UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT

TO § 240.13d-1(a) AND AMENDMENTS THERETO FILED

PURSUANT TO

§ 240.13d-2(a)

(Amendment No. )1

Imperalis Holding Corp.

(Name of Issuer)

Common

Stock, par value $0.001 per share

(Title of Class of Securities)

45257M106

(CUSIP Number)

MILTON C.

AULT, III

c/o BitNile

Holdings, Inc.

11411 Southern Highlands Parkway, Suite 240

Las Vegas, NV 89141

(949)

444-5464

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

December 15, 2021

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously

filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ¨.

Note: Schedules filed

in paper format shall include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for

other parties to whom copies are to be sent.

_______________

1 The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on

the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange

Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

|

1

|

NAME OF REPORTING PERSON

BITNILE HOLDINGS, INC.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) x

(b) ¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

WC

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

U.S.A.

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

139,516,633(1)

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

139,516,633(1)

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

139,516,633

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

81.18%

|

|

14

|

TYPE OF REPORTING PERSON

CO

|

|

|

|

|

|

|

|

(1)

|

Represents (i) 129,363,756 shares of Common Stock held by BitNile, Inc. and (ii) 10,152,877 shares of

Common Stock issuable upon conversion of an outstanding convertible promissory note in the principal face amount of $101,528.77, which

is convertible into shares of Common Stock at a conversion price of $0.01 per share. Does not include shares of Common Stock that are

also issuable upon conversion of the note representing accrued but unpaid interest.

|

|

1

|

NAME OF REPORTING PERSON

BITNILE, INC.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) x

(b) ¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

WC, OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

U.S.A.

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

129,363,756

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

129,363,756

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

129,363,756

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

80.00%

|

|

14

|

TYPE OF REPORTING PERSON

CO

|

|

|

|

|

|

|

1

|

NAME OF REPORTING PERSON

DIGITAL POWER LENDING, LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) x

(b) ¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

WC, OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

U.S.A.

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

10,152,877(1)

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

10,152,877 (1)

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

10,152,877

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.91%

|

|

14

|

TYPE OF REPORTING PERSON

OO

|

|

|

|

|

|

|

1

|

NAME OF REPORTING PERSON

HENRY C.W. NISSER

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) x

(b) ¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Sweden

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

- 0 -

|

|

8

|

SHARED VOTING POWER

- 0 -

|

|

9

|

SOLE DISPOSITIVE POWER

- 0 -

|

|

10

|

SHARED DISPOSITIVE POWER

- 0 -

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

- 0 -

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

- 0 -

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

|

|

|

|

|

1

|

NAME OF REPORTING PERSON

DAVID J. KATZOFF

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) x

(b) ¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

U.S.A.

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

- 0 -

|

|

8

|

SHARED VOTING POWER

- 0 -

|

|

9

|

SOLE DISPOSITIVE POWER

- 0 -

|

|

10

|

SHARED DISPOSITIVE POWER

- 0 -

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

- 0 -

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

- 0 -

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

|

|

|

|

The following constitutes the

Schedule 13D filed by the undersigned (the “Schedule 13D”).

|

|

Item 1.

|

Security and Issuer.

|

This statement relates to the

Common Stock, $0.001 par value per share (the “Shares”), of Imperalis Holding Corp., a Nevada corporation (the “Issuer”).

The address of the principal executive offices of the Issuer is 11411 Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141.

|

|

Item 2.

|

Identity and Background.

|

(a) This

statement is filed by:

|

|

(i)

|

BitNile Holdings, Inc., a Delaware corporation, with respect to the Shares beneficially owned by it through

its subsidiaries BitNile, Inc., and Digital Power Lending, LLC;

|

|

|

(ii)

|

BitNile, Inc., a Nevada corporation, with respect to the Shares directly and beneficially owned by it;

|

|

|

(iii)

|

Digital Power Lending, LLC, a California limited liability company, with respect to the Shares directly

and beneficially owned by it;

|

|

|

(iv)

|

Henry C.W. Nisser, Chief Executive Officer and Director of the Issuer, President, General Counsel and

