As filed with the Securities and Exchange Commission on November 18, 2021

File No. – 333-259600

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

POST-EFFECTIVE AMENDMENT NO. 1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

YIJIA GROUP CORP.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Nevada

|

|

8748

|

|

35-2583762

|

|

(State or other jurisdiction

of incorporation or organization)

|

|

(Primary Standard Industrial Classification Code)

|

|

(I.R.S. Employer Identification No.)

|

30 N Gould St., Suite 22545

Sheridan, WY 82801

Telephone: (310) 266-3738

(Address and telephone number of registrant's principal executive offices)

Barry Sytner

30 N Gould St., Suite 22545

Sheridan, WY 82801

Telephone: (310) 266-3738

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all Correspondence to:

J.M. Walker & Associates

Attorneys At Law

7841 S. Garfield Way

Centennial, Colorado

Telephone: (303) 850-7637

Facsimile: (303) 482-2731

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box: [x]

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this form is a post-effective amendment filed pursuant to Rule 462 (d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

2

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box: [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting registrant.

Large accelerated filer [ ]

Accelerated filer

[ ]

Non-accelerated filer [x]

Smaller reporting registrant

[x]

Emerging growth company

[x]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Explanatory Note

This Post-Effective Amendment No. 1 (this “Post-Effective Amendment”) relates to the registration statement on Form S-1 (File No. 333-259600), initially filed by the Registrant, with the Securities and Exchange Commission (the “SEC”) on September 17, 2021 and declared effective by the SEC on October 18, 2021 (the “Registration Statement”).

This Post-Effective Amendment is being filed pursuant to Section 10(a)(3) of the Securities Act of 1933, as amended (the “Securities Act”) to update the Registration Statement to include, among other things, (i) the condensed financial statements of the Registrant as of and for the period ended October 31, 2021 which were filed with the SEC on November 10, 2021 as part of the Registrant’s Quarterly Report on Form 10-Q.

This Post-Effective Amendment covers only the resale, from time to time, of eight hundred five thousand (805,000) shares of common stock. The Registrant previously paid to the SEC the entire registration fee relating to the shares of common stock that are the subject of this Post-Effective Amendment. The Registrant paid a fee of $12.30 in connection with the registration of 805,000 shares of common stock in connection with the Registration Statement.

This Post-Effective Amendment also revises the plan of distribution as to when the Selling Stockholders no longer have to sell their common shares at a fixed price.

2

Prospectus Dated November 18, 2021

YIJIA GROUP CORP.

805,000 Common Shares to be offered for resale by Selling Stockholders

This prospectus relates to the sale of up to 805,000 common shares, par value of $0.001 by selling stockholders (“Selling Stockholders”). The Selling Stockholders shall sell their common shares at a fixed price of $.14 per common share unless and until our shares are quoted on the OTC Bulletin Board, the OTCQX, the OTCQB or listed on an alternative trading system or a national securities exchange.

The offering will commence on the effective date of this prospectus and will terminate on or before October 31, 2022. In our sole discretion, we may terminate the offering before all of the common shares are sold.

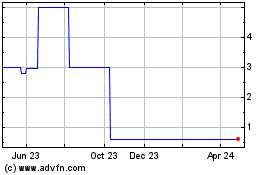

There is a limited market for our securities. Our common stock is presently traded on the Over-The-Counter Pink market under the symbol “YJGJ”.

Our auditor has expressed substantial doubt as to our ability to continue as a going concern.

Investing in our common shares involves a high degree of risk. You should purchase common shares only if you can afford a complete loss. See “Risk Factors” beginning on page 6.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

Per Common Share

|

Underwriter’s discounts

and commissions

|

Total

|

|

Offering Price by Selling Stockholders

|

$.14

|

$0.00

|

$112,700

|

|

Proceeds to Selling Stockholders, before expenses(1)

|

$.14

|

$0.00

|

$112,700

|

4

(1)The Selling Stockholders may sell or otherwise dispose of the common shares covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the Selling Stockholders may sell or otherwise dispose of their common shares in the section entitled "Plan of Distribution." The Selling Stockholders will pay all brokerage fees and commissions and similar expenses. We will pay all expenses (except brokerage fees and commissions and similar expenses) relating to the registration of the common shares with the Securities and Exchange Commission. Each Selling Stockholder is an "underwriter" within the meaning of the Securities Act of 1933, as amended.

3

TABLE OF CONTENTS

Page

Prospectus Summary

5

Risk Factors

6

Forward Looking Statements

11

Use of Proceeds

12

Plan of Distribution

13

Description of Business

14

Dilution

15

Dividend Policy

15

Management's Discussion and Analysis of Financial Condition and Results of Operations

15

Directors, Executive Officers, Promoters and Control Persons

17

Security Ownership of Certain Beneficial Owners and Management

21

Certain Relationships and Related Transactions

22

Description of Capital Stock

23

Selling Stockholders

23

Shares Eligible for Future Sale

25

Disclosure of Commission Position on Indemnification for Securities Act liabilities

25

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

26

Market for Common Stock and Related Stockholder Matters

26

Experts

26

Legal Proceedings

26

Legal Matters

27

Where You Can Find More Information

27

Financial Statements

28

Unless otherwise specified or the context otherwise requires, references in this prospectus to "we", "our" and "us" and the "Company" refer to Yijia Group Corp.

You should rely only on the information contained in this prospectus or contained in any free writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we nor the Selling Stockholders have authorized anyone to provide you with information that is different from that contained in such prospectuses. We are offering to sell our common shares and seeking offers to buy common shares, only in jurisdictions where such offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

In this prospectus, we rely on and refer to information and statistics regarding our industry. We obtained this statistical, market and other industry data and forecasts from publicly available information. While we believe that the statistical data, market data and other industry data and forecasts are reliable, we have not independently verified the data.

For investors outside of the United States: we have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

4

6

PROSPECTUS SUMMARY

To understand this offering fully, you should read the entire prospectus carefully, including the risk factors beginning on page 7 and the financial statements.

The Company:

Yijia Group Corp. (“the Company”, “we”, “us” or “our”) was incorporated as Soldino Group Corp. on January 25, 2017 under the laws of the State of Nevada, United States of America. On November 15, 2018, the Company changed its name to Yijia Group Corp. The Company is in good standing in the State of Nevada and in any jurisdiction where it is qualified to do business.

