7-Eleven's $21 Billion Deal Could Be a Marathon -- Heard on the Street

August 03 2020 - 7:20AM

Dow Jones News

By Jacky Wong

7-Eleven is paying top price for its shopping trip in the

U.S.

The convenience-store operator has agreed to pay $21 billion to

buy gas station chain Speedway from Marathon Petroleum. Activist

investor Elliott Management has been pushing Marathon for a split.

The deal will add about 3,900 stores to 7-Eleven's existing 9,800

in the U.S. and Canada as its Japanese owner tries to diversify

away from its slowing home market.

7-Eleven already bought more than 1,000 U.S.-based convenience

stores and gas stations from Sunoco for $3.3 billion two years ago.

Partly helped by the Sunoco acquisition, 7-Eleven parent company

Seven & I's revenue in North America has grown 50% in the past

four fiscal years, while that in Japan has fallen 8%.

The Speedway deal--7-Eleven's largest ever acquisition--does,

however, look a bit pricey. Morgan Stanley has estimated the value

of Speedway's business at around $17 billion. Seven & I's

shares plunged 4.8% Monday as investors also worry the deal could

add more debt. A strong yen--which has risen against the dollar

2.6% this year--and falling interest rates would help, though the

deal is still big to digest considering Seven & I's market

value is only $25.4 billion.

7-Eleven is willing to pay the premium as it expects to extract

$3 billion of tax benefits and $5 billion of net sale leaseback

proceeds. It also hopes to generate $475 million to $575 million of

synergies a year. 7-Eleven's large store network will help move

toward achieving that goal, though managing such large-scale cost

savings won't be straightforward. Leveraging on its

convenience-store expertise, it hopes to sell more goods, which

earn higher margins than gasoline, to drivers who have to stop by

to fill up their tanks. Gas stations seem to offer a stable

customer base but gasoline sales, which would contribute to 30% of

7-Eleven's gross profits after the deal, have been stagnant as cars

have become more efficient. The rise of electric cars poses a

long-term risk.

The Speedway deal offers convenience to 7-Eleven but it could be

pricey.

Write to Jacky Wong at JACKY.WONG@wsj.com

(END) Dow Jones Newswires

August 03, 2020 07:05 ET (11:05 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

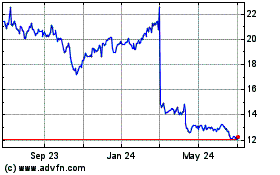

Seven and I (PK) (USOTC:SVNDY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Seven and I (PK) (USOTC:SVNDY)

Historical Stock Chart

From Jan 2024 to Jan 2025