Director of BitNile Holdings, Inc. and President and Director of BitNile, Inc.; and

|

|

|

(v)

|

David J. Katzoff, Chief Financial Officer, Secretary and Treasurer of the Issuer and Manager of Digital

Power Lending, LLC.

|

Each of the foregoing is referred

to as a “Reporting Person” and collectively as the “Reporting Persons.” Each of the Reporting Persons is party

to that certain Joint Filing Agreement, attached hereto as Exhibit 99.1. Accordingly, the Reporting Persons are hereby filing a joint

Schedule 13D.

Set forth on Schedule A annexed

hereto (“Schedule A”) is the name and present principal occupation or employment, principal business address and citizenship

of the executive officers and directors of BitNile Holdings, Inc. To the best of the Reporting Persons’ knowledge, except as otherwise

set forth herein, none of the persons listed in Schedule A beneficially owns any securities of the Issuer or is a party to any contract,

agreement or understanding required to be disclosed herein.

Set forth on Schedule B annexed

hereto (“Schedule B”) is the name and present principal occupation or employment, principal business address and citizenship

of the executive officers and directors of BitNile, Inc. To the best of the Reporting Persons’ knowledge, except as otherwise set

forth herein, none of the persons listed in Schedule B beneficially owns any securities of the Issuer or is a party to any contract, agreement

or understanding required to be disclosed herein.

Set forth on Schedule C annexed

hereto (“Schedule C”) is the name and present principal occupation or employment, principal business address and citizenship

of the executive officers and directors of Digital Power Lending, LLC. To the best of the Reporting Persons’ knowledge, except as

otherwise set forth herein, none of the persons listed in Schedule C beneficially owns any securities of the Issuer or is a party to any

contract, agreement or understanding required to be disclosed herein.

(b) The

principal business address of Mr. Katzoff is c/o Digital Power Lending, LLC, 940 South Coast Drive, Suite 200, Costa Mesa, CA 92626. The

principal business address of Mr. Nisser is c/o BitNile Holdings, Inc., 100 Park Avenue, 16th Floor, Suite 1658A, New York, NY 10017.

The principal business address of BitNile Holdings, Inc. and BitNile, Inc. is 11411 Southern Highlands Parkway, Suite 240, Las Vegas,

Nevada 89141. The principal business address of Digital Power Lending, LLC is 940 South Coast Drive, Suite 200, Costa Mesa, CA 92626.

(c) The

principal occupation of Mr. Nisser is serving as the President and General Counsel of BitNile Holdings, Inc. The principal occupation

of Mr. Katzoff is serving as the Manager of Digital Power Lending, LLC.

BitNile Holdings, Inc. is a

diversified holding company pursuing growth by acquiring undervalued businesses and disruptive technologies with a global impact. Through

its wholly and majority-owned subsidiaries and strategic investments, BitNile Holdings owns and operates a data center at which it mines

Bitcoin and provides mission-critical products that support a diverse range of industries, including defense/aerospace, industrial, automotive,

telecommunications, medical/biopharma, and textiles. The principal business of BitNile, Inc. is Bitcoin mining, data center operations

and decentralized finance initiatives. The principal business of Digital Power Lending, LLC is investing in securities.

(d) No

Reporting Person nor any person listed in Schedules A through C has, during the last five years, been convicted in a criminal proceeding

(excluding traffic violations or similar misdemeanors).

(e) No

Reporting Person nor any person listed in Schedules A through C has, during the last five years, been party to a civil proceeding of a

judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or

final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding

any violation with respect to such laws.

(f) BitNile

Holdings, Inc. is organized under the laws of the State of Delaware. BitNile, Inc. is organized under the laws of the State of Nevada.