Our principal executive offices are virtual and are located at 230 N Gould St., Suite 22545, Sheridan, WY 82801. Our telephone number is (310) 266-3738

Operations:

Starting from July 30, 2021, the Company commenced its operation in the rendering of business consulting service to domestic and international customers.

Common Shares Being Offered

For Resale by the Selling

Stockholders:

805,000 common shares

Common Shares Outstanding

Prior to the Offering:

5,871,250 common shares

Common Shares Outstanding

after the Offering:

5,871,250 common shares

Terms of Offering:

The Selling Stockholders may sell or otherwise dispose of the common shares covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the Selling Stockholders may sell or otherwise dispose of their common shares in the section entitled "Plan of Distribution." The Selling Stockholders will pay all brokerage fees and commissions and similar expenses. We will pay all expenses (except brokerage fees and commissions and similar expenses) relating to the registration of the common shares with the Securities and Exchange Commission. Each Selling Stockholder is an "underwriter" within the meaning of the Securities Act of 1933, as amended.

Termination of the

Offering:

The offering will commence on the effective date of this prospectus and will terminate on or before October 31, 2022. In management’s sole discretion, we may terminate the offering before all of the common shares are sold.

Use of Proceeds:

The Selling Stockholders will receive all of the proceeds from the sale of the common shares offered for sale by them under this prospectus. We will not receive proceeds from the sale of the common shares by the Selling Stockholders.

Risk Factors:

The common shares offered hereby involve a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment.

5

RISK FACTORS

A purchase of common shares offered hereby involves a very high degree of risk and is suitable only for persons of substantial means who have no need for liquidity with respect to an investment in the Company and who can risk the loss of their entire investment. Our business will be subject to numerous risk factors, including the following:

Risks Related to the Offering

1.

You could lose your entire investment.

The securities offered hereby are highly speculative, involve a high degree of risk and should not be purchased by any person who cannot afford the loss of the entire investment. A purchase of our common shares in this offering would be unsuitable for a person who cannot afford to sustain such a loss.

2.

There is only a limited market through which our common shares may be sold

There is currently only a limited market through which our common shares may be sold and the purchasers of such common shares may not be able to resell such securities purchased in this offering. There can be no assurance that a secondary market will develop for our common shares or that any secondary market which does develop will continue. This may affect the pricing of our shares in the secondary market, if any, the transparency and availability of trading prices, the liquidity of the shares and the extent of regulation of such shares.

3.

We may need additional capital in the future, which may not be available to us on favorable terms, or at all, and may dilute your ownership of our common stock.

We currently rely on outside financing to fund our operations, capital expenditures and expansion. We may require additional capital from equity or debt financing in the future to:

a) fund our operations;

b) respond to competitive pressures;

c) take advantage of strategic opportunities, including more rapid expansion of

our business or the acquisition of complementary products, technologies or

businesses; and

d) develop new products or enhancements to existing products.

We may not be able to secure timely additional financing on favorable terms, or at all. The terms of any additional financing may place limits on our financial and operating flexibility. If we raise additional funds through issuances of equity, convertible debt securities or other securities convertible into equity, our existing stockholders could suffer significant dilution in their percentage ownership of the Company, and any new securities we issue could have rights, preferences and privileges senior to those of our common stock. If we are unable to obtain adequate financing or financing on terms satisfactory to us, if and when we require it, our ability to grow or support our business and to respond to business challenges could be significantly limited.

4.

We may expand, through acquisitions of or investments in other companies or through business relationships, all of which may result in additional dilution to our stockholders and consumption of resources that are necessary to sustain our business.

One of our business strategies is to acquire competing or complementary services, technologies or businesses. In connection with one or more of those transactions, we may:

a)

issue additional equity securities that would dilute our stockholders;

b)

use cash that we may need in the future to operate our business;

c)

incur debt on terms unfavorable to us or that we are unable to repay;

6

d)

incur large charges or substantial liabilities;

e)

encounter difficulties retaining key employees of the acquired company or integrating diverse business cultures;

f)

become subject to adverse tax consequences, substantial depreciation or deferred compensation charges; and

g)

encounter unfavorable reactions from investment banking market analysts who disapprove of our completed acquisitions.

5.

Resales of shares purchased by the selling stockholders may cause the market price of our common shares to decline.

Selling Stockholders will have the financial incentive to sell the common shares. The timing of sales and the price at which the common shares are sold by the Selling Stockholders could have an adverse effect upon the public market, if any, for our common shares. There may be no independent or third-party underwriter involved in the offering of the common shares held by or to be received by the Selling Stockholders, and there can be no guarantee that the disposition of those common shares will be completed in a manner that is not disruptive to the market for our common shares.

8

6.

The later sale of our common shares may further dilute your shares.

As of November 18, 2021, we have 5,871,250 common shares outstanding. Our board of directors is authorized to sell additional common shares or securities convertible into common shares, if in their discretion they determine that such action would be beneficial to us. Any such issuance below the offering price of the common shares being sold in this offering would dilute the interest of persons acquiring common shares in this offering.

Risk Factors Relating to Our Business

7.

We have minimal working capital with which to execute our business plan.

We have minimal working capital. We anticipate needing additional working capital as our business expands. We cannot assure you that the revenue received from current operations will provide sufficient working capital to enable us to continue to operate profitably or accomplish the proposed expansion of our business.

8.

Our auditors have raised substantial doubt about our ability to continue as a going concern.

Because we do not have sufficient working capital necessary to pursue our business objectives, our auditors have expressed their opinion that we may fail in the future if we do not generate revenue and profits in the near future. This opinion must be disclosed to all potential investors and other sources of capital, which may adversely affect our ability to raise capital. Shareholders and creditors' confidence may be low in evaluating our Company. If we are successful in acquiring a loan or a line of credit, we may be charged a much higher interest rate because of our financial condition.

We have not yet established an ongoing source of revenues sufficient to cover our operating costs and to allow us to continue as a going concern. Our ability to continue as a going concern is dependent on obtaining adequate capital to fund operating losses until we become profitable. If we are unable to obtain adequate capital, we could be forced to cease operations.

