Volkswagen Notches Early Win in Legal Fight With SEC

August 20 2020 - 6:20PM

Dow Jones News

By Dave Michaels

WASHINGTON -- A federal judge on Thursday dismissed part of a

civil fraud case against Volkswagen AG, a ruling that validated the

company's claims that regulators piled on with a 2019 lawsuit over

its emissions scandal.

Volkswagen had already settled some of the regulatory claims in

a 2016 deal with the Justice Department, wiping out the Securities

and Exchange Commission's ability to sue over some bonds that were

sold, U.S. District Judge Charles Breyer wrote. The settlement

covered claims that Volkswagen's failure to disclose a device that

cheated on emissions tests defrauded purchasers of $4.9 billion in

asset-based bonds.

The decision is a loss for the SEC, which filed the lawsuit in

March 2019 and argued the Justice Department couldn't override its

ability to enforce investor-protection laws. Judge Breyer let some

of the case proceed -- Volkswagen hadn't sought an outright

dismissal -- but he did extinguish certain pillars of the case

related to $8.3 billion in other bonds that were sold.

"Volkswagen is pleased with the court's decision to dismiss all

of the SEC's claims with regard to almost $5 billion in auto

asset-backed securities and to limit the scope of the remaining

litigation," said Robert Giuffra, an attorney for the company at

Sullivan & Cromwell LLP.

SEC spokesmen didn't respond to a request for comment.

The crux of the SEC's case is that Volkswagen sold more than $13

billion in debt securities at a time when, regulators alleged,

senior executives knew that more than 500,000 vehicles in the U.S.

grossly exceeded legal emissions limits. The SEC said in its

complaint that failing to disclose the cars' vehicle-emissions

problems in bond-offering documents defrauded investors.

Judge Breyer previously questioned why the SEC brought

securities-fraud claims against Volkswagen years after other

government agencies resolved their litigation over the auto maker's

diesel-cheating scandal. The judge in 2019 suggested the agency

looked like a "carrion hawk" picking over the remains of a

crime.

Judge Breyer ordered the two sides to try to settle the case,

but the SEC and Volkswagen said in March that they hadn't been able

to reach a deal.

Volkswagen pleaded guilty to criminal charges in 2016 and has

paid more than $25 billion in fines, penalties and compensation to

settle criminal and civil litigation. The company said Thursday

that it plans to continue fighting the SEC and believes the SEC

isn't entitled to obtain any fines stemming from the bond

offerings.

The SEC also sued Martin Winterkorn, Volkswagen's former chief

executive. Mr. Winterkorn, who lives in Germany, has been indicted

in his home country and in the U.S. in connection with the

emissions scandal. Judge Breyer's order allowed the case against

Mr. Winterkorn to proceed.

Write to Dave Michaels at dave.michaels@wsj.com

(END) Dow Jones Newswires

August 20, 2020 18:05 ET (22:05 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

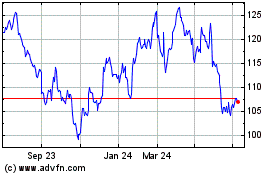

Volkswagen (TG:VOW3)

Historical Stock Chart

From Mar 2024 to Apr 2024

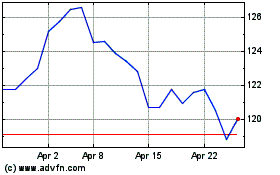

Volkswagen (TG:VOW3)

Historical Stock Chart

From Apr 2023 to Apr 2024