BlackRock Income Portfolio Update

February 20 2023 - 9:48AM

UK Regulatory

TIDMBRIG

The information contained in this release was correct as at 31 January 2023.

Information on the Company's up to date net asset values can be found on the

London Stock Exchange website at:

https://www.londonstockexchange.com/exchange/news/market-news/

market-news-home.html.

BLACKROCK INCOME & GROWTH INVESTMENT TRUST PLC (LEI:5493003YBY59H9EJLJ16)

All information is at 31 January 2023 and unaudited.

Performance at month end with net income reinvested

One Three One Three Five Since

Month Months Year Years Years 1 April

2012

Sterling

Share price 1.8% 13.7% 5.8% 8.0% 12.2% 114.0%

Net asset value 5.3% 11.6% 6.7% 13.7% 21.5% 113.3%

FTSE All-Share Total Return 4.5% 10.4% 5.2% 15.6% 23.1% 108.2%

Source: BlackRock

BlackRock took over the investment management of the Company with effect from 1

April 2012.

At month end

Sterling:

Net asset value - capital only: 208.90p

Net asset value - cum income*: 213.87p

Share price: 194.50p

Total assets (including income): £48.8m

Discount to cum-income NAV: 9.1%

Gearing: 3.2%

Net yield**: 3.8%

Ordinary shares in issue***: 20,968,251

Gearing range (as a % of net assets): 0-20%

Ongoing charges****: 1.2%

* Includes net revenue of 4.97 pence per share

** The Company's yield based on dividends announced in the last 12 months as at

the date of the release of this announcement is 3.8% and includes the 2022

interim dividend of 2.60p per share declared on 22 June 2022 with pay date 1

September 2022 and the 2022 final dividend of 4.70p per share declared on 1

February 2023 with pay date 15 March 2023.

*** excludes 10,081,532 shares held in treasury.

**** The Company's ongoing charges are calculated as a percentage of average

daily net assets and using management fee and all other operating expenses

excluding finance costs, direct transaction costs, custody transaction charges,

VAT recovered, taxation and certain non-recurring items for the year ended 31

October 2022.

Sector Analysis Total assets (%)

Support Services 10.9

Pharmaceuticals & Biotechnology 10.0

Oil & Gas Producers 8.9

Banks 8.8

Media 7.5

Mining 7.1

Financial Services 6.3

Household Goods & Home Construction 6.2

General Retailers 4.3

Personal Goods 4.0

Tobacco 3.2

Life Insurance 3.0

Health Care Equipment & Services 2.9

Electronic & Electrical Equipment 2.6

Food Producers 2.5

Nonlife Insurance 1.8

Gas, Water & Multiutilities 1.3

Fixed Line Telecommunications 1.1

Leisure Goods 1.0

Real Estate Investment Trusts 0.9

Travel & Leisure 0.5

Net Current Assets 5.2

-----

Total 100.0

=====

Country Analysis Percentage

United Kingdom 88.4

Switzerland 2.2

United States 2.2

France 2.0

Net Current Assets 5.2

-----

100.0

=====

Fund %

Top 10 holdings

Shell 7.1

AstraZeneca 6.9

Rio Tinto 4.7

RELX 4.6

Reckitt Benckiser 4.0

3i Group 3.7

British American Tobacco 3.2

Standard Chartered 3.2

Phoenix Group 3.0

Smith & Nephew 2.9

Commenting on the markets, representing the Investment Manager noted:

Performance Overview:

The Company returned 5.3% during the month, outperforming the FTSE All-Share

which returned 4.5%.

Global equity markets had an exceptionally strong start to 2023, unwinding some

of the 2022 year-end moves. Optimism for a dovish stance from central banks,

combined with lower energy prices and a potential boost from China's

accelerated reopening saw some exceptional price moves, with the Nasdaq posting

its best January performance since 2001. Bond yields fell and "risk on" sectors

rose, whilst sectors that proved resilient in 2022 underperformed.

In the US, the dominant market narrative shifted from recession to

soft-landing. Both headline and core inflation eased as goods prices fell

further than the market expected and core services excluding shelter surprised

on the downside. On the other hand, jobs growth slowed further but still showed

resilience as the unemployment rate fell unexpectedly, reverting to a historic

low. Labour costs slowed for the third consecutive quarter though, signalling

that wage inflation is potentially starting to roll over despite a tight labour

market, adding further fuel to the fire that interest rate hikes are nearing

the peak.

Europe returned to growth for the first time since mid-2022 as the composite

Purchasing Managers' Index (PMI) rose for a third consecutive month. This

showed that activity was improving, led by services, as the energy shock

relented and further reinforced the European Central Bank's resolve of further

monetary tightening. This rise in Eurozone PMI contrasted with an unexpected

deterioration in the UK, where the corresponding index recorded the sharpest

decline in activity in 2 years. Another factor that fuelled confidence was the

fact that the mild winter in Europe has meant European higher gas storage in

2021.

In China, Q4 2022 GDP beat depressed expectations after the zero-Covid policy

was suddenly eased. The economy is expected to rebound in 2023 as domestic

consumption and investment are expected to pick up with Chinese households

having accumulated over USD 2.6 trillion1 of bank deposits in 2022.

The FTSE All Share rose 4.5% during the month with Consumer Services,

Telecommunications and Financials as top performing sectors while Health Care

and Consumer Goods underperformed.