In order to continue as a going concern, we will need, among other things, additional capital resources. Management's plan is to obtain such resources for the Company by seeking equity and/or debt financing sufficient to meet our minimal operating expenses and for specific project financing. However, management cannot provide any assurances that we will be successful in accomplishing any of our plans.

7

9.

We do not intend to pay cash dividends on our common shares in the foreseeable future.

Any payment of cash dividends will depend upon our financial condition, results of operations, capital requirements and other factors and will be at the discretion of our board of directors. We do not anticipate paying cash dividends on our common shares in the foreseeable future. Furthermore, we may incur indebtedness that may restrict or prohibit the payment of dividends.

10.

We may not be able to effectively manage our anticipated growth.

In order to accommodate anticipated growth and to compete effectively in our industry, we will need to continue to implement and improve our operations on a timely basis, as well as expand, motivate and manage any personnel. Successful implementation of our strategy also requires that we recruit additional key employees in management, supervision, operations and sales as the need arises. We cannot assure you that our personnel, systems, procedures and controls will be adequate to support our existing and future operations. Any failure to implement and improve such operations could have a material adverse effect on our business, operating results and financial condition.

11.

Our growth depends on our ability to expand our client base, which is unproven.

Our growth depends upon our ability to maintain existing clientele and to expand nationally with new clients. We cannot assure you that our efforts to increase our number of clients can be accomplished on a profitable basis. Our expansion will depend on a number of factors, including some over which we have no control whatsoever (such as market conditions and the actions or omissions of third parties). If we fail to expand the number of clients in a timely manner, it would have a material adverse effect on our business, operating results and financial condition.

12.

Risk management processes may not fully mitigate exposure to the various risks that we face, including individual market risk.

We will continue to refine our risk management techniques, strategies and assessment methods on an ongoing basis. However, risk management techniques and strategies, including those available to the market generally, may not be fully effective in mitigating our risk exposure in all economic market environments or against all types of risk. For example, we might fail to identify or anticipate particular risks that our systems are capable of identifying, or the systems that they use, and that are used within the industry generally, may fail to anticipate certain risks. Some of their strategies for managing risk are based upon our use of observed historical market behavior. Any failures in their risk management techniques and strategies to accurately quantify their risk exposure could limit our ability to manage risks. In addition, any risk management failures could cause our losses to be significantly greater than the

10

historical measures indicate. Further, our risk modeling cannot take all risks into account. Our more qualitative approach to managing those risks could prove insufficient, exposing us to material unanticipated losses.

13.

An inability to access capital readily or on terms favorable to us could impair our ability to fund operations and could jeopardize our financial condition.

Liquidity, or ready access to funds, is essential to our business. In the future we may need to incur debt or issue equity in order to fund our working capital requirements, as well as to execute our growth initiatives that may include acquisitions and other investments. Our access to funding sources could be hindered by many factors, and many of these factors we cannot control, such as economic downturns and the disruption of financial markets or negative news about industries we conduct business in, generally or us specifically. Factors that are specific to our business include the possibility that lenders or investors could develop a negative perception of our long-term or short-term financial

8

prospects, for example if the level of our business activity decreased due to a market and economic downturn. Similarly, our access to funds may be impaired if regulatory authorities took significant action against us, or if we discovered that one of our employees had engaged in serious unauthorized or illegal activity.

We currently do not have a credit rating, which could adversely affect our liquidity and competitive position by increasing our borrowing costs and limiting access to sources of liquidity that require a credit rating as a condition to providing funds.

14.

We rely on our executive officer in the execution of our business plan, and we would be adversely impacted if he was to become unavailable to us.

We believe that our ability to execute our business strategy will depend to a significant extent upon the efforts and abilities of Barry Sytner, our sole officer and director. If he was to become unavailable to us, our operations would be adversely affected.

15.

Our ability to attract, develop and retain highly skilled and productive employees is critical to the success of our business.

We face intense competition for qualified employees from other businesses in our industry, and the performance of our business may suffer to the extent we are unable to attract and retain employees effectively, particularly given the relatively small size of our company and our employee base compared to some of our competitors.

16.

Our exposure to legal liability is significant and could lead to substantial damages.

We face significant legal risks in our businesses. These risks include potential liability under securities laws and regulations in connection with the Company, and our various business transactions. The volume and amount of damages claimed in litigation, arbitrations, regulatory enforcement actions and other adversarial proceedings against companies have increased in recent years. We also are subject to claims from disputes with our employees and our former employees under various circumstances. Risks associated with legal liability often are difficult to assess or quantify and their existence and magnitude can remain unknown for significant periods of time, making the amount of legal reserves related to these legal liabilities difficult to determine and subject to future revision. Legal or regulatory matters involving our directors, officers or employees in their individual capacities also may create exposure for us because we may be obligated or may choose to indemnify the affected individuals against liabilities and expenses they incur in connection with such matters to the extent permitted under applicable law. In addition, like other service-oriented companies, we may face the possibility of employee fraud or misconduct. The precautions we take to prevent and detect this activity may not be effective in all cases and we cannot assure you that we will be able to deter or prevent fraud or misconduct. Exposures from and expenses incurred related to any of the foregoing actions or proceedings could have a negative impact on our results of operations and financial condition. In addition, future results of operations could be adversely affected if reserves relating to these legal liabilities are required to be increased or legal proceedings are resolved in excess of established reserves.

17.

We may not be able to maintain or replace expiring contracts at attractive rates or on a long-term basis.

We are exposed to market risk when our consulting contracts expire and need to be renewed or replaced. We may not be able to extend contracts with existing clients or obtain replacement contracts at attractive rates or on a long-term basis.

18.

We compete with other business consulting service providers.

The principal elements of competition among business consulting service providers are availability of service in a variety of location, quality of service, and bid pricing. If we are not able to remain competitive in these areas, we will have reduced revenues and may have difficulty attracting and maintaining customers.

9

19.

We do not yet have substantial assets or any revenues and we are largely dependent upon our current consulting contacts and advances from our sole officer and director to fully fund our business.

