Further re Acquisition

February 25 2008 - 2:00AM

UK Regulatory

Cubus Lux plc

("Cubus Lux" or the "Company")

Further re acquisition

Further to the announcements of 15 January 2008 and 7 February 2008, the

Company today announces that all conditions contained in the acquisition

agreements in respect of Duboko Plavetnilo - Ugljan Projektant doo ("DPUP") and

Duboko Plavetnilo Hoteli doo ("DPH") (together the "Olive Island Companies")

have been satisfied, and accordingly, the acquisitions were completed on 22

February 2008.

The Company is also pleased to announce that all planning consents required to

build the Olive Island resort have now been granted, and the legal transfer of

the land to DPUP should now be able to proceed. On 14 February 2008, the

Ugljan local authority was granted environmental consent (known in Croatia as

the SUO), and on 22 February 2008, it received the required authorisations from

the Republic of Croatia Ministry of Environmental Protection, Physical Planning

and Construction (known in Croatia as the DPU and the UPU). The process that

remains to be concluded is for the land with all its consents to be transferred

to the Ugljan local authority who will then complete the contract to sell the

land to DPUP.

Pursuant to completion of the acquisitions, the following consideration, as

further described in the admission document of the Company dated 15 January

2008 (the "Admission Document", which is available at the Company's website,

www.cubuslux.com), has been issued:

* 43,933,989 new ordinary shares of 1p, credited as fully paid (the

"Consideration Shares"). Application has been made for admission of the

Consideration Shares to AIM, and this is expected to occur on or around 28

February 2008. Following admission, the Consideration Shares will rank pari

passu with the existing ordinary shares.

* Euro13,000,000 secured convertible loan notes (the "Loan Notes").

* Warrants over a maximum of 11,133,780 ordinary shares (the "Warrants"),

pursuant to the DPH Acquisition, as defined in the Admission Document, and

on the basis that the highest Average Closing Price between 24 December

2007 and the completion date was 19.35p (on 29 January 2008).

Gerhard Huber, Christian Kaiser and Michael Janssen, directors of the Company,

have received Consideration Shares and Loan Notes. These directors have not

received any Warrants. Following the issue of the Consideration Shares, the

interests of the directors in the issued and potential share capital of the

Company are as follows:

Number of Percentage of Loan Notes Options

ordinary ordinary

shares share capital Euro

in issue

Gerhard Huber 19,305,837 13.21% 2,148,066 2,000,000

Christian Kaiser 10,627,269 7.27% 488,141 1,000,000

Michael Janssen 4,606,880 3.15% 513,897 1,000,000

Haggai Ravid 994,313 0.68% - 1,000,000

Leon Nahon 589,665 0.40% - 1,000,000

Steve McCann 300,000 0.21% - 1,300,000

Eli Abramovich 240,000 0.16% - 1,000,000

In addition to the above, and following the issue of the consideration shares,

the Company is aware of the following holders of 3 per cent. or more of the

issued share capital (excluding the directors):

Number of ordinary Percentage of

shares ordinary share

capital in issue

Milan Kotur 12,977,540 8.88%

Allveritas Inversiones SL 10,814,286 7.40%

Kling GmbH 9,000,000 6.16%

Hans Steinbichler 4,685,995 3.21%

Xavier Azalbert 4,544,671 3.11%

Stefan Roever 4,483,671 3.07%

Following the issue of the Consideration Shares, there will be 146,143,655

ordinary shares in issue.

Gerhard Huber, Chairman of Cubus Lux, commented:

"The acquisition of the Olive Island Companies represents a significant step in

the transition from a gaming company to a comprehensive leisure and tourism

business in Croatia. In addition to the acquisitions, we are delighted that the

planning consents have been granted, which are among the last key steps towards

breaking ground on the Olive Island Resort construction.

The considerable growth in the Croatian tourism market leads us to believe that

the Company is entering an exciting time in its development and the management

views the future with optimism."

For further information see www.cubuslux.com or contact:

Cubus Lux plc +44 (0)7900 683 683

Gerhard Huber, Chairman

City Financial Associates Limited +44 (0)20 7492 4777

Nominated Adviser

Liam Murray/Simon Sacerdoti

Lewis Charles Securities Limited, Broker +44 (0)20 7456 9100

Kealan Doyle

Threadneedle Communications, Financial PR +44 (0)20 7936 9605

Graham Herring/Alex White

END

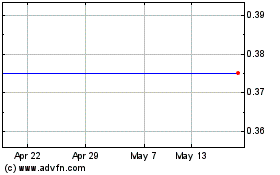

Cellular Goods (LSE:CBX)

Historical Stock Chart

From May 2024 to Jun 2024

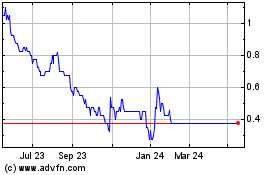

Cellular Goods (LSE:CBX)

Historical Stock Chart

From Jun 2023 to Jun 2024