0001490161

false

--12-31

2023

Q2

0001490161

2023-01-01

2023-06-30

0001490161

2023-08-14

0001490161

2023-06-30

0001490161

2022-12-31

0001490161

2023-04-01

2023-06-30

0001490161

2022-04-01

2022-06-30

0001490161

2022-01-01

2022-06-30

0001490161

us-gaap:CommonStockMember

2023-03-31

0001490161

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001490161

SOWG:CommonStockPayableMember

2023-03-31

0001490161

us-gaap:RetainedEarningsMember

2023-03-31

0001490161

2023-03-31

0001490161

us-gaap:CommonStockMember

2022-03-31

0001490161

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001490161

SOWG:CommonStockPayableMember

2022-03-31

0001490161

us-gaap:RetainedEarningsMember

2022-03-31

0001490161

2022-03-31

0001490161

us-gaap:CommonStockMember

2022-12-31

0001490161

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001490161

SOWG:CommonStockPayableMember

2022-12-31

0001490161

us-gaap:RetainedEarningsMember

2022-12-31

0001490161

us-gaap:CommonStockMember

2021-12-31

0001490161

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001490161

SOWG:CommonStockPayableMember

2021-12-31

0001490161

us-gaap:RetainedEarningsMember

2021-12-31

0001490161

2021-12-31

0001490161

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001490161

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001490161

SOWG:CommonStockPayableMember

2023-04-01

2023-06-30

0001490161

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001490161

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001490161

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001490161

SOWG:CommonStockPayableMember

2022-04-01

2022-06-30

0001490161

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001490161

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001490161

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-06-30

0001490161

SOWG:CommonStockPayableMember

2023-01-01

2023-06-30

0001490161

us-gaap:RetainedEarningsMember

2023-01-01

2023-06-30

0001490161

us-gaap:CommonStockMember

2022-01-01

2022-06-30

0001490161

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-06-30

0001490161

SOWG:CommonStockPayableMember

2022-01-01

2022-06-30

0001490161

us-gaap:RetainedEarningsMember

2022-01-01

2022-06-30

0001490161

us-gaap:CommonStockMember

2023-06-30

0001490161

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001490161

SOWG:CommonStockPayableMember

2023-06-30

0001490161

us-gaap:RetainedEarningsMember

2023-06-30

0001490161

us-gaap:CommonStockMember

2022-06-30

0001490161

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001490161

SOWG:CommonStockPayableMember

2022-06-30

0001490161

us-gaap:RetainedEarningsMember

2022-06-30

0001490161

2022-06-30

0001490161

us-gaap:PrivatePlacementMember

2021-02-04

2021-02-05

0001490161

us-gaap:PrivatePlacementMember

2021-02-05

0001490161

us-gaap:PrivatePlacementMember

2021-07-06

2021-07-07

0001490161

us-gaap:PrivatePlacementMember

2021-07-07

0001490161

SOWG:PromissoryNotesAndWarrantsMember

2021-12-30

2021-12-31

0001490161

SOWG:PromissoryNotesAndWarrantsMember

2021-12-31

0001490161

SOWG:PromissoryNotesAndWarrantsMember

2022-04-07

2022-04-08

0001490161

SOWG:PromissoryNotesAndWarrantsMember

2022-04-08

0001490161

SOWG:PromissoryNotesAndWarrantsMember

2022-08-22

2022-08-23

0001490161

SOWG:PromissoryNotesAndWarrantsMember

2022-08-23

0001490161

SOWG:TwoDirectorsMember

SOWG:PromissoryNotesAndWarrantsMember

2022-09-29

2023-03-07

0001490161

SOWG:PromissoryNotesAndWarrantsMember

2023-04-24

2023-04-25

0001490161

SOWG:PromissoryNotesAndWarrantsMember

2023-05-10

2023-05-11

0001490161

us-gaap:StockOptionMember

2023-01-01

2023-06-30

0001490161

us-gaap:StockOptionMember

2022-01-01

2022-06-30

0001490161

SOWG:SoftwareMember

2023-01-01

2023-06-30

0001490161

SOWG:WebsiteMember

2023-01-01

2023-06-30

0001490161

us-gaap:OfficeEquipmentMember

2023-01-01

2023-06-30

0001490161

us-gaap:FurnitureAndFixturesMember

2023-01-01

2023-06-30

0001490161

us-gaap:MachineryAndEquipmentMember

2023-01-01

2023-06-30

0001490161

us-gaap:LeaseholdImprovementsMember

2023-01-01

2023-06-30

0001490161

SOWG:BradleyBermanMember

2023-05-11

0001490161

SOWG:PromissoryNotesAndWarrantsMember

SOWG:BradleyBermanMember

2023-05-10

2023-05-11

0001490161

SOWG:PromissoryNotesAndWarrantsMember

SOWG:BradleyBermanMember

2023-05-11

0001490161

SOWG:PromissoryNotesAndWarrantsMember

2023-04-25

0001490161

SOWG:MrGoldfarbMember

2023-04-25

0001490161

SOWG:CesarJGutierrezMember

2023-04-25

0001490161

SOWG:OneDirectorMember

SOWG:PromissoryNotesAndWarrantsMember

2023-01-06

2023-04-11

0001490161

SOWG:FiveNonEmployeeDirectorsMember

2023-06-01

0001490161

SOWG:FiveNonEmployeeDirectorsMember

2023-05-30

2023-06-01

0001490161

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CashAndCashEquivalentsMember

2023-06-30

0001490161

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CashAndCashEquivalentsMember

2023-06-30

0001490161

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CashAndCashEquivalentsMember

2023-06-30

0001490161

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2023-06-30

0001490161

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2023-06-30

0001490161

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2023-06-30

0001490161

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

SOWG:NotesPayableRelatedPartiesMember

2023-06-30

0001490161

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

SOWG:NotesPayableRelatedPartiesMember

2023-06-30

0001490161

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

SOWG:NotesPayableRelatedPartiesMember

2023-06-30

0001490161

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

SOWG:NotesPayableMember

2023-06-30

0001490161

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

SOWG:NotesPayableMember

2023-06-30

0001490161

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

SOWG:NotesPayableMember

2023-06-30

0001490161

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CashAndCashEquivalentsMember

2022-12-31

0001490161

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CashAndCashEquivalentsMember

2022-12-31

0001490161

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:CashAndCashEquivalentsMember