We have limited capital resources. Unless we are able to increase the number of our clients to finance operations as a going concern, we may experience liquidity and solvency problems. Such liquidity and solvency problems may force us to cease operations if additional financing is not available. We are not aware of any available alternative or additional sources of funds to us to fund our business strategy.

20.

We may suffer losses if our reputation is harmed.

Our ability to attract and retain clients and employees may be diminished to the extent our reputation is damaged. If we fail, or are perceived to fail, to address various issues that may give rise to reputational risk, we could harm our business prospects. These issues include, but are not limited to, appropriately dealing with market dynamics, potential conflicts of interest, legal and regulatory requirements, ethical issues, customer privacy, record-keeping, sales practices, and the proper identification of the legal, reputational, credit, liquidity and market risks inherent in our products and services. Failure to appropriately address these issues could give rise to loss of existing or future business, financial loss, and legal or regulatory liability, including complaints, claims and enforcement proceedings against us, which could, in turn, subject us to fines, judgments and other penalties.

Regulatory Risks

21.

We are a smaller reporting company, and we cannot be certain if the reduced disclosure requirements applicable to smaller reporting companies will make our common stock less attractive to investors.

We are currently a “smaller reporting company,” meaning that we are not an investment company, an asset- backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $250 million and annual revenues of less than $100 million during the most recently completed fiscal year. “Smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, only being required to provide two years of audited financial statements in annual reports and in a registration statement under the Exchange Act on Form 10. Decreased disclosures in our SEC filings due to our status as a “smaller reporting company” may make it harder for investors to analyze our results of operations and financial prospects.

22.

We lack sufficient internal controls and implementing acceptable internal controls will be difficult with only one officer and director thereby it will be difficult to ensure that information required to be disclosed in our reports filed and submitted under the Exchange Act is recorded, processed, summarized and reported as and when required.

We lack internal controls over our financial statements and it may be difficult to implement such controls with only one officer and director. The lack of these internal controls makes it difficult to ensure that information required to be disclosed in our reports is recorded, processed, summarized and reported as and when required.

The reason we believe our disclosure controls and procedures are not effective is because there is a lack of segregation of duties necessary for a good system of internal control due to insufficient accounting staff due to the size of the Company.

12

23.

The regulation of penny stocks by SEC and FINRA may discourage the tradability of our securities.

We are a "penny stock" company. Our s common stock trades on the OTC Market Pink Sheets and we are subject to a Securities and Exchange Commission rule that imposes special sales practice requirements upon broker-dealers who sell such securities to persons other than established customers or accredited investors. For purposes of the rule, the phrase "accredited investors" means, in general terms, institutions with assets in excess of $5,000,000, or individuals

10

having a net worth in excess of $1,000,000 or having an annual income that exceeds $200,000 (or that, when combined with a spouse's income, exceeds $300,000). For transactions covered by the rule, the broker-dealer must make a special suitability determination for the purchaser and receive the purchaser's written agreement to the transaction prior to the sale. Effectively, this discourages broker-dealers from executing trades in penny stocks. Consequently, the rule will affect the ability of investors to sell their securities in any market that might develop therefore because it imposes additional regulatory burdens on penny stock transactions.

In addition, the Securities and Exchange Commission has adopted a number of rules to regulate "penny stocks". Such rules include Rules 3a51-1, 15g-1, 15g-2, 15g-3, 15g-4, 15g-5, 15g-6, 15g-7, and 15g-9 under the Securities and Exchange Act of 1934, as amended. Because our securities constitute "penny stocks" within the meaning of the rules, the rules would apply to us and to our securities. The rules will further affect the ability of owners of shares to sell our securities in any market that might develop for them because it imposes additional regulatory burdens on penny stock transactions.

Shareholders should be aware that, according to Securities and Exchange Commission, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (i) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (ii) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (iii) "boiler room" practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (iv) excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and (v) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities.

24.

The occurrence of the COVID-19 pandemic may negatively affect our operations depending on the severity and longevity of the pandemic.

The COVID-19 pandemic is currently impacting countries, communities, supply chains and markets as well as the global financial markets. A pandemic typically results in social distancing, travel bans and quarantine, and this may limit access to our facilities, management, support staff and professional advisors. These factors, in turn, may not only impact our operations, financial condition and demand for our goods and services but our overall ability to react timely to mitigate the impact of this event. Also, it may hamper our efforts to comply with our filing obligations with the Securities and Exchange Commission. Depending on the severity and longevity of the COVID-19 pandemic, our business and shareholders may experience a significant negative impact. Currently, the COVID-19 pandemic has limited our ability to move forward with our operations and has negatively affected our ability to timely comply with our ongoing filing obligations with the Securities and Exchange Commission.

FORWARD LOOKING STATEMENTS

The information herein contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Actual results may materially differ from those projected in the forward-looking statements as a result of certain risks and uncertainties set forth in this report. Although management believes that the assumptions made and expectations reflected in the forward-looking statements are reasonable, there is no assurance that the underlying assumptions will, in fact, prove to be correct or that actual results will not be different from expectations expressed in this report.

We desire to take advantage of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. This filing contains a number of forward-looking statements that reflect management’s current views and expectations with respect to our business, strategies, products, future results and events, and financial performance. All statements made in this filing other than statements of historical fact, including statements addressing operating performance, clinical developments which management expects or anticipates will or may occur in the future, including statements

11

related to our technology, market expectations, future revenues, financing alternatives, statements expressing general optimism about future operating results, and non-historical information, are forward looking statements. In particular, the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “may,” variations of such words, and similar expressions identify forward-looking statements, but are not the exclusive means of identifying such statements, and their absence does not mean that the statement is not forward-looking. These forward-looking statements are subject to certain risks and uncertainties, including those discussed below. Our actual results, performance or achievements could differ materially from historical results as well as those expressed in, anticipated, or implied by these forward-looking statements. We do not undertake any obligation to revise these forward-looking statements to reflect any future events or circumstances.

