UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C INFORMATION

INFORMATION STATEMENT PURSUANT TO SECTION 14C OF THE

SECURITIES EXCHANGE ACT OF 1934

|

x

|

Filed by the Registrant

|

|

o

|

Filed by a Party other than the Registrant

|

|

Check the appropriate box:

|

|

|

|

|

o

|

Preliminary Information Statement

|

|

x

|

Definitive Information Statement Only

|

|

o

|

Confidential, for Use of the Commission (as permitted by Rule 14c)

|

SAVWATT USA, INC.

(Name of Registrant as Specified In Its Charter)

Name of Person(s) Filing Information Statement, if other than Registrant:

Payment of Filing Fee (Check the appropriate box):

|

o

|

Fee computed on table below per Exchange Act Rules 14C-5(g) and 0-11.

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount of which the filing fee is calculated and state how it was determined):

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a) (2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

1)

|

Amount previously paid:

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

SAVWATT USA, INC.

1100 Wicomico Street -- Suite 700

Baltimore, Maryland 21230

Notice of Proposed Action by Written Consent of the Holder of the Majority of the Voting Power to be taken on or

about

January 6, 2012

To the Stockholders of SavWatt USA, Inc.

Notice is hereby given that upon written consent by the holder of a majority of the voting power of the Company, the Company intends to take certain action as more particularly described in this Information Statement. The action will be effected on or after 20 days from the date this Information Statement is mailed to stockholders, which mailing is expected to be on or about January 25, 2012

.

Only stockholders of record at the close of business on January 6, 2012 will be given Notice of the Action by Written Consent. The Company is not soliciting proxies.

By Order of the Board of Directors

|

/s/ Isaac Sutton

|

|

|

President

|

|

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY.

SavWatt USA, Inc. 11

0

0 Wicomico Street -- Suite 700, Baltimore, Maryland 21230

INFORMATION STATEMENT

CONSENT ACTION BY STOCKHOLDERS WITHOUT A MEETING

This Information Statement is furnished to all holders of the Common Stock and the holders of the Preferred Stock of the Company in connection with proposed action by the holder of the majority of the voting power of the Company to take the following action:

* To approve an amendment to the Company's Articles of Incorporation to increase the authorized capital stock to 9,800,000,000 of Common Stock.

The action is proposed to occur on or about February 16, 2012. This Information Statement is first being mailed to stockholders on or about January 25, 2012.

Only stockholders of record at the close of business on January 6, 2012 are entitled to notice of the action to be taken. There will be no vote on the matters by the shareholders of the Company because the proposed action will be accomplished by the written consent of the holder of the majority voting power of the Company as allowed by the Delaware Corporation Law. The elimination of the need for a special meeting of the stockholders to approve the actions set forth herein is authorized by Delaware Law, which provides that action may be taken by the written consent of the holders of outstanding shares of voting capital stock, having not less than the minimum number of votes which would be necessary to authorize or take the action at a meeting at which all shares entitled to vote on a matter were present and voted.

The holder of the majority of the issued and outstanding Common Stock of the Company has adopted, ratified and approved resolutions to effect the action described. No other votes are required or necessary. See the caption "Vote Required for Approval," below.

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

DISSENTER'S RIGHTS OF APPRAISAL

The Delaware Corporation Law ("DELAWARE LAW") does not provide for dissenter's rights of appraisal in connection with the corporate action to be taken.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

The Board of Directors has fixed the close of business on January 6, 2012 as the record date for the determination of the common shareholders entitled to notice of proposed action by written consent. At the record date, the Company had outstanding 3,192,078,480 shares of Common Stock, par value $0.0001 per share. The holder of the majority of the issued and outstanding Common Stock on the record date has signed a consent to the taking of the corporate action described. This consent will be sufficient, without any further action, to provide the necessary stockholder approval of the action.

CORPORATE ACTIONS TO BE TAKEN

AMENDMENTS TO THE ARTICLES OF INCORPORATION

INCREASE IN AUTHORIZED CAPITAL STOCK

We believe that it is in the best interests of the Company and its shareholders that the authorized capital stock be increased to 9,800,000,000 shares of Common Stock, par value $0.0001 per share. The increase in our authorized capital stock will provide the Company with needed stock to enable it to undertake financing transactions in which the Company may employ the common stock, including transactions to raise working capital through the sale of common stock. Since the Board of Directors believes that the currently authorized number of shares may be not be sufficient to meet anticipated needs in the immediate future, the Board considers it desirable that the Company has the flexibility to issue an additional amount of Common Stock and Preferred Stock without further stockholder action, unless otherwise required by law or other regulations. The availability of these additional shares will enhance the

Company's flexibility in connection with any possible acquisition or merger, stock splits or dividends, financings and other corporate purposes and will allow such shares to be issued without the expense and delay of a special stockholders' meeting, unless such action is required by applicable law or rules of any stock exchange on which the Company's securities may then be listed. At the present time, the Company has no plans, proposals or arrangements, written or otherwise, to issue any additional authorized shares of Common Stock or Preferred Stock.

