Glencore Says Operations Performed as Expected in 2021 -- Commodity Comment

February 02 2022 - 2:54AM

Dow Jones News

By Jaime Llinares Taboada

Glencore PLC said Wednesday that its operations performed

largely in line with guidance expectations last year, with copper

output falling 5% on year. Here's what the FTSE 100 mining and

commodity-trading major had to say:

On 2021 performance:

"Overall, our operations largely performed in line with guidance

expectations. We completed the Cerrejon acquisition and Ernest

Henry disposal in January, such transactions being consistent with

our continued strategy to simplify and align our portfolio with the

materials needed for the energy transition and the responsible

decline of our coal business."

"Own sourced copper production of 1,195,700 tonnes was 62,400

tonnes (5%) lower than 2020, mainly due to the Mopani disposal

(23,800 tonnes), expected lower copper grades at Antapaccay (14,800

tonnes) and lower copper by-products from our mature zinc and

nickel mines (26,600 tonnes)."

"Own sourced cobalt production of 31,300 tonnes was 3,900 tonnes

(14%) higher than 2020 due to the limited restart of production at

Mutanda in 2021."

"Own sourced zinc production of 1,117,800 tonnes was 52,600

tonnes (4%) lower than 2020, mainly reflecting the expected decline

of the Maleevsky mine in Kazakhstan, being lagged by the slower

than expected ramp-up of replacement Zhairem mine tonnage (19,600

tonnes); Mount Isa producing additional metal from ore stockpile

drawdowns in the base period (24,400 tonnes); and Kidd lower grades

(13,800 tonnes). These factors were partly offset by stronger zinc

production at Antamina, which was suspended for part of 2020 due to

Covid restrictions."

"Nickel production of 102,300 tonnes was 7,900 tonnes (7%) lower

than in 2020, mainly due to the lengthy scheduled statutory

shutdown and maintenance issues at Murrin Murrin earlier in the

year."

"Attributable ferrochrome production of 1,468,000 tonnes was

439,000 tonnes (43%) higher than 2020 mainly due to the South

African national lockdown in the prior year, and a strong operating

performance."

"Coal production of 103.3 million tonnes was 2.9 million tonnes

(3%) lower than 2020, reflecting Prodeco's care and maintenance

status and lower domestic power demand / export rail capacity

constraints in South Africa, offset by higher production at

Cerrejon, following a Covid suspension and strike in 2020."

"Entitlement interest production of 5.3 million boe was 1.3

million boe (34%) higher than 2020 mainly due to commencement of

the gas phase of the Alen project in Equatorial Guinea. There was

no production from the Chad fields in 2021."

On 2022 guidance:

"2022 production guidance unchanged from the Investor Update in

December 2021. Purchase of the remaining interest in Cerrejon

completed in January 2022, a few months earlier than initially

assumed. Changes, if any, to 2022 guidance will be updated in

April, together with our 1Q production report."

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

February 02, 2022 02:39 ET (07:39 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

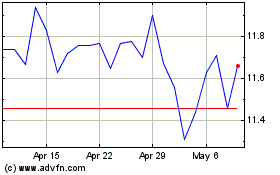

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Aug 2024 to Sep 2024

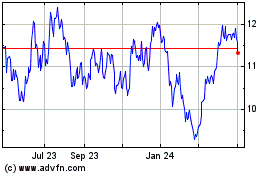

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Sep 2023 to Sep 2024