Readers should not place undue reliance on these forward-looking statements, which are based on management’s current expectations and projections about future events, are not guarantees of future performance, are subject to risks, uncertainties and assumptions (including those described below), and apply only as of the date of this filing. Our actual results, performance or achievements could differ materially from the results expressed in, or implied by, these forward-looking statements. Factors which could cause or contribute to such differences include, but are not limited to, the risks to be discussed in this Form S-1 Registration and in the press releases and other communications to shareholders issued by us from time to time which attempt to advise interested parties of the risks and factors which may affect our business. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

The statements contained in this prospectus that are not historical fact are forward-looking statements which can be identified by the use of forward-looking terminology such as "believes," "expects," "may," "should," or "anticipates" or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy that involve risks and uncertainties. We have made the forward-looking statements with management’s best estimates prepared in good faith.

Because of the number and range of the assumptions underlying our projections and forward-looking statements, many of which are subject to significant uncertainties and contingencies that are beyond our reasonable control, some of the assumptions inevitably will not materialize and unanticipated events and circumstances may occur subsequent to the date of this prospectus.

These forward-looking statements are based on current expectations, and we will not update this information other than required by law. Therefore, the actual experience of the Company, and results achieved during the period covered by any particular projections and other forward-looking statements should not be regarded as a representation by the Company, or any other person, that we will realize these estimates and projections, and actual results may vary materially. We cannot assure you that any of these expectations will be realized or that any of the forward-looking statements contained herein will prove to be accurate.

14

USE OF PROCEEDS

The Selling Stockholders are selling all of the common shares covered by this prospectus for their own accounts. Accordingly, we will not receive any proceeds from the resale of the common shares.

The Selling Stockholders will pay any underwriting discounts and commissions and expenses incurred by the selling stockholder for brokerage, accounting, tax or legal services or any other expenses incurred by the Selling Stockholders in disposing of the shares. We will bear all other costs, fees and expenses incurred in effecting the registration of the shares covered by this prospectus, including, without limitation, all registration and filing fees,

fees and expenses of our counsel, certain expenses of counsel to the Selling Stockholders and our independent registered public accountants.

12

PLAN OF DISTRIBUTION

The Selling Stockholders may, from time to time, sell any or all of 805,000 common shares covered hereby on any stock exchange, market or trading facility on which the common shares are traded or in private transactions. The Selling Stockholders shall sell their common shares at a fixed price of $.14 per common share unless and until our shares are quoted on the OTC Bulletin Board, the OTCQX, the OTCQB or listed on an alternative trading system or a national securities exchange. The Selling Stockholders may use any one or more of the following methods when selling shares:

-

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

-

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

-

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

-

an exchange distribution in accordance with the rules of the applicable exchange;

-

privately negotiated transactions;

-

in transactions through broker-dealers that agree with the Selling Stockholders to sell a specified number of such shares at a stipulated price per share;

-

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

-

a combination of any such methods of sale; or

-

any other method permitted pursuant to applicable law.

The Selling Stockholders may also sell common shares under Rule 144 under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by the Selling Stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated, provided such amounts are in

16

compliance with FINRA Rule 2121. Discounts, concessions, commissions and similar selling expenses, if any, that can be attributed to the sale of common shares will be paid by the Selling stockholders and/or the purchasers.

Any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act, and such broker-dealers or agents will be subject to the prospectus delivery requirements of the Securities Act.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities with respect to the common shares for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of common shares by the Selling Stockholders or any other person. We will make copies of this prospectus available to the Selling Stockholder sand have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale.

Under the securities laws of some states, the common shares may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states the common shares may not be sold unless such common shares have been registered or qualified for sale in such state or an exemption from registration or qualification is available and is complied with.

The Selling Stockholders will act independently of us in making decisions with respect to the timing, manner and size of each sale. There can be no assurance that the selling stockholder will sell any or all of the common shares registered pursuant to the registration statement, of which this prospectus forms a part.

13

At any time, a particular offer of the common shares is made by the Selling Stockholder, a revised prospectus or prospectus supplement, if required, will be distributed. Such prospectus supplement or post-effective amendment will be filed with the SEC to reflect the disclosure of any required additional information with respect to the distribution of the common shares. We may suspend the sale of common shares by the Selling Stockholders pursuant to this prospectus for certain periods of time for certain reasons, including if the prospectus is required to be supplemented or amended to include additional material information.

Penny Stock

Under the rules of the Securities and Exchange Commission, our common stock will come within the definition of a “penny stock” because the price of our common stock is below $5.00 per share. As a result, our common stock will be subject to the "penny stock" rules and regulations. Broker-dealers who sell penny stocks to certain types of investors are required to comply with the Commission’s regulations concerning the transfer of penny stock. These regulations require broker-dealers to:

·

Make a suitability determination prior to selling penny stock to the purchaser;

·

Receive the purchaser’s written consent to the transaction; and

·

Provide certain written disclosures to the purchaser.

DESCRIPTION OF BUSINESS

The Company

The Company was incorporated as Soldino Group Corp. on January 25, 2017 under the laws of the State of Nevada, United States of America. On November 15, 2018, the Company changed its name to Yijia Group Corp. The Company is in good standing in the State of Nevada and in any jurisdiction where it is qualified to do business.

Starting from July 30, 2021, the Company commenced its operation in the rendering of business consulting service to domestic and international customers. The Company provides consulting services to its clients with regards to funding and other financial matters.

Revenue Stream

The Company currently earns revenues from monthly consulting fees received from its two consulting clients.

The terms of the Company’s consulting agreements are separately negotiated depending on the scope of the consulting services requested.

Consulting Agreements

On July 30, 2021, the Company entered into a consulting agreement, effective August 2, 2021, with Care 365 LLC. The term of the consulting agreements is for an initial term of three months. Unless terminated in writing prior to the end of the period, the consulting agreement shall renew for successive three month periods by either party. During the term of the consulting agreement, the Company shall receive a monthly consulting fee of $10,000.

On July 30, 2021, the Company entered into a consulting agreement, effective August 2, 2021 ,with SBV Workforce Management. The term of the consulting agreements is for an initial term of three months. Unless terminated in writing prior to the end of the period, the consulting agreement shall renew for successive three month periods by either party. During the term of the consulting agreement, the Company shall receive a monthly consulting fee of $5,000.

Market Strategy

The business consulting service industry is highly competitive. The Company will utilize the past business experience and relationships developed by its sole officer and director to identify and pursue new consulting opportunities.

