Amended Statement of Beneficial Ownership (sc 13d/a)

July 31 2020 - 5:19PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 4)

SHARING

SERVICES GLOBAL CORPORATION

(Name

of Issuer)

Class

A Common Stock, $0.0001 Par Value

(Title

of Class of Securities)

819536103

(CUSIP

Number)

Frank

D. Heuszel

c/o

Document Security Systems, Inc.

200

Canal View Boulevard

Suite

104

Rochester,

New York 14623

(585)

325-3610

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

July

21, 2020

(Date

of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.

[ ]

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

*The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the

subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in

a prior cover page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section

18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

|

1

|

NAMES

OF REPORTING PERSON

|

|

Document

Security Systems, Inc.

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

|

|

(a)

[ ]

(b)

[ ]

|

|

3

|

SEC

USE ONLY

|

|

|

|

4

|

SOURCE

OF FUNDS (See Instructions)

WC

|

|

|

|

5

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

|

[ ]

|

|

6

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

|

|

New

York

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE

VOTING POWER:

|

|

72,417,593(1)

|

|

8

|

SHARED

VOTING POWER:

|

|

|

|

9

|

SOLE

DISPOSITIVE POWER:

|

|

72,417,593(1)

|

|

10

|

SHARED

DISPOSITIVE POWER:

|

|

|

|

11

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

72,417,593(1)

|

|

12

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

|

[ ]

|

|

13

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

57.44%(2)

|

|

14

|

TYPE

OF REPORTING PERSON (See Instructions)

|

|

CO

|

|

(1)

|

Includes

10,000,000 warrants to purchase shares of Class A Common Stock at an average exercise

price of $0.20.. The Warrants immediately vested and may be exercised at any time commencing

on the date of issuance and ending three (3) year from such date. See Item 6 for more

details.

|

|

(2)

|

Based

on 126,072,386 shares of Class A Common Stock issued and outstanding as of June 30, 2020,

as reported on the Issuer’s Annual Report on Form 10-K for the year ended April

30, 2020, and does not include issuances of Class A Common Stock after June 30, 2020,

including issuances to the Reporting Person.

|

Schedule

13D

This

Amendment No. 4 (this “Amendment”) amends and supplements the statement on Schedule 13D (the “Schedule

13D) filed by Document Security Systems, Inc., a New York corporation (the “Reporting Person”), on April 3,

2020, as amended by Amendment No .1 to the Schedule 13D filed on April 7, 2020, as amended by Amendment No. 2 to the Schedule

13D filed on April 21, 2020, and as amended by Amendment No. 3 to the Schedule 13D filed on June 23, 2020, relating to

the beneficial ownership of shares of Class A Common Stock, $0.0001 par value per share (“Class A Common Stock”)

of Sharing Services Global Corporation, a Nevada Corporation (the “Issuer”). Capitalized terms used herein and not

otherwise defined shall have the respective meanings ascribed to them in the Schedule 13D.

Item

2. Identity and Background

Item

2 is hereby amended as follows:

|

a)

|

This

statement is being filed by Document Security Systems, Inc., a New York corporation (the “Reporting Person”).

The shares covered by this Schedule 13D are held of record by Decentralized Sharing Systems, Inc., a Nevada corporation (“DSSS”),

a wholly-owned subsidiary of the Reporting Person, which is controlled by the Reporting Person.

|

|

|

|

|

(b)

|

The

address of the principle office of each of the Reporting Person and DSSS is 200 Canal View Boulevard, Suite 104, Rochester,

New York 14623.

|

|

|

|

|

(c)

|

Present

principal occupation or employment and the name, principal business and address of any

corporation or other organization in which such employment is conducted:

Reporting

Person’s principal business is developer and marketer of secure document and product technologies.

The

principle business of DSSS, a direct subsidiary of the Reporting Persons, is to provide services to assist companies in

the new business model of the peer-to-peer decentralized sharing marketplaces and direct marketing

The

information required by instruction C to Schedule 13D with respect to the executive officers and directors of the Reporting

Persons set forth below.

Document

Security Systems, Inc.

Directors

Frank

D. Heuszel

Heng

Fai Ambrose Chan

Sassuan

Lee

Jose

Escudero

John

Thatch

Lowell

Wai Wah

William

Wu

Executive

Officers

Frank

D. Heuszel – Chief Executive Officer

Jason

Grady – Chief Operating Officer

Decentralized

Sharing Systems, Inc.

