UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

TO

(Amendment

No. 2)

TENDER

OFFER STATEMENT UNDER SECTION 14(D)(1) OR 13(E)(1) OF THE SECURITIES EXCHANGE ACT OF 1934

SIDECHANNEL,

INC.

(Name

of Subject Company (Issuer) and Name of Filing Person (Issuer)

Warrants

to Purchase Common Stock with an Exercise Price of $1.00

Warrants

to Purchase Common Stock with an Exercise Price of $0.36

Warrants

to Purchase Common Stock with an Exercise Price of $0.18

(Title

of Class of Securities)

N/A

(CUSIP

Number of Warrants)

Ryan

Polk

Chief

Financial Officer

SideChannel,

Inc.

146

Main Street, Suite 405

Worcester,

MA 01608

Phone:

(508) 925-0114

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications on Behalf of Filing Persons)

with

a copy to:

Michael

E. Storck, Esq. Paul J. Schulz, Esq. Lippes Mathias LLP

50

Fountain Plaza, Suite 1700

Buffalo,

New York 14202

(716)

853-5100

CALCULATION

OF FILING FEE

Transaction

valuation* $1.1 million; Amount of filing fee* $112

*

Estimated for purposes of calculating the amount of the filing fee only. SideChannel, Inc. (“SideChannel” or the “Company”)

is offering to holders of certain of its warrants, as more fully described herein, the opportunity to exchange such warrants for shares

of the Company’s common stock, par value $0.001 per share (“Shares” or “Common Stock”) by tendering (i)

six (6) warrants with an exercise price of $0.36 in exchange for one (1) share of our Common Stock, and (ii) four (4) warrants with an

exercise price of $1.00 or $0.18, as the case may be, in exchange for one (1) share of our Common Stock. The amount of the filing fee

assumes that all outstanding warrants that are the subject of the Offer will be exchanged and is calculated pursuant to Rule 0-11(b)

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The transaction value was determined assuming that

all warrants to purchase SideChannel’s Common Stock eligible to participate in the Offer are exchanged, and that the approximately

12,602,770 shares issued as a result of the Offer have an aggregate value of $1.1 million calculated based on the average of the low

and high trading price on August 16, 2023 which was $0.08.

The

amount of the filing fee, calculated in accordance with Rule 0-11(b) under the Exchange Act, equals $110.20 per million dollars

of the transaction valuation.

| ☐ |

Check

the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was

previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| Amount

Previously Paid: N/A |

Filing

Party: N/A |

| Form

or Registration No.: N/A |

Date

Filed: N/A |

| ☐ |

Check

the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check

the appropriate boxes below to designate any transactions to which the statement relates:

| |

☐ |

third-party

tender offer subject to Rule 14d-1. |

| |

☒ |

issuer

tender offer subject to Rule 13e-4. |

| |

☐ |

going-private

transaction subject to Rule 13e-3. |

| |

☐ |

amendment

to Schedule 13D under Rule 13d-2. |

Check

the following box if the filing is a final amendment reporting the results of the tender offer: ☐

SCHEDULE

TO

Amendment

No. 2

This

Amendment No. 2 (this “Amendment”) amends the Tender Offer Statement on (together with any amendments and supplements thereto,

the “Schedule TO”), filed with the Securities and Exchange Commission on August 22, 2023 by SideChannel, Inc., a Delaware

corporation (the “Company” or “SideChannel”).

This

Schedule TO relates to the offer by the Company to holders of certain of the Company’s outstanding warrants (the “Warrants”).

The offer is made upon the terms and subject to the conditions set forth in the Company’s offer to exchange, dated August 21, 2023

(the “Offer to Exchange”), and in the related Offer to Exchange materials which are filed as Exhibits (a)(1)(A), (a)(1)(B),

(a)(1)(C), (a)(1)(D) and (a)(1)(E) to this Schedule TO (which the Offer to Exchange and related Offer to Exchange materials, as amended

or supplemented from time to time, collectively constitute the “Offer Materials”). This is an Offer for all or none of the

Warrants. The Offer is subject to the requirement that all Warrants must be tendered by all eligible holders of the Warrants.

