UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

(Mark One)

þ

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended June 30, 2012

o

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 0-8157

THE RESERVE PETROLEUM COMPANY

(Exact Name of Registrant as Specified in Its Charter)

|

DELAWARE

|

73-0237060

|

|

|

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

6801 BROADWAY EXT., SUITE 300

OKLAHOMA CITY, OKLAHOMA

73116-9037

(405) 848-7551

|

|

|

|

(Address and telephone number, including area code, of registrant’s principal executive offices)

|

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes

þ

No

o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes

þ

No

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

|

Large accelerated filer

o

|

Accelerated filer

o

|

Non-accelerated filer

o

|

Smaller reporting company

þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

o

No

þ

As of August 10, 2012, 160,918.64 shares of the Registrant’s $.50 par value common stock were outstanding.

PART I – FINANCIAL INFORMATION

|

THE RESERVE PETROLEUM COMPANY

|

|

BALANCE SHEETS

|

|

|

|

ASSETS

|

|

|

|

June 30,

|

|

|

December 31,

|

|

|

|

|

2012

|

|

|

2011

|

|

|

|

|

(Unaudited)

|

|

|

(Derived from

|

|

|

|

|

|

|

|

audited financial

|

|

|

|

|

|

|

|

Statements)

|

|

|

|

|

|

|

|

|

|

|

Current Assets:

|

|

|

|

|

|

|

|

Cash and Cash Equivalents

|

|

$

|

10,037,983

|

|

|

$

|

10,150,742

|

|

|

Available-for-Sale Securities

|

|

|

6,652,196

|

|

|

|

6,654,838

|

|

|

Trading Securities

|

|

|

408,637

|

|

|

|

398,964

|

|

|

Refundable Income Taxes

|

|

|

202,543

|

|

|

|

816,125

|

|

|

Receivables

|

|

|

2,136,706

|

|

|

|

1,903,862

|

|

|

|

|

|

19,438,065

|

|

|

|

19,924,531

|

|

|

Investments:

|

|

|

|

|

|

|

|

|

|

Equity Investment

|

|

|

560,012

|

|

|

|

521,852

|

|

|

Other

|

|

|

151,839

|

|

|

|

151,839

|

|

|

|

|

|

711,851

|

|

|

|

673,691

|

|

|

Property, Plant and Equipment:

|

|

|

|

|

|

|

|

|

|

Oil and Gas Properties, at Cost,

|

|

|

|

|

|

|

|

|

|

Based on the Successful Efforts Method of Accounting –

|

|

|

|

|

|

|

|

|

|

Unproved Properties

|

|

|

920,362

|

|

|

|

1,179,882

|

|

|

Proved Properties

|

|

|

35,891,564

|

|

|

|

32,441,403

|

|

|

|

|

|

36,811,926

|

|

|

|

33,621,285

|

|

Less – Accumulated Depreciation, Depletion, Amortization and

Valuation Allowance

|

|

|

22,462,025

|

|

|

|

21,177,541

|

|

|

|

|

|

14,349,901

|

|

|

|

12,443,744

|

|

|

Other Property and Equipment, at Cost

|

|

|

417,526

|

|

|

|

417,526

|

|

|

|

|

|

|

|

|

|

|

|

|

Less – Accumulated Depreciation

|

|

|

248,961

|

|

|

|

227,895

|

|

|

|

|

|

168,565

|

|

|

|

189,631

|

|

|

Total Property, Plant and Equipment

|

|

|

14,518,466

|

|

|

|

12,633,375

|

|

|

Other Assets

|

|

|

361,453

|

|

|

|

361,802

|

|

|

Total Assets

|

|

$

|

35,029,835

|

|

|

$

|

33,593,399

|

|

|

THE RESERVE PETROLEUM COMPANY

|

|

BALANCE SHEETS

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

June 30,

|

|

|

December 31,

|

|

|

|

|

2012

|

|

|

2011

|

|

|

|

|

(Unaudited)

|

|

|

(Derived from

|

|

|

|

|

|

|

|

audited financial

|

|

|

|

|

|

|

|

Statements)

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities:

|

|

|

|

|

|

|

|

Accounts Payable

|

|

$

|

392,696

|

|

|

$

|

276,017

|

|

|

Other Current Liabilities – Deferred Income Taxes and Other

|

|

|

276,972

|

|

|

|

292,166

|

|

|

|

|

|

669,668

|

|

|

|

568,183

|

|

|

Long-Term Liabilities:

|

|

|

|

|

|

|

|

|

|

Asset Retirement Obligation

|

|

|

1,053,420

|

|

|

|

990,074

|

|

|

Dividends Payable

|

|

|

1,456,064

|

|

|

|

1,419,884

|

|

|

Deferred Tax Liability

|

|

|

3,130,352

|

|

|

|

2,726,978

|

|

|

|

|

|

5,639,836

|

|

|

|

5,136,936

|

|

|

Total Liabilities

|

|

|

6,309,504

|

|

|

|

5,705,119

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity:

