Cartier Parent Richemont Warns on Profit After Slide in Sales -- 2nd Update

September 14 2016 - 3:24AM

Dow Jones News

By Brian Blackstone

ZURICH-- Cie. Financière Richemont SA's sales tumbled in the

five months through August, prompting a warning from the maker of

Cartier jewelry of sharply lower first-half profit, reflecting the

challenges facing luxury-goods companies from weaker demand in Asia

and a decline in tourism in Europe.

The Geneva-based group said sales fell 14% for the five months

through August from the previous year at actual exchange rates. At

constant exchange rates, sales fell 13%.

The Swiss company also said it expects operating profit for the

six months through September to be down around 45% from the

previous year.

"We are of the view that the current negative environment as a

whole is unlikely to reverse in the short term," the company

said.

The results came weeks after Swatch Group AG reported a 52%

plunge in first-half profit. Net sales at the company, known for

its cheap plastic watches but also the owner of expensive brands

such as Omega, Blancpain and Breguet, fell 11%.

Watchmakers and other luxury good companies have been hit by a

series of shocks in recent years: weaker global growth that

depresses incomes; corruption crackdowns in China; terrorism fears

in shopping hubs such as Paris that have hurt tourism; and new

entrants into the market, particularly smartwatches.

Richemont said that sales were down in much of Europe,

"particularly in France, due to a significantly lower level of

tourist activity."

In Asia, sales growth in mainland China and Korea "was more than

offset by the continuing weakness of the Hong Kong and Macau

markets," where the company is buying back inventory, Richemont

said. Japan showed sharply lower sales in part due to the strong

yen which hurt tourism there.

Sales also fell in the Americas, but at a slower rate than in

other regions. They grew in the U.K. after the referendum to leave

the European Union, which weakened the pound.

Richemont maintained an upbeat view about the long-term

prospects for the luxury goods industry. The company "is well

positioned," it said, citing a strong balance sheet and its

well-known brands.

Hermès International, Richemont's French luxury-goods rival,

said Wednesday that its first-half net profit rose 13% from the

same period last year, supported by sales of leather goods and

saddlery.

The company sounded a more cautious note about its prospects.

Sales, including the effect of currency fluctuations, would grow

this year, but management is no longer specifying by how much.

Earlier this year, Hermés said full-year sales would grow around

8%.

-- Manuela Mesco in Milan contributed to this article.

Write to Brian Blackstone at brian.blackstone@wsj.com

(END) Dow Jones Newswires

September 14, 2016 03:09 ET (07:09 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

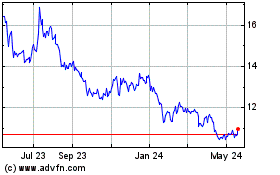

Swatch (PK) (USOTC:SWGAY)

Historical Stock Chart

From May 2024 to Jun 2024

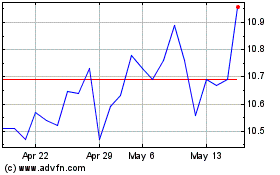

Swatch (PK) (USOTC:SWGAY)

Historical Stock Chart

From Jun 2023 to Jun 2024