ------------ -------------

Operating expenses (1,360,027) (1,586,305) (3,196,659)

Operating loss from discontinued

operations (266,166) (343,437) (878,869)

Interest payable (2,779) (14,062) (6,637)

Taxation (54,238) 42,324 110,184

Net loss from discontinued

operations (323,183) (315,175) (775,322)

---------------------------------- ------------ ------------ -------------

The separately identifiable cost of GBP70,000 above, relates to

a payment made to a joint venture partner during the period in full

and final settlement of their agreement with Pinnacle CDT Limited.

The intangible assets figure below includes GBP326,000 paid to the

owners of Accent Telecom North Limited, as part payment against the

acquisition of the remaining share capital in that business.

Accordingly, all assets held by the Group on behalf of RMS

Managed ICT Security Limited and Pinnacle CDT Limited (the disposal

group) at 31 March 2016 have been recorded as assets classified as

held for sale in the Consolidated Balance Sheet of the Group. The

net carrying value of these assets and liabilities at 31 March 2016

is GBP593,675, made up of current and non-current assets classified

as held for sale of GBP2,947,768 and liabilities classified as held

for sale of GBP2,354,093 as follows:

5.2 Assets of the disposal group and non-current

assets classified as held for sale

At 31

March

2016

GBP

-------------------------------------------------- ----------

Intangible assets 988,033

Property, plant and equipment 125,116

Inventories 18,424

Trade and other receivables 1,816,195

---------------------------------------------------- ----------

Assets of the disposal group and non-current

assets classified as held for sale 2,947,768

---------------------------------------------------- ----------

5.3 Liabilities of the disposal

group classified as held

for sale

At 31

March

2016

GBP

--------------------------------- ------------

Short term borrowings (24,658)

Trade and other payables (1,225,450)

Other taxes and social security

costs (94,511)

Accruals and other payables (781,472)

Long term borrowings (30,395)

Deferred tax liability (197,607)

----------------------------------- ------------

Liabilities of the disposal

group classified as held

for sale (2,354,093)

----------------------------------- ------------

6. Taxation

6 Months 6 Months 12 Months

to to to

The tax credit represents: 31 March 31 March 30 September

2016 2015 2015

GBP GBP GBP

------------------------------- --------- --------- -------------

Reversal of timing difference

in the period 13,021

------------------------------- --------- --------- -------------

Taxation 13,021 - -

------------------------------- --------- --------- -------------

7. Loss per share 6 Months 6 Months 12 Months

to to to

31 March 31 March 30 September

2016 2015 2015

p/share p/share p/share

--------------------------------- ----------- ----------- --------------

Basic and fully diluted -

continuing operations 0.56 0.51 0.95

Basic and fully diluted -

discontinued operations 0.48 0.78 1.56

Basic and fully diluted 1.04 1.29 2.51

Loss on continuing operations (372,155) (206,349) (476,720)

Loss on discontinued operations (323,183) (315,175) (775,322)

Loss attributable to ordinary

shareholders (695,338) (521,524) (1,252,042)

Weighted average number of

shares in issue:

Basic and fully diluted 66,757,368 40,427,272 49,924,907

--------------------------------- ----------- ----------- --------------

8. Intangible assets

Intangible assets are non-physical assets which have been

obtained as part of an acquisition and which have an identifiable

future economic benefit to the Group at the point of acquisition.

The Group's policy regarding assessing impairment of intangible

assets remains the same as disclosed in the financial statements

for the year ended 30 September 2015.

- Maintenance contracts to be amortised over a period of 10

years

- Customer lists to be amortised over a period of 10 years

- Intellectual property and software applications to be amortised over a period of 10 years

8.1 Movement on intangible As at As at As at

assets 31 March 31 March 30 September

2016 2015 2015

GBP GBP GBP

-------------------------------------- ------------- ------------- ---------------

Net intangible assets

at start of period 490,773 992,096 992,096

Transferred to non-current

assets held for sale (490,773) - -

Intangible asset additions

* Ancar-B Technologies Limited 3,021,712 - -

* Weston Communications Limited 1,005,944 - -

Impairment in the

period - (46,857) (190,903)

Amortisation in the

period (65,105) (155,210) (310,420)

--------------------------------------- ------------- ------------- ----------------

Net intangible assets

at period end 3,962,551 790,029 490,773

--------------------------------------- ------------- ------------- ----------------

8.2 Acquisition of Ancar-B Technologies Limited

On 10 February 2016, the Group acquired the entire issued share

capital of Ancar-B Technologies Limited for a total consideration

of GBP5.0 million which includes a cash for cash payment of GBP1.5

million resulting in net consideration of GBP3.5 million. The

consideration was satisfied as to GBP2.75 million in cash and

GBP0.75 million in new Ordinary Shares at 4.2p per share.

