Prospectus Filed Pursuant to Rule 424(b)(5) (424b5)

March 26 2018 - 5:18PM

Edgar (US Regulatory)

|

Supplement No. 1 dated March 26, 2018

to the

Prospectus Supplement dated December

4, 2017

|

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-213777

|

|

(To the Prospectus dated September 23, 2016)

|

|

Series A Convertible Preferred Stock

Class D-1 Warrants to Purchase Shares

of Common Stock

This prospectus supplement

(the “Supplement”) supplements information contained in that certain prospectus supplement, dated December 4, 2017

(the “Prospectus Supplement”) to name certain purchasers of the securities offered thereby and should be read in conjunction

with such Prospectus Supplement and the prospectus dated September 23, 2016. The sole purpose of this Supplement is to identify

certain investors who purchased securities pursuant to the Prospectus Supplement.

Pursuant to the Prospectus

Supplement, Northwest Biotherapeutics, Inc. (the “Company,” “we” or “us”) offered and sold,

directly to selected investors (the “Series A Preferred Offering”) 7,058,235 shares of our Series A Convertible Preferred

Stock, par value $0.001 per share (the “Series A Preferred Stock”), each convertible into 10 shares of our common stock,

par value $0.001, per share (the “Common Stock”) and Class D-1 Common Stock Purchase Warrants to purchase up to 70,582,351

shares of Common Stock at an exercise price of $0.22 per share (the “Class D-1 Warrants”). The Company received gross

proceeds of approximately $12.0 million from the Series A Preferred Offering.

In the Series A Preferred

Offering, we sold (i) Brightforge Management, L.L.C. an aggregate of 73,529 shares of Series A Preferred Stock, convertible into

up to 735,294 shares of Common Stock, and two-year Class D-1 Warrants to purchase up to 735,294 shares of Common Stock, (ii) Gravitas

Capital LP an aggregate of 58,824 shares of Series A Preferred Stock, convertible into up to 588,235 shares of Common Stock, and

two-year Class D-1 Warrants to purchase up to 588,235 shares of Common Stock, (iii) The Norman Spivock Trust 1993 an aggregate

of 299,597 shares of Series A Preferred Stock, convertible into up to 2,995,971 shares of Common Stock, and two-year Class D-1

Warrants to purchase up to 2,995,971 shares of Common Stock, (iv) SDS Long/Short LP an aggregate of 1,134,984 shares of Series

A Preferred Stock, convertible into up to 11,349,841 shares of Common Stock, and two-year Class D-1 Warrants to purchase up to

11,349,841 shares of Common Stock, and (v) PKBT Holdings, LLC an aggregate of 1,176,471 shares of Series A Preferred Stock, convertible

into up to 11,764,706 shares of Common Stock, and two-year Class D-1 Warrants to purchase up to 11,764,706 shares of Common Stock.

The Series A Preferred

Stock is convertible from and after the date on which the Company has sufficient shares of Common Stock authorized and available

for issuance to satisfy its obligation to deliver Common Stock upon conversion of the Series A Preferred Stock, but in any event

not later than June 1, 2018. Except as may otherwise be permitted pursuant to the Certificate of Designations relating to the Series

A Preferred Stock, no shares of Series A Preferred Stock shall be convertible to the extent such conversion would result in a holder

and its affiliates beneficially owning more than 9.9% of the total number of shares of Common Stock then issued and outstanding.

The Class D-1 Warrants

are exercisable for two years from the date they become exercisable.

Our Common Stock is

traded on the OTCQB tier of the OTC Markets under the symbol “NWBO”. On March 23, 2018, the closing sale price of our

Common Stock was $0.32 per share. Certain of our warrants are traded on the OTCQB tier of the OTC Markets under the symbol “NWBOW”.

There is no established public trading market for the Series A Preferred Stock or the Class D-1 Warrants included in the Series

A Preferred Offering, and we do not expect a market for such securities to develop.

Investing in our

securities involves a high degree of risk. See “Risk Factors” beginning on page S-3 of the Prospectus Supplement and

page 3 of the accompanying prospectus and the documents incorporated by reference herein for a discussion of certain information

that should be considered in connection with an investment in our securities.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined whether

this Supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Supplement No. 1 to

the Prospectus Supplement is March 26, 2018.

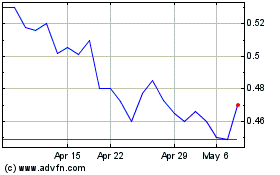

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From May 2024 to Jun 2024

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Jun 2023 to Jun 2024