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

|

92,368

|

|

|

|

92,368

|

|

|

Additional Paid-in Capital

|

|

|

65,000

|

|

|

|

65,000

|

|

|

Retained Earnings

|

|

|

29,411,165

|

|

|

|

28,563,474

|

|

|

|

|

|

29,568,533

|

|

|

|

28,720,842

|

|

|

|

|

|

|

|

|

|

|

|

|

Less – Treasury Stock, at Cost

|

|

|

848,202

|

|

|

|

832,562

|

|

|

Total Stockholders’ Equity

|

|

|

28,720,331

|

|

|

|

27,888,280

|

|

|

Total Liabilities and Stockholders’ Equity

|

|

$

|

35,029,835

|

|

|

$

|

33,593,399

|

|

|

THE RESERVE PETROLEUM COMPANY

|

|

STATEMENTS OF INCOME

|

|

(Unaudited)

|

|

|

|

Three Months Ended

|

|

|

Six Months Ended

|

|

|

|

|

June 30,

|

|

|

June 30,

|

|

|

|

|

2012

|

|

|

2011

|

|

|

2012

|

|

|

2011

|

|

|

Operating Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil and Gas Sales

|

|

$

|

2,964,869

|

|

|

$

|

3,292,789

|

|

|

$

|

6,346,602

|

|

|

$

|

5,847,316

|

|

|

Lease Bonuses and Other

|

|

|

99,811

|

|

|

|

194,341

|

|

|

|

232,312

|

|

|

|

259,038

|

|

|

|

|

|

3,064,680

|

|

|

|

3,487,130

|

|

|

|

6,578,914

|

|

|

|

6,106,354

|

|

|

Operating Costs and Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production

|

|

|

521,389

|

|

|

|

514,063

|

|

|

|

1,141,537

|

|

|

|

970,200

|

|

|

Exploration

|

|

|

81,340

|

|

|

|

4,093

|

|

|

|

98,954

|

|

|

|

38,716

|

|

Depreciation, Depletion, Amortization

and Valuation Provisions

|

|

|

879,793

|

|

|

|

592,464

|

|

|

|

1,612,925

|

|

|

|

1,044,901

|

|

|

General, Administrative and Other

|

|

|

388,831

|

|

|

|

374,563

|

|

|

|

830,931

|

|

|

|

770,839

|

|

|

|

|

|

1,871,353

|

|

|

|

1,485,183

|

|

|

|

3,684,347

|

|

|

|

2,824,656

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from Operations

|

|

|

1,193,327

|

|

|

|

2,001,947

|

|

|

|

2,894,567

|

|

|

|

3,281,698

|

|

|

Other Income, Net

|

|

|

413,844

|

|

|

|

261,629

|

|

|

|

494,195

|

|

|

|

300,079

|

|

|

Income before Provision for Income Taxes

|

|

|

1,607,171

|

|

|

|

2,263,576

|

|

|

|

3,388,762

|

|

|

|

3,581,777

|

|

|

Provision for Income Taxes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current

|

|

|

288,829

|

|

|

|

389,846

|

|

|

|

613,595

|

|

|

|

603,310

|

|

|

Deferred

|

|

|

206,243

|

|

|

|

236,146

|

|

|

|

318,180

|

|

|

|

348,479

|

|

|

Total Provision for Income Taxes

|

|

|

495,072

|

|

|

|

625,992

|

|

|

|

931,775

|

|

|

|

951,789

|

|

|

Net Income

|

|

$

|

1,112,099

|

|

|

$

|

1,637,584

|

|

|

$

|

2,456,987

|

|

|

$

|

2,629,988

|

|

|

Per Share Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income, Basic and Diluted

|

|

$

|

6.91

|

|

|

$

|

10.16

|

|

|

$

|

15.26

|

|

|

$

|

16.32

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Dividends Declared and / or Paid

|

|

$

|

10.00

|

|

|

$

|

10.00

|

|

|

$

|

10.00

|

|

|

$

|

10.00

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding,

Basic and Diluted

|

|

|

160,937

|

|

|

|

161,154

|

|

|

|

160,959

|

|

|

|

161,185

|

|

|

THE RESERVE PETROLEUM COMPANY

|

|

CONDENSED STATEMENTS OF CASH FLOWS

|

|

(Unaudited)

|

|

|

|

Six Months Ended

|

|

|

|

|

June 30,

|

|

|

|

|

2012

|

|

|

2011

|

|

|

|

|

|

|

|

|

|

|

Net Cash Provided by Operating Activities

|

|

$

|

4,706,443

|

|

|

$

|

4,495,830

|

|

|

Cash Flows Applied to Investing Activities:

|

|

|

|

|

|

|

|

|

|

Purchases of Available-for-Sale Securities

|

|

|

(6,652,196

|

)

|

|

|

(12,893,876

|

)

|

|

Maturity of Available-for-Sale Securities

|

|

|

6,654,837

|

|

|

|

13,138,811

|

|

|

Proceeds from Disposal of Property, Plant and Equipment

|

|

|

35,795

|

|

|

|

303,648

|

|

|

Purchase of Property, Plant and Equipment

|

|

|

(3,283,882

|

)

|

|

|

(2,820,443

|

)

|

|

Cash Distribution from Investment

|

|

|

15,000

|

|

|

|

3,000

|

|

|

Net Cash Applied to Investing Activities

|

|

|

(3,230,446

|

)

|

|

|

(2,268,860

|

)

|

|

Cash Flows Applied to Financing Activities:

|

|

|

|

|

|

|

|

|

|

Dividends Paid to Stockholders

|

|

|

(1,573,116

|

)