Directors

Frank

D. Heuszel

Jason

Grady

Lum

Kan Vai (Vincent)

Executive

Officers

Heng

Fai Ambrose Chan – Chief Executive Officer

Frank

D. Heuszel – President

Jason

Grady – Vice President

Todd

D. Macko - Treasurer

|

|

|

|

|

(d)

|

Neither

the Reporting Persons nor individuals referenced above in Item 2 have been convicted in a criminal proceeding in the past

five years.

|

|

|

|

|

(e)

|

During

the last five years, the Reporting Person and individuals referenced above in Item 2 has not been a party to a civil proceeding

of a judicial or administrative body of competent jurisdiction and as a result thereof were or are subject to a judgment,

decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state

securities laws or finding any violation with respect to such laws.

|

|

|

|

|

(f)

|

Except

for Jose Escudero, a citizen of Spain, Sassuan Lee, William Wu, Lowell Wai Wah, and Kum Kan Vai (Vincent), each a citizen

of the Republic of China, Hong Kong, and Heng Fai Ambrose Chan, a citizen of Singapore and the Republic of China,

Hong Kong, all the individuals listed above are citizens of the United States.

|

Item

3. Source and Amount of Funds or Other Considerations

Item

3 is hereby amended as follows:

As

of July 21, 2020, the Reporting Person had purchased via open-market transactions 13,917,593 shares of the Issuer’s

Class A Common Stock at an average purchase price of $0.05 per share and purchased 48,500,000 shares of the Issuer’s

Class A Common stock in private placements at an average purchase price of $0.08 per share. In addition, on July 23,

2020, the Company purchased 10,000,000 warrants to purchase shares of Class A Common Stock at an average purchase price of $0.20

per share.

The total consideration paid by the Reporting

Person for such shares was approximately $5,291,000. The source of funds used in making the purchases was the Reporting

Person’s working capital.

Item

5. Interest in Securities of the Issuer

Item5

is hereby amended as follows:

|

(a)

|

The

Reporting Person beneficially owns 32,417,593 shares of Class A Common Stock, which constitutes 57.44% of the

shares of Class A Common Stock issued and outstanding as of June 30, 2020, as reported on the Issuer’s Annual

Report on Form 10-K for the year ended April 30, 2020, and does not include issuances of Class

A Common Stock after June 30, 2020, including issuances to the Reporting Person.

|

|

|

|

|

(b)

|

The

Reporting person has the sole power to vote and to dispose of the shares of Class A Common Stock.

|

|

|

|

|

(c)

|

The

Reporting Person has affected, within the last sixty (60) days, the following transactions involving the Issuer’s Class

A Common Stock:

|

Date

of

Transaction

|

|

Type

of

Transaction

|

|

Number

of Shares

|

|

Price

per Share

|

|

How

Effected

|

|

07/23/2020

|

|

|

Purchase

|

|

|

10,000,000

|

(1)

|

|

$

|

0.20

|

|

|

Subscription

Agreement between Reporting Person and Issuer

|

|

07/23/2020

|

|

|

Purchase

|

|

|

30,000,000

|

(1)

|

|

$

|

0.08

|

|

|

Subscription Agreement

between Reporting Person and Issuer

|

|

07/21/2020

|

|

|

Purchase

|

|

|

8,000,000

|

|

|

$

|

0.08

|

|

|

Private purchase

from third party

|

|

07/21/2020

|

|

|

Purchase

|

|

|

3,000,000

|

|

|

$

|

0.08

|

|

|

Private purchase

from third party

|

|

06/19/2020

|

|

|

Purchase

|

|

|

5,000,000

|

|

|

$

|

0.08

|

|

|

Private purchase

from third party

|

|

06/04/2020

|

|

|

Purchase

|

|

|

316,169

|

|

|

$

|

0.07

|

|

|

Open Market

|

|

06/03/2020

|

|

|

Purchase

|

|

|

7,000

|

|

|

$

|

0.07

|

|

|

Open Market

|

(1)

See Item 6

|

(d)

|

No

other person is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from

the sale of, such securities.

|

|

|

|

|

(e)

|

Not

applicable.

|

Item

6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

Item

6 is hereby amended to add the following:

On

July 23, 2020, Chan Heng Fai Ambrose, the Chairman of the Board of the Reporting Person, assigned a Stock Purchase and Share Subscription

Agreement by and between Mr. Chan and the Issuer, pursuant to which the Reporting Person purchased 30,000,000 shares of Class

A Common Stock (the “Shares”) and 10,000,000 warrants to purchase Class A Common Stock (the “Warrants”

and, collectively, the Shares together with the Warrants, the “Securities”). The Warrants immediately vested and may

be exercised at any time commencing on the date of issuance and ending three (3) year from such date. The Securities are also

subject to a one (1) year trading restriction pursuant to the terms of a Lock-Up Agreement entered into between Mr. Chan and the

Company and assigned to the Reporting Person.

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

Dated:

July 31, 2020

|

|

/s/

Frank D. Heuszel

|

|

|

Name:

|

Frank

D. Heuszel

|

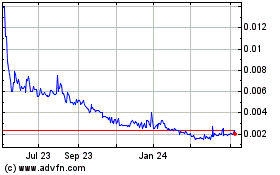

Sharing Services Global (PK) (USOTC:SHRG)

Historical Stock Chart

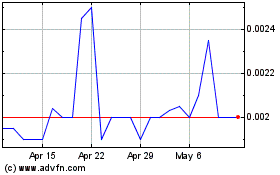

From Mar 2024 to Apr 2024

Sharing Services Global (PK) (USOTC:SHRG)

Historical Stock Chart

From Apr 2023 to Apr 2024