14

Number of Employees

Other than our sole officer, the Company currently has no full-time employees. We currently have people ready to fill positions as soon as they are needed in both office staff and work force roles.

Description of Property

Our principal executive offices are virtual and are located at 30 N Gould St., Suite 22545, Sheridan, WY 82801. Our telephone number is (310) 266-3738. The premises leased at $30 per month.

18

DILUTION

Further Dilution

In the future, the Company may issue equity and debt securities. Any sales of additional securities may have a depressive effect upon the market price of our common shares.

DIVIDEND POLICY

We have not declared or paid dividends on our common shares since our formation, and we do not anticipate paying dividends in the foreseeable future.

Instead, we will retain any earnings for use in our business. This policy will be reviewed by our board of directors from time to time in light of, among other things, our earnings and financial position.

No distribution may be made if, after giving it effect, we would not be able to pay its debts as they become due in the usual course of business; or the corporation's total assets would be less than the sum of its total liabilities plus (unless the articles of incorporation permit otherwise) the amount that would be needed, if we were to be dissolved at the time of the distribution, to satisfy the preferential rights upon dissolution of shareholders whose preferential rights are superior to those receiving the distribution.

The board of directors may base a determination that a distribution is not prohibitive either on financial statements prepared on the basis of accounting practices and principles that are reasonable in the circumstances or on a fair valuation of other method that is reasonable in the circumstances.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Recent Events

COVID-19 Pandemic

The COVID-19 pandemic is currently impacting countries, communities, supply chains and markets as well as the global financial markets. Governments have imposed laws requiring social distancing, travel bans and quarantine, and these laws may limit access to the Company’s facilities, management, support staff and professional advisors. These factors, in turn, may not only impact the Company’s operations, financial condition and demand for the Company’s goods and services, but the Company’s overall ability to react timely to mitigate the impact of this event. Also, it has affected the Company’s efforts to comply with filing obligations with the Securities and Exchange Commission. Depending on the severity and longevity of the COVID-19 pandemic, the Company’s business, customers, and stockholders may experience a significant negative impact. Currently, the COVID-19 pandemic has limited our ability to move forward with our operations and has negatively affected our ability to timely comply with our ongoing filing obligations with the Securities and Exchange Commission.

15

Critical Accounting Policies

The Company’s financial statements and accompanying notes are prepared in accordance with accounting principles generally accepted in the United States of America. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue and expenses. These estimates and assumptions are affected by management's applications of accounting policies. Critical accounting policies for the Company include revenue recognition, valuation of convertible promissory notes and related warrants, stock and stock option compensation, estimates, and derivative financial instruments.

The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America and include the accounts of the Company.

Results of Operations

We have incurred recurring losses to date. Our financial statements have been prepared assuming that we will continue as a going concern and, accordingly, do not include adjustments relating to the recoverability and realization of assets and classification of liabilities that might be necessary should we be unable to continue operations.

We expect we will require additional capital to meet our long-term operating requirements. We expect to raise additional capital through, among other things, the sale of equity or debt securities.

On July 28, 2021, Barry Sytner, a non-affiliate of the registrant, purchased an aggregate of 5,066,250 common shares from Kim Lee Poh, Jian Yang and Shaoyin Wu, officers and directors of the registrant and from Jiang Bo, Chen Bo Bo and Zheng Lixing, other majority shareholders of the registrant. The purchase price for the common shares was paid from Mr. Sytner’s personal funds resulting in a change of control of the registrant. The common shares were transferred to Barry Sytner effective August 4, 2021. The 5,066,250 common shares represent 86.3% of the currently issued and outstanding common shares of the Company.

Starting on July 30, 2021, the Company commenced its operation in the rendering of business consulting service to domestic and international customers. On July 30, 2021, the Company entered into two consulting agreements with non-affiliates to provide business consulting services. Under the consulting agreements, the Company will receive consulting fees of $5,000 and $10,000 per month, respectively. The term of the consulting agreements is for an initial three month period. Unless terminated in writing prior to the end of the period, the consulting agreement are renewable for successive three month periods.

Results of operation for the three months ended October 31, 2021 and October 31, 2020:

Revenue

The Company commenced its operation on July 30, 2021 and the Company generated revenues of $45,000 and $0 for the three months ended October 31, 2021 and 2020, respectively.

Operating expenses for the three months ended October 31, 2021 and 2020 were $29,991 and $12,385, respectively.

Net Income/Loss

The net income for the three months ended October 31, 2021was $15,009, due to the commencement of operations from July 30, 2021.

The net loss for the three months ended October 31, 2020 was $12,385.

Results of operation for the six months ended October 31, 2021 and October 31, 2020:

Revenue

The Company commenced its operation on July 30, 2021 and the Company generated revenues of $45,000 and $0 for the six months ended October 31, 2021 and 2020, respectively.

16

Operating expenses for the six months ended October 31, 2021 and 2020 were $40,477 and $23,632, respectively.

Other income

The Company generated other income of $153,049 and $0 for the six months ended October 31, 2021 and 2020, respectively. The increase is primarily attributable to the gain from forgiveness of related party debt.

Net Income/Loss

The net income for the six months ended October 31, 2021was $157,572.

The net loss for the six months ended October 31, 2020 was $23,632.

Results of operation for the years ended April 30, 2021 and April 30, 2020:

Revenue

There was no revenue and cost of sales for the years ended April 30, 2021 and 2020. Operating expenses for the years ended April 30, 2021 and 2020 were $52,094 and $72,334, respectively.

Net Loss

The net loss for the years ended April 30, 2021 and 2020 was $52,094 and $72,334 accordingly.

Liquidity and Capital Resources

As of October 31, 2021, our current assets were $31,693 ($0 as of April 30, 2021), our current liabilities were $48,791 ($174,670 as of April 30, 2021) and stockholders’ deficit was $17,098 ($174,670 as of April 30, 2021).

As of April 30, 2021 and 2020, our total assets were $0.

As of April 30, 2021, our current liabilities were $174,670 ($122,576 as of April 30, 2020) and stockholders’ deficit was $174,670 ($122,576 as of April 30, 2020).