Upon the approval of increase in authorized capital stock as described herein, we will pursue our new business in the consumer market for energy efficient LED lighting which we believe is a growing market. We may undertake business combination transactions which are intended to foster the implementation of our business plan. At the present time, there are no plans, proposals or arrangements, written or otherwise, to issue any additional authorized shares of Common Stock or Preferred Stock in a specific business combination transaction. At such time as a specific business combination transaction is identified, we will submit such transaction to our security holders for a vote.

In certain circumstances, a proposal to increase the authorized capital stock may have an anti-takeover effect. The authorization of classes of preferred or common stock with either specified voting rights or rights providing for the approval of extraordinary corporate action may be used to create voting impediments or to frustrate persons seeking to effect a merger or otherwise gain control of the Company by diluting the stock ownership of any persons seeking to obtain control of the Company. Management of the Company might use the additional authorized capital stock to resist or frustrate a third-party transaction which might provide an above-market premium that is favored by a majority of the independent shareholders. Management of the Company has no present plans to adopt any proposals or to enter into other arrangements that may have material anti-takeover consequences. There are no anti-takeover provisions in the Company's Articles of Incorporation, Bylaws or other governing documents.

The creation of a new class of Common and/or Preferred Stock could have potential negative consequences on the voting power of existing shareholders. For example, the creation of special voting rights such as the right to vote as a separate class on certain corporate actions; the granting of voting rights equal to a certain multiple of shares held; or the right to convert into Common Stock on greater than a one-for-one basis, all of which has the potential to decrease the voting power of the shares of Common Stock held by existing shareholders.

DESCRIPTION OF CAPITAL STOCK AND VOTING RIGHTS

Our current authorized capital, prior to the proposed increase in our authorized capital stock, consists of 4,800,000,000 shares of Common Stock, par value $0.0001 per share. As of January 6, 2012, there were 3,192,078,480 shares of Common Stock issued and outstanding. As of January 6, 2012 there were 16,000,000 shares of Preferred Stock issued and outstanding. Each share of Common Stock is entitled to one (1) vote on all matters to come before a vote of the stockholders of the Company. Each share of Preferred Series A is entitled to two hundred (200) votes on all matters to come before a vote of the stockholders of the Company.

VOTE REQUIRED FOR APPROVAL

Delaware Law and our articles of incorporation permit the holders of a majority of the shares of the outstanding Common Stock of our Company to approve and authorize actions by written consent as if the action were undertaken at a duly constituted meeting of the stockholders of the Company. On January 6, 2012, our Board of Directors approved the corporate actions described in this Information Statement and recommended that the proposed actions be presented to

the stockholders for approval. On January 9, 2012, votes representing approximately 51% of the total shares of Common Stock entitled to vote on the action set forth herein, consented in writing without a meeting of shareholders.

SECURITY OWNERSHIP OF EXECUTIVE OFFICERS, DIRECTORS

AND FIVE PERCENT STOCKHOLDERS

The following table sets forth certain information concerning the ownership of the Company's Common Stock and Preferred Stock as of January 6, 2012 with respect to: (i) each person known to the Company to be the beneficial owner of more than five percent of the Company's Common Stock; (ii) all directors; and (iii) directors and executive officers of the Company as a group. To the knowledge of the Company, each shareholder listed below possesses sole voting and investment power with respect to the shares indicated.

|

Title of Class

|

|

Name and Address of

Beneficial Owner

|

|

Amount and Nature of

Beneficial Ownership

|

|

|

Percent

of Class

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

Isaac H. Sutton (1)

Sutton Global Associates, Inc.

152 Madison Ave, 23

rd

floor

New York, New York 10016

|

|

|

50,723,310

|

|

|

|

1.58

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred A

|

|

Isaac H. Sutton (1)

Sutton Global Associates, Inc.

152 Madison Ave, 23

rd

floor

New York, New York 10016

|

|

|

16

,000,000

|

|

|

|

100

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

All Executive Officers and

Directors as a Group (1 person)

|

|

|

50,773,310

|

|

|

|

1.58

|

%

|

INTEREST OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON

No person who has been a director or officer of the Company at any time since the beginning of the last fiscal year, nominee for election as a director of the Company, nor associates of the foregoing persons have any substantial interest, direct or indirect, in proposed amendment to the Company's Articles of Incorporation which differs from that of other stockholders of the Company. No director of the Company opposes the proposed amendment of the Company's Articles of Incorporation.

ADDITIONAL INFORMATION

Additional information may be obtained from SavWatt USA, Inc., 1100 Wicomico Street -- Suite 700, Baltimore, Maryland 21230 and matters which have been filed the Securities and Exchange Commission through its "Electronic Data Gathering, Analysis and Retrieval System" or "EDGAR" may be viewed online or at the offices of the U.S. Securities and Exchange Commission at 100 F Street N.E., Washington, DC 20549-2736.

Dated: February 16, 2012

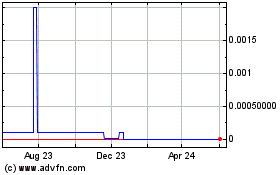

SavWatt USA (CE) (USOTC:SAVW)

Historical Stock Chart

From Apr 2024 to May 2024

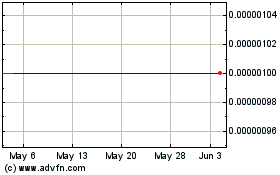

SavWatt USA (CE) (USOTC:SAVW)

Historical Stock Chart

From May 2023 to May 2024