Provisional

8.2.1 Ancar-B Technologies Fair

Limited Book value Provisional

Cost adjustment Fair Value

GBP GBP GBP

-------------------------------- ---------- --------------- ---------------

Non-current assets

Intangible asset - 3,021,712 3,021,712

Property, plant and

equipment 153,576 (117,649) 35,927

Investments 35,319 - 35,319

-------------------------------- ---------- --------------- ------------

Total non-current

assets 188,895 2,904,063 3,092,958

-------------------------------- ---------- --------------- ------------

Current assets

Inventories 9,000 (9,000) -

Trade and other receivables 325,972 - 325,972

Cash at bank 1,625,941 - 1,625,941

-------------------------------- ---------- --------------- ------------

Total current assets 1,960,913 (9,000) 1,951,913

-------------------------------- ---------- --------------- ------------

Total assets 2,149,808 2,895,063 5,044,871

-------------------------------- ---------- --------------- ------------

Current liabilities

Trade and other payables (191,072) - (191,072)

Other taxes and social

security costs (227,094) - (227,094)

Deferred Income and

accruals (273,966) - (273,966)

-------------------------------- ---------- --------------- ------------

Total current liabilities (692,132) - (692,132)

-------------------------------- ---------- --------------- ------------

Total non-current

liabilities

Long term borrowings (13,676) - (13,676)

Deferred Tax Liability - (604,342) (604,342)

-------------------------------- ---------- --------------- ------------

Total liabilities (705,808) (604,342) (1,310,150)

-------------------------------- ---------- --------------- ------------

Net (Liabilities)

/ Assets 1,444,000 2,290,721 3,734,721

* Consideration in cash (4,250,000)

* Consideration in shares (750,000)

-------------------------------- ---------- --------------- ------------

Fair value of cost

of acquisition (5,000,000)

-------------------------------- ---------- --------------- ------------

Goodwill 1,265,279

-------------------------------- ---------- --------------- ------------

8.3 Acquisition of Weston Communications Limited

On 10 February 2016, the Group acquired the entire issued share

capital of Weston Communications Limited for a total consideration

of GBP1.5 million satisfied by the issue of 35,714,285 shares at

4.2p per share.

Provisional

8.3.1 Weston Communications Fair

Limited Book Value Provisional

Cost adjustment Fair Value

GBP GBP GBP

-------------------------------- ---------- --------------- ---------------

Non-current assets

Intangible asset 4,178 1,001,766 1,005,944

Property, plant and

equipment 48,832 - 48,832

Total non-current

assets 53,010 1,001,766 1,054,776

-------------------------------- ---------- --------------- ------------

Current assets

Inventories 51,361 (30,920) 20,441

Trade and other receivables 250,251 - 250,251

Cash at bank 175,281 - 175,281

-------------------------------- ---------- --------------- ------------

Total current assets 476,893 (30,920) 445,973

-------------------------------- ---------- --------------- ------------

Total assets 529,903 970,846 1,500,749

-------------------------------- ---------- --------------- ------------

Current assets

Trade and other payables (134,972) - (134,972)

Other taxes and social

security costs (33,023) - (33,023)

Deferred Income and

accruals (165,167) - (165,167)

-------------------------------- ---------- --------------- ------------

Total current liabilities (333,162) - (333,162)

-------------------------------- ---------- --------------- ------------

Total non-current

liabilities

Deferred Tax Liability - (251,486) (251,486)

-------------------------------- ---------- --------------- ------------

Total liabilities (333,162) (251,486) (584,648)

-------------------------------- ---------- --------------- ------------

Net (Liabilities)

/ Assets 196,741 719,360 916,101

-------------------------------- ---------- --------------- ------------

* Consideration in shares (1,500,000)

-------------------------------- ---------- --------------- ------------

Fair value of cost

of acquisition (1,500,000)

