Reckitt Benckiser 1st Half Pretax Profit Fell Despite Price Growth; Backs Revenue Guidance

July 26 2023 - 2:56AM

Dow Jones News

By Joe Hoppe

Reckitt Benckiser Group said Wednesday that pretax profit for

the first half of the year slipped despite a rise in revenue, as

volumes slipped and operating expenses rose, and backed its revenue

growth expectations for the full year.

The consumer-goods company--which houses Dettol, Harpic and

Durex among its brands--posted a pretax profit of 1.64 billion

pounds ($2.12 billion) for the six months compared with a profit of

GBP1.69 billion in the year-earlier period. Prices/mix was up

10.4%, while volumes fell 4.4%.

Adjusted operating profit rose to GBP1.77 billion, from GBP1.765

billion.

Reckitt backed guidance for 2023 revenue growth on a

like-for-like basis in the range of 3% to 5%. It raised guidance

for its adjusted operating margin to be slightly ahead of 2022

levels from prior guidance of it being flat, when excluding a

one-off benefit related to U.S. nutrition.

Revenue rose to GBP7.45 billion from GBP6.89 billion the prior

year. Meanwhile, revenue for the second quarter was GBP3.53

billion, compared with GBP3.46 billion for the second quarter a

year before.

The board declared an interim dividend of 76.6 pence a share, up

from 73 pence last year.

"Amidst a backdrop of challenging market conditions and

uncertainty, the business has strong momentum, yet with an

opportunity to further strengthen our execution, optimise our cost

base, and deliver improved returns to shareholders," Chief

Executive Officer Nicandro Durante said.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

July 26, 2023 02:41 ET (06:41 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

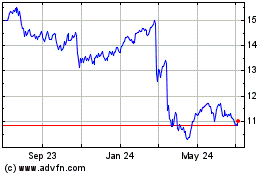

Reckitt Benckiser (PK) (USOTC:RBGLY)

Historical Stock Chart

From Dec 2024 to Jan 2025

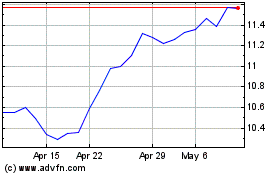

Reckitt Benckiser (PK) (USOTC:RBGLY)

Historical Stock Chart

From Jan 2024 to Jan 2025