|

|

|

(1,572,572

|

)

|

|

Purchase of Treasury Stock

|

|

|

(15,640

|

)

|

|

|

(24,640

|

)

|

|

Total Cash Applied to Financing Activities

|

|

|

(1,588,756

|

)

|

|

|

(1,597,212

|

)

|

|

Net Change in Cash and Cash Equivalents

|

|

|

(112,759

|

)

|

|

|

629,758

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and Cash Equivalents, Beginning of Period

|

|

|

10,150,742

|

|

|

|

2,940,967

|

|

|

Cash and Cash Equivalents, End of Period

|

|

$

|

10,037,983

|

|

|

$

|

3,570,725

|

|

THE RESERVE PETROLEUM COMPANY

NOTES TO FINANCIAL STATEMENTS

June 30, 2012

(Unaudited)

Note 1 – BASIS OF PRESENTATION

The accompanying balance sheet as of December 31, 2011, which has been derived from audited financial statements, the unaudited interim financial statements and these notes, have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission. Accordingly, certain disclosures normally included in financial statements prepared in accordance with the accounting principles generally accepted in the United States of America (“GAAP”) have been omitted. The accompanying financial statements and notes thereto should be read in conjunction with the financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011.

In the opinion of Management, the accompanying financial statements reflect all adjustments (consisting only of normal recurring accruals), which are necessary for a fair statement of the results of the interim periods presented. The results of operations for the current interim periods are not necessarily indicative of the operating results for the full year.

Note 2 – OTHER INCOME, NET

The following is an analysis of the components of Other Income, Net for the three months and six months ended June 30, 2012 and 2011:

|

|

|

Three Months Ended

|

|

|

Six Months Ended

|

|

|

|

|

June 30,

|

|

|

June 30,

|

|

|

|

|

2012

|

|

|

2011

|

|

|

2012

|

|

|

2011

|

|

Net Realized and Unrealized Gain (Loss)

on Trading Securities

|

|

$

|

(54,053

|

)

|

|

$

|

(24,305

|

)

|

|

$

|

8,824

|

|

|

$

|

2,023

|

|

|

Gain on Asset Sales

|

|

|

431,643

|

|

|

|

267,909

|

|

|

|

434,573

|

|

|

|

269,232

|

|

|

Interest Income

|

|

|

8,766

|

|

|

|

6,047

|

|

|

|

16,116

|

|

|

|

12,335

|

|

|

Equity Earnings in Investee

|

|

|

19,866

|

|

|

|

9,599

|

|

|

|

38,160

|

|

|

|

24,471

|

|

|

Other Income

|

|

|

15,599

|

|

|

|

8,996

|

|

|

|

15,873

|

|

|

|

9,044

|

|

|

Interest and Other Expenses

|

|

|

(7,977

|

)

|

|

|

(6,617

|

)

|

|

|

(19,351

|

)

|

|

|

(17,026

|

)

|

|

Other Income, Net

|

|

$

|

413,844

|

|

|

$

|

261,629

|

|

|

$

|

494,195

|

|

|

$

|

300,079

|

|

Note 3 – INVESTMENTS AND RELATED COMMITMENTS AND CONTINGENT LIABILITIES, INCLUDING GUARANTEES

Equity Investment consists of a 33% ownership interest in Broadway Sixty-Eight, Ltd. (the “Partnership”), an Oklahoma limited partnership, which owns and operates an office building in Oklahoma City, Oklahoma. Although the Company invested as a limited partner, it agreed, jointly and severally, with all other limited partners to reimburse the general partner for any losses suffered from operating the Partnership. The indemnity agreement provides no limitation to the maximum potential future payments. To date, no monies have been paid with respect to this agreement.

Note 4 – PROVISION FOR INCOME TAXES

In 2012 and 2011, the effective tax rate was less than the statutory rate, primarily as a result of allowable depletion for tax purposes in excess of the cost basis in oil and gas properties and the corporate graduated tax rate structure.

Excess federal percentage depletion, which is limited to certain production volumes and by certain income levels reduces estimated taxable income projected for any year. The federal excess percentage depletion estimates will be updated throughout the year until finalized with the detail well-by-well calculations at year-end. When a provision for income taxes is recorded, federal excess percentage depletion benefits decrease the effective tax rate. The benefit of federal excess percentage depletion is not directly related to the amount of pre-tax income recorded in a period. Accordingly, in periods where a recorded pre-tax income is relatively small, the proportional effect of these items on the effective tax rate may be significant.

Note 5 – ASSET RETIREMENT OBLIGATION

The Company records the fair value of its estimated liability to retire its oil and natural gas producing properties in the period in which it is incurred (typically the date of first sale). The estimated liability is calculated by obtaining current estimated plugging costs from the well operators and inflating it over the life of the property. Current year inflation rate used is 4.08%. When the liability is first recorded, a corresponding increase in the carrying amount of the related long-lived asset is also recorded. Subsequently, the asset is amortized to expense over the life of the property and the liability is increased annually for the change in its present value which is currently 3.25%.