2022-12-31

0001490161

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2022-12-31

0001490161

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2022-12-31

0001490161

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2022-12-31

0001490161

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

SOWG:NotesPayableRelatedPartiesMember

2022-12-31

0001490161

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

SOWG:NotesPayableRelatedPartiesMember

2022-12-31

0001490161

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

SOWG:NotesPayableRelatedPartiesMember

2022-12-31

0001490161

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

SOWG:NotesPayableMember

2022-12-31

0001490161

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

SOWG:NotesPayableMember

2022-12-31

0001490161

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

SOWG:NotesPayableMember

2022-12-31

0001490161

us-gaap:OfficeEquipmentMember

2023-06-30

0001490161

us-gaap:OfficeEquipmentMember

2022-12-31

0001490161

us-gaap:MachineryAndEquipmentMember

2023-06-30

0001490161

us-gaap:MachineryAndEquipmentMember

2022-12-31

0001490161

us-gaap:SoftwareDevelopmentMember

2023-06-30

0001490161

us-gaap:SoftwareDevelopmentMember

2022-12-31

0001490161

SOWG:WebsiteMember

2023-06-30

0001490161

SOWG:WebsiteMember

2022-12-31

0001490161

us-gaap:LeaseholdImprovementsMember

2023-06-30

0001490161

us-gaap:LeaseholdImprovementsMember

2022-12-31

0001490161

us-gaap:ConstructionInProgressMember

2023-06-30

0001490161

us-gaap:ConstructionInProgressMember

2022-12-31

0001490161

SOWG:NotesPayablesRelatedParties1Member

SOWG:BradleyBermanMember

2023-06-30

0001490161

SOWG:BradleyBermanMember

SOWG:NotesPayablesRelatedParties1Member

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties1Member

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties1Member

2022-12-31

0001490161

SOWG:NotesPayablesRelatedParties2Member

SOWG:CesarJGutierrezMember

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties2Member

SOWG:CesarJGutierrezMember

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties2Member

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties2Member

2022-12-31

0001490161

SOWG:NotesPayablesRelatedParties3Member

SOWG:MrGoldfarbMember

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties3Member

SOWG:MrGoldfarbMember

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties3Member

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties3Member

2022-12-31

0001490161

SOWG:NotesPayablesRelatedParties4Member

SOWG:LyleABermaMember

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties4Member

SOWG:LyleABermaMember

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties4Member

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties4Member

2022-12-31

0001490161

SOWG:NotesPayablesRelatedParties5Member

SOWG:LyleABermaMember

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties5Member

SOWG:LyleABermaMember

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties5Member

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties5Member

2022-12-31

0001490161

SOWG:NotesPayablesRelatedParties6Member

SOWG:MrGoldfarbMember

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties6Member

SOWG:MrGoldfarbMember

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties6Member

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties6Member

2022-12-31

0001490161

SOWG:NotesPayablesRelatedParties7Member

SOWG:MrGoldfarbMember

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties7Member

SOWG:MrGoldfarbMember

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties7Member

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties7Member

2022-12-31

0001490161

SOWG:NotesPayablesRelatedParties8Member

SOWG:LyleABermanMember

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties8Member

SOWG:LyleABermanMember

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties8Member

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties8Member

2022-12-31

0001490161

SOWG:NotesPayablesRelatedParties9Member

SOWG:LyleABermanMember

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties9Member

SOWG:LyleABermanMember

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties9Member

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties9Member

2022-12-31

0001490161

SOWG:NotesPayablesRelatedParties10Member

SOWG:MrGoldfarbMember

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties10Member

SOWG:MrGoldfarbMember

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties10Member

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties10Member

2022-12-31

0001490161

SOWG:NotesPayablesRelatedParties11Member

SOWG:LyleABermanMember

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties11Member

SOWG:LyleABermanMember

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties11Member

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties11Member

2022-12-31

0001490161

SOWG:NotesPayablesRelatedParties12Member

SOWG:MrGoldfarbMember

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties12Member

SOWG:MrGoldfarbMember

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties12Member

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties12Member

2022-12-31

0001490161

SOWG:NotesPayablesRelatedParties13Member

SOWG:MrAndMrsGoldfarbMember

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties13Member

SOWG:MrAndMrsGoldfarbMember

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties13Member

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties13Member

2022-12-31

0001490161

SOWG:NotesPayablesRelatedParties14Member

SOWG:IraGoldfarbMember

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties14Member

SOWG:IraGoldfarbMember

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties14Member

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties14Member

2022-12-31

0001490161

SOWG:NotesPayablesRelatedParties15Member

SOWG:LyleABermanMember

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties15Member

SOWG:LyleABermanMember

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties15Member

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties15Member

2022-12-31

0001490161

SOWG:NotesPayablesRelatedParties16Member

SOWG:MrAndMrsGoldfarbMember

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties16Member

SOWG:MrAndMrsGoldfarbMember

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties16Member

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties16Member

2022-12-31

0001490161

SOWG:NotesPayablesRelatedParties17Member

SOWG:LyleABermanMember

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties17Member

SOWG:LyleABermanMember

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties17Member

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties17Member

2022-12-31

0001490161

SOWG:NotesPayablesRelatedParties18Member

SOWG:BradleyKBurkeMember

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties18Member

SOWG:BradleyKBurkeMember

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties18Member

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties18Member

2022-12-31

0001490161

SOWG:NotesPayablesRelatedParties19Member

SOWG:CesarJGutierrezLivingTrustMember

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties19Member

SOWG:CesarJGutierrezLivingTrustMember

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties19Member

2023-06-30

0001490161

SOWG:NotesPayablesRelatedParties19Member

2022-12-31

0001490161

SOWG:NotesPayableRelatedPartiesMember

2022-01-01

2023-05-11

0001490161

SOWG:StockBasedWarrantExpenseMember

SOWG:NotesPayableRelatedPartiesMember

2023-01-01

2023-06-30

0001490161

SOWG:StockBasedWarrantExpenseMember

SOWG:NotesPayableRelatedPartiesMember

2022-01-01

2022-06-30

0001490161

SOWG:NotesPayableAMember

2023-06-30

