Alteration to Loan Notes

December 11 2008 - 11:31AM

UK Regulatory

Cubus Lux plc

("Cubus Lux" or the "Company")

Alteration to Loan Notes

Cubus Lux, the Croatia-focused leisure resort operator and developer, announces

that it has agreed to change the terms of the loan notes issued in

consideration for the acquisition of the Olive Island Resort companies as set

out herein.

In February 2008, Cubus Lux acquired companies which own the Olive Island

Resort development project in consideration for which they issued Euro13 million

of loan notes (the "Loan Notes") and Euro14.45 million of ordinary shares in the

Company to the vendors (who included three directors of Cubus Lux: Gerhard

Huber, Christian Kaiser and Michael Janssen). Details of this transaction were

set out in an admission document published on 15 January 2008.

Under the documentation constituting the Loan Notes, the holders of the Loan

Notes had, during a 10 business day period commencing on 22 November 2008, the

right to require the Company to redeem the Loan Notes by giving three months

notice, at 103 per cent. of the par value.

The acquisition agreement by which the Olive Island companies were acquired

included a condition subsequent whereby until good title to, or a constituted

construction right over, the Olive Island land is granted, then the acquisition

can be required to be unwound.

Although good progress is being made by Cubus Lux towards acquiring full title

and construction rights over the land, this has not yet been legally granted.

Therefore, had the Loan Note holders required the Company to redeem the Loan

Notes, the Company would have had no choice but to unwind the acquisition

agreement. The Board and Loan Note holders agreed that this was in the interest

of neither the Company nor the Loan Note holders. Accordingly the Company and

the Loan Note holders have agreed that in consideration for the Loan Note

holders not issuing a notice requiring the redemption of the Loan Notes, the

Company would permit the Loan Note holders to require redemption on 31 December

2009, by giving three months' notice.

Since three of the Loan Note holders (Gerhard Huber, Christian Kaiser and

Michael Janssen) are directors of Cubus Lux, this extension constitutes a

related party transaction as defined in the AIM Rules for Companies. Where a

company whose shares are quoted on AIM enters into such a transaction, the

requirement is for those directors of the company who are independent of the

transaction to consider, after consultation with the company's nominated

adviser, whether the terms of the transaction are fair and reasonable insofar

as the company's shareholders are concerned.

The independent directors (being all of the directors with the exception of

Gerhard Huber, Christian Kaiser and Michael Janssen), having consulted with

Dowgate Capital Advisers Limited, consider that the changes to the terms of the

Loan Notes are fair and reasonable insofar as the shareholders of the Company

are concerned.

For further information please see www.cubuslux.com or contact:

Steve McCann

Cubus Lux plc

+385 (0)99 214 9636

Simon Sacerdoti/Liam Murray, Nominated Adviser

Dowgate Capital Advisers Limited

+44 (0)20 7492 4777

Claire Louise Noyce/Stephen Austin, Broker

Hybridan LLP

+44 (0)20 3159 5085

Pam Spooner

City Road Communications

+44 (0) 20 7248 8010

+44 (0)7858 477 747

END

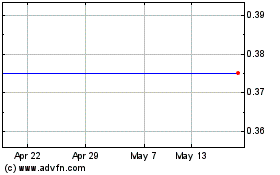

Cellular Goods (LSE:CBX)

Historical Stock Chart

From May 2024 to Jun 2024

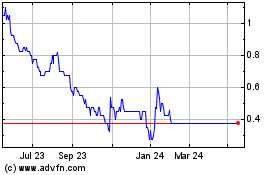

Cellular Goods (LSE:CBX)

Historical Stock Chart

From Jun 2023 to Jun 2024