Cash flows from operating activities

For the six months ended October 31, 2021, net cash generated from operating activities was $12,651. For the six months ended October 31, 2020, net cash used in operating activities was $30,571.

For the year ended April 30, 2021, we have not generated positive cash flows from operating activities. Net cash flows used in operating activities was $42,286, which consisted of increase in accruals and other payables.

For the year ended April 30, 2020, we have not generated positive cash flows from operating activities. Net cash flow used in operating activities was $53,579, which consisted of increase in accruals and other payables.

Cash flows from investing activities

For the six months ended October 31, 2021 and 2020, net cash flows from investing activities were $0 and $0, respectively.

Cash flows from financing activities

For the six months ended October 31, 2021 and 2020, net cash generated from financing activities were $19,042 and $30,571 from proceeds of related party loans, respectively.

For the year ended April 30, 2021, net cash flow provided by financing activities was $42,286 from proceeds from a related party.

For the year ended April 30, 2020, net cash flow provided by financing activities was $53,579 from proceeds from a related party.

17

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

20

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS

AND CONTROL PERSONS

The following persons listed below have been retained to provide services as director until the qualification and election of his successor. All holders of common stock will have the right to vote for directors.

The board of directors has primary responsibility for adopting and reviewing implementation of the business plan of the Company, supervising the development business plan, review of the officers' performance of specific business functions. The board is responsible for monitoring management, and from time to time, to revise the strategic and operational plans of the Company. A director shall be elected by the shareholders to serve until the next annual meeting of shareholders, or until his or her death, or resignation and his or her successor is elected.

The name and age of our sole director and officer and his positions with the Company are as follows:

|

|

|

|

|

|

Name

|

|

Position

|

|

Term(s) of Office

|

|

Barry Sytner, age 68

|

|

Chief Executive Officer/

|

|

|

|

|

|

Chief Financial Officer/Controller/Director

|

|

July 28, 2021 to present

|

Resumes

Barry Sytner

Mr. Sytner has been the sole officer and director of the Company since July 28, 2021. From August 21, 2017, Mr. Sytner has been the managing member of Innovation Consulting, LLC providing overseas financial consulting to private and public companies. Mr. Sytner acted as Chief Executive Officer of Tri-Mark Manufacturing, Inc., a public company from 2008 to 2001. Mr. Sytner obtained a bachelor of arts degree in education from Yeshiva College in 1971 and from the University of Scranton in 1973.

Committees of the Board of Directors

We do not have standing audit, nominating or compensation committees, or committees performing similar functions. Our board of directors believes that it is not necessary to have standing audit, nominating or compensation committees at this time because the functions of such committees are adequately performed by our board of directors.

Code of Ethics Policy

Prior to the termination of this offering, ae intend to adopt a formal code of ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions.

Corporate Governance

There have been no changes in any state law or other procedures by which security holders may recommend nominees to our board of directors. In addition to having no nominating committee for this purpose, we currently have no specific audit committee and no audit committee financial expert. Based on the fact that our current business affairs are simple, any such committees are excessive and beyond the scope of our business and needs.

Indemnification

The Company shall indemnify to the fullest extent permitted by, and in the manner permissible under the laws of the State of Nevada, any person made, or threatened to be made, a party to an action or proceeding, whether criminal, civil, administrative or investigative, by reason of the fact that he is or was a director or officer of the Company, or served any other enterprise as director, officer or employee at the request of the Company.

18

The board of directors, in its discretion, shall have the power on behalf of the Company to indemnify any person, other than a director or officer, made a party to any action, suit or proceeding by reason of the fact that he/she is or was an employee of the Company.

Insofar as indemnification for liabilities arising under the Act may be permitted to directors, officers and controlling persons of the Company, the Company has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Company of expenses incurred or paid by a director, officer or controlling person of the Company in the successful defense of any action, suit or proceedings) is asserted by such director, officer, or controlling person in connection with any securities being registered, the Company will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issues.

Executive Compensation

The following table sets forth the compensation paid to officers and board of directors since inception. The table sets forth this information for salary, bonus, and certain other compensation to the board of directors and named executive officers since inception and includes all board of directors and officers for the years ended April 30, 2021 and 2020.

|

|

|

|

|

|

|

|

|

|

|

Name and

Principal Position

(a)

|

Year

(b)

|

Salary

($)

(c)

|

Bonus

($)

(d)

|

Stock

Awards

($)

(e)

|

Option

Awards

($)

(f)

|

Non-Equity

Incentive Plan

Compensation

($)

(g)

|

Nonqualified

Deferred

Compensation

Earnings ($)

(h)

|

All Other

Compensation(1) ($)

(i)

|

Total

($)

(j)

|

|

|

|

|

|

|

|

|

|

|

|

Barry Sytner, CEO and CFO

|

2021

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

|

2020

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

|

Shaoyin Wu, former CEO and President

|

2021

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

|

2020

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Kim Lee Poh, former CFO and Secretary

|

2021

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

|

2020

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

Outstanding Equity Awards

There are currently no equity awards outstanding.

Employment Agreements

The Company is currently negotiating employment agreements with its sole officer. As of the date of this prospectus, no employment agreements have been executed. The proposed terms of these agreements are as follows:

Each of the aforenamed executives shall have a term of office of seven years unless terminated prior to that time, and these agreements shall be automatically extended upon the same terms and conditions for successive one-year periods unless written notice is provided by the executive. The executives are entitled to a base annual salary of $150,000 which may be increased each successive year of employment at the discretion of the Board. Each executive is eligible to receive an annual performance bonus at the discretion of the Board. The salary can be renegotiated once the Company starts generating revenues.

The Company will provide each executive a life insurance policy (with coverage not to exceed $100,000 death benefit) and group health, dental, vision and disability insurance plans for the coverage of medical expenses for the executive. In addition, each executive shall receive twelve weeks of paid vacation, with the limitation that they shall not take more than four consecutive weeks of vacation without consent of the CEO and provided that reasonable efforts are

19

taken to consider seasonal peaks. Any unused time can be paid out or rolled over to the following year. The Company will reimburse reasonable and necessary out-of-pocket business, entertainment and travel expenses incurred in the course of performing their duties. The Company will provide each executive with a $2,000 per month automobile allowance and a $2,000 per month housing allowance (which can be increased to a total of $5,000 in the event that the Company requests the executive to live away from home).

