Toyota CEO Will Take the Reins of Its Electric-Car Efforts

November 30 2016 - 2:00PM

Dow Jones News

Toyota Motor Corp. President Akio Toyoda is taking the helm of a

battery-powered vehicle project, accelerating the Japanese auto

giant's effort to catch up to General Motors Co., Tesla Motors Inc.

and Nissan Motor Co. in electric-car development.

Toyota, well-known for its leadership in hybrid vehicles that

use batteries to assist conventional engines, has long been

skeptical of the pure electric-vehicle market, investing instead in

hydrogen fuel-cell research. Mr. Toyoda, who in the past also took

over leadership of branding efforts at the Lexus luxury division,

will lead a newly formed EV Business Planning Department alongside

other executives.

The electric push follows Mr. Toyoda's move to boost

autonomous-vehicle research efforts with a $1 billion investment

and hiring spree in Silicon Valley. The world's largest auto maker

in sales and profit, Toyota has considerable financial resources to

pour into future engineering projects; meanwhile, its top rival,

Volkswagen AG, faces billions of dollars in fines and settlement

costs related to emissions-test cheating in the U.S.

Mr. Toyoda, grandson of Toyota's founder, envisions making cars

that drive themselves on highways by 2020. Toyota, however, is

likely to engineer cars that still keep drivers engaged in the

operation of a vehicle—a strategy that departs from Alphabet Inc.'s

Google car project.

While Google's pioneering work on autonomous cars has led to a

frenzy of investment in driverless-vehicle research,

electric-vehicle research also is thriving. Auto makers need to

respond to emissions and other regulatory pressures that overshadow

the current lack of strong demand for battery-powered vehicles like

Nissan's Leaf or BMW AG's i3 small cars.

Even though Toyota has been more bullish on fuel cells—a

technology that is not yet viable despite being under development

for decades—the company appeared to have interest in diving into

EVs several years ago.

Toyota was an early investor in Tesla, investing $50 million in

the company in 2010—well before the launch of Chief Executive Elon

Musk's popular Model S electric sedan. Toyota had an agreement to

buy batteries from Tesla, but that ended amid disagreements between

Messrs. Musk and Toyoda related to the merits of fuel-cell

technology compared with batteries.

Toyota still plans to sell 30,000 fuel-cell vehicles a year by

2020, in time for the Summer Olympics in Tokyo. But it faces

challenges. Delays in construction of hydrogen refueling stations

in California, for instance, are hampering sales of its Mirai

fuel-cell car.

Toyota recently said it would set up a new unit to build a

battery-powered car and get it to market as quickly as possible.

The move comes as sales of the Prius hybrid are declining in the

U.S. and regulators in major auto markets around the world are

pushing for more pure EVs as a way to lower vehicle emissions in

the coming decade.

Electric vehicles currently represent less than 1% of global

light-vehicle market share, but sales are growing due to hefty

government subsidies in China, the U.S. and certain European

markets, such as Norway. The incentives are particularly rich in

China, where sales of electrics and plug-in hybrids have soared

more than 80% in 2016 to 337,000—just a fraction of the 22-plus

million passenger cars likely to be delivered in that market this

year.

Other than Tesla, most auto makers have thus far offered

electric cars with limited capabilities. Nissan's Leaf, for

instance, can drive about 100 miles on a charge and GM's Chevrolet

Volt travels about half that distance before kicking over to a

gasoline engine that is also on board.

Concerns about range, combined with relatively high prices and

limited charging infrastructure, have affected demand. The U.S.

government's $7,500 EV tax credit is designed to ease those

concerns, but with gasoline prices low buyers are flocking to

heavier and more capable pickups, sport-utility vehicles and

crossover wagons—leaving battery-powered vehicle sales just a

sliver of the 17.5 million light vehicles expected to be sold in

the U.S. this year.

GM will launch its 200-mile-range Bolt for $30,000 in California

and Oregon next month, but it is unclear when that car will be

widely available in the U.S. Volkswagen, Daimler AG and others have

recently signaled sizable financial commitments to electrified

vehicles, including a $4.5 billion push by Ford Motor Co. through

2020.

Others also hope to replicate Tesla's success. Silicon Valley

startup Lucid Motors Inc., formerly known at Atieva, said this week

it will invest more than $700 million to build an EV factory in

Arizona with production is slated to begin in 2018.

That follows an ambitious plan by Faraday Future Inc., which is

building a factory in Nevada.

Write to Sean McLain at sean.mclain@wsj.com and John D. Stoll at

john.stoll@wsj.com

(END) Dow Jones Newswires

November 30, 2016 13:45 ET (18:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

Nissan Motor (PK) (USOTC:NSANY)

Historical Stock Chart

From Oct 2024 to Nov 2024

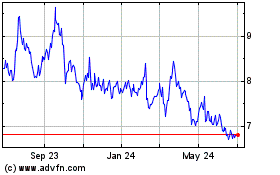

Nissan Motor (PK) (USOTC:NSANY)

Historical Stock Chart

From Nov 2023 to Nov 2024