Digital Power Lending, LLC is organized under the laws of the State of California. Mr. Nisser is a citizen of Sweden. Mr. Katzoff is a

citizen of the United States of America.

|

|

Item 3.

|

Source and Amount of Funds or Other Consideration.

|

The securities of the Issuer

purchased by each of BitNile, Inc. and Digital Power Lending, LLC were purchased with working capital. The aggregate purchase price of

the 129,363,756 Shares directly owned by BitNile, Inc. is $200,000. The aggregate purchase price of the convertible promissory note currently

convertible into 10,152,877 Shares (excluding any Shares issuable upon conversion of accrued but unpaid interest) is $100,000.

|

|

Item 4.

|

Purpose of Transaction.

|

The Reporting Persons purchased

the securities of the Issuer based on the Reporting Persons’ belief that the securities, when purchased, were undervalued and represented

an attractive investment opportunity. Depending upon overall market conditions, other investment opportunities available to the Reporting

Persons, and the availability of securities of the Issuer at prices that would make the purchase or sale of such securities desirable,

the Reporting Persons may endeavor to increase or decrease their position in the Issuer through, among other things, the purchase or sale

of securities of the Issuer on the open market or in private transactions or otherwise, on such terms and at such times as the Reporting

Persons may deem advisable.

Mr. Nisser is the Chief Executive

Officer and Director of the Issuer. Mr. Katzoff is the Chief Financial Officer, Secretary and Treasurer of the Issuer.

The Reporting Persons may vote

its or his shares or otherwise cause the Issuer to enter into acquisitions and strategic partnerships to expand the business of the Issuer.

These acquisitions or strategic partnerships may be funded through the issuance of additional securities of the Issuer, working capital

or a combination of both. It is the understanding of the Reporting Persons that one or more of the Reporting Persons have had discussions

regarding the possibility of one or more companies affiliated with one or more of the Reporting Persons being acquired by the Issuer in

the future.

Except as set forth above in

this statement, the Reporting Persons do not have any present plan or proposal which would relate to or result in any of the matters set

forth in subparagraphs (a) - (j) of Item 4 of Schedule 13D except as set forth herein or such as would occur upon or in connection with

completion of, or following, any of the actions discussed herein. The Reporting Persons intend to review their investment in the Issuer

on a continuing basis. Depending on various factors including, without limitation, the Issuer’s financial position, the Reporting

Persons’ investment strategies, the price levels of the Shares, conditions in the securities markets and general economic and industry

conditions, the Reporting Persons may in the future take such actions with respect to their investment in the Issuer as they deem appropriate

including, without limitation, purchasing additional securities of the Issuer, selling some or all of their securities, engaging in short

selling of or any hedging or similar transaction with respect to the securities of the Issuer, or changing their intention with respect

to any and all matters referred to in Item 4.

|

|

Item 5.

|

Interest in Securities of the Issuer.

|

The aggregate percentage of

Shares reported owned by each Reporting Person is based upon 161,704,695 Shares outstanding, which is the total number of Shares outstanding

as reported by the Issuer as of December 21, 2021.

|

|

A.

|

BitNile Holdings, Inc.

|

|

|

(a)

|

As of the close of business on December 21, 2021, BitNile Holdings, Inc. may be deemed to beneficially

own 139,516,633 Shares, consisting of (i) 129,363,756 Shares held by BitNile, Inc. and (ii) 10,152,877 Shares issuable upon conversion

of an outstanding convertible promissory note in the principal face amount of $101,528.77, which is convertible into Shares at a conversion

price of $0.01 per share. Does not include Shares that are also issuable upon conversion of the note representing accrued but unpaid interest.