-------------------------------- ---------- --------------- ------------

Goodwill 583,899

-------------------------------- ---------- --------------- ------------

9. Profit and loss reserve & Share Capital

9.1 Profit and loss reserve

6 Months 6 Months 12 months

to to to

31 March 31 March 30 September

2016 2015 2015

GBP GBP GBP

--------------------- ------------- ------------- --------------

Opening deficit (13,788,692) (12,536,650) (12,536,650)

Loss for the period (695,338) (521,524) (1,252,042)

--------------------- ------------- ------------- --------------

Closing deficit (14,484,030) (13,058,174) (13,788,692)

--------------------- ------------- ------------- --------------

9.2 Share Capital

The total number of shares issued in the 6 month period to 31

March 2016 was 167,882,542 ordinary shares. The placing and open

offer resulted in the issue of 114,311,113 ordinary shares for 4.2

pence which raised GBP4,801,067 in cash. 53,571,429 ordinary

shares, with an aggregate fair value of GBP2,250,000, were issued

as consideration in relation to the acquisition of Ancar-B

Technologies Limited and Weston Communications Limited as

above.

10. Cashflow from operating 6 months 6 months 12 months

activities to to to 30

31 March 31 March September

Note 2016 2015 2015

GBP GBP GBP

------------------------------- ------ ---------- ---------- -----------

Loss before tax from

continuing operations (385,176) (206,349) (476,720)

Adjustments for:

Depreciation 6,050 - -

Amortisation 65,105 - -

Impairment of intangible - - -

assets

Share of loss from associate - - -

Share option charge 1,170 7,363 19,015

Loss on disposal of fixed - - -

assets

Interest expense 186 918 158

Decrease/(increase) in

trade and other receivables 348,359 3,646 37,167

Decrease/(Increase) in (63,146) - -

inventories

Increase/(decrease) in

trade payables, accruals

and other creditors (297,984) (25,464) (79,444)

--------------------------------------- ---------- ---------- -----------

Net cash flow from continuing

operations (325,436) (219,886) (499,824)

--------------------------------------- ---------- ---------- -----------

11. Post Balance Sheet Events

Disposal of RMS Managed ICT Security Limited

On 30 April 2016, the Group disposed of the entire share capital

of RMS Managed IT Security Limited ("RMS") (and its dormant

subsidiary Aware Distribution Limited) to Intronovo Limited for

GBP1. On disposal of RMS, the balance sheet of RMS was negative,

therefore the disposal represented a net gain to the Group of

GBP45,001.

Disposal of Pinnacle CDT Limited to Chess ICT Limited

On 13 May 2016, the Group sold the trade and assets of Pinnacle

CDT Limited to Chess ICT Limited ("Chess") for GBP2.8m in cash.

Business Growth Fund Loan of GBP5m

On 26 May the Company issued GBP5 million unsecured loan notes

("Loan Notes") to the Business Growth Fund Plc ("BGF"). The Loan

Notes have a 7 year term, with redemption permissible from the

third anniversary and required from the fifth anniversary, and

carry interest at a rate of 8% per annum. In addition, the Company

agreed to grant the BGF an option to subscribe for 50,000,000

ordinary shares of 1 pence each in the capital of the Company

("Ordinary Shares") at a price of 6 pence per Ordinary Share (the

"Option").

Acquisition of Adept4 Limited

On 26 May 2016, the Group announced that it had acquired the

entire issued share capital of adept4 Limited ("adept4"), a

provider of cloud based IT services and solutions headquartered in

Warrington, for an initial cash consideration of GBP4.5m, plus

deferred consideration of GBP1m payable in cash in January 2018.

Further contingent consideration of up to GBP1.5m is also payable

in cash in March 2018, subject to performance criteria for the year

to 31 December 2017.

Change of Name to adept4 Plc

On 13 June 2016 the Company changed its name from Pinnacle

Technology Group plc to adept4 plc.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR AKCDPPBKKPAB

(END) Dow Jones Newswires

June 29, 2016 02:00 ET (06:00 GMT)

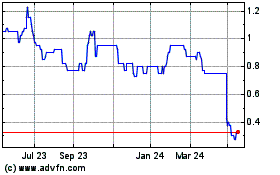

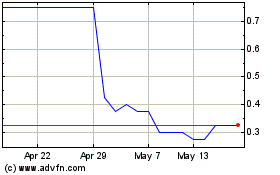

Cloudcoco (LSE:CLCO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cloudcoco (LSE:CLCO)

Historical Stock Chart

From Jul 2023 to Jul 2024