Cubus Lux plc

("Cubus Lux" or the "Company")

Half- yearly Report

Cubus Lux plc, the Croatia-based leisure and tourism company,

announces its half year results for the six months ended 30 September 2008.

Highlights:

- Turnover up 9% to �963,000 (six months to 30 September 2007: �886,000)

- Operating profit of �967,000 (six months to 30 September 2007: �341,000)

which includes negative goodwill of �1,686,000 arising from the Tiha Uvala

acquisition. Excluding this negative goodwill, operating loss of �719,000

- Earnings per share 1.6p, including the negative goodwill on the Tiha Uvala

acquisition. Loss per share of 10.0p excluding negative goodwill

- Acquisition of Hotel Sutomiscica project

- Annual contracts for more than 90% of marina berths

In September 2008 we purchased a hotel project on land adjoining our marina at

Sutomiscica. Our total purchase price will be HRK 9 million (approximately �1

million) which includes the project plus the leasehold on approximately 11,000

square metres of coastal land for a period of 40 years. This project includes

a 100 bed Hotel, a small apartment house, and conferencing and leisure

facilities. In addition we will receive a sea concession for moorings. This

facility will complement both the existing marina operation and the Olive

Island Resort, and we believe it will support a stand-alone business including

conferencing and training.

Commenting on the results, executive chairman Gerhard Huber said:

"The `Olive Island' project continues to be our main focus. This is

the first of our large real estate developments and the realisation of the

planned resort will provide a strong foundation for the Company's future

development. In addition, we are pursuing opportunities in all our divisions.

We continue to focus on creating sustainable shareholder value,

through a firm strategy of introducing profitable new projects with strong

potential to fulfil that aim. We are well known and well positioned in both

Croatia and its neighbouring countries and are able to compete effectively for

a wide variety of projects. As a result, we look forward to the Company's

future with excitement."

For further information please see www.cubuslux.com or contact:-

Steve McCann

Cubus Lux plc

+385 (0)99 214 9636

Simon Sacerdoti/Liam Murray, Nominated Adviser

Dowgate Capital Advisers Limited

+44 (0)20 7492 4777

Kealan Doyle/Nicholas Nicolaides, Broker

Lewis Charles Securities Limited

+44 (0)20 7456 9100

Pam Spooner

City Road Communications

+44 (0) 20 7248 8010

+44 (0)7858 477 747

CHAIRMAN'S STATEMENT

I am pleased to present the results for the six months ended 30

September 2008.

Operations

The Group's three principle operating divisions are the casinos,

the marina and the newly established resort management division. In addition,

we have a general real estate business where we take up opportunities to

initiate commercial and residential developments. Our established divisions,

the casinos and the Olive Island Marina have now matured and are both poised

to move into periods of expansion.

Our new division, including the Olive Island Resort, is progressing

on plan in terms of valuation and financial projections. There has been some

slippage in timing as a direct result of the slowdown in the pipeline of bank

funding for construction - a factor beyond your Company's control however, we

believe the difficulties within the banking sector are easing, so that the

impact will be only to push the start of our construction into the first

quarter of 2009 from the planned last quarter of 2008.

Cubus Lux d.o.o. - the gaming company

As reported in the 2008 Report and Accounts we have added to our

Pula casino operation in Istria with a seasonal casino in Selce, south of

Rijeka. Both of the casinos are located in hotels. For the first time we did

not achieve budget at Pula as the hotel experienced a reduced number of

visitors, partly as the result of a refurbishment programme and partly because

of economic factors. As a consequence we have shifted our emphasis and

investment from holiday makers towards promoting the casino locally and from

early September have started to see improvements which we will pursue over the

coming months. Selce started well but, due to only three months operation and

start up costs, the division as a whole returned a small loss of Euro30,000.

We will continue to explore opportunities during the continued

redevelopment of Hotel Histria and in addition, we are close to finalising

negotiations to open a further casino in Split.

Plava Vala d.o.o. - the marina company

The marina in Sutomiscica, Ugljan, near Zadar, has now completed

its first full year in its phase 1 status. During this last 12 months

management was able to return an operating profit, and towards the end of the

half year period achieved a better than expected annual contracted occupancy

level of more than 90%. The benefits of this will continue to be seen over the

current financial period. The next phase of expansion will include a 50%

increase in berths, leisure facilities and a repair area with travel lift.