A reconciliation of the Company’s asset retirement obligation liability is as follows:

|

Balance at December 31, 2011

|

|

$

|

990,074

|

|

|

Liabilities incurred for new wells

|

|

|

48,465

|

|

|

Accretion expense

|

|

|

14,881

|

|

|

Balance at June 30, 2012

|

|

$

|

1,053,420

|

|

Note 6 – FAIR VALUE MEASUREMENTS

Inputs used to measure fair value are organized into a fair value hierarchy based on the observability of the inputs. Level 1 inputs consist of quoted prices in active markets for identical assets. Level 2 inputs are inputs, other than quoted prices, for similar assets that are observable. Level 3 inputs are unobservable inputs.

Recurring Fair Value Measurements

Certain of the Company’s assets are reported at fair value in the accompanying balance sheets on a recurring basis. The Company determined the fair value of the available-for-sale securities using quoted market prices for securities with similar maturity dates and interest rates. At June

30, 2012 and December

31, 2011, the Company’s assets reported at fair value on a recurring basis are summarized as follows:

|

|

|

June 30, 2012

|

|

|

|

|

Level 1 Inputs

|

|

|

Level 2 Inputs

|

|

|

Level 3 Inputs

|

|

|

Financial Assets:

|

|

|

|

|

|

|

|

|

|

|

Available-for Sale Securities –

|

|

|

|

|

|

|

|

|

|

|

U.S. Treasury Bills Maturing in 2012

|

|

$

|

—

|

|

|

$

|

6,652,196

|

|

|

$

|

—

|

|

|

Trading Securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Domestic Equities

|

|

$

|

211,103

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

International Equities

|

|

$

|

115,106

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Others

|

|

$

|

82,428

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

|

|

December 31, 2011

|

|

|

|

|

Level 1 Inputs

|

|

|

Level 2 Inputs

|

|

|

Level 3 Inputs

|

|

|

Financial Assets:

|

|

|

|

|

|

|

|

|

|

|

Available-for Sale Securities –

|

|

|

|

|

|

|

|

|

|

|

U.S. Treasury Bills Maturing in 2012

|

|

$

|

—

|

|

|

$

|

6,654,838

|

|

|

$

|

—

|

|

|

Trading Securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Domestic Equities

|

|

$

|

275,516

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

International Equities

|

|

$

|

95,223

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Others

|

|

$

|

28,225

|

|

|

$

|

—

|

|

|

$

|

—

|

|

Non-Recurring Fair Value Measurements

The Company’s asset retirement obligation annually represents a non-recurring fair value liability. The fair value of the non-financial liability incurred in the six months ended June 30, was $48,465 in 2012 and $32,452 in 2011 and was calculated using Level 3 inputs. See Note 5 above for more information about this liability and the inputs used for calculating fair value.

Fair Value of Financial Instruments

The Company’s financial instruments consist primarily of cash and cash equivalents, trade receivables, marketable securities, trade payables and dividends payable. At June

30, 2012 and December 31

, 2011, the historical cost of cash and cash equivalents, trade receivables, trade payables and dividends payable are considered to be representative of their respective fair values due to the short-term maturities of these items.

Note 7 – NEW ACCOUNTING PRONOUNCEMENTS

Since December 31, 2011, there were no accounting pronouncements issued and none that became effective during that time which were directly applicable to the Company.

|

ITEM 2.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

This discussion and analysis should be read with reference to a similar discussion in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011 as filed with the Securities and Exchange Commission (hereinafter, the “2011 Form 10

-

K”), as well as the financial statements included in this Form 10-Q.

Forward Looking Statements

This discussion and analysis includes forward looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward looking statements give the Company’s current expectations of future events. They include statements regarding the drilling of oil and gas wells, the production that may be obtained from oil and gas wells, cash flow and anticipated liquidity and expected future expenses.

Although management believes the expectations in these and other forward looking statements are reasonable, we can give no assurance they will prove to have been correct. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Factors that would cause actual results to differ materially from expected results are described under “Forward Looking Statements” on page 8 of the 2011 Form 10-K.

We caution you not to place undue reliance on these forward looking statements, which speak only as of the date of this report, and we undertake no obligation to update this information. You are urged to carefully review and consider the disclosures made in this and our other reports filed with the Securities and Exchange Commission that attempt to advise interested parties of the risks and factors that may affect our business.

Financial Conditions and Results of Operations

Liquidity and Capital Resources

Please refer to the Balance Sheets and the Condensed Statements of Cash Flows in this Form 10-Q to supplement the following discussion. In the first half of 2012, the Company continued to fund its business activity through the use of internal sources of cash. The Company had cash provided by operations of $4,706,443 and cash provided by the maturities of available-for-sale securities of $6,654,837. Additional cash of $50,795 was provided by property dispositions and an investment distribution for total cash provided of $11,412,075. The Company utilized cash for the purchase of available-for-sale securities of $6,652,196, property additions of $3,283,882 and financing activities of $1,588,756 for total cash applied of $11,524,834. Cash and cash equivalents decreased $112,759 (1%) to $10,037,983.

Discussion of Significant Changes in Working Capital.

In addition to the changes in cash and cash equivalents discussed above, there were other changes in working capital line items from December 31, 2011. A discussion of these items follows.

Refundable income taxes decreased $613,582 (75%) to $202,543 from $816,125 due to the first half 2012 current income tax provision of $613,595.

Receivables increased $232,844 (12%) to $2,136,706 from $1,903,862. This increase was the net result of a $424,428 receivable for a June 2012 sale of some non-producing leasehold in Hodgeman County, Kansas, offset by a sales receivable decline of approximately $200,000. Sales variances are discussed in the “Results of Operations” section below.