0001490161

SOWG:NotesPayableAMember

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayableAMember

2022-12-31

0001490161

SOWG:NotesPayableBMember

2023-06-30

0001490161

SOWG:NotesPayableBMember

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayableBMember

2022-12-31

0001490161

SOWG:NotesPayableCMember

2023-06-30

0001490161

SOWG:NotesPayableCMember

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayableCMember

2022-12-31

0001490161

SOWG:NotesPayableDMember

2023-06-30

0001490161

SOWG:NotesPayableDMember

2023-01-01

2023-06-30

0001490161

SOWG:NotesPayableDMember

2022-12-31

0001490161

2022-04-07

2023-04-25

0001490161

SOWG:StockBasedWarrantExpenseMember

2023-01-01

2023-06-30

0001490161

SOWG:StockBasedWarrantExpenseMember

2022-01-01

2022-06-30

0001490161

2023-06-01

0001490161

us-gaap:StockOptionMember

2023-06-30

0001490161

us-gaap:StockOptionMember

2023-01-01

2023-06-30

0001490161

us-gaap:StockOptionMember

2022-01-01

2022-06-30

0001490161

us-gaap:OptionMember

2023-06-04

2023-06-05

0001490161

us-gaap:OptionMember

2023-01-01

2023-06-30

0001490161

us-gaap:OptionMember

2023-06-30

0001490161

us-gaap:WarrantMember

2023-06-30

0001490161

us-gaap:WarrantMember

us-gaap:PrivatePlacementMember

2023-05-10

2023-05-11

0001490161

us-gaap:WarrantMember

2023-05-10

2023-05-11

0001490161

us-gaap:WarrantMember

2023-05-11

0001490161

us-gaap:WarrantMember

2023-01-01

2023-06-30

0001490161

us-gaap:WarrantMember

2023-06-30

0001490161

SOWG:Warrant1Member

us-gaap:PrivatePlacementMember

2023-04-24

2023-04-25

0001490161

SOWG:Warrant1Member

2023-04-24

2023-04-25

0001490161

SOWG:Warrant1Member

2023-04-25

0001490161

SOWG:Warrant1Member

2023-01-01

2023-06-30

0001490161

SOWG:Warrant1Member

2023-06-30

0001490161

SOWG:Warrant2Member

us-gaap:PrivatePlacementMember

2023-04-24

2023-04-25

0001490161

SOWG:Warrant2Member

2023-04-24

2023-04-25

0001490161

SOWG:Warrant2Member

2023-04-25

0001490161

SOWG:Warrant2Member

2023-01-01

2023-06-30

0001490161

SOWG:Warrant2Member

2023-06-30

0001490161

SOWG:Warrant3Member

us-gaap:PrivatePlacementMember

2023-04-24

2023-04-25

0001490161

SOWG:Warrant3Member

2023-04-24

2023-04-25

0001490161

SOWG:Warrant3Member

2023-04-25

0001490161

SOWG:Warrant3Member

2023-01-01

2023-06-30

0001490161

SOWG:Warrant3Member

2023-06-30

0001490161

SOWG:Warrant4Member

us-gaap:PrivatePlacementMember

2023-04-10

2023-04-11

0001490161

SOWG:Warrant4Member

2023-04-10

2023-04-11

0001490161

SOWG:Warrant4Member

2023-04-11

0001490161

SOWG:Warrant4Member

2023-01-01

2023-06-30

0001490161

SOWG:Warrant4Member

2023-06-30

0001490161

SOWG:Warrant5Member

us-gaap:PrivatePlacementMember

2023-03-06

2023-03-07

0001490161

SOWG:Warrant5Member

2023-03-06

2023-03-07

0001490161

SOWG:Warrant5Member

2023-03-07

0001490161

SOWG:Warrant5Member

2023-01-01

2023-06-30

0001490161

SOWG:Warrant5Member

2023-06-30

0001490161

SOWG:Warrant6Member

us-gaap:PrivatePlacementMember

2023-03-01

2023-03-02

0001490161

SOWG:Warrant6Member

2023-03-01

2023-03-02

0001490161

SOWG:Warrant6Member

2023-03-02

0001490161

SOWG:Warrant6Member

2023-01-01

2023-06-30

0001490161

SOWG:Warrant6Member

2023-06-30

0001490161

SOWG:Warrant7Member

us-gaap:PrivatePlacementMember

2023-01-31

2023-02-01

0001490161

SOWG:Warrant7Member

2023-01-31

2023-02-01

0001490161

SOWG:Warrant7Member

2023-02-01

0001490161

SOWG:Warrant7Member

2023-01-01

2023-06-30

0001490161

SOWG:Warrant7Member

2023-06-30

0001490161

SOWG:Warrant8Member

us-gaap:PrivatePlacementMember

2023-01-04

2023-01-05

0001490161

SOWG:Warrant8Member

2023-01-04

2023-01-05

0001490161

SOWG:Warrant8Member

2023-01-05

0001490161

SOWG:Warrant8Member

2023-01-01

2023-06-30

0001490161

SOWG:Warrant8Member

2023-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT UNDER SECTION 13

OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For quarterly period ended June 30, 2023

or

☐ TRANSITION REPORT UNDER SECTION 13

OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________

to ______________

Commission File Number 000-53952

SOW GOOD INC.

(Exact name of registrant as specified in its

charter)

|

Nevada

(State or other jurisdiction of incorporation or

organization) |

27-2345075

(I.R.S. Employer Identification No.)

|

1440 N. Union Bower, Irving, TX 75061

(Address of principal executive offices) (Zip Code)

Issuer’s telephone Number: (214) 623-6055

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

See definitions of “large accelerated filer,” “accelerated filer, “smaller reporting company,” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

|

Smaller reporting company |

☒ |

| Emerging growth company |

☐ |

|

|

|

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

SOWG |

OTCQB |

The number of shares of registrant’s common

stock outstanding as of August 14, 2023 was 4,868,083.

TABLE

OF CONTENTS

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

SOW GOOD INC.

CONDENSED BALANCE SHEETS

| | |

| | |

| |

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | |

| |

| | |

| | |

| |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 293,024 | | |

$ | 276,464 | |

| Accounts receivable, net | |

| 726,672 | | |

| 191,022 | |

| Prepaid expenses | |

| 119,843 | | |

| 137,692 | |

| Inventory | |

| 918,969 | | |

| 1,972,879 | |

| Total current assets | |

| 2,058,508 | | |

| 2,578,057 | |

| | |

| | | |

| | |

| Property and equipment: | |

| | | |

| | |

| Construction in progress | |

| – | | |

| 2,487,673 | |

| Property and equipment | |

| 5,905,432 | | |

| 3,055,579 | |

| Less accumulated depreciation | |

| (663,673 | ) | |

| (508,257 | ) |

| Total property and equipment, net | |

| 5,241,759 | | |

| 5,034,995 | |

| | |

| | | |

| | |

| Security deposit | |

| 58,765 | | |

| 24,000 | |

| Right-of-use asset | |

| 1,226,708 | | |

| 1,261,525 | |

| | |

| | | |

| | |

| Total assets | |

$ | 8,585,740 | | |

$ | 8,898,577 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 376,349 | | |

$ | 452,606 | |

| Accrued expenses | |

| 657,411 | | |

| 385,028 | |

| Current portion of operating lease liabilities | |

| 56,011 | | |

| 52,543 | |

| Current maturities of notes payable, related parties,

net of $699,297 of debt discounts at June 30, 2023 | |

| 200,703 | | |

| – | |

| Current maturities of notes payable,

net of $306,498 of debt discounts at June 30, 2023 | |

| 93,502 | | |

| – | |

| Total current liabilities | |

| 1,383,976 | | |

| 890,177 | |

| | |

| | | |

| | |

| Operating lease liabilities | |

| 1,272,626 | | |

| 1,301,355 | |

| Notes payable, related parties,

net of $3,027,998 and $2,692,757 of debt discounts at June 30, 2023 and December 31, 2022, respectively | |

| 4,667,002 | | |

| 3,502,243 | |

| Notes payable, net of $262,705

and $336,085 of debt discounts at June 30, 2023 and December 31, 2022, respectively | |

| 467,295 | | |

| 393,915 | |

| | |

| | | |

| | |

| Total liabilities | |

| 7,790,899 | | |

| 6,087,690 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| – | | |

| – | |

| | |

| | | |

| | |

| Stockholders' equity: | |

| | | |

| | |

| Preferred stock, $0.001 par value, 20,000,000 shares

authorized, no shares issued and outstanding | |

| – | | |

| – | |

| Common stock, $0.001 par value,

500,000,000 shares authorized, 4,868,083 shares issued and outstanding | |

| 4,868 | | |

| 4,847 | |

| Additional paid-in capital | |

| 61,191,965 | | |

| 58,485,602 | |

| Accumulated deficit | |

| (60,401,992 | ) | |

| (55,679,562 | ) |

| Total stockholders' equity | |

| 794,841 | | |

| 2,810,887 | |

| | |

| | | |

| | |

| Total liabilities and stockholders' equity | |

$ | 8,585,740 | | |

$ | 8,898,577 | |

See accompanying notes to unaudited condensed financial statements.

SOW GOOD INC.