These additions will consolidate the profitability of the division. We have

had a successful year with regattas and are establishing our marina as a

renowned location for charter boats.

The marina management continues to look for expansion opportunities

and is exploring possible acquisitions of existing marinas as well as

tendering for new projects.

Olive Island Resort companies

After the acquisition of the resort project on Ugljan we are

progressing well with the development. We have agreed the land purchase, are

in the final stages of securing the necessary bank finance and expect to break

ground by the end of the first quarter of 2009. This project includes a four

star hotel with 500 beds to be operated by Sol Melia, a marina, 126 villas and

305 apartments. We believe that this project will be one of the first green

field coastal resorts to open in Croatia.

Tiha Uvala d.o.o. - Hotel Sutomiscica

On 30 September 2008, the Company acquired Tiha Uvala d.o.o.

(translated as "Acquired Bay Ltd") for a consideration of HRK 9 million

payable in two instalments in cash (approximately �1,000,000). The vendor is

Heres d.o.o. who will also be retained as constructor for the project.

The consideration is payable in two tranches. The first tranche of

the consideration comprises 50 per cent of the purchase price and is payable

on receipt of building permits, which is expected to take place in the first

quarter of 2009. The second tranche is payable on completion of construction.

Tiha Uvala d.o.o. holds (1) a long term lease on 4,416 square

metres of coastal land at Sutomiscica, Ugljan, Croatia, (2) a concession over

approximately 6,000 square metres of adjoining coastal land and (3) a 15 metre

sea concession along 250 metres of sea shore for moorings.

Approvals have been granted from the local council to build a 3

storey, 40 room, 4+ stars hotel with restaurant, shops, conferencing facility

and underground parking. In addition, approval has been granted for the

building of an adjoining luxury apartment block of 9 apartments. Heres d.o.o.

will undertake the construction.

The concession land will be used for a cafe-bar with outside

seating, tennis courts and a park.

The whole site adjoins the Groups current Olive Island Marina in

the bay of Sutomiscica. Construction is anticipated to commence in January

2009 and is envisaged to be completed in approximately 18-24 months. Heres doo

will be the constructor and remain a partner for up to three years.

Financial:

For the six months ended 30 September 2008 the Company reports

revenues of �963,000 and a pre-tax profit of �229,000.

Earnings per share amounted to 1.6p.

Plans for the future:

The `Olive Island' project continues to be our main focus. This is

the first of our large real estate developments and the realisation of the

planned resort will provide a strong foundation for the Company's future

development. In addition, we are pursuing opportunities in all our divisions.

We continue to focus on creating sustainable shareholder value,

through a firm strategy of introducing profitable new projects with strong

potential to fulfil that aim. We are well known and well positioned in both

Croatia and its neighbouring countries and are able to compete effectively for

a wide variety of projects. As a result, we look forward to the Company's

future with excitement.

GERHARD HUBER

Chairman

Executive Director

GROUP INCOME STATEMENT

Six months to Six months to Year ended

30 September 30 September 31 March

2008

2007 2008

Unaudited Unaudited Audited

Note �'000 �'000 �'000

REVENUE 2 963 886 3,078

Cost of sales (106) (113) (202)

------------- ------------- -------------

GROSS PROFIT 857 773 2,876

Administrative expenses (1,576) (1,206) (2,399)

Other income 4 1,686 774 4,693

------------- ------------- -------------

OPERATING PROFIT 967 341 5,170

Net finance expense (738) (97) (290)

-------------- -------------- -------------

PROFIT ON ORDINARY

ACTIVITIES BEFORE TAXATION 229 244 4,880

Tax on ordinary activities 3 (3) (4) (9)