Accounts payable increased $116,679 (42%) to $392,696 from $276,017. This increase was due primarily to increased drilling activity at June 30, 2012 versus December 31, 2011.

Discussion of Significant Changes in the Condensed Statements of Cash Flows.

As noted in the first paragraph above, net cash provided by operating activities was $4,706,443 in 2012, an increase of $210,613 (5%) from the comparable period in 2011. The increase was primarily due to increased oil and gas sales revenue, partially offset by increased operating costs. For more information see “Operating Revenues” and “Operating Costs and Expenses” below.

Net cash provided by the purchase and sale of available-for-sale securities in 2012 was $2,641 compared to net cash provided in 2011 of $244,935. The change was the result of not renewing a $250,000 certificate of deposit (CD) that matured in the first quarter of 2011.

Purchases of available-for-sale securities were $6,652,196 in 2012, a decrease of $6,241,680 (48%) from the comparable period in 2011. The decline was the result of investing a portion of the proceeds from maturing securities in the fourth quarter of 2011 in money market accounts with higher interest rates than the short-term treasury bill rates.

Cash applied to the purchase of property additions in 2012 was $3,283,882, an increase of $463,439 (16%) from cash applied in 2011 of $2,820,443. In both 2012 and 2011, cash applied to property additions was mostly related to oil and gas exploration and development activity. See the subheading “Exploration Costs” in the “Results of Operations” section below for additional information.

Property disposal proceeds in 2012 were $35,795, a decrease of $267,853 from the comparable period in 2011. The decrease was primarily due to proceeds from 2012 sales of non-producing leaseholds in Kansas not received until July.

Conclusion.

Management is unaware of any additional material trends, demands, commitments, events or uncertainties, which would impact liquidity and capital resources to the extent that the discussion presented in the 2011 Form 10-K would not be representative of the Company’s current position.

Material Changes in Results of Operations Six Months Ended June 30, 2012, Compared with Six Months Ended June 30

, 2011

Net income decreased $173,001 (7%) to $2,456,987 in 2012 from $2,629,988 in 2011. Net income per share, basic and diluted, decreased $1.06 to $15.26 in 2012 from $16.32 in 2011.

A discussion of revenue from oil and gas sales and other significant line items in the statements of income follows.

Operating Revenues

. Revenues from oil and gas sales increased $499,286 (9%) to $6,346,602 in 2012 from $5,847,316 in 2011. The $499,286 increase is a combination of a decrease in natural gas sales of $928,560, offset by an increase in crude oil sales of $1,372,464 and an increase in miscellaneous oil and gas product sales of $55,382.

The $1,372,464 (40%) increase in oil sales to $4,789,023 in 2012 from $3,416,559 in 2011 was the net result of an increase in the volume sold and a decrease in the average price per barrel (Bbl). The volume of oil sold increased 15,735 Bbls to 52,838 Bbls in 2012, resulting in a positive volume variance of $1,448,937. This volume increase was the net result of an increase of about 22,000 Bbls for production that began after June 30, 2011, offset by a decline of about 6,300 Bbls from older properties. The average price per Bbl decreased $1.45 to $90.64 per Bbl in 2012, resulting in a negative price variance of $76,473.

The $928,560 (40%) decrease in gas sales to $1,392,330 in 2012 from $2,320,890 in 2011 was the result of a decrease in both the average price per thousand cubic feet (MCF) and the volume sold. The volume of gas sold decreased 46,083 MCF to 508,160 MCF from 554,243 MCF in 2011, for a negative volume variance of $192,972. This volume decrease was the net result of an increase of about 89,000 MCF for production from wells that began producing after June 30, 2011, offset by a decline of about 135,000 MCF from older properties. The average price per MCF decreased $1.45 to $2.74 per MCF from $4.19 per MCF in 2011, resulting in a negative price variance of $735,588.

Sales from the Robertson County, Texas royalty interest properties provided approximately 33% of the Company’s first half 2012 gas sales volumes and about 46% of the first half 2011 gas sales volumes. See discussion on page 12 of the 2011 Form 10-K under the subheading “Operating Revenues” for more information about these properties.

For both oil and gas sales, the price change was mostly the result of a change in the spot market prices, upon which most of the Company’s oil and gas sales are based. These spot market prices have had significant fluctuations in the past and these fluctuations are expected to continue.

Sales of miscellaneous oil and gas products were $165,249 in 2012 as compared to $109,867 in 2011.

The Company received lease bonuses of $20,209 in the first half of 2012 for leases on its owned minerals. Lease bonuses for the first half of 2011 were $157,805.

Coal royalties were $212,103 for the first half of 2012, compared to $101,232 for 2011, for coal mined during these periods on North Dakota leases. See subheading “Operating Revenues” on page 12 of the 2011 Form 10-K for more information about this property.

Operating Costs and Expenses

. Operating costs and expenses increased $859,691 (30%) to $3,684,347 in 2012 from $2,824,656 in 2011. Material line item changes are discussed and analyzed in the following paragraphs.

Production Costs.