The

69,281,020 Warrants subject to our Offer to Exchange consist of (i) warrants to purchase an aggregate of 5,398,966 Shares issued to certain

designees of Paulson Investment Company, LLC (“Paulson”) in 2018 with a ten-year term and with an exercise price of $1.00

(“2018 Paulson Warrants”), (ii) warrants to purchase an aggregate of 8,332,439 Shares that were issued to certain designees

of Paulson in 2021 with a ten-year term and that had an exercise price of $0.18 (“2021 Paulson Warrants”); and (iii) warrants

to purchase an aggregate of 55,549,615 Shares issued to certain investors in 2021 with a five-year term and with an exercise price of

$0.36 (“2021 Investor Warrants”). The 2018 Paulson Warrants and the 2021 Paulson warrants are sometimes herein collectively

referred to as the “Paulson Warrants.” Under the Offer to Exchange, the holders of the Paulson Warrants will be entitled

to receive one (1) share of Common Stock for each four (4) Paulson Warrants exchanged (“Paulson Exchange Ratio”), and (ii)

the holders of the Investor Warrants will be entitled to receive one (1) share of Common Stock for each six (6) Investor Warrants exchanged

(“Investor Exchange Ratio”).

Except

as otherwise set forth in this Amendment No. 2, the information set forth in this Schedule TO, as previously amended, remains

unchanged and is incorporated herein by reference to the extent relevant to the items in this Amendment. Capitalized terms used but not

defined herein have the meanings ascribed to them in the Schedule TO.

Items

1 through 9 and 11

The

Offer to Exchange and Items 1 through 9 and 11 of the Schedule TO, to the extent such items incorporate by reference the information

contained in the Offer to Exchange, are hereby amended by adding the following text thereto:

“On

September 19, 2023, the Company extended the Expiration Date of the Offer. The Offer was previously scheduled to expire at 5:00 p.m.,

Eastern Time, on September 19, 2023. The Expiration Date has been extended until 5:00 p.m. Eastern Time on November 1, 2023, or such

later date to which the Company may extend the Offer. The Company has indicated that as of 5:00 p.m. Eastern Time on September 19, 2023,

approximately 23,452,785 warrants had been validly tendered into and not validly withdrawn from the Offer, representing approximately

42.2% of the Warrants.”

Amendments

to the Offer to Exchange and Exhibits to the Schedule TO

All

references to “5:00 p.m. Eastern Time, on September 19, 2023” set forth in the Offer to Exchange Common Stock for Certain

Outstanding Warrants (Exhibit (a)(1)(A)), Letter of Transmittal for the Paulson Warrants (Exhibit (a)(1)(B)), Letter of Transmittal for

the Investor Warrants (Exhibit (a)(1)(C)), Notice of Withdrawal for the Paulson Warrants (Exhibit (a)(1)(D)), Notice of Withdrawal for

the Investor Warrants (Exhibit (a)(1)(E)), Letter from the Chief Financial Officer of the Company to the Holders of Warrants (Exhibit

(a)(1)(F)), Warrant Exchange Offer Webinar Presentation (Exhibit (a)(1)(G)), and Executed Letter of Transmittal Confirmation (Exhibit

(a)(1)(H)), each as amended by Amendment No. 1 to the Schedule TO, are hereby amended and replaced with “5:00 p.m. Eastern Time,

on November 1, 2023.”

Item

12. Exhibits.

Item

12 of the Schedule TO is hereby amended and supplemented by adding the following exhibits:

*

Filed herewith.

SIGNATURE

After

due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| SIDECHANNEL,

INC. |

|

|

| |

|

|

| Date:

September 20, 2023 |

By: |

/s/

Ryan Polk |

| |

Name: |

Ryan

Polk |

| |

Title: |

Chief

Financial Officer |

Exhibit (a)(1)(I)

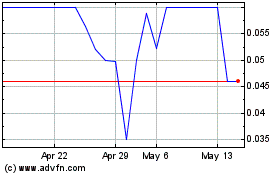

SideChannel (QB) (USOTC:SDCH)

Historical Stock Chart

From Apr 2024 to May 2024

SideChannel (QB) (USOTC:SDCH)

Historical Stock Chart

From May 2023 to May 2024