------------- ------------- -------------

PROFIT FOR THE PERIOD 226 240 4,871

====== ====== ======

EARNINGS PER SHARE

Basic 7 1.6p 2.5p 47.8p

====== ====== ======

Diluted 7 1.5p 2.3p 45.4p

====== ====== ======

GROUP BALANCE SHEET

As at 30 As at 30 As at 31 March

September 2008 September

2008

2007

Unaudited Unaudited Audited

Note �'000 �'000 �'000

FIXED ASSETS

Non-current assets

Intangible assets 5 39,093 5,372 35,902

Goodwill 689 - 940

Property, plant and equipment 6 4,748 4,236 4,702

------------- ------------- --------------

44,530 9,608 41,544

------------- ------------- --------------

CURRENT ASSETS

Inventories 3,310 2,187 3,172

Trade and other receivables 2,098 1,929 2,384

Cash at bank 2,251 1,068 2,372

------------- ------------- ------------

7,659 5,184 7,928

------------- ------------- --------------

TOTAL ASSETS 52,189 14,792 49,472

====== ====== =======

EQUITY

Capital and reserves attributable

to the Company's equity

shareholders

Called up share capital 1,463 977 1,463

Share premium account 16,028 8,711 16,028

Merger reserve 347 347 347

Retained earnings and translation 3,377 (1,296) 3,120

reserves

------------- ------------- --------------

TOTAL EQUITY 21,215 8,739 20,958

-------------- -------------- --------------

LIABILITIES

Non-current liabilities

Deferred tax liabilities 7,819 290 7,180

Loans 16,161 2,999 5,053

Amounts due under finance leases 24 3 38

------------- ------------- -------------

24,004 3,292 12,271

-------------- -------------- -------------

Current liabilities

Trade and other payables and 6,228 2,600 5,433

deferred income

Loans 737 156 10,805

Amounts due under finance leases 5 5 5

------------- ------------- --------------

6,970 2,761 16,243

-------------- -------------- --------------

TOTAL LIABILITIES 30,974 6,053 28,514

-------------- -------------- --------------

TOTAL EQUITY AND LIABILITIES 52,189 14,792 49,472

======= ====== =======

GROUP CASH FLOW STATEMENT

Six months to Six months to Year ended 31

30 September 30 September March

2008

2007 2008

Unaudited Unaudited Audited

�'000 �'000 �'000

Cash flows from operating activities

Profit before taxation 229 240 4,880

Adjustments for:

Net finance expense (738) 97 (290)

Net interest paid 738 (97) 290

Profit on disposal of fixed assets - - 26

Exchange rate difference 8 - 578

Share based payments 110 102 222

Depreciation and amortisation 167 74 256

Negative goodwill written back to income (1,686) - (3,739)

statement

Movement in trade and other receivables 289 (979) 373

Movement in inventories (138) (2,146) (2,571)

Movement in trade and other payables 163 2,011 957

-------------- -------------- ---------------

Cash flow from operating activities (858) (698) 982

Taxation paid (3) - (9)

-------------- -------------- ---------------

Net cash outflow from operating activities (861) (698) 973

-------------- -------------- ---------------

Cash flow from investing activities

Purchase of property, plant and equipment (111) (836) (982)

and intangibles

Proceeds from sale of property 16 - 66

Purchase of subsidiaries - - (795)

Cash acquired with subsidiary - - 18

-------------- -------------- ---------------

Net cash outflow from investing activities (95) (836) (1,693)

-------------- -------------- ---------------

Cash flows from financing activities

Issue of shares - 1,568 2,341

Capital element of finance lease repaid - (5) -

Net loans undertaken less repayments 1,018 (105) 499

-------------- -------------- ---------------

Cash inflow from financing activities 1,018 1,458 2,840

-------------- -------------- ---------------

Cash and cash equivalents at beginning of 2,372 1,375 1,375

period

Net cash inflow/(outflow) from all 62 (76) 2,120

activities

Non-cash movement arising on foreign (183) (231) (1,123)

currency translation

--------------- -------------- ---------------

Cash and cash equivalents at end of period 2,251 1,068 2,372

======= ====== ======

Cash and cash equivalents comprise

Cash (excluding overdrafts) and cash 2,251 1,068 2,372

equivalents

======= ====== ======

NOTES TO THE GROUP CASH FLOW STATEMENT

1. ACQUISITION OF SUBSIDIARIES

a) On 30 May 2008 the company purchased 100% of the issued share capital of

Deep Blue Development Liegenschaftserschliessungs GmbH.

The shares in Deep Blue Development Liegenschaftserschliessungs GmbH. were

acquired for �Nil consideration.