BitNile Holdings, Inc. may be deemed to beneficially own the Shares beneficially owned by BitNile, Inc. and Digital Power Lending, LLC

by virtue of its relationship with such entity described in Item 2.

|

Percentage: 81.18%

|

|

(b)

|

1. Sole power to vote or direct vote: 0

|

2. Shared power to vote or direct vote: 139,516,633

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 139,516,633

|

|

(c)

|

BitNile Holdings, Inc. has not entered into any transactions in the Shares during the past sixty days.

|

|

|

(a)

|

As of the close of business on December 21, 2021, BitNile, Inc beneficially owns 129,363,756 shares of

Common Stock held directly by it.

|

Percentage: 80.00%

|

|

(b)

|

1. Sole power to vote or direct vote: 0

|

2. Shared power to vote or direct vote:

129,363,756

3. Sole power to dispose or direct

the disposition: 0

4. Shared power to dispose or direct

the disposition: 129,363,756

|

|

(c)

|

The only transaction by BitNile in the Shares during the past sixty days was the purchase of an aggregate

of 129,363,756 Shares for $200,000 in a privately negotiated transaction with three shareholders of the Issuer.

|

|

|

C.

|

Digital Power Lending, LLC

|

|

|

(a)

|

As of the close of business on December 21, 2021, Digital Power Lending, LLC may be deemed to beneficially

own 10,152,877 Shares issuable upon conversion of an outstanding convertible promissory note in the principal face amount of $101,528.77,

which is convertible into Shares at a conversion price of $0.01 per share. Does not include Shares that are also issuable upon conversion

of the note representing accrued but unpaid interest.

|

Percentage: Less than 5.91%

|

|

(b)

|

1. Sole power to vote or direct vote: 0

|

2. Shared power to vote or direct vote:

10,152,877

3. Sole power to dispose or direct

the disposition: 0

4. Shared power to dispose or direct

the disposition: 10,152,877

|

|

(c)

|

The only transaction by Digital Power Lending, LLC in the Shares during the past sixty days was the exchange,

on December 15, 2021, of those certain promissory notes dated August 18, 2021 and November 5, 2021 issued to Digital Power Lending, LLC

by the Issuer in the aggregate principal amount of $100,000, which promissory notes had accrued interest of $1,528.77 as of December 15,

2021, for a convertible promissory note in the principal face amount of $101,528.77.

|

|

|

(a)

|

As of the close of business on December 21, 2021, Mr. Nisser does not beneficially own any Shares.

|

Percentage: 0.0%

|

|

(b)

|

1. Sole power to vote or direct vote: 0

|

2. Shared power to vote or direct vote:

0

3. Sole power to dispose or direct

the disposition: 0

4. Shared power to dispose or direct

the disposition: 0

|

|

(c)

|

Mr. Nisser has not entered into any transactions in the Shares during the past sixty days.

|

|

|

(a)

|

As of the close of business on December 21, 2021, Mr. Katzoff does not beneficially own any Shares.

|

Percentage: 0.0%

|

|

(b)

|

1. Sole power to vote or direct vote: 0

|

2. Shared power to vote or direct vote:

0

3. Sole power to dispose or direct

the disposition: 0

4. Shared power to dispose or direct

the disposition: 0

|

|

(c)

|

Mr. Katzoff has not entered into any transactions in the Shares during the past sixty days.

|

The filing of this Schedule

13D shall not be deemed an admission that the Reporting Persons are, for purposes of Section 13(d) of the Securities Exchange Act of 1934,

as amended, the beneficial owners of any securities of the Issuer that he or it does not directly own. Each of the Reporting Persons specifically

disclaims beneficial ownership of the securities reported herein that he or it does not directly own.

|

|

(d)

|

No person other than the Reporting Persons is known to have the right to receive, or the power to direct the receipt of dividends

from, or proceeds from the sale of, the Shares.

