UCASU expands at fast pace in lucrative cannabis property investment

February 02 2022 - 10:38AM

InvestorsHub NewsWire

February 2, 2022 -- InvestorsHub NewsWire

-- via MoneyChatsGroup

UC Asset LP (OTCQX:

UCASU) is expanding at fast pace its portfolio in cannabis

property investment, which is arguably one of the most lucartive

property type in the current economy. The company

announced yesterday that it signed an LOI to acquire a second

Oklahoma cannabis property, for a consideration of $440k. The

property is a 5-acre licensed cannabis growth facility, including 2

grow buildings and a single wide trailer.

UC Asset has engaged a licensed grower who will likely lease the

property once it is officially acquired. According to the grower,

operations from this facility may generate a gross revenue of a

minimum of $120k per month, based on the current market

condition.

This is the second cannabis property UC Asset has a signed an

LOI to acquire in the past two months. Last month, UC Asset signed

an LOI to acquire a 4-acre licensed grow property in Oklahoma City

area. The acquisition price for the first property has been

negotiated down to $500k since the initial signing of the LOI.

“After careful consideration of all factors, we believe the

second opportunity could prove more lucrative even than the first,”

says Greg Bankston, managing general partner of UC Asset.

“Depending on the availability of our capital and other reasons, we

may opt to close on one or both properties, in the coming weeks,”

Bankston reveals.

According to its SEC filings, the company had over $800k cash at

the end of 2021’s third quarter. Since then, the company has exited

more investment in its portfolio.

If UC Asset acquires the property, it will lease the property to

licensed growers, implementing a business model similar to other

established public companies, such as Power REIT. In February 2020,

Power REIT announced expanding its portfolio in greenhouses for

both food and cannabis cultivation. In less than 2 years since this

announcement, its stock price has soared from $8.45 (February 03,

2020) to $73.01 (January 18, 2021), an increase of more than

860%.

Last November, Zack Small-cap

Research set the target price of UCASU at $4.50 per share in its

research report.

Disclaimer: Money Chats

Group (Moneychatsgroup.com) provides dissemination service that

collects and distributes investment related news and information

that are already in the public domain. Money Chats Group does NOT

verify the information it disseminates. The contents included in

this distribution do not construe any investment or other advice.

Nothing contained in this distribution constitutes a solicitation,

recommendation, endorsement, or offer by Money Chats Group of any

third parties to buy or sell any

securities.

SOURCE: Money Chats

Group

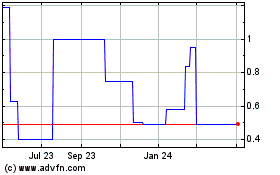

UC Asset Limited Partner... (QB) (USOTC:UCASU)

Historical Stock Chart

From Mar 2024 to Apr 2024

UC Asset Limited Partner... (QB) (USOTC:UCASU)

Historical Stock Chart

From Apr 2023 to Apr 2024