�'000

Net assets acquired:

At book value:

Tangible fixed assets 14

Creditors (3)

Loans (14)

---------

(3)

Goodwill 3

---------

Consideration -

=====

b) On 30 September 2008, the company purchased 100% of the issued share

capital of Tiha Uvala d.o.o. a company registered in Croatia. The purchase

price includes an initial payment of HRK 4.5 million payable on receipt of all

building permits and a further HRK 4.5 million payable on completion of the

construction of a Hotel. The respective timings of the payments are 6 months

and 2 years.

Net assets acquired: �'000

At fair value:

Intangible fixed assets (note 5) 3,191

Deferred tax provision (638)

-------------

2,553

-------------

Debtors 2

-------------

2

-------------

Total 2,555

Negative goodwill-written back to the income statement (1,686)

in `other income'

-------------

869

-------------

The negative goodwill has arisen as the Group received

a bargain purchase.

Satisfied by:

Deferred consideration 869

======

GROUP STATEMENT OF CHANGES IN EQUITY

Merger Retained Translation

Share Capital Share Premium Reserve Earnings Reserve Total

�'000 �'000 �'000 �'000 �'000 �'000

At 31 March 2007 881 7,239 347 (1,574) 9 6,902

Share based payments - - - 222 - 222

Total recognised income

and

expenses - - - 4,871 (408) 4,463

Issue of shares (net of - -

costs) 141 2,199 - 2,340

Acquisition of

subsidiaries

(net of costs) 441 6,590 - - - 7,031

------------- -------------- ------------- -------------- ---------- --------------

At 31 March 2008 1,463 16,028 347 3,519 (399) 20,958

Share based payments - - - 110 - 110

Total recognised income

and

expenses - - - 226 (79) 147

------------- -------------- ------------- -------------- ---------- --------------

At 30 September 2008 1,463 16,028 347 3,855 (478) 21,215

====== ======= ====== ====== ====== =======

NOTES

1. ACCOUNTING POLICIES

The accounting policies, applied on a consistent basis in the preparation of

the financial information, are as follows:

(a) Basis of Preparation

These half year 2008 interim consolidated financial statements of Cubus Lux

Plc are for the six months ended 30 September 2008. The information included

within this document has been prepared on the basis of the recognition and

measurement requirements of IFRS standards, IAS standards and IFRIC

interpretations in issue that are endorsed by the European Commission and

effective at 19 November 2008.

The Group accounting policies are as set out in the March 2008 report and

financial statements.

2. Business segment analysis

Period ended 30 September Property Resort

2007: Casino Marina Central Total

�'000 �'000 �'000 �'000 �'000 �'000

Revenue

External sales 689 197 - - - 886

====== ====== ===== ======= ==== ======

Profit/(loss)

Segment operating 18 -

profit/(loss) 147 (177) 353 341

Net finance costs (97)

-------------

Profit before taxation 244

======

Assets and liabilities

Segment assets 1,468 3,553 2,257 - 7,514 14,792

Segment liabilities (271) (3,675) (1,700) - (407) (6,053)

------------ ------------- -------------- --------------- ------------- -------------

Net assets/(liabilities) 1,197 (122) 557 - 7,107 8,739

====== ====== ====== ======== ====== ======

Year ended 31 March 2008:

Revenue

External sales 962 361 - 1,755 - 3,078

======= ====== ====== ====== ====== =======

Profit/(loss)

Segment operating

profit/(loss) 65 (229) 31 1,725 3,578 5,170

Net finance costs (290)

------------

Profit before taxation 4,880

======

Assets and liabilities

Segment assets 1,461 3,904 2,616 2,449 39,042 49,472

Segment liabilities (344) (4,147) (1,996) (1,993) (20,034) (28,514)

-------------- ------------- -------------- ------------- --------------- -------------

Net assets/(liabilities) 1,117 (243) 620 456 19,008 20,958

======= ====== ====== ====== ======= ======

Casino Marina Property Resort Central Total

�'000 �'000 �'000 �'000 �'000 �'000

Period ended 30 September

2008:

Revenue

External sales 533 387 - 43 - 963

====== ====== ===== ======= ==== ======

Profit/(loss)

Segment operating

(loss)/profit (30) 2 12 (67) 1,050 967

Net finance costs (738)