CONDENSED STATEMENTS OF OPERATIONS

(Unaudited)

| | |

| | |

| | |

| | |

| |

| | |

For the Three Months | | |

For the Six Months | |

| | |

Ended June 30, | | |

Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 1,315,347 | | |

$ | 244,943 | | |

$ | 1,514,277 | | |

$ | 293,315 | |

| Cost of goods sold | |

| 2,695,820 | | |

| 150,603 | | |

| 2,772,500 | | |

| 198,094 | |

| Gross profit (loss) | |

| (1,380,473 | ) | |

| 94,340 | | |

| (1,258,223 | ) | |

| 95,221 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| General and administrative expenses: | |

| | | |

| | | |

| | | |

| | |

| Salaries and benefits | |

| 538,916 | | |

| 1,242,900 | | |

| 1,083,469 | | |

| 2,159,055 | |

| Professional services | |

| 63,329 | | |

| 53,295 | | |

| 109,535 | | |

| 115,988 | |

| Other general and administrative expenses | |

| 483,260 | | |

| 487,789 | | |

| 841,727 | | |

| 892,865 | |

| Total general and administrative expenses | |

| 1,085,505 | | |

| 1,783,984 | | |

| 2,034,731 | | |

| 3,167,908 | |

| Depreciation and amortization | |

| 7,413 | | |

| 67,693 | | |

| 83,631 | | |

| 132,919 | |

| Total operating expenses | |

| 1,092,918 | | |

| 1,851,677 | | |

| 2,118,362 | | |

| 3,300,827 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net operating loss | |

| (2,473,391 | ) | |

| (1,757,337 | ) | |

| (3,376,585 | ) | |

| (3,205,606 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other expense: | |

| | | |

| | | |

| | | |

| | |

| Interest expense, including $684,144 and $1,054,822 of warrants issued as a debt discount for the three and six months ending June 30, 2023, and $262,074 and $321,798 for the three and six months ending June 30, 2022, respectively | |

| (847,509 | ) | |

| (355,452 | ) | |

| (1,345,845 | ) | |

| (459,245 | ) |

| Total other expense | |

| (847,509 | ) | |

| (355,452 | ) | |

| (1,345,845 | ) | |

| (459,245 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (3,320,900 | ) | |

$ | (2,112,789 | ) | |

$ | (4,722,430 | ) | |

$ | (3,664,851 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding - basic and diluted | |

| 4,854,208 | | |

| 4,837,950 | | |

| 4,850,815 | | |

| 4,823,974 | |

| Net loss per common share - basic and diluted | |

$ | (0.68 | ) | |

$ | (0.44 | ) | |

$ | (0.97 | ) | |

$ | (0.76 | ) |

See accompanying notes to unaudited condensed financial statements.

SOW GOOD INC.

STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

(Unaudited)

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

For the Three Months Ended

June 30, 2023 | |

| | |

| | |

| | |

Additional | | |

Common | | |

| | |

Total | |

| | |

Common Stock | | |

Paid-in | | |

Stock | | |

Accumulated | | |

Stockholders' | |

| | |

Shares | | |

Amount | | |

Capital | | |

Payable | | |

Deficit | | |

Equity | |

| Balance, March 31, 2023 | |

| 4,847,384 | | |

$ | 4,847 | | |

$ | 59,484,859 | | |

$ | – | | |

$ | (57,081,092 | ) | |

$ | 2,408,614 | |

| Common stock issued to officers and directors for services | |

| 20,699 | | |

| 21 | | |

| 125,208 | | |

| – | | |

| – | | |

| 125,229 | |

| Common stock warrants granted to

related parties pursuant to debt financing | |

| – | | |

| – | | |

| 1,075,904 | | |

| – | | |

| – | | |

| 1,075,904 | |

| Common stock warrants granted to

note holders pursuant to debt financing | |

| – | | |

| – | | |

| 374,153 | | |

| – | | |

| – | | |

| 374,153 | |

| Common stock options granted to officers

and directors for services | |

| – | | |

| – | | |

| 112,974 | | |

| – | | |

| – | | |

| 112,974 | |

| Common stock options granted to employees

and advisors for services | |

| – | | |

| – | | |

| 18,867 | | |

| – | | |

| – | | |

| 18,867 | |

| Net loss for the three months ended

June 30, 2023 | |

| – | | |

| – | | |

| – | | |

| – | | |

| (3,320,900 | ) | |

| (3,320,900 | ) |

| Balance, June 30, 2023 | |

| 4,868,083 | | |

$ | 4,868 | | |

$ | 61,191,965 | | |

$ | – | | |

$ | (60,401,992 | ) | |

$ | 794,841 | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

For the Three Months Ended

June 30, 2022 | |

| | |

| | |

| | |

Additional | | |

Common | | |

| | |

Total | |

| | |

Common Stock | | |

Paid-in | | |

Stock | | |

Accumulated | | |

Stockholders' | |

| | |

Shares | | |

Amount | | |

Capital | | |

Payable | | |

Deficit | | |

Equity | |

| Balance, March 31, 2022 | |

| 4,820,655 | | |

$ | 4,821 | | |

$ | 54,502,342 | | |

$ | 10,000 | | |

$ | (45,104,556 | ) | |

$ | 9,412,607 | |

| Common stock warrants granted to related parties pursuant to debt financing | |

| – | | |

| – | | |

| 2,249,684 | | |

| – | | |

| – | | |

| 2,249,684 | |

| Common stock warrants granted to note holders pursuant to debt financing | |

| – | | |

| – | | |

| 444,330 | | |

| – | | |

| – | | |

| 444,330 | |

| Common stock issued to officers and directors for services | |

| 8,064 | | |

| 8 | | |

| 24,990 | | |

| – | | |

| – | | |

| 24,998 | |

| Common stock issued to advisory board for services | |

| 12,255 | | |

| 12 | | |

| 29,988 | | |

| (10,000 | ) | |

| – | | |

| 20,000 | |

| Common stock options granted to officers and directors for services | |

| – | | |

| – | | |

| 296,002 | | |

| – | | |

| – | | |

| 296,002 | |

| Common stock options granted to employees and advisors for services | |

| – | | |

| – | | |

| 90,370 | | |

| – | | |

| – | | |

| 90,370 | |

| Net loss for the three months ended June 30, 2022 | |

| – | | |

| – | | |

| – | | |

| – | | |

| (2,112,789 | ) | |

| (2,112,789 | ) |

| Balance, June 30, 2022 | |

| 4,840,974 | | |

$ | 4,841 | | |

$ | 57,637,706 | | |

$ | – | | |

$ | (47,217,345 | ) | |

$ | 10,425,202 | |

(continued)

SOW GOOD INC.

STATEMENTS OF CHANGES

IN STOCKHOLDERS’ EQUITY

(Unaudited)

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

For the Six Months Ended

June 30, 2023 | |

| | |

| | |

| | |

Additional | | |

Common | | |

| | |

Total | |

| | |

Common Stock | | |

Paid-in | | |

Stock | | |

Accumulated | | |

Stockholders' | |

| | |

Shares | | |

Amount | | |

Capital | | |

Payable | | |

Deficit | | |

Equity | |

| Balance, December 31, 2022 | |

| 4,847,384 | | |

$ | 4,847 | | |

$ | 58,485,602 | | |

$ | – | | |

$ | (55,679,562 | ) | |

$ | 2,810,887 | |

| Common stock issued to officers and

directors for services | |

| 20,699 | | |

| 21 | | |

| 125,208 | | |

| – | | |

| – | | |

| 125,229 | |

| Common stock warrants granted to

related parties pursuant to debt financing | |

| – | | |

| – | | |

| 1,948,325 | | |

| – | | |

| – | | |

| 1,948,325 | |

| Common stock warrants granted to

note holders pursuant to debt financing | |

| – | | |

| – | | |

| 374,153 | | |

| – | | |

| – | | |

| 374,153 | |

| Common stock options granted to officers

and directors for services | |

| – | | |

| – | | |

| 224,707 | | |

| – | | |

| – | | |

| 224,707 | |

| Common stock options granted to employees

and advisors for services | |

| – | | |

| – | | |

| 33,970 | | |

| – | | |

| – | | |

| 33,970 | |

| Net loss for the six months ended

June 30, 2023 | |

| – | | |

| – | | |

| – | | |

| – | | |

| (4,722,430 | ) | |

| (4,722,430 | ) |

| Balance, June 30, 2023 | |

| 4,868,083 | | |

$ | 4,868 | | |

$ | 61,191,965 | | |

$ | – | | |

$ | (60,401,992 | ) | |

$ | 794,841 | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

For the Six Months Ended

June 30, 2022 | |

| | |

| | |

| | |

Additional | | |

Common | | |

| | |

Total | |

| | |

Common Stock | | |

Paid-in | | |

Stock | | |

Accumulated | | |

Stockholders' | |

| | |

Shares | | |

Amount | | |

Capital | | |

Payable | | |

Deficit | | |

Equity | |

| Balance, December 31, 2021 | |

| 4,809,070 | | |

$ | 4,809 | | |

$ | 54,342,027 | | |

$ | 26,066 | | |

$ | (43,552,494 | ) | |

$ | 10,820,408 | |

| Common stock warrants granted to related parties pursuant to debt financing | |