Production costs increased $171,337 (18%) in 2012 to $1,141,537 from $970,200 in 2011. Lease operating expense and transportation and compression expense increased $120,151 (16%) in 2012 to $854,168 from $734,017 in 2011 due to lease operating expense on wells that first produced after June 30, 2011. Production taxes increased $51,185 (22%) to $287,369 in 2012 from $236,184 in 2011 due to the increased oil and gas sales revenues described above in the “Operating Revenues” section.

Exploration Costs.

Total exploration expense increased $60,238 (156%) to $98,954 in 2012 from $38,716 in 2011. Dry hole costs increased $65,717 (198%) in 2012 to $98,954 from $33,237 in 2011. This increase was offset by a decline in geological and geophysical expense to zero from $5,479 in 2011.

The following is a summary as of July 27, 2012, updating both exploration and development activity from December 31, 2011, for the period ended June 30, 2012.

The Company participated with its 18% working interest in the completion of three development wells as commercial oil and gas producers on a Barber County, Kansas prospect (these wells were drilled in 2011). The Company participated in two additional development wells on the prospect that have been completed and are being tested, and in the drilling of a salt water disposal well. Four additional development wells will be drilled starting in July 2012. Capitalized costs for the period were $183,902, including $52,986 in prepaid drilling costs.

The Company participated in the drilling of two step-out wells on a Woods County, Oklahoma prospect (12% and 8% working interests). Both wells were completed as commercial oil and gas producers. The Company will participate with working interests ranging from 14% to 16% in the drilling of six additional step-out wells starting in August 2012. Capitalized costs for the period were $136,800, including $16,473 in prepaid drilling costs.

The Company participated with a 4.6% working interest in the drilling of a step-out well on a Woods County, Oklahoma prospect. The well was completed as a commercial oil and gas producer. Total capitalized costs for the period were $37,462.

The Company participated with a 17.3% working interest in the drilling of a development well on a Woods County, Oklahoma prospect. A completion is in progress. Prepaid drilling costs for the period were $46,732.

The Company participated with its 16% working interest in the completion of a step-out well and an exploratory well as commercial oil producers on a Hodgeman County, Kansas prospect (these wells were drilled in 2011). The Company also participated in the drilling of three additional exploratory wells on the prospect. One well was completed as a commercial oil producer and the other two as dry holes. Four additional exploratory wells will be drilled starting in July 2012. Capitalized costs for the period were $56,142, including $23,403 in prepaid drilling costs. Dry hole costs were $29,521 for the period.

The Company participated with a 9.4% working interest in the completion of an exploratory well on a Grady County, Oklahoma prospect (the well was drilled in 2011). The well is currently shut in awaiting pipeline connection. Capitalized costs for the period were $119,314.

The Company participated with its 4.1% working interest in the drilling of an additional horizontal well in a Harding County, South Dakota waterflood unit. A completion is in progress. Capitalized costs for the period were $49,306.

The Company participated with its 18% working interest in the drilling of an exploratory well on a Ness County, Kansas prospect. Completion attempts have been unsuccessful and $93,600 was charged to dry hole costs.

The Company participated with its 18% working interest in the drilling of an exploratory well on a Ness and Hodgeman Counties, Kansas prospect. The well was completed as a commercial oil producer. The Company also participated in the drilling of a salt water disposal well. Capitalized costs for the period were $117,979, including $28,640 in prepaid drilling costs.

The Company participated with 10.5% and 6.6% working interests in the drilling of two step-out horizontal wells on a Garfield County, Oklahoma prospect. Completions are in progress on both wells. The Company also participated in the drilling of a salt water disposal well. Prepaid drilling costs for the period were $623,596.

The Company participated with its 7% interest in the re-entry and conversion to salt water disposal of a plugged well on a Custer County, Oklahoma prospect. Capitalized costs for the period were $60,747.

The Company participated with a 9.3% working interest in the completion of an exploratory horizontal well as a marginal oil producer on a Grayson County, Texas prospect (the well was drilled in 2011). The Company will participate with its 7% working interest in the drilling of two additional exploratory horizontal wells starting in September 2012. Capitalized costs for the period were $78,457.

The Company participated with its 18% working interest in the drilling of an exploratory well on a McClain County, Oklahoma prospect. The well was completed as a commercial oil producer. Capitalized costs for the period were $173,556.

The Company participated with its 18% working interest in the completion of a horizontal development well as a marginal oil producer on a Comanche County, Kansas prospect (the well was drilled in 2011). The Company also participated in the fracking of a marginal well on the prospect, which remained marginal, and in the drilling of a salt water disposal well. Capitalized costs for the period were $167,882 and an impairment of $200,000 was taken on the horizontal well.

The Company participated with a fee mineral interest in the drilling of an exploratory horizontal well in Beaver County, Oklahoma. The Company has a 10.2% interest in the well, which was completed as a commercial oil producer. Capitalized costs for the period were $222,256.

The Company participated with 6.2% and 5.7% working interests in the drilling of two exploratory horizontal wells on a Dewey County, Oklahoma prospect. One well was completed as a commercial oil and gas producer and the other is awaiting completion. The Company will participate with a 5.2% interest in the drilling of an additional exploratory horizontal well. Capitalized costs for the period were $340,923.

The Company is participating with a fee mineral interest in four horizontal development wells in Van Buren County, Arkansas. The Company has interests of 6.6%, 7.1%, 7.2% and 2.8% in the wells, which have been drilled and are awaiting completion. Capitalized costs for the period were $864,674, including $622,027 in prepaid drilling costs.