-------------

Profit before taxation 229

======

Assets and liabilities

Segment assets 1,421 4,012 2,666 2,566 41,524 52,189

Segment liabilities (304) (4,421) (2,039) (2,093) (22,117) (30,974)

------------ ------------- -------------- --------------- ------------- -------------

Net assets/(liabilities) 1,117 (409) 627 473 19,407 21,215

====== ====== ====== ======== ====== ======

3. Taxation

The Company is controlled and managed by its Board in Croatia. Accordingly,

the interaction of UK domestic tax rules and the taxation agreement entered

into between the U.K. and Croatia operate so as to treat the Company as solely

resident for tax purposes in Croatia. The Company undertakes no business

activity in the UK such as might result in a Permanent Establishment for tax

purposes and accordingly has no liability to UK corporation tax.

4. Other income

Other income of �1,686,000 in the period ended 30 September 2008, relates to

negative goodwill arising from the acquisition of Tiha Uvala d.o.o. and

subsequent valuation of the intangible fixed assets acquired.

In compliance with the IFRS, the company obtained an external valuation by

Brand Finance plc and the intangible assets which were valued at �3,191,000

(see note 1b to the group cash flow).

5. Intangible fixed assets

Marina Licence Olive Olive Olive Olive Olive Olive Olive Sutomiscica:

Island Island Island Island Island Island Island Right to

resort: resort: resort: hotel: hotel: hotel hotel: Develop

Right to Brand Total Right Brand Management

Develop to Contract Total Total

Develop

�'000 �'000 �'000 �'000 �'000 �'000 �'000 �'000 �'000 �'000

Cost or valuation

At 31 March 5,372 - - - - - - - - 5,372

2007

Acquired on - 26,382 121 26,503 2,187 110 1,730 4,027 - 30,530

acquisition

---- ---- ---- ---- ---- ---- ---- ---- ---- ----

At 31 March 5,372 26,382 121 26,503 2,187 110 1,730 4,027 - 35,902

2008

Acquired on - - - - - - - - 3,191 3,191

acquisition

---- ---- ---- ---- ---- ---- ---- ---- ---- ----

At 30 5,372 26,382 121 26,503 2,187 110 1,730 4,027 3,191 39,093

September

2008

=== === === === === === === === === ===

6. Tangible fixed assets

Casino Marina Resort Casino Marina Central Resort Total

leasehold leasehold leasehold assets assets assets

premises premises assets

�'000 �'000 �'000 �'000 �'000 �'000 �'000 �'000

Cost or valuation

At 31 March 2007 59 2,516 - 1,002 146 - - 3,723

Additions 26 586 - 251 149 1 - 1,013

Acquired on - - 3 - - - 10 13

acquisition

Disposals - (44) - (47) (42) - - (133)

Exchange rate movements 14 549 - 218 41 - - 822

---- ---- ---- ---- ---- ---- ---- ----

At 31 March 2008 99 3,607 3 1,424 294 1 10 5,438

---- ---- ---- ---- ---- ---- ---- ----

Additions 8 91 - 21 5 - - 125

Acquired on - - - - - - 17 17

acquisition

Disposals - - - (23) - - - (23)

Exchange rate movements 2 74 - 29 6 - (3) 108

---- ---- ---- ---- ---- ---- ---- ----

At 30 September 109 3,772 3 1,451 305 1 24 5,665

2008

---- ---- ---- ---- ---- ---- ---- ----

Depreciation

At 31 March 2007 35 2 - 349 22 - - 408

Acquired on - - 2 - - - 4 6

acquisition

Charge for the year 16 86 - 98 56 - - 256

Disposals - - - (27) (14) - - (41)

Exchange rate 9 12 - 76 10 - - 107

movements

---- ---- ---- ---- ---- ---- ---- ----

At 31 March 2008 60 100 2 496 74 - 4 736

---- ---- ---- ---- ---- ---- ---- ----

Charge for the 8 59 - 70 32 - 1 170

period

Disposals - - - (7) - - - (7)