| – | | |

| – | | |

| 2,249,684 | | |

| – | | |

| – | | |

| 2,249,684 | |

| Common stock warrants granted to note holders pursuant to debt financing | |

| – | | |

| – | | |

| 444,330 | | |

| – | | |

| – | | |

| 444,330 | |

| Common stock issued to officers and directors for services | |

| 19,649 | | |

| 20 | | |

| 51,044 | | |

| (26,066 | ) | |

| – | | |

| 24,998 | |

| Common stock issued to advisory board for services | |

| 12,255 | | |

| 12 | | |

| 29,988 | | |

| – | | |

| – | | |

| 30,000 | |

| Common stock options granted to officers and directors for services | |

| – | | |

| – | | |

| 417,742 | | |

| – | | |

| – | | |

| 417,742 | |

| Common stock options granted to employees and advisors for services | |

| – | | |

| – | | |

| 102,891 | | |

| – | | |

| – | | |

| 102,891 | |

| Net loss for the six months ended June 30, 2022 | |

| – | | |

| – | | |

| – | | |

| – | | |

| (3,664,851 | ) | |

| (3,664,851 | ) |

| Balance, June 30, 2022 | |

| 4,840,974 | | |

$ | 4,841 | | |

$ | 57,637,706 | | |

$ | – | | |

$ | (47,217,345 | ) | |

$ | 10,425,202 | |

See accompanying notes to unaudited condensed financial statements.

SOW GOOD INC.

CONDENSED STATEMENTS OF CASH FLOWS

(Unaudited)

| | |

| | |

| |

| | |

For the Six Months | |

| | |

Ended June 30, | |

| | |

2023 | | |

2022 | |

| CASH FLOWS FROM OPERATING ACTIVITIES | |

| | | |

| | |

| Net loss | |

$ | (4,722,430 | ) | |

$ | (3,664,851 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Bad debts expense | |

| 185,485 | | |

| – | |

| Depreciation and amortization | |

| 155,416 | | |

| 148,655 | |

| Common stock issued to officers and directors for services | |

| 125,229 | | |

| 24,998 | |

| Common stock awarded to advisors and consultants for services | |

| – | | |

| 30,000 | |

| Amortization of stock options | |

| 258,677 | | |

| 520,633 | |

| Amortization of stock warrants issued as a debt discount | |

| 1,054,822 | | |

| 321,798 | |

| Decrease (increase) in current assets: | |

| | | |

| | |

| Accounts receivable | |

| (721,135 | ) | |

| (181,699 | ) |

| Prepaid expenses | |

| 17,849 | | |

| (28,884 | ) |

| Inventory | |

| 1,053,910 | | |

| (394,062 | ) |

| Security deposits | |

| (34,765 | ) | |

| (14,000 | ) |

| Right-of-use asset | |

| 34,817 | | |

| 33,457 | |

| Increase (decrease) in current liabilities: | |

| | | |

| | |

| Accounts payable | |

| (76,257 | ) | |

| 766,089 | |

| Accrued expenses | |

| 272,383 | | |

| 185,545 | |

| Lease liabilities | |

| (25,261 | ) | |

| (22,040 | ) |

| Net cash used in operating activities | |

| (2,421,260 | ) | |

| (2,274,361 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | |

| | | |

| | |

| Purchase of property and equipment | |

| (362,180 | ) | |

| (124,384 | ) |

| Cash paid for construction in progress | |

| – | | |

| (1,884,720 | ) |

| Cash paid for intangible assets | |

| – | | |

| (5,929 | ) |

| Net cash used in investing activities | |

| (362,180 | ) | |

| (2,015,033 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| | | |

| | |

| Proceeds received from notes payable, related parties | |

| 2,400,000 | | |

| 3,120,000 | |

| Proceeds received from notes payable | |

| 400,000 | | |

| 580,000 | |

| Net cash provided by financing activities | |

| 2,800,000 | | |

| 3,700,000 | |

| | |

| | | |

| | |

| NET CHANGE IN CASH AND CASH EQUIVALENTS | |

| 16,560 | | |

| (589,394 | ) |

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | |

| 276,464 | | |

| 3,345,928 | |

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | |

$ | 293,024 | | |

$ | 2,756,534 | |

| | |

| | | |

| | |

| SUPPLEMENTAL INFORMATION: | |

| | | |

| | |

| Interest paid | |

$ | 25,685 | | |

$ | 43,606 | |

| Income taxes paid | |

$ | – | | |

$ | – | |

| | |

| | | |

| | |

| NON-CASH INVESTING AND FINANCING ACTIVITIES: | |

| | | |

| | |

| Value of debt discounts attributable to warrants | |

$ | 2,322,478 | | |

$ | 2,694,014 | |

See accompanying notes to unaudited condensed financial statements.

SOW GOOD INC.

Notes to Condensed

Financial Statements

(Unaudited)

Note 1 – Organization and Nature of Business

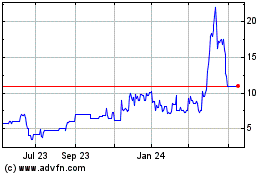

Effective January 21, 2021, we changed our name

from Black Ridge Oil & Gas, Inc. to Sow Good Inc. (“SOWG,” “Sow Good,” or the “Company”) to pursue

the freeze dried fruits and vegetables business as acquired with our October 1, 2020 acquisition of S-FDF, LLC. Our common stock is traded

on the OTCQB under the trading symbol “SOWG”. At that time, our common stock

started to be quoted on the OTCQB under the trading symbol “SOWG”, from the former trading symbol “ANFC”. Prior

to April 2, 2012, the Company name was Ante5, Inc., which became an independent company in April 2010. We became a publicly traded company

when our shares began trading on July 1, 2010. From October 2010 through August 2019, we had been engaged in the business of acquiring

oil and gas leases and participating in the drilling of wells in the Bakken and Three Forks trends in North Dakota and Montana and/or

managing similar assets for third parties.

On October 1, 2020, the

Company completed its acquisition of S-FDF, LLC pursuant to an Asset Purchase Agreement. In connection with the closing of the Asset Purchase

Agreement, the Company acquired approximately $2.2 million in cash and certain assets and agreements related to the Seller’s

freeze-dried fruits and vegetables business for human consumption and entered into certain employment and registration rights agreements.

On February 5, 2021,

the Company raised over $2.5 million of capital from the sale of 631,250 newly issued shares at a share price of $4.00 in a private placement.

The proceeds were used to find capital expenditures and working capital investment.

On May 5, 2021, the Company

announced the launch of our direct-to-consumer freeze-dried consumer packaged goods (CPG) food brand, Sow Good. Sow Good launched with

its first line of non-GMO products including 6 ready-to-make smoothies and 9 snacks.

On July 7, 2021,

the Company raised over $3

million of capital from the sale of 714,701

newly issued shares at a share price of $4.25

in a private placement. Investors in the private placement included Sow Good’s Chief Executive Officer, Executive Chairman,

and Chief Financial Officer, in addition to other Sow Good board members and a small group of accredited investors. The proceeds

were used to invest in inventory ahead of pursuing larger business-to-business relationships, as well as funding incremental capital

expenditures and general operating expenses.