|

|

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

|

On December 15, 2021, the Issuer

entered into an exchange agreement (the “Exchange Agreement”) with Digital Power Lending, LLC, pursuant to which the Issuer

issued a convertible promissory note (the “Convertible Note”) to Digital Power Lending, LLC, in the principal amount of $101,528.77,

in exchange for those certain promissory notes dated August 18, 2021 and November 5, 2021 (the “Promissory Notes”) issued

to Digital Power Lending, LLC in the aggregate principal amount of $100,000, which Promissory Notes had accrued interest of $1,528.77

as of December 15, 2021. The Convertible Note accrues interest at 10% per annum, is due on December 15, 2023, and the principal, together

with any accrued but unpaid interest on the amount of principal, is convertible into Shares at Digital Power Lending, LLC’s option

at a conversion price of $0.01 per share. A copy of the Exchange Agreement and the Convertible Note are attached as exhibits hereto and

are incorporated herein by reference.

On December 16, 2021 Vincent

Andreula, Michael Andreula and Kristie Andreula, each a stockholder of the Issuer (collectively, the “Sellers”), entered into

a stock purchase agreement (the “Stock Purchase Agreement”) with BitNile, Inc. Pursuant to the Stock Purchase Agreement, BitNile,

Inc. purchased 129,363,756 Shares from the Sellers in exchange for $200,000. A copy of the Stock Purchase Agreement is attached as an

exhibit hereto and is incorporated herein by reference.

On December 23, 2021, the Reporting

Persons entered into a Joint Filing Agreement in which the Reporting Persons agreed to the joint filing on behalf of each of them of statements

on Schedule 13D with respect to the securities of the Issuer. A copy of this agreement is attached as an exhibit hereto and is incorporated

herein by reference.

|

|

Item 7.

|

Material to be Filed as Exhibits.

|

|

|

99.1

|

Joint Filing Agreement by and among Henry C.W. Nisser, David J. Katzoff, BitNile Holdings, Inc., BitNile, Inc. and Digital Power Lending, LLC, dated December 23, 2021.

|

|

|

|

|

|

|

99.2

|

Exchange Agreement between Imperalis Holding Corp. and Digital Power Lending, LLC, dated as of December 15, 2021 (incorporated by reference to Exhibit 10.1 of the Current Report on Form 8-K filed with the SEC on December 21, 2021).

|

|

|

|

|

|

|

99.3

|

Convertible Promissory Note, dated December 15, 2021, made by Imperalis Holding Corp. in favor of Digital Power Lending, LLC (incorporated by reference to Exhibit 4.1 of the Current Report on Form 8-K filed with the SEC on December 21, 2021).

|

|

|

|

|

|

|

99.4

|

Form of Stock Purchase Agreement among BitNile, Inc., Vincent Andreula, Michael Andreula and Kristie Andreula, dated as of December 16, 2021 (incorporated by reference to Exhibit 99.1 of the Current Report on Form 8-K filed with the SEC on December 21, 2021).

|

SIGNATURES

After reasonable inquiry and

to the best of his knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete

and correct.

Dated: December 23, 2021

|

|

|

BITNILE HOLDINGS, INC.

|

|

/s/ Henry C.W. Nisser

|

|

|

|

|

HENRY C.W. NISSER

|

|

By:

|

/s/ Henry C.W. Nisser

|

|

|

|

|

Name:

|

Henry C.W. Nisser

|

|

|

|

|

Title:

|

President

|

|

|

|

BITNILE, INC.

|

|

/s/ David J. Katzoff

|

|

|

|

|

DAVID J.KATZOFF

|

|

By:

|

/s/ Henry C.W. Nisser

|

|

|

|

|

Name:

|

Henry C.W. Nisser

|

|

|

|

|

Title:

|

President

|

|

|

|

DIGITAL POWER LENDING, LLC

|

|

|

|

|

|

|

|

|

By:

|

/s/ David J.Katzoff

|

|

|

|

|

Name:

|

David J.Katzoff

|

|

|

|

|

Title:

|

Manager

|

SCHEDULE A

Officers and Directors of BitNile Holdings,

Inc.

