UNITED STATES

SECURITIES AND EXCHANGE COMMISION

Washington, D.C. 20549

FORM 8-A

FOR REGISTRATION OF CERTAIN CLASSES OF SECURITIES PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

(Exact name of registrant as specified in its charter)

|

NEVADA

|

98-0384073

|

|

(State or other jurisdiction of incorporation or organization)

|

(IRS Employer Identification No.)

|

|

|

|

1260 N. Hancock Street, Suite 105

Anaheim, CA 92807

(Address of principal executive offices)

Phone number: 714-777-7873

(Issuer Telephone Number)

Securities to be registered pursuant to Section 12(b) of the Act:

None

If this form relates to the registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General Instruction A.(c), check the following box. [ ]

If this form relates to the registration of a class of securities pursuant to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A. (d), check the following box. [X]

Securities Act registration statement file number to which this form relates. None.

Securities to be registered pursuant to Section 12(g) of the Act:

Common - $0.0001 par value common stock

(Title of class)

Item 1. Description of Registrant’s Securities to be Registered

General

The Company’s Articles of Incorporation authorize the issuance of One Hundred Million (100,000,000) shares of common stock, $.0001 par value per share and Ten Million (10,000,000) shares of preferred stock, $.0001 par value per share. Further, the classes or series may have such voting powers (full, limited, extra, or none), such preferences, relative rights, and qualifications, limitations or restrictions as stated in the resolutions adopted by the board of directors.

Common Stock

Holders of our common stock are entitled to one vote for each share on all matters submitted to a stockholder vote. Holders of common stock do not have cumulative voting rights and each holder is entitled to one vote for each director vacancy being filled. Directors are elected by a plurality of the votes cast in the election of directors. Therefore, holders of a majority of the shares of common stock voting for the election of directors can elect all of the directors. Except as otherwise expressly provided by the laws of the State of Nevada, or by the Articles of Incorporation, at any and all meetings of the stockholders of the Company, for a quorum, there must be present, either in person or by proxy, stockholders owning a majority of the issued and outstanding shares of the capital stock of the Company entitled to vote at the meeting. A vote by the holders of a majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our articles of incorporation.

Holders of common stock are entitled to share equally in all dividends that the board of directors, in its discretion, declares from legally available funds. In the event of a liquidation, dissolution, or winding up, each outstanding share of common stock entitles its holder to participate pro rata in all assets that remain after payment of liabilities.

Holders of our common stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to our common stock.

Dividend Policy

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

Preferred Stock

The Company’s Articles of Incorporation authorizes Ten Million (10,000,000) shares of $.0001 par value preferred stock and states the board by resolution only and without further action or approval, may cause the Corporation to issue one or more classes or one or more series of preferred stock within any class thereof and which classes or series may have such voting powers, full or limited, or no voting powers, and such designations, preferences and relative, participating, optional or other special rights, and qualifications, limitations or restrictions thereof, as shall be stated and expressed in the resolution or resolutions adopted by the board of directors, and to fix the number of shares constituting any classes or series and to increase or decrease the number of shares of any such class or series.

The Company’s directors on July 19, 2011 adopted resolutions determining the Designations, Rights and Preferences of the Series A Preferred Stock consisting of One Million (1,000,000) shares. The Series A Preferred Stock is senior to the common stock and all other shares of Preferred Stock that may be later authorized. Each outstanding share of Series A Preferred Stock has One Thousand (1,000) votes on all matters submitted to the stockholders and votes with the common stock on all matters. The Series A Preferred Stock voting separately as a class has the right to elect three persons to serve on the board of directors. The shares of Series A Preferred (i) do not have a liquidation preference; (ii) do not accrue, earn, or participate in any dividends; and (iii) are not subject to redemption by the Corporation.

After December 31, 2012, each outstanding share of Series A Preferred Stock may be converted, at the option of the owner, into fifty (50) shares of the Company's common stock; provided however, that no conversion shall be permitted unless (i) the Company's common stock is quoted for public trading in the United States or other international securities market and (ii) the Company's market capitalization (i.e., the number of issued and outstanding shares of common stock multiplied by the daily closing price) has exceeded Fifty Million Dollars ($50,000,000) for 90 consecutive trading days.

In addition to any other rights provided by law, the Company shall not, without first obtaining the affirmative vote or written consent of the holders of ninety percent (90%) of the outstanding shares of Series A Preferred Stock, do any of the following:

|

|

take any action which would either alter, change or affect the rights, preferences, privileges or restrictions of the Series A Preferred or increase the number of shares of such series authorized hereby or designate any other series of Preferred Stock;

|

|

|

increase the size of any equity incentive plan(s) or arrangements;

|

|

|

make fundamental changes to the business of the Company;

|

|

|

make any changes to the terms of the Series A Preferred or to the Company’s Articles of Incorporation or Bylaws, including by designation of any stock;

|

|

|

create any new class of shares having preferences over or being on a parity with the Series A Preferred as to dividends or assets, unless the purpose of creation of such class is, and the proceeds to be derived from the sale and issuance thereof are to be used for, the retirement of all Series A Preferred then outstanding;

|

|

|

make any change in the number of authorized directors, currently five (5);

|

|

|

repurchase any of the Company's Common Stock;

|

|

|

sell, convey or otherwise dispose of, or create or incur any mortgage, lien, charge or encumbrance on or security interest in or pledge of, or sell and leaseback, all or substantially all of the property or business of the Company or more than 50% of the stock of the Company;

|

|

|

make any payment of dividends or other distributions or any redemption or repurchase of stock or options or warrants to purchase stock of the Company; or

|

|

|

make any sales of additional Preferred Stock.

|

No share or shares of Series A Preferred acquired by the Company by reason of conversion or otherwise shall be reissued as Series A Preferred, and all such shares thereafter shall be returned to the status of undesignated and unissued shares of Preferred Stock of the Company.

On July 19, 2011, the Company issued 1,000,000 shares of the newly created Series A Preferred Stock to Weed & Co. LLP, or its designee, in exchange for a $100,000 reduction of the outstanding accounts payable, being the equivalent of One Cent ($0.1) per share of Series A Preferred Stock.

Options

We have not issued and do not have any outstanding options to purchase shares of our common stock.

Transfer Agent

Our transfer agent is Continental Stock Transfer & Trust Co., 17 Battery Place, New York NY 10004. Tel: (212) 845-3218 and Fax: (212) 616-7615

Item 2. Exhibits

None

SIGNATURE

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

LIVEWIRE ERGOGENICS INC.

|

|

|

|

|

|

|

|

|

|

/s/ Bill Hodson

|

|

|

|

|

Bill Hodson, PRESIDENT

|

|

|

|

|

|

|

|

|

|

|

|

4

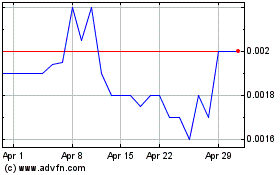

Livewire Ergogenics (PK) (USOTC:LVVV)

Historical Stock Chart

From May 2024 to Jun 2024

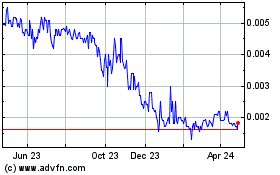

Livewire Ergogenics (PK) (USOTC:LVVV)

Historical Stock Chart

From Jun 2023 to Jun 2024