On July 23, 2021, we

launched six new gluten-free granola products under the Sow Good brand. Sow Good’s granola products are made with health-conscious

ingredients such as freeze-dried fruit, almonds, hemp hearts, and coconut oil.

On December 31, 2021,

we sold an aggregate $2,075,000 of promissory notes and warrants to purchase an aggregate 311,250 shares of common stock to related parties,

representing 15,000 warrant shares per $100,000 of promissory notes. The warrants are exercisable at a price of $2.21 per share over a

ten-year term. The proceeds were used for working capital investment and to ramp up our freeze-dried consumer packaged goods business.

On

April 8, 2022, we sold an aggregate $3,700,000 of promissory notes and warrants to purchase an aggregate 925,000 shares of common

stock, including $3,120,000 and warrants to purchase an aggregate 780,000 shares of common stock, to related parties.

The warrants are exercisable at a price of $2.35 per share over a ten-year term. These proceeds were used for working capital investment

and to ramp up our freeze dried consumer packaged goods business.

SOW GOOD INC.

Notes to Condensed

Financial Statements

(Unaudited)

On August 23, 2022, we

closed on an offering to sell up to $2,500,000 of promissory notes and warrants to purchase an aggregate 625,000 shares of the Company’s

common stock, exercisable over a ten-year period at a price of $2.60 per share, representing 25,000 warrant shares per $100,000 of Notes

purchased. The notes mature on August 23, 2025. Interest on the notes accrue at a rate of 8% per annum, payable on January 1, 2025.

Loans may be advanced to the Company from time to time from August 23, 2022 to the Maturity Date. On various dates from September 29,

2022 through March 7, 2023, the Company received aggregate proceeds of $2,250,000 from two of the Company’s Directors on the

sale of these notes and warrants.

In the first quarter

of 2023, the Company launched a freeze-dried candy product line with a 9-SKU offering that is projected to continue being a major driver

of growth. And, in the second quarter of 2023, we completed the construction of our second and third freeze driers to facilitate the increased

production demands for our recently launched candy products. Furthermore, the significant and rising demand for our freeze-dried candy

products has led us to begin construction of our fourth and fifth freeze drier, which we expect to be completed in the first quarter of

2024.

On

April 25, 2023 and May 11, 2023, Sow Good raised an aggregate $1.3 million from the sale of Promissory Notes and Warrants,

including $900,000 received from related parties, resulting in approximately $293,000 of cash on hand as of June 30, 2023.

Note 2 – Basis of Presentation and Significant

Accounting Policies

The interim condensed financial statements included

herein, presented in accordance with United States generally accepted accounting principles and stated in US dollars, have been prepared

by the Company, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and

footnote disclosures normally included in financial statements prepared in accordance with generally accepted accounting principles have

been condensed or omitted pursuant to such rules and regulations, although the Company believes that the disclosures are adequate to not

make the information presented misleading.

These statements reflect all adjustments,

which in the opinion of management, are necessary for fair presentation of the information contained therein. Except as otherwise

disclosed, all such adjustments are of a normal recurring nature. It is suggested that these interim condensed financial statements

be read in conjunction with the audited financial statements for the year ended December 31, 2022, which were included in

our Annual Report on Form 10-K. The Company follows the same accounting policies in the preparation of interim reports.

Fair Value of Financial Instruments

The Company discloses the fair value of certain

assets and liabilities in accordance with ASC 820 – Fair Value Measurement (“ASC 820”). Under FASB ASC 820-10-05,

the Financial Accounting Standards Board establishes a framework for measuring fair value in generally accepted accounting principles

and expands disclosures about fair value measurements. This Statement reaffirms that fair value is the relevant measurement attribute.

The adoption of this standard did not have a material effect on the Company’s financial statements as reflected herein. The carrying

amounts of cash, accounts payable and accrued expenses reported on the balance sheets are estimated by management to approximate fair

value primarily due to the short-term nature of the instruments. The Company had no items that required fair value measurement on a recurring

basis.

Use of Estimates

The preparation of financial statements in conformity

with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of

assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount

of revenues and expenses during the reporting period. Actual results could differ from those estimates.

SOW GOOD INC.

Notes to Condensed

Financial Statements

(Unaudited)

Cash in Excess of FDIC Limits

The Company maintains its cash in bank deposit

accounts which, at times, may exceed federally insured limits. Accounts are guaranteed by the Federal Deposit Insurance Corporation (FDIC)

up to $250,000 under current regulations. The Company had $45,420 of cash in excess of FIDC insured limits at June 30, 2023, and has not

experienced any losses in such accounts.

Property and Equipment

Property and equipment are stated at the lower

of cost or estimated net recoverable amount. The cost of property, plant and equipment is depreciated using the straight-line method

based on the lesser of the estimated useful lives of the assets or the lease term based on the following life expectancy:

| Schedule of estimated useful lives of assets |

|

| Software |

3 years, or over the life of the agreement |

| Website |

3 years |

| Office equipment |

5 years |

| Furniture and fixtures |

5 years |

| Machinery and equipment |

7-10 years |

| Leasehold improvements |

Fully extended lease-term |

Repairs and maintenance expenditures are charged

to operations as incurred. Major improvements and replacements, which extend the useful life of an asset, are capitalized and depreciated

over the remaining estimated useful life of the asset. When assets are retired or sold, the cost and related accumulated depreciation

and amortization are eliminated and any resulting gain or loss is reflected in operations. Depreciation was $155,416 and $148,655 for

the six months ended June 30, 2023 and 2022, respectively. A total of $71,785 and $15,736 of the depreciation expense was allocated to

inventory overhead, resulting in $83,631 and $132,919 of depreciation expense for the six months ended June 30, 2023 and 2022, respectively.

Impairment

of Long-Lived Assets

Long-lived assets held and used by the Company

are reviewed for possible impairment whenever events or circumstances indicate the carrying amount of an asset may not be recoverable

or is impaired. Recoverability is assessed using undiscounted cash flows based upon historical results and current projections of earnings

before interest and taxes. Impairment is measured using discounted cash flows of future operating results based upon a rate that corresponds

to the cost of capital. Impairments are recognized in operating results to the extent that carrying value exceeds discounted cash flows

of future operations.

Our intellectual property

is comprised of indefinite-lived brand names acquired and have been assigned an indefinite life as we currently anticipate that these

brand names will contribute cash flows to the Company perpetually. We evaluate the recoverability of intangible assets periodically by

taking into account events or circumstances that may warrant revised estimates of useful lives or that indicate the asset may be impaired.

Inventory

Inventory, consisting of raw materials, material

overhead, labor, and manufacturing overhead, are stated at the average cost or net realizable value and consists of the following:

| Schedule of inventory | |

| | | |

| | |

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Finished goods | |

$ | 252,753 | | |

$ | 384,241 | |

| Packaging materials | |

| 83,441 | | |

| 416,663 | |

| Work in progress | |

| – | | |

| 864,460 | |

| Raw materials | |

| 582,775 | | |

| 307,515 | |

| Total inventory | |

$ | 918,969 | | |

$ | 1,972,879 | |

During the six months ending June 30, 2023, the

Company wrote down $1,919,686 of non-candy freeze dried inventory to pivot exclusively to its better selling candy products. No reserve

for obsolete inventories has been recognized.

SOW GOOD INC.