Exchange rate 1 4 - 11 2 - - 18

movements

---- ---- ---- ---- ---- ---- ---- ----

At 30 September 69 163 2 570 108 - 5 917

2008

---- ---- ---- ---- ---- ---- ---- ----

Net Book Value

At 31 March 2008 39 3,507 1 928 220 1 6 4,702

==== ==== ==== ==== ==== ==== ==== ====

At 30 September 40 3,609 1 881 197 1 19 4,748

2008

==== ==== ==== ==== ==== ==== ==== ====

7. Earnings per share

The earnings per share of 1.6p (Year ended 31 March 2008:

earnings 47.8p; six months ended 30 September 2007: earnings 2.5p) has been

calculated on the weighted average number of shares in issue during the year

namely 14,614,365 (year ended 31 March 2008: 10,181,002; six months ended 30

September 2007: 9,549,284) and profits of �226,450 (year ended 31 March 2008:

profit �4,871,401; six months ended 30 September 2007: profit �240,431).

The calculation of diluted earnings per share of 1.5p (year

ended 31 March 2008: earnings 45.4p; six months ended 30 June 2007: earnings

2.3p) is based on the loss on ordinary activities after taxation and the

diluted weighted average of 15,481,865 (year ended 31 March 2008: 10,724,816;

six months ended 30 June 2007: 10,249,284) shares.

At the Annual General Meeting of 6th August 2008 the

company's ordinary shares of �0.01 each were consolidated by the factor 10:1

into ordinary shares of �0.1 each.

The previously reported comparative earnings per share of 30

September 2007 (Basic 0.25p, diluted 0.23p) and 31 March 2008 (Basic 4.78p,

diluted 4.54p) have been restated.

INDEPENDENT REVIEW REPORT TO CUBUS LUX PLC

Introduction

We have been engaged by the company to review the group financial statements

in the interim report for the six months ended 30 September 2008 which

comprises the Group Income Statement, the Group Balance Sheet, the Group Cash

Flow Statement, the Group Statement of Changes in Equity and related

explanatory notes.

We have read the other information contained in the interim report and

considered whether it contains any apparent misstatements or material

inconsistencies with the information in the group financial statements.

Directors' responsibilities

The interim report, including the financial information contained therein, is

the responsibility of and has been approved by the directors. The directors

are responsible for preparing the interim report in accordance with the rules

of the London Stock Exchange for companies trading securities on the

Alternative Investment Market which require that the interim report be

presented and prepared in a form consistent with that which will be adopted in

the company's annual accounts having regard to the accounting standards

applicable to such annual accounts.

Our responsibility

Our responsibility is to express to the Group a conclusion on the group

financial statements in the interim report based on our review.

Our report has been prepared in accordance with the terms of our engagement

and for no other purpose. No person is entitled to rely on this report unless

such a person is a person entitled to rely upon this report by virtue of and

for the purpose of our terms of engagement or has been expressly authorised to

do so by our prior written consent. Save as above, we do not accept

responsibility for this report to any other person or for any other purpose

and we hereby expressly disclaim any and all such liability.

Scope of review

We conducted our review in accordance with International Standard on Review

Engagements (UK and Ireland) 2410, "Review of Interim Financial Information

Performed by the Independent Auditor of the Entity", issued by the Auditing

Practices Board for use in the United Kingdom. A review of interim financial

information consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit conducted in

accordance with International Standards on Auditing (UK and Ireland) and

consequently does not enable us to obtain assurance that we would become aware

of all significant matters that might be identified in an audit. Accordingly,

we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to

believe that the group financial statements in the interim report for the six

months ended 30 September 2008 are not prepared, in all material respects, in

accordance with International Accounting Standard 34, as adopted by the

European Union, and the Disclosure and Transparency Rules of the United

Kingdom's Financial Services Authority.

haysmacintyre

Chartered Accountants

Registered Auditors

Fairfax House

15 Fulwood Place

London WC1V 6AY

18 November 2008

END

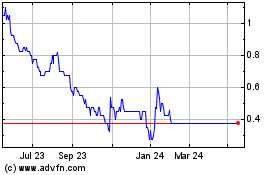

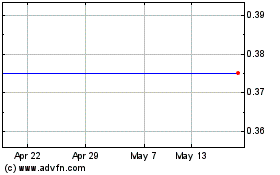

Cellular Goods (LSE:CBX)

Historical Stock Chart

From May 2024 to Jun 2024

Cellular Goods (LSE:CBX)

Historical Stock Chart

From Jun 2023 to Jun 2024