22

Should the executive’s term of employment expire or should the executive be terminated for cause, the executive shall be entitled to receive any accrued but unpaid base salary and accrued by unused vacation time, any earned but unpaid annual bonus with respect to any completed fiscal year immediately preceding the termination date, reimbursement for unreimbursed business expenses properly incurred by the executive, and any employee benefits the executive may be entitled to as of the termination date.

Should the executive be terminated without cause, the Company shall pay the aforementioned accrued amounts, and a lump sum payment depending on how long the executive has been with the Company. If the termination occurs before the two-year anniversary of the employment agreement, the Company shall pay a lump sum of $2,000,000. If the termination occurs between the two-year anniversary and the four-year anniversary of the employment agreement, the Company shall pay a lump sum of $1,600,000. If the termination occurs after the four-year anniversary of the employment agreement, the Company shall pay a lump sum of $1,200,000.

In the event that the executive is terminated without cause, the executive will have a one-time right to require that the Company purchase all shares of the Company’s stock held by the executive. The executive must provide written notice of exercise within three months of such termination. In the event that the executive is terminated for any reason other than termination without cause, the Company will have a one-time right to require that the executive sell all of the Company’s stock held by the executive. The Company must provide written notice of exercise within three months of such termination. The parties will negotiate in good faith to agree on a purchase price. If they are unable to agree, the purchase price will be based on the Company valuation used in the most recent sale of Company stock if it occurred within the last six months. If no such sale has occurred, the purchase price will instead be referred to an independent third-party valuation expert mutually agreed upon by all parties and the fair market value of the stock as determined by such expert shall be the purchase price.

In the event that an executive proposes to make any assignment, sale, disposition, or transfer of Company stock held by the executive to a third party in amounts greater than 5% of the currently issued and outstanding stock, the executive shall first deliver a written notice to the Company setting forth the material terms and conditions, including price and form of consideration and the identity of the proposed transferee. Following the Company’s receipt of such notice, the Company shall, for a period of fourteen days thereafter, have the right, but not the obligation, to purchase all of the stock subject to such proposed transfer on the same terms and conditions specified in the executive’s notice. The Company must provide written notice of its intent to exercise this right of first refusal within the same fourteen day period. The executive is annually entitled to transfer up to five percent of the aggregate issued and outstanding stock of the Company owned by the executive without triggering this right of first refusal or without first getting Board approval.

Significant Employees

We have no significant employees who are not executive officers or directors.

Family Relationships

No officer or director of the Company has a family relationship with any other member of the Company.

Directorships

None

20

Involvement in Certain Legal Proceedings

During the past ten years, no director, promoter or control person:

has filed a petition under federal bankruptcy laws or any state insolvency laws, nor had a receiver, fiscal agent or similar officer appointed by a court for the business or property of such person, or any partnership in which he was a general partner at or within two years before the time of such filing, or any corporation or business association of which he was an executive officer at or within two years before the time of such filing;

was convicted in a criminal proceeding or named subject to a pending criminal proceeding (excluding traffic violations and other minor offenses);

was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him or her from or otherwise limiting the following activities:

Acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated person, director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice in connection with such activity;

Engaging in any type of business practice; or

Engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of Federal or State securities laws or Federal commodities laws;

was the subject of any order, judgment or decree, not subsequently reverse, suspended or vacated, of any Federal or State authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described in the preceding bullet point, or to be associated with persons engaged in any such activity;

was found by a court of competent jurisdiction in a civil action or by the SEC to have violated any Federal or State securities law, and the judgment in such civil action or finding by the SEC has not been subsequently reversed, suspended, or vacated;

was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated;

was the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of:

any Federal or State securities or commodities law or regulation; or

any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or

any law or regulation prohibiting mail or wire fraud in connection with any business activity; or

21

was the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, or any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act, or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The table below sets forth the beneficial ownership of our common stock, as of November 18, 2021, by:

•

All of our current directors and executive officers, individually; and

•

All persons who beneficially own more than 5% of our outstanding common stock.

24

The beneficial ownership of each person was calculated based on 5,871,250 common shares outstanding as of November 18, 2021. The SEC has defined “beneficial ownership” to mean more than ownership in the usual sense. For example, a person has beneficial ownership of a share not only if he owns it in the usual sense, but also if he has the power (solely or shared) to vote, sell or otherwise dispose of the share. Beneficial ownership also includes the number of shares that a person has the right to acquire within 60 days, pursuant to the exercise of options or warrants or the conversion of notes, debentures or other indebtedness, but excludes stock appreciation rights. Two or more persons might count as beneficial owners of the same share. The inclusion herein of any shares listed as beneficially owned does not constitute an admission of beneficial ownership. Each person named in the table has sole voting and investment power with respect to all of the shares of our common stock shown as beneficially owned by such person, except as otherwise set forth in the notes to the table. Unless otherwise noted, the address of the following persons listed below is c/o Yijia Group Corp. 30 N. Gould St., Suite 22545, Sheridan, WY 82801.

The following table sets forth, as of September 17, 2021, the number and percentage of our outstanding shares of common stock owned by (i) each person known to us to beneficially own more than 5% of its outstanding common stock, (ii) each director, (iii) each named executive officer and significant employee, and (iv) all officers and directors as a group.

|

|

|

|

|

Name

|

Amount Owned

|

Percentage

owned

|

|

|

Barry Sytner

|

5,066,250

|

86.3%

|

|

|

All Officers and Directors as a Group

(one person)

|

5,066,250

|

86.3%

|

(1)Based upon 5,871,250 outstanding common shares as of November 18, 2021.

(2)Assumes the sale of all of the shares being offered by the Selling Stockholder.

Changes in Control

There are no present arrangements or pledges of our securities that may result in a change in control of the Company.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

None

Promoters and Certain Control Persons

Except as indicated under the heading “Transactions with Related Persons” above, there have been no transactions since inception, or any currently proposed transaction in which we were or are to be a participant and the amount involved exceeds the lesser of $120,000 or one percent of the average of our total assets at year-end for the last three completed fiscal years.

22

Director Independence