Notes to Condensed

Financial Statements

(Unaudited)

Revenue Recognition

The Company recognizes revenue in accordance with

ASC 606 — Revenue from Contracts with Customers (“ASC” 606”). Under ASC 606, the Company recognizes revenue

from the sale of its freeze-dried food products, in accordance with a five-step model in which the

Company evaluates the transfer of promised goods or services and recognizes revenue when customers obtain control of promised goods or

services in an amount that reflects the consideration which the Company expects to be entitled to receive in exchange for those goods

or services. To determine revenue recognition for the arrangements that the Company determines are within the scope of ASC 606, the Company

performs the following five steps: (1) identify the contract(s) with a customer, (2) identify the performance obligations in

the contract, (3) determine the transaction price, (4) allocate the transaction price to the performance obligations in the

contract and (5) recognize revenue when (or as) the entity satisfies a performance obligation. The Company has elected, as a practical

expedient, to account for the shipping and handling as fulfillment costs, rather than as a separate performance obligation. Revenue is

reported net of applicable provisions for discounts, returns and allowances. Methodologies for determining these provisions are dependent

on customer pricing and promotional practices. The Company records reductions to revenue for estimated product returns and pricing adjustments

in the same period that the related revenue is recorded. These estimates are based on industry-based historical data, historical sales

returns, if any, analysis of credit memo data, and other factors known at the time.

Accounts Receivable

Accounts receivable are carried at their estimated

collectible amounts. Trade accounts receivable are periodically evaluated for collectability based on past credit history with customers

and their current financial condition. The Company had an allowance for doubtful accounts of $185,485 at June 30, 2023.

Basic and Diluted Earnings (Loss) Per Share

The basic

net loss per common share is computed by dividing the net loss by the weighted average number of common shares outstanding. Diluted net

loss per common share is computed by dividing the net loss adjusted on an “as if converted” basis, by the weighted average

number of common shares outstanding plus potential dilutive securities. For the periods presented, potential dilutive securities had an

anti-dilutive effect and were not included in the calculation of diluted net loss per common share.

Stock-Based Compensation

The Company accounts for equity instruments issued

to employees in accordance with the provisions of ASC 718 Stock Compensation (ASC 718) and Equity-Based Payments to Non-employees pursuant

to ASC 2018-07 (ASC 2018-07). All transactions in which the consideration provided in exchange for the purchase of goods or services consists

of the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the

equity instrument issued, whichever is more reliably measurable. The measurement date of the fair value of the equity instrument issued

is the earlier of the date on which the counterparty’s performance is complete or the date at which a commitment for performance

by the counterparty to earn the equity instruments is reached because of sufficiently large disincentives for nonperformance. Stock-based

compensation was $383,906 and $575,631, consisting of $258,677 and $520,633 of stock options expense, using the Black-Scholes options

pricing model and an effective term of 6 to 6.5 years based on the weighted average of the vesting periods and the stated term of the

option grants and the discount rate on 5 to 7 year U.S. Treasury securities at the grant date, incurred in the six months ended June 30,

2023 and 2022, respectively, and $125,229 and $54,998 of expense related to shares of common stock issued to officers and consultants

for services rendered in the six months ended June 30, 2023 and 2022, respectively. In addition, $1,054,822 and $321,798 of expenses

related to the amortization of warrants in-the-money issued in consideration for debt financing for the six months ended June 30, 2023

and 2022, respectively.

Income Taxes

The Company recognizes deferred tax assets and

liabilities based on differences between the financial reporting and tax basis of assets and liabilities using the enacted tax rates and

laws that are expected to be in effect when the differences are expected to be recovered. The Company provides a valuation allowance for

deferred tax assets for which it does not consider realization of such assets to be more likely than not.

SOW GOOD INC.

Notes to Condensed

Financial Statements

(Unaudited)

Recent Accounting Pronouncements

From time to time, new

accounting pronouncements are issued by the Financial Accounting Standards Board ("FASB") that are adopted by the Company as

of the specified effective date. If not discussed, management believes that the impact of recently issued standards, which are not yet

effective, will not have a material impact on the Company's financial statements upon adoption.

In July 2023, the FASB issued Accounting Standards

Update (“ASU”) 2023-03 to amend various SEC paragraphs in the Accounting Standards Codification to primarily reflect the issuance

of SEC Staff Accounting Bulletin No. 120. ASU No. 2023-03, “Presentation of Financial Statements (Topic 205), Income Statement—Reporting

Comprehensive Income (Topic 220), Distinguishing Liabilities from Equity (Topic 480), Equity (Topic 505), and Compensation—Stock

Compensation (Topic 718): Amendments to SEC Paragraphs Pursuant to SEC Staff Accounting Bulletin No. 120, SEC Staff Announcement at the

March 24, 2022 EITF Meeting, and Staff Accounting Bulletin Topic 6.B, Accounting Series Release 280—General Revision of Regulation

S-X: Income or Loss Applicable to Common Stock.” ASU 2023-03 amends the ASC for SEC updates pursuant to SEC Staff Accounting

Bulletin No. 120; SEC Staff Announcement at the March 24, 2022 Emerging Issues Task Force (“EITF”) Meeting; and Staff Accounting

Bulletin Topic 6.B, Accounting Series Release 280 - General Revision of Regulation S-X: Income or Loss Applicable to Common Stock. These

updates were immediately effective and did not have a significant impact on our financial statements.

In October 2021, the FASB issued ASU 2021-08,

Business Combinations (Topic 805): Accounting for Contract Assets and Contract Liabilities from Contracts with Customers, which creates

an exception to the general recognition and measurement principle for contract assets and contract liabilities from contracts with customers

acquired in a business combination. The new guidance will require companies to apply the definition of a performance obligation under

accounting standard codification (“ASC”) Topic 606 to recognize and measure contract assets and contract liabilities (i.e.,

deferred revenue) relating to contracts with customers that are acquired in a business combination. Under current GAAP, an acquirer in

a business combination is generally required to recognize and measure the assets it acquires and the liabilities it assumes at fair value

on the acquisition date. The new guidance will result in the acquirer recording acquired contract assets and liabilities on the same basis

that would have been recorded by the acquiree before the acquisition under ASC Topic 606. These amendments are effective for fiscal years

beginning after December 15, 2022, with early adoption permitted. The adoption of ASU 2021-08 is not expected to have a material impact

on the Company’s financial statements or related disclosures.

No other new accounting pronouncements, issued

or effective during the period ended June 30, 2023, have had or are expected to have a significant impact on the Company’s financial

statements.

Note 3 – Going Concern

As shown in the accompanying financial statements,

as of June 30, 2023, the Company has incurred recurring losses from operations resulting in an accumulated deficit of $60,401,992, and

had cash on hand of $293,024. We are too early in our development stage to project revenue with a necessary level of certainty; therefore,

we may not have sufficient funds to sustain our operations for the next twelve months and we may need to raise additional cash to fund

our operations. These factors raise substantial doubt about the Company’s ability to continue as a going concern. The Company has

commenced sales and continues to develop its operations.

In the event sales do not materialize at the expected

rates, management would seek additional financing or would attempt to conserve cash by further reducing expenses. There can be no assurance

that we will be successful in achieving these objectives.

The financial statements do not include any adjustments

that might result from the outcome of any uncertainty as to the Company’s ability to continue as a going concern. The financial

statements also do not include any adjustments relating to the recoverability and classification of recorded asset amounts, or amounts

and classifications of liabilities that might be necessary should the Company be unable to continue as a going concern. Our ability to

scale production and distribution capabilities and further increase the value of our brands, is largely dependent on our success in raising

additional capital.

SOW GOOD INC.