Depreciation, Depletion, Amortization and Valuation Provision (DD&A).

DD&A increased $568,024 (54%) in 2012 to $1,612,925 from $1,044,901 in 2011. The change was mostly the result of an increase of about $397,000 in depreciation expense on oil and gas properties and an impairment loss of $200,000, offset by a decrease of about $45,000 in the provision for impairment of leaseholds. The impairment loss was related to a marginal horizontal well in Comanche County, Kansas.

General, Administrative and Other (G&A).

G&A increased $60,092 (8%) to $830,931 in 2012 from $770,839 in 2011. The increase is the net result of increases in salaries expense of $28,770; directors’ fees of $14,000; medical insurance expense of about $25,000 and accounting fees of about $15,000; offset by a decline in franchise tax expense of $22,100. The franchise tax decrease is due to expensing Oklahoma and Kansas taxes in the second quarter of 2011 versus the third quarter of 2012.

Other Income, Net

. This line item increased $194,116 to $494,195 in 2012 from $300,079 in 2011. See Note 2 to the accompanying financial statements for the analysis of the various components of this line item. Components with significant changes are discussed in the following paragraphs.

Gains on trading securities in 2012 were $8,824 as compared to gain of $2,023 in 2011, an increase of $6,801. In 2012, the Company had realized losses of $8,525 and unrealized gains of $17,349 from adjusting the securities to estimated fair market value. In 2011, the Company had realized gains of $6,245 and unrealized losses of $4,222.

Gain on asset sales increased $165,341 to $434,573 in 2012 from $269,232 in 2011. The increase was due mostly to a $406,000 gain from sales of the Company’s interest in some non-producing leaseholds in Oklahoma and Kansas.

Provision for Income Taxes

. The provision for income taxes decreased $20,014 to $931,775 in 2012 from $951,789 in 2011. The decrease was due to the decline in income before income taxes of $193,015 to $3,388,762 in 2012 from $3,581,777 in 2011. Of the 2012 income tax provision, the estimated current tax expense was $613,595 and the estimated deferred tax expense was $318,180. Of the 2011 income tax provision, the current and deferred tax expenses were $603,310 and $348,479, respectively. See Note 4 to the accompanying financial statements for additional information on income taxes.

Material Changes in Results of Operations Three Months Ended June 30, 2012 Compared with Three Months Ended June

30, 2011

.

Net income decreased $525,485 to $1,112,099 in 2012 from $1,637,584 in 2011. The material changes in the results of operations, which caused the decrease in net income, will be discussed below.

Operating Revenues.

Revenues from oil and gas sales decreased $327,920 to $2,964,869 in 2012 from $3,292,789 in 2011. The decrease was the net result of an increase in oil sales of $362,107 (18%) to $2,321,262; a decrease in gas sales of $701,996 (55%) to $563,051; and an increase in sales of miscellaneous products of $11,969 to $80,556.

The $362,107 increase in oil sales was the net result of an increase in the volume of oil sold of 6,722 Bbls to 26,730 Bbls, for a positive volume variance of $658,219, offset by a decrease in the average price received of $11.08 per Bbl to $86.84, for a negative price variance of $296,112.

The $701,996 decrease in gas sales was the result of a decrease in the volume of gas sold of 67,638 MCF, for a negative volume variance of $291,377, and a decrease in the average price of $1.82 per MCF to $2.49, for a negative price variance of $410,619.

Other operating revenues decreased $94,530 to $99,811 in 2012 from $194,341 in 2011. This decrease was primarily due to a decrease in lease bonuses for minerals in various Oklahoma and Texas Counties.

Exploration Expense.

Exploration expense increased $77,247 to $81,340 in 2012 from $4,093 in 2011. The increase is due to a dry hole in the three months ended June 30, 2012 with no similar amounts in 2011. See the 2012 exploration and development activity discussion above in “Item 2.” under “Exploration Costs” for more information.

Depreciation, Depletion, Amortization and Valuation Provision (DD&A).

DD&A increased $287,329 in 2012 to $879,793 from $592,464 in 2011. The change was due to an increase of about $102,000 in depreciation expense and impairment loss of $200,000, offset by a decrease of about $20,000 in the provision for impairment of leaseholds.

Other Income, Net.

This line item increased $152,215 to $413,844 in 2012 from $261,629 in 2011. See Note 2 to the accompanying financial statements for an analysis of the components of other income, net. Components with significant changes are discussed in the following paragraphs.

Trading securities losses in 2012 were $54,053 compared to losses of $24,305 in 2011; primarily unrealized losses in both periods.

Gain on asset sales increased $163,734 to $431,643 in 2012 from a gain of $267,909 in 2011. The increase was due to the gain from sales of the Company’s interest in some non-producing leaseholds in Oklahoma and Kansas discussed in “Item 2.” above, for the six months ended June 30, 2012.

Provision for Income Taxes.

Provision for income taxes declined $130,920 to $495,072 in 2012 from $625,992 in 2011. See discussion above in “Item 2.” and Note 4 to the accompanying financial statements for a discussion of the changes in the provision for income taxes.

There were no additional material changes between the quarters, which were not covered in the discussion in “Item 2.” above, for the six months ended June 30, 2012.