|

Name and Position

|

Principal Occupation

|

Principal Business Address

|

Citizenship

|

|

Milton C. Ault, III

Executive Chairman

|

Executive Chairman of BitNile Holdings, Inc.

|

c/o BitNile Holdings, Inc. 11411 Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141

|

USA

|

|

William B. Horne

Chief Executive Officer and Director

|

Chief Executive Officer of BitNile Holdings, Inc.

|

c/o BitNile Holdings, Inc. 11411 Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141

|

USA

|

|

Henry C.W. Nisser

President, General Counsel and Director

|

President and General Counsel of BitNile Holdings, Inc.

|

c/o BitNile Holdings, Inc. 100 Park Avenue, 16th Floor, Suite 1658A, New York, NY 10017

|

Sweden

|

|

Kenneth S. Cragun

Chief Financial Officer

|

Chief Financial Officer of BitNile Holdings, Inc.

|

c/o BitNile Holdings, Inc. 11411 Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141

|

USA

|

|

Howard Ash

Independent Director

|

Chairman of Claridge Management

|

c/o BitNile Holdings, Inc. 11411 Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141

|

USA

|

|

Jeffrey A. Bentz

Independent Director

|

President of North Star Terminal & Stevedore Company

|

c/o BitNile Holdings, Inc. 11411 Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141

|

USA

|

|

Robert O. Smith

Independent Director

|

Independent Executive Consultant

|

c/o BitNile Holdings, Inc. 11411 Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141

|

USA

|

|

Moti Rosenberg

Independent Director

|

Independent Consultant

|

c/o BitNile Holdings, Inc. 11411 Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141

|

Israel

|

|

Glen Tellock

Independent Director

|

Independent Consultant

|

c/o BitNile Holdings, Inc. 11411 Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141

|

USA

|

SCHEDULE B

Officers and Directors of BitNile, Inc.

|

Name and Position

|

Principal Occupation

|

Principal Business Address

|

Citizenship

|

|

William B. Horne

Chief Executive Officer and Director

|

Chief Executive Officer of BitNile Holdings, Inc.

|

c/o BitNile Holdings, Inc. 11411 Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141

|

USA

|

|

Henry C.W. Nisser

President and Director

|

President and General Counsel of BitNile Holdings, Inc.

|

c/o BitNile Holdings, Inc. 100 Park Avenue, 16th Floor, Suite 1658A, New York, NY 10017

|

Sweden

|

|

Kenneth S. Cragun

Chief Financial Officer

|

Chief Financial Officer of BitNile Holdings, Inc.

|

c/o BitNile Holdings, Inc. 11411 Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141

|

USA

|

|

Christopher K. Wu

Executive Vice President and Director

|

Executive Vice President of Alternative Investments of BitNile Holdings, Inc.

|

c/o BitNile Holdings, Inc. 11411 Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141

|

USA

|

|

Darren M. Magot

Director

|

Chief Executive Officer of Ault Alliance, Inc.

|

c/o Ault Alliance, Inc. 11411 Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141

|

USA

|

SCHEDULE C

Officers and Directors of Digital Power Lending,

LLC

|

Name and Position

|

Principal Occupation

|

Principal Business Address

|

Citizenship

|

|

David J. Katzoff

Manager

|

Manager of Digital Power Lending, LLC

|

c/o Digital Power Lending, LLC, 940 South Coast Drive, Suite 200, Costa Mesa, CA 92626

|

USA

|

16

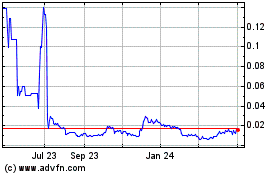

Imperalis (PK) (USOTC:IMHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

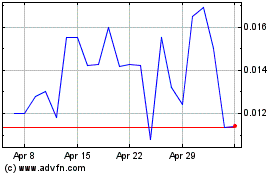

Imperalis (PK) (USOTC:IMHC)

Historical Stock Chart

From Apr 2023 to Apr 2024