Notes to Condensed

Financial Statements

(Unaudited)

Note 4 – Related Party

Debt Financing

On May 11, 2023, the

Company received proceeds of $100,000 from Bradley Berman, one of the Company’s directors, on behalf of the Bradley Berman Irrevocable

Trust, from the sale of notes and warrants pursuant to an offering to sell up to $1,500,000 of promissory notes and warrants to purchase

an aggregate 375,000 shares of the Company’s common stock, exercisable over a ten-year period at a price of $2.50 per share, representing

25,000 warrant shares per $100,000 of Notes purchased. The notes mature on May 11, 2024. Interest on the Notes accrue at a rate of 8%

per annum, payable in cash semi-annually on June 30 and December 31.

On April 25, 2023, we

closed on an offering to sell up to $1,500,000 of promissory notes and warrants to purchase an aggregate 375,000 shares of the Company’s

common stock, exercisable over a ten-year period at a price of $2.50 per share, representing 25,000 warrant shares per $100,000 of Notes

purchased. The notes mature on April 25, 2024. Interest on the Notes accrue at a rate of 8% per annum, payable in cash semi-annually on

June 30 and December 31. On April 25, 2023, the Company received proceeds of $750,000 and $50,000 from the Company’s Chairman,

Mr. Goldfarb, and the Cesar J. Gutierrez Living Trust, as beneficially controlled by the brother of the Company’s CEO, respectively,

on the sale of these notes and warrants.

On August 23, 2022, we

closed on an offering to sell up to $2,500,000 of promissory notes and warrants to purchase an aggregate 625,000 shares of the Company’s

common stock, exercisable over a ten-year period at a price of $2.60 per share, representing 25,000 warrant shares per $100,000 of Notes

purchased. The notes mature on August 23, 2025. Interest on the Notes accrue at a rate of 8% per annum, payable on January 1, 2025.

Loans may be advanced to the Company from time to time from August 23, 2022 to the Maturity Date. On various dates between January 5,

2023 and April 11, 2023, the Company received aggregate proceeds of $1,500,000 from two of the Company’s Directors on the sale

of these notes and warrants.

Common Stock Issued to Directors for Services

On June 1, 2023,

the Company issued an aggregate 20,699 shares of common stock amongst its five non-employee Directors for annual services to be rendered.

The aggregate fair value of the common stock was $125,229, based on the closing price of the Company’s common stock on the date

of grant. The shares were expensed upon issuance.

Note 5 – Fair Value of Financial Instruments

The Company discloses the fair value of certain

assets and liabilities in accordance with ASC 820 – Fair Value Measurement (“ASC 820”). Under FASB ASC 820-10-5,

fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between

market participants at the measurement date (an exit price). The standard outlines a valuation framework and creates a fair value hierarchy

in order to increase the consistency and comparability of fair value measurements and the related disclosures. Under GAAP, certain assets

and liabilities must be measured at fair value, and FASB ASC 820-10-50 details the disclosures that are required for items measured at

fair value.

The Company’s financial assets and liabilities

are measured using inputs from the three levels of the fair value hierarchy. The three levels are as follows:

Level 1 - Inputs are unadjusted quoted

prices in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date.

Level 2 - Inputs include quoted prices

for similar assets and liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are

not active, inputs other than quoted prices that are observable for the asset or liability (e.g., interest rates, yield curves, etc.),

and inputs that are derived principally from or corroborated by observable market data by correlation or other means (market corroborated

inputs).

Level 3 - Unobservable inputs that

reflect our assumptions about the assumptions that market participants would use in pricing the asset or liability.

SOW GOOD INC.

Notes to Condensed

Financial Statements

(Unaudited)

The following schedule summarizes the valuation

of financial instruments at fair value on a recurring basis in the balance sheets as of June 30, 2023 and December 31, 2022:

| Valuation of financial instruments at fair value | |

| | | |

| | | |

| | |

| | |

Fair Value Measurements at June 30, 2023 | |

| | |

Level 1 | | |

Level 2 | | |

Level 3 | |

| Assets | |

| | |

| | |

| |

| Cash and cash equivalents | |

$ | 293,024 | | |

$ | – | | |

$ | – | |

| Total assets | |

| 293,024 | | |

| – | | |

| – | |

| Liabilities | |

| | | |

| | | |

| | |

| Notes payable, related parties, net of $3,727,295 of debt discounts | |

| – | | |

| 4,867,705 | | |

| – | |

| Notes payable, net of $569,203 of debt discounts | |

| – | | |

| 560,797 | | |

| – | |

| Total liabilities | |

| – | | |

| 5,428,502 | | |

| – | |

| | |

$ | 293,024 | | |

$ | 5,428,502 | | |

$ | – | |

| | |

Fair Value Measurements at December 31, 2022 | |

| | |

Level 1 | | |

Level 2 | | |

Level 3 | |

| Assets | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 276,464 | | |

$ | – | | |

$ | – | |

| Total assets | |

| 276,464 | | |

| – | | |

| – | |

| Liabilities | |

| | | |

| | | |

| | |

| Notes payable, related parties, net of $2,692,757 of debt discounts | |

| – | | |

| 3,502,243 | | |

| – | |

| Notes payable, net of $336,085 of debt discounts | |

| – | | |

| 393,915 | | |

| – | |

| Total liabilities | |

| – | | |

| 3,896,158 | | |

| – | |

| | |

$ | 276,464 | | |

$ | 3,896,158 | | |

$ | – | |

There were no transfers of financial assets or

liabilities between Level 1 and Level 2 inputs for the three months ended June 30, 2023.

SOW GOOD INC.

Notes to Condensed

Financial Statements

(Unaudited)

Note 6 – Prepaid Expenses

Prepaid expenses consist of the following:

| Schedule of prepaid expenses | |

| | | |

| | |

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Prepaid software licenses | |

$ | 60,961 | | |

$ | 36,424 | |

Prepaid insurance costs

| |

| 14,284 | | |

| 16,746 | |

| Trade show advances | |

| 25,728 | | |

| 18,707 | |

| Prepaid rent | |

| 13,340 | | |

| 27,043 | |

| Prepaid office and other costs | |

| 5,530 | | |

| 38,772 | |

| Total prepaid expenses | |

$ | 119,843 | | |

$ | 137,692 | |

Note 7 – Property and Equipment

Property and equipment at June 30, 2023 and December 31, 2022,

consists of the following:

| Property and equipment | |

| | | |

| | |

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Office equipment | |

$ | 13,872 | | |

$ | 13,872 | |

| Machinery | |

| 4,357,267 | | |

| 1,643,010 | |

| Software | |

| 70,000 | | |

| 70,000 | |

| Website | |

| 71,589 | | |

| 71,589 | |

| Leasehold improvements | |

| 1,392,704 | | |

| 1,257,108 | |

| Construction in progress | |

| – | | |

| 2,487,673 | |

| | |

| 5,905,432 | | |

| 5,543,252 | |

| Less: Accumulated depreciation and amortization | |

| (663,673 | ) | |

| (508,257 | ) |

| Total property and equipment, net | |

$ | 5,241,759 | | |

$ | 5,034,995 | |

Construction in progress consisted of costs incurred

to build our second and third freeze driers, and to build out our offices within our facility in Irving, Texas. A total of $2,705,524

and $135,596 of these costs were capitalized as Machinery and Leasehold Improvements, respectively, when they were placed in service during

the six months ended June 30, 2023.

The Company recognized depreciation of $155,416

and $148,655, of which $71,785 and $15,736 was allocated to inventory overhead, resulting in $83,631 and $132,919 of depreciation expense

for the six months ended June 30, 2023 and 2022, respectively.

SOW GOOD INC.

Notes to Condensed

Financial Statements

(Unaudited)

Note 8 – Leases