Off-Balance Sheet Arrangement

The Company’s off-balance sheet arrangement relates to Broadway Sixty-Eight, Ltd., an Oklahoma limited partnership. The Company does not have actual or effective control of this entity. Management of this entity could at any time make decisions in its own best interest, which could materially affect the Company’s net income or the value of the Company’s investment.

For more information about this entity, see Note 3 to the accompanying financial statements.

|

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

Not applicable.

|

ITEM 4.

|

CONTROLS AND PROCEDURES

|

As defined in Rule 13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934 (the “Exchange Act”), the term “disclosure controls and procedures” means controls and other procedures of an issuer that are designed to ensure that information required to be disclosed by the issuer in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Exchange Act is accumulated and communicated to the issuer’s management, including its principal executive and principal financial officers, or persons performing similar functions as appropriate, to allow timely decisions regarding required disclosure.

The Company’s Principal Executive Officer and Principal Financial Officer evaluated the effectiveness of the Company’s disclosure controls and procedures. Based on this evaluation, they concluded that the Company’s disclosure controls and procedures were effective as of June 30, 2012.

Internal Control over Financial Reporting

As defined in Rule 13a-15(f) and 15d-15(f) of the Exchange Act, the term “internal control over financial reporting” means a process designed by, or under the supervision of, the issuer’s principal executive and principal financial officers, or persons performing similar functions, and effected by the issuer’s board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes, in accordance with generally accepted accounting principles and includes those policies and procedures that:

|

(1)

|

Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the issuer;

|

|

|

(2)

|

Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the issuer are being made only in accordance with authorizations of management and directors of the issuer; and

|

|

|

(3)

|

Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the issuer’s assets that could have a material adverse effect on the financial statements.

|

|

The Company’s management is responsible for establishing and maintaining adequate internal control over financial reporting for the Company. There were no changes in the Company’s internal control over financial reporting during the quarter ended June 30, 2012 that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

PART II – OTHER INFORMATION

During the second quarter ended June 30, 2012, the Company did not have any material legal proceedings brought against it or its properties.

Not applicable.

|

|

UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

|

ISSUER PURCHASES OF EQUITY SECURITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period

|

|

Total Number

of Shares

Purchased

|

|

|

Average

Price Paid

Per Share

|

|

Total Number of Shares

Purchased as Part of

Publicly Announced Plans

or Programs

1

|

|

|

Approximate Dollar Value

of Shares that May Yet Be

Purchased Under the Plans

or Programs

1

|

|

|

April 1 to April 30, 2012

|

|

|

24

|

|

|

|

$

|

160.00

|

|

|

|

—

|

|

|

|

—

|

|

|

May 1 to May 31, 2012

|

|

|

4

|

|

|

|

$

|

160.00

|

|

|

|

—

|

|

|

|

—

|

|

|

June 1 to June 30, 2012

|

|

|

6

|

|

|

|

$

|

180.00

|

|

|

|

—

|

|

|

|

—

|

|

|

Total

|

|

|

34

|

|

|

|

$

|

163.53

|

|

|

|

—

|

|

|

|

—

|

|

1

The Company has no formal equity security purchase program or plan. The Company acts as its own transfer agent, and most purchases result from requests made by stockholders receiving small odd lot share quantities as the result of probate transfers.

|

|

DEFAULTS UPON SENIOR SECURITIES

|

None.

Not applicable.

None.

The following documents are exhibits to this Form 10-Q. Each document marked by an asterisk is filed electronically herewith.

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

101.INS*#

|

|

XBRL Instance Document

|

|

101.SCH*#

|

|

XBRL Taxonomy Extension Schema Document

|

|

101.CAL*#

|

|

XBRL Taxonomy Calculation Linkbase Document

|

|

101.LAB*#

|

|

XBRL Taxonomy Label Linkbase Document

|

|

101.PRE*#

|

|

XBRL Taxonomy Presentation Linkbase Document

|

|

|

|

|

|

|

|

*

Filed electronically herewith.

|

|

|

|

|

|

|

|

#

Pursuant to Rule 406T of Regulation S-T, the Interactive Data Files on Exhibit 101 hereto are deemed not filed or part of a registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933, as amended, are deemed not filed for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, and otherwise are not subject to liability under those sections.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereto duly authorized.

|

|

|

|

THE RESERVE PETROLEUM COMPANY

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

Date:

|

August 14, 2012

|

|

/s/ Cameron R. McLain

|

|

|

|

|

|

Cameron R. McLain,

|

|

|

|

|

Principal Executive Officer

|

|

|

|

|

|

|

|

Date:

|

August 14, 2012

|

|

/s/ James L. Tyler

|

|

|

|

|

|

James L. Tyler

|

|

|

|

|

Principal Financial and Accounting Officer

|

15

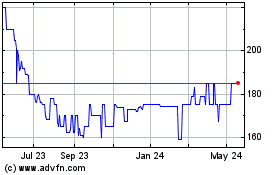

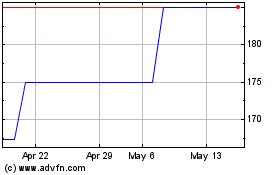

Reserve Petroleum (PK) (USOTC:RSRV)

Historical Stock Chart

From May 2024 to Jun 2024

Reserve Petroleum (PK) (USOTC:RSRV)

Historical Stock Chart

From Jun 2023 to Jun 2024