Stocks:

3i was the top contributor to relative portfolio performance as the company

delivered strong results with discount retailer Action performing very well

over the Christmas period. This drove a significant increase in 3i's NAV which

positively surprised against modest expectations. Consumer facing names

including Whitbread and Howden Joinery also performed well as the market

continued to be positively surprised by consumer spending holding up over the

Christmas period. BHP also contributed to relative performance as markets

sought Chinese exposure given the economy's re-opening post the end of Covid

lockdowns.

Pearson was a top detractor from relative performance during the month; the

company was a very strong performers during 2022 and January saw some

consolidation in its share price. Rentokil was modestly weaker during January

as investors rotated into cyclicals. Similarly, other defensive holdings

including Reckitt Benckiser and Smith & Nephew also detracted for the same

reason.

Changes:

During the period, we purchased Swiss pharmaceutical company, Roche. Following

a period of underperformance, we view the company as having an attractive

valuation supported by a strong balance sheet. We also purchased NatWest as

banks continue to see meaningful upgrades in the rising interest rate

environment. We sold Equifax, Kone and Whitbread following strong recent

performance. Whilst Kone and Equifax have been relatively recent additions,

purchased in the second half of 2022, we have been pleasantly surprised by the

early strong performance. Both share prices reached levels where we felt their

prospects were well understood and consequently saw better value elsewhere.

Outlook:

As we look ahead into 2023, the headwinds facing global equity markets are

evident. Inflation has consistently surprised in its depth and breadth, driven

by the resilient demand, supply chain constraints, and most importantly by

rising wages in more recent data. Central banks across the developed world

continue to unwind ten years of excess liquidity by tightening monetary policy

desperate to prevent the entrenchment of higher inflation expectations.

Meanwhile, the risk of policy error from central banks or politicians remains

high as evidenced by the turmoil created by the 'mini-budget' in the UK that

sent gilts spiralling. The cost and availability of credit has changed and

strengthens our belief in investing in companies with robust balance sheets

capable of funding their own growth. The rise in the risk-free or discount rate

also challenges valuation frameworks especially for long duration, high growth

or highly valued businesses. We are mindful of this and feel it is incredibly

important to focus on companies with strong, competitive positions, at

attractive valuations that can deliver in this environment

The political and economic impact of the war in Ukraine has been significant in

uniting Europe and its allies, whilst exacerbating the demand/supply imbalance

in the oil and soft commodity markets. We are conscious of the impact this has

on the cost of energy, and we continue to expect divergent regional monetary

approaches with the US being somewhat more insulated from the impact of the

conflict, than for example, Europe. Complicating this further, is the continued

impact COVID is having on certain parts of the world, notably China, which has

used lockdowns to control the spread of the virus impacting economic activity.

We also see the potential for longer-term inflationary pressure from

decarbonisation and deglobalisation, the latter as geopolitical tensions rise

more broadly across the world.

As we enter 2023, we have seen the first signs of demand weakness, notably in

areas of consumer spending impacted by rising interest rates such as demand for

new housing. We would expect broader demand weakness as we enter 2023 although

the 'scars' of supply chain disruption are likely to support parts of

industrial capex demand as companies seek to enhance the resilience of their

supply chains. A notable feature of our conversations with a wide range of

corporates has been the ease with which they have been able to pass on cost

increases and protect or even expand margins during 2022 as evidenced by US

corporate margins reaching 70-year highs. We believe that as demand weakens and

as the transitory inflationary pressures start to fade during 2023 (e.g.

commodity prices, supply chain disruption) then pricing conversations will

become more challenging despite pressure from wage inflation which may prove

more persistent. While this does not bode well for margins in aggregate, we

believe that 2023 will see greater differentiation as corporates' pricing power

will come under intense scrutiny.

The UK's policy has somewhat diverged from the G7 in fiscal policy terms as the

present government attempts to create stability after the severe reaction from

the "mini-budget". The early signs of stability are welcome as financial market

liquidity has increased and the outlook, whilst challenged, has improved.

Although the UK stock market retains a majority of internationally weighted

revenues, the domestic facing companies have continued to be impacted by this

backdrop, notably financials, housebuilders and property companies. The

valuation of the UK market remains highly supportive as currency weakness

supports international earnings, whilst domestic earners are in many cases at

COVID or Brexit lows in share price or valuation terms. Although we anticipate

further volatility ahead as earnings estimates moderate, we know that in the

course of time, risk appetites will return and opportunities are emerging.

We continue to focus the portfolio on cash generative businesses with durable,

competitive advantages boasting strong leadership as we believe these companies

are best-placed to drive returns over the long-term. We anticipate economic

and market volatility will persist in 2023 and we are excited by the

opportunities this will likely create by identifying those companies using this

cycle to strengthen their long-term prospects as well as attractive turnarounds

situations

1 Financial Times - China's record $2.6tn rise in savings fuels 'revenge

spending' hopes

20 February 2023

END

(END) Dow Jones Newswires

February 20, 2023 09:48 ET (14:48 GMT)

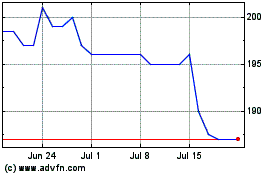

Blackrock Income And Gro... (LSE:BRIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blackrock Income And Gro... (LSE:BRIG)

Historical Stock Chart

From Apr 2023 to Apr 2024